When the rare extreme weather becomes frequent, can our fragile economy sustain fluctuations? Since June, there has been a noticeable increase in sea surface temperatures in the central and eastern equatorial Pacific, indicating the onset of El Niño. The abnormal droughts and floods will cause great damage. It is assumed that there was $4.1 trillion and $5.7 trillion in global income losses to the 1982–83 and 1997–98 El Niño events, respectively. This time, it is predicted that over $80 trillion in losses. The volatile changes in weather will directly affect industries like agriculture, and mining, which will cause serious fluctuations in the commodity prices. Last week, the Chinese had a 3-day holiday for the traditional festival, and thereby, the market last week only ran for 3 days. Because of the low demand, the prices of stainless steel tended to drop. If you want to know more about the market, and how El Niño influences the market, please keep reading our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,310 | -16 | -0.75% |

| Foshan | 2,350 | -16 | -0.73% | ||

| Hongwang | Wuxi | 2,250 | -21 | -0.96% | |

| Foshan | 2,230 | -21 | -0.99% | ||

| 304/NO.1 | ESS | Wuxi | 2,145 | -19 | -0.94% |

| Foshan | 2,170 | -12 | -0.58% | ||

| 316L/2B | TISCO | Wuxi | 3,975 | -27 | -0.71% |

| Foshan | 4,005 | -7 | -0.18% | ||

| 316L/NO.1 | ESS | Wuxi | 3,775 | 8 | 0.23% |

| Foshan | 3,815 | 0 | 0% | ||

| 201J1/2B | Hongwang | Wuxi | 1,430 | -16 | -1.18% |

| Foshan | 1,405 | -21 | -1.60% | ||

| J5/2B | Hongwang | Wuxi | 1,345 | -14 | -1.12% |

| Foshan | 1,335 | -21 | -1.69% | ||

| 430/2B | TISCO | Wuxi | 1,255 | 3 | 0.25% |

| Foshan | 1,250 | 3 | 0.25% |

TREND|| Stainless steel market experienced ‘Pre- holiday depression’

There were only 4 trade days last week due to the Dragon Boat Festival holiday, but the stainless-steel price overall did not paddle upward.

Stainless steel 300 series: Tsingshan drew red lines on agent price.

The market price of stainless steel 304 turned slightly lower in hesitant trading. Until 21st June, the mainstream base price of cold-rolled stainless steel 304 fell US$21/MT to US$2210/MT, and the hot-rolled stainless steel lost US$28/MT and was quoted as US$2135/MT. Most of the sellers undersold stainless steel goods in the first two days last week as market sentiment turned bearish, then one of the biggest suppliers, Tsingshan, stood their ground and conducted supervision on resell prices.

Stainless steel 200 series: The price fell US$14 overall.

The spot price of stainless steel 201 performed weakly last week. Until 21st June, the mainstream base price of both cold-rolled stainless steel 201 and 201J2/J5 dropped US$14/MT to US$1405/MT and US$1320/MT accordingly; the 5-foot hot-rolled stainless steel slid US$7 to US$1345/MT.

Stainless steel 400 series: weak demand but the price was stabilized.

400 series’ performance is distinguished from among other stainless steel series. The mainstream quoted price remains unchanged at between US$1255/MT-US$ 1260/MT.

25th June, as the first working day after the holiday, the market remain untouchable, The base price of cold-rolled 4-foot mill-edge stainless steel 304 in the Wuxi market was quoted at US$2200/MT, and hot-rolled 304 reported as US$2145/MT.

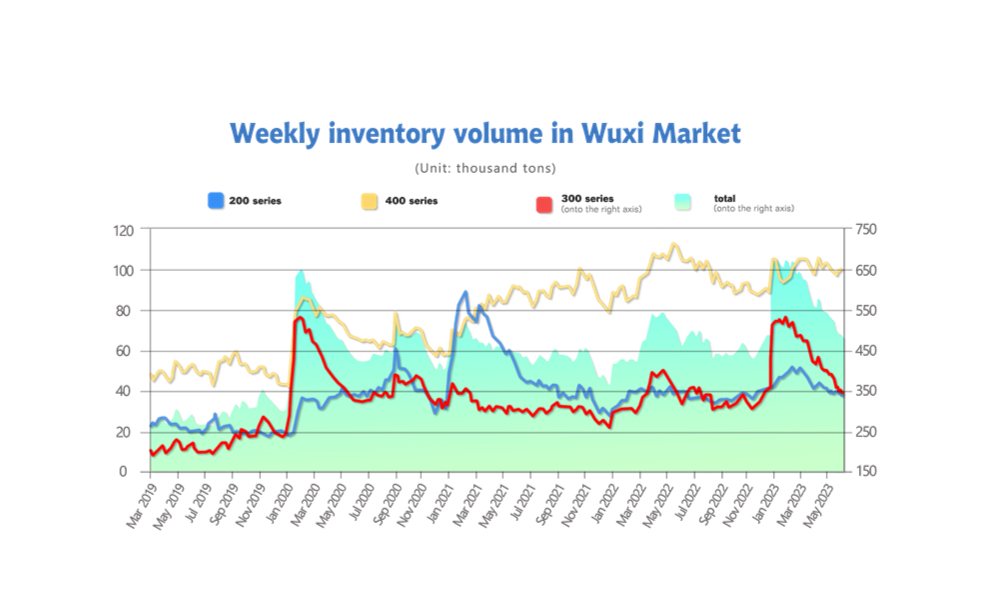

INVENTORY|| A new low in 200 series inventory

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| June 15th | 38,918 | 348,509 | 98,406 | 485,833 |

| June 21st | 37,605 | 342,021 | 99,558 | 479,184 |

| Difference | -1,313 | -6,488 | 1,152 | -6,649 |

The total inventory at the Wuxi sample warehouse fell by 6,649 tons to 479,184 tons (as of 21st June).

the breakdown is as followed:

200 series: 1,313 tons down to 37,605 tons

300 Series: 6,488 tons down to 342,021 tons

400 series: 1,152 tons up to 479,184 tons

Stainless steel 200 series: Inventory hit 2023 rock bottom

The inventory level has been up and down last week but reported a decline eventually on 21st June. Most of the downstream users postpone the purchase and wait for further price movement after the slide in the spot price, transactions then turned sluggish.

Stainless steel 300 series: Busy pre-holiday deliveries

Marking seven consecutive weeks of inventory reduction, futures prices led to the decline in spot prices during the week, and market buying activity remained subdued with low pre-holiday stocking intentions. However, with the arrival of the Dragon Boat Festival holiday, customers concentrated on picking up their orders. Coupled with ongoing distribution reduction by steel mills, Delong Hot-rolled offered a 40% discount on distribution, and cold-rolled distribution remained at a low level. Several warehouses experienced a slight reduction in inventory during the week. It is reported that as the cost of raw materials held by Delong gradually decreases, the inventory of finished products in the plant has been effectively depleted. The operating rates of various production lines are gradually increasing, and with an increase in steel production, the distribution volume of cold-rolled resources by agents in the East China region is expected to recover. At the same time, hot-rolled resources from steel mills in South China continue to arrive, and the post-holiday inventory reduction trend may undergo a transformation.

Stainless steel 400 series: Varied differently from 200 series and 300 series.

The transaction of the 400 series also cooled down as the holiday approached, there was no significant movement in inventory. The supply of 400 series is expected to slide as JISCO and Fuxin special steel had just initiated on 25th June, and sellers are giving enough support to the price.

RAW MATERIAL|| Sluggish demand in stainless steel to compress the price growth on raw materials.

Chrome

The high chrome market was quite right before the Dragon Boat Festival, the mainstream EXW price remain stable at between US$1320/MT-US$1345/MT.

The high chrome industries are now setting eyes on the coming tendering-base purchase in July.

The export of ferrochrome in South Africa had a slight drop as the winter close in. Marking a 46.63% descend in supply of the ferrochrome, the import of ferrochrome in China had slid to 219,900 tons or a 46.63% drop.

Meanwhile, the price of Coke has also started to strengthen. It is reported that the prices of coke raw materials, such as coal, in Inner Mongolia, Ningxia, Shaanxi, Shanxi, and other regions have been continuously rising. After experiencing a previous period of overselling, the price of Coke has now encountered a rebound opportunity, some coke businesses even added US$14/MT to their previous quote price.

Overall, strong support from high chromium costs can be observed. However, considering the decrease in stainless steel production, it is anticipated within the industry that the procurement prices for high chromium steel will be adjusted downward in July. Referring to the mainstream purchasing prices of US$1345/MT-US$1375/MT (50% chromium) in June, the downward adjustment is expected to be around US$28/MT-US$42/MT(50% chromium).

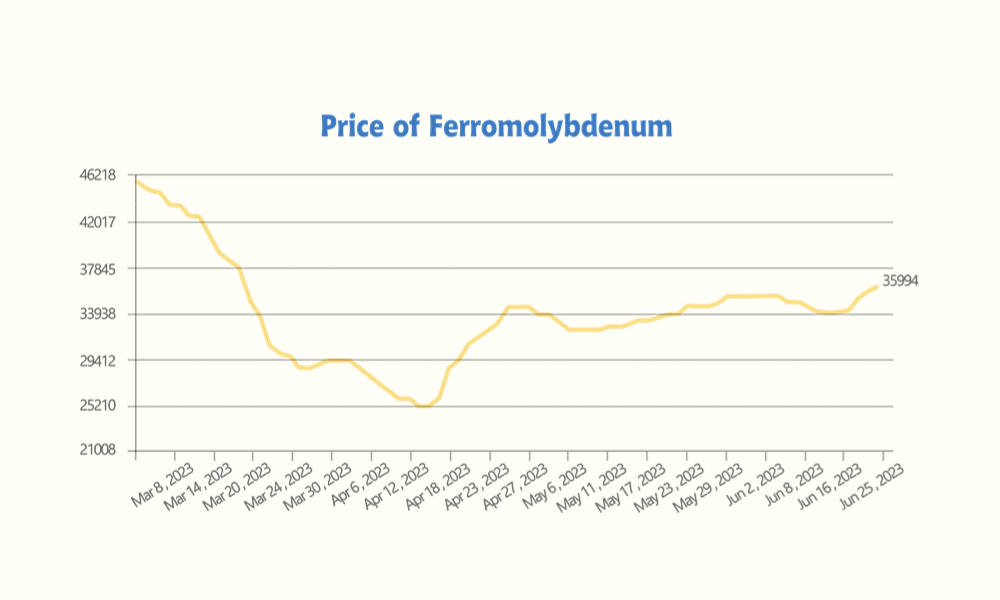

Molybdenum

The Molybdenum market remains bullish, the price of 45%-47% molybdenum concentrate was quoted at US$655/MT-US$600/MT, and 40% molybdenum concentrate rose US$9.8/MT to US$650/MT. The mainstream quoted price had reached US$3730/MT (60% Molybdenum).

The upward momentum of molybdenum has been lasting for 4 consecutive weeks, accumulating a US$2505/MT growth over the month.

MACRO|| El Nino gonna give a harsh crash on the economic malaise

Since May this year, many regions in China have recorded extremely high temperatures. It only happened in the Southern provinces earlier, but the heatwave spread to the North in June. With the upcoming and getting-more-frequent heat, they are usually associated with El Niño.

Since June, there has been a noticeable increase in sea surface temperatures in the central and eastern equatorial Pacific, indicating the onset of El Niño.

According to the forecast by China Climate Center, the central and eastern equatorial Pacific is expected to remain in an El Niño state for the next three months. The sea temperature index will continue to rise, indicating the formation of a moderate to strong Eastern Pacific El Niño event during the upcoming autumn of this year.

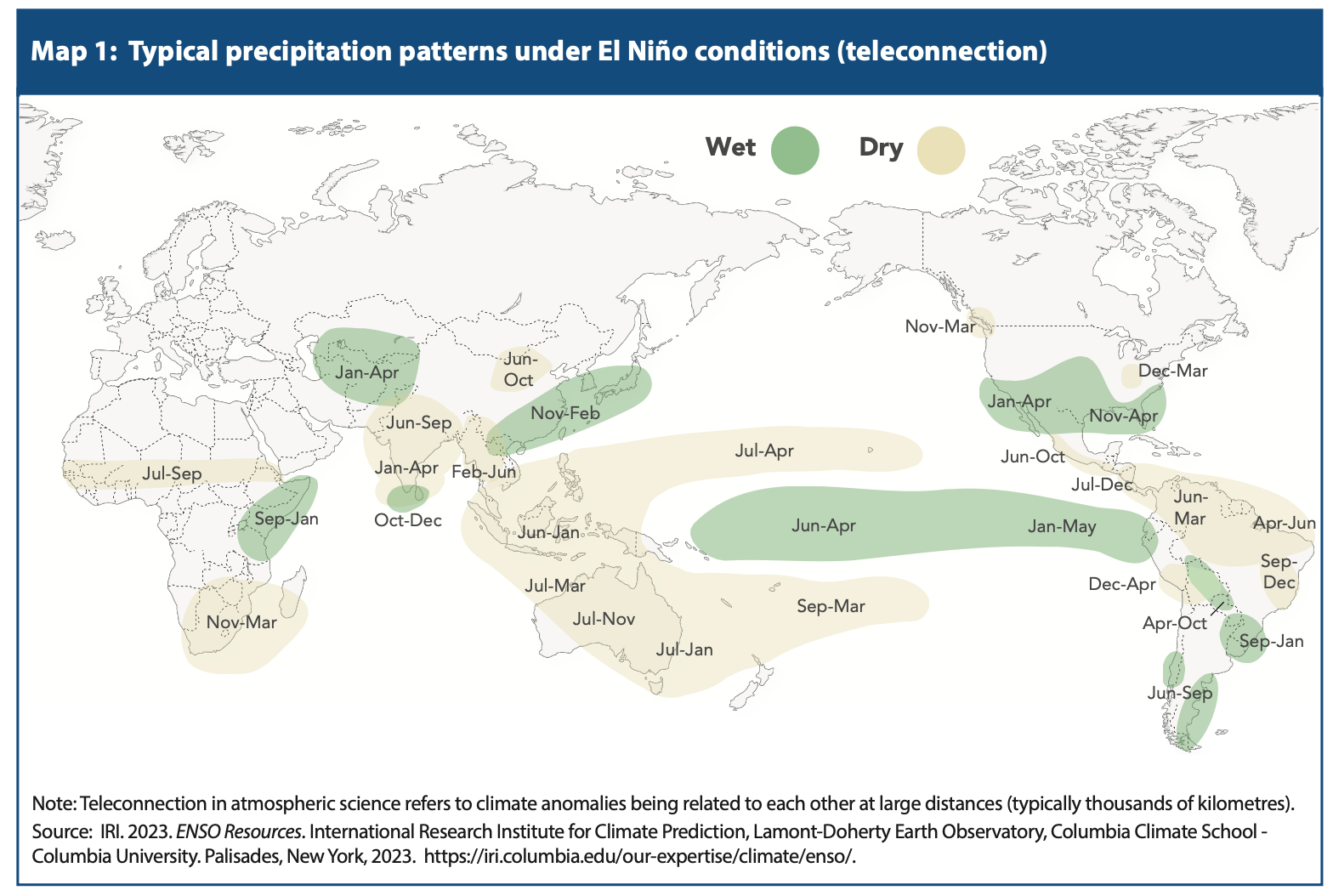

El Nino can have significant impacts on weather patterns around the globe, which, in turn, can influence various sectors of the world economy. Studies found that El Niño events have an important influence on the world’s production of primary commodities. The changes in weather can relate to unusual flooding, landslides, droughts, tropical cyclones, heatwaves, and wildfires. These rising disasters will directly influence commodity prices, typically, in industries like agriculture, mining, fisheries, energy, etc.

For example, El Niño during 2015 ~ 2016, contributed to wildfires in Indonesia, resulting in haze and air pollution that affected neighboring countries. Additionally, it brought heavy rainfall and flooding to parts of South America, including Peru and Ecuador. These violate changes led to the shutdown of local mines and ruined the fields, which were the major pillars of the states’ economy. According to new research, Persistent effect of El Niño on global economic growth, “Here we show that El Niño persistently reduces country-level economic growth; we attribute $4.1 trillion and $5.7 trillion in global income losses to the 1982–83 and 1997–98 El Niño events, respectively. In an emissions scenario consistent with current mitigation pledges, increased ENSO amplitude and teleconnections from warming are projected to cause $84 trillion in 21st-century economic losses, but these effects are shaped by stochastic variation in the sequence of El Niño and La Niña events. ”

Indonesia's central bank said last month that it expected the El Ni phenomenon to affect the country's food inflation in the second half of the year. The governor of India's central bank also warned against the impact of El Niño on India's economy.

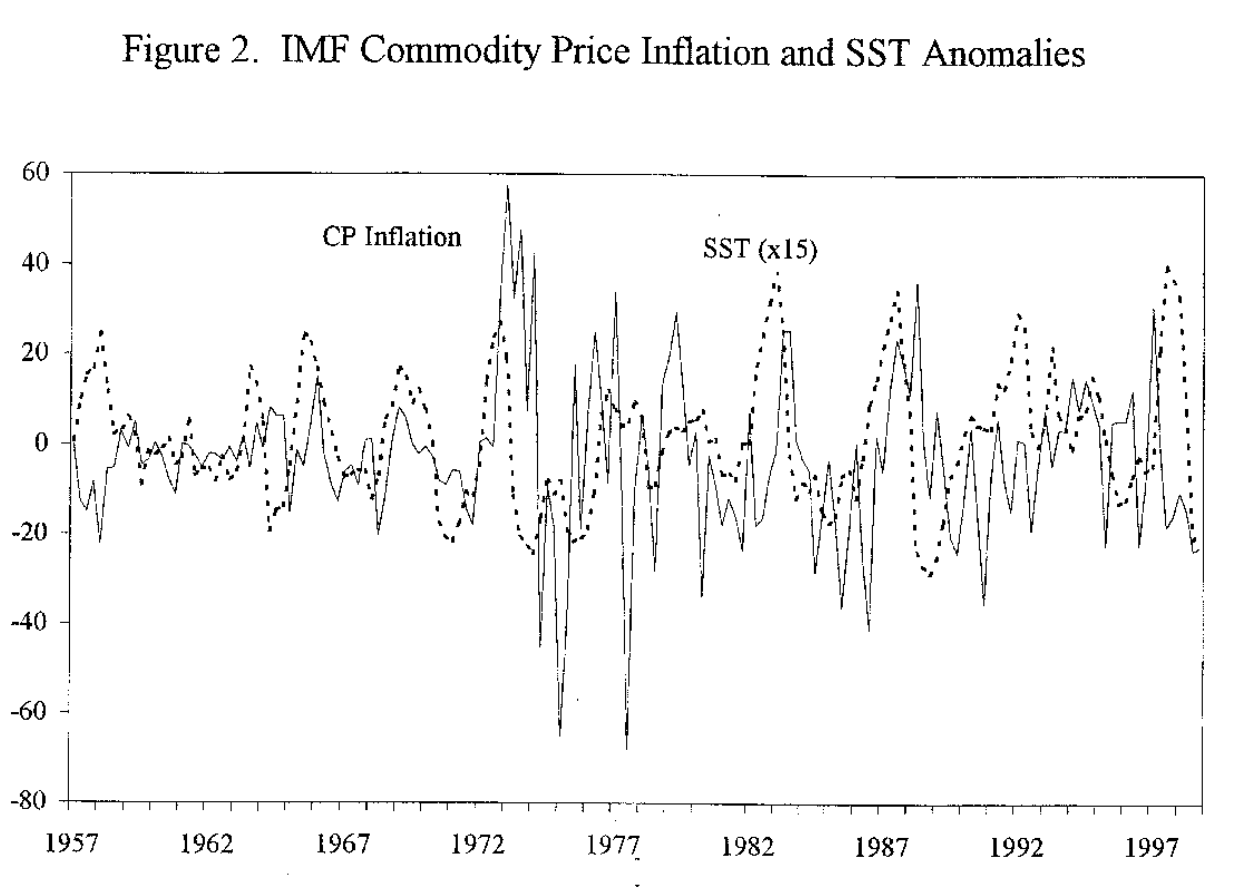

According to a survey from IMF Working Paper, El Nino and World Primary Commodity Prices: Warm Water or Hot Air?

The analysis indicates that the El Niño-Southern Oscillation. For example, ENSO raises real commodity price inflation about 3-1/2 to 4 percentage points. Moreover, ENSO appears to account for almost 20 percent of commodity price inflation movements over the past several years. ENSO also has some explanatory power for world consumer price inflation and world economic activity, accounting for about 10 to 20 percent of movements in those variables.

When extreme weathers become more common, it is not just about the planet getting hotter or cooler, moister or drier, human will have to pay more to fix the consequences.

During ENSO events the changes in sea surface temperature cause (and are influenced by) changes in atmospheric circulation (i.e. wind and pressure patterns) and in temperature and rainfall. Through atmospheric dynamics, these atmospheric changes extend well beyond the tropical Pacific region.

Sea Freight|| Sea freight market continue to slide.

Freight rates overall on multiple sea routes turn sluggish due to the “long weekend” , the freight rates of multiple sea route went down. On 21st June, the Shanghai Containerized Freight Index fell by 11.1% to 924.29.

Europe/ Mediterranean:

The economy in Euro is still laying low, the euro area annual inflation rate was 6.1% in May 2023, down from 7.0% in April. A year earlier, the rate was 8.1%. The European Central Bank answered the hiking inflation rate with a further interest rate growth.

Until 21st June, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$793/TEU, which fell by 1.9%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1588/TEU, which fell by 0.8%

North America:

U.S. unemployment claims had reached at 262,000 until 10th June which has surpass 260,000 two weeks in a row, and it is keep surprising the market. A further stimulus is urgently needed to deploy to shipping market because of the unideal recovery of demand.

Until 21st June, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1173/FEU and US$2061/FEU, 2.8 and 2% drop accordingly.

The Persian Gulf and the Red Sea:

Until 21st June, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 1% fall from last week's posted US$1226/TEU.

Australia/ New Zealand:

Until 21st June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$272/TEU, an 1.1% growth from the previous week.

South America:

The freight market had a slight rebound. on 21st June, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2419/TEU, an 1.9% growth from the previous week.