Back from the Dragon Boat Festival, the stainless steel market kept going down. It is a frustrating situation for everyone. Although we saw a slight recovery of China's manufacturing PMI, this news could not revoke our positive attitude because if we go deeper, it is not difficult for us to find out that the demand remained sluggish. This situation also reflects on the stainless steel market. However, the stainless steel production remains large in July, which appeals to market concerns during the slack season. If you want to read more about the Stainless Steel Market Summary in China, please swipe up.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,310 | -14 | -0.66% |

| Foshan | 2,350 | -14 | -0.64% | ||

| Hongwang | Wuxi | 2,250 | -19 | -0.87% | |

| Foshan | 2,230 | -18 | -0.86% | ||

| 304/NO.1 | ESS | Wuxi | 2,145 | -10 | -0.86% |

| Foshan | 2,170 | -20 | -0.50% | ||

| 316L/2B | TISCO | Wuxi | 3,975 | -9 | -0.99% |

| Foshan | 4,005 | -27 | -0.69% | ||

| 316L/NO.1 | ESS | Wuxi | 3,775 | 8 | 0.23% |

| Foshan | 3,815 | -11 | -0.30% | ||

| 201J1/2B | Hongwang | Wuxi | 1,430 | -5 | -0.40% |

| Foshan | 1,405 | -7 | -054% | ||

| J5/2B.54 | Hongwang | Wuxi | 1,345 | -13 | -1.02% |

| Foshan | 1,335 | -7 | -0.57% | ||

| 430/2B | TISCO | Wuxi | 1,255 | 0 | 0% |

| Foshan | 1,250 | 0 | 0% |

TREND|| Market stayed bearish after the holiday

Tsingshan withdrew their price limitation of cold-rolled 4-foot stainless steel 304, 201, and stainless steel 304 coil plates on the last day of June. The stainless steel price overall then turned red.

The price of cold-rolled 4-foot 201J1 closed at US$1365/MT; the spot price of 201J2 was quoted as US$1290/MT. The future price of 201J1 was reported as US$1355/MT and J2 reached US$1285/MT. The mainstream contract price of stainless steel fell from US$2175/MT to US$2180/MT.

Stainless steel 300 series:

Last week, both the future price and spot price of the 300 series went down synchronously.

The mainstream base price of cold-rolled 304 closed at US$2180/MT and hot-rolled stainless steel dropped US$14/MT and was quoted as US$2120/MT. The transaction had a U-turn after a two-days surge, and the downstream users remained cautious toward the rally in stainless steel price.

Stainless price 200 series: imbalance supply-demand

The spot price of stainless steel 201 remained steady but fell slightly. Until 30th Jun, the mainstream base price of cold-rolled stainless steel 201 fell US$7/MT to US$1390/MT; 201J2 had a US$21 descent and closed at US$1285/MT and 5-foot hot rolled stainless steel pinned at US$1315 with a further drop of US$28/MT.

Similar to the market performance of the 300 series, the 200 series’ transaction fell soon after the holiday break. The cancelation of the price limit then even added more salt into the wound—the deeper dive in the spot price, Stainless steel J2/J5 hit US$1285/MT.

Stainless steel 400 series: Price remained stabilized

The market guidance of 430/2B quoted by TISCO and JISCO both remained unchanged, reported as US 1375/MT and US$1475/MT accordingly. The mainstream price of 430/2B in the Wuxi market was also untouchable at between US$1250/MT-US$ 1255/MT.

Summary:

The current stainless steel prices are running near previous lows with weak transactions. Steel mills have maintained high production levels in July, and the pressure of oversupply remains significant in the future. If prices continue to decline, it is uncertain whether there will be sufficient transaction volume to support the prices. It is expected that the stainless steel market will continue to experience weak and volatile conditions.

300 series: The current inventory of stainless steel spot market has shifted from a decline to an increase, and the demand is still in the low season. Downstream purchasing activity remains sluggish. Meanwhile, the prices of nickel and chromium iron have declined, weakening the cost support. In the short term, the prices of private cold-rolled stainless steel are expected to exhibit weak and fluctuating trends within the range of US$2145/MT-US$2215/MT.

200 series: Steel mills are gradually increasing their supply, but the market and downstream have entered the traditional off-season, resulting in a narrowing of end-user demand and further decline in market transactions. In addition, recent transaction prices have fallen below the price limits set by steel mills last week. The market will pay attention to the actions and offerings of steel mills in the coming week. It is expected that the spot prices for 201 series will continue to decline, with J2/J5 cold-rolled stainless steel prices fluctuating in the range of US$1270-US$1300 per ton.

400 series: Recently, the transactions in the 400 series stainless steel market have been average. Combined with the 28 USD/MT(50% chromium) decrease in high-chromium raw material steel prices in July, the support for prices in the 400 series stainless steel market has weakened. It is expected that the prices will experience a slight decline in the coming week.

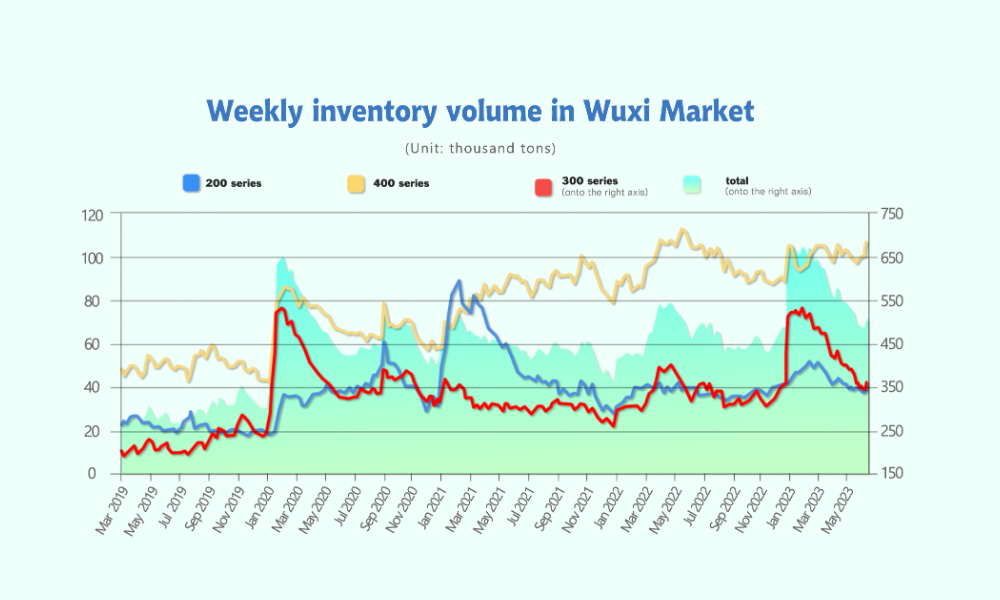

INVENTORY|| 25,000 tons hike appeared to be a bad omen

The total inventory at the Wuxi sample warehouse rose by 25,047 tons to 504,231 tons (as of 29th June).

the breakdown is as followed:

200 series: 1,204 tons up to 38,809 tons

300 Series: 16,356 tons up to 358,377 tons

400 series: 7,487 tons up to 107,045 tons

Stainless steel 200 series: Imbalance supply and demand boosts the inventory.

The 3.20% of inventory nearly wiped out the destocking from the previous week. Most of the arriving resources belong to Beigang New Material and it temporally relieved the shortage of some specification.

Stainless steel 300 series: Inventory started to increase.

The transaction was warmed up by some of the downstream purchasers a bit on the first trading day after the Dragon Boat festival, but the enthusiasm was exhausted very soon on the next day, the 7-week destocking is now ceased by the 4.78% inventory growth last week. Delong’s rapid recovery of stainless-steel production since mid-June largely contributed to the inventory surge.

Stainless steel 400 series: Inventory hike added more pressure to the sales.

400 series was added 7,487 tons more to the inventory and marked the second biggest weekly increment this year with 7.52%. It is believed that the deserted transaction was the main reason for the inventory growth.

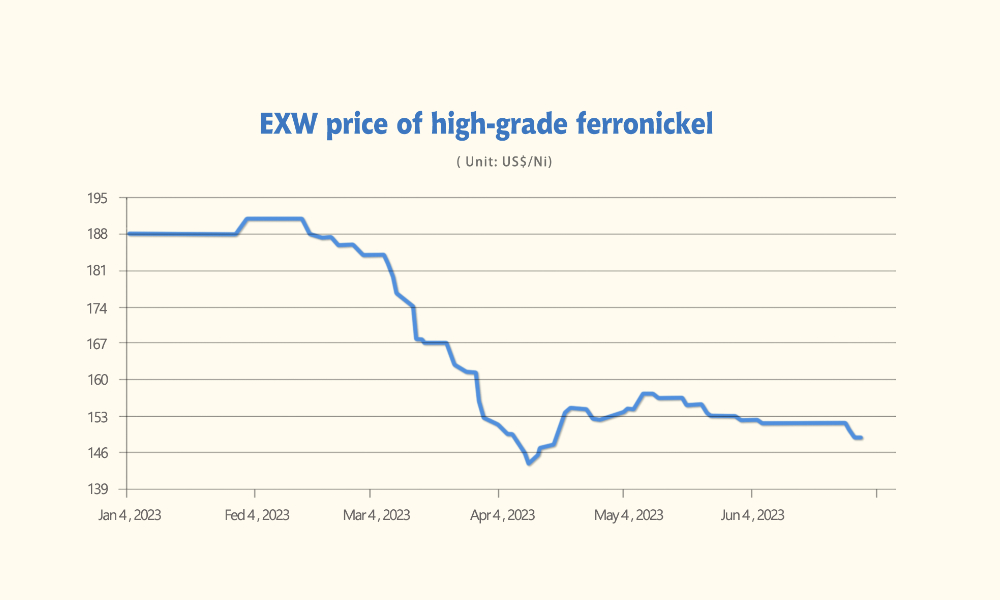

RAW MATERIAL|| Further drop in the price.

Nickel:

On 30th June, Dongfang Special Steel (ESS) steel mills finalized a deal with over a thousand tons of high-carbon ferronickel in about US$255/nickel unit.

Numerous steel mills announced maintenance in the early June while the nickel market remained quiet. Producer might asked for quote in countless times, but it was hardly finalized a deal. The price of ferronickel is estimated to drop in the short term.

Chrome:

The mainstream EXW price of high chrome recorded a significant descend, closed at between US$1300/MT-US$1325/MT (50% chromium).

The spot price of chrome ore and coke ore were stabilized last week.

There were no obvious movement on high chrome production cost.

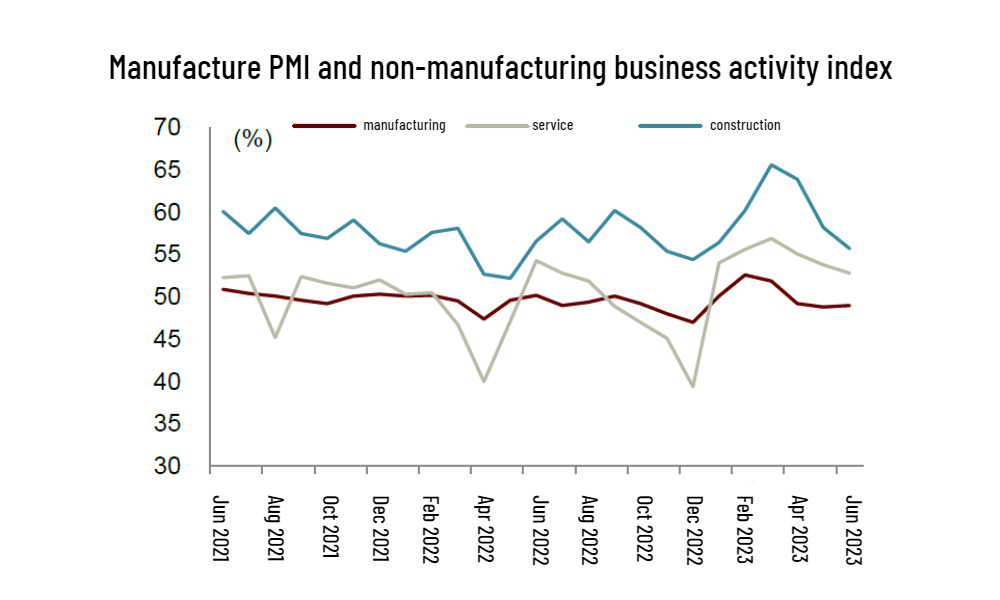

MARCO|| PMI recover while demand is still staying down.

China’s official manufacturing purchasing managers’ index (PMI) came in at 49.0 in June —perfectly matched with Bloomberg’s forecast— according to data from the National Bureau of Statistics released on Friday. The overall manufacture was still poorly performed considering the PMI was still landed on the “contract zone”.

1. Manufacture PMI and non-manufacturing business activity index

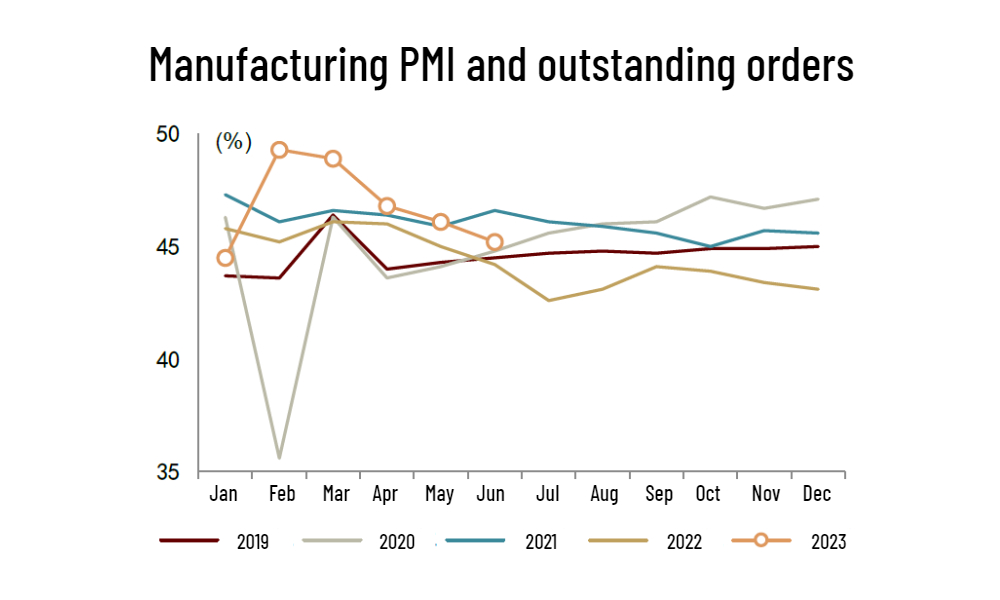

2. Manufacturing PMI and outstanding orders

Although the sub-index of new orders has slightly increased by 0.3 percentage points month-on-month to 48.6%, it still remains in the contraction zone and at a relatively low level. Among them, new export orders have decreased by 0.8 percentage points month-on-month to 46.4%.

The backlog of orders has decreased by 0.9 percentage points month-on-month to 45.2%, which reflects the further decline of the support effect from the previous backlog of orders. On the other hand, it is also lower than the level during the same period last year, indicating a relatively insufficient overall level of orders.

3. The PMI for production and business activity expectations has decreased by 0.7 percentage points month-on-month to 53.4%, marking the fourth consecutive month of decline.

In terms of industry breakdown, the PMI for the basic raw materials industry has increased by 0.8 percentage points month-on-month to 46.6%, showing a marginal improvement trend, but still remains weak, possibly mainly influenced by the real estate sector. The PMI for the construction industry in June has decreased by 2.5 percentage points month-on-month to 55.7%, possibly mainly influenced by the real estate sector, with the PMIs for architectural installation, decoration, and other construction activities, as well as residential construction, declining by 6.1 and 5.0 percentage points, respectively.

Sea Freight|| North America’s Sea freight market rebounded.

China’s sea freight market was stabilized despite freight rates overall on multiple sea routes recorded various trend last week. On 30th June, the Shanghai Containerized Freight Index rose by 3.2% to 953.6.

Europe/ Mediterranean:

Compiled by S&P Global, HCOB's final manufacturing Purchasing Managers' Index (PMI) fell to 43.4 from May's 44.8, its lowest since the COVID pandemic was cementing its grip on the world, below a preliminary reading of 43.6 and further from the 50 mark separating growth from contraction.

The economy in Euro is still laying low, shipping demand is in urgent needs of recovery. Until 30th June, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$763/TEU, which fell by 3.8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1466/TEU, which fell by 7.7%

North America:

The overall PCE price index, a reflection of consumer spending, rose by 0.1% but the core index, which strips out volatile food and energy prices and is preferred by the Fed rose 0.3%.

Until 30th June, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1408/FEU and US$2,368/FEU, 20% and 14.9% rose accordingly.

The Persian Gulf and the Red Sea:

Until 30th June, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 0% change from last week's posted US$1226/TEU.

Australia/ New Zealand:

Until 30th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$260/TEU, a 4.4% slide from the previous week.

South America:

The freight market had a slight rebound. on 30th June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2532/TEU, an 4.7% growth from the previous week.