We pray and work for a bright future. The situation in Mainland China has led to turbulence in both the domestic and abroad stock market this week. From November 21 to November 25, the weekly average price of the major grades of stainless steel mostly decreased while some remained. However, the demand is still sluggish although it is now the last purchasing peak in 2022. To resist the gloomy prices, steel mills decide to cut down production in November and December, and the 300 series which increased the most previously will be cut down the most. Nickel also gives credit for stainless steel prices to prop up as Indonesia will come out with specific plans about the export tax imposition on ferronickel. Meanwhile, the inventory volumes of LME nickel and ShFE nickel are low. For more about the latest details of the stainless steel market, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICE

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,575 |

-28 |

-1.14% |

|

Foshan |

2,620 |

-28 |

-1.12% |

||

|

Hongwang |

Wuxi |

2,500 |

0 |

0.00% |

|

|

Foshan |

2,505 |

-17 |

-0.70% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,390 |

-23 |

-0.98% |

|

Foshan |

2,455 |

-3 |

-0.12% |

||

|

316L/2B |

TISCO |

Wuxi |

4,180 |

-20 |

-0.49% |

|

Foshan |

4,250 |

-8 |

-0.21% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,025 |

0 |

0.00% |

|

Foshan |

4,080 |

0 |

0.00% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,495 |

-17 |

-1.21% |

|

Foshan |

1,460 |

-8 |

-0.63% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,410 |

-24 |

-1.82% |

|

Foshan |

1,385 |

-15 |

-1.21% |

||

|

430/2B |

TISCO |

Wuxi |

1,225 |

0 |

0.00% |

|

Foshan |

1,220 |

0 |

0.00% |

TREND|| Late fall on reserve requirement ratio is the silver lining of production cut.

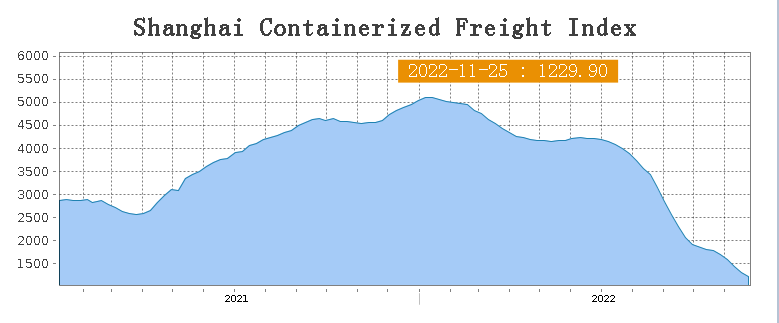

Over 300,000 tons of stainless steel production will be cut by steel mills in November and December

Delong: There will be approximately 120,000-160,000 tons of production deducted in November as two AOD furnaces and two hot annealing and pickling lines (HAPL) ceased production for a month long. Meanwhile about 105,000 tons or 70% of the Stainless steel 300 series shorted on production in the rest of this year.

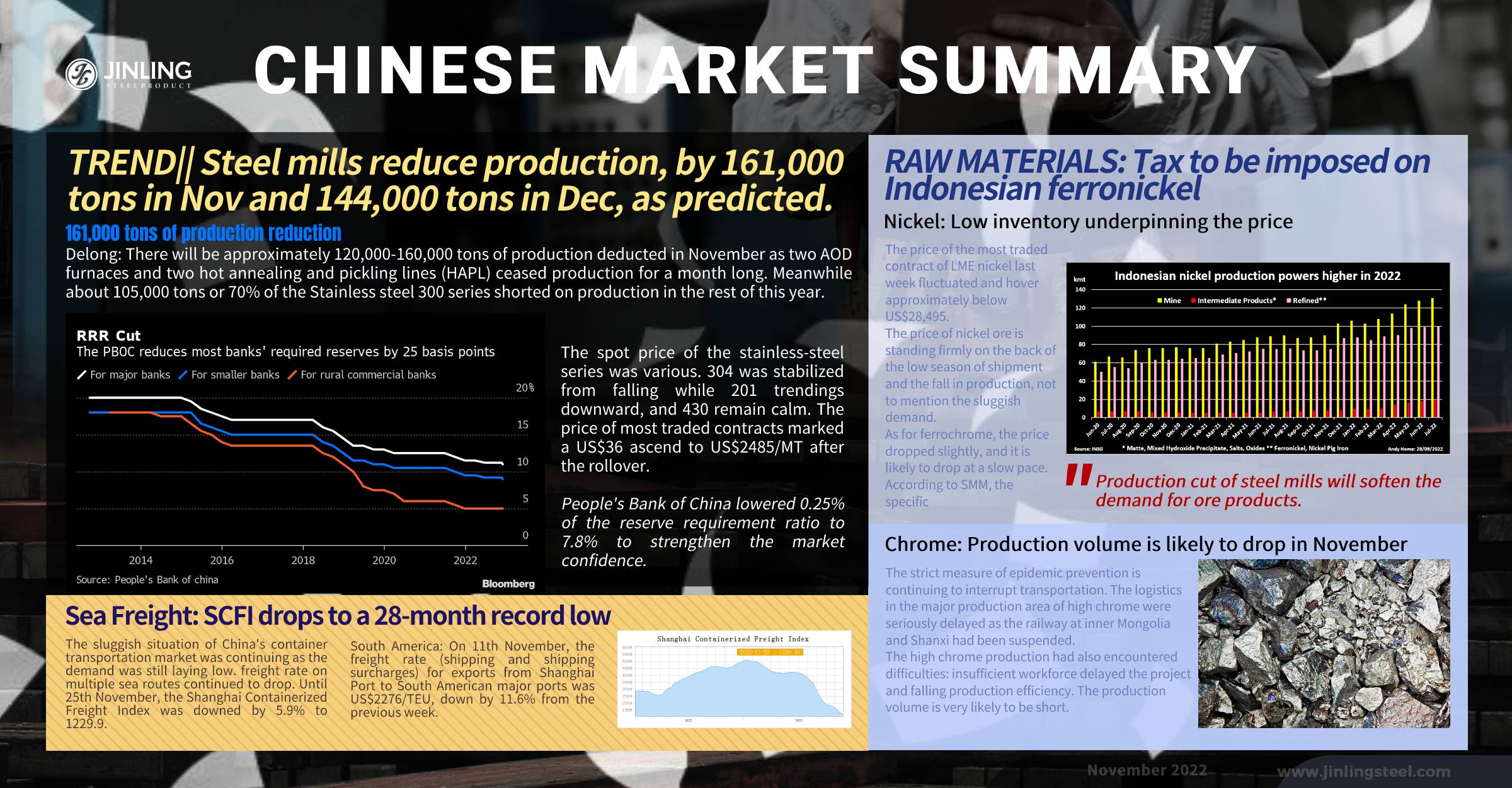

The spot price of the stainless-steel series was various. 304 was stabilized from falling while 201 trendings downward, and 430 remain calm. The price of most traded contracts marked a US$36 ascend to US$2485/MT after the rollover. People's Bank of China lowered 0.25% of the reserve requirement ratio to 7.8% to strengthen the market confidence.

image from bloomberg

Stainless Steel 300 Series: Production cut stabilized the price

The spot price of stainless steel 304 fluctuated. Cold-rolled 4-foot mill-edge stainless steel 304 had closed at US$2460/MT with US$21 rose.

The price of hot rolled stainless steel 304 rose by US$14, quoted US$2405/MT. The covid-19 pandemic had spiked again across China to interrupt the transportation of stainless-steel products, mills are cutting their production in manage to stabilize the market. The theoretical production cost downed US$4 to US$2520/MT.

Stainless Steel 200 Series: Transactions remain sluggish

The most traded base price of cold rolled stainless steel 201 propped up at US$1470/MT, cold rolled stainless steel 201J2 fell US$21 to US$1375/MT, hot rolled 5-foot stainless steel also declined US$21 to US$1390/MT.

The transaction performance of stainless steel 201 was dull, the agencies of Tsingshan reduced their price and received a fair response from the market until Wednesday, then it turned featureless.

Stainless Steel 400 series: slight increment in inventory

The guidance price of stainless steel 430/2B quoted by TISCO and JISCO had both stabilized at US$1340/MT and US$1300/MT accordingly.

EXW price of high chrome stabilized between US$1255-1285/MT.

Stainless Steel Futures:

The most traded contract price of stainless steel had a small rebound to US$2490/MT under the influence of the production cut.

The current contango structure was caused by:

1. The shaken-off market confidence and sluggish transaction

2. The down-turning inventory level.

The term structure could be shifted to distant contango under the influence of the production reduction, narrowing price difference by month and the possibility of a heavy tax on nickel.

In summary:

The indigestion of inventory may ease off in the coming weeks as the plan of production cut is settled for November and December, the sluggish transaction might leave limited space for the price to grow.

Stainless steel 300 Series: Both demand and supply had a significant drop, but the decrease in the reserve ratio which was newly announced by the People Bank of China would stimulate commodity investment.

Stainless steel 200 series: Traders still hold pessimistic toward the market as it is frequently interrupted by the pandemic.

Stainless steel 400 series: There was no further improvement in the transaction (as other series do), and it is likely to remain weak in a short period of time.

INVENTORY|| The late decline in November

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| November 17th | 37,760 | 334,371 | 91,571 | 463,702 |

| November 24th | 37,502 | 324,196 | 92,431 | 454,129 |

| Difference | -258 | -10,175 | 860 | -9,573 |

The inventory level at the Wuxi sample warehouse rose by 9,573 tons to 454,129 tons (as of 24th November).

the breakdown is as followed:

200 series: 258 tons down to 37,502 tons

300 Series: 10,175 tons down to 324,196 tons

400 series: 860 tons up to 92,431 tons

Stainless steel 200 series: Slight decrease

The first reduction in November recorded 258 tons. Beigang New Material account for the majority amount of arriving resources and Baosteel Desheng’s shipment dropped by 30%-50%. The reduction in the market softens the pressure over Wuxi inventory.

Stainless steel 300 series: Slight decrease

The inventory level had shifted downward. The reasons are clear: production cut, high standing production cost and the gloomy performance of the transaction. Delong has stopped its two production lines in Xiangshui's mill and the the production in Dainan Base has completely seized. There was a 70% decrease in stainless steel shipment from Delong reportedly. And some recent new resources are from Indonesia arrived, which were produced in mid-October.

Stainless steel 400 series: Insignificant increase

860 tons of inventory increase did not accelerate the digestion. Contiunous strong quarantine, delayed shipment and spiking freight fare might slow the digestion down further.

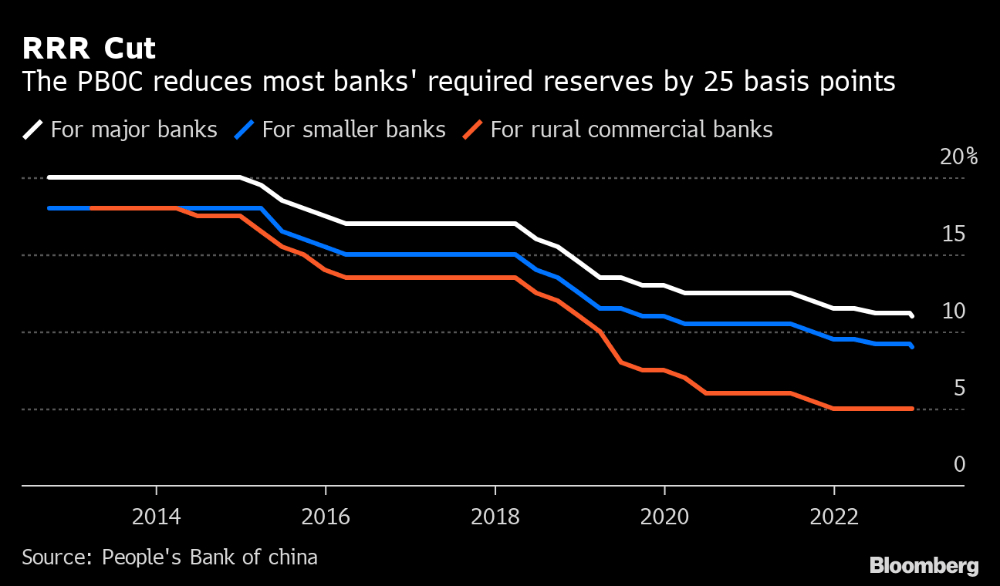

RAWMATERIALS|| Production cut of steel mills to soften the demand for ore products.

Nickel: Low inventory underpinning the price

The price of the most traded contract of LME nickel last week fluctuated and hover approximately below US$28,495.

The price of nickel ore is standing firmly on the back of the low season of shipment and the fall in production, not to mention the sluggish demand.

As for ferrochrome, the price dropped slightly, and it is likely to drop at a slow pace. According to SMM, Indonesian specific plan for export tax on Nickel will be published later this week, the ratio will be varied by the price movement of LME Nickle up to 12% allegedly.

image from bloomberg

As for refined nickel, transactions remained in a weak trend, the current price level cannot correctly match the purchasing power of the downstream user. The inventory level of LME Nickel rebound to 51,400 tons, but it is still considered low. The affected by the pace of the US interest rate rise is slowed, but the heavy impact on the nickel price remains as the inflation rate

As a whole, the price of nickel ore and ferrochrome was bearing the pressure from production cuts, and demand of refine nickel stayed sluggish.

Chrome: Production volume is likely to drop in November

The strict measure of epidemic prevention is continuing to interrupt transportation. The logistics in the major production area of high chrome were seriously delayed as the railway at inner Mongolia and Shanxi had been suspended.

The high chrome production had also encountered difficulties: insufficient workforce delayed the project and falling production efficiency. The production volume is very likely to be short.

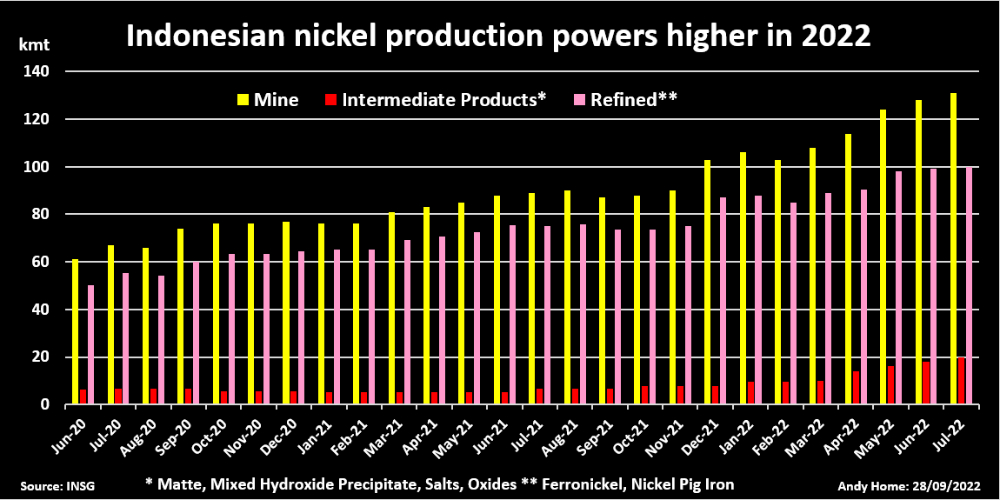

SEA FREIGHT|| SCFE index falls to 28-month recond low

The decline in container freight rates has not stopped, and the US-West line and the European line have fallen back to the starting point in 2020. The small peak season for shipments before the Spring Festival may be "lost".

The sluggish situation of China's container transportation market was continuing as the demand was still laying low. freight rate on multiple sea routes continued to drop. Until 25th November, the Shanghai Containerized Freight Index was downed by 5.9% to 1229.9. It fell for the 23rd consecutive week, hitting a 28-month low since late August 2020, and freight rates on major routes fell across the board.

Europe/ Mediterranean: The Eurozone Manufacturing purchasing managers index (PMI) arrived at 47.3 in November, according to Markit, The overwhelming economy in Europe is continuing to be haunted by the spiking energy price and it had driven the index to lay below the threshold for 5 months long.

On 25th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1100/TEU, an 6.1% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1842/TEU, down by 6.4%

North America: According to the figures newly released by Markit, the Manufacturing purchasing managers index landed at 47.6, down from 50.4 in October. “The S&P Global Flash US Manufacturing PMI signalled a renewed decline in operating conditions at manufacturers in November. The deterioration in the health of the sector was solid and the first since June 2020.”

On 25th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1496/FEU and US$3687/FEU, 4% and 4.9% fall accordingly.

The Persian Gulf and the Red Sea: The freight rate dropped significantly last week. On 25th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 10.3% fall from last week's posted US$1250/TEU.

Australia/ New Zealand: The freight rate continued to drop. On 25th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$613/TEU, down by 23.6% from the previous week.

South America: The supply-demand curve was imbalanced and drag the freight rate down. On 11th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2276/TEU, down by 11.6% from the previous week.