It's difficult to determine whether it's a good time to make a purchase. A drop in spot inventory is a positive sign, but the supply and demand relationship is still uncertain. Recently, the stainless steel 300 series marked its fourth consecutive drop due to reduced output from steel mills. However, the price of stainless steel didn't react positively and continued to fall. This pessimistic trend is linked to market sentiment, where people lack faith in both the current and future macroeconomy, domestically and internationally. The cost of ferronickel has also decreased, which further pushed down the prices of stainless steel. The ferronickel price has been decreasing since September, and it broke down below CNY¥1000/Ni in November, currently standing at US$235/Ni (around CNY¥900/Ni). The lower cost of raw materials reduces the credibility of stainless steel prices to remain stable. At last, a small tip about the shipping issue. Approaching the end of the year, sea freight is fluctuating and the shipping space is getting tight. Make sure you have confirmed the best date for your products during the holiday season. Besides, Chinese New Year falls on February 10th, which means that some steel mills might begin their holiday in late January after your New Year holiday. If you want to know more information, please keep reading our Stainless Steel Market Summary In China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,095 | -21 | -1.06% |

| Foshan | 2,140 | -21 | -1.04% | ||

| Hongwang | Wuxi | 2,020 | -17 | -0.88% | |

| Foshan | 2,005 | -27 | -1.40% | ||

| 304/NO.1 | ESS | Wuxi | 1,920 | -20 | -1.09% |

| Foshan | 1,930 | -32 | -1.76% | ||

| 316L/2B | TISCO | Wuxi | 3,520 | -3 | -0.08% |

| Foshan | 3,580 | -17 | -0.49% | ||

| 316L/NO.1 | ESS | Wuxi | 3,420 | 3 | 0.09% |

| Foshan | 3,410 | 17 | 0.52% | ||

| 201J1/2B | Hongwang | Wuxi | 1,360 | -7 | -0.56% |

| Foshan | 1,355 | -10 | -0.79% | ||

| J5/2B | Hongwang | Wuxi | 1,260 | -7 | -0.61% |

| Foshan | 1,270 | -10 | -0.85% | ||

| 430/2B | TISCO | Wuxi | 1,270 | -16 | -1.34% |

| Foshan | 1,260 | -1 | -0.12% |

TREND||Stainless steel spot prices remain fluctuating at the bottom.

The spot price of stainless steel remained hesitant at the bottom last week, the overall value was depreciated by the weak demand.

In the past four weeks, inventory has consistently decreased, and steel production has been reduced, leading to some improvement in the overall fundamentals. This, combined with positive macroeconomic sentiments both domestically and internationally, continued efforts in real estate policies, and a slight rebound in prices on Friday. However, the decline in raw material costs has led to weak spot transactions.

As the year-end approaches, the demand is relatively poor during the off-season, prompting traders to lower prices for inventory clearance. In the short term, there is a balance between weak current realities and strong expectations, keeping spot prices in a fluctuating state.

Until last Friday, The mainstream price of stainless steel fell US$33/MT to US$2050/MT.

Stainless steel 300 series: rebounded powerlessly.

Last week, the overall market price of stainless steel 304 was stabilized but weak trend: the mainstream base price of cold-rolled 4-foot stainless steel 304 rose US$7/MT to US$1985/MT; hot-rolled stainless steel 304 remained steady at US$1930/MT; the future price seesawed around US$2025/MT.

Stainless steel 200 series: A promising trend for the 200 series.

The spot price of stainless steel 201 was mainly walking on a downtrend last week: until last Thursday, the mainstream base price of stainless steel 201J1 and 201J2/J2 fell by US$7/MT to US$1330/MT and US$1230/MT respectively; the 5-foot hot-rolled stainless steel fell US$14/MT to US$1275/MT.

Stainless steel 400 series: Inventory and production remained high.

TISCO and JISCO remained unchanged for their market guidance price of stainless steel 430/2B at US$1450/MT and US$1565/MT.

Ningbo Baoxin remained open for negotiations of the EXW price of cold-rolled stainless steel 304, while they quoted cold-rolled stainless steel 430 for US$1555/MT with a US$28/MT drop.

The quoted price of cold-rolled stainless steel 430 in Wuxi market fell US$14/MT to around US$1260/MT and hot-rolled stainless steel 430 was unchanged at US$1140/MT.

INVENTORY|| Shrunken supply: a magic bullet to destock.

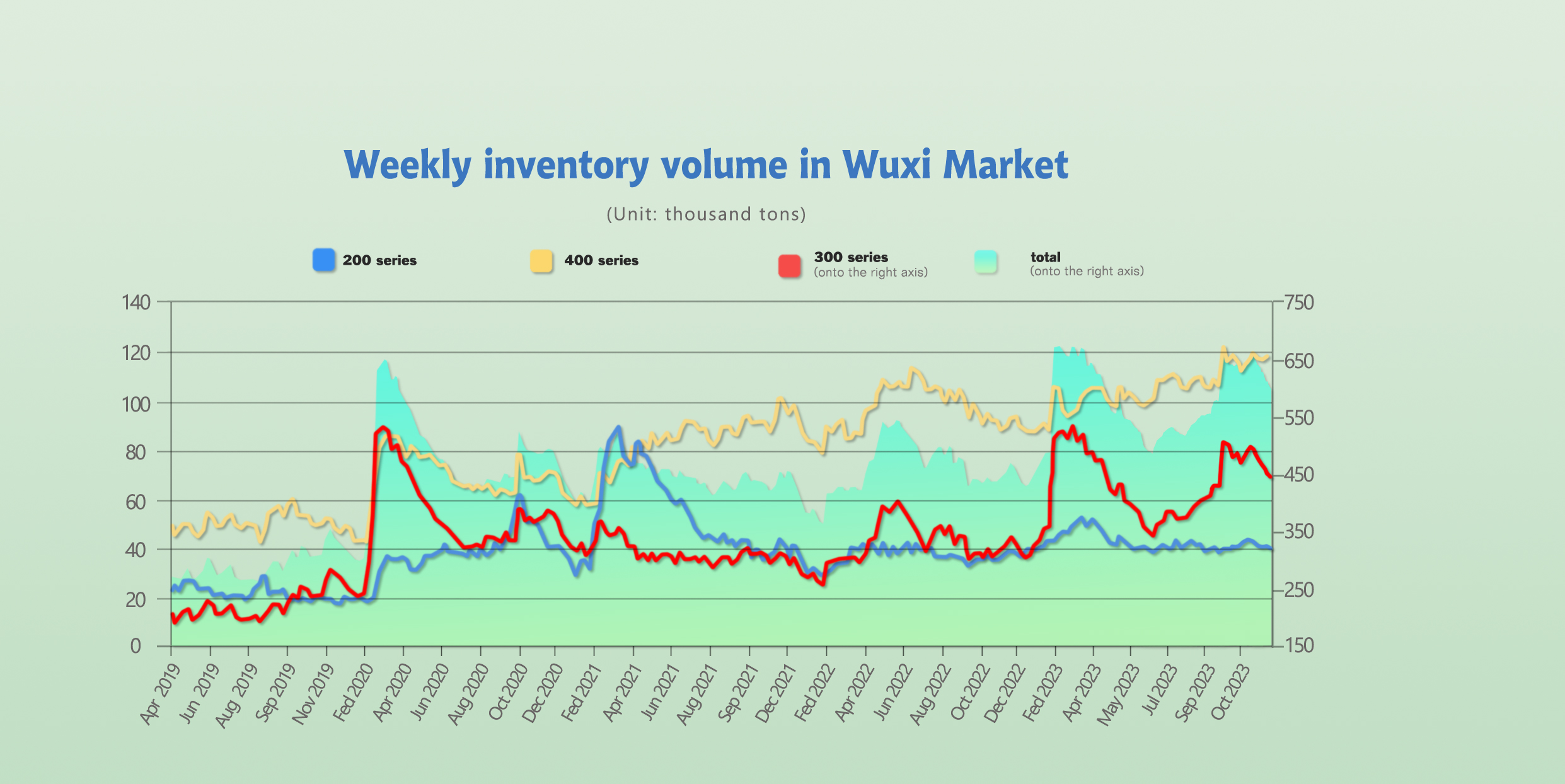

The total inventory at the Wuxi sample warehouse downed by 12,797 tons to 595,497 tons (as of 14th December).

the breakdown is as followed:

200 series: 905 tons down to 38,744 tons

300 Series: 14,132 tons down to 437,282 tons

400 series: 2,240 tons up to 119,471 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| December 7th | 39,649 | 451,414 | 117,231 | 608,294 |

| December 14th | 38,744 | 437,282 | 119,471 | 595,497 |

| Difference | -905 | -14,132 | 2,240 | -12,797 |

Stainless steel 300 series: It was the fourth week of destocking.

The shrink in the output apparently is effectively bringing down the inventory level of 300 series, it recorded almost the same amount of decrease from the previous week with about 14,100 tons.

Stainless steel 200 series: inventory continued to fall.

Both hot and cold rolled stainless steel had at least 2% drop in inventory last week. It is estimated that the weak prices will be continues, due to the price limitations, low inventory and the bareish market sentiment.

Stainless steel 400 series: Accumulation continued.

Efforts were made by merchants to lower the inventory level as they continued to undersell their products, but the inventory was concluded otherwise with 1.91% increase from previous week. The supply of the 400 series crude steel is likely to be lifted and further adding pressure to the inventory.

RAW Material|| Production continued to dived.

The mainstream market price of high carbon ferronickel extended the downtrend from previous week and dropped to US$235/Nickle point; the high-carbon ferrochrome rose by US$14/MT to US$1315/MT (50% chromium).

Nickle: Downtrend extended.

China’s mainstream EXW price of high carbon ferronickel was quoted as US$235/Nickel point earlier on last Tuesday, and the price of Nickle ore Philippine 1.5% was landed on US$49/WMT. The steel mills, however, still suffering losses from production despite the price of the raw material is declining lately.

An Indonesian government official stated that the country's nickel production is expected to be between 1.65-1.75 million tons in 2023. According to data from the International Nickel Study Group (INSG), last year, Indonesia's primary nickel production increased by 32% to reach 1.16 million tons, accounting for 38% of global production, more than doubling the country's 16% share in 2019."

Chrome: Output reduced and price rose.

Last week, the mainstream EXW price of high ferrochrome landed at between US$1315/MT-US$1345/MT(50% chromium), with a US$14/MT decrease.

Due to the rise in coke prices, the production costs of high-chromium enterprises have increased, leading to a decline in the enthusiasm of high-chromium production enterprises since December. Particularly in the southern region in China, more high-chromium producers have reduced or stopped production to alleviate the pressure from rising costs.

Several industry reports from Sichuan have indicated a decrease in production enthusiasm in local factories due to significant losses, resulting in widespread production stoppages. In Qinghai and Inner Mongolia, the two main production areas, producers have also undergone maintenance and shutdowns.

However, considering that the high-chromium production in the northern main production areas remains relatively high, the market supply has not yet shown signs of tightening. Overall, the recent demand for high-chromium raw materials in stainless steel production has decreased. Due to the dual consideration of winter storage factors in the bidding for high-chromium steel in January 2024, it is expected that downstream purchases may increase. Given the tightening supply, the recent retail market prices for high-chromium remain stable, with the possibility of a slight increase.

SUMMARY|| Inventory pressure eased off.

Stainless steel downstream demand had a slight improve while overall transaction performance being average. Social inventories had a decline and steel mills' performance in receiving period orders has improved, leading to some relief in pressure. Inventories remain at a low level, and overall, the fundamental contradictions in the stainless steel market have somewhat eased. Future attention will be on steel mill policies, production plans, and the destocking situation.

In the 300 series: Recently, nickel iron prices have continued to decline, leading to a reduction in stainless steel production costs. However, steel mills are operating near the breakeven point, and the lack of momentum in stainless steel price increases is evident. Spot prices remain stable, coupled with a slight increase in futures prices, driving an improvement in spot transactions, with inventories destocking for four consecutive weeks. Short-term stainless steel prices are expected to fluctuate between US$1955/MT and US$2025/MT, with continued focus on downstream purchasing trends.

In the 200 series: This week, spot prices in the 201 market overall showed a fluctuating downward trend. The price of 201J2 cold-rolled base material fluctuated narrowly around US$1245/MT. Current market inventories are at a low level, with shortages in some specifications. Multiple positive factors, such as the announcement of the "Tsingshan Hui" launching the "Transaction Price Limitation Policy," support weak and stable prices.

In the 400 series: This week, the quoted price for 430 cold-rolled products decreased by US$14/MT, and businesses are still actively destocking to digest inventory. The 430 hot-rolled market price remained stable, and this week's hot-rolled arrivals replenished some specifications that were previously out of stock. According to data, in December, the crude steel volume of the 400 series increased, and the supply increased. Although the current trend of high chromium prices is relatively strong, downstream procurement trends have not changed. Coupled with the 400 series' Wuxi market spot inventory reaching around the highest value of the year, with high inventory and high production, it is expected that the 430/2B price will remain weak.

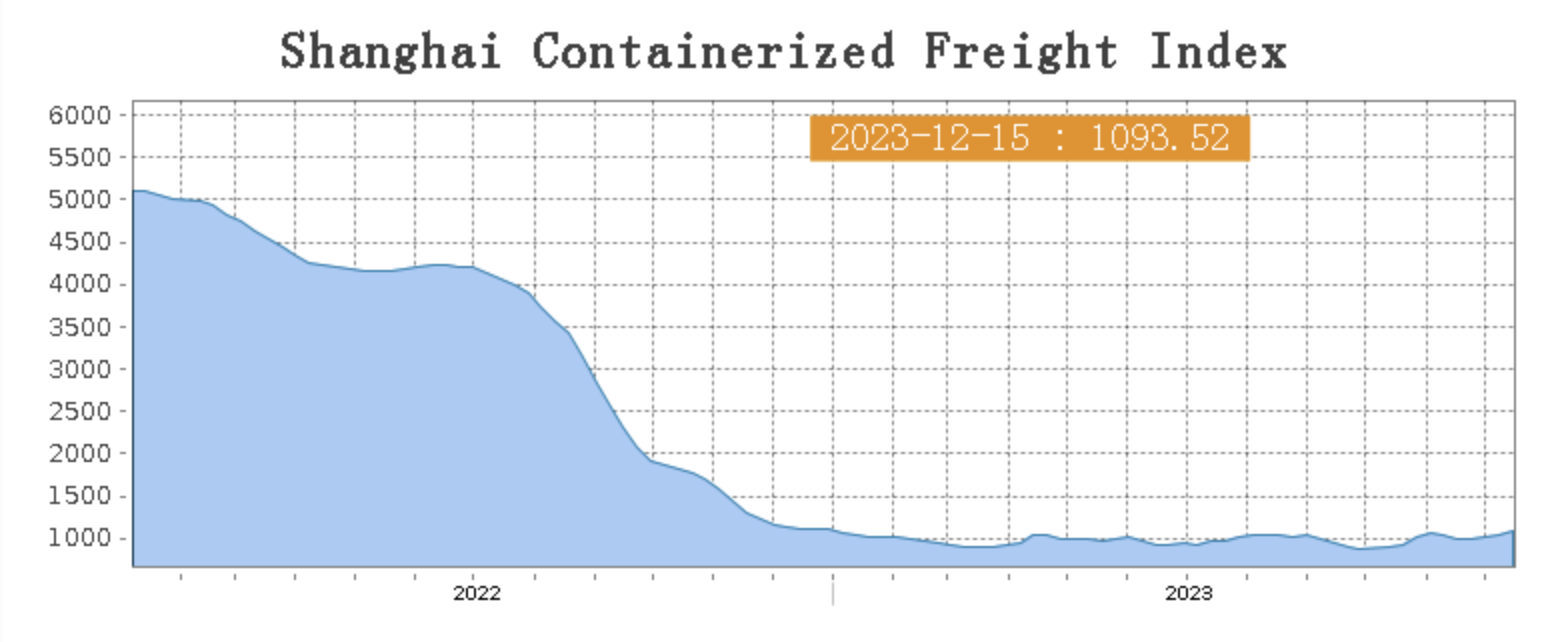

Sea Freight|| Freight demand rebound.

China’s Containerized Freight market was overall stabilized, On 15th December, the Shanghai Containerized Freight Index rose by 5.9% to 1093.52.

Europe/ Mediterranean:

The ZEW Indicator of Economic Sentiment for the Euro Area jumped by 9.2 points to 23 in December 2023, marking the highest reading in ten months and well above market forecasts of 11.2.

On 15th December, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1029/TEU, which rose by 11.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1569/TEU, which surged by 13.1%

North America:

On 15th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1819/FEU and US$2805/FEU, reporting a 9% and 14.9% spike accordingly.

The Persian Gulf and the Red Sea:

On 15th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 1.6% from last week's posted US$1175/TEU.

Australia/ New Zealand:

On 15th December ,the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$916/TEU, a 0.1% jump from the previous week.

South America:

On 15th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2329/TEU, an 6.2% slide from the previous week.