Officially, it is the peak season traditionally. Do you feel the market warming up? However, last week, the stainless steel prices headed down and steel mills struggled to hold up. Although the raw material cost remains high, and down to earth, the weaker the demand, the more hesitant the buyers become. The spot inventory is stacking up due to the bleak market. Moreover, according to statistics of the scheduled output of stainless steel in China, the output in September will increase to 3,195.3 kilotonnes, MoM 0.29%, and YoY 20.47% higher. When global output (China excluded) and global demand both drop, the increase in China's output only conveys worries to us. It is overcapacity. How to digest the extra resources? It seems like in the long run, the price only has one way to go, and the competition will get intense. If you want to know more about the Stainless Steel Market Summary in China, please keep rolling down.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,360 | -13 | -0.55% |

| Foshan | 2,405 | -10 | -0.42% | ||

| Hongwang | Wuxi | 2,280 | -25 | -1.14% | |

| Foshan | 2,290 | -15 | -0.70% | ||

| 304/NO.1 | ESS | Wuxi | 2,200 | -18 | -0.86% |

| Foshan | 2,230 | -17 | -0.78% | ||

| 316L/2B | TISCO | Wuxi | 4,080 | -3 | -0.07% |

| Foshan | 4,145 | -17 | -0.41% | ||

| 316L/NO.1 | ESS | Wuxi | 3,945 | -19 | -0.51% |

| Foshan | 3,945 | -11 | -0.29% | ||

| 201J1/2B | Hongwang | Wuxi | 1,405 | -1 | -0.11% |

| Foshan | 1,405 | 3 | 0.22% | ||

| J5/2B | Hongwang | Wuxi | 1,325 | -6 | -0.46% |

| Foshan | 1,330 | -1 | -0.11% | ||

| 430/2B | TISCO | Wuxi | 1,285 | 3 | 0.24% |

| Foshan | 1,260 | 4 | 0.36% |

TREND|| Steel mills have got tricks up their sleeve to lift the price.

The trend of stainless-steel spot price last week was slightly weak, almost all series ended up with a similar result as the previous week: stainless steel 201 stabilized after a fall; stainless steel 304 experienced a bumpy ride; stainless steel 430 stabilized. Last Friday, the mainstream contract price of stainless steel rose US$2 to US$2325/MT.

Stainless steel 300 series: Another price limitation

The market price of stainless steel 304 harvested a sluggish performance: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 fell US$7 to US$2240/MT, private-produced hot-rolled stainless steel dropped US$21 to US$2195/MT.

The future price and the spot price fell together in the first half of last week, and Tsingshan simultaneously announced a limitation on the sales price. Then the downward trend was stopped somehow in the second half of last week. It is understood that one of the biggest steel mills in East China is shifting its production priority from flat billet to square billet.

Stainless steel 200 series: Weak demand and weak transaction.

The spot price movement of stainless steel 201 was relatively weak last week: the mainstream base price of cold-rolled stainless steel 201 fell US$7 to US$1380/MT, cold-rolled stainless steel 201J2 closed at US$1295/MT with a US$14 drop, the 5-foot hot rolled stainless steel remained flat at US$1335/MT.

Stainless steel 400 series: Remained a steady performance.

The spot price of stainless steel 430 was overall stabilized: the mainstream quote price of cold-rolled stainless-steel 430 remained unchanged from the previous week, closed at US$1285/MT, and hot-rolled stainless steel 430 grew by US$14 to US$1140.

Summary:

Stainless steel prices rebounded this week, putting an end to the previous decline. Raw material prices continue to support stainless steel prices but also exert pressure on steel production costs. However, sluggish downstream demand has led to a cautious market sentiment. With the arrival of the traditional peak season of "Golden September and Silver October", the focus in the future will be on delivery conditions, changes in steel mill production schedules, and whether end demand can match the pace of supply. The expected outlook for stainless steel is a relatively strong and fluctuating trend.

300 Series: Currently, raw material prices remain strong, and steel production costs are at a high level. In September, steel mills are facing significant operational pressures, leading to price stabilization following recent measures such as price limits and production shifts by steel mills. Market trading confidence is gradually improving, boosting prices to stop a further decline. In the short term, it is expected that the quotation for 300 series stainless steel cold-rolled by private enterprises will remain stable with a slight strengthening trend, in the range of US$2195/MT-US$ 2290/MT.

200 Series: The overall trend for 201 stainless steel in August was positive, while market transactions have been relatively flat. Currently, steel mill supply remains tight, and with the arrival of the traditional peak season in September, there is an expectation of improved downstream demand. It is predictable that in September, 201 stainless steel will operate with an initial downtrend followed by a rebound, with 201J2/J5 cold-rolled prices fluctuating in the range of US$1280/MT-US$1330/MT.

400 Series: When looking at the current steel mill production situation, some steel mills have completed maintenance in August and are resuming production in September, increasing supply. There has been a slight increase in downstream inquiries, but manufacturers' quotations remain firm, and there is a strong wait-and-see sentiment. The price of 430 stainless steel is currently stable. In the long term, with the traditional peak season approaching and increased demand, combined with high steel production costs, it is expected that the price of 430 cold-rolled stainless steel in September will fluctuate in the range of US$1265/MT-US$1310/MT.

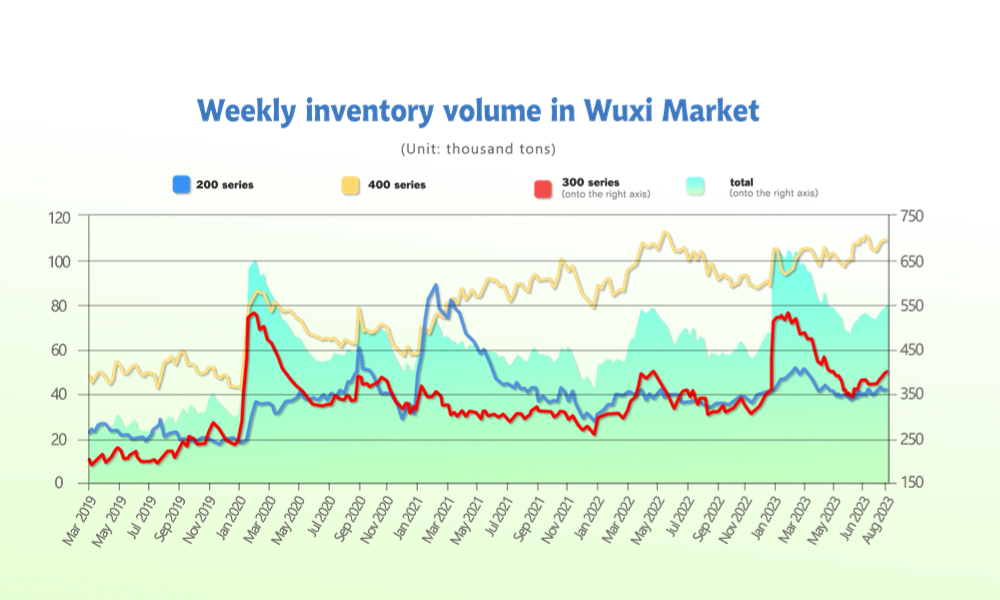

INVENTORY|| Inventory anticipates a “weight loss” in peak season.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| August 24th | 40,762 | 389,527 | 107,946 | 538,235 |

| August 31st | 40,092 | 398,283 | 108,488 | 546,863 |

| Difference | -670 | 8,756 | 542 | 8,628 |

The total inventory at the Wuxi sample warehouse rose by US$8,628 tons to 546,863 tons (as of 31st August).

the breakdown is as followed:

200 series: 670 tons down to 40,092 tons

300 Series: 8,756 tons up to 398,283 tons

400 series: 542 tons up to 108,488 tons

Stainless steel 300 series: Three consecutive increase

The stainless steel 300 series inventory concluded a decent growth, and it was the third week in a row. The demand was weak still. During this inventory cycle, the prices of futures and spot goods have experienced a weak pullback, with sluggish performance in spot transactions and outbound shipments. The downstream purchases have not kept pace with the continuous orders from agents and traders in the previous period, resulting in continuous inventory increases in the East China region for the 300 series.

Stainless steel 200 series: Supply narrowed

The slight decrease in inventory mainly was cold-rolled stainless steel. Tsingshan’s stainless steel resources had the largest share in the goods' arrival last week despite the supply from other steel mills contracting.

Stainless steel 400 series: A slight increase

It is known that the “wait and see” sentiment was considerably strong downstream although the market received increasing price inquiry. The inventory level of the stainless steel 400 series is expected to lift in the coming week.

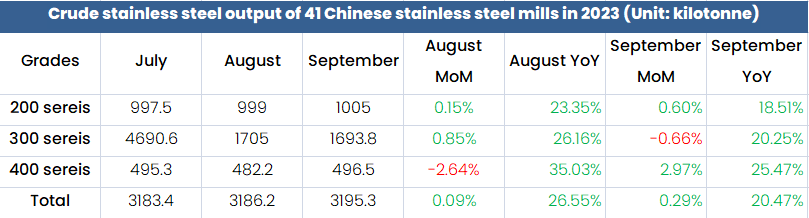

Production||China's September stainless steel production is expected to increase by 20.47% year-on-year

August stainless steel production

The total production of crude steel in August was 3.18 million tons, 0.09% increased month on month, 26.55% climb year on year.

The break down as follows:

Series 200:

Production: 999,000 tons, 0.15% tons more than July, 23.35% more than the same period last year.

Series 300:

Production: 1,705,000 tons, 0.85% tons more than July, 26.16% more than the same period last year.

Series 400:

Production: 482,200 tons, 2.64 % tons less than July, 35.03% more than the same period last year.

September stainless steel production

In September 2023, the planned production volume of crude steel by China steel mills was 3.195 million tons, an increase of 0.29% compared to the previous month, and a surge of 20.47% year-on-year.

The break down as follows:

Series 200:

Production: 1,005,000 tons, 0.6% tons more than August, 18.51% more than the same period last year.

Series 300:

Production: 1,693,800 tons, 0.66% tons less than August, 20.25% more than the same period last year.

Series 400:

Production: 496,500 tons, 2.97 % tons more than August, 25.47% more than the same period last year.

Opinion: The excess capacity is causing trouble for China's Stainless steel industry.

The domestic stainless steel production in China had already outpaced the overseas production this year, and China is grabbing a larger share in crude steel production with about a 3% annual increment. Hence, the world’s crude steel production is likely to drop 1% in the year 2023, while the traditional crude steel producer countries further shrunk the production volume.

However, behind the delightful figures, the production in the Chinese stainless-steel market has actually reached saturation point, while the production cost is too high to derive new substitutions. It might be a long shot to wait for a well-balanced supply-demand in current scenarios.

China summarized 30.6 million tons of crude steel production in 2022, and the nominal consumption to hit 32.22 million tons. Surprisingly, the production capacity was accounted for 47,42 million tons, over 46% higher than the demand. Unfortunately, there will be more straws to stack on the camel’s back- about 4.36 million tons of new production capacity will be released in 2023 and 10 million tons more in the short future.

RAW Material|| Indonesian nickel smelters turn to Philippines for ore as local supply tightens.

The mainstream EXW price of high ferronickel remained unchanged at US$270/MT, the ferrochrome also remained flat at US$1380/MT.

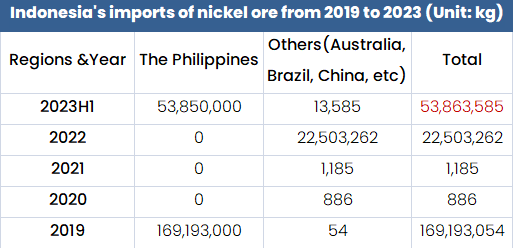

Nickel smelters in top producer Indonesia are making rare purchases of ore from the Philippines to ease tight supplies, people familiar with the matter said, upending trade flows of the raw material and pushing up costs across the supply chain.

Jakarta recently delayed the issuing of mining quotas and suspended operations at a key site of state miner Aneka Tambang (ANTM.JK) (Antam) after an investigation into corrupt practices in issuing mining allowances.

While mining at other sites continues and Indonesia, which accounts for half of global mined supply, has said there is no shortage of ore, prices have risen about 8% this week, following a 10% surge a week earlier, local buyers say.

Indonesia imported 53,864 metric tons of nickel ore in the first half of 2023, up from 22,503 tons for all of 2022, Indonesian trade data showed.

But imports from the Philippines only started in May, and all arrived at Morowali port in a huge nickel processing park run partly by Chinese nickel giant Tsingshan Group, the Indonesian data showed.

"The ore from the Philippines is generally lower grade than Indonesian material which will push operating costs higher due to lower production from same tonnage of ore," said Wood Mackenzie analyst Andrew Mitchell.

Indonesia exported much of its ore before a 2020 ban halted all shipments and attracted billions of dollars worth of investment in nickel smelting, mostly from Chinese companies.

Imports from the Philippines could rise to 100,000 tons for July and August combined because of the supply tightness, according to a Chinese consultancy.

Sea Freight|| Demand overall stabilized.

China’s Containerized Freight market was overall stabilized. On 1st September, the Shanghai Containerized Freight Index fell by 2.0% to 1033.67.

Europe/ Mediterranean:

In August 2023, the Economic Sentiment Indicator (ESI) continued to decline in both the EU (-0.6 points to 92.9) and the euro area (-1.2 points to 93.3). Also the Employment Expectations Indicator and consumer confidence indicator declined further.

Until 1st September, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$768/TEU, which fell by 4.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1364/TEU, which fell by 6.3%

North America:

Workers filing for the first time for unemployment benefits reached a seasonally adjusted 228,000 last week, down 4,000 from the previous week and the lowest total in a month, according to new statistics from the Labor Department released last Thursday.

On 1st September, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2136/FEU and US$3132/FEU, reporting a 6.5% and 2.6% growth accordingly.

The Persian Gulf and the Red Sea:

On 1st September, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 5.3% from last week's posted US$962/TEU.

Australia/ New Zealand:

On 1st September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$588/TEU, a 13.1% jump from the previous week.

South America:

The freight market had a slight rebound. On 1st September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2055/TEU, an 2.5% fall from the previous week.