Is it an all- round collapse of the stainless steel market? Sluggish demand, declining ore prices, massive inventory, unstable financing environment are making the market more difficult to recover. The cost of molybdenum declines and the price of stainless steel 316 follows to drop further. The real estate industry in China starts to slow down and meanwhile, the abroad demand also keeps low as we can see the retail inventory remained high for a long time. The only increasing tip in the market is the sea freight of some lines such as destination to South America. People related to the industry indicate that the sea freight to North America will rise as well because there are so many voyages canceled and the capacity declines. If you want to know more about the market, please keep reading our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,530 | -63 | -2.57% |

| Foshan | 2,570 | -63 | -2.52% | ||

| Hongwang | Wuxi | 2,450 | -56 | -2.35% | |

| Foshan | 2,450 | -49 | -2.05% | ||

| 304/NO.1 | ESS | Wuxi | 2,385 | -49 | -2.10% |

| Foshan | 2,425 | -60 | -2.56% | ||

| 316L/2B | TISCO | Wuxi | 4,550 | -244 | -5.25% |

| Foshan | 4,705 | -212 | -4.44% | ||

| 316L/NO.1 | ESS | Wuxi | 4,385 | -229 | -5.13% |

| Foshan | 4,460 | -200 | -4.43% | ||

| 201J1/2B | Hongwang | Wuxi | 1,540 | -10 | -0.72% |

| Foshan | 1,525 | -6 | -0.42% | ||

| J5/2B | Hongwang | Wuxi | 1,450 | 7 | 0.56% |

| Foshan | 1,450 | -3 | -0.22% | ||

| 430/2B | TISCO | Wuxi | 1,280 | -12 | -1.00% |

| Foshan | 1,270 | -12 | -1.01% |

Trend|| A deeper dive in 300 series, steel mills lift price to rescue

Last week, there was not much movement made by the price trend of stainless steel 201, compared to another steep slide in stainless steel 300 series.

The futures price of stainless steel experienced a bottoming-out last week, with a continuous decline over the first four trading days. The trading volume was relatively active, and the open interest increased day by day. Last Friday, the price opened low but then rebounded, with a significant increase in trading volume and relatively stable open interest. The market trend this week was influenced by the increase in short positions and new positions taken by the bears, as well as the decline in lackluster spot prices. After a continuous decline this week, the market rebounded on Friday. During Thursday's night session, the price of the main contract was only one step away from the integer threshold of 15,000, with an increasingly intense speculative atmosphere.

Stainless steel 300 series: A slow-motion disaster

Last Friday, the mainstream base price cold-rolled 4-foot mill-edge stainless steel 304 was quoted US$2370/MT with a US$59 fall. The price of hot-rolled stainless steel fell by US$66 to US2340/MT.

The down trending price of raw material is gradually shifting the production cost down and also indirectly pushing the price down. Allegedly, one of a special steel mills in Eastern China made a US$280/MTU bid for over thousand tons of high-grade ferronickel. However, the buyers in the stainless-steel market for the moment is not impressed by the off-selling price.

Stainless steel price 200 series: Steel mills prompted the price up

The spot price of stainless steel 201 rose after a fall on early last week. The mainstream base price of cold-rolled stainless steel 201 rose US$7 to US$1515/MT; stainless steel 201J2 closed at US$1430/MT with a US$29 rose; hot rolled 5-foot stainless steel fell US$15 to US$1455/MT.

Stainless steel 400 series: lackluster demand still hunting the market.

Stainless steel 430/2B quoted low at Wuxi market, between US$1275/MT-US$1285/MT.

The guidance price quoted by TISCO fell US$22 to US$1445/MT and JISCO remain unchanged at US$1515/MT.

It is obvious that 400 series producers is taking a tough stance on their selling price despite the low in demand.

Summary:

As the production cost fell, the stainless price is not likely to be pinned in the current level, not to mention the bearish looking market trend.

Stainless Steel 300 series: The price curve continued to slide while steel mills were underselling goods. The average price of cold rolled stainless steel is drawing close to US$2325/MT.

Stainless Steel 200 series: The three major steel mills can feel the disappointment about the market reflection on their price raise last week. The increment of the price indeed stimulated the market to some extends, but the bottom line is the sluggish demand.

Stainless Steel 400 series: Last week, the mainstream prices of high-chromium steel have shown a steady but slightly weak trend. This trend can be attributed to the high cost of chromium ore and the stable prices of coke. Despite the stable production costs of high-chromium steel, stainless steel manufacturers are showing a strong inclination to raise prices, indicating a reluctance to sell their products at lower prices. However, the demand for downstream procurement has been lackluster, resulting in slow inventory turnover. In particular, the price of 430 cold-rolled steel has shown weak support in the market. Consequently, it is anticipated that the upcoming week will see a continuation of the weak and stable price trend.

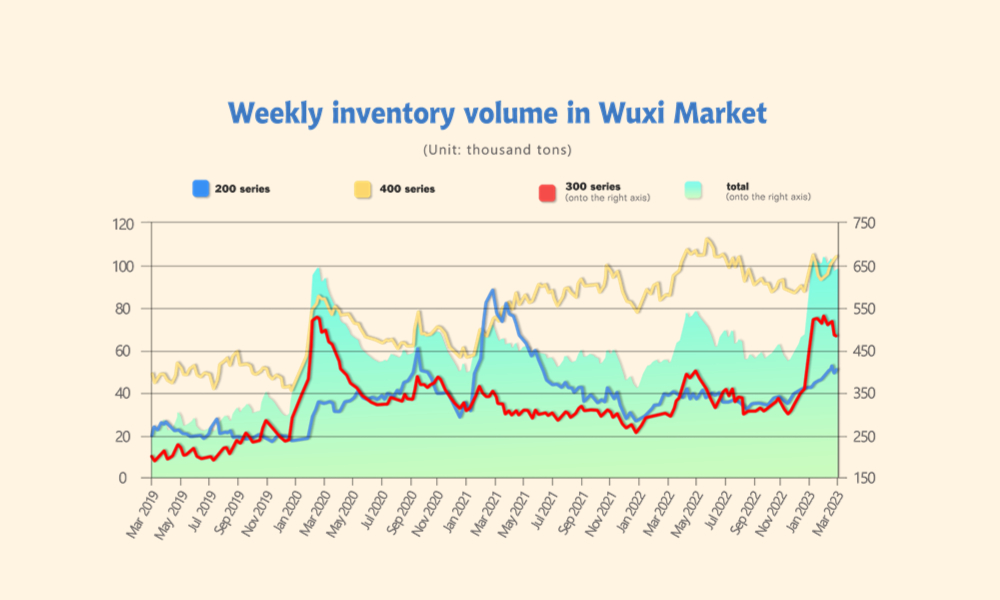

Inventory|| Inventory raised again.

The inventory level at the Wuxi sample warehouse rose by 5,863 tons to 639,941 tons (as of 16th March).

the breakdown is as followed:

200 series: 2,473 tons up to 50,360 tons

300 Series: 482,868 tons up to 485,341 tons

400 series: 1,790 tons up to 104,240 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| March 16th | 48,760 | 482,868 | 102,450 | 634,078 |

| March 23rd | 50,360 | 485,341 | 104,240 | 639,941 |

| Difference | 1,600 | 2,473 | 1,790 | 5,863 |

Stainless steel 300 series: a short break from major destocking

The inventory of cold-rolled steel has seen a slight decrease, while the inventory of hot-rolled steel has shown a small increase. During the week, the spot prices of both cold-rolled and hot-rolled steel have been weak, and market transactions have been mediocre. Steel mills have been receiving shipments of resources, with Delong Steel meeting its cold-rolled demand and reducing its hot-rolled supply, while Xin Hai Steel's hot-rolled resources have been gradually entering the market, supplementing the supply of hot-rolled steel resources and resulting in an increase in hot-rolled steel inventory.

Currently, the price of ferrochrome remains high, and steel mill production costs remain high as well. Some steel mills have started to reduce their production to alleviate the pressure of high inventory levels.

Stainless steel 200 series: Producers undersells to relieve the pain in inventory

During the past week, the shipment volume of steel products in the Wuxi market remained low, which, coupled with the continuous arrival of goods at various steel mills, led to a slight increase in the spot inventory. Since the fourth quarter of the previous year, the inventory of 200 series in the Wuxi market has been volatile and showed an upward trend, resulting in high inventory levels. This surge in inventory levels has put significant pressure on spot prices. However, despite this pressure, there have been no visible signs of a shortage of specific grades of steel products.

In an effort to reduce the inventory pressure, it has been reported that a certain steel mill in East China plans to offer a 20% discount on the agreement quantity of 200 series in April. This move is expected to provide some relief to the inventory pressure of the 200 series in the market in the upcoming month.

Stainless steel 400 series: the market is less active than before.

Last week, there has been no significant improvement in demand for 400-series stainless steel, with downstream procurement being driven mainly by essential needs. The turnover of existing inventory has continued to be slow. Given that the production costs of 400-series stainless steel remain high and difficult to reduce, steel companies are experiencing severe losses, resulting in a decreased willingness to sell at lower prices. It is expected that in the short term, the price of 400-series stainless steel will remain weak and stable. Next week, inventory levels are expected to remain relatively high.

Raw Material|| Cheaper inputs, but steel mills bore heavier losses.

Nickel: The price could one step downward.

The EXW price of high ferronickel fell US$4 to US$280/MTU, the price of ferrochrome lost US$15 to US$1430/MT(with 50% chromium), the theoretical production cost of cold-rolled stainless steel 304 was US$2455/MT.

Despite a drop in nickel-iron prices, the price of stainless steel has experienced a more significant decline, exacerbating losses for steel mills. Consequently, pressure to lower the cost of raw materials is expected to persist. According to the latest data on nickel ore imports, the end of the rainy season in the Philippines has led to a surge in nickel ore imports and a corresponding continuous fall in nickel prices. This, in turn, has substantially weakened the cost support for nickel-iron. Based on these developments, it is expected that nickel-iron prices will remain weak in the short term.

Chrome: Sufficient supply reported

The EXW price of high chrome remained weakly at between US$1430/MT to US$1460/MT (50% Chromium), a US$15 drop.

According to the latest data from China Customs, the supply of high chrome rose continuously:

In January, there were 234,000 tons of ferrochrome imported, a 95.75% increase from December and 26% more than the same month last year. In February, the figure climbed up to 277,900 tons, about 110.6% different from last year.

Most recently, the production of high chrome is largely expanded. The two major production areas, Inner Mongolia and Shanxi had initiated new product lines to increase the supply.

However, considering the cost aspect, the production cost of high-chromium steel remains at a high level, and there is little short-term pressure on the chromium ore supply. According to the statistics from China Customs, in January 2023, China imported a total of 1.05 million tons of chromium ore, a month-on-month decrease of 20.08% and a year-on-year decrease of 13.96%. In February, the import volume of chromium ore increased to 1.38 million tons, with a cumulative year-on-year increase of 7.99% in January and February. However, the monthly import volume was still lower than the average level of 1.2506 million tons in 2022.

It is worth noting that a nationwide labor strike began in South Africa on March 20th, which has led to a decrease in transportation and port shipping efficiency. The South African Road Freight Association has advised freight companies to consider delaying transportation until the end of the protest activities, which may affect the recent shipment of chromium ore and chromium iron, and add uncertainty to the South African export supply. Overall, the recent stable trend of high-chromium prices has been gradually affected by the high pressure of supply and the weakness in stainless steel prices.

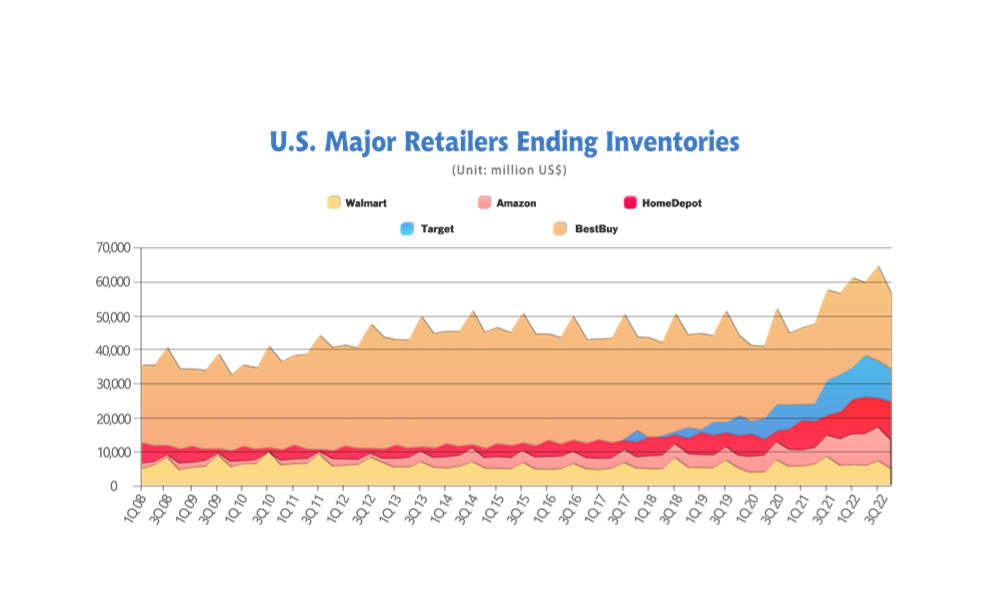

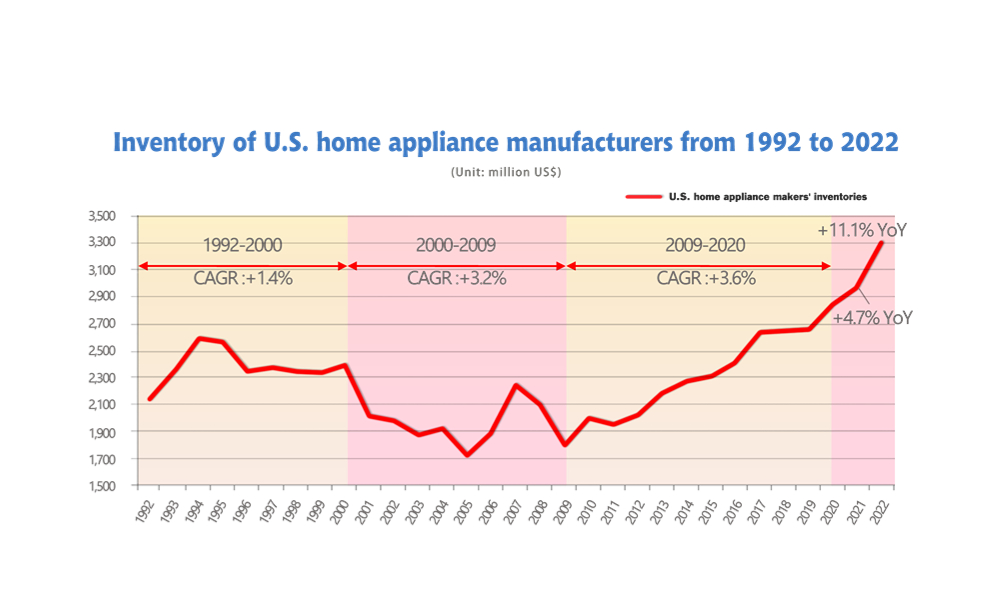

MACRO|| High in stockage concerns the retail industry.

The inventory of home appliances in the US peaked, in December’s figure was 24.9% and 16.7% higher than the same period in the years 2019 and 2020. Retail giants like Amazon, Walmart, Target, HomeDeport, and Bestbuy had suffered different levels of losses.

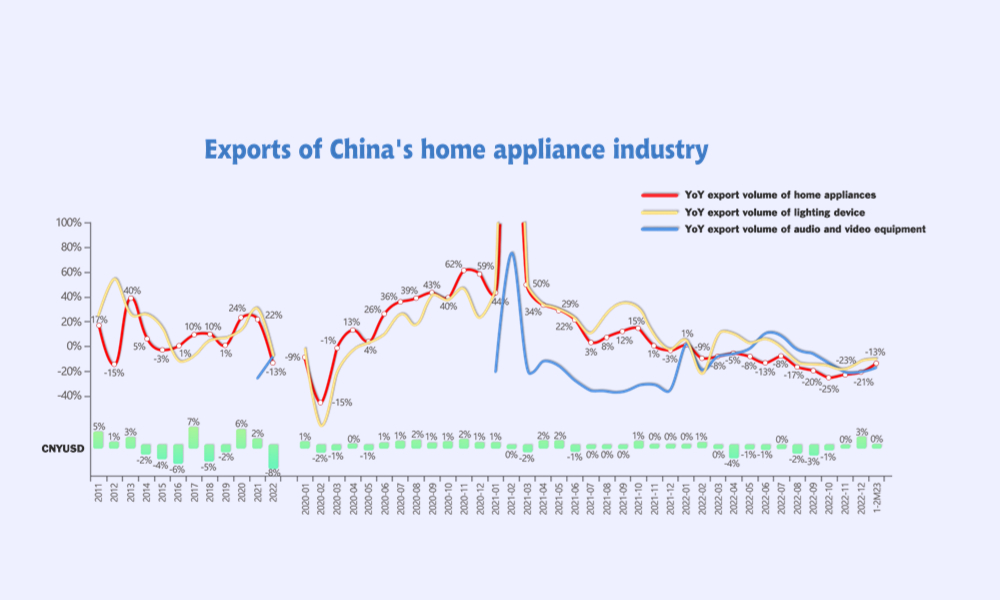

China home appliances export: Adjustment after 2 years of increase

According to data from China Customs, the export value (in USD) of the household appliance industry increased by 24% and 22% year-on-year in 2020 and 2021, respectively. This is mainly due to a significant increase in time spent at home after the outbreak of the pandemic, which led to an increase in the demand for quality and quantity of household appliances. After two years of high export growth, the export value of the household appliance industry is expected to decrease by 13% year-on-year in 2022. However, compared to the same period in 2019, it is still up by 10%. Our calculations show that the compound annual growth rate of the export value (in USD) of the household appliance industry from 2019 to 2022 and from 2010 to 2022, after adjusting for inflation, is 16.9% and 3.6%, respectively.

The pandemic has had an overall positive impact on the demand for household appliances, especially on the export demand, which temporarily declined in 2022 due to the overdrawn potential caused by the high growth in 2020 and 2021.

SEAFREIGHT|| Freight rate rallied across different routes.

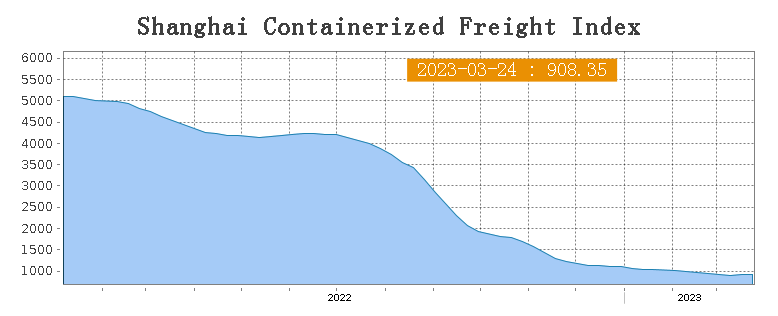

Freight rates overall on multiple sea routes stabilized last week as the market is still recovering. On 224th March, the Shanghai Containerized Freight Index fell by 0.2% to 908.35.

Europe/ Mediterranean: Although there has been some recent recovery in European manufacturing data, the economic recovery in Europe still faces challenges from high inflation and geopolitical risks, and the future economic outlook remains uncertain. This week, transportation demand has been generally stable, and after sustained adjustments in the market freight rates, there has been a slight rebound.

Until 24th March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$884/TEU, rose by 0.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1606/TEU, which fell by 2.7%.

North America: The interest rate had raised aging by the Fed last week, escalating worry of economic recession.

Until 24th March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,155/FEU and US$2,088/FEU, 0.5% and 2.4% fall accordingly.

The Persian Gulf and the Red Sea: Until 24th March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 1.7% rose from last week's posted US$894/TEU.

Australia/ New Zealand: Until 24th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$324/TEU, which gained by 17% from the previous week.

South America: The freight market had been violated again due to the peaked inflation rate. on 17th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1422/TEU, an 8.9% rose from the previous week.