The most worrying is when will the prices of stainless steel stop decreasing. Last week, the stainless steel prices mostly decreased. Although we believe that when China's domestic demand recovers (which is actually happening but slowly), the stainless steel prices will tend to be stable and increase. However, in a broader view, we look from the macroeconomy, there is theory and evidence supporting that the commodity has reached the peak and now is in a downward tendency. If you want to read more about the analysis, just roll down to Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,865 |

-12 |

-0.43% |

|

Foshan |

2,910 |

-12 |

-0.43% |

||

|

Hongwang |

Wuxi |

2,720 |

-2 |

-0.57% |

|

|

Foshan |

2,685 |

-37 |

-1.44% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,595 |

-30 |

-1.20% |

|

Foshan |

2,640 |

-45 |

-1.75% |

||

|

316L/2B |

TISCO |

Wuxi |

4,400 |

-51 |

-1.18% |

|

Foshan |

4,450 |

-36 |

-0.82% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,085 |

-69 |

-1.71% |

|

Foshan |

4,125 |

-66 |

-1.62% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,555 |

0 |

0% |

|

Foshan |

1,530 |

-1 |

-0.11% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,435 |

0 |

0% |

|

Foshan |

1,440 |

-1 |

-0.11% |

||

|

430/2B |

TISCO |

Wuxi |

1,260 |

-54 |

-4.49% |

|

Foshan |

1,265 |

-76 |

-6.22% |

TREND|| FUTURES once dropped below US$2,515/MT, and closed at US$2,525/MT.

CPI of June in the US soared to 9.1% on a month-on-month basis, the highest since 1984; China’s recovering momentum and domestic demand are weaker than expected. The commodity prices slumped later last week. The price of stainless steel reached a new low. Until July 15th, the most-traded contact of stainless steel futures dropped by US$130/MT to US$2,525/MT, bottoming at US$2,505/MT which was the lowest price in 2022.

300 series of stainless steel: Prices remain weak.

Wuxi has been under pandemic and regulations and the transaction volume fell. Due to the bad news of the macroeconomy, the prices slumped and stainless steel spot prices followed suit. Until July 15th, the base price of the cold-rolled 4-foot mill-edge stainless steel 304 declined by US$60/MT to US$2,655/MT; the hot-rolled stainless steel 304 by the private-owned mills was US$2,575/MT which was down by US$30/MT.

200 series of stainless steel: Prices were stable.

From July 11th to July 15th, the prices of cold-rolled stainless steel 201 remained steady. The price of the hot-rolled 5-foot stainless steel slightly decreased. Until July 15th, the mainstream base price of the cold-rolled stainless steel 201 and the 201J2 in Wuxi remained at US$1,525/MT and US$1,405/MT respectively. The hot-rolled 5-foot resources were reduced by US$15/Mt to US$1,405/MT. Worrying about the transportation that has been influenced by the pandemics, some clients preferred ordering in other markets over buying in Wuxi.

The cold-rolled stainless steel 430 was weak. In Wuxi, the quotation of stainless steel 430/2B of TISCO and JISCO kept declining last week. The price was between US$1,230/MT and US$1,240/MT which reduced by US$60/MT compared to July 9th.

400 series of stainless steel: Prices kept falling.

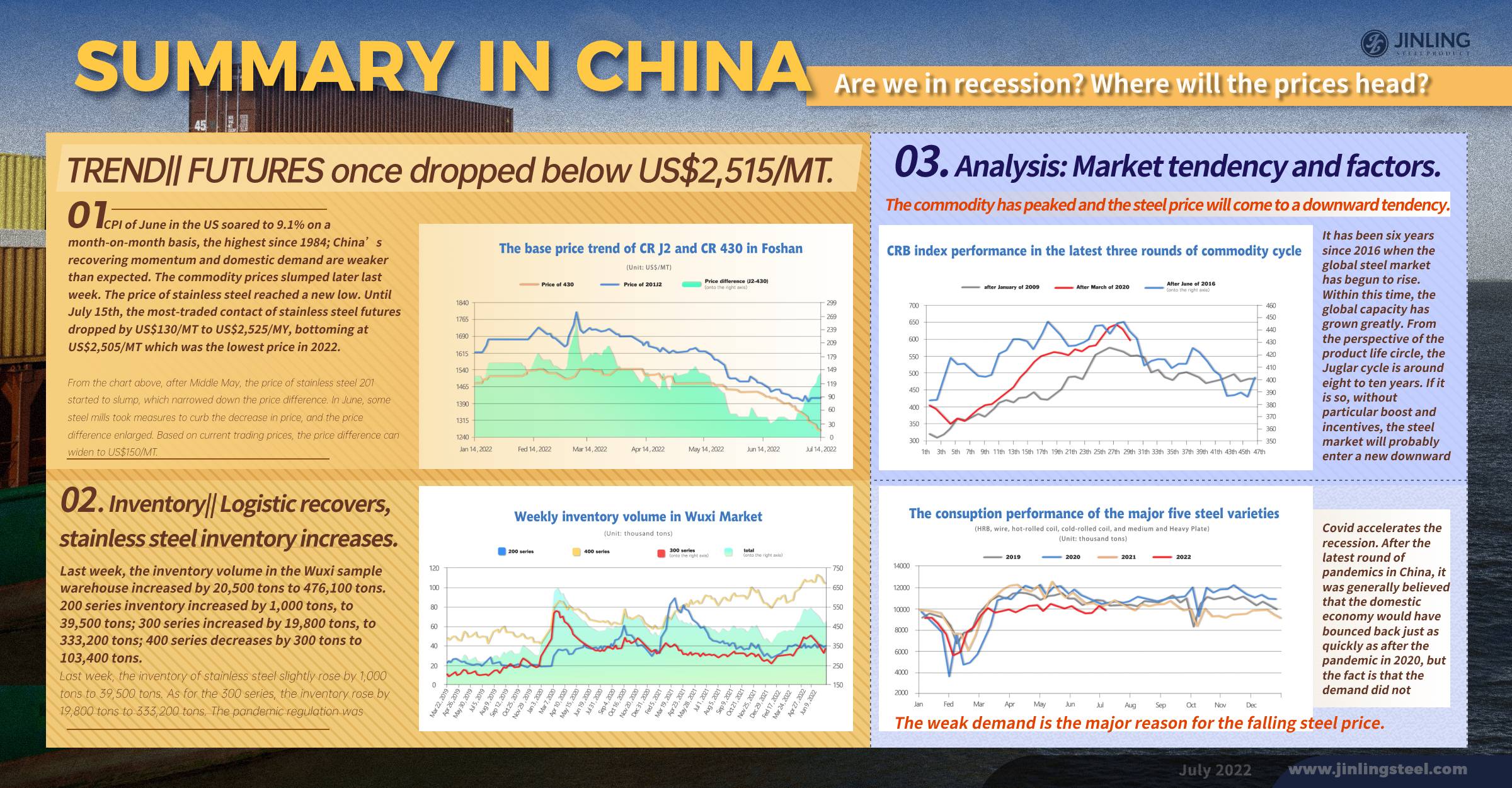

400 series is often compared with the 200 series when talking of price trends. The trading of stainless steel 400 series has been tepid and many steel mills have to reduce the production of 400 series and meanwhile propped up the price of 200 series. Now, the price difference between stainless steel 201 and 430 widens again.

From the chart above, after Middle May, the price of stainless steel 201 started to slump, which narrowed down the price difference. In June, some steel mills took measures to curb the decrease in price, and the price difference enlarged. Based on current trading prices, the price difference can widen to US$150/MT.

Summary:

The most-traded contract of stainless steel futures fluctuated to decrease. Influenced by the downward nickel price of Shanghai Futures Exchange, the stainless steel futures lowest reduced below US$2,515/MT. Generally, the stainless steel price is still decreasing tendency. One major reason is the weak demand which has greatly ripped off buyers’ confidence. Another reason is related to the continuously falling nickel price. Although it is difficult to seek some lighten-ups from the demand side, some people still think that the stainless steel price has some chance to rebound. First is the raw material cost can’t fall without limit because the raw materials are now in deficit and stainless steel makers can’t find more profit margin from this side. Second is the low inventory volume of the stainless steel warehouse receipts. It is expected that by raising the price, the discount will be narrowed in the short term.

300 series of stainless steel: The “broad-based” inflation worldwide triggers concern. In China, the pandemic remains, the GDP of Q2 is lower than expected, and demand is weak, which is significantly worse for the nickel and stainless steel prices. But the spot price decreased slowly, and it is predicted that in a short term, the cold-rolled stainless steel 304 of the private-owned mills will maintain between US$2,595/MT and US$2,670/MT.

200 series of stainless steel: Sellers are firm in supporting the prices although the transaction is still weak so far. The pandemic is under control and the logistic warms up, so it is predicted that the price of stainless steel 201 will stay steady. The price of cold-rolled stainless steel J2 (coil) will be maintained above US$1,435/MT.

400 series of stainless steel: The July purchasing price of high chromium of TISCO dropped significantly by US$97/50 base ton to US$1,313/50 base ton. The price of 400 series lost the support from raw material. As the pandemic is eased, the trade in stainless steel will turn better. It is predicted that the price of stainless steel 430/2B will become stable, reaching US$1,195/MT~US$1,225/MT.

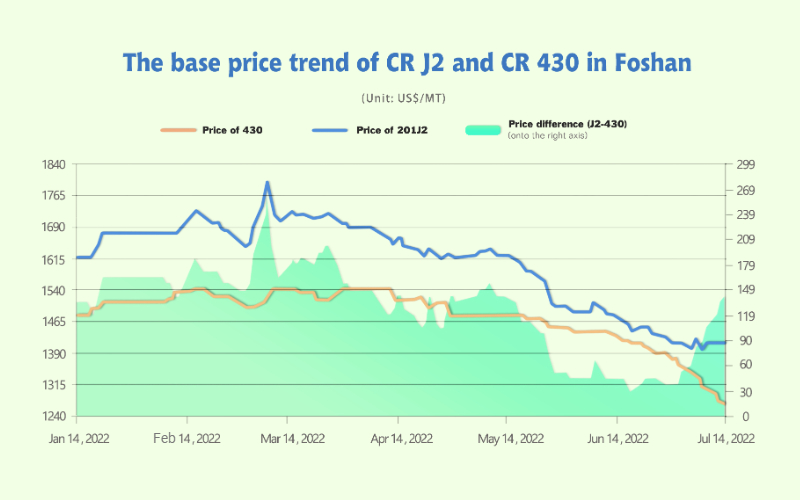

Inventory|| Logistic recovers, stainless steel inventory increases.

Last week, the inventory volume in the Wuxi sample warehouse increased by 20,500 tons to 476,100 tons. 200 series inventory increased by 1,000 tons, to 39,500 tons; 300 series increased by 19,800 tons, to 333,200 tons; 400 series decreases by 300 tons to 103,400 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| July 7th | 38,473 | 313,459 | 103,700 | 455,632 |

| July 14th | 39,489 | 333,246 | 103,389 | 476,124 |

| Difference | 1,016 | 19,787 | -311 | 20,492 |

200 series and 300 series of stainless steel: Pandemics ease and the delivery recovers.

Last week, the inventory of stainless steel slightly rose by 1,000 tons to 39,500 tons. As for the 300 series, the inventory rose by 19,800 tons to 333,200 tons. The pandemic regulation was eased last week and steel mills’ delivery returned to normal. But some clients choose to buy in other markets worrying about the lockdown. Thereby, the inventory increased.

400 series of stainless steel: Steel mills cut down production in July.

The production of 400 series in June decreased by 118,200 tons, to 485,400 tons. Last week, the inventory in Wuxi was reduced by 300 tons to 103,400 tons. In July, JISCO will reduce the production by 30,000 tons ~ 40,000 tons; TISCO will cut down by 40,000 tons, and another steel mill in eastern China will reduce 30,000 tons of output.

Raw Materials|| Ore prices decrease.

Chromium: Loss is expanding. High chromium decreased by US$45/50 base ton.

Last week, the price of high chromium decreased by US$45/50 base ton to US$1,299/50 base ton. The deficit of high chromium producers increases. However, the chromium ore quotation remains. What maintains the price stable is that the inventory of chromium ore remains low in China. Besides, the recent power outages, strikes, and other emergencies in South Africa have caused instability in the export of chrome ore.

Nickel: The interest rate hike continues to suppress the nickel price.

The most traded contract of ShFE nickel fluctuated and slumped below CNY150,000 (US$22,388). After the surge in March, LME nickel has gone all the way down. Until July 14th, it closed at US$19,190/MT, which dropped by US$35,810/MT compared to the peak of US$55,000/MT.

The Ferronickel maintained at US$194/Ni last week. To keep pace with stainless steel production, it is possible that the ferronickel factories will also start to reduce production. It is predicted that in a short term, the price of ferronickel will be stable.

As for that refined nickel, with the decline of price, transactions and purchases rise. Because the CPI of the US rose beyond expectation, the Fed might probably accelerate the rate hike, which will hit the commodity price.

Macro||Analysis: Market tendency and factors.

On July 11th, the most-traded contract of HRB futures dropped sharply below US$597/MT. Compared to the price on June 10th, it decreased by more than US$119/MT; on a month-on-month basis, it reduced by 17.8%. The prices of raw materials decreased largely. Iron ore and coke declined by 19.3% and 20.9% respectively. The value of the ferrous industry decreases significantly.

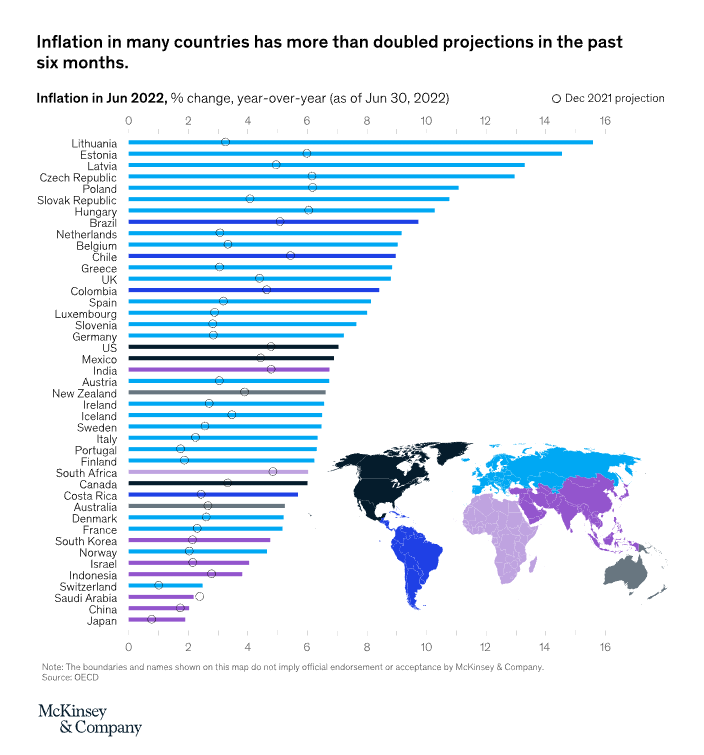

On July 13th, it is released that the CPI of the US in June rises to 9.1% MoM, which is the highest since 1981, far higher than the market expectation. After the data was released, the three major U.S. stock futures indexes plunged quickly, with Nasdaq futures down 1.56% and S&P 500 futures down more than 1%.

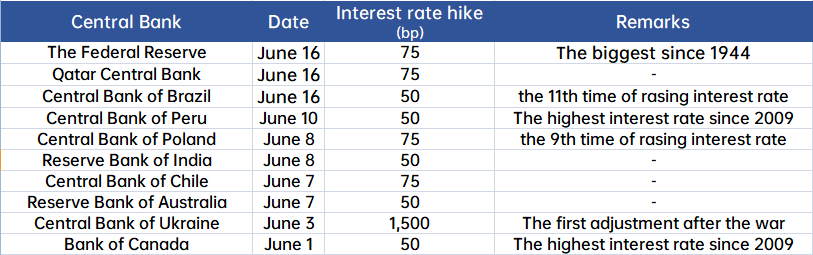

Many people believe that the Fed will further raise the interest rate in July, between 75bp and 100bp. Facing the increasing rate, the commodity prices will be further suppressed and the world economy will risk recession.

In the past two months, China’s stainless steel prices have continued to decrease. It is widely believed that the weak demand within China is the major backlash to the prices. Besides, the global economy is very close to recession, which further brings down steel prices. The stainless steel price is largely concerned with steel prices and output. In this part, we will go deep into the steel market tendency as a whole, to analyze the current state quo we are facing.

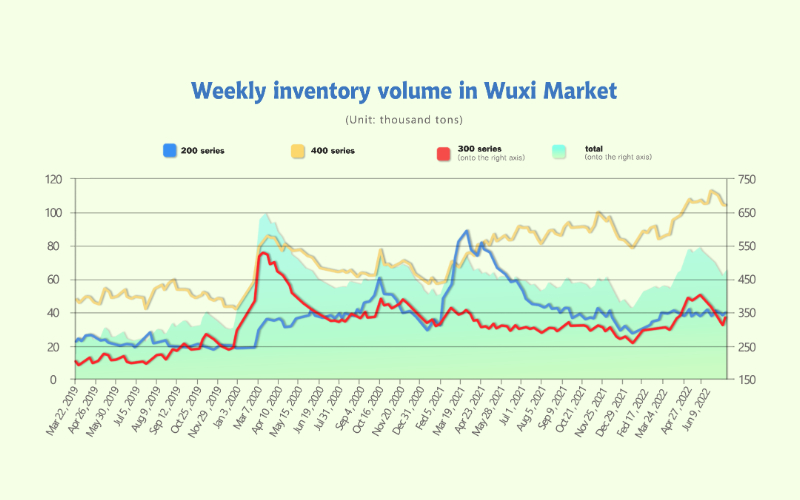

1. The commodity has peaked and the steel price will come to a downward tendency.

It has been six years since 2016 when the global steel market has begun to rise. Within this time, the global capacity has grown greatly. From the perspective of the product life circle, the Juglar cycle is around eight to ten years. If it is so, without particular boost and incentives, the steel market will probably enter a new downward round in the future two and three years.

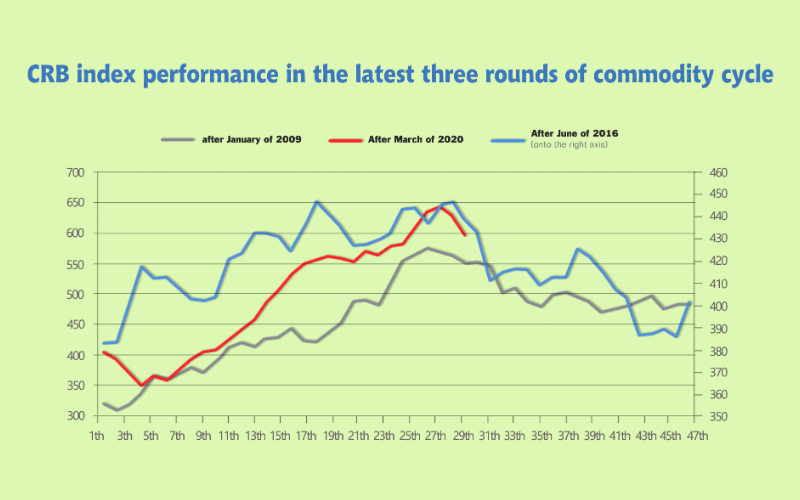

Globally, the peak has reached and all commodity prices will start to fall. Based on the CRB index, the commodity tendency of this round is somehow similar to the past terminologies. The past two rounds, one started in 2009 and the other started in 2016, both reached their peak around 27~30months after they began. As for this round, the CRB index has passed the inflection point and now it is on the way to falling.

2. The weak demand is the major reason for the falling steel price.

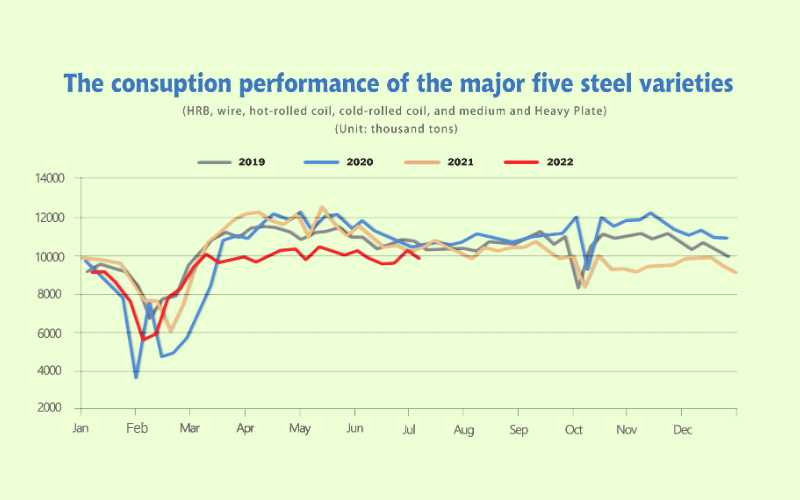

Covid accelerates the recession. After the latest round of pandemics in China, it was generally believed that the domestic economy would have bounced back just as quickly as after the pandemic in 2020, but the fact is that the demand did not recover as expected. Until July 7th, the apparent consumption volume of the major five varieties (HRB, wire, hot-rolled coil, cold-rolled coil, and medium and Heavy Plate) is 9.78 million tons, MoM decreasing by 3.5%, YoY lower by 6.5%. One of the biggest demands for steel is for buildings, China’s monthly transaction volume of steel for buildings is 152,000 tons which dropped by 5% from last month, and YoY decreased by 22.1%.

3. Concerns of recession drag down the prices even further.

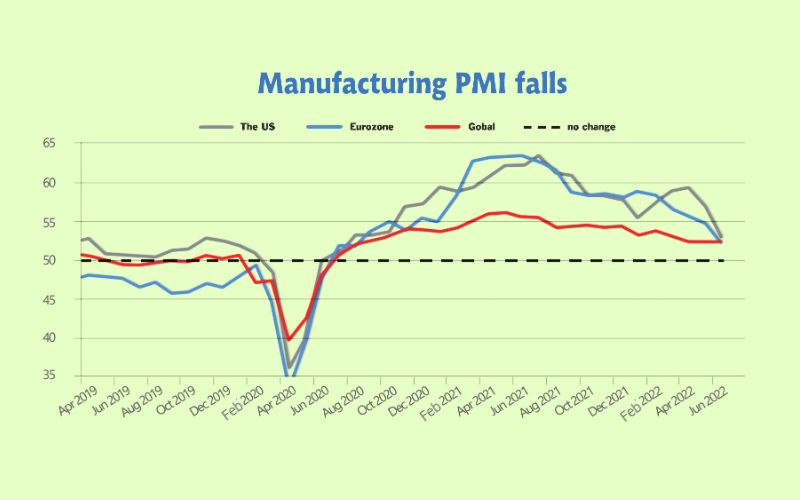

The manufacturing PMI index of the US and Eurozone in June month-on-month decreased by 3.1% and 2.5% respectively, closing to the “no-change line (50%)”, reflecting the important economic entities in the world are weakening. What’s more, the Eurozone investor confidence index fell sharply to -26.4% in July, far lower than the market anticipation. Afraid of the broad recession, market sentiment is pessimistic and all commodity prices have declined after July. Crude oil and non-ferrous metal start to decrease firstly, influencing the ferrous metal price to reduce.

The hawkish move will remain in raising the interest rate. As the Fed raises the rate, and it intends to be enlarged, the currency of other countries or regions depreciates significantly against the US dollar. To maintain the value of the currency, it is possible that the central banks will have to increase the interest rate as well. On the other hand, to cool down the inflation which has spread to many countries, raising interest rates is necessary. Therefore, the Fed raises interest rates sharply, marking the beginning of the global interest rate hike cycle, and the liquidity will be significantly tightened.

Future of steel in China: economy slowly increase, steel production will reduce.

The manufacturing PMI in June was 50.2%, in May and April, it was 49.6% and 47.7% respectively. The manufacturing industry and infrastructure investment will still be the key momentum driving China’s economy to improve. On July 15th, according to China’s National Bureau of Statistics, the GDP of the H1 this year is 2.5%. The goal of GDP growth in China in 2022 is 5.5%. But many constitutions lower the expectation, mostly below 5%. Meeting the goal is very important to the government, certainly, Beijing will expand the investment to boost the economy in the second half of the year.

The output of the steel industry will decrease. On April 19, the National Development and Reform Commission stated at a press conference that it will continue to carry out the reduction of national crude steel output this year to ensure that the national crude steel output will decrease year-on-year in 2022.

Crude steel output in the second half of the year will decrease by about 55 million tons compared with the first half of the year. According to the National Bureau of Statistics, the crude steel output from January to May was 435.016 million tons, and my country's crude steel output in June was about 90 million tons, that is, my country's crude steel output in the first half of the year will reach about 525 million tons. The crude steel reduction target in 2022 may be controlled within 1 billion tons, the annual crude steel reduction may be around 40 million tons, and the crude steel output in the second half of the year will be reduced by about 55 million tons compared with the first half of the year.

Freight|| Service to South America maintains to increase.

Compared to the previous week, the SCFI on July 15th slightly decreased by 1.7% to 4074.70.

Europe/ Mediterranean: Last week, the transportation market remained stable, and the market freight rate fell slightly. On July 15th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$5,612/TEU, down by 1.5% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$6,268/TEU, down by 1.4% from the previous week.

North America: On July 15th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$6,883/FEU and US$9,534/FEU, respectively, down by 3.3% and 0.7% from the previous week.

The Persian Gulf and the Red Sea: The demand of transportation returns to normal after Ramaḍān. On July 15th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$3,201/TEU, decreasing by 3.3% from the last week.

Australia/ New Zealand: On July 15h, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$3,189/TEU, down by 3.7% from the previous week.

South America: This service is now in the traditional peak season. The spot market booking price continued to rise. On July 15th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$9,312 /TEU, up by 4.0% from the previous week.

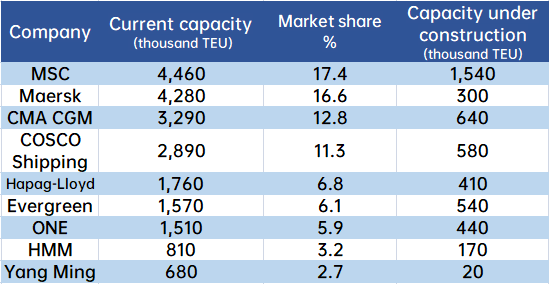

The shipping capacity will surge in the next two years.

Last week, for the first time in the market, containership building order volume surpassed bulk carriers and tankers. It is reported that the volume of current cumulative container ship orders are almost 900 which reaches 7 million TEU. These orders will begin to be delivered in the second half of the year, and peak in the next two years, and the market supply will surge by more than 27% in the future.

There are concerns over the sharply increasing capacity, if the demand decreases and over supply, a price war should be no surprise.

The industry estimates that from the fourth quarter of this year to the first quarter of next year, with the release of new capacity, if the demand cannot be maintained, it may lead to a freight price war.

The global undelivered container ships account for about 27.9% of the current total operating capacity, of which more than 1 million TEUs will be added this year, the increasing volume will be double in the next year, increasing to 2.45 million TEU and in the year after, the new capacity will further rise by 2.74 million TEU.