It is really difficult to write a useful and timely market insight, particularly in recent days. News released 5 hours ago is no longer new because the market has been extremely volatile. Effort and time on March 8th seem to be vain or an illusion. Briefly, in this article, we put our eyes on this week earlier in order to provide a more practical view to you. For more about the volatile market insight, please roll down to the Stainless Steel Market Summary in China.

Highlight|| LME forced to halt nickel trading, cancel deals, after prices top $100,000

March 8 The London Metal Exchange (LME) was forced to halt nickel trading and cancel trades after prices doubled on Tuesday to more than $100,000 per tonne in a surge sources blamed on short covering by one of the world's top producers.

The LME's shock move came as Western sanctions threatened supply from major producer Russia and marked the biggest crisis to hit the 145-year-old exchange in decades.

In the 1990s a rogue Sumitomo trader tried to corner the copper market and tin trading was stopped for five years in the 1980s.

"The current events are unprecedented," the LME said in a notice to members. "The suspension of the nickel market has created a number of issues for market participants which need to be addressed."

The LME announced that all trades will be voided from midnight until 8:15 a.m. on Tuesday when trading stopped and added that it was considering a closure of several days.

"People will be asking if this really a functioning market... This is meant to be a market of last resort and people can't get inventories to deliver against positions," said Colin Hamilton, managing director of commodities research at BMO Capital Markets.

The LME also deferred physical delivery of maturing contracts and announced it would temporarily stop publishing official and closing nickel prices.

"The LME will actively plan for the reopening of the nickel market, and will announce the mechanics of this to the market as soon as possible."

PRICES DOUBLE IN HOURS

Three-month nickel on the LME more than doubled to $101,365 a tonne before the LME halted trade on its electronic systems and in the open outcry ring.

Nickel had pared gains to $80,000 a tonne when trading was halted, up 66% on the day and a staggering 177% since Monday.

In China, the Shanghai Futures Exchange raised fees for nickel trading and urged investors to "fend off risks, invest rationally, and work together to maintain market stability".

Nickel on the Shanghai exchange hit its upward limit in night trading at a record 267,700 yuan ($42,380.39) per tonne and also reached the 15% limit up early on Tuesday.

CITIC Futures, China's biggest futures company, warned clients that if nickel prices continued to jump on Wednesday, the Shanghai exchange could take action, including forced position cuts, an internal notice seen by Reuters showed.

LME nickel suspended after it doubles

MARKET BATTLE: Chinese metals tycoon faces steep losses on nickel price surge

The explosive gains, which have seen prices quadruple over the past week, resulted from two major players facing off, said Malcolm Freeman of Kingdom Futures, who declined to identify them.

One entity has control of between 50% and 80% of LME inventories, LME data shows.

"There's a very big short and a very big long who've been sparring. And because of their sparring, it's brutalised so many other shorts," said Freeman. (They refer to TSINGSHAN AND GLENCORE, source said.) Beijing time, in the afternoon of March 8th, Glencore replied to the media that the speculation is total nonsense.

The soaring price of nickel left the Chinese metals tycoon facing billions of dollars in potential losses.

The nickel price surged as banks and brokers rushed to close part of a huge position amassed by Xiang Guangda, the billionaire founder of China’s leading stainless steel producer Tsingshan Holding Group. It later pulled back closer to $80,000.

Xiang had bet that the price of nickel would fall, but when the market moved sharply the other way, he would have been required to either post more cash to cover his losses or buy back the position.

The move on Tuesday followed a jump of more than 70 per cent in the previous session as rumours about the size of Xiang’s position swirled around London’s tight-knit metals market. The size of Xiang’s short position is unclear but it is at least 100,000 tonnes of nickel, according to people with familiar with the matter, who said the LME had been forced to act when it became clear that some of its small members were also facing large demands for extra cash to cover trades put on for clients. Several market participants said Xiang faced potential losses stretching into billions of dollars given the size of the trade, but that the figure could change depending on where nickel prices reopen.

On March 9th, Tsingshan replied that they have allocated enough stock to carry out the settlement.

Some small industrial users have been caught in the crossfire, having taken positions to get physical delivery but then hit with margins calls costing millions of dollars.

LME, which is owned by Hong Kong Exchanges and Clearing, said it had taken the decision to halt trading on “orderly market grounds” and warned that it was considering a closure of several days. “The LME will actively plan for the reopening of the nickel market, and will announce the mechanics of this to the market as soon as possible,” it said. Nickel’s main use is to make stainless steel, but the fastest-growing market for use of the metal is in the batteries that power electric vehicles. The LME contract is for high-grade metal prized by carmakers.

TREND|| Stainless steel futures delivered in April rose by US$308/MT to US$3,620/MT.

As LME nickel increased to US$50,300/MT in the morning of March 8th, the stainless steel futures delivered in April rose by US$308/MT to US$3,620/MT. The price of stainless steel spot could not fall based on the surging market.

Fears of the Russian nickel turning to China’s market due to the sanctions, China’s nickel price struggled to rise. The rise of nickel in Shanghai Futures Exchange was obviously slower than that in LME. On March 7th, nickel of Shanghai Futures Exchange hit the limit up, increasing by 12%, closing at ¥210,950/MT (US$33,806/MT), which was the highest price since it firstly come into the market.

Nickel price on Shanghai Futures Exchange hits limit up on March 7th.

Stainless steel 300 series:

Turning to the spot market of stainless steel, on March 7th, the cold-rolled stainless steel 316L in Wuxi was US$5,000/MT. On March 8th, the price rose to US$5,385/MT ~ US$5,450/MT, which increased by US$358/MT ~US$450/MT within half a day. Even more, ZPSS directly raised the guidance price by US$480/MT. The price of cold-rolled 3016L has hit the high for 8 years on 7th. The price of 8th, the last time it went to US$5,450/MT can be traced back to more than 10 years ago, in October of 2011.The increasing rate was astonishing. About the hot-rolled stainless steel 316L by the private-owned mills, the price increased to US$5,125/MT on the morning of March 8th. In the afternoon of March 8th, most traders stopped quoting as the market was out of control.

In the spot market on March 7th, the cold-rolled 4-foot mill-edge stainless steel 304 of the private-owned mills in Wuxi was US$3,315/MT, US$176/MT higher than a week ago. Later in the afternoon, the cold-rolled stainless steel 304 increased again, above US$3,350/MT.

On March 7th, about the hot-rolled stainless steel 304, Shandong Shengyang Metal opened at US$3,285/MT. Traders proactively made orders but the steel mill set a limiting volume. As for Delong, the cold-rolled stainless steel 304 was opened at US$3,270/MT which was US$144/MT compared to one week ago. It soon stopped quoting. When it reopened in the afternoon, the price increased to US$3,315/MT, rising by more than US$190/MT in one day.

Stainless steel 200 series and 400 series:

About the stainless steel 200 series, the spot price went with the trend, slightly rising by US$48/MT. However, as the market went boldly, the stainless steel 201 cold-rolled J2 rose to US$1,925/MT, which was US$96/MT higher than the price earlier in the day. Different from the robust market trend, the stainless steel 400 series tended to remain weak. The price was around US$1,700/MT.You should be more cautious.

The surge of nickel price might support the price of the stainless steel futures to remain high, but the demand and supply are yet to change. If you have followed the Chinese market, the demand has been tepid while the supply is expected to increase. Meanwhile, the price difference between spots and futures narrowed down. Plus that the war appeals to the supply concern which is yet to come true, it is necessary to be warier.

It is also the reality in the stainless steel market——though the market was furious, few buyers reach their hands at the actual products. The surge of stainless steel prices hinders the demand to make it down to earth. In March, most steel giants maintain the production. Two basements of Delong start to tune on the stainless steel production. It is predicted that the crude steel production of stainless steel 304 will be up to 1,520,000 tons, 230,000 tons more than February.

The situation of Russia and Ukraine remains obscure. China’s exports to these two countries have been suspended. If the demand is still lower than expected, the inventory will be raised and stacked. When the intensity is relieved, the nickel price will soon fall back.

Besides, Beijing has remained his attention on the surging price of commodities. The National Development and Reform Committee once again emphasized on the press conference on March 7th, “eyes closer to the market dynamics, and strengthening the regulations on the market”, in detail, they said, “Pay close attention to the supply and demand and price trends of key commodity markets and strengthen monitoring, analysis, and judgment. Maintain the high-pressure situation of market supervision, intensify the joint supervision of the futures and spot markets, and severely crackdown on illegal and irregular acts such as fabricating and spreading information on price increases, hoarding, and driving up prices, especially malicious speculation by capital, will be resolutely cracked down.”

From our point of view, if the prices keep going way too exaggeratedly and out of control, it won’t be surprising that Beijing will take drastic action to regulate the market.

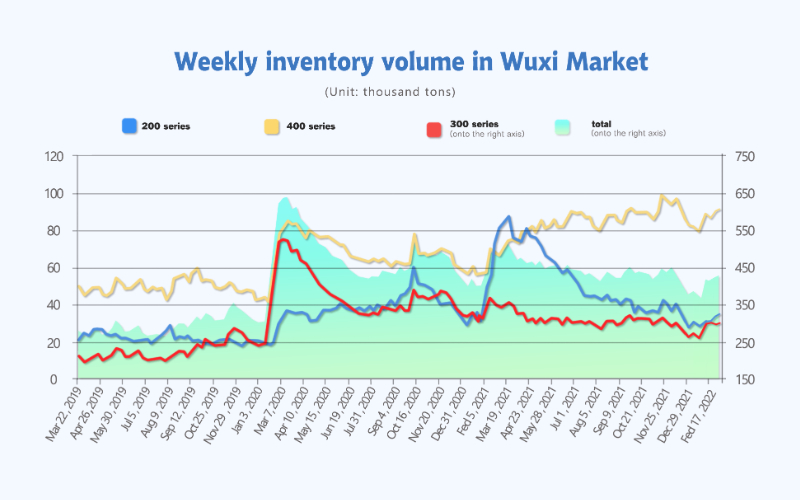

INVENTORY|| Prices increase but inventory stacks.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| Fenruary 28th ~ March 4th | 34.2 | 299.3 | 91.0 | 424.5 |

| February 21st ~ February 25th | 33.2 | 297.7 | 89.8 | 420.7 |

| Difference | 1.0 | 2.1 | 1.0 | 3.8 |

Last week, the inventory volume in the Wuxi sample warehouse increased by 3,800 tons, to 424,500 tons. 200 series inventory rose by 1,000 tons, to 34,200 tons; 300 series went up by 1,600 tons, to 299,300 tons; 400 series increases by 1,200 tons to 9,100 tons.

200 series of stainless steel: Hot-rolled stainless steel remains shortage.

Baosteel Desheng and Beigang New Materials delivered cold-rolled stainless steel to the market. The spot inventory of stainless steel 201 rose by 1,000 tons. It is still short on 5-foot hot-rolled products because of low delivery volume and high transaction volume.

300 series of stainless steel: Inventory increased slightly after steel mills recover to produce.

Until March 3rd, the inventory volume increased by 1,600 tons to 299,300 tons. The increase comes from Delong, Guangxi Jinhai, and Shengyang Metal. After the winter Olympics, the production suspension in consideration of the environment, steel mills return to their normal production at the end of February. The new resources will arrive on the market soon. Besides, because of the busy transactions of warehouse receipts in Shanghai Futures Exchange, the consumption in traditional traders’ spot inventory slowed down. In March, the latest projects of Delong will start. Meanwhile, the output of the stainless steel 300 series will increase significantly. If the demand fails to keep up, it is expected that the inventory will stack.

400 series of stainless steel: Output and transaction remain low.

The inventory of the stainless steel 400 series rose slightly last week. JISCO produced as usual and the delivery increased compared to the previous time. But TISCO reduced the production and the delivery stayed low because of the machine maintenance. The transaction has been tepid. It is predicted that the inventory of stainless steel 400 series will remain.

Opinion|| This Russian Metals Giant Might Be Too Big to Sanction, comments said.

The uncertainty caused by Russia's invasion and resulting sanctions has added to an already bullish nickel market due to low inventories, which have halved on the LME since October. Sanctions on Russian individuals and corporates have prompted many banks, shippers and other firms to stop working with Russian companies or goods.

Russia not only supplies about 10% of the world's nickel but Russia's Nornickel is the world's biggest supplier of battery- grade nickel at 15%-20% of global supply, said JPMorgan analyst Dominic O'Kane.

Norilsk Nickel is a key supplier of nickel and palladium, two metals that are key for electric-vehicle batteries and semiconductors.

From its base at a former Arctic gulag, Russia’s MMC Norilsk Nickel PJSC digs up a large portion of two metals that are essential to greener transport and computer chips.

So far the U.S. and its allies haven’t sanctioned the company, or its oligarch chief executive, underscoring the dilemma some analysts say governments face in seeking to punish Russia without hurting their own access to key commodities.

The mining company is responsible for about 5% of the world’s annual production of nickel, a key component of electric-vehicle batteries, and some 40% of its palladium, which goes into catalytic converters and semiconductors. Nornickel, as the company is known, also supplies energy transition metals such as cobalt and copper.

The price of those metals has jumped since Russia invaded Ukraine amid concerns that Western sanctions or logistical difficulties stemming from the conflict could choke supplies. On Friday, nickel traded at its highest level for a decade, and is up 37% so far this year. Palladium is up around 57% year to date.

Despite the rally in metals prices, Nornickel’s share price—like that of other Russian commodity companies—has dropped, and is down 17% so far this year. The fall is likely to be more severe, given trading in Moscow listed stocks was suspended several days ago as they began to plummet. On Saturday, Fitch Ratings downgraded Nornickel’s debt to junk, reflecting the tougher environment in Russia and weakened financial flexibility of its commodity companies.

Several Western companies say they are looking to diversify their supply away from Nornickel. That mirrors a trend across several commodities, including oil and steel, as Western buyers steer clear of Russian suppliers amid concerns they could be hit by sanctions or simply have problems getting products out of the country.

Western sanctions in response to the current conflict have so far largely avoided companies that provide the West with oil, gas and other key commodities.

Few companies are as pivotal in large commodity markets as Nornickel, particularly for palladium.

Since Russia invaded Ukraine at the end of February, the U.S. and allied countries have imposed heavy sanctions on Russia.

Among the companies looking for alternative supplies of nickel is Outokumpu Oyj, one of the world’s largest stainless steel manufacturers. The Finnish company said around 6% to 7% of its nickel comes from Nornickel, with the rest coming from recycled steel. “Given the situation in Ukraine, we are looking for alternatives for Russian supply for nickel,” a spokeswoman said.

Germany’s BASF SE, meanwhile, said it would fulfill existing contracts with Nornickel but not pursue any new business with the Russian company.

Nornickel’s production is important, analysts say, because demand for nickel is forecast to grow strongly amid the growing popularity of electric vehicles. Nickel had the biggest supply deficit of any base metal last year relative to market size, at about 6%, according to analysts at BMO.