It is rare to see continuous increments in stainless steel prices now, and last week, we witnessed some steady rises. Mostly, people believe the price rise was contributed by the increasing LME and ShFE nickel prices, which was boosted by a rumor that China will purchase nickel as a reserve. And now, it might be the right time for Beijing to do so as the nickel price was at its low point for a long time. Therefore, people has taken advantage of this speculation, to push up the prices. To the stainless steel market, the demand recovery would still be the primary hurdle for continued price growth, based on the circumstance that the stainless steel market is now overwhelmed with oversupply. If you want to know more about Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,295 | 7 | 0.33% |

| Foshan | 2,335 | 7 | 0.32% | ||

| Hongwang | Wuxi | 2,230 | 4 | 0.20% | |

| Foshan | 2,225 | 17 | 0.81% | ||

| 304/NO.1 | ESS | Wuxi | 2,115 | 0 | 0.00% |

| Foshan | 2,140 | 11 | 0.56% | ||

| 316L/2B | TISCO | Wuxi | 3,970 | 3 | 0.07% |

| Foshan | 4,005 | 8 | 0.22% | ||

| 316L/NO.1 | ESS | Wuxi | 3,815 | 6 | 0.15% |

| Foshan | 3,820 | 6 | 0.15% | ||

| 201J1/2B | Hongwang | Wuxi | 1,365 | -4 | -0.34% |

| Foshan | 1,365 | 8 | 0.68% | ||

| J5/2B | Hongwang | Wuxi | 1,275 | -4 | -0.36% |

| Foshan | 1,280 | 6 | 0.49% | ||

| 430/2B | TISCO | Wuxi | 1,260 | 0 | 0% |

| Foshan | 1,230 | -25 | -2.22% |

TREND|| The future price and spot price jumped together.

The futures of stainless steel and the nickel became more valuable last week amid the speculation of the national nickel acquisition. The market sentiment was bearish at the beginning of last week, but then the stainless steel price had a significant hike on Thursday. The mainstream contract price closed at US$2285/MT with a weekly growth of 2.54%. The spot price of stainless steel 201 and 304 spiked after a tepid trend, stainless steel 430 remained flat.

Stainless steel 300 series: The price surge makes 300 series outstands.

The price trend of stainless steel 304 last week was choppy: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 harvested a US$28 growth and closed at US$2215/MT; the hot-rolled stainless steel 304 gained US$35 and reached US$2150/MT. The sellers received few responses at the beginning of last week but the market then turned warm as the spot price rose.

Stainless steel 200 series: The price of stainless steel rebound.

The spot price of stainless steel 201 in Wuxi experienced a bumpy ride last week but all end up with a decent gain from the previous week: the mainstream base price of cold-rolled stainless steel 201 closed at US$1355/MT with a US$21 growth; cold-rolled stainless steel 201J2 reported US$1260/MT which harvested US$14 increase and the 5-foot hot-rolled stainless steel also gain US$14 and closed at US$1300/MT.

The spot price of the 200 series had a slight descent in the first two days last week, but then immediately rebounded as the price of stainless steel J2/J5 touched US$1240/MT. It is believed that the sudden U-Turn could be the result of the intervention from Tsingshan and the hike of the stainless steel 300 series.

Stainless steel 400 series: The price remained untouched.

Two major steel mills have settled the guidance price of 430/2B at the same level for 5 weeks in a row, TISCO quoted for US$1390/MT and JISCO quoted for US$1490/MT.

The quoted price of 430/2B in the Wuxi market also remained flat and steady, the mainstream quoted price hold still being between US$1260/MT-US$ 1270/MT.

Specifications such as 1.0mm, 1.2mm, and 1.5mm were running short on storage allegedly.

Summary:

The stainless steel price had a significant growth last week, it had also lifted the transaction. But the demand recovery would still be the primary hurdle for continued price growth, based on the circumstance that the stainless steel market now is overwhelmed with oversupply.

300 Series: The inventory had gone up for 4 weeks in a row while one of the biggest stainless steel producers in China had fired up on the production. The upward momentum of stainless steel's future price is hooked with the spot price, the volatility of stainless steel price in the short term is foreseeable.

200 series: Contrary to the 300 series, the market performance of the 200 series remains sluggish, the weak demand diminishes the correlation between the price and the market transaction. The price of stainless steel 201 is projected to stabilize and remain strong, the mainstream price of cold rolled stainless steel 201J2 is likely to seesaw at between US$1240/MT-US$1285/MT.

400 series: The overall market performance of the 400 series was sedated by the disagreement between sellers and buyers on the sales price, the producer denied the possibility of underselling as the production cost is already peaked. The price movement of stainless steel 430 is likely to remain stable in the short term.

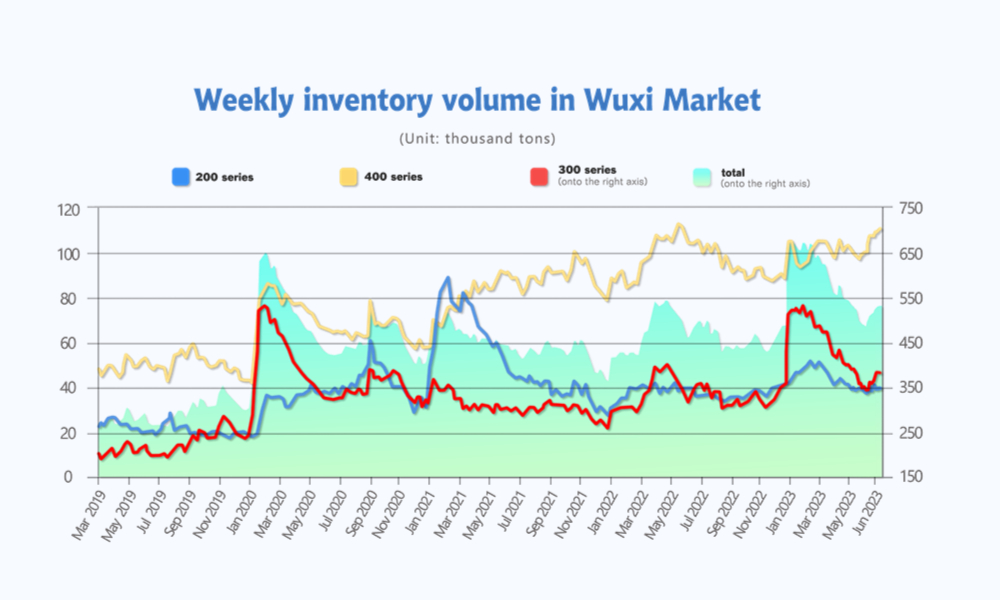

INVENTORY|| Inventory continued to stack up.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| July 13rd | 39,320 | 377,292 | 108,478 | 525,090 |

| July 20th | 39,720 | 378,992 | 109,590 | 528,302 |

| Difference | 400 | 1,700 | 1,110 | 3,212 |

The total inventory at the Wuxi sample warehouse rose by 3,212 tons to 528,302 tons (as of 20th July).

the breakdown is as followed:

200 series: 400 tons up to 39720 tons

300 Series: 1,700 tons up to 378,992 tons

400 series: 1,112 tons up to 109,590 tons

Stainless steel 200 series: A slight movement in inventory.

The 5-foot hot-rolled stainless steel dominated the 400 inventory increment last week while the cold-rolled stainless steel inventory dropped slightly.

Stainless steel 300 series: Production resumed, enlarging the supply scale.

The inventory of cold rolled resources of 300 series saw a 5,929 tons increase and the hot rolled inventory on the other hand was destocked by 4,267 tons.

Delong recover its production in Xiangsui and Liyang, and the distribution of cold rolled and hot rolled was slightly improved. Hence, Delong’s new production line in Liyang can hit the ground running in a short period.

Stainless steel 400 series: More inventory were labeled “unsaleable”.

The inventory of the stainless steel 400 series just refreshed a record high in 2023, reflecting the gloomy market performance. It is believed that the shrinking profit margin is the main reason for the producer not to undersell the resources.

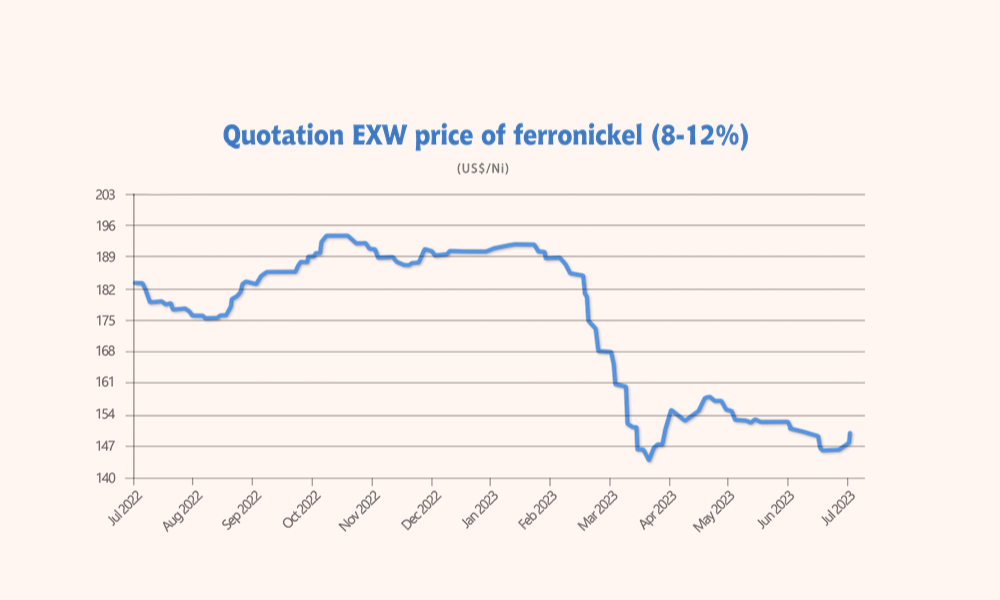

Raw Materials|| Nickel price pull up by the acquisition rumor.

The EXW price of high grade ferronickel rose by US$3.5 to US$260/Nickle point, and the price of Ferrochrome remain unchanged at US$1320/MT. The EXW price of high grade ferrochrome also remained stable at between US$1320/MT-US$1345/MT(50% Chromium). The spot price of coke ore rose US$7.

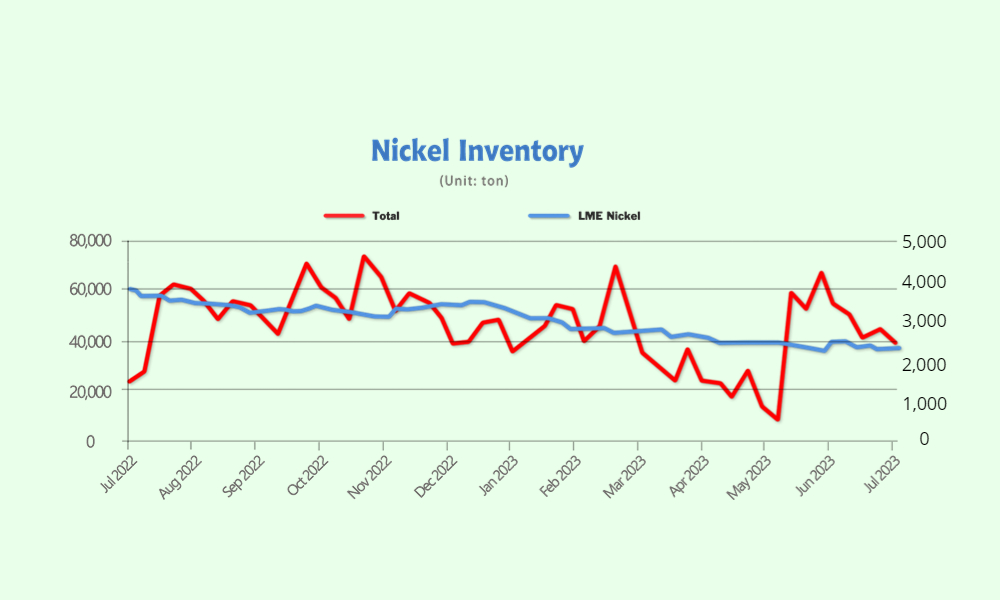

Nickel: Stainless steel future to reach the highest point since March.

The Nickel market last week harvest a decent result, affecting by the rumor of the national nickel reserve plans. The EXW price of high grade pig-iron (8-12%) went up by 2.39% to US$255/Nickel point.

According to the story reported by Financial Times in early June, China’s National Food and Strategic Reserves Administration (NFSRA) was set to purchase about 30,000 tons of nickel for depository and made inquires about the Copper. Apparently, the English’s claim swayed the Chinese metal market to some extent.

It could be the right time for NFSRA to acquire Nickel since the nickel price is already hit rock bottom. However, it is believed that even if the National Reserve Bureau enters the market for acquisition, the boost to nickel prices will likely be short-lived. On one hand, there are still around 180,000 tons of nickel inventories in the LME market. On the other hand, the current consumption demand in the nickel market has not shown significant improvement, with steel mills, electroplating companies, and nickel processors making purchases based on immediate needs. Thus, in the medium term, a downward trend may still be dominant.

Marco|| 6.3% GDP growth badly missing analysts' expectations.

The world’s second-largest economy expanded by 6.3% in the April to June months from a low base a year ago, according to data released by the National Bureau of Statistics (NBS) Monday.

The first industry went up by 3.7% compared to the same period last year, the second industry gain 4.3% and the third industry had a 6.4% increase. It is worth mentioning that the statistic of the second quarter last year was deeply affected by the COVID pandemic and the Shanghai lockdown, the GDP growth merely recorded a 0.4% in Q2 2022.

The quarterly overview reflects a passive image of China’s economic growth: the second quarter only grow 0.8 from Q1 2023, while the latter had a 2.2% jump from Q4 2022. Nevertheless, the half-year GDP growth (5.5%) presented so far has already achieved the goal of a 5% yearly increment which was established by Two Session in March.

The meeting of the Politburo of the Chinese Communist Party in late July might reveal China’s responses to the economic slump and the detailed economic stimulus.

Sea Freight|| Stabilized demand secured the index from a deeper fell.

The overall freight market in China was stabilized but it was being weak in growth. China’s Containerized Freight market was overall stabilized, but the demand recovery hit a bottleneck. On 21st July, the Shanghai Containerized Freight Index fell by 1.3% to 966.45.

Europe/ Mediterranean: According to Eurostat, The Harmonised Index of Consumer Prices in June recorded a 5.5% growth, but dropped slightly from May.

Until 21st July, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$742/TEU, which rose by 0.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1407/TEU, which fell by 0.4%.

North America: Until 21st July, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,764/FEU and US$2,676/FEU, reporting a 0.4% growth and 0.5% growth accordingly.

The Persian Gulf and the Red Sea: Until 21st July, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 7.4% from last week's posted US$938/TEU.

Australia/ New Zealand: Until 21st July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$257/TEU, a 3.6% growth from the previous week.

South America: On 21st July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2580/TEU, an 3.2% growth from the previous week.