The most astonishing news is not that 2023 is ending, but the disaster exploded in the Indonesian Tsingshan nickel factory. This absolutely needs the industry's attention to take action to protect people's safety and rights. Last week, stainless steel prices magically increased. The rise in futures boosted the spot prices to follow suit. Spot inventory kept decreasing, and some specifications were running short. However, there was still no recovering sign in demand. In November, the imports of stainless steel decreased, which also reduced the stress on supply and inventory. As for the exports, it was about 57,300 tons and 6% higher than October. Until November, the total export volume of China reaches 3.8 million tons, 8% lower than the same period of 2022. Influenced by the Red Sea Risk, Sea freight soared. Our business partners in the Middle East region, we will make efforts to reduce your costs and we hope the voyages will safely arrive for you. If you want to know more about the market, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,135 | 38 | 1.93% |

| Foshan | 2,175 | 38 | 1.89% | ||

| Hongwang | Wuxi | 2,050 | 31 | 1.64% | |

| Foshan | 2,045 | 38 | 2.02% | ||

| 304/NO.1 | ESS | Wuxi | 1,960 | 44 | 2.44% |

| Foshan | 1,975 | 44 | 2.42% | ||

| 316L/2B | TISCO | Wuxi | 3,540 | 20 | 0.58% |

| Foshan | 3,610 | 28 | 0.82% | ||

| 316L/NO.1 | ESS | Wuxi | 3,450 | 31 | 0.95% |

| Foshan | 3,440 | 28 | 0.86% | ||

| 201J1/2B | Hongwang | Wuxi | 1,370 | 13 | 1.02% |

| Foshan | 1,370 | 17 | 1.37% | ||

| J5/2B | Hongwang | Wuxi | 1,275 | 14 | 1.23% |

| Foshan | 1,285 | 17 | 1.47% | ||

| 430/2B | TISCO | Wuxi | 1,260 | -1 | -0.12% |

| Foshan | 1,260 | -6 | -0.49% |

TREND|| Spot market sparked with a timely Santa Claus rally.

The overall price trend of the stainless steel series was stabilized last week: The mainstream contract price of stainless steel jumped by US$34.6/MT to US$2085/MT last Friday, and it had once traveled to US$2100/MT. The spot price rose after steady.

Stainless steel 300 series: Positive market sentiment.

Until last Friday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 was quoted as US$2020/MT with a US$35/MT hike; The hot-rolled stainless steel 304 surged by US$56/MT to US$1985/MT. The weekly average future price has been jumping for 8 consecutive weeks while the market atmosphere was totally lifted last week.

Stainless steel 200 series: Tsingshan guides the rebound of 200 series.

Affected by the uptrend of the 300 series and future price, the spot price of stainless steel 201 had a tick from US$1230/MT to US$1260/MT.

Tsingshan revealed the latest guidance price of cold-rolled stainless steel 201: 4-foot cold-rolled stainless steel 201J1 was quoted as US$1345/MT; 4-foot cold-rolled stainless steel 201J2 was quoted as US$1260/MT, there will be extra US$7/MT on the specification of 0.55mm. It is obvious that the sentiment is turning warm as most of the downstream buyers start making their entrance into the market for procurement.

Stainless steel 400 series: Prices remained steady.

TISCO downward adjusted their guidance price of stainless steel 430/2B for US$14/MT to US$1435/MT, and JISCO remained steady at US$1555/MT.

Ningbo Baoxin remained open for negotiations of the EXW price of cold-rolled stainless steel 304, while they quoted cold-rolled stainless steel 430 for US$1600/MT with a US$28/MT monthly drop.

The market price of cold-rolled stainless steel 430 in Wuxi was weak but stabilized last week, it remained steady with hot-rolled stainless steel 430 at US$1260/MT and US$1140/MT respectively.

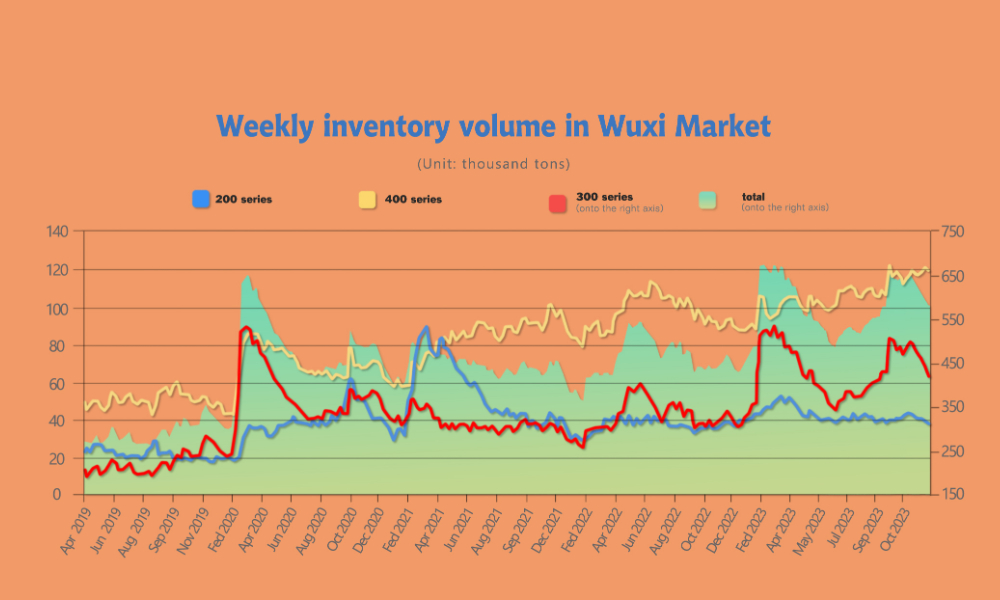

INVENTORY|| Inventory is in a good shape.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| December 14th | 38,744 | 437,282 | 119,471 | 595,497 |

| December 21st | 37,208 | 413,724 | 118,724 | 569,407 |

| Difference | -1,536 | -23,558 | -996 | -26,090 |

The total inventory at the Wuxi sample warehouse downed by 26,090 tons to 569,407 tons (as of 21st December).

the breakdown is as followed:

200 series: 1,536 tons down to 37,208 tons

300 Series: 23,558 tons down to 413,724 tons

400 series: 996 tons down to 118,475 tons

Stainless steel 300 series: Destock accelerated

The steady increment of future prices boosted the market last week, and the inventory of the 300 series recorded the biggest destocking in the second half of 2023. Also, the extreme weather in northern China led to heavy delays in shipping, but it eventually relieved the inventory pressure.

Stainless Steel 200 series: The seventh week of destocking.

It is understood that Baosteel will commence a month-long maintenance at the end of December, and it stands for a 150,000 tons decrease in supply in the coming month. The destocking record is likely to extend to the “eight consecutive weeks”.

Stainless steel 400 series: First drop in December.

The inventory in Wuxi has finally seen its first decline this month. On one hand, steel mills have not received significant deliveries, and on the other hand, businesses have actively reduced their inventories. Hence, it was contributed by the downstream consumption. As the end of the month approaches, it is anticipated that steel mill deliveries will increase, and downstream demand will lead to on-demand purchasing. However, inventory pressure in the 400 series stainless steel market is still present.

Summary: Supply and demand are now finding a balance.

Stainless steel prices showed a relatively strong and fluctuating trend last week. Downstream demand showed little change, overall transaction performance was moderate, social inventory continued to decline, traders maintained relatively low inventories, steel mills' order fulfillment improved, and the pressure has eased. However, there is anticipation of increased pressure from agency deliveries.

300 Series: The decline in the import of ferronickel and stainless steel has eased domestic supply pressure. The inventory in the Wuxi region for the 300 series spot market has been continuously reduced. Concentrated procurement demands from steel mills have stabilized nickel iron prices, leading to a rebound in both spot and futures prices. Attention is on the sustained buying strength in the market.

200 Series: Last week, positive news such as low inventory, the limit on prices by Tsingshan, and steel mill maintenance have propelled the 201 market. In the short term, it is expected that 201 prices will continue to remain stable and improve.

400 Series: In this traditional off-season, transactions were not as strong as the previous week. There was a slight reduction in inventory for the 400 series, with some active destocking by merchants. On one hand, there were not many arrivals at the steel mills, and on the other hand, merchants actively destocked with some inventory digestion. It is expected that towards the end of the month when steel mill resources arrive, the supply will increase, putting pressure on 430 cold-rolled prices.

Statistic|| 3.8 million tons of stainless steel shipped from China since 2023

The export volume of stainless steel in November was about 57,300 tons, it had 6% MoM increase and 11% decrease YoY. The total export volume is now accumulated to 3.80 million tons with an 8% drop YoY.

Sending over 641,300 tons stainless steel and claiming a 32% hike YoY, India had become the biggest shipping destination in China’s stainless-steel export this year. There were also some significant growths in other countries such as Russia, South Korea and UAE. It is worth to mention that the top 20 countries in China stainless steel export are taking part of 80% of total export.

Sea Freight|| Geographical volatilities shook the freight market.

The recent conflicts in Red Sea is making the freight shipping costly. China’s Containerized Freight market was overall stabilized, on 22nd December, the Shanghai Containerized Freight Index rose by 14.8% to 1254.99.

Europe/ Mediterranean:

The European freight line is now unfortunately caught up in a whirling vortex of the dispute in Red Sea, most of the sea freights are forced to sail in longer route. The freight rate of European freight line is expected to hike in the short term.

On 22nd December the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$14970/TEU, which surged by 45.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2054/TEU, which also jump by 30.9%

North America:

According to data released by IHS Markit, the preliminary composite Purchasing Managers' Index (PMI) for the United States in December is 51, which is better than the previous reading and market expectations. This marks a new high since July 2023. Similarly, the services sector PMI data also reached a new high since July.

On 22nd December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1855/FEU and US$2982/FEU, reporting a 2% and 6.3% growth accordingly.

The Persian Gulf and the Red Sea:

Being the center of the Red Sea conflict, freight rate had a significant growth.

On 22nd December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 25.7% from last week's posted US$1477/TEU.

Australia/ New Zealand:

Until 13th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$923/TEU, a 0.8% growth from the previous week.

South America:

The freight market had a slight rebound. on 13th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2340/TEU, an 0.5% increment from the previous week.