Happy to see you still reading our reports in 2022. In the new year, what do you expect for the stainless steel market? Last week, the stainless steel prices were quite stable and increased slightly. The market inventory kept reducing. Though the price of raw materials such as high chrome is decreasing, it is estimated that stainless steel prices will rise. If your business is based in Turkey, there is really good news---- Turkey has revised its import duties on cold-rolled stainless sheets from 12% to 8%. For some factors that influence the prices in January and February of 2022, keep reading the Stainless Steel Market Summary in China, we predict that the price will have an increasing force before the Chinese New Year and the supply will gradually grow next year.

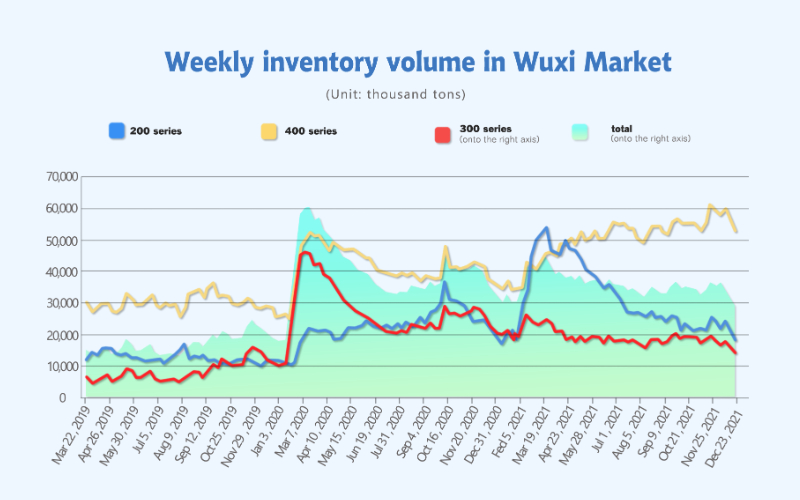

INVENTORY|| The total inventory continues to decrease, more than 1,000 tons less per week.

Last week, the total volume of the Wuxi sample warehouse decreases by 10,900 tons, to 378,200 tons. 200 series inventory reduces by2,800 tons, to 28,100 tons; 300 series down by 5,500 tons, to 266,900 tons; 400 series decreases by 2,600 tons to 83,200 tons.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| December 27th ~ December 31st | 28.1 | 266.9 | 83.2 | 378.2 |

| December 20th ~ December 24th | 30.9 | 272.4 | 95.5 | 389.1 |

| Difference | -2.8 | -5.5 | -2.6 | -1.09 |

200 series of stainless steel: The new arrivals of products are too little to make up the consumption volume.

Last week, the prices of the stainless steel 200 series remained. The inventory volume has been low and the transaction was light. Until Friday, the price of cold-rolled stainless steel 201 in Wuxi market was US$1,810/MT, increasing by US$16/MT compared to the last weekly average price; the base price of cold-rolled stainless steel 201J2 was quoted at US$1,715/MT, which increased by US$16/MT. About the hot-rolled 5-foot product, the price rose by US$16/MT as well, reaching US$1,700/MT.

From the perspective of trading, the transaction was weaker than two weeks ago. Even the transaction of the hot-rolled 5-foot 201 which has been in shortage turned bland. Though the transaction volume decreased, the volume of the new arrival was small and thereby the spot inventory was still reduced. The coming Chinese New Year Holiday did not stimulate the demand. So far, the market maintains a stable mind to the future trend regardless of the inventory of stainless steel 200 series has dropped for consecutive three weeks. The inventory volume hits a low point within the year. However, it is predicted that the demand won’t grow much recently before people are unwilling to stock up before the long new year holiday.

300 series of stainless steel: Inventory keeps reducing and the on-the-road resources are sold out.

Last week, the inventory of stainless steel 300 series continued to decrease for consecutive three weeks. The transaction started to weaken and is not as hot as two weeks ago. Besides, the latest bidding price of the ferrochrome of Tsingshan dropped greatly, which cools down the market. On December 30th, the stock price increased and also brought up the trade of spot products. Later on the same day, the spot price increased by US$16/MT.

Recently, fewer products are sent out by steel mills because steel mills deliberately control the delivery volume. Last week, several cargos of stainless steel were on the road to the market, but it is said that most of the resources have already been sold out. As soon as they arrive, the products will head to the buyers. The social inventory volume keeps decreasing, which maintains the prices of stainless steel high. After the Chinese New Year holiday, more new resources will be released by steel mills and alleviate the decline of inventory.

400 series of stainless steel: The inventory keeps reducing.

Last week, the mainstream quotation of the cold-rolled stainless steel 430 was US$1,570/MT, which remained as two weeks ago and the trading price was slightly lower, at around US$1,555/MT. As for TISCO’s guidance price of cold-rolled stainless steel 430, it increased by US$8/MT to US$1,660/MT. The transaction was light but the social inventory continues to decrease. Although the inventory volume of the stainless steel 400 series remains high, the pressure over the high inventory has released a bit thanks to the reduction of inventory that has lasted for a month.

Raw Materials|| High chrome production will be reduced due to profit deficit.

The mainstream quotation of high chrome has been reduced in recent days. Previously, it dropped by US$63/50 base tons, down to US$1,333/50 base tons ~US$1,365/50 base tons. It is estimated that the price will keep decreasing.

Tsingshan gave out the January purchasing price of high chrome, which is US$1,300/50 base tons, US$222 lower than the price for December. From the feedbacks of different factories, high chrome factories based in the south mostly couldn’t accept the low price.

Some long-term suppliers are now considering a pause of the production in the future because such a low price will harm their profit for sure. But the northern factories tend to follow the decline in price and the price in January will reduce to US$1,270/MT.

Because the power supply policy is different from region to region and the production costs are various in different factories, once the price of high chrome drops significantly, the regional advantage will stand out. For example, a newly built production line in Inner Mongolia is beneficial due to its low production cost, while in Guangxi and Guizhou Provinces, the high power cost and the outdated production technology bring up the total cost. Therefore, many southern producers are considering stopping production earlier.

From the perspective of the supply, the high chrome production has kept increasing in the fourth quarter of 2021 but the production of stainless steel continued to decrease. Supply was over demand, and the price of high chrome had to fall. If the factories reduce or stop the production of high chrome, the supply will be lighter and the price will be stable.

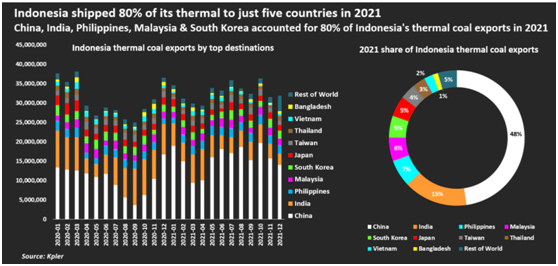

Coal: Indonesia suddenly suspends coal exports in January.

JAKARTA, Jan 1 (Reuters) - Indonesia has banned coal exports in January due to concerns that low supplies at domestic power plants could lead to widespread blackouts, a senior official at the energy ministry said on Saturday.

The Southeast Asian country is the world's biggest exporter of thermal coal, exporting around 400 million tonnes in 2020. Its biggest customers are China, India, Japan and South Korea.

Indonesia coal exports to top destinations

Ridwan said coal supplies to power plants each month were below the DMO, so by the end of the year "there was a coal stockpile deficit," adding that the ban will be evaluated after January 5.

The Indonesian Coal Mining Association (ICMA) called on the energy minister to revoke the export ban, saying in a statement the policy was "taken hastily without being discussed with business players".

Ahmad Zuhdi Dwi Kusuma, an industry analyst at Bank Mandiri, said the ban would push global coal prices higher in coming weeks as stockpiles decline, adding Indonesia's customers may turn to Russia, Australia or Mongolia.

China's benchmark thermal coal futures rose by as much as 7.8% in the first day of trading since the policy was announced. The futures closed at 713.80 yuan ($112) a tonne, up 6.4%.

It was the biggest daily increase since Oct. 19, when prices climbed to a record 1,848 yuan a tonne amid a supply deficit in China caused by shortages from domestic mines.

Indonesia is China’s largest coal importer: According to statistics from the General Administration of Customs, a total of 290 million tons of coal was imported from January to November last year, and Indonesia supplied 178 million tons of coal to China, accounting for about 61%.

Not long ago (December 21), many Chinese companies and Indonesian coal companies signed an order at the China Coal Import Summit in 2021, and China will continue to import coal from Indonesia.

Tariff || Turkey cuts import duties on cold-rolled stainless sheet.

According to a statement published in the country’s Official Gazette, Turkey has revised its import duties on cold rolled stainless sheet from 12% to 8%, effective as of January 1, 2022.

In the January-November period this year, Turkey imported 275,486 tons of the given product, according to the data provided by the Turkish Statistical Institute (TUIK). The largest suppliers were China with 94,069 tons, Indonesia with 40,401 tons, Spain with 30,646 tons, Taipei China with 25,913 tons, and Italy with 19,402 tons.

The products currently fall under Customs Tariff Statistics Position Numbers 721931000000, 721932100000, 721932900000, 721933100000, 721933900000, 721934100000, 721934900000, 721935100000, 721935900000, 722020210011, 722020290011, 722020410011, 722020490011, 722020810011, and 722020890011.

Capability to be enlarged in 2022. What will influence the stainless steel prices?

MACROECONOMY

1. Recently, China Central Bank has successively lowered the RRR and interest rates. In a short term, the policy is to remain loose. Besides, at the beginning of every year, more capital will flow into the real economy, which promotes the market.

2. The real estate market in China was strictly controlled. But now it has started to recover, which will mobilize the whole industry chain to develop.

Supply

1.In December 2021, 6 steel mills united to reduce production and stop the stainless steel prices from decreasing further. Some steel mills also reduced production due to profit deficit; others reduced because of environmental investigation and maintenance. The stainless steel production of December dropped compared to November. In January and February of 2022, two production basements of Tsingshan will carry out maintenance, influencing the production of the stainless steel 300 series.

2.About the new capability in 2022, it is estimated that 8,880,000 tons of capability will be invested. Amid, 4,980,000 tons belong to stainless steel 300 series, which is 56% of the total increase. The increase in supply won’t be effective in January because the plans will start after February.

Demand

1.Currently, the inventory volume of the market and downstream manufacturers are small. It is predicted that the purchase will boom in the first half of January before the holiday begins.

2.The pandemic is still spreading. Fortunately, the supply chain in China is completed and safe comparatively. The export demand is outstanding, typically when the stainless steel prices fell from an extremely high level. It is estimated that overseas demand will remain as this 2021 as long as the pandemic is influencing.

Summary

In a short term, as usual, steel mills arrange overhaul and maintenance in January, while downstream manufacturers tend to stock up before the Spring Festival. Therefore, the prices of stainless steel will remain and even increase in the first half of January. In mid-January, when Chinese traders and buyers will start their holiday, the prices of stainless steel will maintain stably. However, during this time, how much will the production be reduced shall be paid attention to. In a long term, it is predicted that the capability will be enlarged in 2022. At the end of February of 2022, the downstream manufacturers will return to work, and the demand will increase. If the new capabilities to be realized in March as the plan, the future supply will be expanded.