Short squeeze ends. The price of 304 slumps.

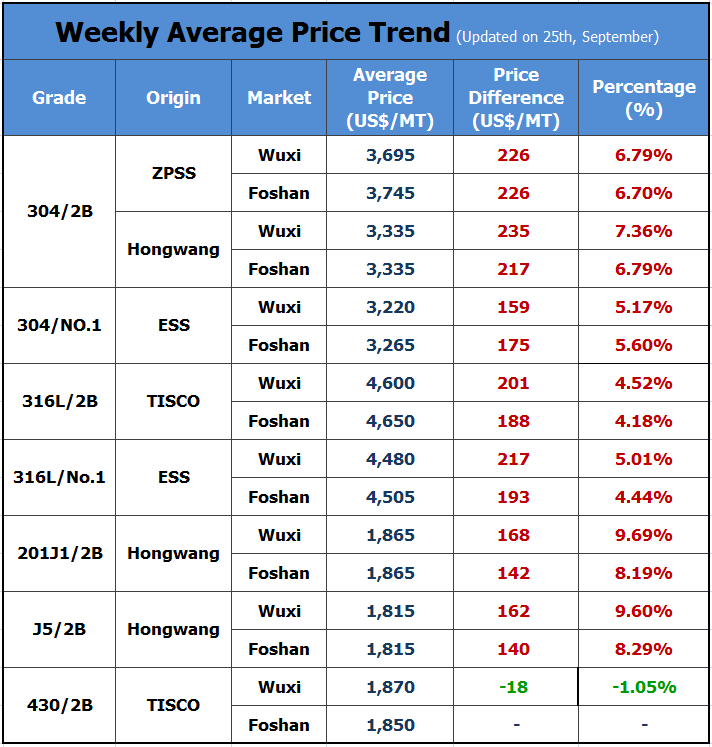

Last week, stainless steel futures and spot prices kept increasing from Monday to Thursday, and the 304 spot once went beyond US$3,590/MT, but it turns down significantly on last Friday. Until Friday’s close, stainless steel futures contract 2110 declined by US$160/MT. As for the spot in Wuxi market, the cold-rolled 304 of the private-owned mills also fell by US$125/MT and the base price of the CR, mill edge product by the private-owned mills went down to US$3,385/MT.

300 series: Prices drop, short squeeze ends.

The whole stainless steel industry has been affected by the production limit in China. Tsingshan Fujian plans to cut down 30% of its output in October, surprisingly did not boost the prices but the market prices fell down from high prices, Friday, the price of futures dropped by more than US$155/MT within one day, and the main contract closed at US$3,425/MT. The base price of cold-rolled mill-edge spots were mostly dealt in US$3,385/MT which was US$140/MT lower than the transaction price on Thursday.

Although Tsingshan Fujian is reducing the production, about 150,000 tons of stainless steel coils with 2E finish (Cold rolled with oxide scale) are declaring the custom for entry and will be further processing to be cold-rolled products and sold in China. If the 2E finish products fail to be duty free as a cold-roll product, they will be charged for 20% tariff and the import volume of the HR products from Indonesia will increase.

The Indonesian HR stainless steel coils are used to sold to Southeast Asia mostly. However, the region is suffering the pandemic and their economy and demand for stainless steel remain weak, so Chinese demand can make it up. For now, the stainless steel price in China is so high that facing the custom of 20%, exporting to China is still a considerable business to Indonesian sellers.

From the perspective of the futures market, the Shanghai Futures Exchange raised the transaction fee for stainless steel futures again: the transaction fee for stainless steel futures contract SS2110 and SS2111 will be adjusted to US$2/lot; if closing the position in the same day, the transaction fee has been adjusted to US$3/lot. Currently, the Shanghai Futures Exchange has not taken stringent control measures such as restricting position opening. Last Friday, both the contract SS2110 and SS2111 heat their intraday limit. The contract 2110 held about 38,000 lots, which decreased by 17,000 lots from the previous two weeks. At present, the "short squeeze" comes to an end.

In the raw material market, the high-nickel iron worked stably last week. Until last Friday, the domestic mainstream quotation was US$231/nickel, which remained the same as before the holiday. Recently, domestic electricity and production restrictions have been stricter, and the production of ferronickel in many places across the country are affected in September. The production of ferronickel in Jiangsu, Shandong, Guangdong, Fujian and other places is expected to decline significantly, but the import of ferronickel from Indonesia has increased significantly, which is beneficial to the shortage of China’s ferronickel resources. (According to customs data, in August, domestic imports of ferronickel were 349,700 tons, increasing by 24.4% month-on-month and 19.78% year-on-year. Among, the import of ferronickel from Indonesia was 303,100 tons, MoM 31.86% higher and YoY increasing by 27.2%. ) There are currently many companies with limited production of stainless steel. More stainless steel enterprises are involved in the production limit. The reduction of the 300 series in September is predicted to be as large as at least 200,000 tons. The decrease in stainless steel production will surely cause impact on the ferronickel market.

Talking about the nickel, the price of nickel ore gets stuck in a dilemma. On one hand, because of the restriction in output, the demand for nickel ore is weakening. On the other hand, with the rainy season in The Philippines is approaching, but the inventory in China can only meet contemporarily needs in stainless steel produce, the future supply must decline. Therefore, the nickel ore market hesitates.

About the inventory, the inventory of the 300 series increased by 6,800 tons, reaching 316,500 tons. During the price increase last week, the downstream purchase sentiment tends to be felt. Many resources are circulated among intermediaries. Last week, it was reported that the stainless steel warehouse was influenced by electricity restrictions, causing difficulties for delivery.

Based on the delivery of Tsingshan and Beigang New Materials, it is estimated that 12,000 tons of hot rolled products will arrive. The "Dual limits" in electric power and production reduce the supply, but downstream demand has fallen more. Now, the changes in demand side is getting more influential in the price trend.

200 series: Prices might increase slight.

Last week, the inventory of the 200 series in Wuxi market decreased slightly from 41,000 tons to 41,600 tons compared with last week, which remained stable. Last week, the price of 200 series continued to rise under the production limit.Until last Friday, the price of cold-rolled 201J2coil in Wuxi market was slightly increased by US$172/MT, rising to US$1,965/MT.

In September, the production of 200 series cuts down, and in August CR 200 series production reduced significantly, which makes the price of CR going over HR. The price of hot-rolled rose weakly, and the price of CR is US$95/MT higher than HR. In the short term, due to the dual control of energy consumption and environmental protection inspections, steel mills have implemented a production restriction plan and prices have risen sharply. However, the production restriction in October is still to be determined. In the short term, it is predicted that the price will be lowered by US$30/MT- US$45/MT.

400 series: The output of ferrochrome and stainless steel both decrease.

Recently, the power shortage in the main production areas of high chromium in Inner Mongolia has been enlarged. The high chromium factory giants have been seriously affected, because the power supply is cut down by 70-80%. It is difficult to deliver on time. The high chromium market supply is getting increasingly nervous.

In September, the production of 400 series will reduce by 20,000 tons and in October, the reduction will continue. Although the supply is decreasing, downstream demand has not recovered fully and thereby the inventory of last week kept increasing to 92,600 tons, 2,000 tons more than the last two weeks.

Summary:

300 series: Influenced by production limit and electric power control, supply and demand are weak. How the production limit keeps carrying out after the National Holiday will determines the market trend. Before the specific government instruction announced, it is predicted that the stainless steel price will fluctuate in a short term.

201: Affected by the dual control of energy consumption and environmental protection inspections, the steel mills implement the output limit plan, so the price has risen sharply. However, the price may weaken slightly, by US$30-US$45/MT.

430: Market traders said that the transaction price last week was around US$1,805/MT~US$1,805/MT. It is expected that the market transaction price of TISCO and JISCO 430/2B will remain this week.

RAW MATERIALS|| High chrome is in shortage. The price will keep increasing.

The electric power control gets more sever in Inner Mongolia, the main production area for high chrome in China. More high chrome factories sent urgent enquiry for the high chrome raw materials. The purchase demand is as high as 30,000 tons and some ask for 3,000 tons, because their output is not enough to complete the orders on time.

Earlier in this month, it seems that the shortage of electric power would fade out. But now, the control in output and electric power return and even get worst, striking the high chrome industry and leading some high chrome giants urging for finished products to deliver the orders.

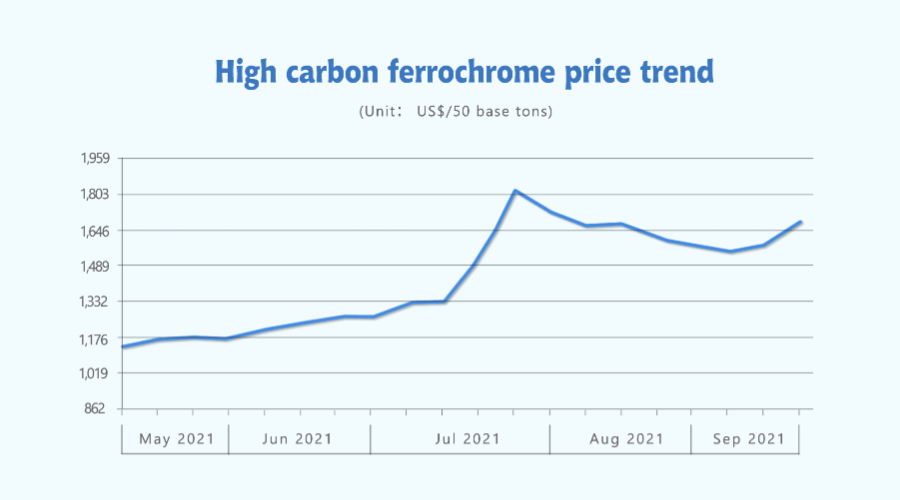

In the state quo, the quotation of high chrome is increasing after the Mid-Autumn Festival. On September 26th, the quotations were various ranging from US$1,677/50 base tons to US$1,803/50 base tons. As for the major EXW price, it was about US$1,724~US$1,740/50 base tons, which increased by over US$40 compared to the last working day (September 24th). After the Mid-Autumn Day, the price has increased by over US$140/50 base tons.

At the end of the month, it is about the time for steel mills to buy raw material for October production. However, there is no any sign showing that the “Dual Controls” will get lax and the market is still out of stock. When the steel mills begin the bidding and purchasing process, the shortage of high chrome will be worsening.

For now, the high chrome market is in a mud. Many suppliers say that they are out of stock, but it makes the buyers proactively purchase and prepare for the stock because a 7-day holiday (National Day, October 1st~7th) is approaching. Many steel mills bring the high chrome purchasing work ahead of holiday of October. Steel mills generally hold a view that the purchasing bidding price in October will increase over US$1,724/50 base tons.

The dual controls also affect the production of steel mills. Recently, more and more steel mills release their October production plans: a steel mill in Southern China will reduce 30% of its output; a CR stainless steel producer in Northern China will shut down all the production lines and there is no exact day of its reopen; a stainless steel mill in Eastern China also announces that milling, hot rolling and other processing will stop for the whole month. With so many shutdown news of the steel mills, the raw material demand shall decrease as well.

Referring to the production of stainless steel in September, the production of stainless steel is expected to fall by 440,000 tons, amounting to 2.61 million tons, which needs 460,000 tons of chromium materials. Only considering stainless steel production demand, the demand for high chromium is expected to be around 760,000 tons in September. However, according to the current production in the main producing areas of high chromium and the import volume of ferrochromium in August, the supply shortage of high chromium in September is expected to reach 170,000 to 180,000 tons.

In all, the dual controls result in the decreasing output of ferrochrome and stainless steel, but the declining rate of ferrochrome is larger than that of stainless steel. In the future, the dual controls will keep influencing the market. Before the end of the National holiday, the price of high chrome will remain high!

EXPORT|| Net export volume hits the 10-year low.

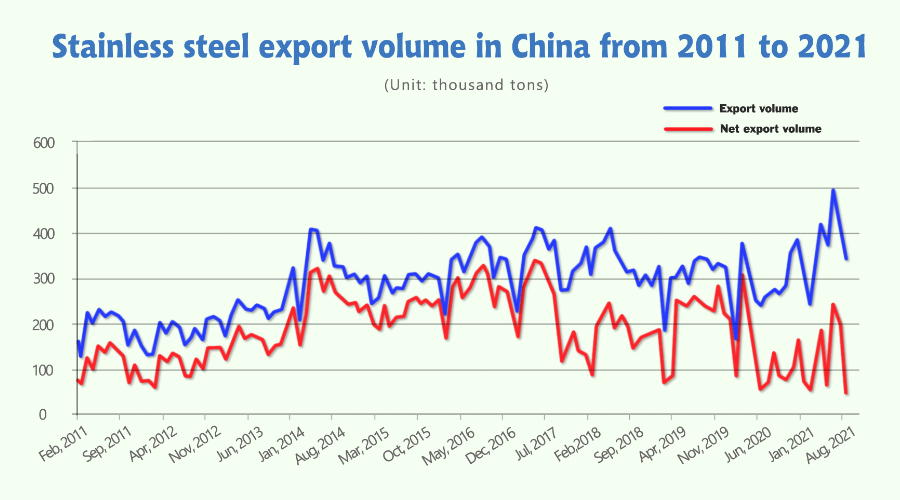

In August 2021, China's stainless steel imports amounted to 286,300 tons, increasing by 29.76% compared to last month; compared to the same period of last year, it increases by 113%. From January to August, the total import volume was 1.9154 million tons, year-on-year increasing by 99.37%.

In August, China's stainless steel exports amounted to 337,300 tons, MoM decreasing by 17.75%, while YoY increasing of 25.27%. The total export volume from January to August was 2.9363 million tons, 37.14% more than the same period of last year.

Among them, exports to South Korea's fell the most. In August, although most of China's stainless steel exports were in a month-on-month decline, exports to South Korea were the least, only 26,200 tons, sharply dropping by 51.41% from the previous month.

Previously, at the end of July, South Korea announced that it would impose an anti-dumping duty rate of 7.17-25.82% on stainless steel flat-rolled products from China, Indonesia, and Taiwan.

In August, under the influence of the decline in exports and the rebound in imports, the net export volume was only 51,000 tons, hitting the lowest point in the past ten years.

At present, the prices of raw materials and stainless steel are high. Under the influence of China's "production restriction" policy, China's stainless steel supply has tightened. According to the survey, stainless steel production in September is expected to decrease by 440,000 tons, reducing to 2.21 million tons. Both the production of 200 series and the 300 series reduced by more than 200,000 tons. The gap between supply and demand in the market is gradually emerging. To create a new balance, it may rely on overseas markets.

Earlier, it was rumored that China will abolish anti-dumping against Indonesia. Some industry insiders think that increasing imports and reducing exports would help alleviate the current dilemma of tight raw materials and high prices in the stainless steel market.

Summary:

Under the production limit, China's stainless steel output has been declining month by month, and typically the output dropped sharply in September. While the current market inventory is low, imports are now increasing and exports are decreasing, which may ease the domestic supply tension. At present, under the strict implementation of production restrictions by steel mills, stainless steel prices are expected to rise in the short term, but it is necessary to pay attention to the impact of the decline in stainless steel export demand. And always be cautious that the highest the prices are, the larger the risk is hidden.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China