Peak season? Golden September? Or a short-lived bloom? The stainless steel market was thrilled to experience the increasing price tendency in the last several weeks. However, last week, the prices again slid down. Of course, the weak demand is to be blamed. Only after Tsingshan uninterruptedly announced the price floor on the 300 series, did the transaction slightly lift. The strongest support is the nickel price, due to the ongoing Indonesian nickel drama. Indonesian President Joko Widodo said, "Indonesian nickel ore worth 17 times more in export value since the ban in 2020". Impressive number! According to the latest news, Indonesian government official Septian Hario Seto said that Indonesia will not issue new mining quotas this year. Indonesia is the world’s largest nickel producer. This move may further tighten the supply of nickel ore. Facing the confronting constraint supply of nickel, the ore cost will tend to increase. If you want to know more about the market dynamics, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,340 | -31 | -1.36% |

| Foshan | 2,385 | -31 | -1.33% | ||

| Hongwang | Wuxi | 2,260 | -40 | -1.85% | |

| Foshan | 2,265 | -35 | -1.59% | ||

| 304/NO.1 | ESS | Wuxi | 2,185 | -38 | -0.78% |

| Foshan | 2,200 | -40 | -1.90% | ||

| 316L/2B | TISCO | Wuxi | 4,085 | -18 | -0.46% |

| Foshan | 4,115 | -19 | -0.49% | ||

| 316L/NO.1 | ESS | Wuxi | 3,925 | -24 | -0.62% |

| Foshan | 3,940 | -7 | -0.18% | ||

| 201J1/2B | Hongwang | Wuxi | 1,405 | 0 | 0% |

| Foshan | 1,405 | -10 | -0.75% | ||

| J5/2B | Hongwang | Wuxi | 1,330 | -7 | -0.57% |

| Foshan | 1,320 | -13 | -1.03% | ||

| 430/2B | TISCO | Wuxi | 1,295 | 0 | 0% |

| Foshan | 1,280 | 6 | 0.48% |

TREND|| Steel mill plays hardball to refuse the price drop.

The price of stainless steel was weakening last week, while the social inventory and warrants are hanging on a high level: Stainless steel 201 fell slightly but overall stabilized; stainless steel rose after a fall and stainless steel 430 continued to lay flat. The mainstream contract price of stainless steel was traveling to US$2265/MT with a US$13 descent.

Stainless steel 300 series: High cost prevents the price from diving.

The market price of stainless steel 304 remained weak last week: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 had a US$35 plunge to US$2220, and hot-rolled stainless steel fell US$28 to US$2185/MT.

There was no significant improvement in trading except for a decent start last Monday, the prices of the 300 series harvested a mixed result last Thursday and Friday. Due to the maintenance of steel mills in Eastern China, there will be 20,000 tons of production affected. The transaction was slightly lifted after Tsingshan uninterruptedly announced the price floor on the 300 series.

Stainless steel 200 series: grade 201 had a first decline in peak season.

The mainstream base price of cold-rolled stainless steel 201 remained unchanged from the previous week at US$1380/MT.

Last Friday, cold-rolled stainless steel 201J2/J5 and 5-foot hot-rolled stainless steel fell by US$14 to US$1310/MT.US$1295/MT and US$1320/MT accordingly.

Stainless steel 400 series: grade 430 continued to thrive

TISCO and JISCO decided to remain unchanged for their guidance price of stainless steel 430/2B at US$1420/MT and US$1530/MT.

The mainstream market price of stainless steel 430/2B in Wuxi was roaming between US$1295/MT-US$ 1300/MT; 430/NO.1 stayed at US$1140/MT.

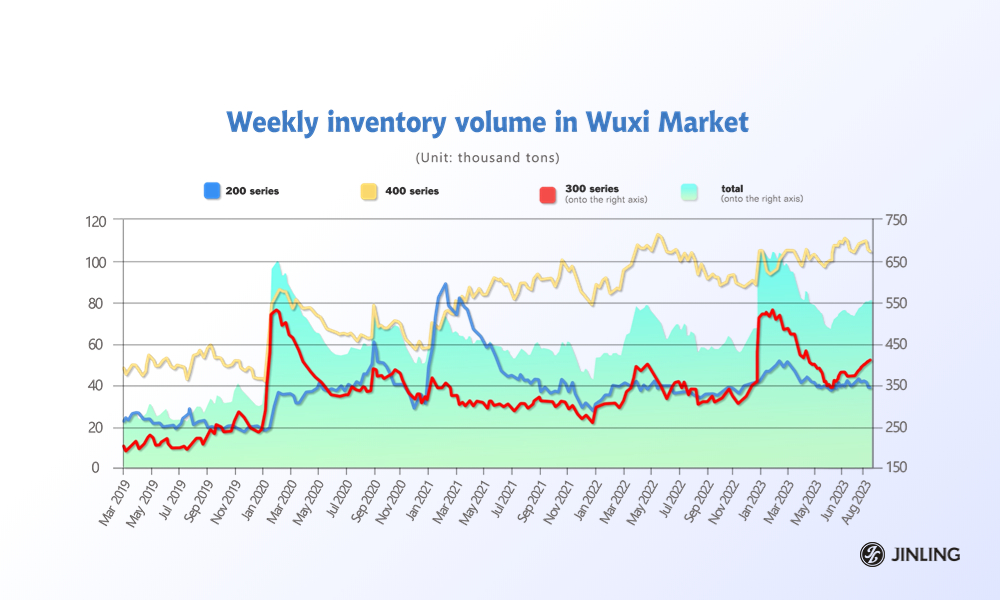

INVENTORY|| Fifth successive growth for 300 series inventory

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| September 7th | 38,383 | 404,686 | 104,872 | 547,941 |

| September 14th | 38,964 | 408,257 | 103,916 | 551,137 |

| Difference | -670 | 3,571 | -956 | 3,196 |

The total inventory at the Wuxi sample warehouse rose by US$3,196 tons to 551,137 tons (as of 14th September).

the breakdown is as followed:

200 series: 581 tons up to 38,964 tons

300 Series: 3,571 tons up to 408,257 tons

400 series: 956 tons up to 103,916 tons

Stainless steel 300 series: inventory grows for 5 consecutive weeks

The cold-rolled stainless steel inventory recorded the longest period of increase, and it was mainly taken up by Delong. The future price had a small rebound within the stocking-taking period, and the spot price followed suit. It is estimated that the production of cold-rolled stainless steel 300 series in August was 753,400 tons, recording a 4.96% growth from July, and about a 30% hike year on year.

Stainless steel 200 series: A small accumulation and a weakened transaction

BaoSteel’s resources took the majority part of the inventory increment last week, but Baosteel put the 2nd steel production on halt due to the severe rainstorm. The spot price was open with a downtrend last week, and it decelerated the inventory destocking and the transaction volume.

Stainless steel 400 series: Price stabilized

As mentioned earlier, the production of the stainless steel 400 series will be lifted in September, but the spot goods are rarely seen in the market so far. The demand is estimated to recover soon as the peak season is already on, and the quoted price from producers is not likely to be shaken largely. Nonetheless, spot inventory might have an insignificant change in the short term.

Stainless steel 300 series: inventory grows for 5 consecutive weeks

The cold-rolled stainless steel inventory recorded the longest period of increase, and it was mainly taken up by Delong. The future price had a small rebound within the stocking-taking period, and the spot price followed suit. It is estimated that the production of cold-rolled stainless steel 300 series in August was 753,400 tons, recording a 4.96% growth from July, and about a 30% hike year on year.

Stainless steel 200 series: A small accumulation and a weakened transaction

BaoSteel’s resources took the majority part of the inventory increment last week, but Baosteel put the 2nd steel production on halt due to the severe rainstorm. The spot price was open with a downtrend last week, and it decelerated the inventory destocking and the transaction volume.

Stainless steel 400 series: Price stabilized

As mentioned earlier, the production of the stainless steel 400 series will be lifted in September, but the spot goods are rarely seen in the market so far. The demand is estimated to recover soon as the peak season is already on, and the quoted price from producers is not likely to be shaken largely. Nonetheless, spot inventory might have an insignificant change in the short term.

Production: Five major steel mills have arranged murders in September

According to the latest infomation, the five stainless steel mills will cause over 90,000 tons of production reduced in September.

the breakdown is as followed:

Stainless steel 200 series: 15,000 tons

Stainless steel 300 serie: 53,000 tons

Stainless steel 400 serie: 23500 tons

Compared with the last two years, the current inventory in the market this year has remained large. What's more, because of the sluggish demand, the oversupply problem is getting more sever.

RAW Material|| Nicke price soaring and chrome ore beg to differ.

The EXW price of high carbon nickel remained unchanged at US$270/nickel point; ferrochrome also remained flat at US$1370/MT(50% Chromium), the high-graded ferrochrome roaming at between US$1370/MT-US$1385/MT(50% Chromium).

Nickle: Ferronickel price is upheld strongly by nickel ore

The price of ferronickel has been robust lately although the price of stainless steel was rather weak. At the moment, Indonesian nickel ore has achieved a price premium while the local producers are forced to spend more on the raw material. Meanwhile, the production cost of Chinese ferronickel is also rising as Indonesians, even some steel mills have already suffered from heavy losses.

Boasting the earth's largest reserves of nickel, Indonesia is anxious to develop its domestic EV and batteries industries and has stopped exports of nickel ore to ensure supply and attract investments for domestic processing plants.

“Indonesian nickel ore worth 17 times more in export value since the ban in 2020,” said Joko Widodo on 16th September, the president of Indonesia. “The ban received quite a lot backfire from IMF and WTO, but similar plans will be implemented to other key minerals such as copper, aluminum and zinc”.

Chrome: Diminishing demand as more cuts in production.

While the total demand in the industrial chain is walking downhill, the chrome market is also brewing bearish sentiment.

A slow market recovery caused more cuts in stainless steel production. There was about 100,000 tons of stainless crude steel was canceled lately, and the demand will be 20,000 tons short. As a result, steel mills are seemingly cautious about the peaked raw material price while the concentrated ore (40%~42%) from South Africa and Chrome Lump Turkey (Cr2O3 40-42%) reached around US$9/MT. Hence, the expectance of growing chrome imports from South Africa will undoubtedly squeeze out the profit margin of producers.

It is understood that one of the major high chrome producers in inner Mongolia suspended production for a fortnight in September and it will greatly reduce over a thousand tons of production.

The industry believes that the steel tendering in October is crucial for the market trend of high-graded chrome ore, and steel mills now are choosing between “a red pill and a blue pill” when it comes to calculating the production cost.

MACRO|| Production was motivated by turning points.

China's industrial output grew 4.5% in August from a year earlier, accelerating from the 3.7% pace seen in July, suggesting that the recent flurry of support measures may be starting to slowly stabilize a stumbling economic recovery. China's service production index went up 6.8 percent year on year in August, data from the National Bureau of Statistics last week. The upward momentum could be led by an improvement in demand and the natural recovery of the economy.

On the production side, as demand marginally improves and cross-seasonal disruptions dissipate, industrial production growth is recovering. On the demand side, the total retail sales growth rate has improved by more than 2 percentage points, and robust offline activities during the summer provide certain support to consumption. Month-on-month, fixed asset investment has seen a slight increase, with the manufacturing sector experiencing a relatively significant improvement in investment. In addition, the narrowing decline in export data released last week, along with both CPI and PPI growth rates trending upward, also reflects a marginal recovery in economic activity. However, the improvement in nominal investment growth in August is likely driven mainly by price, especially in the areas of infrastructure and real estate, where actual investment growth may be slowing down.

Sea Freight|| Freight market performance slumped down again.

China’s Containerized Freight market was overall powerless. On 15th September, the Shanghai Containerized Freight Index fell by 5.1% to 948.68.

Europe/ Mediterranean:

Results from the hiking inflation rate, Euro Central Bank further lifted the interest rate from it’s record height.

Until 15th September, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$658/TEU, which fell by 7.8%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1248/TEU, which fell by 4.6%

North America:

Until 15th September, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1888/FEU and US$2550/FEU, reporting a 7.3% and 11.1% decline accordingly.

The Persian Gulf and the Red Sea:

Until 15th September, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 8.9% from last week's posted US$864/TEU.

Australia/ New Zealand:

Until 15th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$617/TEU, a 2.1% fall from the previous week.

South America:

The freight market had a slight rebound. on 15th September, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1816/TEU, an 5.6% fall from the previous week.