The market remains just the same sluggish as before. China's export volume slumped by 12.4% in June as global demand weakened; meanwhile, China's import volume also slides 6.8% from May. It appeals to people's concerns about the future economy. But to a certain extent, some might have already established the mindset to accept the gloomy future. Stainless steel prices tended to fall last week, while the stainless steel inventory increased by 12,509 tons. Please keep reading if you want to know more about the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,285 | -1 | -0.07% |

| Foshan | 2,330 | -1 | -0.06% | ||

| Hongwang | Wuxi | 2,225 | -4 | -0.20% | |

| Foshan | 2,205 | 4 | 0.20% | ||

| 304/NO.1 | ESS | Wuxi | 2,115 | -6 | -0.28% |

| Foshan | 2,125 | -7 | -0.35% | ||

| 316L/2B | TISCO | Wuxi | 3,965 | -6 | -0.15% |

| Foshan | 3,995 | 0 | 0% | ||

| 316L/NO.1 | ESS | Wuxi | 3,805 | 0 | 0% |

| Foshan | 3,815 | -8 | -0.23% | ||

| 201J1/2B | Hongwang | Wuxi | 1,370 | -34 | -2.62% |

| Foshan | 1,355 | -14 | -1.12% | ||

| J5/2B | Hongwang | Wuxi | 1,280 | -27 | -2.25% |

| Foshan | 1,275 | -23 | -1.90% | ||

| 430/2B | TISCO | Wuxi | 1,260 | 0 | 0% |

| Foshan | 1,255 | 0 | 0% |

TREND|| Stock accumulation in weak season concerns the market.

The future price of stainless steel price went up at the beginning of last week along with the nickel price, the spot price follow suit but reported losses on Friday. The mainstream contract price of stainless steel once hit US$2245/MT last week then closed at US$2230/MT last Friday with 1.46% growth.

Stainless steel 200 series: the heaviest price drop among other series.

The transaction of 200 series started actively but then it turned sedated at the bottom half of last week: The mainstream base price of stainless steel 201 fell by US$7 to US$1340/MT; cold rolled stainless steel 201J2 fell by US$14/MT and reported US$1250/MT; the hot rolled 5-foot stainless steel also dropped US$14 to US$1385/MT.

Most of the stainless steel traders were holding a “wait and see” attitude amid the then early collapse last week. It is understood that the off-season led to a sluggish market performance.

Stainless steel 300 series: Accumulation continues

Similar to the market performance of the 200 series, the transaction 300 series turned weak in the second half of last week.

The mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 closed at US$2185/MT with a US$7 descent, the hot-rolled 304 also reported a US$7 loss and closed at US$2115/MT.

Stainless steel 400 series: Price was too stubborn to move.

The market guidance price quoted by TISCO and JISCO has been frozen at the same position for a month, reporting US$1390/MT and US$1490/MT accordingly.

The quoted price of 430/2B in the Wuxi market also remained untouched at between US$1260/MT-US$ 1270/MT.

INVENTORY|| Cold rolled down, hot rolled up.

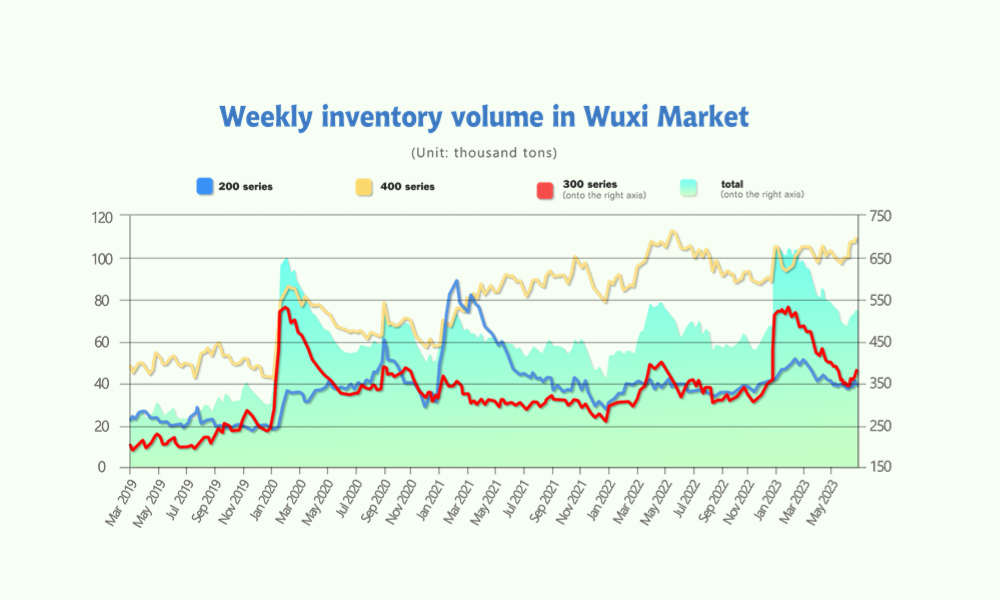

The total inventory at the Wuxi sample warehouse rose by 12,509 tons to 525,090 tons (as of 13th July).

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| July 6th | 40,713 | 364,436 | 107,432 | 512,581 |

| July 13rd | 39,320 | 377,292 | 108,478 | 525,090 |

| Difference | -1,393 | 12,856 | 1,046 | 12,509 |

the breakdown is as followed:

200 series: 1,393 tons went down to 39,320 tons

300 Series: 12,856 tons went up to 377,292 tons

400 series: 1,046 tons went up to 108,478 tons

Stainless steel 200 Series: Slower supply, inventory dropped slightly.

Steel mill deliveries were scarce last week, with Tsingshan resources being the main source, and some steel mill resources were in transit and had not yet arrived in Wuxi. The delivery of the 200 series may be affected by maintenance at Baosteel. Market transactions were weak during last week, accompanied by a decline in prices led by steel mills. The J2/J5 cold-rolled price dropped to US$1240/MT. With the background of a slow season and falling prices, the buyers in the downstream became more cautious, resulting in a relatively narrower overall outflow. However, due to delayed supply replenishment, spot inventory showed a reduction.

Stainless steel 300 Series: High production levels boost the inventory

Both cold-rolled and hot-rolled production saw an increase. Tsingshan Steel increased its registered warehouse delivery, accumulating an additional 26,000 tons of warehouse receipts over seven trading days, which diverted some of the cold-rolled resources in the spot market and alleviated the pressure of inventory accumulation. The production of the 300 series in July is expected to remain at a high level of 1.66 million tons, with the potential for increased inventory and attention to downstream stocking pace during the peak season.

Stainless steel 400 Series: Continual inventory accumulation

Market transactions for the 400 series have been moderate recently. Despite a slight increase in high-chromium raw material prices, large-scale maintenance is being conducted by major steel mills such as JISCO and Fuxin, resulting in manufacturers' reluctance to sell at low prices. Although there has not been a significant decline in prices, the 400 series stainless steel market has had a few positive factors recently, coupled with significant inventory pressure. It is expected that manufacturers will become more active in deliveries next week, leading to a potential reduction in spot inventory.

Summary:

Stainless steel futures prices performed stronger than the spot market last week, but the trading atmosphere in the spot market remained sluggish. Steel mill production levels remained high, causing concerns about inventory accumulation in the market, which hindered transactions. It is expected that stainless steel prices will experience a weak and fluctuating trend in the future.

300 Series: Overall positive sentiment in the commodities market led to volatility in stainless steel futures prices, with a slight increase in spot prices. However, after the price increase, trading volume declined. Short-term private cold-rolled stainless steel prices are predominantly weak, ranging between US$2165/MT-US$ 2235/MT.

200 Series: Under the influence of the steel mill's downward price trend at the opening, the cold-rolled J2/J5 x price finally reached the US$1240/MT mark. Faced with oversold prices, traders were unable to respond. Currently, it is still the low season for demand, and the downward price trend has slowed compared to the previous week. Future attention will be on the actions of steel mills, and it is expected that the spot price of stainless steel 201 will operate in a stable-to-weak manner next week, with the cold-rolled stainless steel J2/J5 base price ranging between US$1215/MT-US$1255/MT.

400 Series: This week, mainstream ex-factory prices for high-chromium stainless steel saw a slight increase. The spot price of the concentrated ore (40%~42%) from South Africa remained around US$8.16/MT, while the price of Chrome Lump Turkey (Cr2O3 40-42%) stabilized at 9 USD/ton. The mainstream price of stainless steel 430/2B in the Wuxi market continued to be weak and stable, remaining at US$1260/MT-US$ 1270/MT.

Market transactions for the stainless steel 400 series were moderate this week, with a significant inventory accumulation in the spot market. Manufacturers of the 400 series faced increased sales pressure. It is expected that the price of cold-rolled stainless steel 430 will continue to be stable-to-weak next week.

RAW Material|| “Powerless” supply

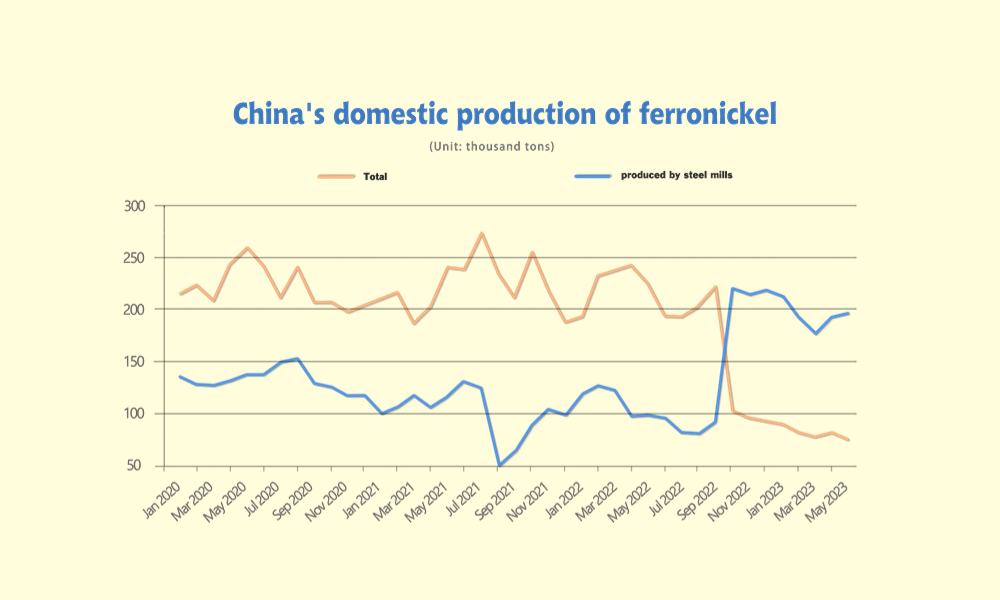

Nickel: Production slid

The EXW price of high-grade ferronickel remained flat at US$255/nickel point. The price of ferrochrome rose US$7/MT to US$1320/MT(50% nickel).

The total production of high-grade ferronickel in June dropped slightly, even though most of the steel mills in China can report decent profitability at the current production cost.

According to statistics, the overall production of major ferronickel producers and steel mills in China in June 2023 was approximately 270,900 tons, a decrease of 2,700 tons compared to May 2023, which had a production of 273,600 tons. Among them, the production of high-nickel iron by steel mills was approximately 196,100 tons, an increase of 4,000 tons compared to the previous month, while the production of High-grade ferronickel by factories was approximately 74,800 tons, a decrease of 6,700 tons compared to the previous month.

In early July, nickel-iron prices accelerated their decline, and the current mainstream EXW price is around US$255/Nickel point, falling below the cost line. Domestic iron plants are facing significant losses, and stainless steel prices are also weak, fluctuating near the cost line. Steel mills are increasing their efforts to negotiate lower prices for raw materials. If iron plants continue to suffer losses, the domestic production of high-nickel iron in July is expected to decline.

Chrome: The power cut troubles the production.

The spot price of the concentrated ore (40%~42%) from South Africa remained around US$8.16/MT, while the price of Chrome Lump Turkey (Cr2O3 40-42%) stabilized at 9 USD/ton.

The price of chrome ore, on the other hand, had a US$7.04/MT surged between US$1320/MT-US$1345/MT.

Eskom has in the middle of icy weather announced the implementation of intermittent Stage 4 and Stage 6 load shedding. In a statement on Wednesday morning, the power utility cited a “loss of additional generating units overnight, the extensive use of Open Gas Cycle Turbines, and the inability to replenish pumped storage dam levels”. According to Eskom, Stage 4 load shedding will be implemented from 07:00 last Wednesday morning until 14:00. Thereafter, Stage 6 load shedding will be implemented from 14:00 on last 12 July until 05:00 on 14 July – it said.

MACRO: China Exports Slumped 12.4% in June as Global Demand Weakened

China’s exports tumbled 12.4 percent in June from a year earlier as demand weakened after central banks raised interest rates to curb inflation even as Chinese leaders struggled to keep a post-COVID recovery from faltering.

Customs data released Thursday showed imports slid 6.8 percent to $214.7 billion. Exports edged up slightly from the month before, totaling $285.3 billion. The trade surplus was $70.6 billion, rising from $65.8 billion in May.

Several factors contributed to this situation: firstly, the high base effect from the same period last year; secondly, the lingering impact of backlogged orders from previous periods; and thirdly, although overseas demand showed resilience, it has slowed down on a month-to-month basis, and structural effects are present.

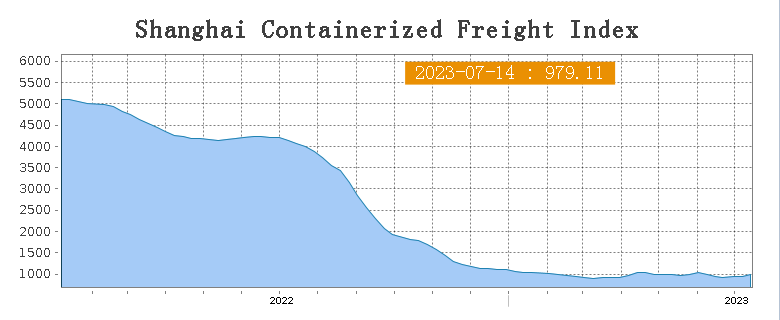

Sea Freight|| Freight market steadily marching on.

China’s Containerized Freight market was overall stabilize. On 14th July, the Shanghai Containerized Freight Index rose by 5.1% to 979.11.

Europe/ Mediterranean: The loading rate of European freight line landed above 95% which secured by the stable supply-demand.

Until 14th July, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$738/TEU, which fell by 0.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1412/TEU, which fell by 0.1%

North America: The imbalance supply-demand of East America freight line has been easing off, loading rates of serval shipping organizations bounce back to around 90%-95%, and they had adjusted their freight rate accordingly.

Until 14th July, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1771/FEU and US$2662/FEU, reporting a 26.1% and 12.4% growth respectively.

The Persian Gulf and the Red Sea: Until 14th July, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 11.5% from last week's posted US$1013/TEU.

Australia/ New Zealand: Until 14th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$248/TEU, a 0.4% slide from the previous week.

South America: The freight market had a slight rebound. on 14th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2665/TEU, an 1.9% growth from the previous week.