Stainless steel prices last week went back to the declining tunnel. On November 28th, a new pricing scheme for Indonesian nickel was settled and started to practice on December 1st. The new pricing standard decouples Indonesian nickel from LME which was blamed that it could not promptly and correctly reflect the demand and supply of nickel in China and Indonesia. The scheme boosted the stock price of stainless steel futures and ShFE nickel soon after the news. the spot price of stainless steel thereby benefited to rise. With the rising price, the transaction was encouraged and the spot inventory was reduced. However, without the support of demand, the prices and transactions were soon to calm down. Demand is fundamental. But from the perspective of China's manufacturing PMI for November, the industry was underperformed. The manufacturing PMI continues to downward tendency from October, decreasing by 49.5% to 49.4%. The new export order index dropped for consecutive three months to 46.3%. The stainless steel industry cannot escape from such a weak market. By the end of 2023, we can see that all prices of major grades of stainless steel were on the way to fall after April on a whole. Amid the decreasing tendency, buyers are more conservative compared to the blooming era which was not far from now. What about your thoughts? We would love to hear from an expert like you! We can exchange our opinions if you are interested in the Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,145 | 6 | 0.28% |

| Foshan | 2,190 | 6 | 0.27% | ||

| Hongwang | Wuxi | 2,075 | 1 | 0.07% | |

| Foshan | 2,075 | -8 | -0.43% | ||

| 304/NO.1 | ESS | Wuxi | 1,970 | -3 | -0.15% |

| Foshan | 2,000 | -4 | -0.22% | ||

| 316L/2B | TISCO | Wuxi | 3,510 | -28 | -0.83% |

| Foshan | 3,615 | 6 | 0.16% | ||

| 316L/NO.1 | ESS | Wuxi | 3,350 | -14 | -0.44% |

| Foshan | 3,395 | -8 | -0.26% | ||

| 201J1/2B | Hongwang | Wuxi | 1,370 | 0 | 0.00% |

| Foshan | 1,370 | -1 | -0.11% | ||

| J5/2B | Hongwang | Wuxi | 1,275 | 0 | 0.00% |

| Foshan | 1,285 | -1 | -0.12% | ||

| 430/2B | TISCO | Wuxi | 1,280 | -3 | -0.24% |

| Foshan | 1,265 | -4 | -0.37% |

TREND|| Production cost is crawling back up

Affecting by Indonesia’s new pricing rule of nickel, the spot price of stainless steel in Wuxi market finally lost what it had gained earlier last week, and the downstream business in stainless steel held “wait and see sentiment” strongly. Until last Friday, the mainstream contract price of stainless steel remained steady at US$2055/MT.

Stainless steel 300 series: A diminishing rebound.

The market price of stainless steel 304 fluctuated: The mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 recorded a US$28/MT rose and closed at US$2040/MT, the hot-rolled stainless steel lifted by US$21/MT to US$1975/MT.

It is believed that China’s stainless-steel price was in the hands of the Indonesian nickel market status quo, it had a rebound at the beginning but sliding down at the bottom half of last week. The purchasing activities are becoming more rational after the “procurement craze” last week.

Stainless steel 200 series: stabilized price trend indicated a good trading sentiment.

The spot price of stainless steel 201 was leveling off last week: The mainstream base price of stainless steel 201J1reached at US$1345/MT, cold-rolled stainless steel 201J2/J5 was closed at US$1245/MT, and 5-foot hot-rolled stainless steel201J1 ended at US$1295/MT.

Stainless steel 400 series: Price was weak but stabilized.

TISCO and JISCO remained steady on their market guidance price for stainless steel 430/2B at US$1450/MT and US$1555/MT respectively.

Ningbo Baoxin remained open for negotiations of the EXW price of cold-rolled stainless steel 304, while they quoted cold-rolled stainless steel 430 for US$1630/MT.

The mainstream quote price of scold-rolled stainless steel 430 was closed at US$1285/Mt and hot rolled stainless steel 430 was quoted as US$1140/MT.

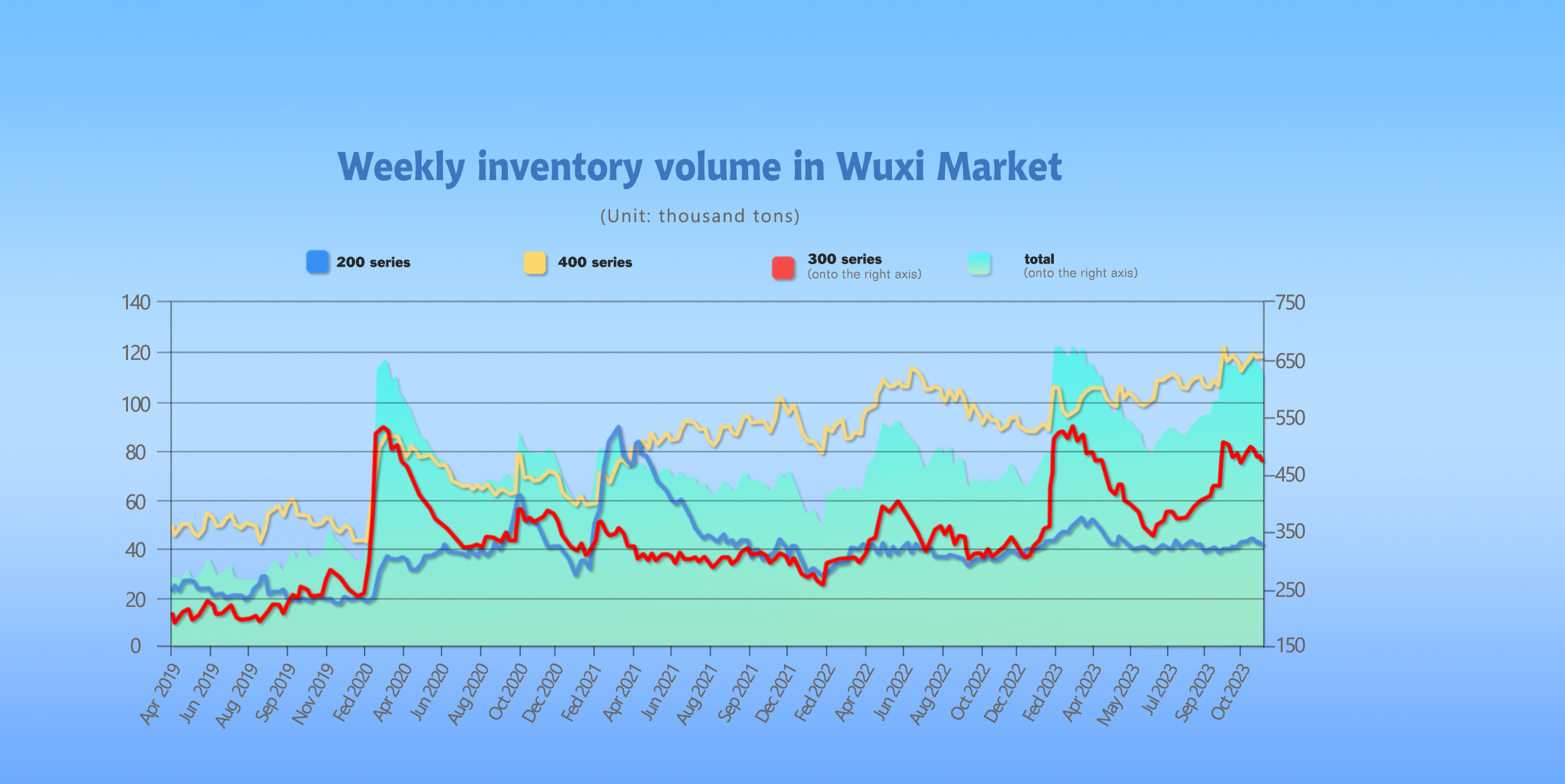

INVENTORY|| Inventory made the first few steps to a greater destocking.

The total inventory at the Wuxi sample warehouse downed by 11,844 tons to 622,233 tons (as of 30th November).

the breakdown is as followed:

200 series: 859 tons down to 39,918 tons

300 Series: 10,752 tons down to 466,126 tons

400 series: 233 tons down to 116,189 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| November 23rd | 40,777 | 476,878 | 116,422 | 634,077 |

| November 30th | 39,918 | 466,126 | 116,189 | 622,233 |

| Difference | -859 | -10,752 | -233 | -11,844 |

Stainless steel 300 series: Bullish market prompted destocking.

There was an obvious drop in cold and hot rolled stainless steel inventory and it was owed to the short-bullish market last week.

The inventory in preposition warehouse raises a little as Delong brought their production back to normal.

Stainless steel 200 series: Arrival reduced.

There was no significant increase in inventory of 200 series within the stocktaking period, but numerous inquiry for stainless steel 201 were made last week despite the downstream is still holding a “wait-and-see” attitude.

Stainless steel 400 series: Arrival reduced.

There was an obvious drop in the inventory of TISCO’s resources last week while the merchants remained weak on their quotations. Although the supply has narrowed, the terminal consumption volume has not shown a significant increase at present. It is expected that the inventory of 400 series spot goods will continue to experience minor fluctuations

RAW Material|| Minning cost shifting upward.

The price of high-carbon ferronickel extended the downtrend from previous week: the mainstream quote price landed at US$240/Nickel point and the ferrochrome rose by US$14/MT to US$1300/MT(50% Chromium).

Nickel: The new pricing scheme is making nickel more valuable.

The EXW price of high ferronickel remained flat at US$265/nickel point, the ferrochrome fell US$21/MT to US$1330/MT (50% chromium). The EXW price of high ferrochrome was weakening at between US$1330/MT-US$1345/MT(50% chromium), with a US$21/MT decrease.

At the 2023 Southeast Asia International Nickel-Chromium-Manganese Stainless Steel Industry Chain Summit, Chinese organizations share their views on exploring the new pricing mechanism based on the current situation of the development of the Indonesian nickel industry and scheduled to implement new mechanism on 1st December. The nickel price, ShFE Nickel and stainless steel future price skyrocketed after the announcement. The ShFE nickel peaked at US$18585/MT (4%); Stainless steel futures closed at US$2,070/MT, increased by US$26/MT (1.36%).

The benchmark price for domestic nickel ore trade in Indonesia previously was linked to the London Metal Exchange (LME), causing the local nickel price to rapidly decline. The trial implementation of the new pricing rules will decouple the nickel ore price from the LME, considering more the profits of the upstream and downstream sectors for pricing.

Chrome: Market price stops falling.

The mainstream bidding purchase price for high-carbon ferrochrome by major domestic steel mills in December has been primarily reduced by US$28/MT(50% Chromium)

Details are as follows:

TISCO: US$1285/MT (DDP, Cash), representing a decrease of US$28/MT compared to the previous month.

Tsingshan: US$1315/MT (DDP, Cash), representing a decrease of US$28/MT compared to the previous month.

Baosteel: US$1315/MT (DDP, Cash), representing a decrease of US$28/MT compared to the previous month.

However, in recent days, retail market prices have not continued to decline but have shown signs of resilience. The mainstream ex-factory price for high-carbon chromium in the market is currently around US$1300/MT to US$1315/MT(50% chromium), and the lower limit of the quotation has quietly risen. Although the overall rise is still weak, it is challenging to find a supply at a price below US$1300.

With the increase in electricity costs across China during the winter, the overall production cost of high-carbon chromium has increased, but the selling price has continued to decline. This has intensified the losses for high-carbon chromium production enterprises, leading to a significant decrease in the willingness of manufacturers to sell at low prices.

From the supply side, the production in the main high-carbon chromium-producing areas has remained at a relatively high level in November, and the current market still faces supply pressure. In the short term, it is also difficult for high-carbon chromium prices to rise. In this context, stability is predominant.

Summary: Inventory remains high, and the market returns to calm.

Stainless steel prices rose slightly last week. The rebound in prices at the beginning of the week stimulated market enthusiasm and promoted some restocking demand, but there was no significant improvement in market demand. Social inventories have been somewhat digested, and the pressure on steel mills has eased slightly, with some profit margins in production. Currently, the market has sufficient supply. The subsequent focus will still be on steel mill policies, production plans, and the destocking situation in social inventories. It is expected that the stainless steel market will operate with fluctuations in the future.

300 series: The adjustment of the nickel ore pricing mechanism may boost confidence in the nickel and stainless steel markets. Early last week, prices rebounded from the low, leading to an improvement in market transactions. However, the pressure of high inventory has not been completely relieved. Steel mills stabilize production, and downstream purchases return cautiously after concentrated restocking. The forecast is that the base price of 304 private cold-rolled stainless steel will fluctuate around US$2025/MT.

200 series: In November, the inventory of stainless steel 201 spot goods showed four consecutive declines to 39,900 tons. Midweek, influenced by the active trading atmosphere in the stainless steel 304 market, the buying atmosphere improved. However, traders and downstream purchases in the 200 series still maintain a cautious attitude. It is expected that in the short term, the base price of cold-rolled stainless steel 201J2/5 will fluctuate around US$1230/MT to US$1300/MT.

400 series: In December, the bid prices for high-chromium from various steel mills were reduced by US$28/MT, weakening cost support. Due to a slight downward shift in costs, it is expected that the production volume of the 400 series in December will remain stable or slightly increase compared to November.

Focusing on inventory digestion, 400 series stainless steel merchants took the initiative to destock. The price of 430 cold-rolled began to decline in the middle of November, with a cumulative reduction of US$28/MT, but the inventory at the end of November, increased by 1% compared to the previous month, remaining high, and market digestion was slow.

Currently, there is still sales pressure on merchants, and short-term 430/2B prices are expected to remain weak. The price range for December 430 cold-rolled is around US$ 1230/MT to US$1285/MT.

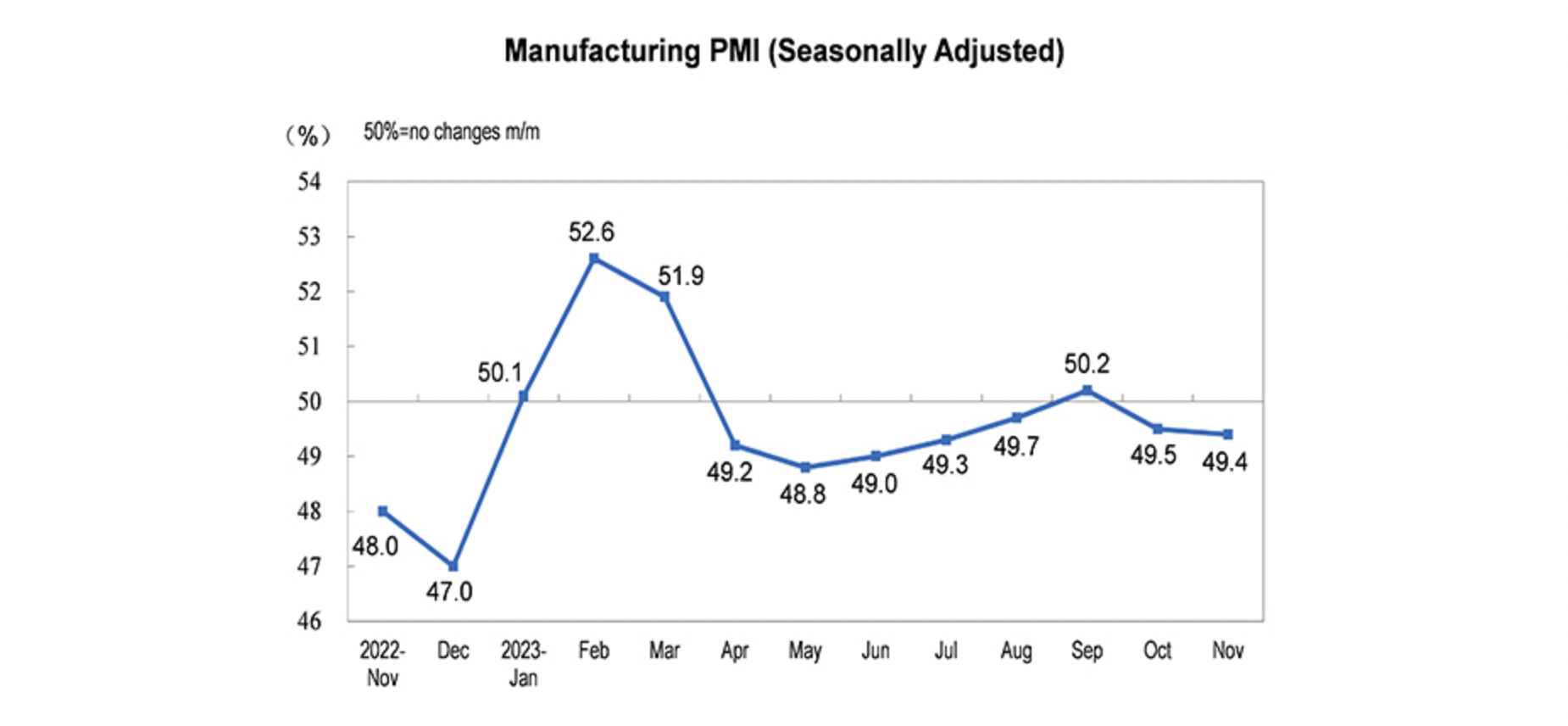

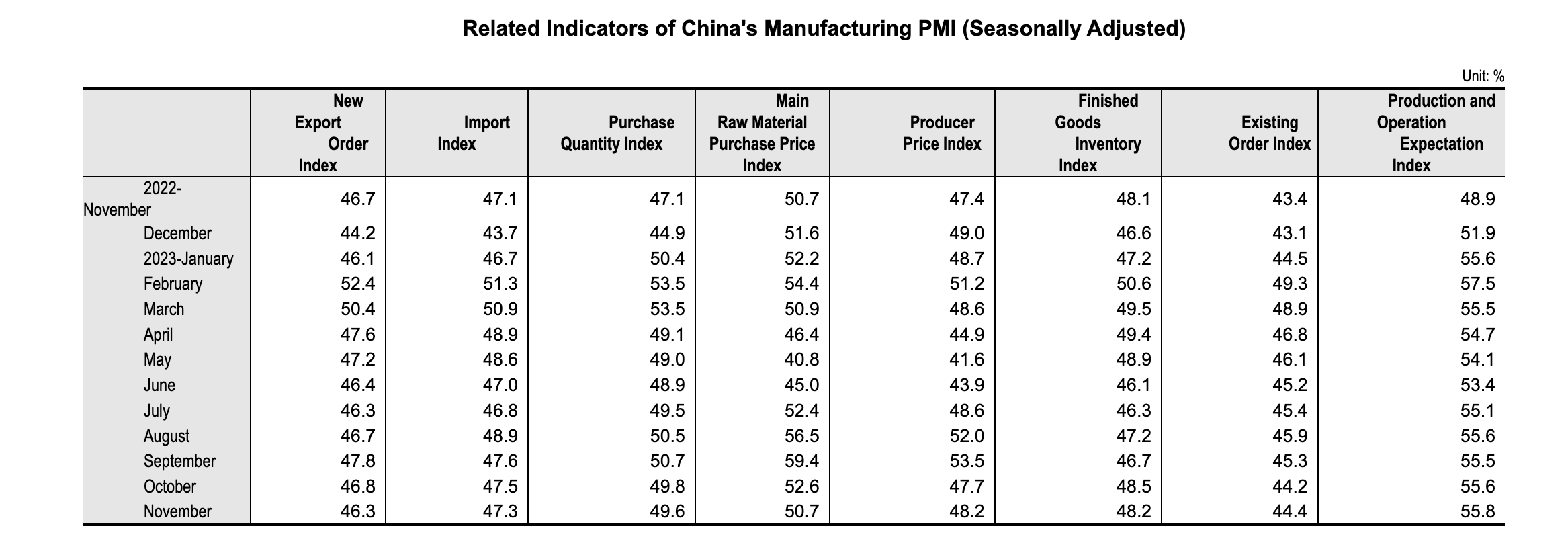

MACRO|| China’s PMI had a 0.1% contraction.

China’s official manufacturing purchasing managers’ index (PMI) stood at 49.4 in November, compared with 49.5 in October.

The reading last month was lower than market expectations and also the lowest reading since hitting 49.3 in July.

There are three main reasons for the current economic situation: First, insufficient endogenous demand, and the time needed for the effects of policies to materialize. Second, challenges exist in the improvement of external demand. Third, industries related to real estate remain weak, and there's a relative weakness in the prosperity of energy-intensive industries. Analysts anticipate that, as external demand gradually improves and policies continue to take effect, there is a high probability of marginal improvement in the Manufacturing Purchasing Managers' Index (PMI).

Within the official manufacturing PMI, the new-orders subindex dropped to 49.4, down from 49.5 in October, while the new-export-orders subindex fell to 46.3 from 46.8 a month earlier.

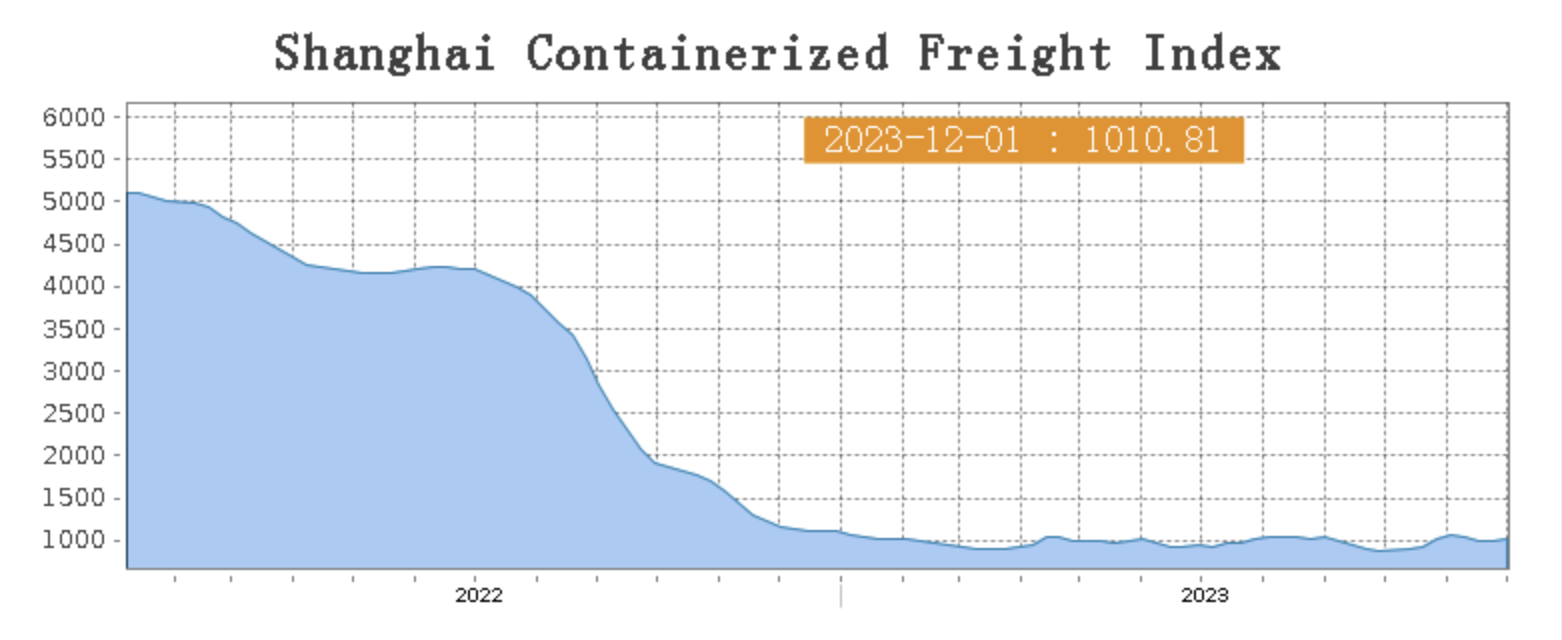

Sea Freight|| Freight rate rebound as the market is stabilized.

China’s Containerized Freight market was overall stabilized, On 1st December, the Shanghai Containerized Freight Index rose by 1.8% to 1010.81.

Europe/ Mediterranean:

The Eurozone’s Economic Sentiment Index has been climbing upward in the last 3 months as the overall market supply-demand structure is stabilized.

On 1st December, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$851/TEU, which fell by 9.2%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1260TEU, which fell by 6.6%.

North America:

The quotes for various sea route on the US West Coast route have shown mixed movements, resulting in a slight increase in the spot market rates. On the US East Coast route, the overall loading rate is better than on the West Coast. Carriers have increased their quotes more than they have decreased them, leading to a rise in spot booking prices.

On 1st December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1646/FEU and US$2446/FEU, reporting a 1.2% and 5.6% growth accordingly.

The Persian Gulf and the Red Sea:

On 1st December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 3.5% from last week's posted US$1152/TEU.

Australia/ New Zealand:

On 1st December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$920/TEU, a 0.8% slide from the previous week.

South America:

The freight market had a slight rebound. On 1st December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2578/TEU, an 4.5% decrease from the previous week.