Extreme heatwave sweep around the earth. It seems that the heat fails to warm up the stainless steel market. China's stainless steel market remained sluggish last week although more factories have to reduce production amid the power outage. Steel mills are stuck in production reduction. Some specifications are out of stock. Stainless steel 200 series and 400 series increased in price because steel mills and the market keep pumping the prices. It used to be exciting at the end of August because the bullish season is to come in September and October. However, most traders are pessimistic about the future market. It is reasonable. An opinion indicates that China's steel industry is stepping into the depression stage based on a theory of the economic cycle. If you want to go deep into the study, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,610 |

-39 |

-1.53% |

|

Foshan |

2,655 |

-39 |

-1.51% |

||

|

Hongwang |

Wuxi |

2,490 |

-21 |

-0.87% |

|

|

Foshan |

2,470 |

-36 |

-1.50% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,410 |

-33 |

-1.41% |

|

Foshan |

2,430 |

-33 |

-1.40% |

||

|

316L/2B |

TISCO |

Wuxi |

4,030 |

-48 |

-1.21% |

|

Foshan |

4,080 |

-68 |

-1.70% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,765 |

-53 |

-1.45% |

|

Foshan |

3,810 |

-53 |

-1.44% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,515 |

0 |

0% |

|

Foshan |

1,500 |

-1 |

-0.11% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,450 |

1 |

0.11% |

|

Foshan |

1,445 |

4 |

0.34% |

||

|

430/2B |

TISCO |

Wuxi |

1,265 |

7 |

0.65% |

|

Foshan |

1,265 |

7 |

0.65% |

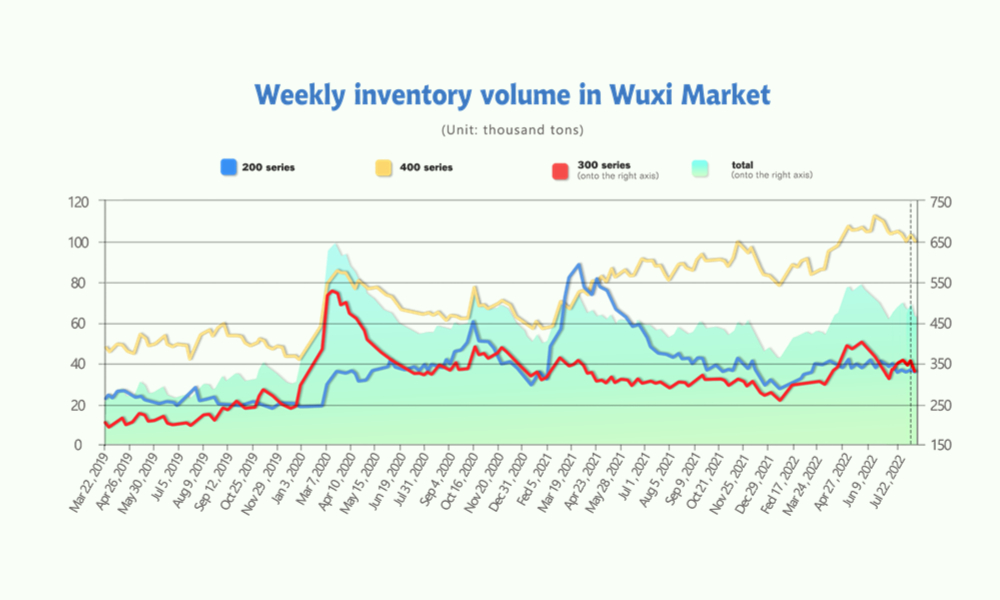

TREND|| Futures price breaks new low in14 months, declining by US$60/MT.

The spot price of all grades of stainless steel was differentiated. Series 304 hit the rock bottom while 201maintaining at horizontal last week. During the week, the contract price of stainless steel had once reached the lowest level (US$2370) in 14 months, closing at US$2395 with a US$63 drop.

Series 300 of stainless steel: Demand remains gloomy, and prices keep decreasing.

The market demand in the stainless-steel market remains bearish. The pandemic still hindering the recovery of the industry sporadically through August is already half past.

After the production release of Indonesian ferronickel, Chinese mills were forced to produce stainless steel to reduce the pressure on the inventory level, resulting in a high supply level. Until 19th August, 304 cold rolled 4-foot stainless steel quoted US$2430/MT, a $15 drop while hot rolled had a $30 decrease, closed at US$2400/MT. 304 cold rolled stainless steel production cost estimated at US$2510/MT.

Series 200 of stainless steel: Trading volume reduces but steel mills and the market insist on propping up the price.

The cold rolled stainless steel 201 was steady at Wuxi during the week, quoted US$1485/MT. The price of 201J2 cold rolled was also calmed at US$1420, and hot rolled 5-foot stainless steel closed at US$1435.

As mentioned above, the price curve of 201 was flatted and expected to have $7-$15/MT volatility, the J2/J5 will reach approximately the level of US$1400/MT.

Series 400 of stainless steel: Supply reduces, price increases but it may be hard to maintain.

Cold rolled stainless steel 430 at Wuxi quoted US$1265/MT on 18th August, merely a $7 raise compared to the week before last week.

The price of chromium dropped continually last week, and the price of iron ore had a $140/MT increase. The supply of high chromium was descending due to Sichuan’s severe ongoing power outage.

Summary:

Series 300: The adverse outcome of the economic recovery had prompted the product price to maintain at a low level, and the supply of Indonesian ferronickel and stainless steel is hiking up. The spot price is drawing close to US$2355/MT.

Series 200: 201 stainless steels at Wuxi was featureless last week as the spot price was limited by the mills' current inventory level, and it is expected to remain the same in a short period. 201J2/J5 is likely to hover between US$1445-1460/MT.

Series 400: TISCO and JISCO’s quotes on 430/2B were both growing up near to US$1280/MT, a $15 increase. TISCO and JISCO remained silent on the purchase price of high chromium. The bid price is likely to head downward in September, referencing the downed bid price from a week before last week. The production cost will be shifting down as the growth in the market transaction is limited. A stable price level of 430/2B stainless steel is anticipated, anchoring at between US$1265-1280/MT.

Stainless steel futures: Raw material cost will prop up the SS prices in a short term, but only when demand increases, can the SS price trend be reversed.

August is coming to an end in less than two weeks, somehow the future price of stainless steel was continuing to dip down during last week, even though September and October were usually the bullish periods in a year.

Stainless steel is not likely to have a major further decrease in the short term, Because:

1.The production costs of stainless steel are stabilizing despite the consumption being seemingly low, and the raw material suppliers still trying to maintain the price level to avoid unnecessary bleeding.

2.The downstream in the industry still have a willingness to purchase stainless steel.

3.The production cut among the mills is still underway, the inventory level is beginning to fall. and the demand and supply curve will gradually shift to the new equilibrium point.

In short, the future price of stainless steel in short term is still constrained by the principal rule of demand and supply, and it is expected to creep upward in the coming week.

INVENTORY|| Stainless steel 304 drops by almost 30,000 tons, but it is to rise in the future.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| August 11th | 36,436 | 355,700 | 102,832 | 494,968 |

| August 18th | 35,451 | 327,371 | 99,584 | 462,406 |

| Difference | -985 | -28,329 | -3,248 | -32,562 |

The inventory level at the Wuxi sample warehouse had 32,600 tons dropping to 462,400 tons. Series 200 fell 10,000 tons to 35,500 tons; Series 300 decrease 28,300 tons to 327,400 tons, series 400 closed at 99,600 tons with a 3300 tons drop.

200 series of stainless steel: Steel mills cut down output. Inventory went low.

The inventory level of series 200 merely had a 1000 tons reduction. The mills still putting a limited amount of goods on the market. Baosteel Desheng, Beigang New Materials and Ansteel LISCO had a small amount of AOG reportedly, but the inventory level of Series 200 still running low. 201 stainless steel’s shipment amount is downward dipping while the gloomy atmosphere still brewing in the market. Although it is close to the traditional peak season, September and October, traders are mostly pessimistic about the future market.

300 series of stainless steel: Inventory reduces significantly as steel mills haul production.

The inventory of series 300 had decreased by 28,300 tons, closed at 327,400 tons, but most of the volume is held by the mills and major traders.

Taishan steel suspended its production on cold rolling and steel making from 16th August to 25th August, 100,000 tons of series 300 stainless steel production will be disrupted. IRNC’s 12,000 tons stainless steel shipment had arrived at Jiangyin, and it is circulating in the market. Also, there will be about 100,000 tons of stainless-steel shipping back to China in September to stimulate the Chinese market. The increasing imports from Indonesia add pressure on the large domestic inventory though Chinese mills have kept reducing the output.

400 series of stainless steel: Transaction is bland and inventory is digested slowly.

The inventory of Series 400 had 3300 tons decreased to 99,600 tons. JISCO halved its production of series 400 to 40,000 tons and TISCO suspended production for 10 days from 16th August, because the margin deficit of production increased greatly. Taishan Steel has changed its production line to plain carbon steel. The AOG of Series 400 was reduced, and the consumption of inventory still going slowly.

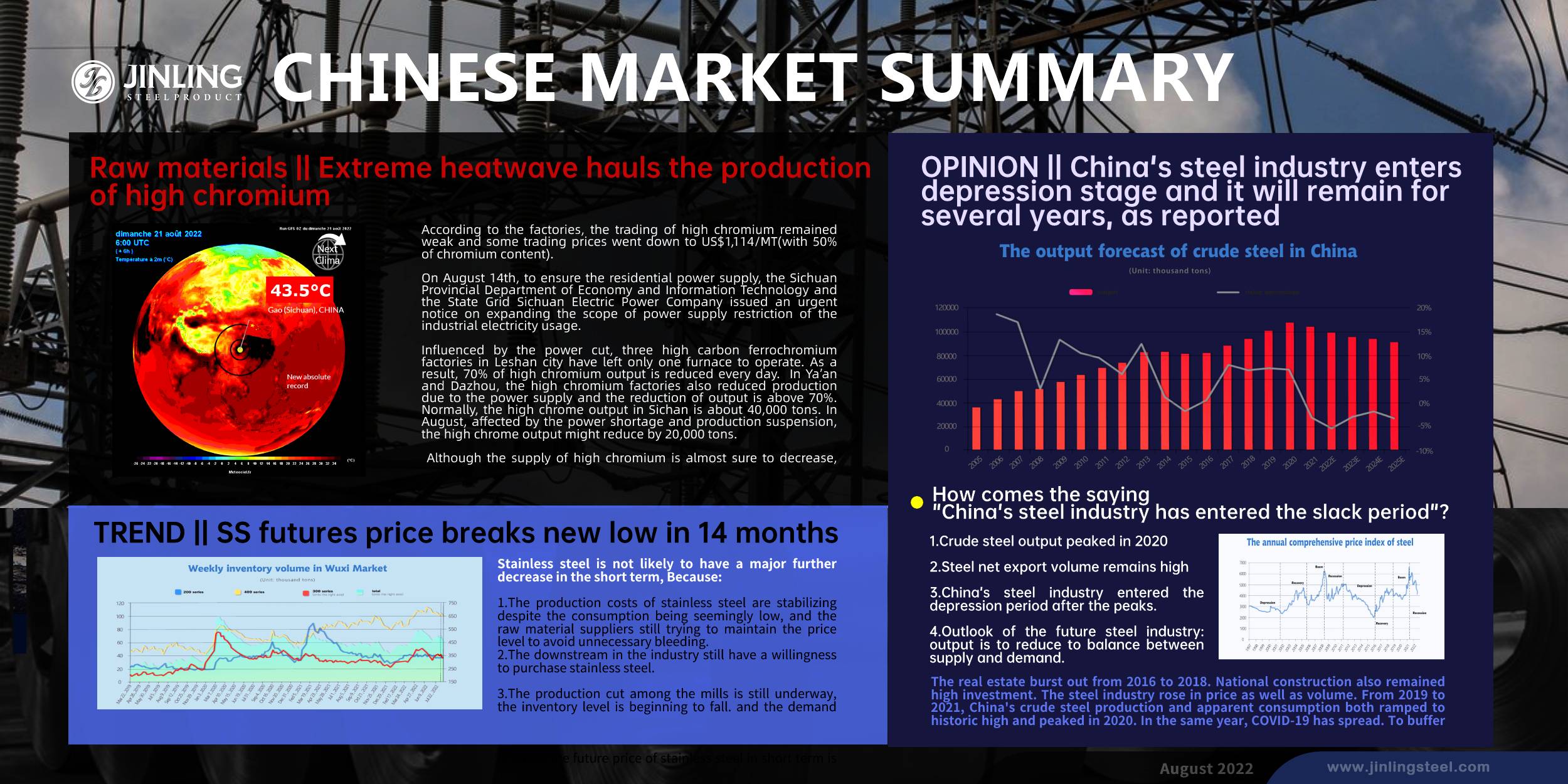

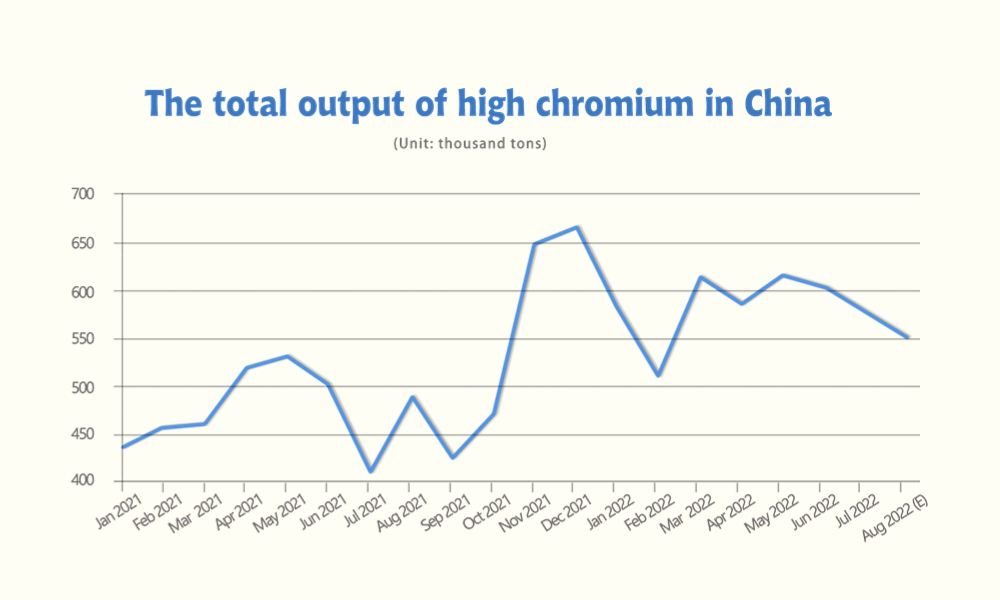

Raw materials|| Extreme heat hauls the production of high chromium

According to the factories, the trading of high chromium remained weak and some trading prices went down to US$1,114/MT(with 50% of chromium content).

On August 14th, to ensure the residential power supply, the Sichuan Provincial Department of Economy and Information Technology and the State Grid Sichuan Electric Power Company issued an urgent notice on expanding the scope of power supply restriction of the industrial electricity usage.

Sichuan Province is an important mineral supplier in China, like chrome, lithium, and polysilicon. On August 15th, 19 cities in Sichuan are included in the scope. All industrial users in Sichuan national grid plan had to suspend production except for security needs.

The local ferrochromium producers who are included in the national grid list had stopped producing on August 15th and some have already turned off production earlier on August 14th.

The extreme heatwave has spread over China this summer. Since July, the mid-Summer which is supposed to be the rainy season, Sichuan has suffered from heat and drought, and it leads to a severe shortage of hydropower because Sichuan locates in the Yangtze River which is famous for the Three Gorges Dam. Besides, the extreme and long-lasting heat makes the power usage surge, which again worsens the shortage of power supply. During the period, more high chromium factories said that they have to reduce their production due to the power cuts.

As early as the first week of August, Leshan City, Sichuan, has firstly bring up the off-peak electricity supply plan to ease the shortage and demands the manufacturers to produce in the off-peak hours.

Influenced by the power cut, three high carbon ferrochromium factories in Leshan city have left only one furnace to operate. As a result, 70% of high chromium output is reduced every day. In Ya’an and Dazhou, the high chromium factories also reduced production due to the power supply and the reduction of output is above 70%. Normally, the high chrome output in Sichan is about 40,000 tons. In August, affected by the power shortage and production suspension, the high chrome output might reduce by 20,000 tons.

Except for Sichuan, the major mineral-producing provinces like Hunan, Guizhou, Shanxi, and Inner Mongolia, more factories have to reduce and stop producing. Although the supply of high chromium is almost sure to decrease, the weak price might be mitigated. However, whether the decrease of high chromium can be stopped is more likely to be decided by the price of chromium ore and stainless steel.

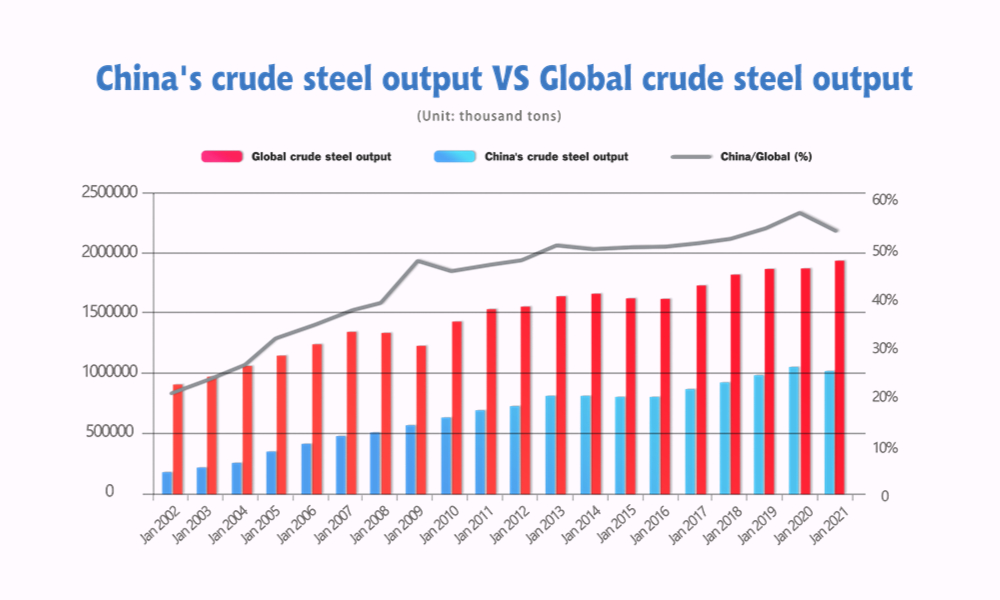

Opinion|| China’s steel industry enters the depression time and it will remain for several years, as reported.

On August 15, the People's Bank of China announced that the open market operation rate and the medium-term lending facility (MLF) rate were cut by 10bp to 2.00% and 2.75%, respectively. The rate cut shows that the central bank's primary policy objective remains growth and bond market leverage is not the focus. Economic fundamentals have yet to show signs of improvement, and monetary easing is likely to continue. This shows that Beijing will insist on promoting economic growth against the backdrop of broad-based inflation. This step seems to run counter to the rate hikes in most countries. The annual GDP target appears to be out of reach, and perhaps Beijing is hoping that looser policies will at least narrow the gap. At the same time, some reports pointed out that China's steel industry has entered a depression period. Whether the support of monetary easing can eventually be transformed into a recovery of the real economy still depends on the turnarounds in finance, real estate and the pandemic.

How comes the saying “China’ s steel industry has entered the slack period”?

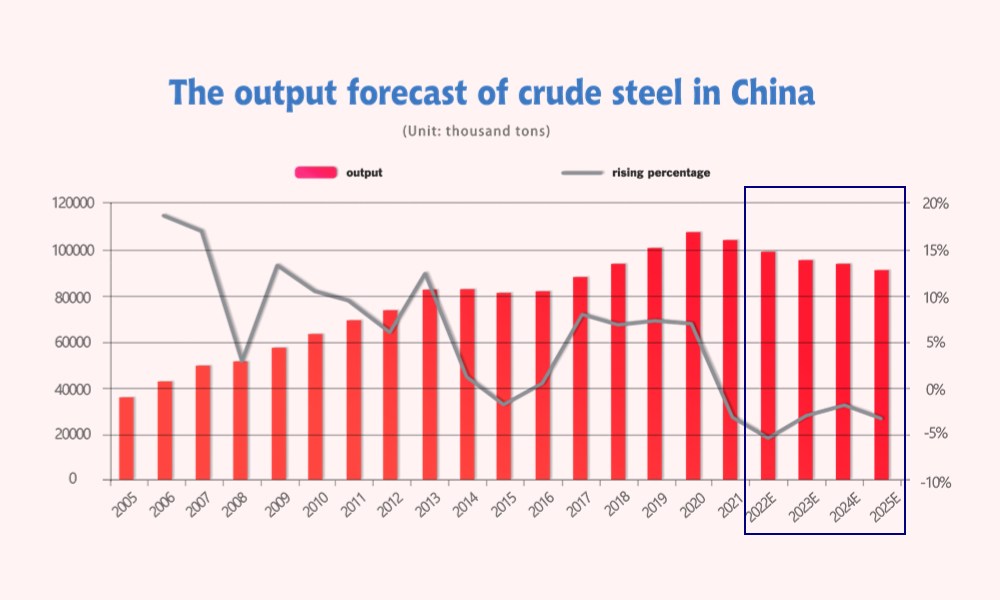

1.Crude steel output peaked in 2020

Since 2000, China’s output of crude steel has increased annually and gradually takes over 50% of the global crude steel output.

China is the world’s biggest iron ore and coal consumer. China’s output of crude steel peaked in 2020, reaching 1.053 billion tons which increased by 7 times over the two decades and it took 57% of the global output. Although in 2021, it decreased slightly, China still contributed 53% of the output globally.

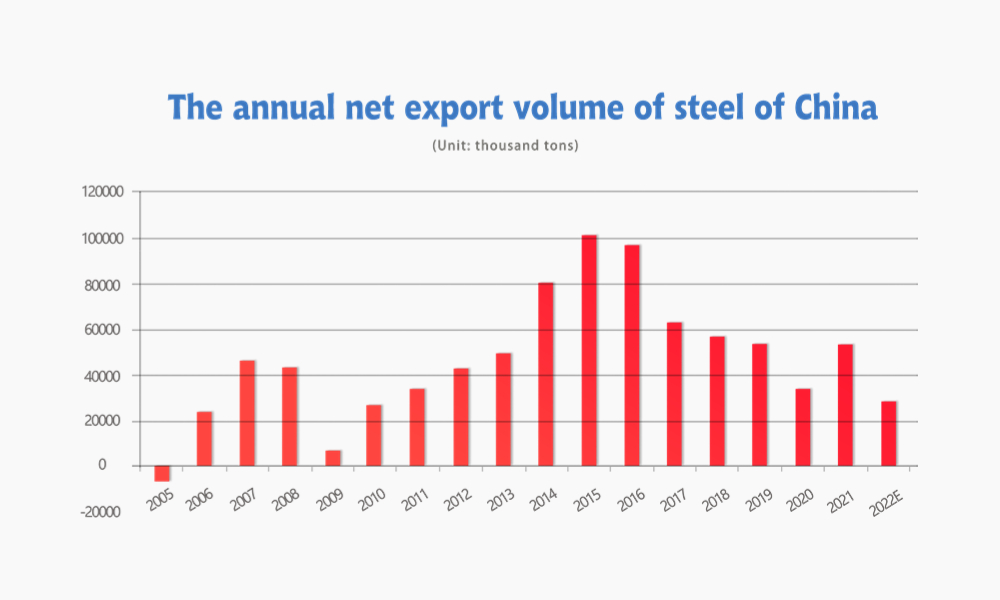

2.Steel net export volume remains high

The export of steel has been fluctuating. Before 2005, China maintained a large amount of steel imports. But with the domestic steel capacity improving, since 2006, the number of the net export volume of steel has stayed positive. It went through a slump in 2009 during the global financial crisis when global demand shrank significantly. The exporting force maintained a strong momentum since then, and in 2015, the volume was over 100 million tons. The reasons are decreasing steel prices and the greater profit of export over import.

3.China’s steel industry entered the depression period after the peaks.

The basic economic cycle is generally divided into four phases——Boom, depression, recession, and recovery stages, and how they reflect on the graphic are peaking, declining, rocking bottom, and expanding. It runs periodically. Investment and consumption influence the steel price trend. Consumption increases while investment is yet to turn on, and the economy is in the recovery stage; when both consumption and investment keep increasing, the economy is expanding to boom; as consumption reduces but the investment inertia remains, the economy gets slack; as both go down, the economy recesses.

From 2000 to 2015, the steel price went through a complete economic cycle. In 2016, “the 16th 5-year plan” of China marks a new round of economic cycles beginning. Now, according to the current price and investment, China’s steel industry is going through from the peak and transiting to the depression period.

The real estate burst out from 2016 to 2018. National construction also remained high investment. The steel industry rose in price as well as volume. From 2019 to 2021, China's crude steel production and apparent consumption both ramped to historic high and peaked in 2020. In the same year, COVID-19 has spread. To buffer the influence of pandemic, the whole world started a round of monetary easing, and the global economy began to recover. Commodity prices surged as well as the supply and demand increased. On May 12th 2021, the price of steel exceeded the highest point in 2008, and the price index of plain steel reached its highest at ¥CNY 6,634 /MT.

Bitterness shows quickly. In 2022, China’s real estate crisis breaks out, and funding is pulling away. Other major economic entities begin the continuous interest rate hike. The Russia-Ukraine war intensifies global geopolitics.

Suppressing by the world-scale volatility, on one hand, most of the commodity prices are caving in under the weakening economic environment. On the other hand, prices of fossil energy such as crude oil and gasoline remained high. The raw materials of steel production, like coking coal and coke, are expensive. The contradiction between cost and demand fails to be alleviated. It is afraid that China’s steel industry has already slit into the depression stage currently.

4.Outlook of the future steel industry: output is to reduce to balance between supply and demand.

In China, the development of real estate is time to cool down. The frantic expansion of real estate can hardly repeat as China’s urbanization is 64.7% in 2021, which is in the mid-late stage of China’s road to urbanization. Besides, the aging population also limits the demand for housing need and it is almost for sure that the overall housing investment is going down. Losing the support of real estate, the domestic demand for steel and crude steel output will also decline.

However, the hope lies in the improvement of the manufacturing industry. China’s developing plan “Made in China 2025” focuses on improving the manufacturing industry. It is believed that Chinese domestic manufacturing demand will create a new pillar of the steel industry.

But the decreasing price is a thing no one can escape from. Unlike China which remains an easing monetary strategy, most countries tend to be more hawkish in the view of monetary policy. It is probably that the commodity prices will keep decreasing.

Actually as early as 2020, the government has already urged the steel industry to reduce output to deal with the lingering problem —— oversupply. But it is almost impossible that Beijing will intervene by administrative means. Only market relations can truly push steel mills to reduce production to ensure their profit per ton. As we have mentioned in the last market report, “ the market is to give a shuffle”. The outdated capacity will be eliminated and those who stand still will be the elites.