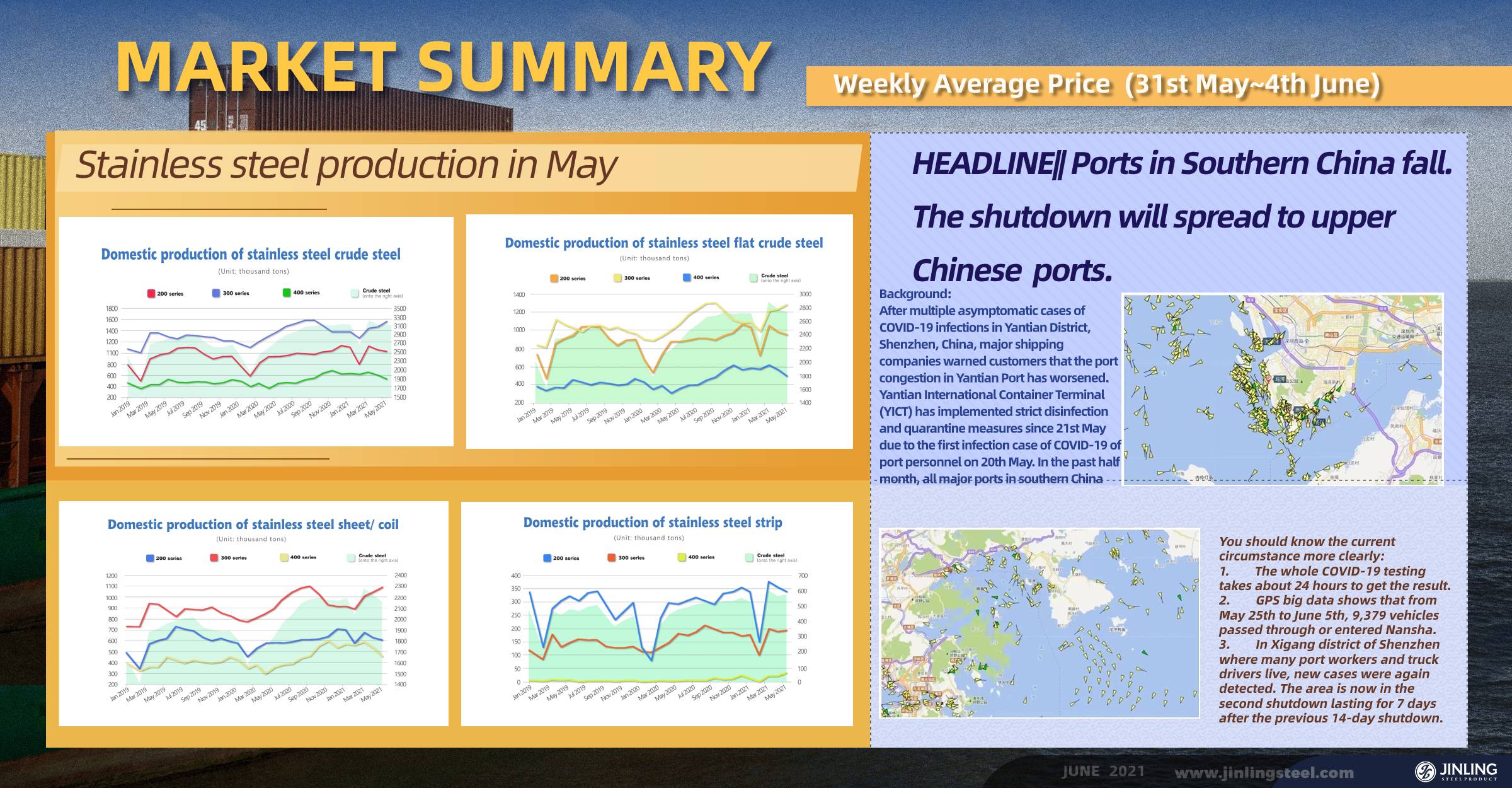

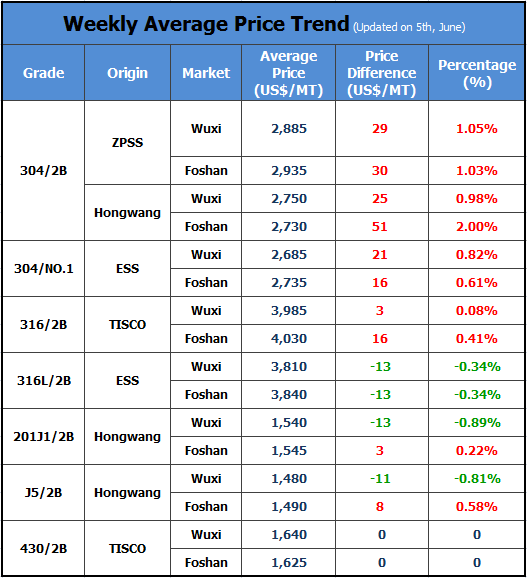

TREND|| Will the prices keep increasing next week?

Last week, the market price trend runs strongly. With Contract 2107 cornering the market, the spot market increased slightly within the week. The price difference between futures and spot was once narrowed down to around US$95/MT, but later the futures’ stock price was reduced significantly, affecting the spot market to turns down. What about the coming prices in the stainless steel market?

304: “Out of stock” remains. The price is expected to rise.

From the perspective of demand, the price will still maintain momentum. In April, the total export volume of stainless steel is 410.5 thousand tons which hits the new record high. The net export volume of stainless steel is 186 thousand tons. According to market experts, exports in May and June will remain hot because South Korea will carry out the anti-dumping policy in July, so the export quota of July will be brought forward in June. Although the production of the 300 series was enlarged in May, the “out of stock” will remain in the Chinese market.

In the present spot market, steel mills deliver products mixing high and low prices, the capital flow is not sufficient, so the inventory will still in low quantity. Also because the capital is in shortage, steel mills tend to buy and sell as quickly as possible to collect their money. Therefore, the low inventory volume and “out of stock” will become a normality.

The market asks for Contract 2107’s settlement. The spot market will face a shortage of products. The market corner of contract 2107 has faded away, but the settlement amount of contract 2107 will much larger than that of contract 2106. It is said that the contract settlement in July by Tsingshan will be about 80,000 tons. A large amount of short-position settlement will lead to stockout in the spot market. From warehouse receipt register, settlement to the resources of warehouse receipt getting back to the market, it takes time, so the supply pressure in this phase in the spot market will be reduced largely.

As for the raw material side, it is a robust factor that supports the price high. It is reported that steel mill giants have been enlarging the purchase of ferronickel within China. In May, the import of Indonesian ferronickel won’t increase much, while domestic stainless steel production is still increasing, and thus lacking ferronickel will make the stainless steel price high. However, lately, the risks, such as the monetary and export policy, as well as the future new capacity will impact the price. If the bad news comes true, investors might hammer in both the nickel and stainless steel futures market, and the stainless steel spot price will probably drop.

201: In the short term, cold-rolled product prices might fall; whereas in a long term, they might rise.

It is happening in Foshan that mills deliver Yongjin’s 304 with Hongwang’s 201, which shows that the transaction of 201 in the Foshan market is bearish. In the Wuxi market, although the Tsingshan agents do not operate like Foshan for now, the fact is that cold-rolling 201 is facing difficulty in the transaction. The sellers may sell the products at a low price.

But from a longer view, based on our production statistics, the production of 200 series will be reduced in June. In May, the domestic stainless steel enterprise above designated size produced 611,000 tons of wide-coil of 200 series crude steel, decreased by 21,700 tons compared to April. The decrease is less than expected, but because some mills will change the production to plain carbon steel, they have maximized the production in May and in June, it will be adjusted to decrease.

Besides, the inventory volume of 200 series has continuously fallen for the seventh time, so to 200 series, the small amount of inventory supports the 201 price trend.

430: The price trend will remain stable.

Much good news supports the high carbon ferrochrome to increase. In May, Inner Mongolia carried out a power rationing policy, resulting in a low output of the raw materials. Entering June, the lack of electric power happened in many regions. For now, the ferrochrome production in June will also remain low as May, so the price will be low still.

Last week in the Wuxi market, the price trend of 430 was stable. Until last Friday, the quotation of cold rolling 430 by Tisco and Jisco remained around US$1,640/MT ~ US$1,650/MT. The guidance price was respectively US$1,640/MT(Tisco) and US$1,650/MT(Jisco). From the point of inventory, last week, in the Wuxi market, 400 series dropped by 2,800 tons, reaching 82,800 tons which still belongs to the high inventory range.

Summary:

304: Price will increase. In the Wuxi market, the price of 304 (2.0) by Hongwang will increase by US$16/MT and rise to US$2,785/MT. The price will continue to rise because of OOS and the increasing export demand.

201: Influenced by spot transactions, 201 will probably fall but after June, it will turn up because the production and inventory will be reduced in June.

430: Thanks to the power rationing policy, the price of high chrome is increasing. Last week, the high carbon ferrochrome increased by US$16/50 base tons, but the inventory of 430 is rather high which offset the increasing raw material cost, so the price of 430 will remain around US$1,635/MT~ US$1,650/MT.

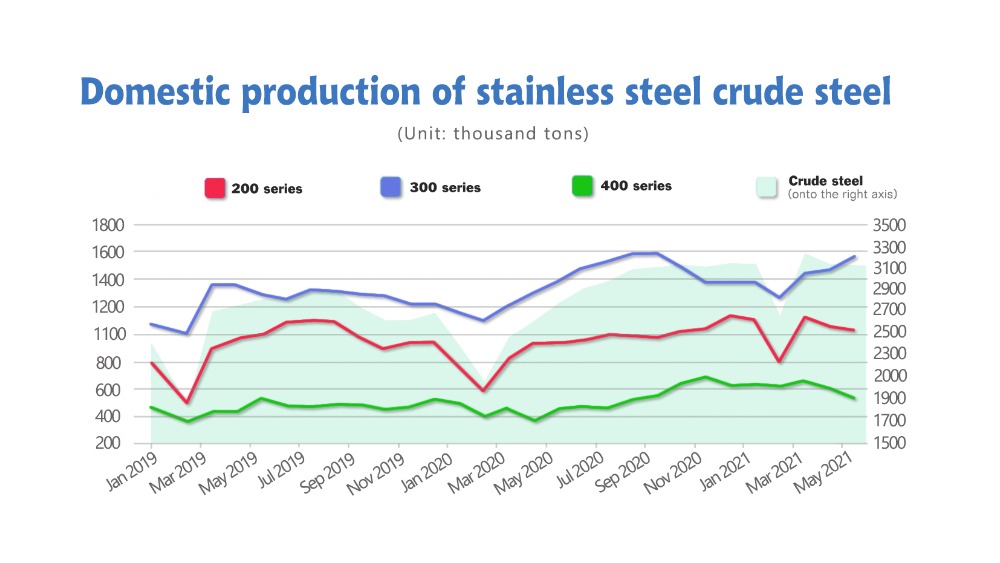

PRODUCTION|| Stainless steel output summary in May.

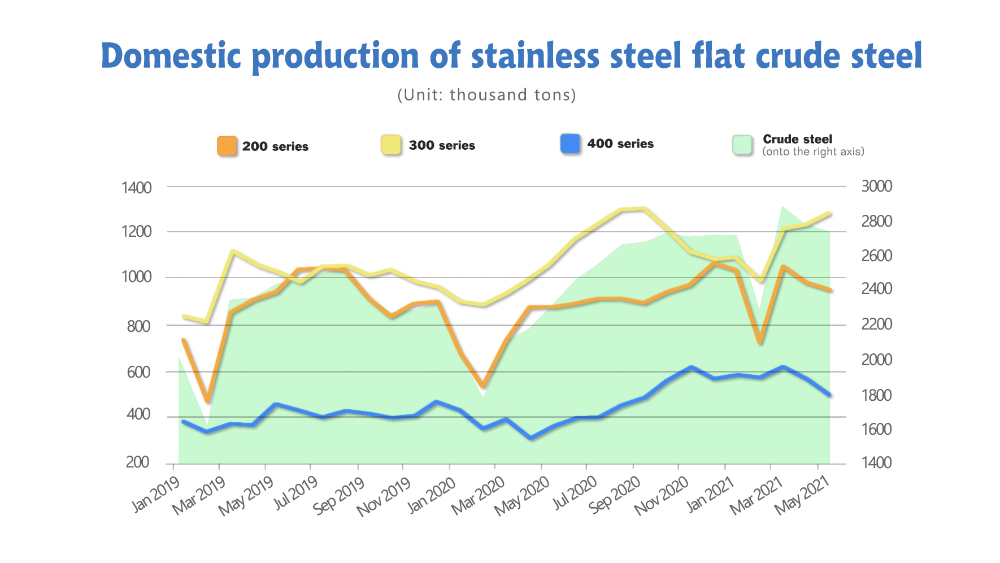

Crude steel:

In May 2021, the crude steel output of domestic stainless steel enterprises above designated size was 3.142 million tons, MoM decreased by 0.87 million tons,and the decreasing percentage is 0.28%; YoY increased by 360,700 tons, rose by 12.97%.

The decrease in output owes to 200 series and 400 series, and the increase in output is dominated by the 300 series.

The output of the 200 series was 1.028 million tons, dropped down by 28,200 tons, 2.67% lower compared to last week, and year-on-year increased by 78,300 tons, which is 8.24% higher.

The output of the 300 series was 1.5658 million tons, 87,600 tons more than the previous month, increasing by 5.92%; compared to the same period of last year, it increased by 183,400 tons, YoY 13.26% higher.

The output of the 400 series was 548,000 tons, 62,700 tons, 10.27% lower than last month, and YoY increased by 99,100 tons, the increasing percentage is 22.08%.

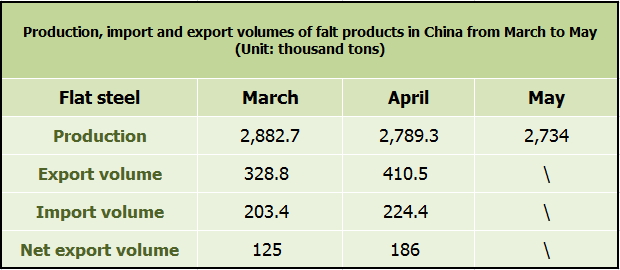

Flat products:

The total production of flat stainless steel in May is 2.734 million tons, which is 1.98% lower than last month but 17.68% higher compared to last May.

In May 2021, stainless steel flat products output of domestic enterprises above designated size was 2.734 million tons, MoM reduced by 55.3 thousand tons, 1.98% lower than last month; compared to the same period of last year, it increased by 410.7 thousand tons, and it is 17.68% higher. The decrease owns to 200 series and 400 series and 300 series makes the total output increased in May.

200 series dropped by 35.2 thousand tons (3.56%) compared to last month and down to 952.2 thousand tons which are 72.2 thousand tons and 8.2% higher than the same period of last year.

300 series MoM dropped by 48.7 thousand tons (3.56%) and decreased to 1.2858 million tons which are 205 thousand tons and 18.96% more than last May.

As for 400 series, it cut down 68.8 thousand tons (12.18%) compared to April and reached 496 thousand tons which YoY increased by 133.5 thousand tons and the rising percentage is 36.84%.

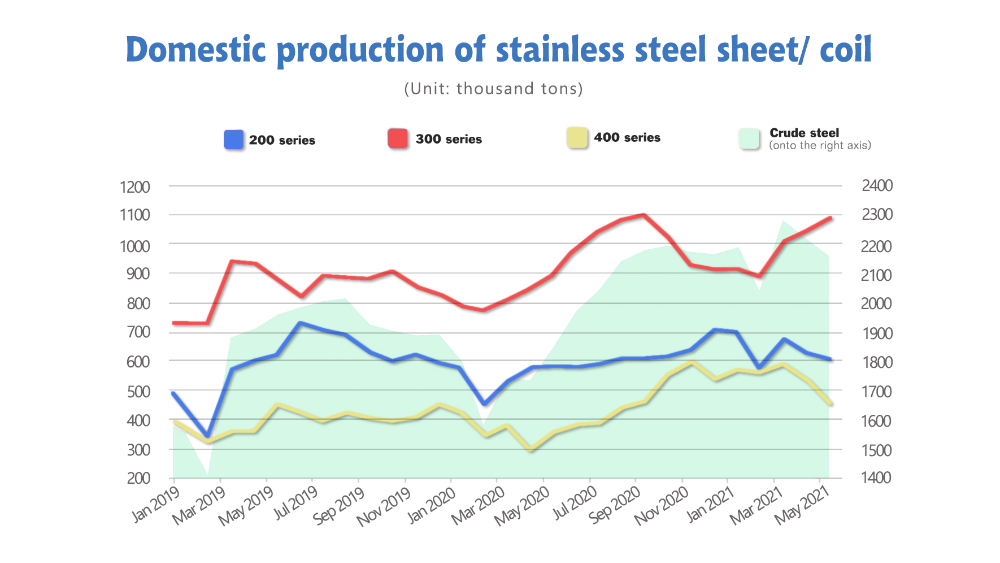

Sheet / Coil:

The domestic production of stainless steel sheet, coil in May reaches 2.163 million tons, which is 2.6% lower than last month but 17.1% higher compared to May 2020.

In May 2021, stainless steel sheet, coil products output of domestic enterprises above designated size was 2.163 million tons, MoM reduced by 557.8 thousand tons, 2.6% lower than last month; compared to the same period of last year, it increased by 315.4 thousand tons, and it is 17.1% higher. The decrease owns to 200 series and 400 series and 300 series makes the total output increased in May.

200 series production dropped by 21.7 thousand tons (3.43%) compared to last month and went down to 611 thousand tons which are 22.2 thousand tons and 3.77% higher than the same period of last year.

300 series production MoM rose by 45 thousand tons (4.3%) and increased to 1.092 million tons which are 192.2 thousand tons and 21.36% more than May 2020.

As for 400 series, the production cut down 81.1 thousand tons (15%) compared to April and reached 461 thousand tons which YoY increased by 101 thousand tons and the rising percentage is 28.1%.

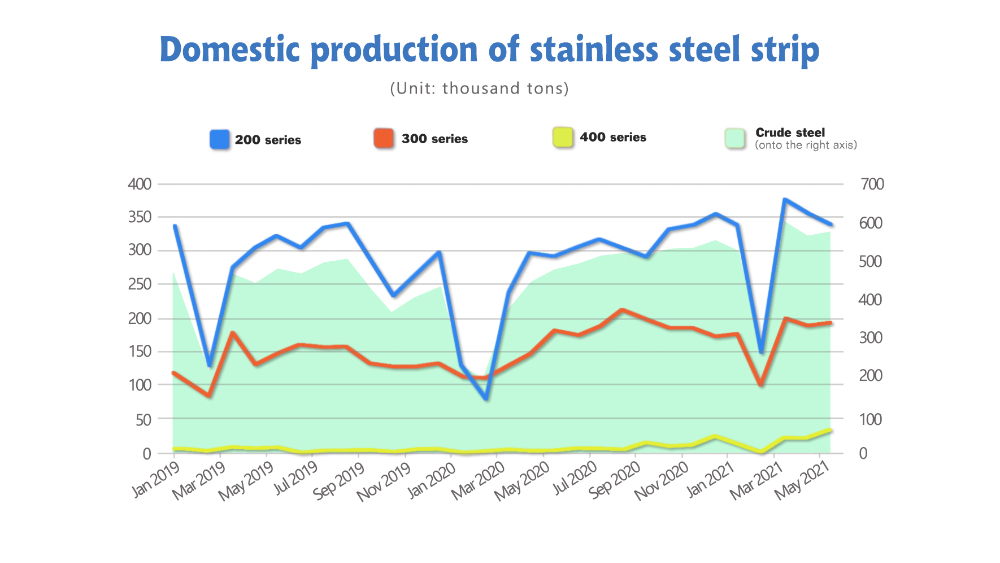

Strip:

The domestic production of stainless steel strip in May reaches 570.5 thousand tons, which is 0.43 higher than last month and 20.05% higher compared to May 2020.

In May 2021, stainless steel strip products output of domestic enterprises above designated size was 570.5 thousand tons, MoM increased by 2,500 tons, 0.43% higher than last month; compared to the same period of last year, it increased by 95.3 thousand tons, and it is 20.25% higher.

200 series production dropped by 13.5 thousand tons (3.81%) compared to last month and went down to 341 thousand tons which are 50 thousand tons and 17.18% higher than the same period of last year.

300 series production MoM rose by 3,600 tons (1.92%) and increased to 194 thousand tons which are 12.8 thousand tons and 7.06%% more than May 2020.

As for the 400 series, the production increased by 12.3 thousand tons (53.06%) compared to last month. In total, it rose to 35.5 thousand tons.

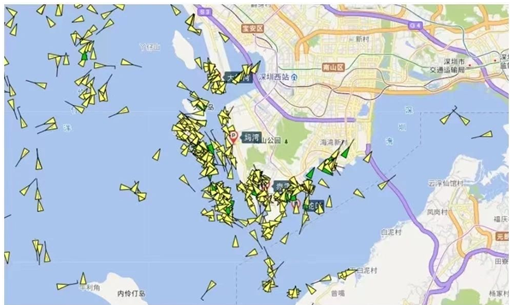

HEADLINE|| Ports in Southern China fall. The shutdown will spread to upper Chinese ports.

Background:

After multiple asymptomatic cases of COVID-19 infections in Yantian District, Shenzhen, China, major shipping companies warned customers that the port congestion in Yantian Port has worsened.

Yantian International Container Terminal (YICT) has implemented strict disinfection and quarantine measures since 21st May due to the first infection case of COVID-19 of port personnel on 20th May. In the past half month, all major ports in southern China have been gradually conquered by this round of epidemic!

"YICT's overall operational capacity has been negatively affected. We expect the current ship berthing delay and port congestion will continue for at least one week," said MSC, the world's second largest container shipping company, in a customer notice on 3rd May.

However, this is worsening.

Due to the business adjustment of YICT, major liner companies have successively issued countermeasures. With the declining capacity of YICT and the worsening congestion, a large amount of cargo has poured into nearby ports, such as Shekou Port(Shenzhen) and Nansha Port(Guangzhou).

However, many ports, including Nansha Port where lately it is reported new COVID-19 affection, have released the latest prevention measures. It is expected that liner companies will also adjust their shipping schedules.

The current situation in South China ports, especially in Shenzhen, is very severe. In fact, they are in suspension.

Just imagine, your products are planned to be shipped from Shenzhen, based on the latest prevention measures, what will you experience?

1. Entering either Shekou or Yantian port, tow truck drivers must hold a nucleic acid test negative certificate within 72 hours.

2. All ports require trailer drivers to have a green itinerary code, otherwise, they are not allowed to enter the port.

3. Yantian Port stipulates that drivers and vehicles who have recently been to Nansha Port are not allowed to enter the port.

4. Dachanwan port stipulates that all container trailers without Guangdong-B license plates (Shenzhen license plate) shall not enter the port.

You should know the current circumstance more clearly:

1.The whole COVID-19 testing takes about 24 hours to get the result.

2.GPS big data shows that from May 25th to June 5th, 9,379 vehicles passed through or entered Nansha.

3.In Xigang district of Shenzhen where many port workers and truck drivers live, new cases were again detected. The area is now in the second shutdown lasting for 7 days after the previous 14-day shutdown.

Now, if you are lucky enough to avoid all the “forbidden” mentioned above, and you are going to set sail from YICT, the next you will face are:

YICT announces that the export max containers have to make an online appointment since 7th June. People that are successfully chosen by the appointment system, your products will have a chance to be loaded onto the containers.

And still, if you are lucky enough to be one of the lucky numbers among thousands of exporting containers waiting in line, let’s see when will your cargo leave?

Dachanwan and Shekou offshore

Yantian offshore

The west side of YICT has been shut down for more than 15 days and it has not yet been recovered, while the capacity of the east side has recovered about 30% only.

Having gone through all the challenges, your products are now in the containers and you are now one of the 200,000 containers in the last turn of the lottery to see when will your containers be arranged onto the cargo.

When many cargo ships change their routines, do your planned ships leave as well?

Can you calculate when will your un-set-out cargos ships arrive at the destination port?

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China