Hope this a new week that won't disapoint you. The weekly average price of all major grades of stainless steel drop. On March 13th, after Tsingshan gave up the limit on the agency price, the price of stainless steel dropped further to be more competitive and soon, other prices followed to decrease in the market. As for the inventory, 200 series finally sees a decline after a consecutv 12-week increase. The turbulence and power outtage has influenced the chrome production, which will be added on the stainless steel price though currently the ore prices are on the way down. Last March, we witnessed the rentless LME nickel. However, as the metal market gets weaker, according to Jinling's recorded LME nickel closing prices, from February 1 to March 21, LME nickel fell from US$30,350 to US$22,700. Slide down for more important news of Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,585 | -78 | -3.07% |

| Foshan | 2,630 | -78 | -3.01% | ||

| Hongwang | Wuxi | 2,495 | -70 | -2.88% | |

| Foshan | 2,490 | -70 | -2.89% | ||

| 304/NO.1 | ESS | Wuxi | 2,425 | -92 | -3.86% |

| Foshan | 2,480 | -60 | -2.49% | ||

| 316L/2B | TISCO | Wuxi | 4,780 | -182 | -3.77% |

| Foshan | 4,905 | -126 | -2.58% | ||

| 316L/NO.1 | ESS | Wuxi | 4,600 | -141 | -3.06% |

| Foshan | 4,645 | -129 | -2.76% | ||

| 201J1/2B | Hongwang | Wuxi | 1,550 | -18 | -1.22% |

| Foshan | 1,525 | -12 | -0.83% | ||

| J5/2B | Hongwang | Wuxi | 1,440 | -23 | -1.75% |

| Foshan | 1,450 | -19 | -1.41% | ||

| 430/2B | TISCO | Wuxi | 1,290 | -53 | -4.32% |

| Foshan | 1,280 | -53 | -4.34% |

Trends|| 300 series stands out among all the price fall

The price trend of the stainless-steel series continued to dive and dived even further last week, the most traded contract price remained unchanged at US$2440/MT.

The most significant price drop since Chinese New Year was allegedly led by Tsingshan who just lifted the limit on their agency price. The products of Tsingshan then received an overwhelming response in the market last week.

Stainless steel 300 series: price finally became recognizable.

There was a major drop in the price of the stainless steel series last week. The most traded base price of cold-rolled 4-foot mill-edge 304 closed at US$2430/MT with a US$59 decrease while the hot rolled lost US$81/MT and quoted US$2405.

The future price also dipped rapidly as a response to the diving price of raw materials and the spot price of stainless steel.

Stainless steel 200 series: Bearish market persisted.

Until last Friday, both the most traded base price of cold-rolled stainless steel 201 and 201J2 fell US$29, closing at US$1505/MT and US$1400/MT respectively.

The hot rolled 5-foot stainless steel fell to US$1470/MT.

Stainless steel 400 series: The downstream is still not satisfied with the low price

The guidance price of 430/2B from TISCO was quoted at US$1470/MT with a US$37 drop, and JISCO quoted US$1515/MT with a US$15 fall.

The quoted price of 430/2B at the Wuxi market continued to drop steeply to US$1335/MT, recording a US59 decrease.

Baoxin (Ningbo) announced the EXW price of cold-rolled stainless steel products in March:

Cold-rolled stainless steel 430: US$1695/MT, a US$29 raise.

Cold-rolled stainless steel 304: Orders negotiated separately.

Summary:

The price of raw materials dropped while the Tsingshan agency price limit regulations were lifted.

Stainless steel series 300:

The price of nickel and stainless steel was maintain a downtrend despite it being gradually accepted by the downstream, and a big chunk of inventory volume was digested.

Stainless steel series 200:

Similar to series 300, series 200 endured a “slow-motion disaster” last week. However, both steel mills and downstream buyers remained in discretion on the current bearish market.

Stainless steel series 400:

The EXW price of high-grade chrome and the spot price of chrome ore remained a steady trend while the concentrated ore (40%~42%) from South Africa was quoted at US$8/MT. The pressure on the inventory persisted until last Friday. JISCO released an announcement urging their agents to comply with the guidance price. It is expected that the downturn could be ceased soon.

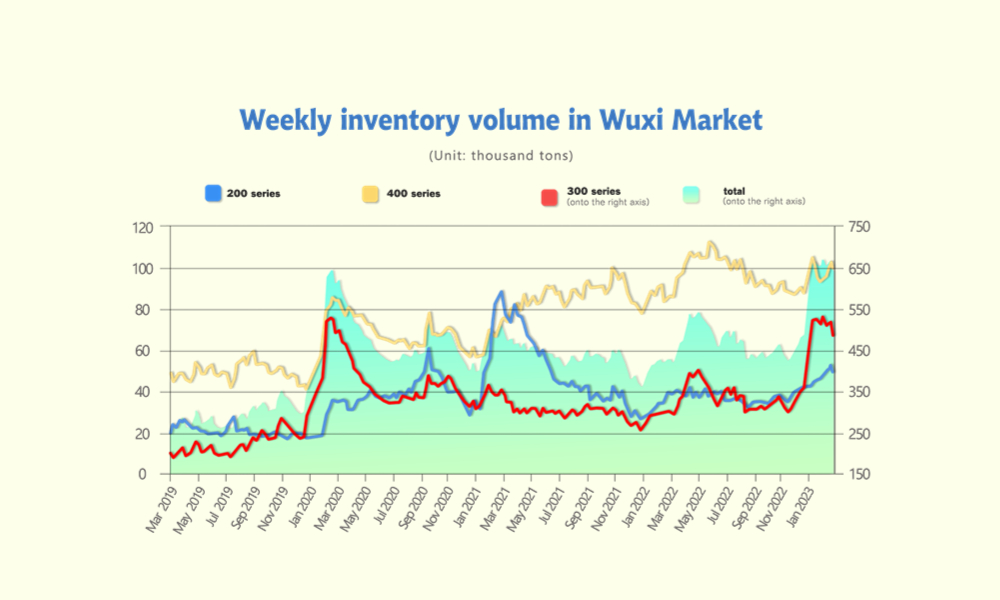

Inventory|| A 30,000 ton of pressure relieved

The inventory level at the Wuxi sample warehouse fell by 30,700 tons to 634,078 tons (as of 16th March).

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| March 9th | 51,160 | 513,743 | 99,900 | 664,803 |

| March 16th | 48,760 | 482,868 | 102,450 | 634,078 |

| Difference | -2,400 | -30,875 | 2,550 | -30,725 |

the breakdown is as followed:

200 series: 2,400 tons down to 48,760 tons

300 Series: 30,875 tons down to 482,868 tons

400 series: 2,550 tons up to 102,450 tons

Stainless steel 300: Biggest reduction since the new year.

Accompanying the down trend of nickel price, the price drop of the 300 series received the warmest acceptance last week. Hence, it is believed that the cutback was the result of the distribution and production drop recently made by Delong.

Stainless steel 200 series: First drop after 3 months

After 12 consecutive increases in inventory, the inventory of the 200 series in the Wuxi market saw its first decline this week. The arrival resources this week mainly come from BGDS and BGXC, with other steel mills also contributing some resources to Wuxi. Due to the recent serious accumulation of spot inventory, there is currently no apparent shortage of specifications in the market.

Stainless steel 400 series: Demand remained sluggish while inventory was still stacking up

Until last Friday, the inventory of 400 series stainless steel in the Wuxi area continues to climb, exceeding 100,000 tons. It has increased by 0.26 million tons to 102,500 tons compared to last week. This week, the transaction in the 400 series stainless steel market continued to be weak, and the sales of spot goods were relatively slow. The market transaction prices have fallen sharply. As a result, the market for chromium-iron raw materials has shown a slight weakening trend, weakening the cost support of 400 series raw materials. It is expected that after the continuous decline in the price of 400 series stainless steel, it will be conducive to accelerating inventory clearance in the later period.

RAW MATERIAL|| Supply pumped up as the price dived.

Chrome: Market supply was higher than expected

The most traded price of high-grade Chrome rallied between US$1440/MT to US$1470/MT (With 50% chromium). As the tendering process Although the retail market has become weaker after the centralized procurement of high-chromium steel in March, and the price support has weakened, transactions below 9000 yuan/50 base tons are still rare in the market.

According to statistics, in February, domestic high-chromium production increased by 45,700 tons to 541,500 tons in the main producing areas. The high-chromium production continued to increase in March. It is reported that mining furnaces have been put into operation in Inner Mongolia and Shanxi, and factories in some southern regions that suspended production before the Spring Festival have also resumed production one after another in the near future. Overall, the high-chromium production in March has increased significantly. At the same time, the import volume of chromium iron in January and February 2023 has also grown beyond expectations, with a cumulative import volume of over 510,000 tons in two months.

The poor power supply adds more straws to stainless steel price.

It is almost the 16th year mark on the application of “power rationing” in South Africa, there are several reasons behind the long-haul power trouble, including:

1. Deficiency of maintenance

2. Unplanned close-down

3. Limited investment in renewable energy resources

4. Political corruption within the state-owned power company

5. Sabotage

It is noteworthy that this abnormality somehow is becoming “normalized” for South Africans as power rationing was adopted more often since 2022.

South Africa is the world's largest producer of chromium and also the second or largest producer of ferrochrome, which is a key raw material in the production of stainless steel. In short, the global supply of ferrochrome depends on reliable power generation in South Africa.

The chromium iron from South Africa is sold to several countries, but the largest importing countries include China, Japan, and the United States. However, further power outages (which have also sparked internal unrest) will certainly bring pressure on South African chromium iron producers. According to analysis, chromium iron producers do not have enough energy independence. To some extent, the impact of this turmoil may be reflected in the cost of stainless steel.

Molybdenum: 27% fell from the peak

The price of molybdenum fell over 27% from US$59085/MTU to US$43120/MTU.

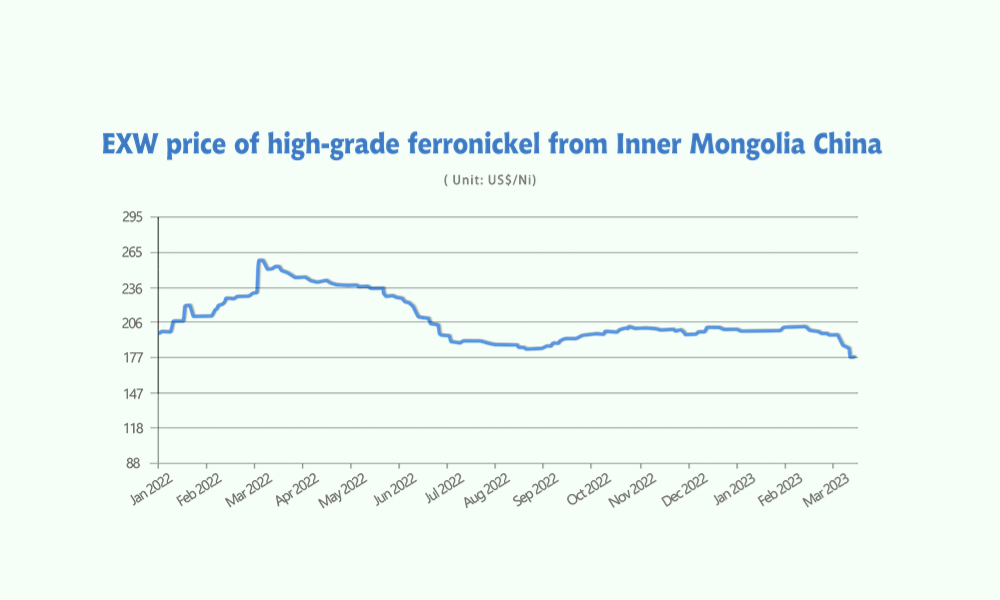

Nickel: The price hit rock bottom

A year ago, the price of nickel on the London Metal Exchange rose by over 270% in just three days, triggering additional margin calls of nearly $16 billion for exchange members as nickel producers and traders covered their short positions. The rapid price fluctuations squeezed dozens of short sellers, including China's largest stainless steel producer, Qingdao-based Tsingshan Holding Group.

As of early March 8, 2022, the price of nickel had surpassed $14,890/MT.

Fast forward to February and March of 2023, the monthly metal index for stainless steel fell by 4.68%. At the same time, the price of nickel also fell sharply. According to Jinling's recorded LME nickel closing prices, from February 1 to March 21, LME nickel fell from US$30,350 to US$22,700.

This week, the ShFE nickel saw a weak downward trend. As of Friday's close, the main contract of Shanghai nickel closed at US$26,115/MT, down 2.04% from the previous Friday's closing price, a decrease of US$544. This week, steel mills and a special steel mill in East China both purchased thousands of tons of high-nickel iron at US$285/MTU, a significant decrease from the previous purchase price.

Recently, stainless steel prices have been weak, and steel production costs have been in a state of continuous inversion. As a result, there has been pressure to lower raw material procurement prices. However, with the continuous decline in nickel-iron prices, steel mills' profits have slightly recovered.

The rainy season in the Philippines is coming to an end, and nickel ore prices have fallen significantly. The cost support of domestic nickel-iron prices has shifted significantly downward. However, most domestic iron mills are still below the break-even line, and they have reduced production and raised prices to cope with losses. Overall, in the short term, nickel-iron prices are expected to remain stable but weak.

Macro: Demand still remain sluggish

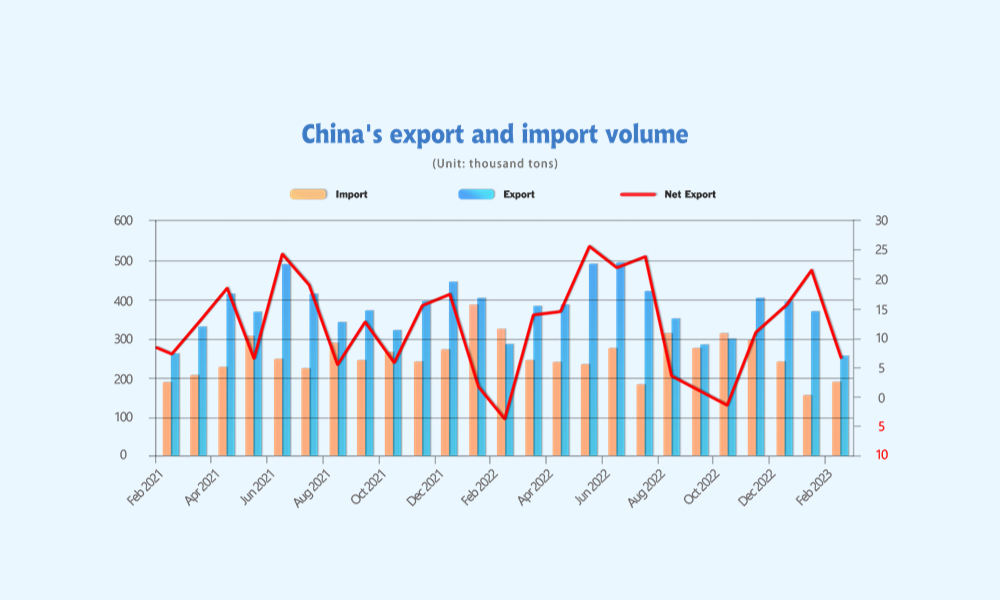

Stainless steel export: drop

In January, China's domestic stainless steel export volume was 364,900 tons, a decrease of 25,600 tons or 6.57% compared to the previous month, and a decrease of 35,800 tons or 8.93% compared to the same period last year.

In February, the domestic stainless steel export volume was 252,900 tons, a decrease of 112,000 tons or 30.69% compared to the previous month, and a decrease of 28,800 tons or 10.22% compared to the same period last year.

The cumulative export volume for January and February was 617,800 tons, a decrease of 9.46% compared to the same period last year.

Stainless steel import: drop

In January, the domestic stainless steel import volume was 150,400 tons, a decrease of 86,400 tons or 36.5% compared to the previous month, and a decrease of 233,200 tons or 60.8% compared to the same period last year.

In February, the domestic stainless steel import volume was 187,300 tons, an increase of 36,900 tons or 24.51% compared to the previous month, and a decrease of 134,100 tons or 41.72% compared to the same period last year.

The cumulative import volume for January and February was 337,600 tons, a decrease of 52.1% compared to the same period last year.

Stainless steel net export: rise

In January, the net export of stainless steel was 214,500 tons, an increase of 60,800 tons or 39.56% compared to the previous month, and an increase of 197,400 tons or 11.56 times compared to the same period last year.

In February, the net export of stainless steel was 65,700 tons, a decrease of 148,900 tons or 69.39% compared to the previous month. The cumulative net export volume for January and February was 280,200 tons, which is a net export of 225,000 tons compared to the same period last year when there was a net import of 22,500 tons.

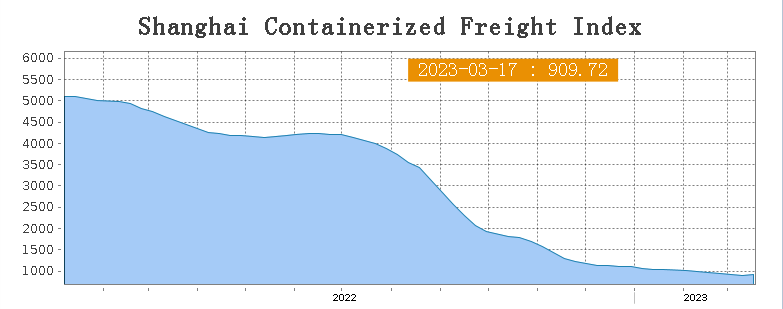

SEAFREIGHT|| Freight rate rallied across different routes.

Freight rates overall on multiple sea routes stabilized last week as the market is still recovering. On 17th March, the Shanghai Containerized Freight Index rose by 0.3% to 909.72.

Europe/ Mediterranean: The European central bank pushed their interest rate higher in fighting the peaked inflation rate.

Until 17th March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$878/TEU, rose by 1.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1651/TEU, rose by 3.9%.

North America: A red flag is raised as the most recent banking problem signaling the economic recession.

Until 17th March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,161/FEU and US$2,088/FEU, 0.2% and 4.8% fall accordingly.

The Persian Gulf and the Red Sea: Until 17th March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 0.1% rose from last week's posted US$879/TEU.

Australia/ New Zealand: Until 17th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$277/TEU, which was downed by 1.1% from the previous week.

South America: The freight market had volatized again due to the peaked inflation rate. On 17th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1306/TEU, a 5.2% drop from the previous week.