Elon’s huge stainless steel bucket successfully launched out. Starship is made of stainless steel, as Tesla describes. Starship is the largest rocket. Stainless steel is an economical material to attain such a volume. But last week, the stainless steel market did not rocket as high as the starship. The stainless steel market met Waterloo because steel mills are expanding the production. The price of four-foot cold-rolled stainless steel 304 was reduced by US$35/MT, to US$1990/MT. Tsingshan's long-term procurement price for high-carbon ferrochromium in April had a significant increase of US$70/MT compared to the previous month, providing strong cost support. Steel mills are working on suppressing the cost because of low demand and low prices, but their increasing output is working in the opposite direction. Looking at a broader sight, the European stainless steel market is another story. Acerinox and Outokumpu are affected by strikes, the productivity declines and delivery time has to exdend. Therefore, stainless steel prices surge in the European market. Markets are complicated and sometimes confuse people. We are here to provide valuable information to help you make the right decision. If you want to go deep into the dynamics, please keep reading our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,145 | -43 | -2.10% |

| Foshan | 2,190 | -43 | -2.06% | ||

| Hongwang | Wuxi | 2,050 | -28 | -1.43% | |

| Foshan | 2,040 | -29 | -1.51% | ||

| 304/NO.1 | ESS | Wuxi | 1,980 | -22 | -1.19% |

| Foshan | 1,985 | -31 | -1.63% | ||

| 316L/2B | TISCO | Wuxi | 3,670 | -11 | -0.32% |

| Foshan | 3,745 | -21 | -0.58% | ||

| 316L/NO.1 | ESS | Wuxi | 3,505 | -22 | -0.66% |

| Foshan | 3,550 | -20 | -0.57% | ||

| 201J1/2B | Hongwang | Wuxi | 1,415 | -20 | -1.49% |

| Foshan | 1,405 | -17 | -1.29% | ||

| J5/2B | Hongwang | Wuxi | 1,320 | -21 | -1.17% |

| Foshan | 1,320 | -15 | -1.26% | ||

| 430/2B | TISCO | Wuxi | 1,260 | -4 | -0.37% |

| Foshan | 1,255 | -7 | -0.61% |

TREND|| Stainless steel mareket met Waterloo.

Last week, the spot prices of stainless steel in the Wuxi market experienced a decline, with prices for the 300 series and 200 series continuing to drop, while the 400 series hot-rolled prices weakened slightly. Futures prices fluctuated throughout the week, with a minor rebound seen in the market on Friday. As of last Friday, the main contract price for stainless steel dropped by US$35/MT to US$2030/MT, representing a decrease of 1.8% from the previous week. On Saturday, bullish news emerged as Tsingshan announced a significant increase of US$70 in the April purchase price of high-carbon ferrochrome, reaching US$1375/50 reference ton (EXW; VAT included) compared to the previous month.

300 Series: Warehouse receipts continue to accumulate, market cautious.

Last week, the prices of 304 in the market continued to trend downward from the previous week. As of Friday, the mainstream base price of four-foot cold-rolled stainless steel 304 in the Wuxi area was reported at US$1990/MT, and the private hot-rolled price was reported at US$1965/MT, both down by US$35/MT from the previous Friday. Market prices fluctuated downward last week, with Tsingshan announcing the cancellation of price limits at the beginning of the week, leading to a loosening of traders' price support mentality. Spot prices continued to decline, downstream enterprises slowed down their purchasing pace, and the market sentiment remained cautious. Spot transactions were light during the week, mostly involving price concessions.

200 Series: The downward trend of stainless steel 201 is difficult to stop.

Last week, the prices of 201 in the Wuxi market were mostly downward. As of last Friday, the mainstream base price of cold-rolled stainless steel 201J1 in Wuxi dropped by US$25/MT from the previous week to US$1375/MT; cold-rolled stainless steel J2/J5 mainstream price dropped by US$35/MT to US$1280/MT; the mainstream price of five-foot hot-rolled dropped by US$21/MT to US$1335/MT. Tsingshan relaxed its price limit policy that had been maintained for several days, with the opening price dropping by US$28/MT, and agent traders also followed suit with price reductions.

The settlement requirement for flat plates must be "payment upon delivery," leading to a series of setbacks and a continuous decline in 201 prices, resulting in weak spot market transactions.

400 Series: Stability in 430 prices.

The guidance price for TISCO’s cold-rolled stainless steel 430 was quoted as US$1460/MT, and for JISCO, it was US$1580/MT, both unchanged from the previous week. Last week, the mainstream quotation for state-owned 430 cold-rolled stainless steel in the Wuxi market was US$1255/MT- US$1265/MT, and the price for hot-rolled 430 was US$1135/MT, both down by US$7 from the previous week.

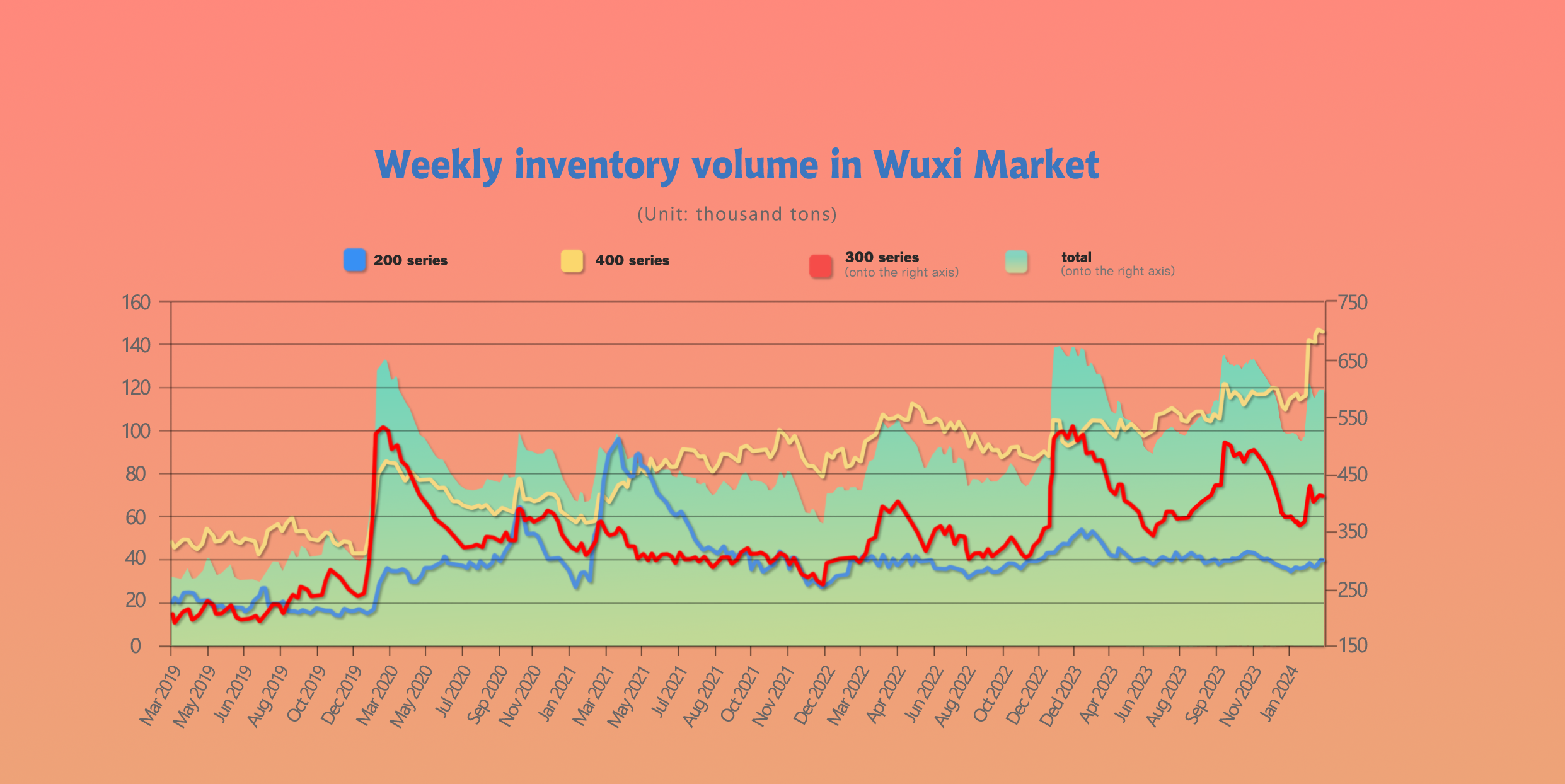

INVENTORY|| Stainless Steel Inventory Pressure Increases.

The total inventory at the Wuxi sample warehouse downed by 147 tons to 592,803 tons (as of 14th March).

the breakdown is as followed:

200 series: 1,645 tons up to 37,756 tons,

300 Series: 450 tons down to 408,893 tons,

400 series: 1,048 tons down to 146,007 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| March 7th | 37,756 | 408,893 | 146,007 | 592,656 |

| March 14th | 39,401 | 408,443 | 144,959 | 592,803 |

| Difference | 1,645 | -450 | -1,048 | 147 |

300 Series: Futures and spot prices decline, cold-rolled increases while hot-rolled decreases!

Last week, the inventory of the 300 series in the Wuxi market decreased by 0.05 million tons to 408,400 tons (excluding warehouse receipts), with accumulation in cold-rolled and a slight decrease in hot-rolled. During last week, spot prices continued to decline, with increased wait-and-see sentiment among end-users, and just-in-time purchases were the main trend. With the decline in the market, hedging resources flowed out to supplement spot resources, but traditional traders' spot price advantages were not significant, leading to slow shipments. Hot-rolled supply was insufficient in the previous period, resulting in a scarce market supply. Downstream enterprises purchased at low prices to replenish inventory, resulting in a slight decrease in hot-rolled inventory. Delong Liyang base is about to resume cold-rolled production, increasing supply. Currently, market demand is relatively weak, and it is expected that inventory may continue to accumulate next week.

200 Series: Increase in 201 inventory by 0.16 million tons.

Last week, the total inventory of sample warehouses in Wuxi increased by 0.01 million tons to 592,800 tons compared to the previous period. Among them, the inventory of the 200 series increased by 0.16 million tons to 39,400 tons, with increases in both cold-rolled and hot-rolled. The March production plan of steel plants increased significantly month-on-month last week, leading to an increase in market arrivals. In addition, Qing Shan and Hongwang have lifted price limit policies, resulting in a decline in 201 prices, and downstream customers purchased according to demand, resulting in inventory accumulation.

400 Series: Slight decrease in cold-rolled inventory.

Last week, the inventory of the 400 series decreased by 0.1 million tons to 145,000 tons. There was a slight accumulation in hot-rolled, while a small amount of cold-rolled inventory decreased. Last week, the market price of 430 cold-rolled decreased, prompting traders to actively reduce inventory to facilitate transactions and recirculate funds. Currently, the high-chromium price of main raw materials remains high, and steel plant costs are stable at a high level. Some steel plants are experiencing losses, and there is a strong willingness to increase prices. However, downstream demand has not yet shown a significant recovery, with demand-driven purchases dominating the market and inventory remaining high.

RAW MATERIAL|| Raw material prices rise but stainless-steel prices fail to follow suit.

The mainstream EXW price of main raw materials, high-chromium, remained unchanged from the previous week, at US$1320/MT-US$1350/MT. During the week, the price of coke fell, but the price of chromite remained firm, and the comprehensive production cost of high chromium remained high. Factories in the southern region are suffering severe losses, and their production enthusiasm remains low. It is expected that the output of factories in the southern region will remain low in March.

Meanwhile, northern high-chromium factories have slightly increased their output due to cost advantages. Tsingshan's long-term procurement price for high-carbon ferrochromium in April was US$1375/50 reference ton (EXW, VAT included), a significant increase of US$70/MT compared to the previous month, providing strong cost support.

On March 18th, LME nickel fell by $245 from the previous trading day, closing at $17,915, with inventories decreasing by 150 to 74,028 tons. LME nickel opened at $18,080, reaching a high of $18,340 and a low of $17,900 during the day before closing at $17,915, a decrease of 1.35% from the previous trading day.

It is understood that a major steel mill in South China purchased tens of thousands of tons of Indonesian high-nickel pig iron at a price of US$133/MT (including taxes) per ton, which remained unchanged from the previous week. Recently, nickel prices have risen sharply. In the second half of February, the slow approval of new regulations by the Indonesian Ministry of Energy and Mineral Resources has led to a temporary tight supply of nickel ore and increased costs. However, local governments have promised to expedite the approval process. Compared to the strong rise in nickel prices, stainless steel prices have indeed been declining all the way. Based on the current raw material prices, steel mills have begun to incur losses. Therefore, they are cautious about purchasing high-priced nickel pig iron. It is expected that nickel pig iron prices will remain stable to slightly weak in the short term.

SUMMARY|| Steel mills aim to reduce production costs.

The raw material side is under pressure, with the impact of the Indonesian nickel ore quota issue diminishing. As steel mills continue to compress their production costs, they may be on the verge of inversion, maintaining pressure on raw material prices. However, steel mill output continues to remain high, leading to increasing pressure on inventory buildup.

300 Series: Pressure continues to mount on current spot market inventory and warehouse receipts, exerting downward pressure on futures prices. However, the purchasing prices of nickel iron and ferrochromium, raw materials for steel mills, are rising, providing strong support on the cost side. Short-term forecast suggests that spot prices for 304 cold-rolled stainless steel will fluctuate around US$2015/MT.

200 Series: With increased planned production in March, inventory buildup, and Qingshan lifting price restrictions, multiple bearish factors have led to a continuous decline in the price of 201 stainless steel. It is expected that in the short term, the price of 201 stainless steel will mainly decline under pressure.

400 Series: The prices of main raw materials, high-chromium, remain high, leading to high production costs for steel mills and varying degrees of losses. There is a strong willingness to raise prices, but downstream demand remains weak. It is anticipated that the price of 430 stainless steel will remain weak and stable in the short term.

During the week, traders actively reduced inventory to promote transactions and recoup funds. Downstream demand has yet to show a significant increase, with procurement being mainly demand-driven.

MACRO|| European Stainless Steel Prices Surge Due to Trade Restrictions and Supply Tightness.

The European Commission has decided to restrict supplies from Asian markets such as Taiwan, Turkey, and Vietnam, further tightening supply in the region. Additionally, the previously rising energy prices have now fallen, supporting stainless steel production in European steel mills.

Furthermore, the interruption of trade in the Red Sea, coupled with rising freight costs, has pushed up prices for stainless steel cold-rolled coils in the European spot market.

With a slight increase in demand from downstream renewable energy and construction industries, buyers have placed large orders.

Concerns about supply shortages have emerged in the European spot market, leading to a significant increase in prices for stainless steel cold-rolled coils.

By the end of February, due to reduced supply from European steel mills, coupled with a decrease in imports, prices for stainless steel cold-rolled coils in Europe have risen.

Due to significant inventory and persistent uncertainty leading to reduced demand, production of stainless steel cold-rolled coils in Europe has been sluggish, with the trend of rising electricity prices persisting throughout 2023.

Entering 2024, the stainless steel industry faces labor disputes, particularly in Spain and Finland. Due to unresolved labor negotiations, Acerinox's Los Barrios plant in Spain has been mired in prolonged strikes, resulting in significant losses of steel.

Meanwhile, in Finland, an upcoming political strike poses a threat to Outokumpu's Tornio plant, potentially disrupting the operation and export of ferrochrome. These factors have reduced the productivity of stainless steel cold-rolled coil production in European steel mills.

As a result, the European stainless steel cold-rolled coil industry faces price increases and longer delivery times, with delivery times extending from the previous 3-4 weeks to at least 8 weeks.

The current anti-subsidy tax (CVD) measures in Indonesia will be imposed on stainless steel cold-rolled coil plate products imported from Taiwan, Turkey, and Vietnam, with a standard tariff of 20.5% applied to designated materials. These factors have led to a decrease in production rates and inventory of stainless steel cold-rolled coils in the European region.

SEA FREIGHT|| Weak Growth in Shipping Demand, Market Rates Continue to Decline.

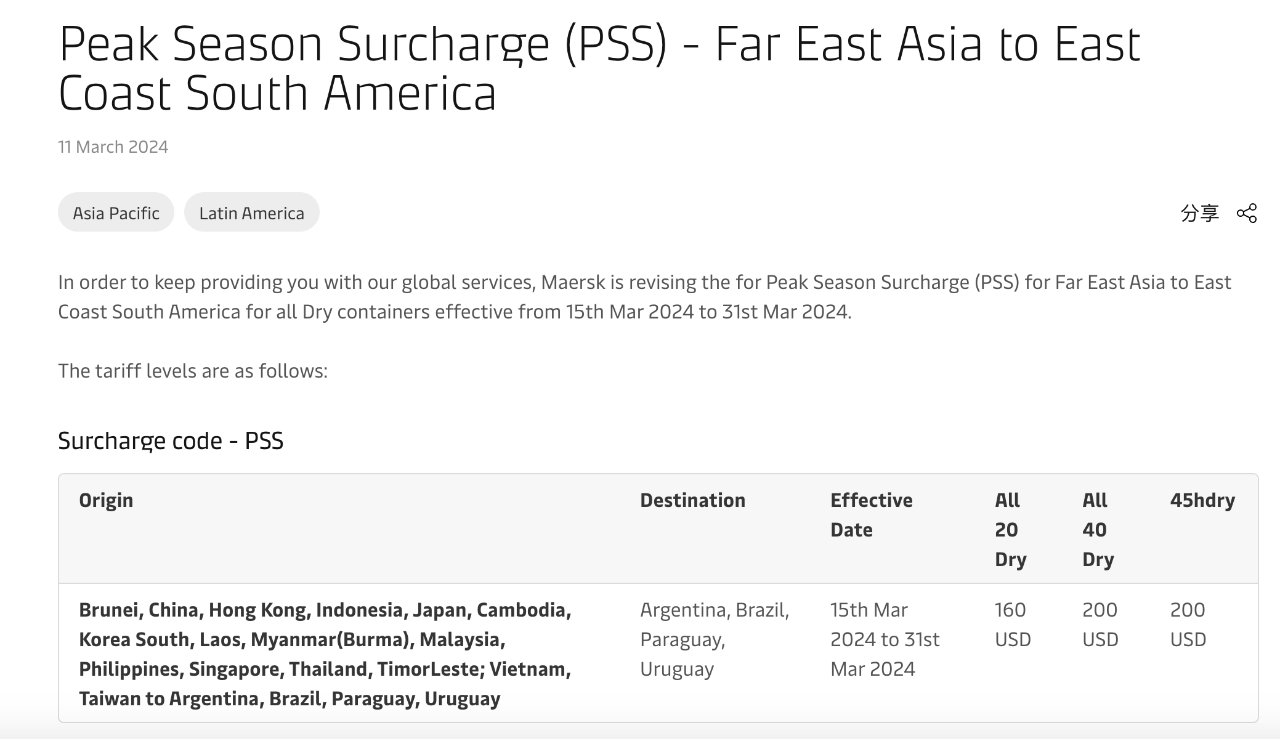

Maersk is adjusting Peak Season Surcharge (PSS) rates for selected routes effective March 1st to 31st March 2024, to ensure continued global service provision.

This market scope includes: from mainland China, Hong Kong, Taiwan, Brunei, Indonesia, Japan, South Korea, Cambodia, Laos, Myanmar, Malaysia, the Philippines, Singapore, Thailand, Timor-Leste, and Vietnam to Argentina, Brazil, Paraguay, and Uruguay. The fee standards are: $160/20 DRY, and $200/40 DRY and 45HC.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 15th March, the Shanghai Containerized Freight Index fell by 6% to 1772.92.

Europe/Mediterranean:

The freight rate of European freight lines are gradually flatted as the rumble in Red Sea continued.

On 15th March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1971/TEU, which dropped by 7.6%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2977/TEU, which decreased by 5.1%.

North America:

On 15th March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3776/FEU and US$5252/FEU, reporting a 6.5% and 6.3% fall accordingly.

The Persian Gulf and the Red Sea:

On 15th March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 11.8% from last week's posted US$1410/TEU.

Australia/New Zealand:

On 15th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$907/TEU, a 10.7% slide from the previous week.

South America:

On 15th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2530/TEU, an 2.5% slide from the previous week.