Stainless steel prices are on a rollercoaster! They surged last week, fueled by good economic news and rising nickel costs. But hold on, some experts are worried this rally might run out of steam soon due to high prices and weak demand. Prices for the most popular 300 series stainless steel jumped, but stockpiles are growing fast. This is because factories are pumping out a lot of metal, and not enough people are buying it right now. The 200 series is in a similar boat, with prices staying flat and warehouses filling up.There's a brighter spot for the 400 series, though. Prices held steady, and some stockpiles even shrank as buying picked up. Nickel is also having a wild ride. Prices spiked due to unrest in Indonesia, a major supplier, but then dipped a bit later in the week. The good news? Prices for another key ingredient, ferrochrome, are expected to stay stable. If you're shipping stainless steel overseas, get ready for sticker shock. Sea freight rates are soaring due to a global container crunch and high demand. Don't expect these rates to cool down anytime soon. If you want to catch up with Chinese stainless steel price dynamics, please keep reading the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,190 | 25 | 1.23% |

| Foshan | 2,230 | 25 | 1.21% | ||

| Hongwang | Wuxi | 2,090 | 25 | 1.29% | |

| Foshan | 2,090 | 25 | 1.29% | ||

| 304/NO.1 | ESS | Wuxi | 2,015 | 17 | 0.89% |

| Foshan | 2,020 | 21 | 1.12% | ||

| 316L/2B | TISCO | Wuxi | 3,670 | -22 | -0.63% |

| Foshan | 3,760 | 14 | 0.39% | ||

| 316L/NO.1 | ESS | Wuxi | 3,540 | 8 | 0.25% |

| Foshan | 3,540 | 0 | 0.00% | ||

| 201J1/2B | Hongwang | Wuxi | 1,400 | 0 | 0.00% |

| Foshan | 1,395 | 7 | 0.55% | ||

| J5/2B | Hongwang | Wuxi | 1,315 | 0 | 0.00% |

| Foshan | 1,310 | 4 | 0.35% | ||

| 430/2B | TISCO | Wuxi | 1,240 | 0 | 0.00% |

| Foshan | 1,240 | 0 | 0.00% |

TREND|| Stainless Steel Prices Remain Strong, but Demand Limits Market Trading.

Stainless steel prices surged last week, leading to a significant increase in overall trading activity, especially later in the week. The main futures contract jumped on Wednesday, pushing spot prices higher and boosting market confidence. While the 300 series followed suit with price increases, the 200 and 400 series remained stable. However, current high prices and cautious market sentiment could limit further gains. Last week, the main stainless steel futures contract closed at US$2170/MT, up 1.88% from the previous week with a peak of US$2205/MT.

300 Series: Buoyed by stronger cost support, 304 prices climbed last week. In Wuxi, the mainstream base price for private cold-rolled 304 four-foot sheets rose US$21/MT from last Friday, reaching US$2050/MT. The private hot-rolled price also increased to US$2015/MT. Early in the week, positive macroeconomic data and news on the nickel supply side fueled the futures market rise. This, in turn, stimulated transactions, boosted downstream buying interest, and led to active daily trading. However, futures prices adjusted back down to around US$2150 on Thursday. With inventory accumulating again, market sentiment turned cautious, resulting in moderate transaction activity in the second half of the week.

200 Series: Factory prices for 201 remained stable, but future price increases are anticipated. The spot price for 201 in Wuxi held steady last week. The mainstream base price for cold-rolled 201J1, cold-rolled J2/J5, and five-foot hot-rolled 201J1 all remained unchanged from last Friday at US$1375/MT, US$1290/MT, and US$1340/MT, respectively. The release of unchanged 201 guiding prices by Qingtuo and Hongwang at the beginning of the week influenced buying sentiment. Sluggish order intake from end customers, who are currently buying on a need-basis only, resulted in average market activity.

400 Series: No price changes were reported for the 400 series last week. Both TISCO and JISCO maintained their guiding prices for 430 cold-rolled at US$1470/MT and US$1600/MT, respectively. Similarly, the mainstream price for state-owned 430 cold-rolled and hot-rolled stainless steel in Wuxi remained unchanged at US$1275/MT for both products.

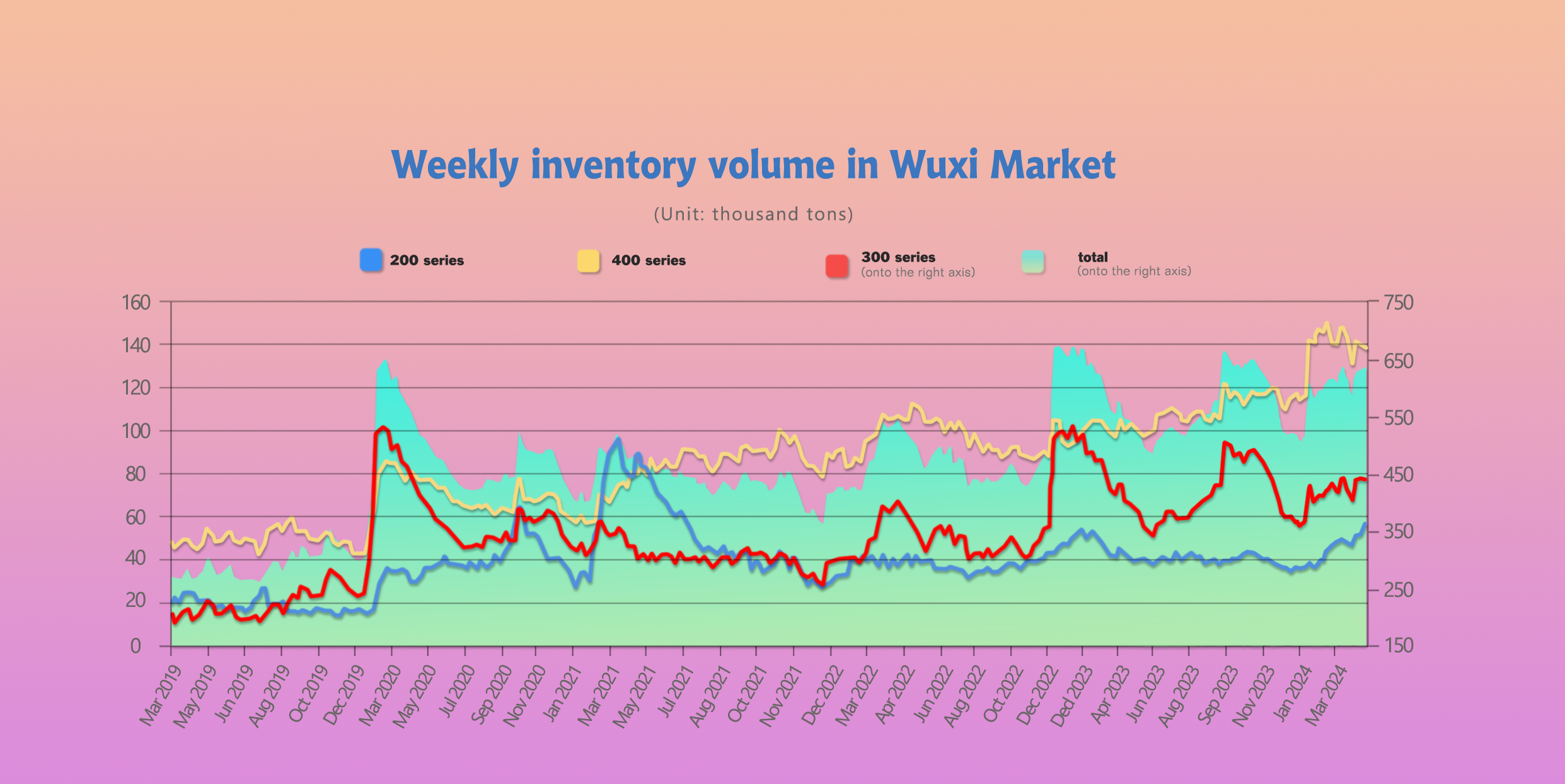

INVENTORY|| Three Consecutive Weeks of Inventory Increase.

The total inventory at the Wuxi sample warehouse downed by 4,402 tons to 634,799 tons (as of 23rd May).

the breakdown is as followed:

200 series: 4,970 tons up to 56,380 tons,

300 series: 1,197 tons up to 440,847 tons,

400 series: 1,765 tons down to 137,572 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| May 16th | 51,410 | 439,650 | 139,337 | 630,397 |

| May 23rd | 56,380 | 440,847 | 137,572 | 634,799 |

| Difference | 4,970 | 1,197 | -1,765 | 4,402 |

300 Series: Cold-Rolled Decreases, Hot-Rolled Increases.

The arrival of Tsingshan’s products continued to increase, primarily in hot-rolled inventory, resulting in a significant increase in 300 series hot-rolled inventory. Cold-rolled arrivals remained normal, with rapid market upswings boosting hedging activity, and the warrant inventory remained high, leading to an increase in registered warrant resources and a decrease in cold-rolled inventory. May production remains high, and weak seasonal demand is expected. Inventory is likely to continue accumulating next week, with close attention to subsequent steel mill production and market transaction conditions.

200 Series: High Supply from Qingshan Maintained.

During last week, continuous arrivals from Tsingshan Hongwang led to a noticeable increase in Tsingshan series inventory. May production plans remain high at approximately 1.22 million tons, indicating significant supply pressure. Throughout the week, Tsingshan Hongwang's 201 guiding price remained unchanged, with end customers placing fewer orders and primarily purchasing based on immediate needs, leading to average market transactions and resulting in inventory accumulation.

400 Series: Improved Downstream Transactions, Continuous Inventory Reduction.

Last week, the market transaction atmosphere in Wuxi gradually improved, with increased purchasing sentiment leading to better transactions compared to the previous week. Additionally, as the end of the month approached, traders focused on selling off inventory to recoup funds, often offering discounts, leading to a noticeable reduction in inventory. Despite high production schedules for May, the market is expected to face ongoing supply pressure.

EXPORT|| Steady Growth Continues for China's Stainless Steel Exports.

China's stainless steel exports maintained their upward trend, reaching 392,600 tons this month. This represents a 1.63% increase from the previous month and a 4.34% increase compared to the same month last year. Year-to-date, cumulative exports have reached 1.4539 million tons, reflecting an 8.22% growth over the same period in 2023.

RAW MATERIAL|| Unstable Environment Drives Up Nickel Prices.

This week, nickel prices on the Shanghai Futures Exchange (SHFE) experienced a rollercoaster ride. After an initial dip, they surged to a near eight-month high of $22,725 per ton. However, the rally was short-lived, and by Thursday's close, the main Shanghai nickel contract settled at $21,445 per ton, reflecting a gain of $670 per ton or 3.27%.

In East China, a special steel plant paid $245 per nickel point (including tax) for high-nickel pig iron, pushing the purchase price further upwards. Major steel mills are also buying around this level. Recent unrest in New Caledonia and warnings of volcanic activity in Indonesia have fueled the rapid rise in nickel prices, which in turn has driven up high-nickel pig iron prices. Slow progress on RKAB approvals in Indonesia and strong domestic trade base prices for nickel have also contributed to the upward trend. However, the latter half of the week saw nickel prices retreat, putting some downward pressure on high-nickel pig iron. Despite this, nickel pig iron prices are expected to remain stable in the short term.

As June approaches, major domestic stainless steel producers have begun announcing their procurement plans for high-carbon ferrochrome. Based on these announcements, the overall trend appears to be stable compared to the previous month, with mainstream procurement prices ranging between $1,345 and $1,375 per 50 reference tons. This aligns with the current mainstream retail market price for high-carbon ferrochrome, which sits around $1,360 per 50 reference tons. The expectation is for prices to remain stable in the near future.

SUMMARY|| Futures and Spot Prices Rise in Tandem, How Long Can the Uptrend Last?

Stainless steel prices moved strongly this week, with steel mill profits improving and output remaining high. Overall market trading activity was average, and off-season downstream consumption demand was also moderate, resulting in limited overall digestion capacity and a slight increase in market inventory. Current prices are at a high level, and market sentiment is relatively cautious. Stainless steel prices are expected to fluctuate in the future.

Overview:

300 Series: Recent domestic macroeconomic favorable policies have been released, and raw material prices have risen. The cost support for the 300 series has strengthened. However, as the effects of high output in the previous period are gradually released, spot market inventory may continue to accumulate, putting pressure on stainless steel prices. It is expected that the spot price of 304 cold-rolled steel will fluctuate strongly in a wide range in the short term, and the subsequent focus will be on inventory changes and the continuous strength of market trading.

200 Series: Recent steel mill supply has been at a high level, and terminal customers have been purchasing on demand, resulting in continuous inventory accumulation. Under the game of supply and demand, it is expected that the spot price of 201 will mainly fluctuate in the short term.

400 Series: Raw material costs support steel mill profits, which have been slightly restored, but are still in a loss-making state. The steel mills have a strong price stance. Given that the spot inventory of the 400 series is still at a high level, and the steel mill output in May is high, there is still supply pressure in the later market, putting pressure on the rise of stainless steel prices. It is expected that the price of 430 will remain stable in the short term, and the subsequent focus will be on inventory changes and market trading conditions.

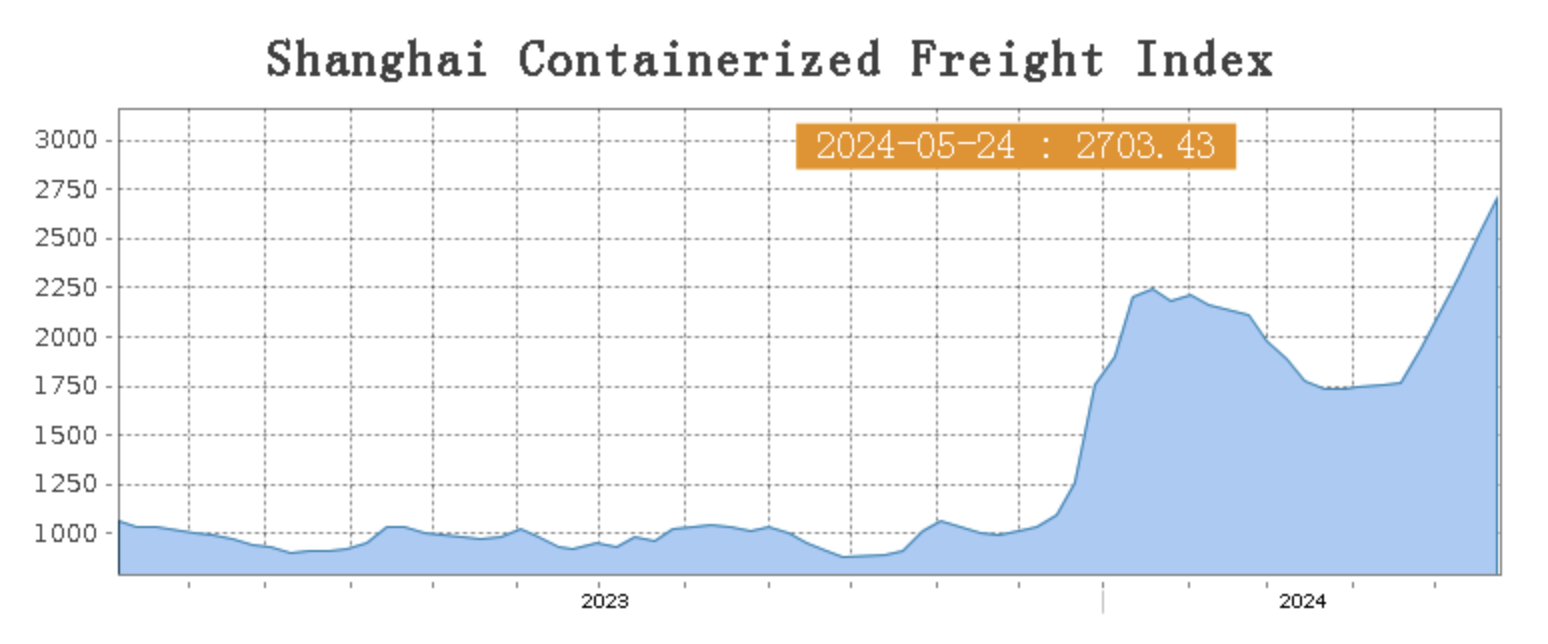

Sea Freight|| High Freight Rates Expected to Persist into Q3.

A shipping company executive noted a surge in container transportation demand as Europe and the United States began inventory replenishment in May. This has led to earlier peak season activity in Europe and congestion at some terminals, prompting customers to ship earlier to avoid rising freight rates. Tight capacity conditions are driving freight rates upward, with concerns that these high rates could persist into the third quarter if the situation isn't addressed soon.

The Shanghai Containerized Freight Index (SCFI) reflects this trend. After a dip before the May Day holiday, the SCFI jumped significantly in the days following, showing a 30% increase in just 20 days. This rise is expected to benefit shipping companies like Wan Hai Lines.

Adding to the pressure is the low level of global idle container capacity, currently hovering around just 0.7% of the total. The Red Sea crisis has further exacerbated the issue by forcing vessels on European routes to take detours, creating capacity shortages on other routes.

Meanwhile, a recovering European economy and inventory replenishment in North America have caused a 23% year-on-year increase in demand for freight from the Far East to the U.S. in the first quarter. This, coupled with a surge in new container orders that has container manufacturers booked solid until November, is straining the supply chain and driving up freight rates beyond just the Europe and U.S. routes. The spillover effect is impacting nearby routes to Australia, New Zealand, West Africa, South Africa, South America, and Southeast Asia, leading to comprehensive increases in freight rates across the board.

Last week, China's export container shipping market continued to perform well, with transportation demand remaining high. Ocean freight rates kept rising, driving the composite index upward. On 28th May, the Shanghai Containerized Freight Index rose by 7.2% to 2703.43.

Europe/ Mediterranean:

According to data released by S&P Global, the Eurozone's manufacturing PMI for May rose to 47.4, surpassing market expectations and reaching its highest value in 15 months. This week, transportation demand remained at a high level, with a favorable supply-demand relationship. Spot market booking prices continued to rise.

On 28th May, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3409/TEU, which rose by 8.1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4248/TEU, which surged by 7.4%

North America:

The preliminary value of the U.S. Markit Composite PMI for May was 54.4, exceeding both the previous value and market expectations, reaching its highest level since April 2022. Among this, the Manufacturing PMI rose to 50.9, surpassing the 50-mark threshold, thereby continuing to support transportation demand for the North American routes.

On 28th May, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$5189/FEU and US$6482/FEU, reporting a 3.3% and 7.6% lift accordingly.

The Persian Gulf and the Red Sea:

On 28th May, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf increased by 7.7% from last week's posted US$2391/TEU.

Australia/ New Zealand:

On 28th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1289/TEU, a 2.4% jump from the previous week.

South America:

On 28th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7065/TEU, a 5.7% growth from the previous week.