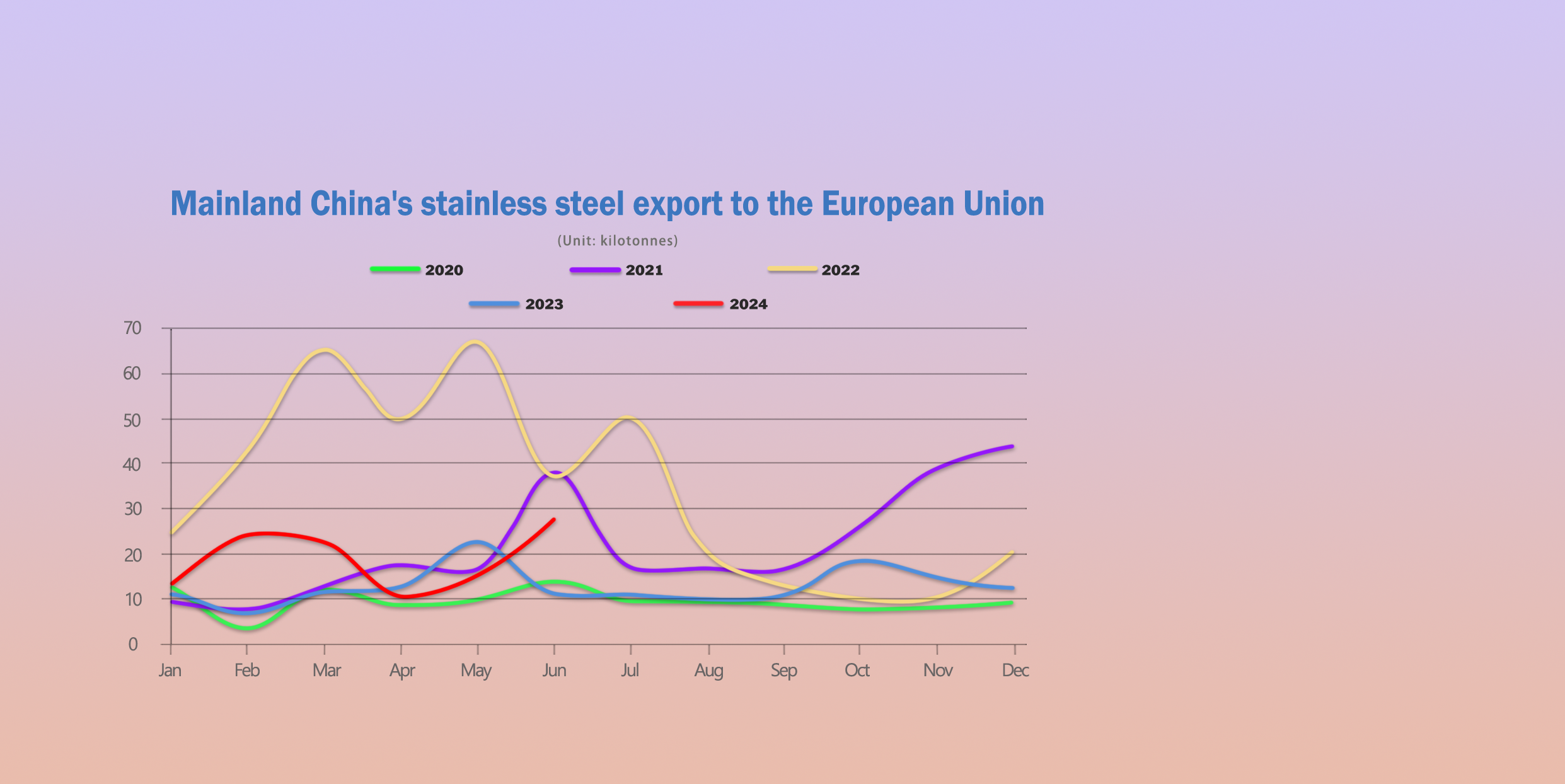

Are you ready for the Games? We hope this summer event can relieve the whole world from conflicts and intense. The world needs happiness and reunions to go through some dilemmas. The stainless steel industry which has suffered consistent tepid demand needs them as well. Last week, the stainless steel futures and spots went down. The latest loan market quoted interest rate (LPR) was released and dropped. The market lacked faith, and later in the week, Chinese stainless steel giants opened to drop. Spot inventory returned to rise because of weak demand. The stacking inventory will remain a burden to the market in the future although the scheduled production in July slightly reduces. Looking at the trading volume, though Turkey withdrew its position as the biggest buyer of Chinese stainless steel, in the past two months, the EU imported more stainless steel and in June, the EU bought 62,100 tons from China, which hit the highest volume in 23 months. This shows that business still exists under harsh terms, as long as the products are of quality enough. This summer really counts until the Olympics immerses us. Fun and work both matters. Before preparing to watch the opening ceremony, read this Stainless Steel Market Summary in China then go for it!

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,145 | -10 | -0.48% |

| Foshan | 2,185 | -10 | -0.47% | ||

| Hongwang | Wuxi | 2,050 | -1 | -0.07% | |

| Foshan | 2,045 | -13 | -0.64% | ||

| 304/NO.1 | ESS | Wuxi | 1,975 | -11 | -0.60% |

| Foshan | 1,975 | -11 | -0.60% | ||

| 316L/2B | TISCO | Wuxi | 3,685 | 17 | 0.47% |

| Foshan | 3,735 | 6 | 0.15% | ||

| 316L/NO.1 | ESS | Wuxi | 3,565 | 33 | 0.98% |

| Foshan | 3,535 | 8 | 0.25% | ||

| 201J1/2B | Hongwang | Wuxi | 1,350 | -14 | -1.11% |

| Foshan | 1,345 | -17 | -1.33% | ||

| J5/2B | Hongwang | Wuxi | 1,245 | -13 | -1.09% |

| Foshan | 1,250 | -17 | -1.45% | ||

| 430/2B | TISCO | Wuxi | 1,210 | -11 | -1.00% |

| Foshan | 1,225 | -1 | -0.12% |

TREND|| Stainless Steel Futures Prices Fluctuate Weakly Last week.

Stainless steel futures prices continued to decline last week and broke through the previous low. Trading volume shrank within the week, but the open interest increased significantly in the three days at the end of the week. The market's disagreement increased, and the low-level game was intense. The price center continued to move down, and the direction will be determined after the volume increases. The main stainless steel futures contract last week closed at US$2040/MT, down 0.65% for the week, and the lowest price in the week was US$2020/MT. Spot stainless steel prices fell slightly last week.

With the continued weak performance of futures prices, the market sentiment is also relatively low. Steel mills have lowered their prices and their order acceptance performance is poor, suppressing trading enthusiasm. Downstream consumer demand is still cautious, mainly rigid demand procurement, and the willingness to replenish inventory is relatively low.

300 Series: Transactions Weaken Compared to Previous Period.

Trading volume weakened and inventory accumulated again. The price of 304 in the market fell slightly last week. As of last Friday, the mainstream base price of 304 civil cold-rolled four-foot in Wuxi area was reported to be US$1995/MT, down US$21/MT from last Friday; the price of civil hot-rolled steel was reported to be US$1965/MT, down US$14/MT from last Friday. The market fluctuated up and down last week, and the lowest fell to US$2020/MT. At the beginning of the week, affected by the macro news of "rate cut and reserve reduction", the market fluctuated and rose, and the market atmosphere improved slightly. However, most traders were cautious, and the terminal procurement did not improve. The transaction was average. After the price of the lower half of the cycle jumped down quickly, the price fell below the previous low and fluctuated. The mentality of the steel mill to support the price has loosened. Tsingshan opened the market and lowered the price, and the quotations of traders followed the downward trend. The actual demand for downstream is still weak, the transaction is weak, and the agent makes concessions to ship. The transaction performance is not good last week.

200 Series: Market Sentiment Suppressed by Trading Activity.

Trading suppressed market confidence, and weak support led to prices falling under pressure. The mainstream base price of 201J1 cold-rolled in the Wuxi market is US$1320/MT, the mainstream base price of J2/J5 cold-rolled is US$1215/MT, and the five-foot hot-rolled price of 201J1 is US$1285/MT. Last week, copper, manganese and ferrochrome prices all showed a slight downward trend, and the support of the raw material market for 201 prices weakened. On Monday, the price of 201 J2/J5 four-foot fell by US$7/MT, the price of 201J1 four-foot and five-foot hot-rolled fell by US$7/MT on Wednesday, and the price of 201 hot-rolled five-foot fell by another US$/7MT on Thursday.

400 Series: Continuous Inventory Accumulation.

Inventory continues to accumulate, and prices fall under pressure. The price of national cold-rolled 430 in the Wuxi spot market is US$1210 to US$1215/MT, down US$14/MT from last week's quotation; the price of national hot-rolled 430 is stable at US$1125/MT, the same as last week's quotation. Last week, the futures market fluctuated and weakened, the spot market sentiment was cautious and wait-and-see, and the market confidence was frustrated later. The enthusiasm of downstream procurement is not high. The continuous decline of high-chromium prices in the raw materials has weakened the cost support for 430, and the price of 430 is under pressure.

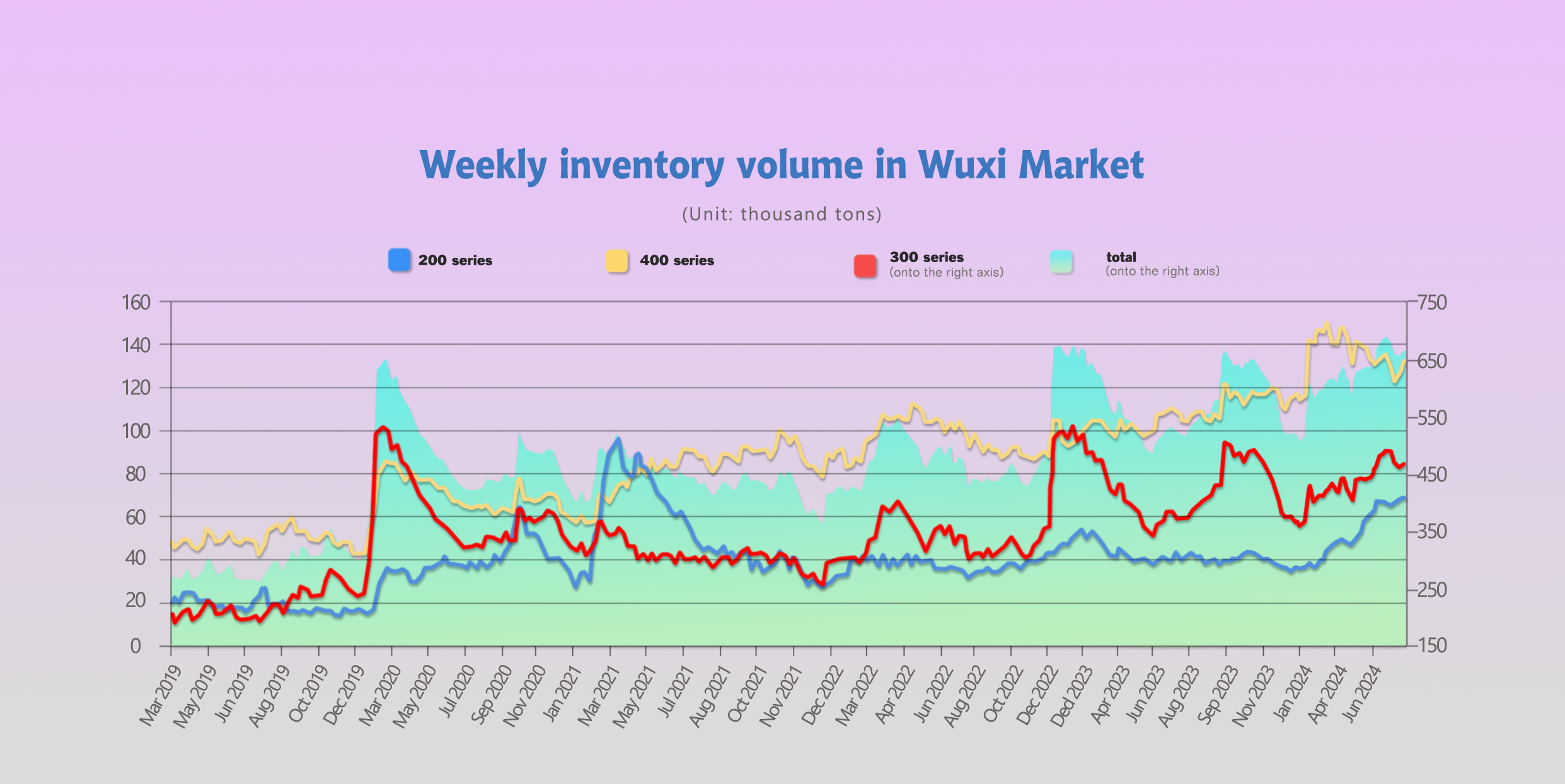

INVENTORY|| Inventory Increase of 10,300 Tons! Expectations Unmet & Inventory Shifts from Decrease to Increase.

The total inventory at the Wuxi sample warehouse up by 10,308 tons to 662,204 tons (as of 18th July).

the breakdown is as followed:

200 series: 982 tons up to 67,770 tons,

300 Series: 3,461 tons up to 462,769 tons,

400 series: 5,865 tons up to 131,665 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| Jul 11th | 66,788 | 459,308 | 125,800 | 651,896 |

| Jul 18th | 67,770 | 462,769 | 131,665 | 662,204 |

| Difference | 982 | 3,461 | 5,865 | 10,308 |

300 Series: Supply and Demand Contraction Leads to Inventory Increase.

A combination of shrinking supply and demand has led to a rise in 300 series steel inventory in the Wuxi market. Last week, inventory climbed by 0.35 million tons to reach 46.28 million tons, with cold-rolled steel accounting for 0.23 million tons and hot-rolled steel for 0.12 million tons of the increase.

The recent inventory cycle saw main futures prices fluctuate within a range, while spot prices remained stable. Production cuts at Indonesia's Yongwang lasting until September have reduced year-on-year imports of cold-rolled steel, tightening available tradable resources in the market. Although hot-rolled arrivals have increased, coupled with a slight uptick in steel mill production schedules for July, overall supply pressure hasn't shown significant improvement.

On the transaction side, a general decline in the commodity market has dampened speculative sentiment. End-user buying enthusiasm is weak, with just-in-time procurement dominating the market. Limited interest in restocking or stockpiling has caused the recent inventory decline to reverse. A slight dip in futures prices slowed the growth of warehouse receipts, with last week showing flat movement compared to the last and a narrowing year-on-year increase. Market confidence is gradually recovering.

Raw material prices remain weak. Based on current prices, steel mills are still operating at a loss, indicating continued pressure on the supply side. Demand recovery is slow, so a slight inventory increase is expected next week.

200 Series: Normal Steel Mill Arrivals, No News of Production Stoppage or Reduction Yet.

Steel mill deliveries were normal, and there haven't been any reports of production cuts or stoppages. Total inventory of 200 series steel in Wuxi rose by 0.1 million tons last week to reach 6.78 million tons, with both cold-rolled and hot-rolled resources contributing to the increase. Since July, inventory of 200 series steel has been steadily accumulating, coinciding with a weak price range for both cold-rolled and hot-rolled products. Frequent price adjustments throughout the week have made traders cautious about buying, with the consumer side mostly adopting a wait-and-see approach. Steel mill deliveries remain normal, with no news of production cuts or stoppages. Weakening raw material costs, with copper and manganese prices continuing to decline, are undermining production cost support for 201 steels. The consumer end hasn't shown any significant improvement, so inventory may continue to see slight increases. In the short term, the spot price of 201 steel is expected to remain mostly stable with a weak bias. Future market developments will hinge on the actions of steel mills and overall market transactions.

400 Series: Continuous Inventory Accumulation.

Inventory in the 400 series continues to accumulate. Last week, Wuxi market inventory for this series rose by 0.59 million tons to reach 13.17 million tons, with both cold-rolled and hot-rolled steel experiencing slight increases. The recent inventory cycle saw a drop in 430 prices, leading to a surge of low-priced resources in the market. This has spurred increased buying activity from downstream users looking to capitalize on lower prices, resulting in a year-on-year improvement in transactions. However, steel mill deliveries have increased last week, and their July production schedules remain high. The supply exceeding demand situation hasn't improved significantly, leading to a continuous rise in inventory. While raw material costs provide some support, the room for price decline is limited, with the overall trend being a weak adjustment. However, the market fundamentals remain weak. The expectation is for 430 prices to continue fluctuating within a range in the short term.

Raw Materials|| Nickel Iron Prices Expected to Break Through 139 US dollar Mark in the Near Future.

Raw material prices have been relatively stable, providing some support for stainless steel prices, and steel mill production costs are still upside down.

As of the early morning inquiry on July 19, the mainstream ex-factory price of high-nickel iron in China was US$135/nickel. However, as many steel mills entered the procurement period, the procurement price rose to US$138/nickel point at most. Although the Indonesian government approved an average annual production of 240 million tons of ore in the next three years in early June, the local nickel ore supply is still tight, the premium remains high, and a large number of Philippine ore is imported to maintain production. Domestic iron mills are also in a state of reduction or production suspension due to long-term cost inversion. The domestic nickel iron supply has turned from a surplus in the previous year to a tight balance. It is expected that nickel iron prices will run strongly in the short term and are expected to break through the RMB 1,000 mark (approximately 138.8 US Dollar).

Why Factory Closures Can't Boost Nickel Prices?

According to the Financial Times, nickel production is estimated to have decreased by 400,000 tons last year, or about 10% of total production, which may not be enough to boost nickel prices.

The newspaper said in a commentary on the nearly 45% drop in metal prices since last year that low-grade supply from Indonesia is largely insensitive to the market.

In addition, investment in upgrading nickel pig iron (in the form of a large influx into the Indonesian market) could flood the high-grade nickel market.

According to Macquarie, China's investment in the Indonesian mining industry will increase its output from 600,000 tons in 2020 to 2.2 million tons this year, accounting for 65% of the global supply. At these prices, Indonesian mines themselves may not generate huge profits. But the Financial Times said that hasn't stopped production from growing.

Last week, BHP Billiton suspended nickel production at its mine in Australia until at least 2027, saying it could not "overcome the huge economic challenges posed by the global surplus of nickel."

Glencore announced in February that it would close its Koniambo mine, in which it owns a 49% stake, after investing more than $4 billion in the mine since 2013. First Quantum Minerals said it would halt nickel and cobalt mining in Western Australia and cut a third of its workforce in response to lower metal prices and rising costs.

The only way to solve the slump in the nickel market is to improve demand for nickel. The newspaper said that two-thirds of the demand comes from stainless steel, which is performing well. But demand for nickel from electric vehicles has not grown significantly.

According to Standard Bank Group's equity data, the growth in electric vehicle demand has slowed from 12% year-to-date in April to 7% year-to-date in May - the sales of hybrid electric vehicles.

"While US dealers have room to replenish inventory, sales have started to slow," said Adrian Hammond, precious metals analyst at the bank, in a report early this month. Sales of internal combustion engine vehicles have been growing steadily at 4% this year.

SUMMARY|| Stainless Steel Market: Trading Light, Social Inventory Re-accumulates.

Stainless steel prices fluctuated weakly last week, futures prices continued to weaken and broke through the previous low, spot prices also fell accordingly, the profit-making promotion of traders had a poor effect, social inventory rose again, and steel mills are expected to cut production in July, which may alleviate the pressure of arrivals in the later market. In the future, we should mainly focus on the production and arrival rhythm of steel mills, the stimulus of domestic macroeconomic policies, and it is expected that the stainless steel market will fluctuate in the later market.

300 Series: At present, the market is in the off-season of consumption, the market demand is weak, and there is no obvious positive news release on the macro fundamentals. The spot market trading is light. Although the production of steel mills has been reduced in July, the supply pressure is still high. It is expected that the spot price of 304 cold-rolled steel will fluctuate in the short term, and the subsequent market trading situation will be concerned.

200 Series: The market sentiment is weak, the overall trading is very limited, and low-priced resources emerge. The multiple price reductions in the short term have made the consumer side adopt a cautious wait-and-see attitude, and the merchants take delivery according to the order quantity. The inventory of the 200 series has increased for three consecutive times, and the steel mills arrive normally. The overall inventory pressure is relatively large. It is expected that the price of 201 will remain weak and stable in the short term, and the price range of 201J2 will be around US$1210/MT to US$1265/MT.

400 Series: In view of the high production cost of steel mills at present, the mentality of supporting prices still exists, and the space for price decline is limited. It is expected that the price of 430 cold-rolled steel will fluctuate within the range of US$1195/MT to US$1225/MT in the short term. In the future, we will continue to pay attention to the market trading and inventory digestion.

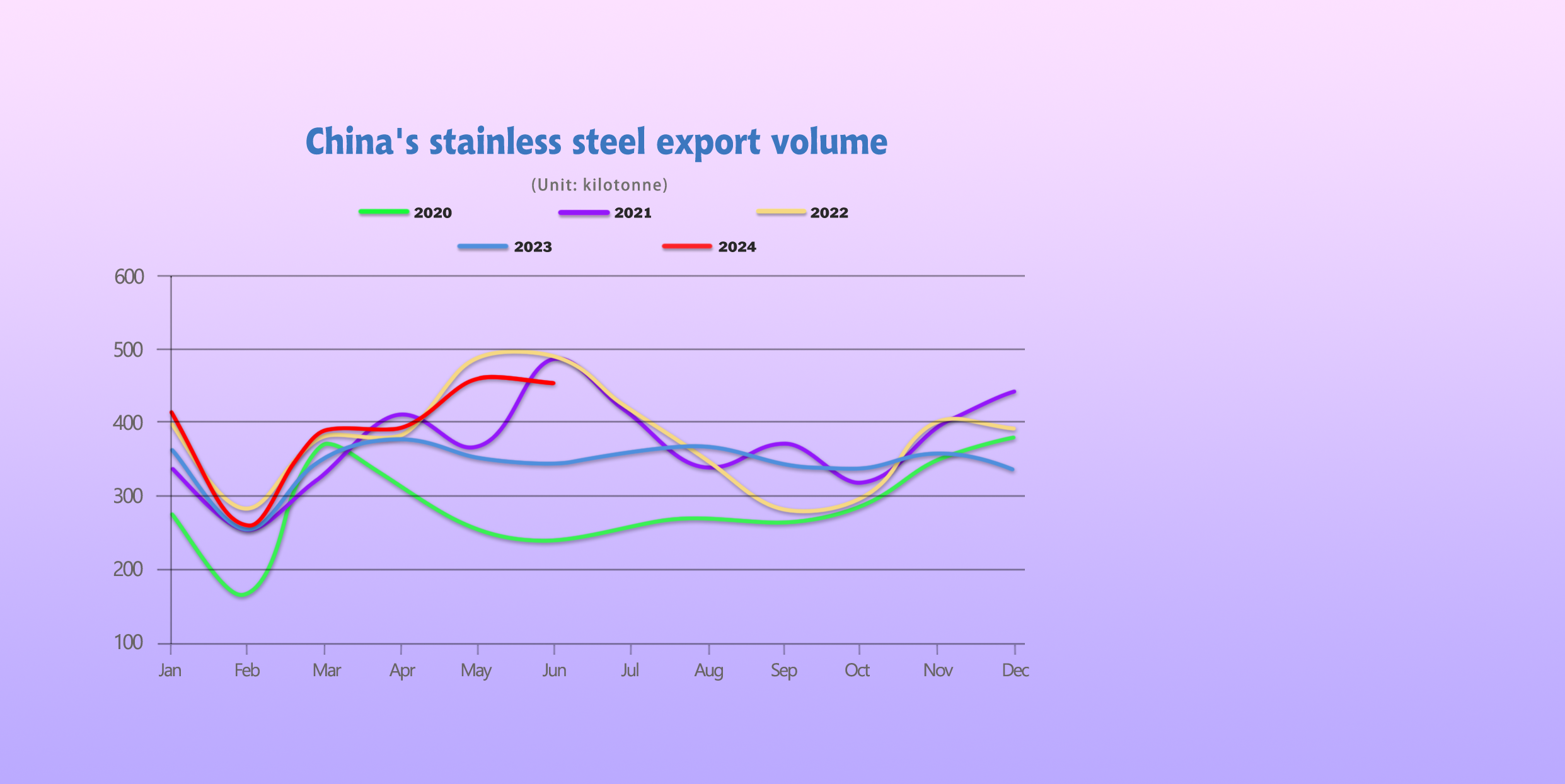

MACRO|| Analysis of China's Stainless Steel Export Data in June 2024.

China's stainless steel exports decreased by 1.1% month-on-month in June 2024.

According to statistics from China Customs, China's stainless steel exports were approximately 452,800 tons in June 2024 (at a historical high), down 49,000 tons from the previous month, a decrease of 1.1%; up 109,500 tons from the same period last year, an increase of 31.9%. From January to June 2024, China's cumulative stainless steel exports were approximately 2.3648 million tons, an increase of 325,900 tons from the same period last year, an increase of 16%.

Exports decreased slightly in June, but remained at a historical high. The main decrease was in the export of hot-rolled coils with a width ≥ 600mm, which decreased by 18,700 tons month-on-month, a decrease of 16.9%.

In June 2024, the export volume of the top ten regions in mainland China was approximately 268,000 tons, accounting for about 59.18%; from January to June, the cumulative volume was approximately 1.444 million tons, accounting for about 61.08%.

Exports decreased slightly month-on-month, and the volume to Turkey decreased significantly, decreasing by 24,700 tons month-on-month, a decrease of 47.7%.

Exports to the EU increased for two consecutive months, with the volume in June reaching approximately 27,600 tons (a new high in 23 months), an increase of 12,500 tons month-on-month, an increase of 82.4%; an increase of 16,500 tons year-on-year, an increase of 147.7%. From January to June 2024, the cumulative volume was approximately 112,900 tons, an increase of 37,600 tons from the same period last year, an increase of 50%.

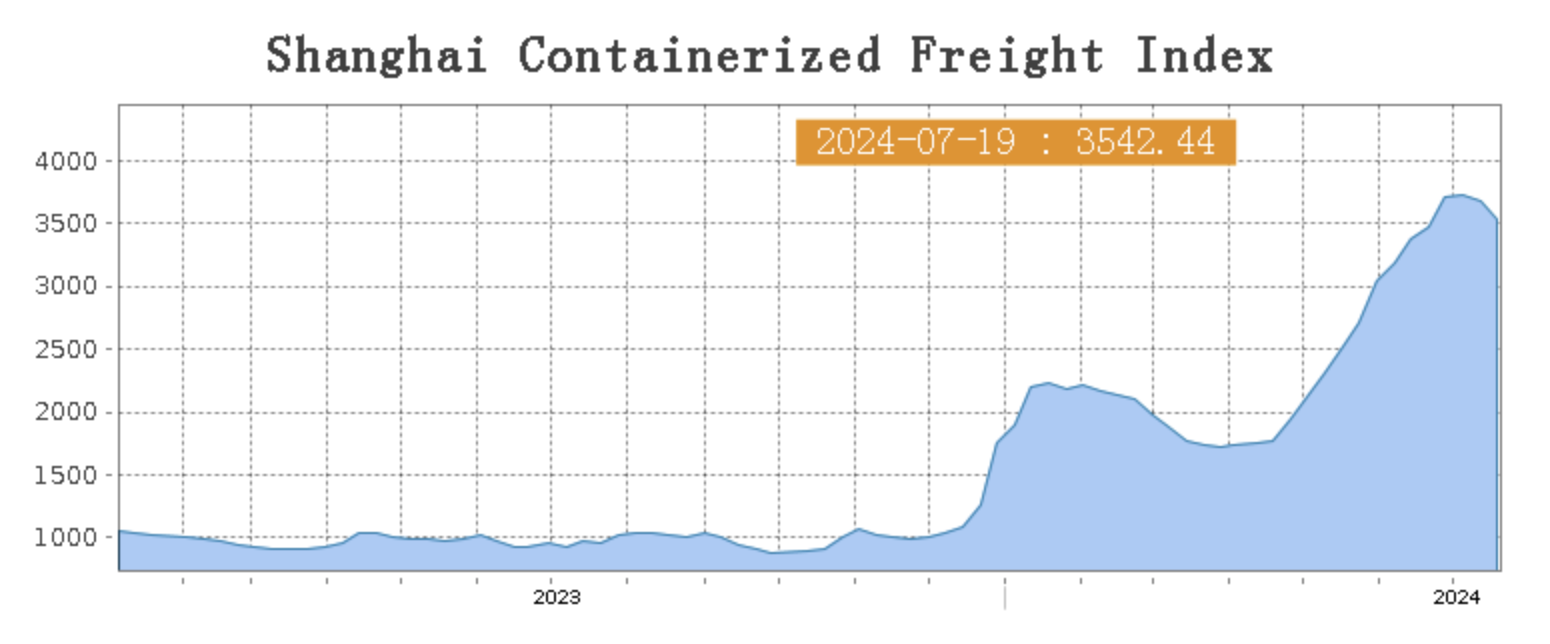

Sea Freight|| Overall Correction in Shipping Market, Down Trends in Ocean Routes.

According to data released by the National Bureau of Statistics, China's GDP grew by 5.0% year-on-year in the first half of the year, maintaining steady growth, indicating that the basic trend of stable and long-term improvement in the economy has not changed, which will provide long-term support for China's export container shipping market in the future. On 19th July, the Shanghai Containerized Freight Index dropped by 3.6% to 3542.44.

Europe/ Mediterranean:

Short-term shipping demand in Europe remains high, but spot market booking prices have fallen slightly due to policy uncertainties facing Sino-European trade.

On 19th July, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$5000/TEU, which dropped by 1%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$5361/TEU, which decreased by 1.2%.

North America:

According to data released by the US Department of Commerce, US retail sales stagnated in June, slowing down month-on-month from May. The weakness in consumer data indicates that the US economy has shown signs of a significant slowdown. There was no further growth in shipping demand last week, the supply-demand relationship weakened, and spot market booking prices continued to adjust.

On 19th July, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$7124/FEU and US$9751/FEU, reporting a 6.9% and 1.3% slide accordingly.

The Persian Gulf and the Red Sea:

On 19th July, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 3.5% from last week's posted US$2193/TEU.

Australia/ New Zealand:

On 19th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1385/TEU, a 1.4% decrease from the previous week.

South America:

On 19th July, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$8212/TEU, an 6.3% down from the previous week.