Export tariff is giving an alarm call.

Last week, news about the tariff on stainless steel export will be imposed on 1st August. It is said that the tax on hot-rolled steel will increase to 20% which is 13% originally. While the cold-rolled product will be added by 11%, which is 0% before the imposition.

This will be the second tax adjustment on steel products in 2021. The first is the cancellation of tax rebate on some steel product export, and the export tax on plain carbon steel is also increased to 13% which previously was 0%.

On 24th July, at the government meeting, the prevention of increasing price was stressed. Ministry of Economic Development (MED) suggested imposing export tariffs on ferrous and nonferrous metal temporarily from 1st August to 31st December. The tariff will include 15% of the basic tax rate and specific tax rate.

TREND|| Electric power rationing and production limit policy will extend the increase in price of SS304.

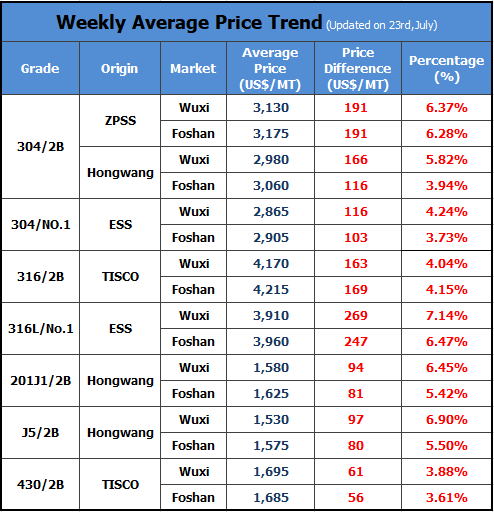

The market of last week shows less aggressive than a week before. The futures stock prices declined firstly before the prices rose later. Until the closing on Friday (23rd, July), contract 2109 rose by US$112/MT, increasing to US$3,140/MT, breaking the record high of stock prices. As for the cold-rolled 304 by private-owned mills in the Wuxi market, the price increased by US$63/MT, growing to US$3,105/MT.

304: Price will still grow due to power rationing and production limit.

Lately, the market has been greatly affected by the power rationing and production limit. Some steel mills have scheduled the production reduction plan. Although many mills are yet to make it practiced, the news still causes the market trend to increasing the price.

Besides, in China, the weather is getting unstable. Typhoons and thunderstorms influence production and transportation. It is reported that a logistic industrial park in Wuxi stops working, making the new resources failed to be delivered because of the heavy rain. The rest resources on the way won’t arrive until the transportation clearing up. HNJH stops producing also because of the rain, while BGXC will reduce the productivity of 300 series due to the power rationing policy. Therefore, in July, the total supply of 300 series will decline.

The prices of raw materials remain high. The purchasing price of high ferronickel is around US$211-US$219/nickel. The factory told that the resource of ferronickel is in short supply. In June, the import volume of ferronickel is 273,000 tons which decreased by 28,000 tons. Due to the worsening epidemic in Indonesia and large stainless steel production, the import volume of ferronickel from Indonesia has been declining for two consecutive months. However, the ferronickel supply in China is difficult to increase due to the short supply of nickel ore. Therefore, the supply of ferronickel will still be short.

The price of ferrochrome has risen sharply recently. Last week, high-carbon ferrochrome has risen by US$359/50 base tons. The purchase price of large state-owned steel plants has reached 11,000 yuan/50 basis tons, according to market news. According to the report, some steel mills purchase at a price of US$1,719/50 base tons. Under the influence of continued power shortages, it is difficult for the supply of the high chromium market to be supplemented in large quantities for a while, and thereby prices are expected to stay in the rising tendency.

Based on the price of US$219/nickel and US$1,875/50 base tons, the cost of HR304 is above US$2,813/MT. When the price of raw materials is increasing, the production cost of steel mills is also growing, suppressing the profit margin. Therefore, it is predicted that stainless steel will be increased to enlarge the profit.

Risks:

1. About the production limit, if the reinforcement affects less on the production reduction, the prices will face a decline.

2. The downstream manufacturers don’t fully accept the high prices. To the products that are normal specifications, people are refusing to pay high for them.

3. Delong set the opened price of spot product at US$3,075/MT last Friday. It was said that the total quantity was 5,000 tons and the lead time was one week. Besides, now Delong delivers by mixing products of high and low price, which can bring profit.

200 series: The inventory volume keeps reducing. The prices are going to increase.

Last week, the increasing speed of SS201 slowed down, but still, it grew by US$63-US$78/MT during the week. Last Friday, Tsingshan opened a new quotation of CR201, which drives the market prices to increase further. CRJ1 rose beyond US$1,690/MT, quoting at US$1,705/MT, while J2 and J5 are US$1,675/MT.

From the perspective of inventory, last week, the inventory of 200 series decreased to 43,800 tons, 1,100 tons less. A market participant said it was not transaction making the inventory decreasing, it was out of the low quantity of new arrival supplying to the market, including Hongwang, Baosteel Desheng, and AHBH.

Due to the recent thunderstorm, HNJH has stopped producing contemporarily. What’s more, because of the shortage of raw materials, the future supply will be influenced. Meanwhile, the power rationing policy also affects the 200 series supply. Therefore, it is expected that the inventory will still go low, which will support the prices to increase.

400 series: The price of high chrome rises significantly.

During last week, the price of high carbon ferrochrome increased by US$359, reaching US$1,703/50 base tons. Reflecting on the cost of 430, it is US$125/MT higher.

The electric power “shortage” is getting more serious in Inner Mongolia. In June, the total production of high chrome was 500,700 tons, and Inner Mongolia contributed about 210,000 tons. In July, the power rationing policy will still affect the production in Inner Mongolia, which is predicted to be reduced to below 150,000 tons. The resource of ferrochrome will still be short and the price will keep going up.

Last week, the market price of 430/2B increased by US$47/MT, reaching US$1,785/MT. The guidance price of TISCO rose to US$1,785/MT, while TISCO increased to US$1,790/MT. In the second half-year, steel mills will officially carry out production reduction as Beijing requires. The supply of stainless steel will be restricted. In all, the prices of the 400 series are predicted to increase.

Summary:

Influenced by production limit, power rationing, and the increasing price of raw materials, the price of 304,201 and 430 are all expected to increase. The CR304 of private-owned mills will increase by US$47/MT; 201 will rise by US$16-31/MT; 430/2B of state-owned mills will increase to US$1,830-1,845/MT, US$63/MT higher.

NEWS|| South Korea implements anti-dumping rate on stainless steel flat-rolled products from China.

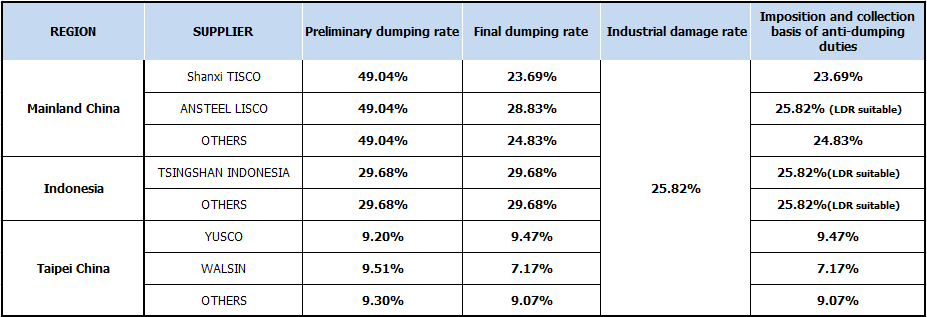

On July 22, 2021, the Korea Trade Commission held its 413th meeting to review anti-dumping investigations on stainless steel flat-rolled products from China, Indonesia and Taipei, China.

The Trade Commission compares the dumping rate and the industrial damage rate, and determines the lower rate as the final anti-dumping duty levy level, and accordingly determines the anti-dumping duty rate of 7.17-25.82%.

According to data from the Korea Trade Commission, until 2019, the South Korean market valued approximately 3-4 trillion won (approximately 2 million tons). The stainless steel imports involved in this anti-dumping accounted for 80% of South Korea’s total imports.

In order to more satisfy Korea’s domestic demand, POSCO will decrease the exports to Turkey, Vietnam, and Thailand. Meanwhile, China and Indonesia will transfer more to the Southeast Asian market. As a result, the international stainless steel export trade pattern will be rebalanced.

Besides, the Korean Trade Commission suggests the "Export Price Increase Commitment", that is, exporters voluntarily increase export prices in consideration of industrial protection, domestic supply and demand, and price stability. According to the price commitment proposal, five exporters, including TISCO of Shanxi China, ANSTEEL LISCO, TSINGSHAN Indonesia, YUSCO Taiwan, and WALSIN Taiwan. The five exporters that accept the price increase will not be levied anti-dumping duties, and these exporters can export at the prices voluntarily provided.

This measure can alleviate the sharp drop in stainless steel exports to South Korea due to the anti-dumping. According to market news, there are certain restrictions on price commitments. For example, TISCO has a quota of 30,000 to 50,000 tons, and now the monthly export volume of TISCO to South Korea is about 3,000 tons.

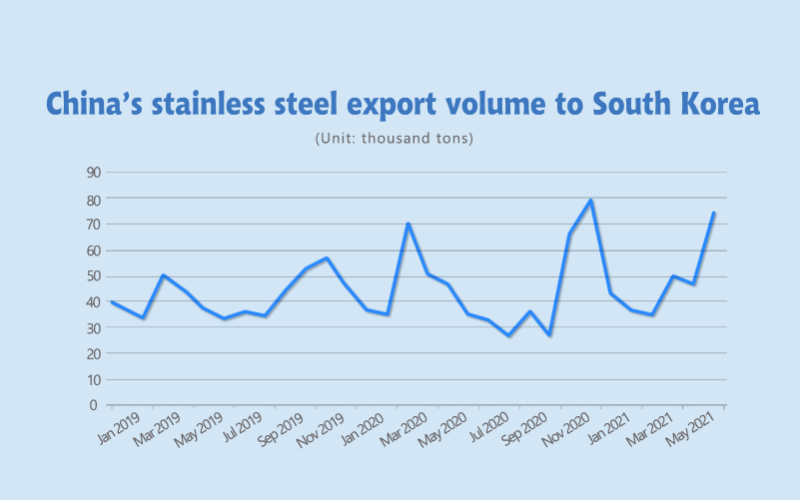

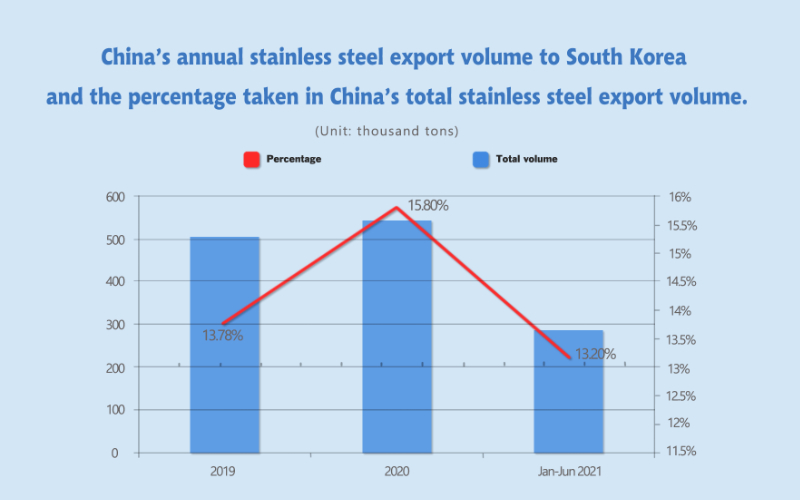

For the Chinese market, from January to June 2021, China exported 284,800 tons of stainless steel to South Korea, increasing by 11,000 tons year-on-year, and the increasing percentage is 4.02%, accounting for 13.2% of China's total exports. In June, stainless steel exports to South Korea reached 73,600 tons, a new high this year.

From the data of China's exports to South Korea in the past two years, the volume of domestic stainless steel exports to South Korea has remained stable. In 2019, the total exports to South Korea were 505,700 tons, accounting for 13.78% of total exports. In 2020, exports to South Korea were 541,000 tons, accounting for15.8% of total exports.

On the whole, the implementation of the anti-dumping tax rate will make Chinese stainless steel exports to South Korea a short-term downward trend. However, due to the low proportion of Chinese stainless steel exports taken in Korea, for example, the apparent consumption brought by the South Korean market only accounts for 1.78%, it won’t cause a large influence on the stainless steel market in China.

RAW MATERIAL|| The price of high chrome rushes to a 10-year record high.

The transaction price of high chromium went beyond US$1,719 yuan/50 base tons! Until July 23, the mainstream ex-factory price of high chromium has soared by US$469/50 base tons, increasing by 37.5%.

Looking back at the price trend of high chromium, it was only the second time that it rushed to such a high level in the past 10 years. The last time high chromium reached such a high price was December 2016.

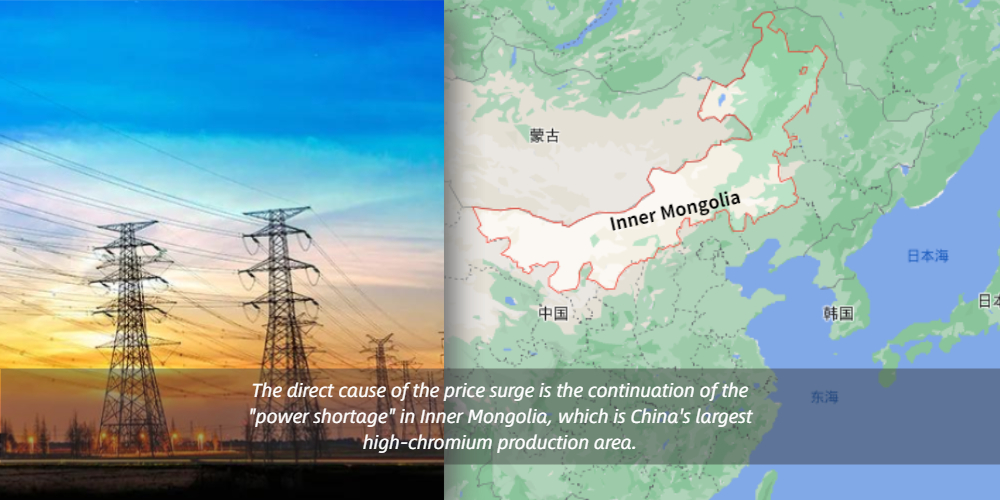

The direct cause of the price surge is the continuation of the "power shortage" in Inner Mongolia, which is China's largest high-chromium production area.

According to feedback from the factory, when the electric power is controlled as the power rationing policy, it is currently only one-third of the high chromium output as before.

The output of high chromium in Inner Mongolia in July may be less than 150,000 tons. In 2020, the average monthly output was 302,200 tons.

In the short term, it is difficult to alleviate the scarcity of high chromium market supply for the time being, and so factory quotations will remain high. When the power supply returns to normal, Inner Mongolia's high chromium production will be quickly replenished, and the price of high chromium will also be at risk of falling. In the later period, it is necessary to pay attention to the power policy of Inner Mongolia.

Affected by China's steel production restriction, iron ore futures ushered in the biggest weekly decline in 17 months.

On Friday (July 23), iron ore futures will record their biggest weekly decline in 17 months as China stepped up its efforts to reduce steel production, prompting steel mills to start cutting production to avoid sanctions.

As of 7:00 GMT, the September contract for China's Dalian Commodity Exchange's most active steelmaking raw material fell by 2%, to RMB1,124 (US$173.60) per ton, extending the decline to the fifth trading day.

The index fell about 10% from last week, the biggest weekly decline since February last year, and is currently down 17% from the record high reached in May.

The most traded iron ore contract on the Singapore Exchange in August fell by 0.2%, reaching US$197.25 per ton.

China, the largest steel producer has stepped up its efforts to reduce the output of construction and manufacturing materials in accordance with its carbon emission reduction targets.

After the production in the first half of the year increased by about 12% over the same period of the previous year, the authorities required steel mills to ensure that this year's output does not exceed the 2020 output.

Commodity strategists at ANZ said in a report that,

“In Tangshan, China’s largest steelmaking city, the government vowed to punish violations of production restrictions. Some independent steel rolling companies stopped production in early July, and more companies are expected to close down in the coming months.”

According to relevant platform data, the spot price of China's benchmark 62% grade iron ore hit a six-week low of US$209.50 per ton on last Thursday.

However, this concern about steel production restrictions has had the opposite effect on steel prices, as there are growing concerns that supplies may tighten.

Shanghai Futures Exchange SRBcv1 construction steel bars rose by 2.2%, and hot-rolled steel coils rose by 1.7%. These two varieties are expected to rise for the fourth consecutive week.

Due to concerns about tight supply, the price of stainless steel in Shanghai rose by 4.8%, setting a record high of US$3,031/MT.

Fears of tight supply also pushed up Dalian Coking Coal DJMcv1 and Coke DCJcv1, up by 2% and 2.1% respectively.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China