Analysis|| Why is the price increasing after the abolishment of tax rebate regarding stainless steel?

On 28th April, the official announcement of the abolishment of tax rebate regarding stainless steel came out, which has been the biggest concern in the industry.

Most of the people, talking about this bomb, showed a pessimistic consumption toward the export business, saying that the price will drop and export will turn to domestic sales. But, how come?

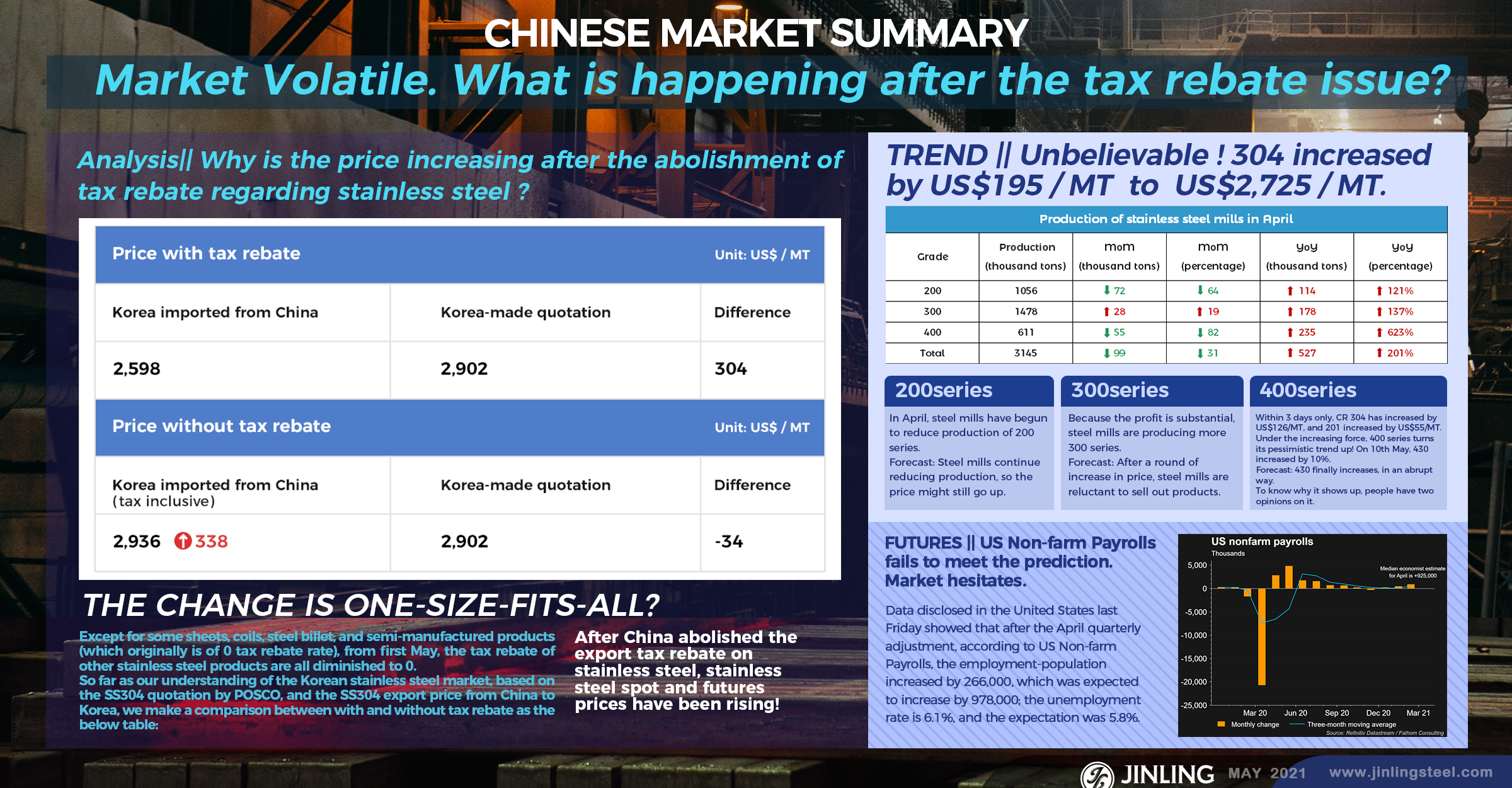

1.The change is one-size-fits-all?

Except for some sheets, coils, steel billet, and semi-manufactured products (which originally is of 0 tax rebate rate), from first May, the tax rebate of other stainless steel products are all diminished to 0.

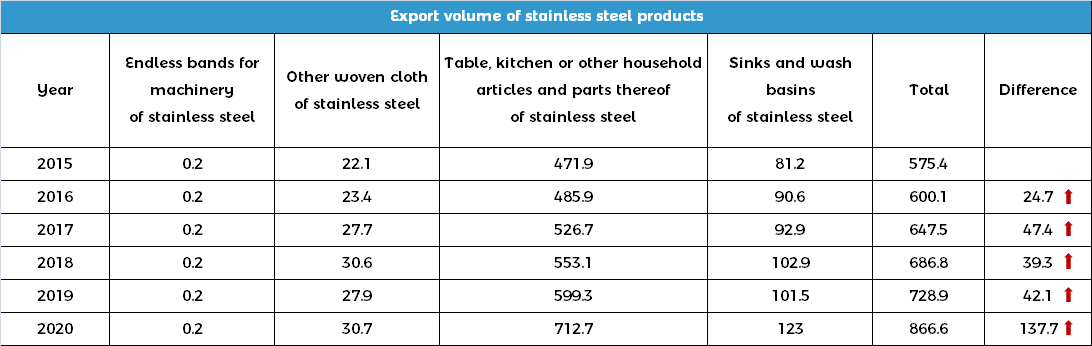

As the statistics, Chinese monthly production of stainless steel reaches 2.83 million tons, and about 10.1% flows out to foreign countries and regions. The abolishment of the tax rebate policy will force some extra output to be consumed within China market, and the 300 series will suffer the hardest change because the 300 series took a major role in stainless steel export. Therefore, the domestic supply of 300 series is under larger stress.

2.The export cost of stainless steel is raised, leading to weak competitiveness.

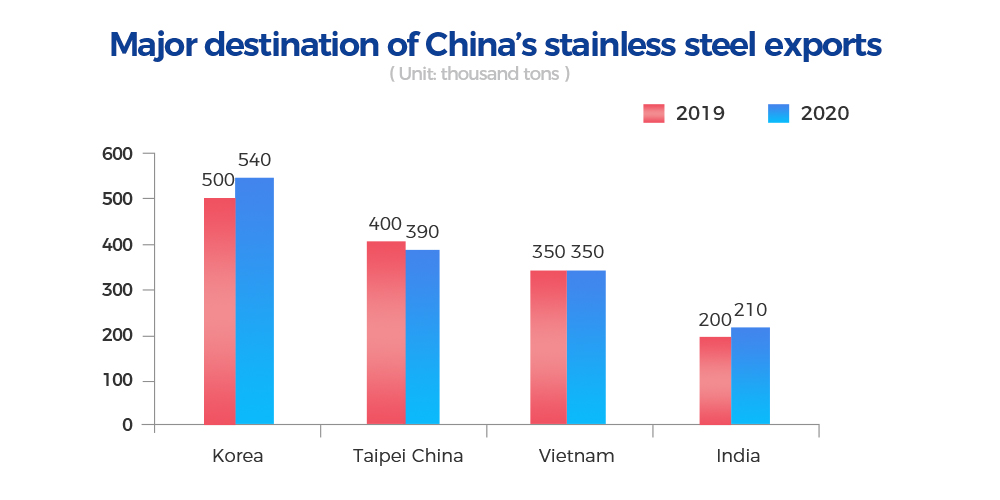

Korea, China Taipei, Vietnam, and India are the four major buyers to the Chinese stainless steel export market.

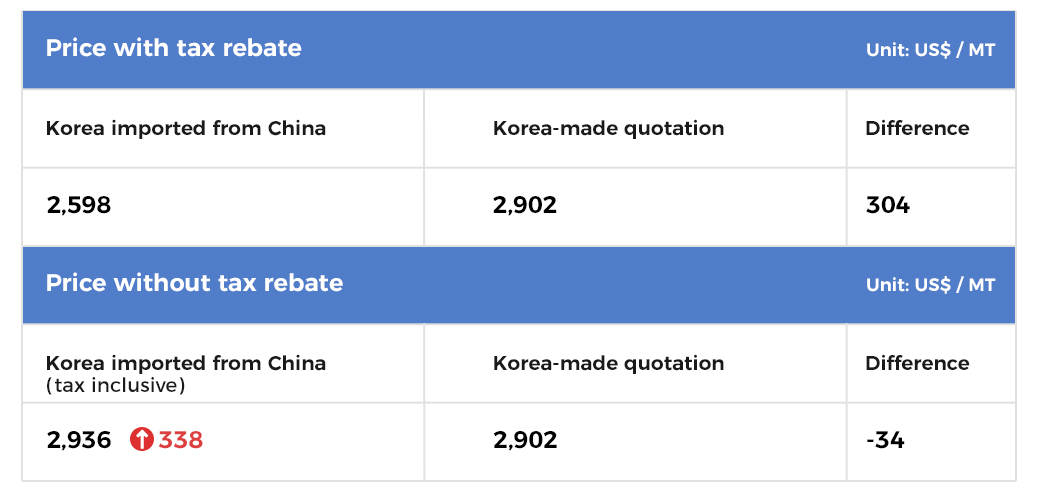

So far as our understanding of the Korean stainless steel market, based on the SS304 quotation by POSCO, and the SS304 export price from China to Korea, we make a comparison between with and without tax rebate rate as the below table:

Obviously, without the export tax rebate rate as high as 13%, the cost for China’s export business certainly goes up, and the additional charge is swift to the buyers. From the perspective of price to foreign buyers, the used-to-be good price is no longer lasted. It seems that there is no reason for people to buy from Chinese steel mills regarding the normal stainless steel.

But why we say, people needn’t be panic without the policy?

- Since May, stainless steel mills have been changing the production to plain carbon steel. The original export part of output can leave to China itself.

Many news were reported before, about the maintenance of steel mills in May, and the enlarging production of plain carbon steel in several major production areas. This situation makes some vacancy in China's domestic supply, which give the export part of the product somewhere to go.

- 3.41 million tons per year from China, the unparalleled exporting output.

Last year, China exported 3.41 million tons of stainless steel to the world. For now, no other country can achieve the huge production volume as China does. Who can supply a 3.41-million-ton output to the world?

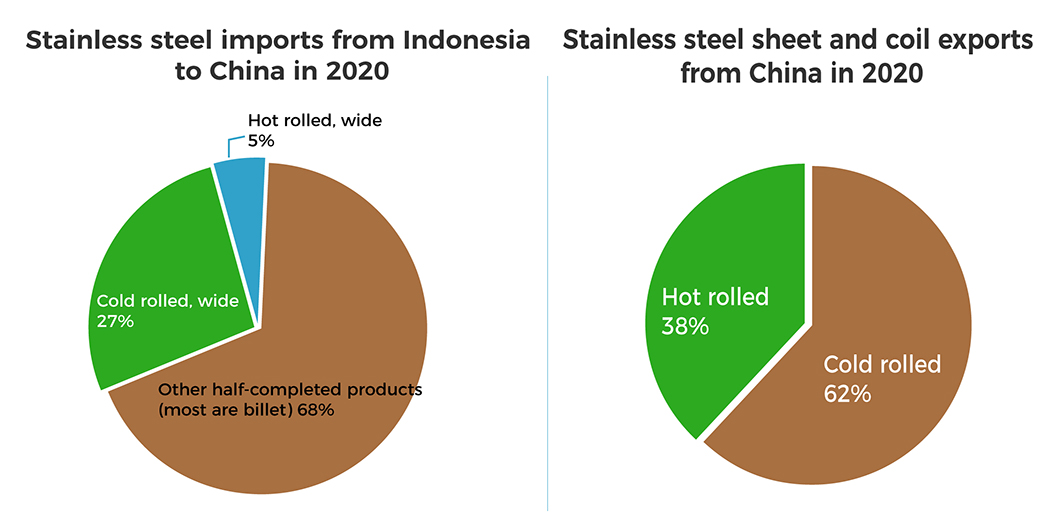

What’s more, we can consume that if the Indonesian price is lower than the Chinese price, Indonesia will replace the Chinese supplier role. But Indonesia will face its output upper limit, which means that it can’t supply to China market as many as it used to do. Under this circumstance, supply stress within China will be reduced, and the demand and supply will get back to their balance.

After the tax rebate issue was announced, the Indonesian stainless steel stock price keeps ramping up.

What we try to tell is that the price in China is increasing and so do the prices in other countries. It is believed that more buyers in the world will adapt to this new normality.

- About anti-dumping: Many countries have anti-dumping policies against Indonesia

The EU executes an anti-dumping duty rate on Taiwan’s stainless steel ranging from 4.1% to 7.5%, which is lower than the EU’s additional tax rates, 17.3% on Indonesia, and 9.2% ~ 19% on mainland China. Taipei is one of the main export regions of Mainland China. The export advantage of Taipei will remain, and we think that the cancellation of the policy will not cause much negativity on the output to Taipei.

As the above anti-dumping policies from many countries, Indonesia suffers the highest export stress. Besides, South Korea will adopt the method of import allocation to Chinese stainless steel companies in the future, which retains some of China's exports to South Korea. It is not a one size fits all!

In the future, manufacturing orders from Indonesia will increase, and China’s supply of cold-rolled 304 will reduce.

This time, the cancellation of tax rebate directly benefits Tsingshan Indonesia and other enterprises, so the Indonesian 2E products to China will be less than before. In China, the OEM of Tsingshan will have more manufacturing orders and China’s cold-rolled 304 production will be restraint.

- China encourages more export of the product with high added value.

When the announcement came out, people focus less on pig iron, crude steel, recycled steel raw materials, ferrochrome, and other products. Producing non-polluting products and exporting abroad at a cheap price, but leaving the polluted production process in China, cannot meet China's new development goals. It is better sooner or later!

In addition, we can see that stainless steel products are not among the ranks of the products list, indicating that China encourages the export of stainless steel value-added products.

Summary: The abolition of export tax rebates has more advantages than disadvantages. To China, it will increase imports, reduce exports, encourage the export of stainless steel value-added products, and promote short-process smelting processes, which benefits the Chinese stainless steel industry to develop robustly and sustainably.

After China abolished the export tax rebate on stainless steel, stainless steel spot and futures prices have been rising!

TREND|| Unbelievable! 304 increased by US$195/MT to US$2,725/MT.

On 8th May, Tsingshan did not open the stock, but Tisco increased by US$47~US$63 and Delong in the Wuxi market increased by US$32 in the opening.

On the same day in the afternoon, 304 in Wuxi market increased again. The hot-rolled resources whose previous price was US$2,530/MT before the Labor’s Day holiday, kept rising to US$2,725/MT. In total, it increases by US$195/MT, and the price sets a record high within one year.

Maybe you are wondering if is it possible that people would buy with such a high price, and will the pricedrop after the large increase in the market?

Let’s go through some data:

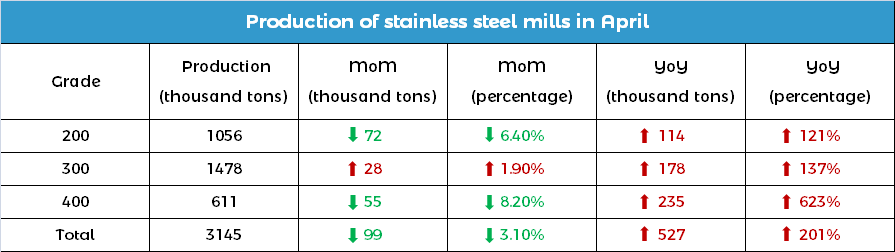

Strip production in April was 568,000 tons, decreasing by 33,000 tons, 5.5%, from March; YoY increased by 124,000 tons, and the percentage is 27.9%.

The output of wide coils was 2.221 million tons, decreased by 60,000 tons, 2.6%from March; increased by 483,000 tons, and the increasing percentage is 27.8% year-on-year.

As for billet, it was 356,000 tons, decreased by 5,600 tons, 1.5% from March; year-on-year reduced by 80,000 tons, and the decreasing percentage is 18.3%.

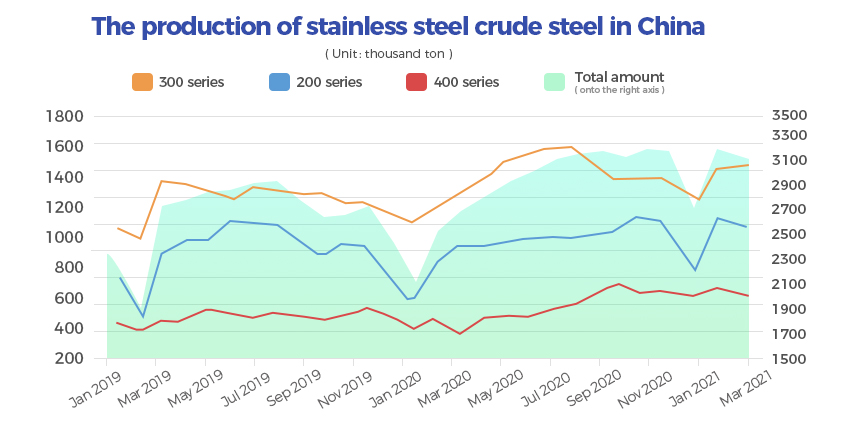

In April, steel mills have begun to reduce production of 200 series. According to the output data, in April, the total production of 200 series reduced by more than 70 thousand tons. 2 strip mills even stopped producing, which is related to the limited profit margin. To them, changing the production area may be a better choice.

Because the profit is substantial, steel mills are producing more 300 series. Tisco, Lisco, Tsingshan, and ESS all increased the production and some steel mills were forced to reduce their production because of power ration (like Baosteel) and maintenance (like Delong).

Within 3 days only, CR 304 has increased by US$126/MT, and 201 increased by US$55/MT.

Under the increasing force, 400 series turns its pessimistic trend up! On 10th May, 430 increased by 10%.

Aggressive 430: the first increase after a 2-month decrease!

With so many prices increasing, 430 couldn’t wait for anymore. 430 starts to increase.

Last week, rumor has it that steel mills would unite to increase the price and on 10th May, it officially effected. Earlier the day, the mainstream quotation of 430 cold-rolled TISCO and JISCO in Wuxi market was US$1,595/MT, and some increased to US$1,610/MT, and the increase was about US$15/MT.

On 10th May, in the opening, the guidance price of TISCO and JISCO were both increased by about US$16/MT. The former rose to US$1,610/MT and the latter rose to US$1,625/MT.

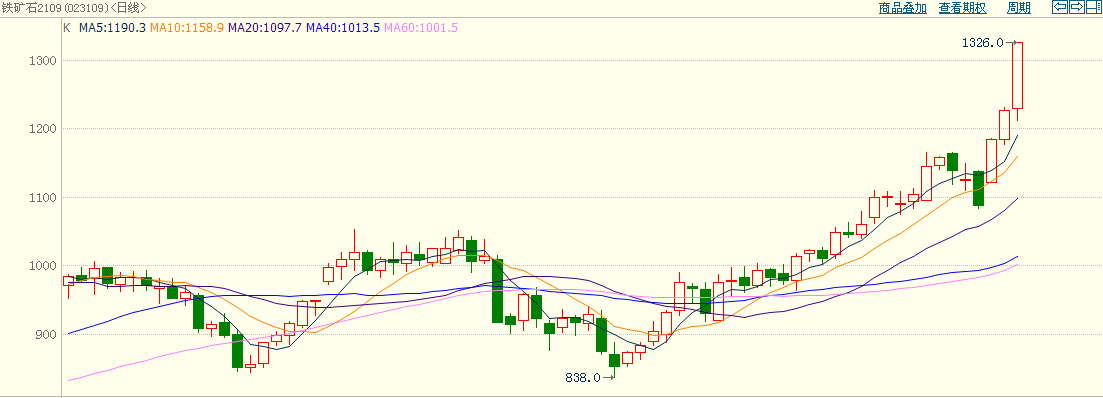

As for the reason why 400 series is increasing in price, most people owe it to the increasing price of iron ore. The black futures ushered the daily limit, and the RB futures and iron ore futures all rose to hit the daily limit (the RB futures rose by 6% and the iron ore rose futures rose by 10%). In only three trading days, iron ore futures have risen by nearly 22%. Compared with the low record in late March, the growth rate of iron ore futures in just two months is as high as 55%. Stainless steel futures rose by nearly US$110/MT and approached the early high of US$2,660/MT during the intraday trading session. The total increase in the past three trading days was nearly US$158/MT.

Forecasts of series of SS200, SS300, and SS400

200 series: Steel mills continue reducing production, so the price might still go up.

Because of the higher profit of 300 series and plain carbon steel, many steel mills stop the production of 200 series in May, resulting in that in the future market, the volume 200 series is assumed to be cut down by 19%. But the tax rebate issue affects little on the exports of 201 because Tsingshan Indonesia and Delong can stop producing 201.

Recently in Wuxi market, 201 has been in inventory digestion. Moreover, downstream buyers have a large demand, plus that the agents and traders are interested in boosting the price. Next week, we might see an increase in 201’s price.

300 series: After a round of increase in price, steel mills are reluctant to sell out products.

There is news stating that many steel mills turn their effort into 304 production because of the grand profit. Calculating the cost by the price of ferronickel and ferrochrome, the cost of HR 304 is around US$2,340/MT while now the mainstream guidance price of HR 304 achieves US$2,690/MT.

After the rise, some steel mills stopped accepting new orders and reluctant to sell because the market price changed so fast. However, the agent company of the steel mills still accepted high-priced spot orders.

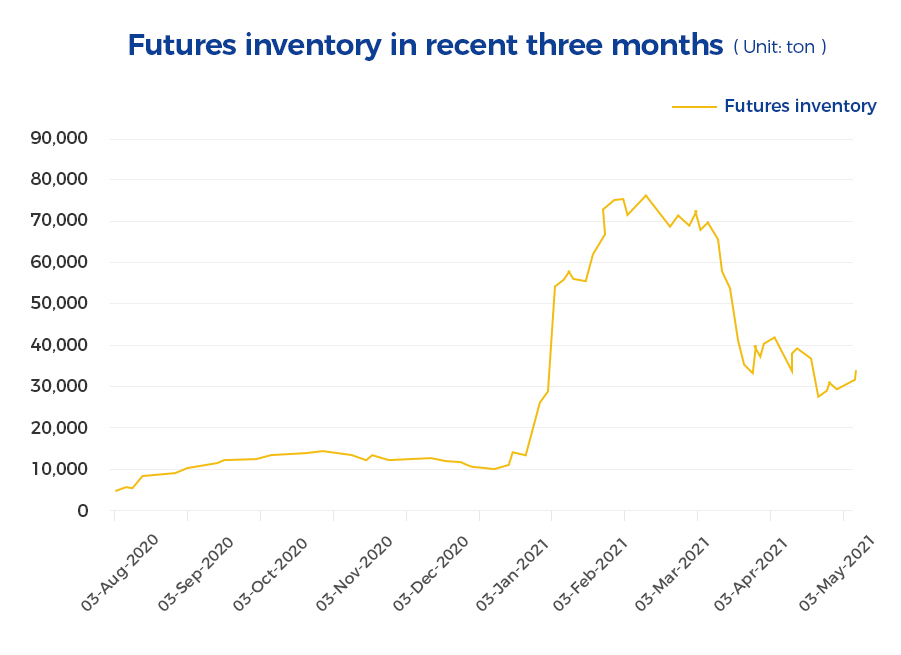

REMINDER: A large number of resources may flow to the market merchandises, and thereby the risks will be transferred to the market. Tsingshan will probably re-present to sell into corrections just like what he did before the Spring holidays. With this operation, spots products will rocket down the price. Besides, after the spring holidays, the overall price keeps increasing, demand is enlarging while the export volume of 304 is subdued due to the tax rebate issue.

430: What’s more in the future?

430 finally increases, in an abrupt way.

To know why it shows up, people have two opinions on it.

First is the increasing price of iron ore. However, this factor is too unstable to rely on, because high chrome is also increasing the production volume and the price will surely go down. Therefore, the cost won’t make the high price of 430 lasted long.

Second, people think it is the overall increase in the industry that leads 430 to increase as well. In a short period, the sharp rise will bring risk. On one hand, the production volume of 430 remains high and the supply is much larger than the demand. On the other hand, people are swinging their ways whether to trace it high or low.

Summary: Recently, the l copper and bulk commodities have been rising steadily, and people still have a bullish sentiment on the stainless steel market in the short term. From the perspective of the stainless steel spot market, the 200-series steel mills will reduce production to raise prices, and the 300-series will have a rise in the future volume.

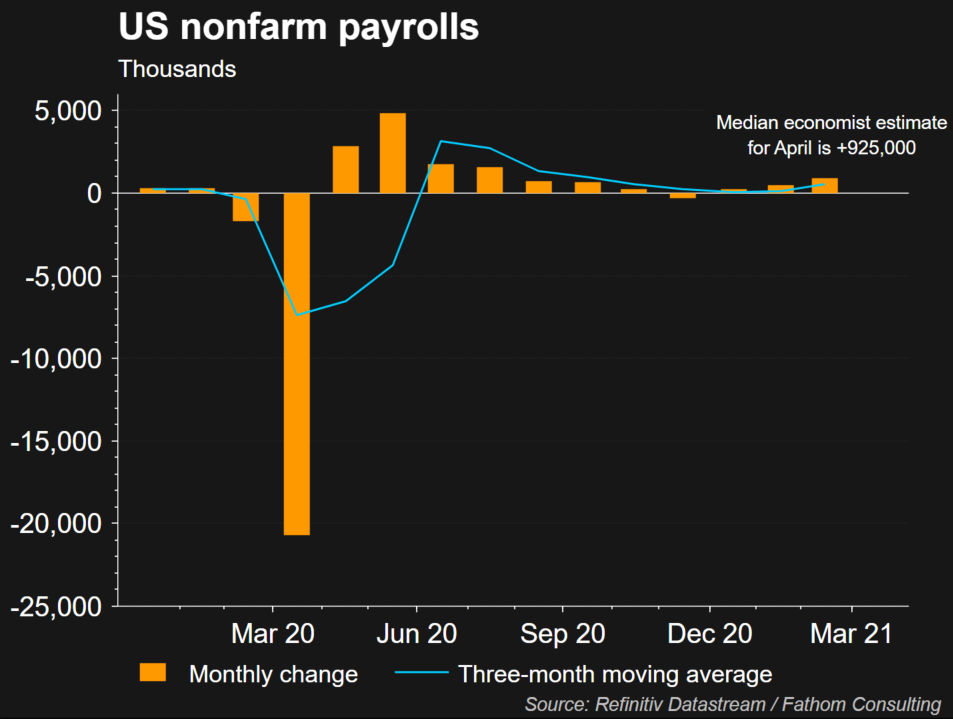

FUTURES|| US Non-farm Payrolls fails to meet the prediction. Market hesitates.

Data disclosed in the United States last Friday showed that after the April quarterly adjustment, according to US Non-farm Payrolls, the employment-population increased by 266,000, which was expected to increase by 978,000; the unemployment rate is 6.1%, and the expectation was 5.8%. US Non-farm Payrolls were significantly lower than expected. What do we know from this inconformity?

Market Participant A: The US Non-farm Payrolls data fell short of expectations, firstly because the rebound of the global epidemic harms economic recovery. Now in India, there have more than 400,000 new confirmed cases every day. The worsening of the epidemic has slowed down employment recovery. Secondly, the impact of the epidemic has prevented some workers from returning to work on time, and the employment field is facing structural contradictions; besides, it may be related to high financial subsidies and assistance, which makes some people unwilling to work, leading to more unemployment in a short term.

Marketer B: The weakening of data means good for the market to some extent. The market has always been concerned about the FED tightening the monetary policy, and FED officials’ statements have increased the market’s worries. The lower-than-expected reflects that the United States is currently getting away from the goal of achieving full employment by the end of the year. Government purchases and interest rate hikes may be postponed. In a short term, it is conducive to the rise of commodity prices, and stainless steel will also benefit from it.

Marketer C: Although the data is surprising, other job market data does not support this argument. For example, the latest weekly release of United States Initial Jobless Claims shows that after the first lockdown in 2020, the number of claims has fallen below 500,000 for the first time. This may reflect that US employment is recovering.

JINLING STEEL: Take precautions and be prepared. Stainless steel futures also appeared to supplement the market under the overall market surge, but from any point, the upward momentum of stainless steel is gradually weakening. The market is volatile. When we are preparing this article, the price keeps increasing and some suppliers even stop replying to inquiries. At this joint, we would say being moderate is an adoptable way. Being stable and cautious when the market is trembling up, so we can better handle the situation when the market is dragged down.

Stainless Steel Market Summary in China || Market Volatile. What is happening after the tax rebate issue? (3rd May~7th May)