We would call it work-life balance if you are concerning the stainless steel market and meanwhile, enjoying the World Cup with a bunch of friends. No worries, Jinling Steel gonna help you to keep up with the trend real quick. Last week (from November 14 to 18), the weekly average price of the major grades of stainless steel all decreased and the spot inventory in the Wuxi market rose. The fall in price and rise in inventory stimulate people's worries about the sluggish market. Different from the gloomy atmosphere of the stainless steel market, the volatility returned to the LME nickel which breached the daily price limit, hitting the US$30,000 mark. As the international trading demand drops, sea voyages and freight continues to reduce. The current sea freight is very close to the pre-pandemic level. If you have time and are interested in our Stainless Steel Market Summary in China, please roll down.

WEEKLY AVERAGE PRICE

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,620 |

-14 |

-0.56% |

|

Foshan |

2,665 |

-14 |

-0.56% |

||

|

Hongwang |

Wuxi |

2,515 |

-9 |

-0.35% |

|

|

Foshan |

2,540 |

-1 |

-0.06% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,430 |

0 |

0.00% |

|

Foshan |

2,475 |

-9 |

-0.36% |

||

|

316L/2B |

TISCO |

Wuxi |

4,230 |

-16 |

-0.38% |

|

Foshan |

4,290 |

-14 |

-0.34% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,050 |

-14 |

-0.36% |

|

Foshan |

4,11 |

-9 |

-0.21% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,525 |

-18 |

-1.29% |

|

Foshan |

1,480 |

-27 |

-1.94% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,445 |

-22 |

-1.60% |

|

Foshan |

1,410 |

-28 |

-2.15% |

||

|

430/2B |

TISCO |

Wuxi |

1,235 |

-16 |

-1.37% |

|

Foshan |

1,230 |

-16 |

-1.38% |

TREND|| Gloomy atmosphere continues

The spot price of stainless steel had verified. Stainless steel 201 fell after stabilising while stainless steel 304 was facing downward, and stainless steel 430 remains lacklustre. The most traded contract price fell by US$77 to US$2465/MT.

Stainless steel 300 series: mills cut production in response to price drop

The price of stainless steel is 304 remaining bearish. The price of cold-rolled 4-foot mill-edge stainless steel 304 fell by US$21 to US$2455/MT, while hot-rolled stainless steel was quoted at US$2405/MT with a $14 drop. While the price of stainless steel heading downward, the price of nickel and scrap was standing up firmly, and mills are planning to cut their production volume by 40% at most.

The theoretical production cost drops $11 to US$2540/MT.

Stainless steel 200 series: price continues to drop

The transaction remains sluggish. Until Friday, the base price of cold rolled stainless steel 201 dropped slightly by US$14 to US$1480/MT. Cold-rolled stainless steel 201J2 also fell by US$14 to US$1405/MT. Hot rolled 5-foot stainless steel closed at US$1420/MT with a US$28 decrease.

Stainless steel 400 series: Inventory increased but transactions remained calm.

The guidance price of 430/2B of TISCO and JISCO had closed at US$1350/MT and US$1305/MT accordingly. The quoted price at the Wuxi market had closed between US1235/MT-US$1240/MT.

The EXW price of high chrome was between US$1265-US$1290/MT (with 50% chromium), a US$14/MT drop. The spot price of coke increased by US$14 and the production cost of chrome shifted downward.

In Summary:

Stianless steel series 300: The increment in production in the early stage is gradually transforming into market resources, but it had broken the equilibrium of supply and demand since the transaction is recently weakening, and it had forced the spot price down. Mills had scheduled the production cut in reply to the volatility.

Stianless steel series 200: The market is still declining and mills had limited responsiveness on the series 200 production. Demand downstream remained lethargic as the economy in China is still in recovery.

Stianless steel series 400: The most traded price of 430/2B had dropped between US$1235-US$1240. Similar to the stainless steel 300 series, more resources had stacked up in inventory, and the transaction was sluggish. The spot price is projected to remain stable.

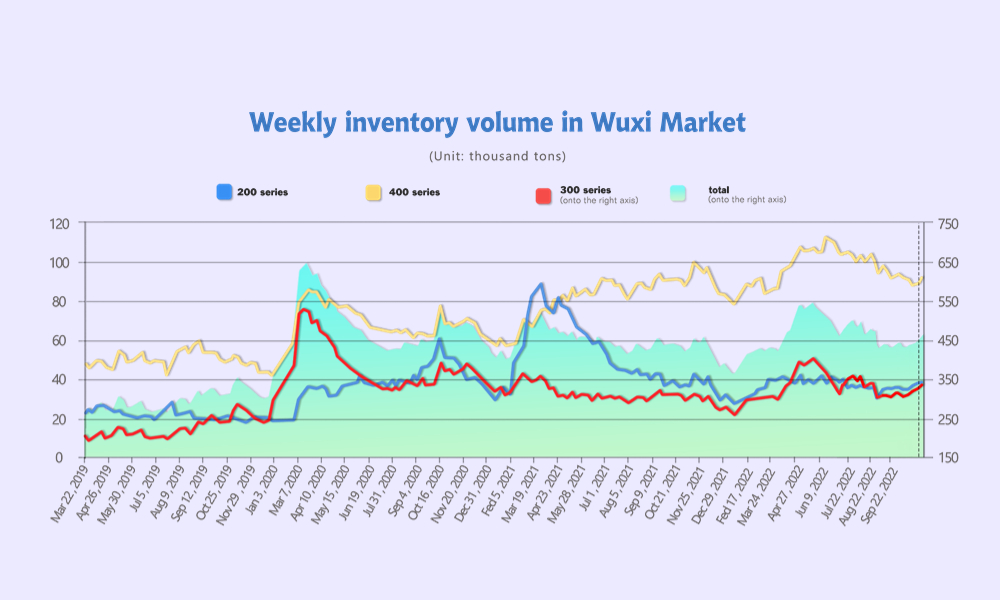

INVENTORY|| Inventory keep piling up

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| November 10th | 37,500 | 323,512 | 88,541 | 449,553 |

| November 17th | 37,760 | 334,371 | 91,571 | 463,702 |

| Difference | 260 | 10,859 | 3,030 | 14,149 |

The inventory level at the Wuxi sample warehouse rose by 14,149 tons to 463,702 tons (as of 17th November).

the breakdown is as followed:

200 series: 260 tons up to 37,760 tons

300 Series: 10,859 tons up to 334,371 tons

400 series: 3,030 tons up to 91,571 tons

Stainless steel 200 Series: Sluggish transactions and a slight increase

Inventory merely had a fractional increase by 260 tons to 37,760 tons, an four consecutive growth. The sign of inventor outage was fading out. Yet, on the other hand, great inventory pressure is emerging.

Stainless steel 300 Series: rapid growth in inventory

Tsingshan and Delong took up a major part of the 10,859-ton increment. Delong allegedly had reduced the volume of distribution of cold-rolled stainless steel from the agencies,30-50% were cut reputedly. The distribution of hot rolled stainless steel remains unaffected. The inventory of the 400 series is not likely to reduce in the coming week.

Stainless steel 400 series: inventory accumulation pushed the price down

Similar to other stainless-steel series, the sluggish transaction slowed the digestion of inventory, even some traders have to offer a discount to lower the inventory. Also, the high-standing price of raw materials was forcing the mills to remain their price unchanged.

RAWMATERIALS|| LME tightens restraints as nickel turns unruly again

Chrome: US$14 drop to US1250/MT

The most traded EXW price of high Chromium had a US$14 drop to US$1290/MT (with 50% chromium), but there was approximately a US$57 difference between the lowest and highest price in the market. The production cost of high chromium shifted downward with the price of coke and chrome ore. But the profitability of the organization in producing high chromium was considered low, production was unable to resume so far.

The supply in the high chromium market had increased but the retail market turned sluggish after the open tendering. Major production areas of high chromium, such as Inner Mongolia and Shanxi were still influenced by the pandemic and logistic problems.

Nickel:Chaos returns to the LME nickel market

LME Nickle had just been through a dramatic week. Monday (11th NOV), The three-month nickel contract surged on 14 November to briefly breach the $30,000/t mark, hitting the LME's daily trading limit of 15% in the process. After peaking at $31,275 on Tuesday, the highest since early May, the price has subsequently imploded, retreating to $25,800/T.

The LME has reacted by raising initial margins by 28% to $6,100 a tonne from Friday’s close and by stepping up market surveillance activity.

While a better-than-expected energy price outlook in Europe, a softer dollar, electric vehicle demand and China optimism have no doubt helped prices, the scale of the increase highlights the effect of low trading liquidity, which has made the nickel contract sensitive to wild price swings.

The trading exchange and the nickel market are paying for the notorious shutdown in March when LME suspended and canceled the trades. Traders blamed low liquidity for the volatility, the most severe since March. The London Metal Exchange (LME) on March 8 canceled all nickel trades and suspended the market for more than a week after prices doubled in a matter of hours.

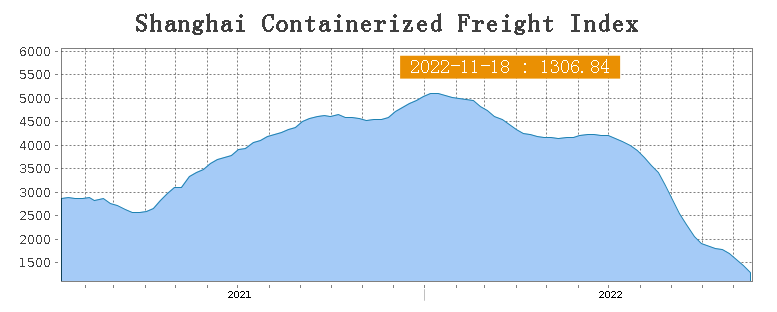

SEA FREIGHT|| Sluggish demand left thousands of containers in idle.

Global trading is very likely to diminish due to the slowing growth of the US economy and the Russo-Ukrainian War.

The over-supply of the container is raising concern for businesses, stated by Drewry, the number of cancelled freight ships will climb up to 14% in early December.

The sluggish situation of China's container transportation market was continuing as the demand was still laying low. freight rate on multiple sea routes continued to drop. Until 18th November, the Shanghai Containerized Freight Index was downed by 9.5% to 1306.84.

Europe/ Mediterranean: The ZEW Indicator of Economic Sentiment for Germany rose sharply by 22.5 points to -36.7 in November 2022. The overwhelming economy in Europe had driven the manufacturing index to break the threshold, and the energy price is continuing to spike along with the progress of warfare between Russia and Ukraine.

On 18th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1172/TEU, an 20.7% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1967/TEU, down by 4.6%.

North America: The latest report confirmed the unemployment rate rose to 3.7%, still close to a 50-year low. The import volume in Los Angeles port recorded a 28% shrinks compare to every October since GFC 2009.

On 18th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1559/FEU and US$3877/FEU, 4.5% and 8.2% fall accordingly.

The Persian Gulf and the Red Sea: Freight rate had dropped significantly after the rose in the week before. On 11th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 15.6% fall from last week's posted US$1393/TEU.

Australia/ New Zealand: The freight rate continued to drop. On 18th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$802/TEU, down by 20.3% from the previous week.

South America: The supply-demand curve was imbalanced and drag the freight rate down. On 11th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2576/TEU, down by 12.5% from the previous week.