Stainless steel 304 just smashes the market last week. Long time no see an upward trend and real demand in the market. Cold-rolled stainless steel 304 increased by US$74/MT to US$2330/MT; inventory in Wuxi was down by 26,129 tons to 443,523 tons. Similar to China's trading performance, which in March exports up 14.8% year-on-year, different from the analytics' prediction. China's Q1 GDP also rose by 4.5% YoY. Markets are getting confident about the future. The shipping industry, meanwhile, keeps on the rising track. Freight rate from Shanghai Port to the US West weekly bounced by 29.1%, to US$1,668/FEU. For more about the market details, please go to our Stainless Steel Market Summary in China below.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,425 | 33 | 1.48% |

| Foshan | 2,470 | 33 | 1.45% | ||

| Hongwang | Wuxi | 2,355 | 42 | 1.92% | |

| Foshan | 2,335 | 36 | 1.68% | ||

| 304/NO.1 | ESS | Wuxi | 2,260 | 39 | 1.84% |

| Foshan | 2,300 | 19 | 0.89% | ||

| 316L/2B | TISCO | Wuxi | 3,985 | -43 | -1.10% |

| Foshan | 4,050 | -55 | -1.46% | ||

| 316L/NO.1 | ESS | Wuxi | 3,795 | -21 | -0.58% |

| Foshan | 3,845 | -56 | -1.48% | ||

| 201J1/2B | Hongwang | Wuxi | 1,515 | -3 | -0.21% |

| Foshan | 1,490 | -7 | -0.48% | ||

| J5/2B | Hongwang | Wuxi | 1,425 | -1 | -0.11% |

| Foshan | 1,420 | -11 | -0.81% | ||

| 430/2B | TISCO | Wuxi | 1,255 | -19 | -1.66% |

| Foshan | 1,245 | -19 | -1.67% |

Trend|| Stainless steel 300 series came back to life after Easter.

The overall price trend of stainless-steel series last week varied differently:

Stainless steel grade 201 stabilized and grade 304 fell after a raise. The mainstream contract price of stainless steel rose US$66/MT to US$2365/MT.

Stainless steel 300 series: promising growth in transaction.

The mainstream price of cold-rolled 4-foot mill-edge stainless steel 304 was quoted US$2330/MT with a US$74/MT growth, and hot-rolled stainless steel quoted US$2290/MT with a US$59/MT raise. The Nickle price was also stabilized.

Stainless steel 200 series: transaction warmed up slightly.

The mainstream price of both cold-rolled stainless steel 201 and 201J2 rose US$7/MT to US$1485/MT and US$1400/MT respectively. The price hot rolled 5-foot stainless steel rose US$15/MT to US$1435/MT.

The spot transaction of stainless steel 201 was reheated last week, following the bullish price trend of grade 304.

Stainless steel 400 series: smooth digestion of inventory might stop the price fall.

The market guidance price of 430/2B of TISCO was quoted US$1415/MT and JISCO quoted US$1495/MT.

Meanwhile, the price of 430/2B in the Wuxi market remained weak at between US1250/MT-US$1255/MT, approximately an US$15/MT drop.

Summary:

The short-term improvement in the market has brought back profits to the steel mills, but the situation of oversupply has not substantially changed. Therefore, the improvement in steel mill profits has made the supply side of the market more inclined to a loose state. The demand, however, it is still lower than expected. The stainless-steel market will continue to maintain a weak state if the demand remains weak.

300 series: Recently, the centralized procurement of raw materials by steel mills has come to an end, and raw materials have stabilized in the short term after continuous declines. Coupled with strong willingness of steel mills to raise prices, the market's pessimistic sentiment has improved. The increase in transactions has driven the rapid decrease of market inventories, and it is expected that the short-term price of stainless steel will run strong above US$2330/MT.

200 series: Currently, with the reduction of production by steel mills and discounted contract volume, the inventory of 200 series in the Wuxi market has shown continuous inventory reduction for four weeks. It is understood that the planned output of domestic stainless steel 200 series crude steel in April will continue to decline. Currently, downstream demand is slowly recovering, and market transactions are seen to be heating up. It is expected that the price of 201 will be stable and slightly strong, with 201J2/J5 cold-rolled base oscillating in the range of US$1385/MT-US$1415/MT.

400 series: Last week, the mainstream ex-factory price of high-chromium remained weak and stable, and the spot price of chromium ore remained stable, with the spot price of the concentrated ore (40%~42%) from South Africa remaining at US$8/MT. The mainstream offer of 430/2B in the Wuxi market remained weak and stable at US$1250/MT-US$1255/MT, a decrease of US$15/MT from the end of last week. The inventory of 400 series stainless steel in the Wuxi market has decreased significantly. Last week, the market transactions have slightly improved. With the increase in downstream demand in the later period, it is expected that the weak state of 430/2B prices will improve next week, and the price trend will be mainly stable.

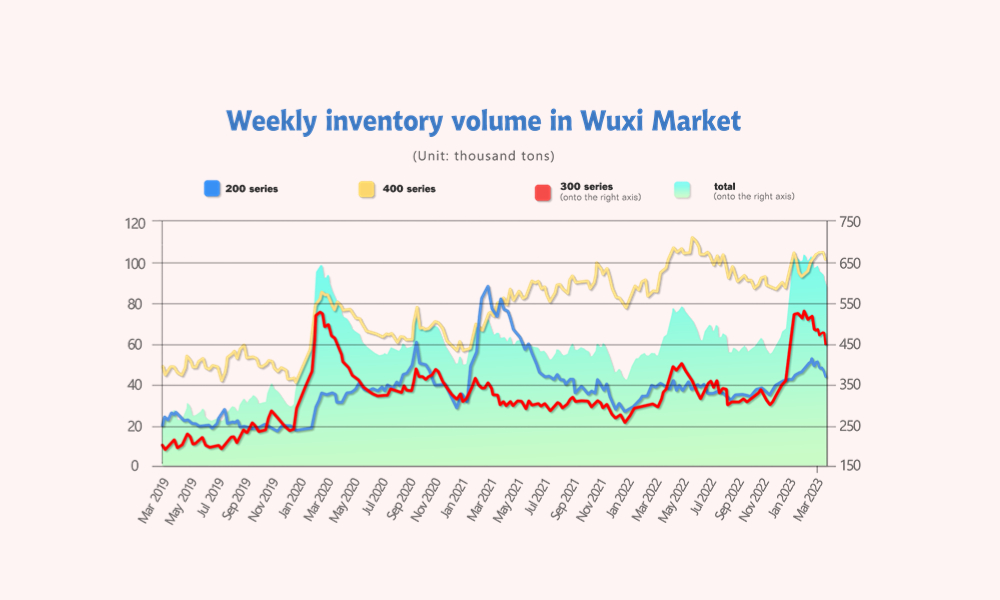

Inventyory|| 30,000 tons reduction in inventory

The inventory level at the Wuxi sample warehouse fell by 32,486 tons to 587,419 tons (as of 13th March).

the breakdown is as followed:

200 series: 3,290 tons down to 43,360 tons

300 Series: 26,129 tons down to 443,523 tons

400 series: 3,067 tons down to 100,536 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| April 7th | 46,650 | 469,652 | 103,640 | 619,905 |

| April 13th | 43,360 | 443,523 | 100,536 | 587,419 |

| Difference | -3,290 | -26,129 | -3,067 | -8,780 |

Stainless steel 300 series: inventory loss 5 times greater the previous week

The significant drop in the inventory reflected the bullish market last week, it was believed that mainly owe to the shorten supply and production cut of cold-rolled stainless-steel resources.

Stainless steel 200 Series: Increased transactions and inventory reduction for four consecutive weeks

With recent maintenance and production cuts in steel mills, coupled with some steel mills offering discounts on their agreements, the current inventory of 200 series stainless steel in the Wuxi market has been reduced for four consecutive weeks. On the one hand, the reduction in production and agreement volumes of 200 series in steel mills in April has resulted in a continuous decline in spot inventory. Currently, there are still some specifications of stainless steel 201J2/J5 cold-rolled that have tight inventory. On the other hand, last week, downstream procurement has entered the market to supplement inventory as a result of the price increase of 304, and the spot transaction has seen some improvement. Additionally, with the narrowed arrival of steel mills last week, the spot inventory has reduced.

Stainless steel 400 Series: Prices continue to fall slightly, and inventory reduction accelerates!

The spot inventory of 400 series stainless steel in the Wuxi region is rapidly decreasing, with a reduction of 0.31 million tons from the previous week to 1.05 million tons, but still at a relatively high level. Demand for 400 series stainless steel in the market has slightly improved last week, with the recent stability of high-carbon chromium-iron raw material prices, the weak trend has significantly improved. As the market demand gradually improves, the inventory reduction is expected to continue to increase.

Raw material|| Weak performance in raw material

Nickel: The price trend of nickel and stainless-steel future went for different direction.

The mainstream contract price of ShFE nickel fell by US$196/MT to US$26,430/MT, while stainless steel future price rose US$15/MT to US$2295/MT. The steel mills still suffering losses despite of the price rebound of ferronickel.

Last week, nickel ore prices fell slightly, and other materials fluctuated slightly. The cost of nickel-iron stabilized, and the price of nickel-iron rose. However, steel mills are still suffering from severe losses. At the beginning of last week, domestic steel mills maintained their purchase of high nickel-iron at around US$260/nickel, but with the strong rise in stainless steel prices and the recovery of steel mill profits, the pressure to purchase raw materials at a lower price weakened, and the purchase price of high nickel-iron was raised to around US$270/nickel. Although iron mills have reduced production to cope with losses, the low-cost nickel-iron from Indonesia continues to fill up the domestic market, and the supply of nickel-iron in China remains in surplus. It is expected that nickel-iron prices will rebound slightly in the short term, but the upside is limited.

Chrome: High chromium fell significantly

In April, TISCO and Baosteel Desheng's high-carbon chromium iron bidding purchase prices were successively determined. The overall bidding price of mainstream high-chromium steel in April was mainly based on a sharp drop of US$88/MT(50% chromium)

Affected by the sharp drop in steel bidding prices, the retail market price of high-chromium fell to US1385-US$1415/MT(50% chromium) in April and then stabilized. According to recent industry feedback, due to the sustained stabilization of spot prices of domestic chromium ore, the cost of high-chromium production enterprises remains high and difficult to reduce, and the downward pressure on high-chromium prices is hindered. Due to losses, more high-chromium factories have reduced or stopped production in April, and market supply has decreased. In the short term, the high-chromium price will remain stable. However, the most worrying thing in the domestic market at present is the impact of low-priced imported chromium iron.

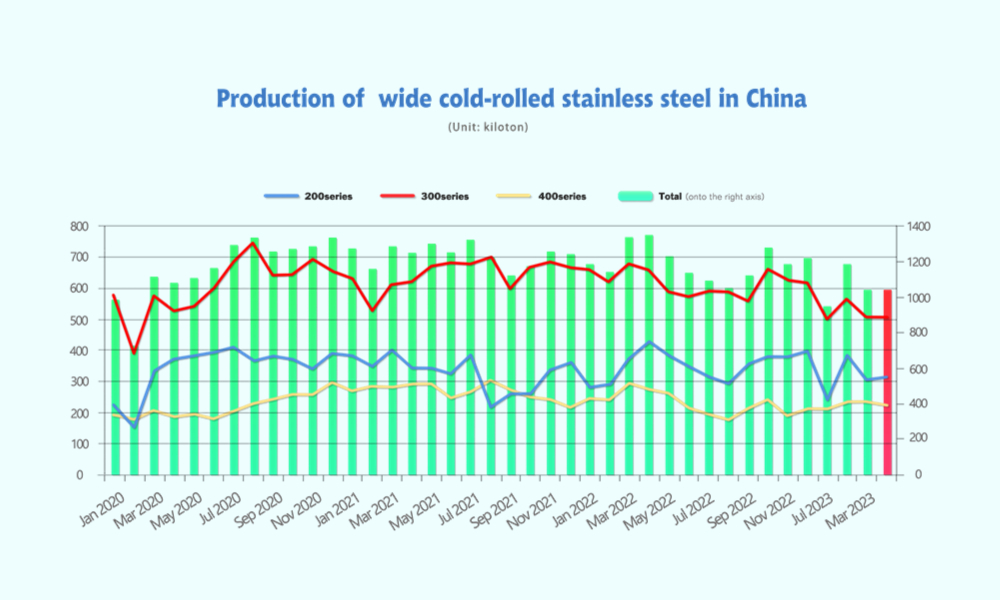

Production||Cold-rolled stainless steel shrank by 140,000 tons

The production of crude stainless steel in March recorded 1,034,100 tons, 12.15% less than February, about 22.4% drop compared to the same period last year.

Here is the breakdown:

Series 200:

Production: 300,000 tons, 21.61% tons less than February, 18.77% less than the same period last year.

Series 300:

Production: 502,000 tons, 10.79% tons less than February, 25.33% less than the same period last year.

Series 400:

Production: 232,100 tons, 0.14% tons more than February, 20.25% less than the same period last year.

In April 2023, the planned production volume of wide cold-rolled steel by China steel mills (large scale) is 1.035 million tons, an increase of 0.08% compared to the previous month, and a decrease of 23.19% year-on-year.

The break down as followed:

Here is the breakdown:

Series 200:

Production: 311,000 tons, 3.67% tons more than February, 26.49% less than the same period last year.

Series 300:

Production: 502,500 tons, 0.1% tons more than February, 22.88% less than the same period last year.

Series 400:

Production: 221,500 tons, 4.58% tons less than February, 18.79% less than the same period last year.

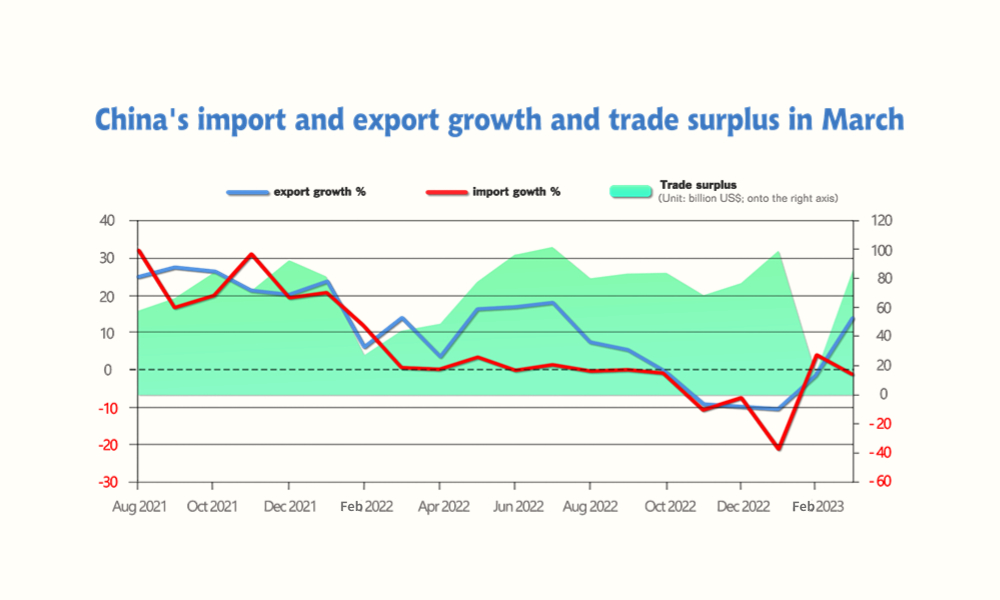

MACRO||China's March exports up 14.8% year-on-year

According to the National Bureau of Statistics of China, The GDP in the first quarter was 28,499.7 billion yuan, calculated at constant prices, a year-on-year increase of 4.5%, and a quarter-on-quarter increase of 2.2% from the fourth quarter of the previous year. In terms of industries, the added value of the primary industry was 1,157.5 billion yuan, a year-on-year increase of 3.7%; the added value of the secondary industry was 1,0794.7 billion yuan, an increase of 3.3%; the added value of the tertiary industry was 16,547.5 billion yuan, an increase of 5.4%.

On Thursday, April 13, the General Administration of Customs released data showing that China’s total import and export value was US$542.99 billion in March this year, a year-on-year increase of 7.4% and a month-on-month increase of 32%.

Among them, exports were US$315.59 billion, a year-on-year increase of 14.8%, which was better than the estimated decrease of 7.1%; imports were US$227.4 billion, a year-on-year decrease of 1.4%, which was better than the estimated decrease of 6.4%; the trade surplus was US$88.19 billion, which was expected to be US$40 billion.

In the first quarter of this year, the total value of China's foreign trade imports and exports was 1.44 trillion US dollars, a year-on-year decrease of 2.9%, of which exports were 821.83 billion US dollars, a year-on-year increase of 0.5%; imports were 204.71 billion US dollars, a year-on-year decrease of 7.1%.

Imports of energy products, consumer goods, etc. increased

In the first quarter, China's crude oil, natural gas, coal and other energy products imported a total of 758.72 billion yuan, a year-on-year increase of 9.1%, accounting for 17.9% of the total import value. During the same period, imported consumer goods were 478.74 billion yuan, an increase of 6.9%.

Among them, the exports of refined oil and steel products increased by 59.8% and 53.2% respectively.

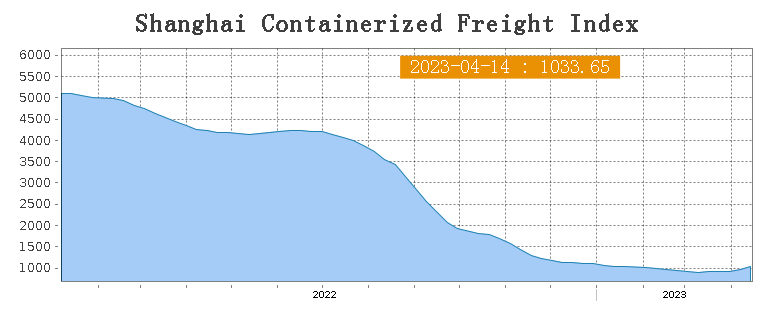

Sea Freight|| Freight rate rose for most routes.

Freight rates overall on multiple sea routes continued to increase last week. The export volume recorded a 14.8% growth according to China Custom. On 14th April, the Shanghai Containerized Freight Index rose by 8% to 1033.65.

Europe/ Mediterranean:

The consumption in Eurozone continued to decelerate, the latest statistics indicated, economy still need a extra push to recover.

Last week, transportation demand remained flat. Until 14th April, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$871/TEU, fell by 0.7%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1618/TEU, which fell by 0.2%.

North America:

The consumer price index, a key gauge of inflation, rose by 5% in March relative to 12 months earlier, the U.S. Bureau of Labor Statistics said Wednesday. And it was 2% higher than what policymakers aim for earlier.

Until 14th April, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,668/FEU and US$2,565/FEU, 29.1% and 19.5% growth accordingly.

The Persian Gulf and the Red Sea:

Until 14th April, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 16.3% rose from last week's posted US$1040/TEU, despite of the tradition festival- Ramadan.

Australia/ New Zealand:

Until 14th April, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$255/TEU, which fell by 4.5% from the previous week.

South America:

The freight market had a significant rebound. on 31st March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2005/TEU, an 10.3% rose from the previous week.