Are you also hanging your orders? Many clients told us that no one wants to buy now. Except for the decreasing price, the major reason is people are pessimistic about the future market. The latest PMI (Purchasing Manager Index) for June is the strongest evidence of their worries. According to the data, the US and Eurozone economies are facing rising stagnation. Chinese domestic demand is no better than theirs. The domestic apparent consumption of stainless steel sheets and strips in June 2022 is lower than that in the same period of the previous three years. The demand is stalling both inside and outside China. In a short term, it is difficult to see a rebound in the global economy. The Persian Gulf is a rare exception. Benefiting from the increasing oil price, their businesses are more active. We can see strong momentum from their economic data. As for the sea freight, SCFI was generally stable. Sea shipping services to the Persian Gulf and South America continued to increase. If you want to go deep into China's stainless steel market and the market tendency, please keep reading and rolling down for our Stainless Steel Market Summary in China for last week.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,015 |

-56 |

-1.90% |

|

Foshan |

3,060 |

-56 |

-1.88% |

||

|

Hongwang |

Wuxi |

2,900 |

-33 |

-1.19% |

|

|

Foshan |

2,875 |

-48 |

-1.83% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,850 |

-21 |

-0.77% |

|

Foshan |

2,865 |

-48 |

-1.74% |

||

|

316L/2B |

TISCO |

Wuxi |

4,625 |

-63 |

-1.40% |

|

Foshan |

4,650 |

-69 |

-1.52% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,360 |

-9 |

-0.21% |

|

Foshan |

4,380 |

-30 |

-0.71% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,575 |

-44 |

-2.93% |

|

Foshan |

1,590 |

-18 |

-1.22% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,465 |

-44 |

-3.16% |

|

Foshan |

1,490 |

-18 |

-1.31% |

||

|

430/2B |

TISCO |

Wuxi |

1,430 |

-57 |

-4.20% |

|

Foshan |

1,455 |

-32 |

-2.32% |

Trend|| Nickel price slumps and stainless steel prices continue to drop.

From June 20th to June 24th, the stainless steel spot price remained weak. Earlier last week, the stainless steel futures price rebounded and rose, and meanwhile, the price of spot products maintained steady. But later the week, the nickel price kept falling, which influenced the stainless steel futures to decrease. In the decreasing vibe, the transaction cools down quickly. Until June 24th, the most-traded contract of stainless steel futures shifted and the price dropped by US$143/MT to US$2,670/MT.

300 series of stainless steel: Stainless steel prices dropped as nickel prices slumped.

Last week, the spot price of stainless steel 304 fluctuated and decreased. On June 24th, the cold-rolled stainless steel 304 by private-owned mills decreased to US$2,835/MT and the hot-rolled stainless steel 304 remained at US$2,850/MT two weeks ago. The trading volume earlier last week increased because the futures and spot prices kept rising, which reduced the spot inventory in Wuxi and Foshan. But when the ShFE nickel price dropped quickly, the stainless steel futures price also fell and the trading became bland.

200 series of stainless steel: Transaction warms up and the decrease slows down.

The spot price of stainless steel 201 was generally stable and slightly declined. The transaction of spot products warmed up. Until June 24th, the cold-rolled mill-edge stainless steel 201 has dropped by US$38/MT to US$1,525/MT; mill-edge stainless steel 201J2and J5 has reduced by US$30/MT to US$1,420/MT; hot-rolled 5-foot stainless steel was down by US$60/MT to US$1,520/MT. The price of cold-rolled was finally above the price of hot-rolled stainless steel.

400 series of stainless steel: The drop in price may maintain as the production cost is to fall and the demand remains tepid.

Last week, the cold-rolled stainless steel 430 dropped slightly. On June 23rd, the cold-rolled stainless steel 430 in Wuxi was US$1,430/MT which was US$30/MT lower than that on June 16th. The major raw materials of stainless steel 400 series, such as chromium and coke, have decreased in cost, which gives a relief to the production cost of high chromium. However, the steel mills’ bidding price for high chromium also fell in July, which is not interested in the high chromium producers.

The price of hot-rolled remained and is more expensive than the price of the cold-rolled price.

The hot-rolled stainless steel 430 was stable in price last week, and the hot-rolled stainless steel 430 of TISCO in Wuxi was US$1,465/MT. The HR price did not drop quickly as the CR price because the cost of HR products is high. As the CR price kept decreasing, the HR price is now above the CR price.

Summary:

300 series of stainless steel: The nickel price continues to fall and the price of ferronickel is difficult to stop decreasing. The production cost of stainless steel has been falling and the price of the cold-rolled 304 of the private-owned mills might decrease and stay above US$2,775/MT. The production of stainless steel remains low because steel mills have meager profits. However, the demand for stainless steel is recovering. The stainless steel inventory in East China has decreased for consecutive five weeks. People are looking forward to the price of stainless steel price to maintain stability and rise as the warehouse receipts inventory is low.

200 series of stainless steel: The market of spot stainless steel 201 fluctuated. Although the demand has been tepid, traders are unwilling to reduce the price because some steel mills are going to reduce their output. It is predicted that the decline of stainless steel 201 will slow down and the price will tend to be stable. The cold-rolled stainless steel 201J2 (coil) will stay above US$1,420/MT.

400 series of stainless steel: In Wuxi, the stainless steel 430/2B of TISCO and JISCO has dropped to US$1,415/MT which was US$45/MT lower than a week ago. TISCO and JISCO are going to reduce the bidding price of high chromium in July. The price of coke has kept falling, so the cost of the 400 series will decrease, but Chinese domestic demand remains low. It is predicted that the price of stainless steel 430/2B will weaken and the lowest will go down to US$1,405/MT.

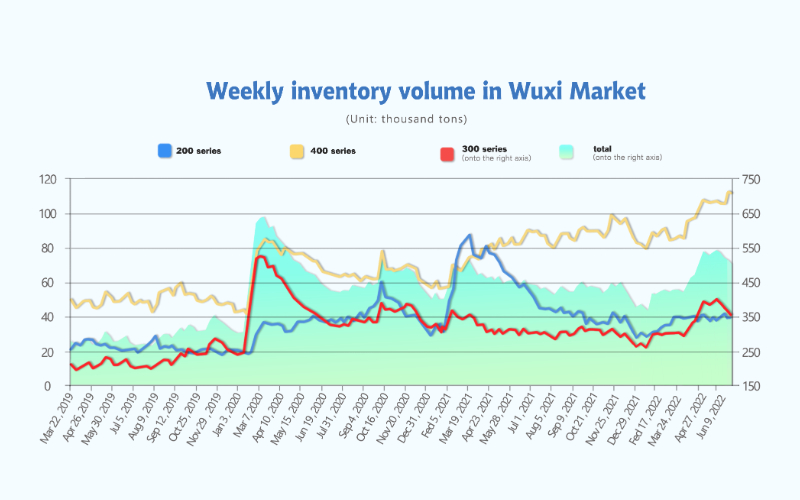

Inventory|| 300 series supply might increase in the second half of 2022.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| June 16th | 37,720 | 358,337 | 111,743 | 507,800 |

| June 23rd | 40,081 | 347,041 | 110,488 | 497,610 |

| Difference | 2,361 | -11,296 | -1,255 | -10,190 |

Last week, the inventory volume in the Wuxi sample warehouse continued to decrease by 10,100 tons to 497,600 tons. 200 series inventory increased by 2,400 tons, to 40,100 tons; 300 series decreased by 11,300 tons, to 347,000 tons; 400 series decreases by 1,200 tons to 110,500 tons.

200 series: The inventory rises slightly.

Baosteel Desheng and Beigang New Materials delivered to the market. In Wuxi, the inventory of 200 series increased slightly by 2,400 tons to 40,100 tons and cold-rolled resources took the majority.

300 series of stainless steel: Steel mills reduce the production, and stainless steel inventory keeps decreasing.

Since June, demand has been low and the cost has stayed high, some steel mills reduce the production of stainless steel 300 series. Delong plans to produce about 160,000 tons ~ 170,000 tons of crude steel of 300 series in June. According to the statistics, in 2022, 8.88 million tons of capacity is to increase in the stainless steel industry. In the second half of 2022, there will be 4.5 million tons of the new capacity to be realized and 300 series is the majority. As the supply expands, the pressure on China’s stainless steel market will increase.

400 series of stainless steel: Steel mills were overhauled and inventory decreased.

In Wuxi, the inventory of 400 series was reduced slightly. JISCO is going to finish maintenance and return to produce. The supply of stainless steel 400 series will recover. The consumption remains slow. When JISCO starts to produce, the inventory of 400 series will be more difficult to digest.

Raw materials|| Costs are decreasing.

Nickel: High nickel iron price continues to decrease.

Last week, the price of high nickel iron kept decreasing. On June 24th, the price dropped to US$210/Ni, which was US$6/Ni lower than a week before.

Since this year, China’s import of ferronickel has broken the record high every month.

According to customs statistics, in May 2022, China’s domestic import of ferronickel was 492,100 tons, MoM increased by 17.42% and YoY increased by 63.5%. The amount of ferronickel imported from Indonesia was 463,700 tons, MoM 18.75% and YoY 76.74% rising respectively. In June, the price of stainless steel continues to fall in China. Some steel mills reduce output to cope with the tepid demand in June and some extend the plan to July. The demand for raw materials keeps declining.

As the stainless steel prices keep decreasing and steel mills cut down their production, the demand for ferronickel reduced, which crashed the Indonesian ferronickel price. In a short term, the price of high nickel iron will remain weak.

Chromium: Price decreases though the supply reduces.

Since the second half of June, the EXW price of high chromium has dropped to US$1,405/50 basis ton (with 50% of chromium content), down by US$30 compared with the price at the beginning of June. However, the price of coke rose by US$45/MT in June. The cost pressure of high-chromium production enterprises increased sharply.

Therefore, in June, many high-chromium factories stopped production due to high costs and continued losses in profit. Until now, the paused production capacity has reached over 50,000 tons; and in the meantime, the import volume of ferrochromium has also decreased significantly.

According to customs statistics, in May 2022, China's total high chromium imports were 158,400 tons, decreasing by 22.13% from the previous month and down by 36.71% from the same period last year. Despite the decline in the supply of high chromium, due to the continuous decline of stainless steel prices, the weak tendency of high chromium still failed to reverse.

Due to the sluggish market, stainless steel will continue to put pressure on the cost, and the price of high chromium is expected to continue to decline.

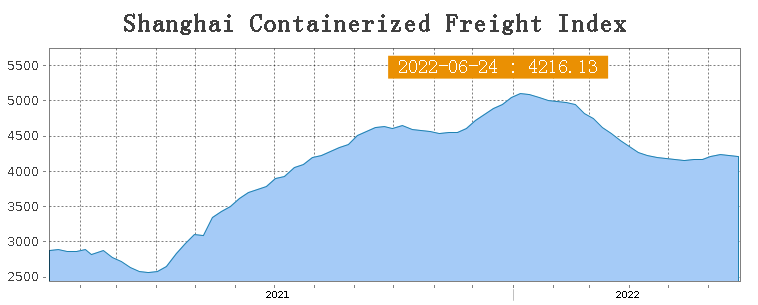

Freight|| Sea freight increases, shipping to the Persian Gulf and South America from Shanghai.

The SCFI on June 24th remained stable, slightly decreased by 5.83% to 4216.13.

Europe/ Mediterranean: Last week, the transportation market remain stable, and the market freight rate fell slightly. On June 24, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$5,766/TEU, down 0.5% from the previous issue. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$6,425/TEU, down 1.0% from the previous issue.

North America: From June 20th to June 24th, the transportation demand was generally stable, the fundamentals of supply and demand remained balanced, and the market freight rate fell slightly. On June 24th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$7,378/FEU and US$9,804/FEU, respectively, down 1.5% and 2.7% from the previous issue.

Persian Gulf and Red Sea: After the traditional Ramadan, the transportation demand is recovering gradually, and the market freight rate continues to rise this week. On June 24, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$3,541/TEU, increasing by 3.6% from the last week.

Australia/ New Zealand: The spot booking price last week was basically the same as the previous period. On June 24, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$3,398/TEU, down 0.1% from the previous week.

South America: The disturbances of corona linger in the destinations. With the Fed raising interest rates leading to capital outflows and increased market volatility, the economy faces greater risks in the future. The spot market booking price continued to rebound this week. On June 24, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$7,884/TEU, up 3.3% from the previous issue.

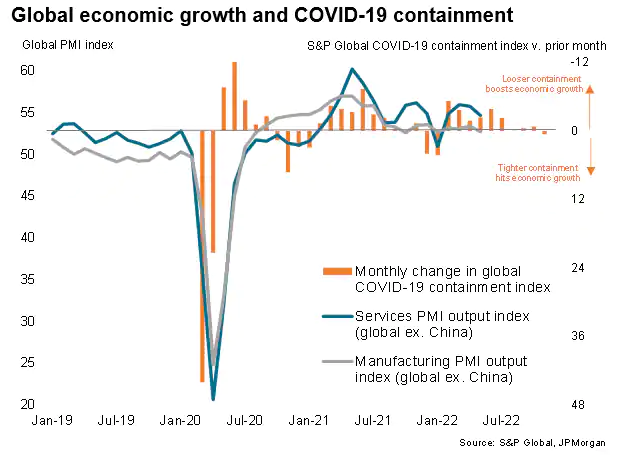

Macro|| Global economy is widely pessimistic.

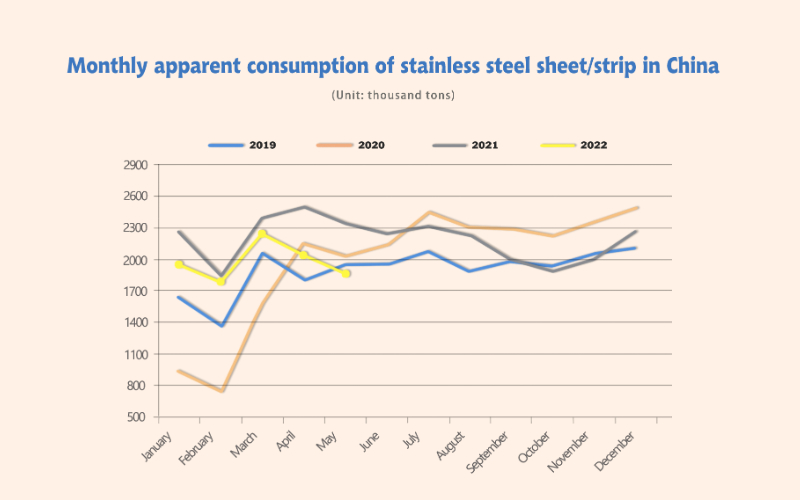

China: Recovery remains sluggish.

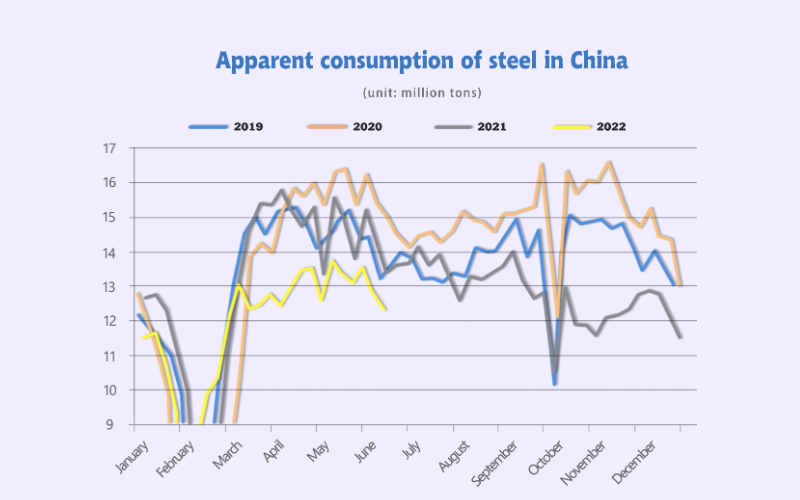

In May of 2022, China’s monthly stainless steel sheet/strip consumption is 1,860,800 tons, which reduces by 20.65% YoY and MoM decreases by 8.97%. It is expected that the apparent consumption in June will slightly increase compared to May.

The apparent consumption of steel also falls in June, which is lower than the same period in 2021, 2020 and 2019. The data of concrete shows a recovering tendency as the inventory starts to decrease slightly and the delivery rate increases by 1.7% from one month ago. It can tell that Chinese domestic demand remaining weak, but it is fixing slowly.

The US and Eurozone: Fear of stagnation increases.

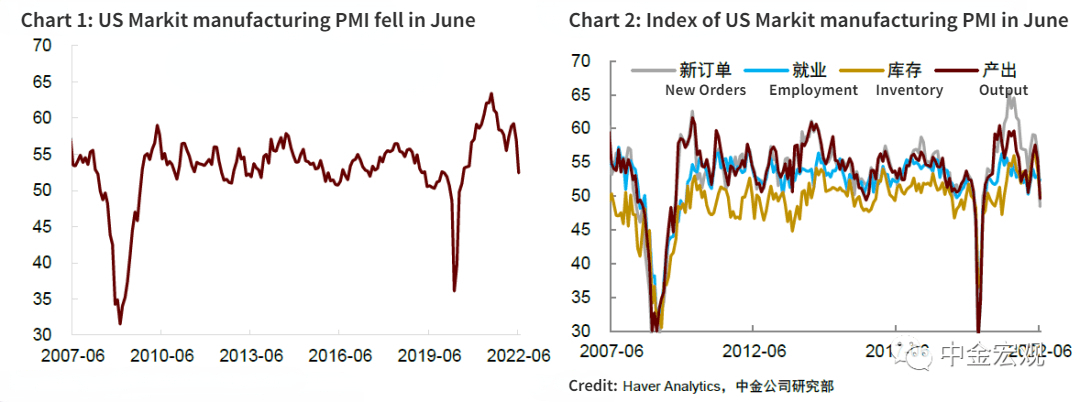

Many clients told us that their local market is sluggish. According to the latest PMI of June, their sayings are trackable. The Markit PMI (preliminary) in Europe and the United States both fell in June, and the decline exceeded market expectations.

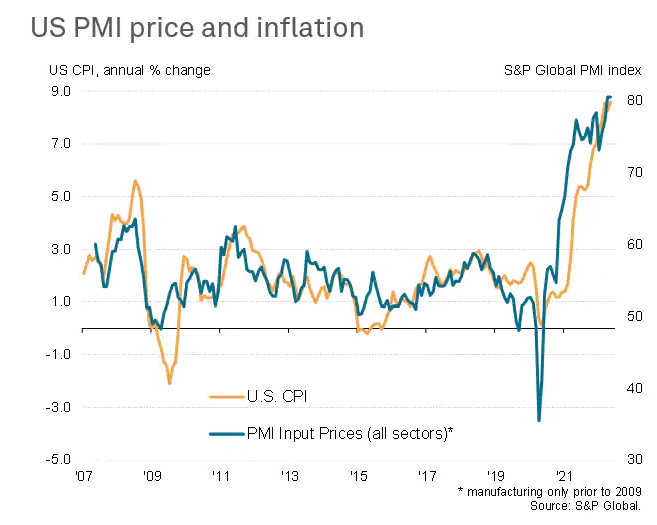

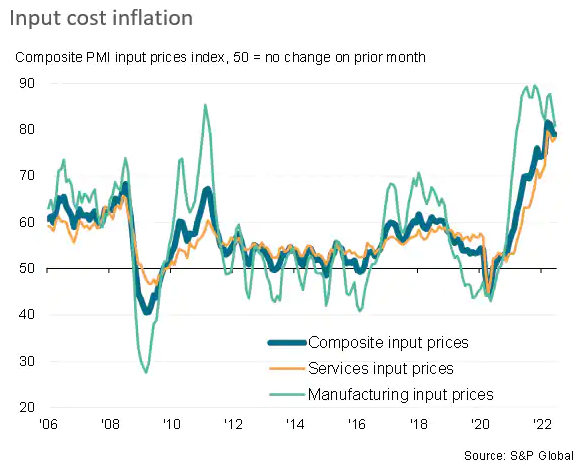

In the US, the output and new orders index of the manufacturing PMI, the new business index of the services PMI. As for the Eurozone, several sub-indices in PMI all fell below 50, indicating a slowdown in the momentum of demand expansion. On the other hand, the price index in the PMI remains high and supplier delivery time remains low, suggesting that inflation brought by the decreasing supply remains. We believe that facing the weak demand and rising prices, the European and American economies will encounter severer "stagflation". To exporters in China, the global economic environment will be even more unfavorable in the second half of the year.

May saw the robust increase in US economy. However, growth has clearly slowed both in the manufacturing sector and in the vast services economy. Manufacturing PMI (preliminary) fell to 52.4 from 57 in the previous month, the lowest level in 23 months (CHART 1). In terms of sub-items, the output index fell sharply from 55.2 to 49.6, and the new orders index fell sharply from 56.1 to 48.4, both of which fell below 50(= no change) (CHART 2). The supplier delivery index in June was 33, remaining low, indicating that supply bottlenecks still exist. The production input price index was 77.9 and the output price index was 69.4, reflecting that inflationary pressures remained high.

Eurozone economy even have greater difficulties, we think. Eurozone economic growth deteriorated sharply to a 16-month low in June, according to preliminary PMI data, reflecting a stalling of demand growth. Companies also scaled back their business expectations for output over the coming year to the lowest since October 2020. Both the stagnation of demand and worsening outlook were widely blamed on the rising cost of living, tighter financial conditions and concerns over energy and supply chains linked to the Ukraine war and ongoing pandemic disruptions. Price pressures meanwhile remained elevated at levels not seen prior to the pandemic, though a moderation of cost growth for a third successive month hinted at a peaking in the rate of inflation.

Persian Gulf: High oil price boosts the business.

Benefiting from the soaring oil price in 2022, the Persian Gulf seems to be more hopeful than the other areas. Take UAE as an example, The UAE’s PMI (Purchasing Managers Index) for May is at 55.6 compared with 54.4 in April. Higher oil prices is driving momentum in UAE’s private sector activity, with businesses reporting ‘renewed increase’ in jobs and new orders. However, according to David Owen, Economist with S&P Global Market Inteligence, "For now, PMI data suggest that companies are choosing to absorb extra costs rather than pass them onto customers, but this is unlikely to continue indefinitely."