Long time no see. China's stainless steel market has been back on track for a few days. The traditional peak season also leaves only a half month here, but from the market performance, it isn't easy to count as a peak period. Before the holiday, stainless steel prices were weak, and after the holiday, in the past, prices tended to rise. This year, the sluggish trade and price lasted throughout and after the holiday. During the holiday, new arrivals of resources were on board and meanwhile, the transaction suspended, resulting in the inventory stacking up. The inventory of stainless steel 300 series has risen for consecutive 7 weeks. Nickel, from a vague view, is now overspply. But to classify the nickel, Class 1 nickel which equals to the nickel that can be traded in LME, and used in battery and stainless steel production, is actually facing shortage. If you want to know more details, please keep reading down below Stainless Steel Market Summary in China

TREND|| An ineffective limitation to stop the price from falling after the holiday

The spot price of stainless steel was running weakly from 22nd September to 28th September, stainless steel 201 and 304 dropped slightly, and stainless steel 430 remained stable.

When we look at the record, the stainless-steel price would normally rebound after the National Day holiday. This year, however, the price trend decided to go in different directions: it fell soon enough in the first day afternoon.

Stainless steel 300 series: Prices keep decreasing after the holiday

The mainstream base price of cold-rolled stainless steel 304 concluded a US$41 decrease to US$2175/MT, and the hot-rolled stainless steel concluded a US$28 drop to US$2155/MT.

Later after the holiday, Tsingshan once again set price limitation on stainless steel 304: a price floor of US$2220/MT for Yongjin and US$2205/MT for Hongwang. There was no significant reaction from the market as the price limitation was released, and the trading also turned sedated.

Stainless steel 200 series: Weak transaction, prices heading down

Until 28th September, the mainstream base price of cold-rolled stainless steel 201 dropped US$7 to US1380/MT, and the 5-foot hot-rolled stainless steel decreased by US$14 to US$1310.

Stainless steel 400 series: Prices remained

The spot price of stainless steel 430 remained stable until 28th September: the mainstream quote price of cold rolled stainless steel and hot rolled stainless steel 430 closed at US$1295/MT and US$1140/MT respectively.

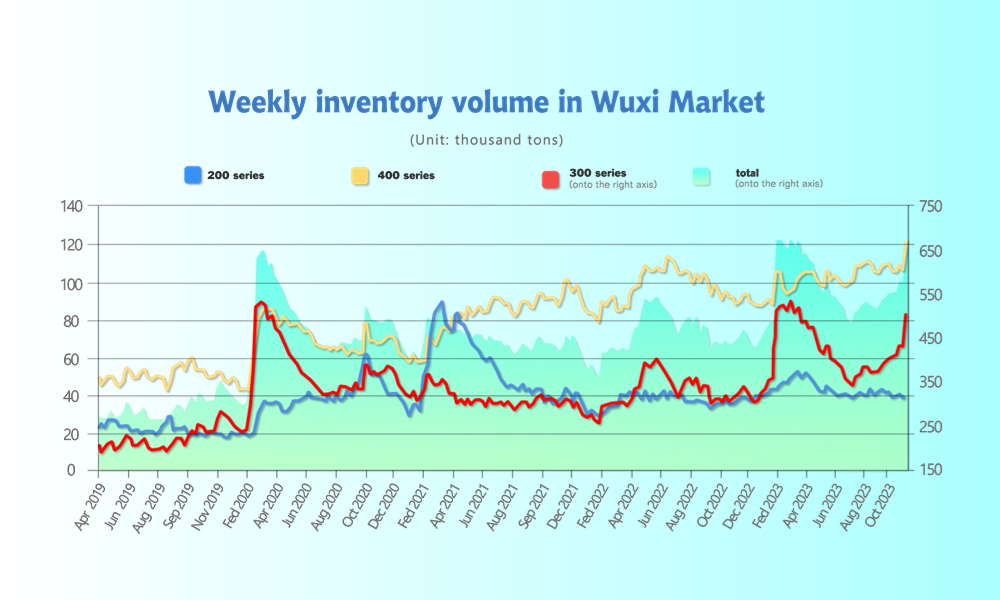

INVENTORY|| Stainless Steel 304 inventory achieved the 7th week of increase.

The total inventory at the Wuxi sample warehouse rose by US$16,293 tons to 529,854 tons (as of 8th October).

the breakdown is as followed:

200 series: 1,170 tons up to 38,952 tons

300 Series: 72,634 tons up to 501,938 tons

400 series: 15,914 tons up to 121,083 tons

Stainless steel 300 series: Cold-rolled inventory stacked for the consecutive 7th week.

During this inventory cycle, market prices have continued to fall, with futures and spot traders offering low-priced goods and maintaining reasonable transaction performance. However, ahead of the holiday season, end customers have been actively picking up goods from inventory, leading to a noticeable slowdown in the rate of inventory accumulation in the market. Except for some steel mills' pre-positioned stocks showing signs of inventory accumulation, many market traders have managed to slightly reduce their inventory. During the holiday period, steel mills' resources have arrived as usual, but outbound deliveries have almost ceased. It is expected that post-holiday inventories will increase significantly.

Stainless steel 200 series: new arrivals were on board amid the holiday

Tsingshan, Beigang, and LISCO took the majority part of the resources that arrival last week during the holiday, but the trade volume of stainless steel remained sluggish which kept the inventory accumulating.

Stainless steel 400 series: Inventory increased by 15%

There were limited stainless steel resources that arrived from JISCO and TISCO last week, and the spot inventory is expected to fluctuate in the short term.

RAW Material|| Divided nickel Class

Nickel: whether nickel is oversupply or in-short?

It is well known that Class I Nickel is used for the production of high-quality stainless steel, electronics, and vehicles. As the demand is surging, the supply now is shorted. Yet, the raw material of lower grade stainless steel, Class II Nickel is in surplus, and the imbalance of Class I and Class II caused critical issues:

1. Quality-orientated stainless-steel businesses will face more volatility in supply and price.

2. The surplus in Class II Nickel added pressure directly to its price and caused a negative effect on producers

The nickel market is forecast to be in overall surplus in 2023, but the opposite scenario is emerging for Grade 1 nickel, the option accepted for delivery on the London Metal Exchange (LME). Despite an expected surplus in the overall nickel market, Grade 1 nickel is in a relatively tight spot as stocks on the LME are historically low. This deficit leads to an increase in nickel prices, which will continue throughout the year.

According to the forecasts of the International Nickel Research Group (INSG), global production of primary nickel has been steadily increasing in recent years, from 2.610 Mt in 2021 to 3.060 Mt in 2022. In the second half of 2023, a further increase to 3.374 million tons is expected, – Stanislav Kondrashov comments on the situation.

A noticeable shift is observed in the dynamics of the nickel market. If in 2021 there was a deficit of 169 thousand tons, then in 2022 the situation reversed and a surplus of 105 thousand tons was formed. According to forecasts, by the end of 2023 this surplus will increase to 239 thousand tons.

Stanislav Kondrashov draws attention to the fact that in previous cases, the surplus in the market was mainly due to class 1 nickel. However, in 2023 the trend will change, and the surplus will be formed mainly by class 2 nickel.

As the nickel market balances these opposing trends, stakeholders and investors will need to keep a close eye on the evolution of class 1 and 2 nickel in order to make informed decisions.

However, the decline in nickel prices is expected to be limited due to tight LME supplies. This limitation of supply should prevent a significant drop in value.

Despite short-term problems, nickel prices are forecast by Stanislav Kondrashov to remain relatively high compared to pre-LME nickel short squeeze levels. This is due to nickel’s vital role in the global energy transition and its attractiveness to investors as an essential green metal. Its importance in electric vehicle batteries, where it improves energy density and extends range, will also contribute to long-term price support. Looking to the future, we can assume that in 2024 prices will average about $20,000 per ton, and in 2025 they will rise to $23,000 per ton.

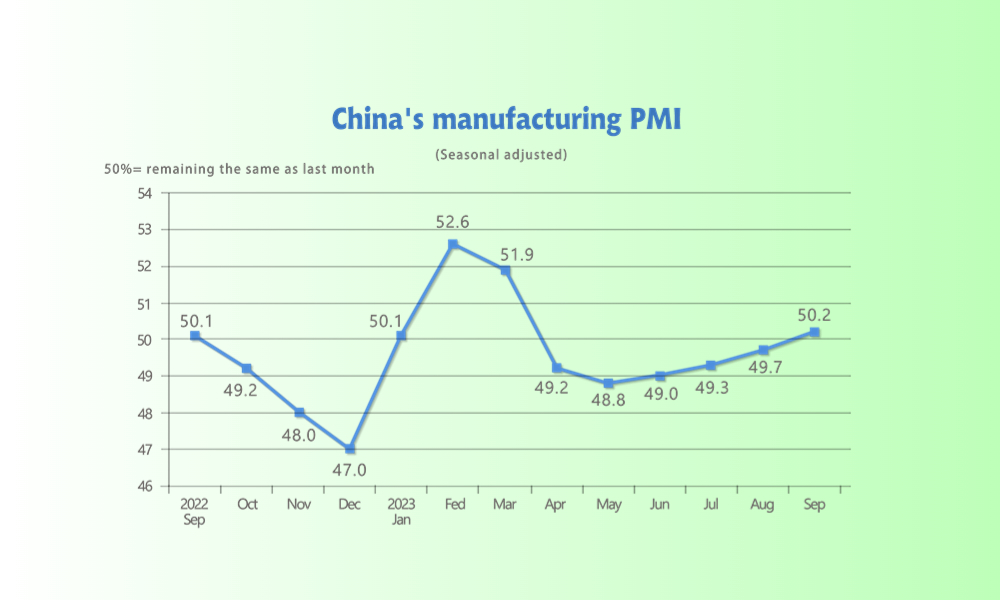

MACRO|| China’s manufacture back on track

The purchasing managers' index (PMI) for China's manufacturing sector came in at 50.2 in September, bouncing back to the expansion zone, data from the National Bureau of Statistics (NBS) revealed on Saturday.

This is the first time since April that the PMI for China's manufacturing sector has surged above 50, following four consecutive months of growth, according to the NBS.

Saturday's data also shows that nonmanufacturing PMI came in at 51.7 in September. The figure, also standing above the boom-or-bust line, went up 0.7 percentage points from a month earlier.

Commenting on the business activities in the country's manufacturing and nonmanufacturing sectors, NBS statistician Zhao Qinghe noted that favorable policies that have been gradually taking effect helped drive the growth of overall economic prosperity.

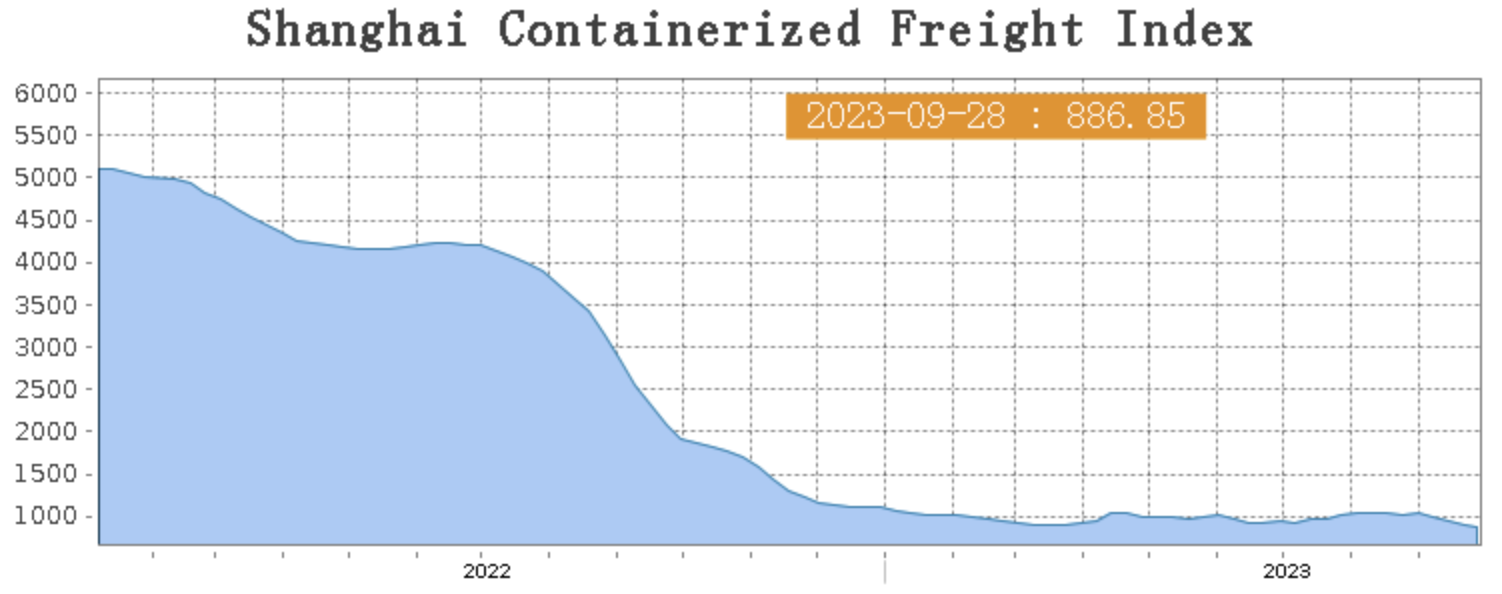

Sea Freight|| Market slump before the long holiday

China’s Containerized Freight market was overall weakening, and the demand recovery hit a bottleneck. On 28th September, the Shanghai Containerized Freight Index fell by 2.7% to 886.85.

Europe/ Mediterranean:

HCOB's final euro zone manufacturing Purchasing Managers' Index (PMI), compiled by S&P Global, dipped to 43.4 in September from August's 43.5, matching a preliminary estimate. A reading below 50 marks a contraction in activity. The freight demand failed to meet the rebound before the China National Day.

Until 28th September, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$599/TEU, which fell by 3.9%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1166/TEU, which fell by 4.2%

North America:

S&P Global's US Composite PMI index dipped to a reading of 50.1 in September, with 50 marking the line between expansion and contraction. The Manufacture PMI was recorded as the 5th consecutive month of shrinking.

Until 28th September, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1729/FEU and US$2249/FEU, reporting a 3.4% and 5.4% decline accordingly.

The Persian Gulf and the Red Sea:

Until 28th September, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 3.1% from last week's posted US$790/TEU.

Australia/ New Zealand:

Until 28th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$600/TEU, a 1.6% decrease from the previous week.

South America:

On 28th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1756/TEU, an 2.1% fall from the previous week.