The U.S. Federal Reserve surprised no one by lifting rates 75 basis points (bps) to 2.25-2.5% on Wednesday, but did alter its statement to cite some softening in recent data. On July 28th, the most-traded contract of stainless steel futures fluctuated along with the rebound of conmmodity price. Until 9am, the price rose to US$2,905/MT, increasing by 0.06%. For more about the stainless steel price trend and analysis, just keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,810 |

-57 |

-2.07% |

|

Foshan |

2,855 |

-57 |

-2.04% |

||

|

Hongwang |

Wuxi |

2,680 |

-42 |

-1.61% |

|

|

Foshan |

2,645 |

-43 |

-1.69% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,555 |

-39 |

-1.57% |

|

Foshan |

2,595 |

-42 |

-1.67% |

||

|

316L/2B |

TISCO |

Wuxi |

4,300 |

-101 |

-2.38% |

|

Foshan |

4,345 |

-107 |

-2.49% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,990 |

-96 |

-2.42% |

|

Foshan |

4,035 |

-93 |

-2.32% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,530 |

-24 |

-1.67% |

|

Foshan |

1,515 |

-13 |

-0.95% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,435 |

0 |

0% |

|

Foshan |

1,445 |

4 |

0.34% |

||

|

430/2B |

TISCO |

Wuxi |

1,220 |

-42 |

-3.66% |

|

Foshan |

1,225 |

-60 |

-5.20% |

TREND|| Spot prices continue to drop.

From July 18th to July 22nd, the stainless steel spot prices in Wuxi remained weak. Although all stainless steel markets have returned to work, the demand remains tepid and the spot prices decreased slightly. Until July 22nd, the most-trader contract of stainless steel futures declined by US$4/MT to US$2,520/MT.

300 series of stainless steel: Prices continue to decrease.

Last week, the nickel price has risen for consecutive four days, which attracted the attention of some traders who tried to raise the selling price, but it was not well accepted by the market. On Friday, the spot price was reduced again. The price of the cold-rolled mill-edge 4-foot stainless steel 304 by the private-owned mills fell by US$22/MT to US$2,630/MT. As for the hot rolling, the stainless steel price was US$2,545/MT which decreased byUS$30/MT. From the perspective of production cost, the cost was reduced, because the price of high-nickel iron was maintained but the price of ferrochromium was reduced by US$45/50 base tons.

200 series of stainless steel: Low demand has increased concern over the future market.

Last week, the price of the cold-rolled stainless steel 201 remained stable at the beginning of the week but tended to fall. Until July 22nd, the cold-rolled stainless steel 201 in Wuxi has decreased by US$45/MT to US$1,480/MT while the cold-rolled stainless steel 201J2 remained at US$1,405/MT. As for the hot-rolled 5-foot stainless steel, last week it fell by US$7/MT to US$1,410/MT.

400 series of stainless steel: Demand recovers slightly but the decline continues.

The price of cold-rolled stainless steel 430 slowed down the decreasing pace. The quotation was around US$1,215/MT, decreasing by US$15/MT.

The high chromium ore decreased in price and it cuts down about US$57/50 base ton in the production cost of chromium ore. In July, the production cost of high chromium continued to drop, but steel mills’ purchasing price also keeps dropping, by US$97/50 base tons. In fact, the selling price declined slightly, which caused greater loss to the factories. According to the customs data, the import volume of ferrochromium in June was only 130,100 tons which was reduced by 14.69% on a year-on-year basis and 17.90% on a month-on-month basis. In July, the supply of high chromium decreases slightly.

Summary:

The most-traded contract of stainless steel futures shifted to contract 09 (for September), and it is gloomy and fluctuating below US$2,515/MT and it did not rise as the nickel price rebounded, the stainless steel stock price has no more room to fall though. First, from the side of raw materials, the prices of nickel ore and ferronickel are being propped up. The price of ferrochromium will not fall easily because the electric supply is rationed during summer and thereby steel mills can hardly keep suppressing the price of raw materials. Second, after the contract shifted to September, the discount is large and moves close to the spot prices.

In a short term, the stainless steel futures will stay steady but it lacks increasing momentum. The reasons we have repeatedly emphasized in the past two months—— weak demand and high inventory. It is predicted that the stainless steel futures price will fluctuate.

300 series of stainless steel: The delivery from steel mills increases as the market reopens after the pandemics. The inventory of 300 series stainless steel stacks, and the price will continue to fluctuate and fall. The base price of cold-rolled stainless steel 304 will be above US$2,515/MT.

200 series of stainless steel: Some specifications of the spot products are out of stock, so people are keen on supporting the prices to remain. It is predicted that the price of stainless steel 201 will tend to decline and the cold-rolled stainless steel 201J2(coil) will remain above US$1,420/MT.

400 series of stainless steel: The prices and production cost of the stainless steel 400 series dropped significantly, but the 400 series is still at a loss. So far, the demand is improved and the inventory decreased a bit. It is predicted that the price of stainless steel 430/2B will slow down the pace in decreasing, and remain above US$1,140/MT in a short term.

Why do stainless steel 200 series prices keep decreasing facing OOS and price support?

1. Steel mills prop up the prices.

So far, the prices of stainless steel 201 of all steel mills stay high. Stainless steel 210J2 and J5 were around US$1,425/MT ~ US$1,435/MT while the trading price of spot fluctuated between US$1,390/MT and US$1,405/MT. Most traders tend to maintain and raise the prices.

2. Some specifications are out of stock.

Last week, the inventory of stainless steel 200 series in Wuxi decreased and the arrival volume also reduced. The cold-rolled J2 and J5 are typically more serious in OOS.

However, the weak transaction is still the major reason that reduces the spot prices. Some sellers lowered the spot trading price to US$1,390/MT and most of them hold a negative view of the future market.

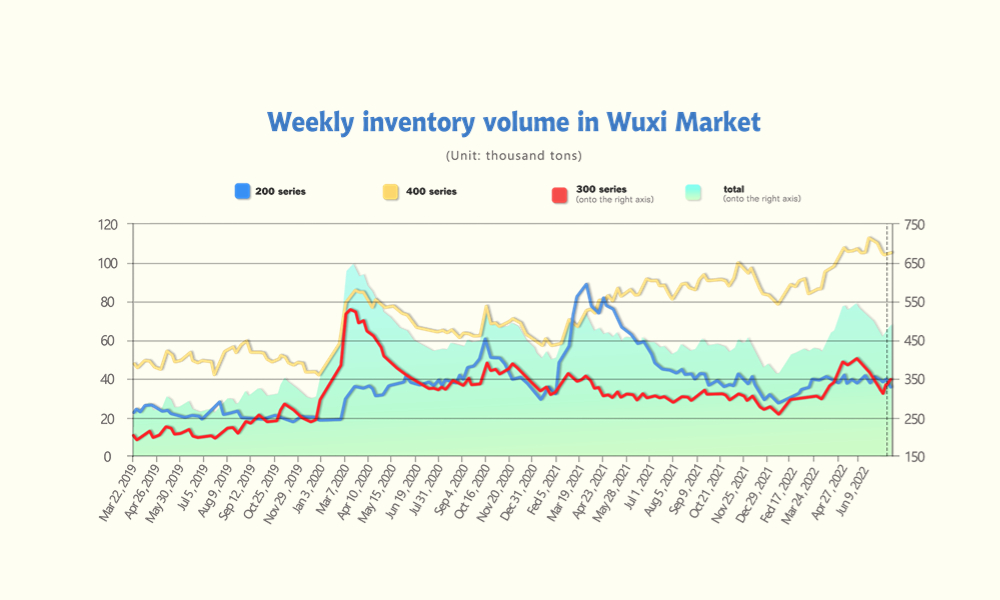

INVENTORY|| The spot inventory continues to rise.

Until July 21st, the inventory volume in the Wuxi sample warehouse decreased by 13,500 tons to 489,600 tons. 200 series inventory decreased by 3,800 tons, to 35,700 tons; 300 series increased by 16,200 tons, to 349,500 tons; 400 series increases by 1,100 tons to 104,500 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| July 14th | 39,489 | 333,246 | 103,389 | 476,124 |

| July 22nd | 35,665 | 349,474 | 104,450 | 489,589 |

| Difference | -3,824 | 16,228 | 1,061 | 13,465 |

200 series of stainless steel: Markets unlocked, inventory reduced.

Last week, the inventory volume of 200 series in Wuxi reduced slightly by 3,800 tons to 35,700 tons. The volume of new arrivals decreased compared to a week ago. Ansteel LISCO and Beigang New Materials all have resources delivered to Wuxi. After all of the industries have returned to work, the transaction warmed up a bit earlier last week, but it went feeble after last Wednesday and the spot prices declined slightly. Compared to the previous weeks, the market trading looked better before Wednesday, and the inventory of stainless steel 200 series was reduced.

300 series of stainless steel: New resources keep reaching on board, inventory increases.

The inventory of stainless steel 300 series in Wuxi raised sharply by 16,200 tons, to 349,500 tons and the majority of the increase comes from the pre-delivery of steel mills. Last week was the first trading week after the pandemic lockdown in Wuxi and many traders are rushing to send out the previous orders. Delong, one of the steel giants, has closed the stock for many days but its resources continued to ship to the pre-inventory which reduces the inventory of traders.

From the perspective of futures, the stainless steel inventory of ShFE has hit a record low. Until July 20th, the warehouse receipts volume of ShFE stainless steel was 7,387 tons which was reduced by more than 70,000 tons compared to the high in April. According to the customs data, in June, the cold-rolled wide products imported from Indonesia were only 35,000 tons. In a short term, the stainless steel warehouse receipt volume will remain low.

400 series: Inventory increases, though the transaction warms up.

JISCO, Taishan Steel, and other steel mills reduced the stainless steel output of 400 series in July. Last week, the spot inventory of stainless steel 400 series increased by 1,100 tons to 104,500 tons. The inventory volume remains high, but hopefully, it will be relief from the stacking spot as steel mills reduce production in July.

Raw material|| Supply decreases.

Chromium: Supply reduced but prices continue to fall.

According to customs data, last month, China imported 130,100 tons of ferrochromium, which decreased by 14.69% YoY and 17.9% MoM; and the import volume of chromium ore was 1,268,300 tons, YoY increased by 3.57%, and MoM decreasing by 11.13%.

Both ferrochromium and chromium ore have a sharp drop in the volume imported from South Africa. The ferrochromium imported from South Africa was 49,400 tons which decreased by 6,300 tons from last month, down by 11.31%.

The decrease in raw material import is related to the floods and electric ration in South Africa since the second quarter.

South Africa suffered continuous floods in April and May. In particular, the floods in April caused major damage to the local power supply system, resulting in power cuts in the second quarter, which affected the mining and production of chrome ore and ferrochrome from May to June.

The insufficient power supply in South Africa and the impact of floods on the transportation of chrome ore and ferrochromium are remaining. The difficulty in growing China’s chrome ore supply is a concern for the industry. Due to the current loss of Chinese ferrochromium plants, the production enthusiasm is low, and in the short term, chrome ore prices will remain weak.

Nickel: The purchasing price of ferronickel maintains at around US$194/Ni.

The EXW price of high-nickel iron averaged US$194/Ni which increased slightly by US$1/Ni compared to a week before; as for the low-nickel iron (1.6%≤Ni≤1.8%), it was quoted and remained at US$701/MT.

Both ShFE nickel and LME nickel increased significantly, offsetting the drop two weeks ago. Until July 22nd, the most-traded contract of ShFE nickel closed at US$25,104/MT (CNY¥168,200/MT) increasing by US$3,697/MT, rising by 17.27%.

Last week, the price of nickel ore, as well as the production cost of high nickel iron, decreased, but the EXW price was maintained. The iron factories have recovered the profit loss more or less.

According to the customs data, in June, the import of ferronickel was 434,900 tons, MoM decreased by 11.62%, and YoY rose by 59.32%. The import from Indonesia was 413,400 tons MoM reduced by 10.86% and rose significantly by 79.44%. The decrease in ferronickel import last month relieves the oversupply within China. A source said that a factory proposes to reduce production in July to prop up the prices. What really matters to the price trend is the demand for stainless steel.

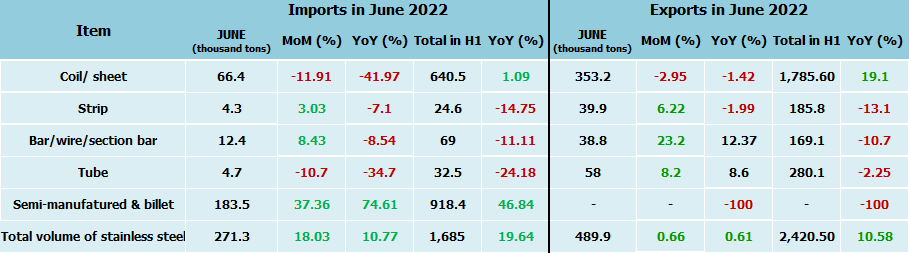

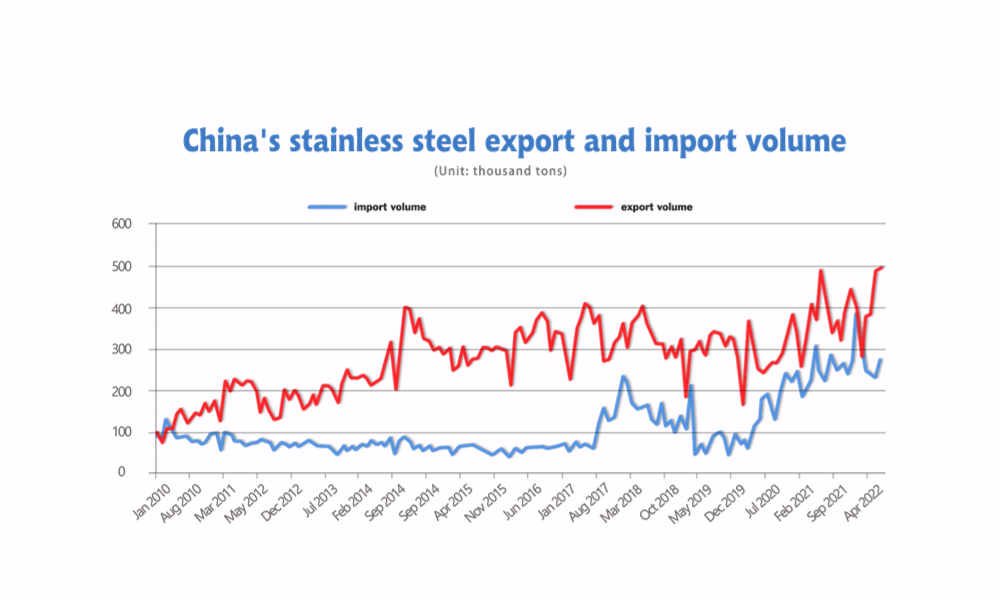

EXPROT|| China’s stainless steel export in June breaks historic high.

China’s stainless steel export in June breaks a historic high.

In June, China’s stainless steel export volume was 489,900 tons, increasing by 0.66% month-on-month and year-on-year rising by 0.61%, setting a new record high! From January to June, the total export was 2,420,500 tons, increasing by 10.58% over the same period last year.

During the first quarter of this year, the Russia-Ukraine triggers the energy crisis, which pushed up stainless steel prices. But in China, at that time, stainless steel prices did not keep the same pace as the increasing prices in the other international markets. The price difference created great opportunities for Chinese suppliers and China’s export trading volume soared. In April, the pandemics spread in China, greatly influencing export delivery and shipping. Things got better in May and peaked in June. The export volume in June breaks the record high, which is higher than the historic peak in June last year, over 3,000 tons.

The stainless steel import volume also increased in June. It rose by 18.03% MoM, to 270,000 tons. The net export volume in June was 220,000 tons which have lowered the extent of China’s stainless steel oversupply. Because the domestic demand recovered far slower than expected, many steel mills have begun to cut down their production. Therefore, with less supply from home and abroad, the domestic spot inventory was reduced obviously.

Cold-rolled resources imported from Indonesia decreased.

The import volume of domestic stainless steel from Indonesia in June was 220,000 tons, growing by 17% month-on-month. The increase was mainly in the import of stainless steel billet. Other importing semi-finished products (mainly billet) was 180,000 tons, increasing by 41% month-on-month. Indonesia's Delong reduced production in the first quarter and began to recover in the second quarter, which expanded the reflow of billet to China.

The import of cold-rolled wide resources MoM increased by 3.43%, to 35,000 tons. It is known that Tsingshan Indonesia was bland in business in June and July, so there is a prediction that in July and August, there will be a large amount of cold-rolled resources exported to China which will be registered as the warehouse receipts of ShFE. Currently, the warehouse receipts of ShFE keep breaking now low this year. Until July 20th, the stainless steel warehouse receipts are 7,387 tons which fell by over 70,000 tons compared to the highest point this year, in April.

Freight|| The increase of sea freight to South America slows down.

Last week, China's export container transportation market was stable, and the freight rates of most shipping routes went lower. Compared to the previous week, the SCFI on July 15th slightly decreased by 1.9% to 3996.77.

Europe/ Mediterranean: Last week, the transportation market remained stable, and the market freight rate fell slightly. On July 22nd, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$5,570/TEU, down by 0.7% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$6,201/TEU, down by 1.1% from the previous week.

North America: On July 22nd, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$6,722/FEU and US$9,441/FEU, respectively, down by 2.3% and 1.0% from the previous week.

The Persian Gulf and the Red Sea: The demand of transportation returns to normal. On July 22nd, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$2,971/TEU, decreasing by 7.2% from the last week.

Australia/ New Zealand: On July 22nd, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$3,143/TEU, down by 1.3% from the previous week.

South America: Influenced by the Fed rate hike, the local economy has been fluctuating. The sea shipping is now in the traditional peak season. The spot market booking price continued to rise. On July 22th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$9,483 /TEU, up by 1.8% from the previous week.