In the rest days of 2024, we will witness a great change in the reshaping of political powers. Stainless steel is never an exception. Keep updated with the fluctuations is meaningful for making a good decision. You are free to keep reading the full report, Stainless Steel Market Summary in China, and contact us for the most immediate quotation. Last week, stainless steel prices slightly fluctuated to rise. However, the increase did not fix the loss of stainless steel mills. It is said that stainless steel mills have been losing profit in production because the selling price is too low. But the tricky point is that chromium iron which is one of the raw materials for making stainless steel, is also in a loss.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,155 | 11 | 0.55% |

| Foshan | 2,195 | 11 | 0.54% | ||

| Hongwang | Wuxi | 2,045 | 10 | 0.51% | |

| Foshan | 2,060 | 11 | 0.58% | ||

| 304/NO.1 | ESS | Wuxi | 1,980 | 11 | 0.60% |

| Foshan | 1,980 | 11 | 0.60% | ||

| 316L/2B | TISCO | Wuxi | 3,660 | -6 | -0.16% |

| Foshan | 3,720 | -6 | -0.15% | ||

| 316L/NO.1 | ESS | Wuxi | 3,505 | -11 | -0.33% |

| Foshan | 3,505 | -7 | -0.21% | ||

| 201J1/2B | Hongwang | Wuxi | 1,365 | -6 | -0.44% |

| Foshan | 1,370 | 0 | 0.00% | ||

| J5/2B | Hongwang | Wuxi | 1,260 | -7 | -0.60% |

| Foshan | 1,270 | 0 | 0.00% | ||

| 430/2B | TISCO | Wuxi | 1,225 | -1 | -0.10% |

| Foshan | 1,230 | -1 | -0.12% |

TREND|| Stainless Steel Spot Prices in Wuxi Show Mixed Trends Last week.

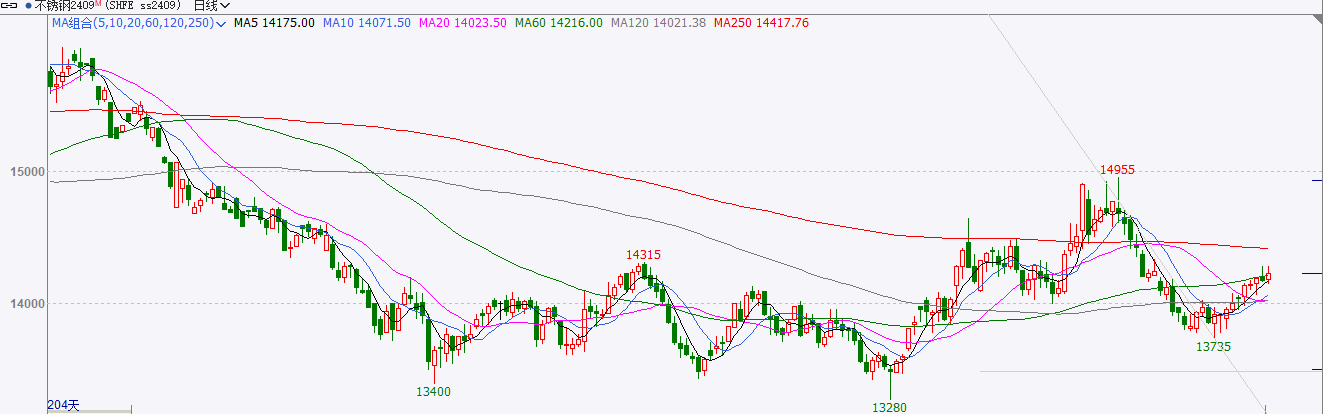

Stainless steel spot prices in the Wuxi market showed mixed trends last week, with 300 and 200 series stainless steel spot prices rising, while 400 series prices fell slightly. Futures prices has got off to a flying start last week, reaching a high of US$2105/MT, spot prices followed suit, driving an improvement in the market trading atmosphere and inventory destocking. As of the Friday of last week, the main stainless steel futures contract price rose by US$26/MT to US$2095/MT compared with last week.

300 Series: Opening Red Breaks Through US$2090/MT, Inventory Destocking Helps Prices Rise.

The price of 304 rose last week, and as of Friday, the mainstream base price of cold-rolled four feet 304 civil in Wuxi was US$2010/MT, and the price of hot-rolled stainless steel was US$1985/MT, both up US$14/MT from last Friday. The market performance was strong last week, with prices rising steadily to break through US$2090/MT. Spot prices rose steadily, market sentiment improved, terminal consumption improved month-on-month, and inventory was significantly destocked. The recovery of macro expectations boosted market confidence, coupled with the rise of Tsingshan's opening price, traders raised their prices, downstream buyers entered the market for procurement, traders actively shipped goods, and transactions warmed up significantly.

200 Series: Raw Materials Help Spot Prices Rebound.

The spot price of 201 in the Wuxi market was mainly stable and strong last week. As of last Friday, the mainstream base price of cold-rolled 201J1 in Wuxi was US$1345/MT, the mainstream base price of cold-rolled J2/J5 was US$1240/MT, and the mainstream base price of five-foot hot-rolled 201J1 was US$1310/MT. Last week , raw materials showed mixed trends, with non-ferrous metals showing a strong trend. The rise in copper prices provided support for the price of 201, but manganese and ferrochrome prices showed a slight downward trend in the second half of the week.

400 Series: Prices Return to Stability.

Last week, the guiding price for TISCO cold-rolled stainless steel 430 was US$1450, and the guiding price for JISCO cold-rolled stainless steel 430 was US$1600/MT, both unchanged from last week. In the Wuxi market, the price for state-owned cold-rolled 430 is US$1225-US$1230/MT, down US$2.7/MT from last week, while the price for state-owned hot-rolled 430 remains stable at around US$1125/MT, unchanged from last week's price.

RAW MATERIALS|| Ferrochrome Profits Squeezed on Both Sides, Production Cuts and Shutdowns Increase.

Since the end of June, the mainstream ex-factory price of high-carbon ferrochrome has fallen by US$28 to US$1222 -1236/50 reference ton.

However, costs remain high and difficult to come down. At present, the spot market price of 40-42% South African powder ore in the domestic chrome ore market remains at US$8.8/MT, and the price of 40-42% Turkish block ore remains stable around US$10.4/MT.

After a small increase of US$7/MT in late June, coke prices have continued to run steadily, putting pressure on the profits of high-carbon ferrochrome enterprises.

Under the influence of falling retail prices and high costs, the profits of high-carbon ferrochrome production enterprises have shrunk significantly, and their production enthusiasm has decreased significantly. In July, the phenomenon of production cuts and shutdowns of enterprises has increased.

According to industry feedback, enterprises in Inner Mongolia and Sichuan have recently started overhauls.

A high-carbon ferrochrome production enterprise in the main producing area of Sichuan has shut down and overhauled one 16500KVA electric furnace, which is expected to affect the monthly output of high-carbon ferrochrome by nearly 3,000 tons.

A high-carbon ferrochrome production enterprise in Inner Mongolia has shut down two electric furnaces, one 42000KVA electric furnace is shut down for overhaul for about 10 days, affecting the output of high-carbon ferrochrome by about 2,000 tons; another electric furnace in the group's factory area has also started a 40-day overhaul.

In addition to the above two enterprises, a high-carbon ferrochrome production enterprise in Fengzhen, Inner Mongolia has shut down one 25000KVA electric furnace, which is expected to affect the monthly output of high-carbon ferrochrome by more than 4,000 tons.

At present, it seems that the overhauls of the above enterprises will affect the reduction of the output of high-carbon ferrochrome in July by about 18,000 tons. In view of the overall high output of high-carbon ferrochrome, the overhaul of some factories has a limited impact on the market supply in the short term, and the price of high-chromium will continue to run weakly in the short term.

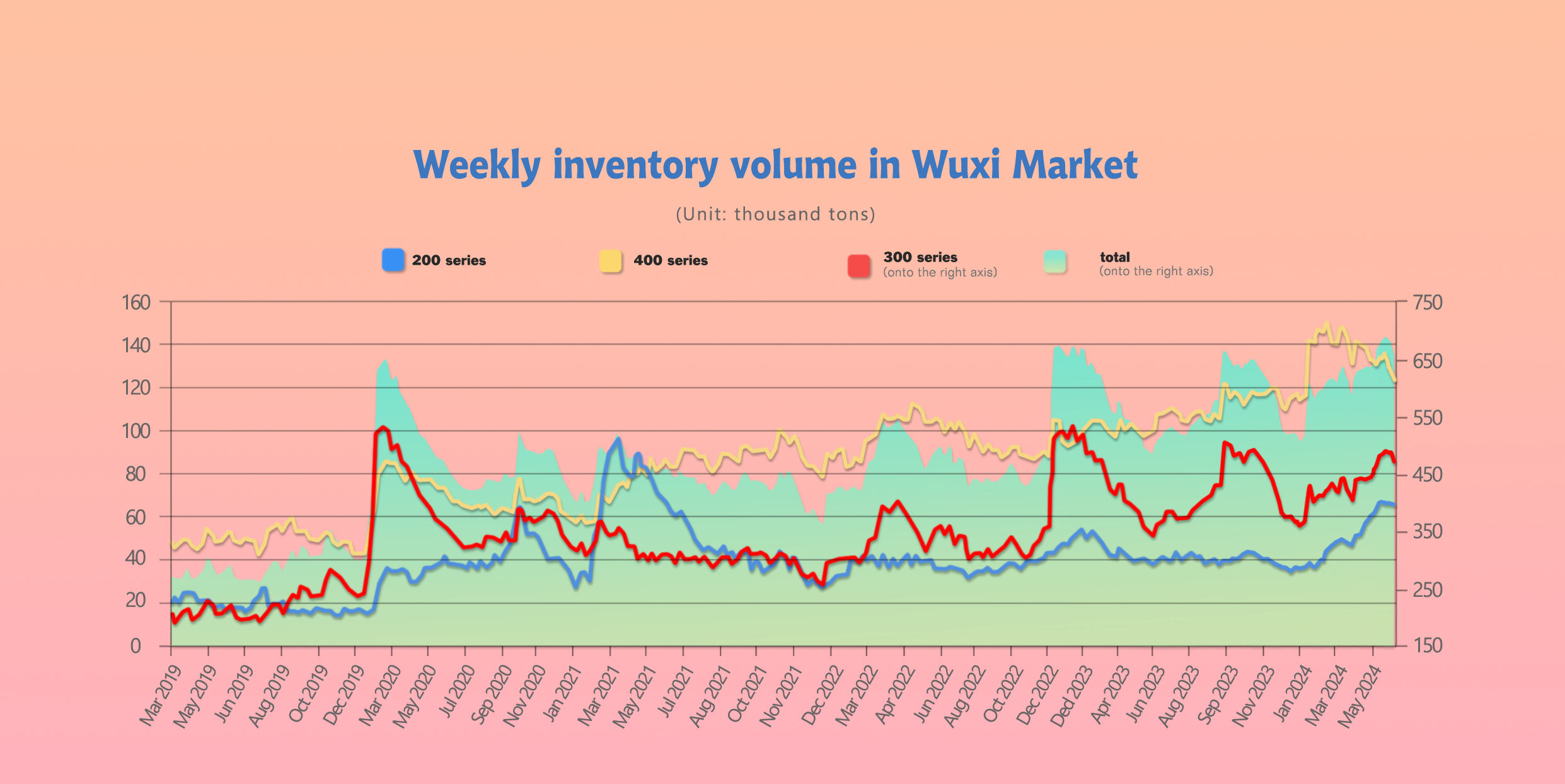

INVENTORY|| July opened with 23,000 tons of destocking.

The total inventory at the Wuxi sample warehouse dived by 22,976 tons to 654,611 tons (as of 4th July).

the breakdown is as followed:

200 series: 452 tons up to 65,463 tons,

300 Series: 16,820 tons down to 466,711 tons,

400 series: 6,608 tons down to 122,437 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jun 27th | 65,011 | 483,531 | 129,045 | 677,587 |

| Jul 4th | 65,463 | 466,711 | 122,437 | 654,611 |

| Difference | 452 | -16,820 | -6,608 | -22,976 |

300 Series: Inventory Destocking, Fundamentals Improve.

Last week, the main futures prices continued to rise, and spot prices followed suit with a slight increase. The market arrivals last week decreased month-on-month, steel mills actively reduced production to reduce inventory, and the increase in warehouse receipts reduced the amount of tradable resources. With the prices rebounding from the bottom, market sentiment warmed up, and the enthusiasm of terminal procurement improved. Both rigid demand procurement and speculative transactions have improved. At the end of the month, the number of agency withdrawals increased, the pre-order was fulfilled, and the agency shipped goods according to the market price, and the inventory decreased significantly. The warehouse receipts are still showing an upward trend year-on-year, but the growth rate is gradually narrowing. Futures continue to be strong, and market confidence is gradually recovering. Calculated based on the current raw material prices, steel mills are still in a loss state, steel mills' output is declining, and demand is slowly recovering. The fundamentals have improved, and macro sentiment has warmed up. It is expected that the inventory will continue to decline next week. Continue to pay attention to the subsequent production of steel mills and market trading conditions.

200 Series: Supply Pressure Persists.

During last week, steel mills arrived normally, and the Tsingshan Hongwang guide price remained unchanged. The mainstream quotation for 201J2 cold-rolled in the agency market was maintained at US$1230-US$1240/MT. At the beginning of the week, some traders raised prices by US$7/MT, but the market's acceptance of high-priced resources was limited. Demand has not seen a significant boost, and downstream customers are cautious about purchasing. The rise in copper prices and the slight increase in costs have provided strong support for the price of 201, and the confidence of merchants has recovered, and their willingness to purchase has increased. It is expected that the spot price of 201 will remain stable and strong in the short term.

400 Series: Inventory Continues to Destock, Supply Pressure Eases.

The market arrivals of resources decreased, and coupled with the urging of steel mills to settle and withdraw goods at the end of June, the traders' shipping mentality was positive, the market purchasing sentiment warmed up, and transactions improved significantly. Inventory destocking was obvious. Calculated according to the current raw material prices, the profit of steel mills has slightly recovered, but it is still in a loss state, and the price-holding mentality continues. There are no large-scale overhaul plans for steel mills in July, and the supply pressure in the market will not be reduced in the later period. Downstream procurement is still mainly based on rigid demand. Although the supply and demand situation has improved, it has not yet reversed.

SUMMARY||Stainless Steel Futures Continue to Probe Higher.

Stainless steel prices have been fluctuating on the strong side last week, with futures prices continuing to probe higher last week, spot prices relatively stable, raw material prices under pressure and falling but still at high levels, steel mill production profits at the cost margin, steel mills expected to cut production in July, the overall market trading atmosphere is generally average, and downstream consumer demand remains sluggish. In the future, it is necessary to pay close attention to the pace of steel mill production and arrivals, the strength of domestic macroeconomic policy stimulus, and it is expected that stainless steel will fluctuate in the later market.

300 Series: The supply side is expected to increase slightly in July, and the supply pressure remains unchanged. With the price increase, the transition from the off-season to the peak season, the demand is repaired and improved, the terminal procurement sentiment warms up, the fundamentals turn good, and the inventory is destocked. At present, there is still support from the raw material side, and the downward space for stainless steel prices is limited. The rebound of domestic and foreign non-ferrous metals and the favorable macro policy are expected to maintain the strong upward trend of stainless steel prices next week.

200 Series: The futures market rebounded, driving the market trading sentiment. After the spot market rose, traders actively shipped goods, and the number of inquiries and transactions from downstream customers increased significantly. Affected by the continuous price reduction in the previous week, the market accumulated a small amount of inventory, and the supply pressure still exists. There is no plan for steel mills to increase or decrease production in July. It is expected that the price of 201 will remain stable and strong in the short term.

400 Series: Steel mills have no overhaul plans in July, and the supply pressure in the later market will not be reduced. Downstream procurement is still mainly based on rigid demand. Although the supply and demand situation has improved, it has not yet reversed. The upward momentum of prices is insufficient. It is expected that the price of 430 will fluctuate in the short term, and the inventory changes and market trading conditions will be continuously monitored in the future.

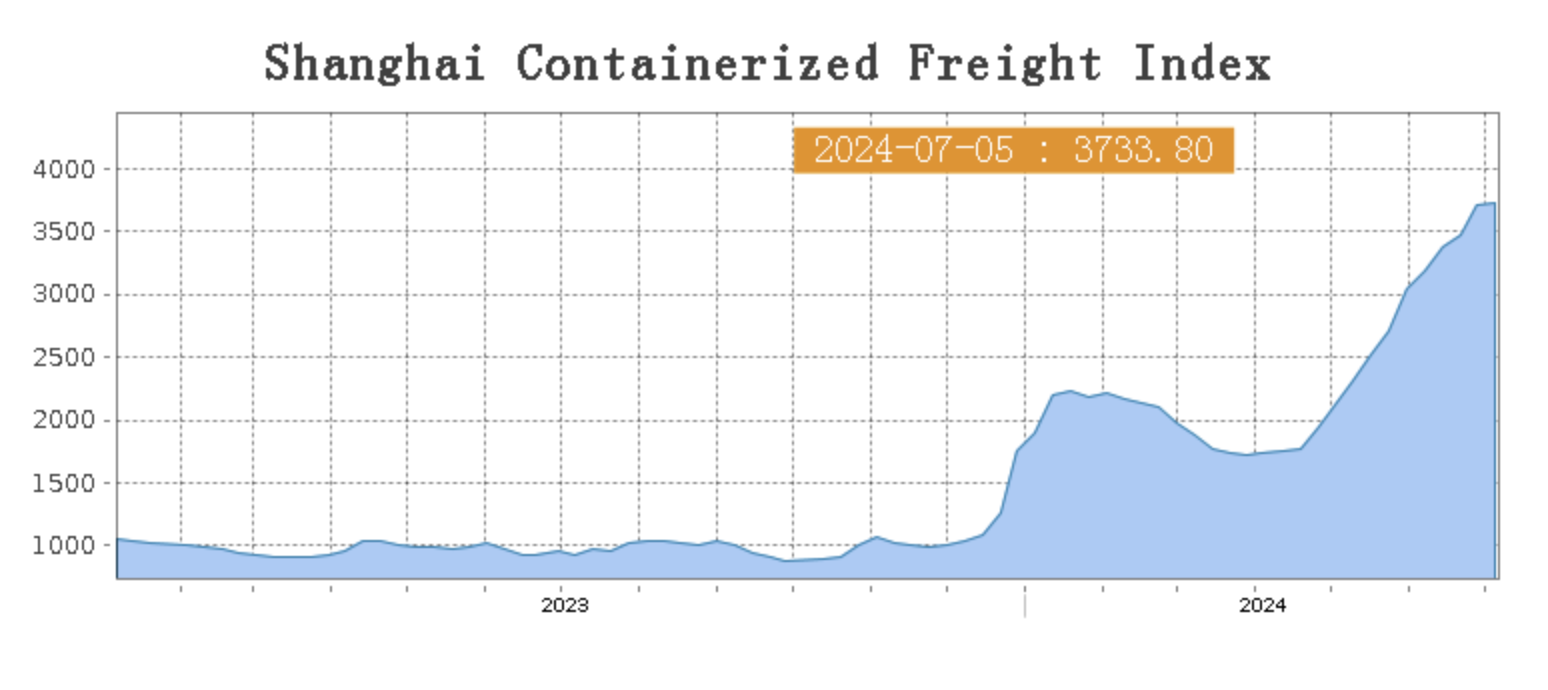

Sea Freight|| Composite Index increment slows down, but the jam in Asian ports might last to August.

The upward Trend in the Chinese Export Container Shipping Market has been slowed last week, and freight rates on multiple sea routes went on different direction. The comprehensive index continued to rise. On 5th July, the Shanghai Containerized Freight Index rose by 0.5% to 3733.80.

Europe/ Mediterranean:

According to data released by the European Union Statistics Office, the eurozone's economic sentiment index for June was 95.9, lower than the previous value and market expectations. Among them, the employment index has declined for the third consecutive month, indicating that the recovery of the European economy is still facing challenges.

The European Union will start imposing tariffs on electric vehicles exported from China last week , and the future trend of China-EU trade faces a certain degree of uncertainty. After continuous increases, the upward trend of market freight rates has stagnated last week .

On 5th July, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$4857/TEU, which dropped by 0.5%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$5432/TEU, which jumped by 0.8%.

North America:

According to data released by the Institute for Supply Management (ISM), the US ISM non-manufacturing index for June was 48.8, which was significantly lower than market expectations and fell below the critical line. The contraction of service sector activities is at its fastest pace in four years, mainly due to the sharp decline in business activities and order declines. Against the backdrop of long-term high interest rates, the future economic outlook for the United States is not optimistic. Last week , transportation demand remains high, the supply and demand fundamentals are solid, and market freight rates continue to rise. On 5th July, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$8103/FEU and US$9945/FEU, reporting a 3.5% and 7.2% lift accordingly.

The Persian Gulf and the Red Sea:

On 5th July, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 10.1% from last week's posted US$2436/TEU.

Australia/ New Zealand:

On 5th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1375/TEU, a 1.6% slide from the previous week.

South America:

On 5th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$9026/TEU, an 1.9% growth from the previous week.

According to Taiwanese media reports on July 4, 2024, congestion at Asia's busy trade hub ports may persist into August as more ships divert away from congested ports, causing bottlenecks at other ports. Meanwhile, the Red Sea crisis continues, with Yemen's Houthi rebels carrying out a record number of attacks on merchant ships last month. A long queue of ships has formed waiting to berth at Singapore's Port Klang, the world's second-busiest container terminal. Many ships avoiding the Red Sea are rerouting through Singapore, causing delays.Some ships have been diverted to Port Klang and Tanjung Pelepas in Malaysia, shifting congestion there. This problem is expected to take at least a month to resolve.