Closing to holiday, it doesn't seem that the market is preparing for a rest. We are still open to you and you are welcome to have a chat or ask for a quotation but the products will be shipped out when we finish the Chinese New Year holiday. The market last week was stable and showed an increasing tendency. Until today (January 12th), the market of stainless steel 304 and 201 was once closed because the prices increased. With the Beijing Wither Olympics approaching, it is widely believed that Beijing will take stricter actions to control the production of high-polluted factories. Steel mills and other raw materials factories are in the red list. If you want to know more about the Stainless Steel Market Summary in China, please keep reading.

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,010 |

17 |

0.60% |

|

Foshan |

3,060 |

17 |

0.59% |

||

|

Hongwang |

Wuxi |

2,910 |

33 |

1.22% |

|

|

Foshan |

2,875 |

43 |

1.59% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,885 |

37 |

1.35% |

|

Foshan |

2,860 |

27 |

1.00% |

||

|

316L/2B |

TISCO |

Wuxi |

4,355 |

12 |

0.28% |

|

Foshan |

4,385 |

12 |

0.28% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,205 |

16 |

0.40% |

|

Foshan |

4,255 |

14 |

0.35% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,845 |

- |

- |

|

Foshan |

1,820 |

2 |

0.12% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,750 |

- |

- |

|

Foshan |

1,735 |

7 |

1.43% |

||

|

430/2B |

TISCO |

Wuxi |

1,570 |

- |

- |

|

Foshan |

1,570 |

8 |

0.53% |

TREND|| More new products shipped to the market while transaction weakened.

Last week, the prices of stainless steel tended to decrease at first, but with the steel mills opening new prices and increasing the delivery prices, the trading warmed up and the spot prices increased as well. Until January 7th, the contract prices of stainless steel futures declined by US$35/MT, to US$2,820/MT. The price difference between spot and futures increased to US$120/MT.

300 series of stainless steel: The inventory in Wuxi market starts to stack up.

Earlier last week, the stainless steel prices remained the increasing trend as before. Prices of cold and hot rolled stainless steel increased slightly. But the transaction failed to keep up with the prices. Until Friday (January 7th), the base price of stainless steel 304 in Wuxi market rose by US$32/MT compared to the last week’s average price, increasing to US$2,870/MT; the price of hot-rolled stainless steel also increased by US$32/MT, to US$2,885/MT. Although more products were sent to the market, the shortage of some specifications of hot-rolled stainless steel remained. The futures prices fell. Influenced by the expectation of the Fed’s tighter fiscal policy, the ferrous stock prices decreased.

From the perspective of cost, the EXW price of high nickel-iron rose by US$2/nickel compared to two weeks ago, to US$213/nickel. As for the ferrochrome, the price decreased by US$48/50 base tons to US$1,270/50 base tons. With the decreasing raw material prices, the theoretical production cost of the cold-rolled stainless steel 304 also moved down to US$2,667/MT. Thanks to the rising spot prices, the metallurgy production method make much profit. The profit per metric ton rose to US$63/MT.

200 series of stainless steel: Hot-rolled prices rose, but cold-rolled prices decreased.

Last week, the price of stainless steel 201 maintained stable. Influenced by the increasing price of hot-rolled stainless steel 304, the price of hot-rolled stainless steel 201 grew as well, about US$15/MT higher. As for the cold-rolled stainless steel, the prices remained, but due to the light trading, some merchants reduced the price by US$8~US$16/MT.

Generally, the transaction of stainless steel 201 became weaker during last week. However, most people still hold a positive attitude because they have foreseen the weak demand before the holiday.

400 series of stainless steel: Trading went light and prices remained.

The supply of high chrome is rich though the production is decreasing recently due to the industrial improvement in Inner Mongolia. Besides, some high chrome factories in other regions also reduce production because of the profit deficit.

Summary:

The main contract of stainless steel futures once grew to US$2,915/MT, but it soon fell to US$2,790/MT because the tension of inventory shortage was eased. Generally, bearish factors will continue to affect stainless steel prices.

First, a large number of stainless steel warehouse receipts have been registered after the holiday, and the inventory warehouse receipts reached 24,000 tons, which has completely met the demand for contract delivery in January, and thereby the short squeeze risk in futures is largely reduced.

Second, steel mills opened many far month futures to stimulate demand and maintain the prices high. Steel mills laid much control in the delivery of the product. The market was stuck in inventory shortage and the social inventory kept reducing while the inventory of steel mills was high. With the Spring Festival approaching, the logistic industry will gradually begin their days off and steel mills will send more inventories to the market, which will bring down the stainless steel prices.

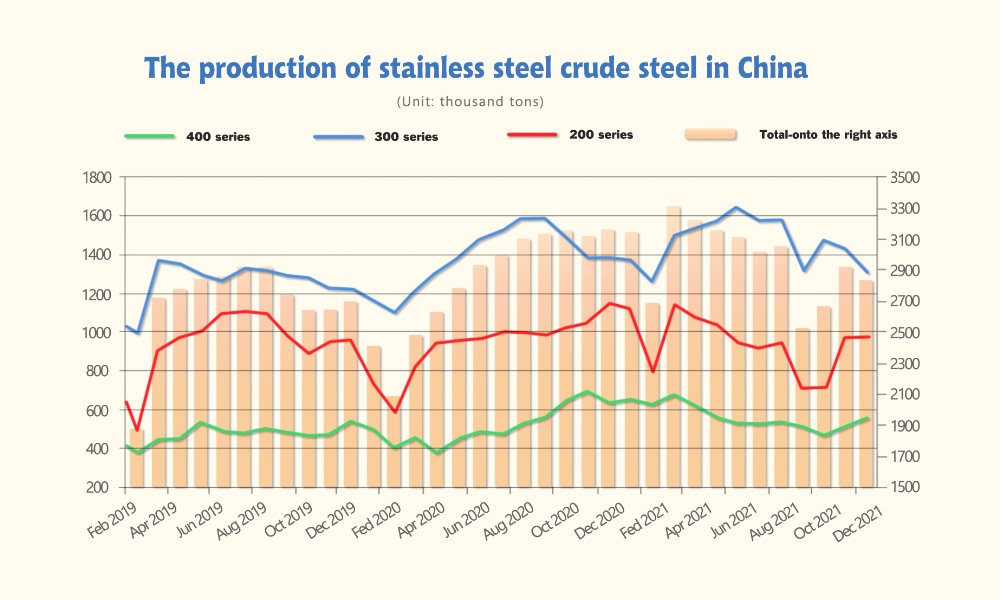

Third, the major reason is that the industry is now in slack season. Steel mills carry out the maintenance plan at the end of a year, so the production of stainless steel 300 series reduced slightly. However, stainless steel production in Indonesia remains high. Compared to the same period of last year, the monthly production of December is double of last year. The monthly supply is more than 200,000 tons, which is too much for Indonesian demand. Most of the materials are exported to China. In a short term, the decline of domestic supply won’t affect the market.

Policy|| Close to the Winter Olympics, production controls are getting stricter.

Influenced by the environmental protection actions, the largest high carbon ferrochrome producer in Yuncheng, Shanxi province has to stop producing. The average production of the factory is about 30,000 tons monthly. Because of the Winter Olympics, Beijing focuses much on environmental regulations. So far, Beijing has not announced any document, but the local measures against air pollution are taken already.

According to the latest requirement of the Yuncheng government, during the red sign warning period, the high-polluted factories must reduce production. Enterprises in the list, many of the are steel and high carbon ferrochrome factories.

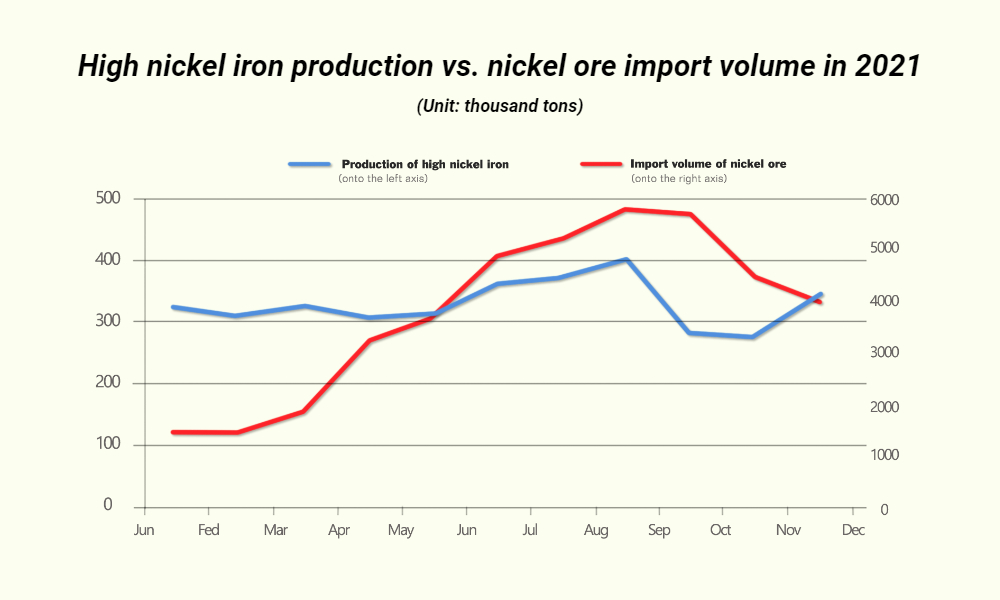

RAW MATERIAL|| The supply of nickel ore cuts down by over 30%, but the price drops.

The price of high nickel-iron keeps increasing in recent days due to the former increase of stainless steel prices. Since late December, the EXW price of high nickel-iron increased by US$11/nickel to US$213/nickel. However, the price of ferronickel does not increase as it used to be. It is even more strange that the market prices were not stimulated though less supply of nickel ore imported from The Philippines due to the rainy season.

During the rainy season, since September of 2021, the import volume of The Philippines nickel ore continues to decrease till November. In August, the import volume was 5,777,100 tons but in November, it reduced to 4,007,700 tons, cutting down by 30.63%. However, either the price of nickel ore or ferronickel did not increase as it should.

According to customs statistics, from January to November 2021, China imported 41,614,600 tons of nickel ore, increasing by 5,684,200 tons which is 15.82% over the same period in 2020; of which 37,507,900 tons of nickel ore were imported from the Philippines, compared with last year in the same period, it increased by 8,016,100 tons, 27.18% higher.

However, China’s production of ferronickel has dropped sharply, especially in September and October, the output of high-nickel iron YoY dropped by 162,100 tons. Besides, China’s nickel ore demand was also far lower than the large import volume. In 2021, the supply of nickel ore was rich in China, even in the third quarter during the rainy season in the Philippines. Chinese manufacturers stocked up in case of the shortage of nickel ore in the fourth quarter. In a word, the weak demand and large inventory both contributed to the low price of nickel ore.

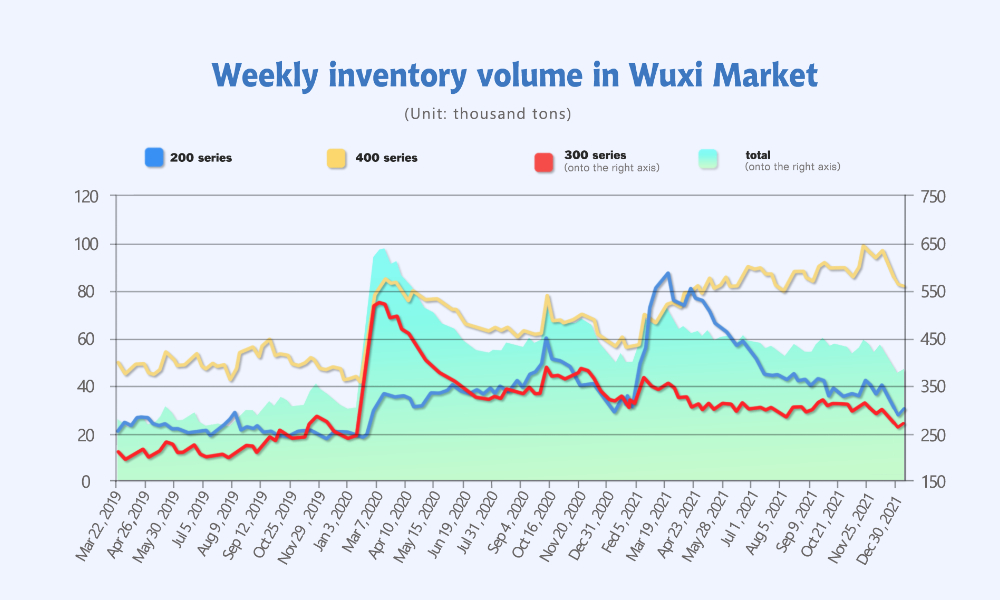

INVENTORY|| Inventory stops decreasing.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| January 3rd ~ January 7th | 30.8 | 272.1 | 82.4 | 385.3 |

| December 27th ~ December 31st | 28.1 | 266.9 | 83.2 | 378.2 |

| Difference | 2.7 | 5.2 | -0.8 | 7.1 |

Last week, the total volume of the Wuxi sample warehouse increases by 7,100 tons, to 395,300 tons. 200 series inventory rises by 2,700 tons, to 30,800 tons; 300 series increases by 5,200 tons, to 272,100 tons; 400 series decreases by 800 tons to 82,400 tons.

200 series of stainless steel: The output did not reduce in December when the sic steel mills reduce production.

Early December, the prices of stainless steel 200 series were low and steel mills started to reduce the production, mostly saying that in the first quarter of 2022 the supply of 200 series will be cut down by 30%~60%. Some steel mills started the maintenance earlier, which also reduced the production of 200 series.

When some steel mills like Beigang New Materials and Desheng stopped milling, some other steel mills in southern China expanded the production of stainless steel 200 series. Therefore, in December, the crude steel output of 200 series maintains as November, only 400 tons lower than November.

But in January, many steel mills in southern China ceased the high furnaces, so the production will keep decreasing. It is predicted that in January, the flat products of the 200 series will decline by 15,000 tons compared to last month.

The transaction last week was tepid. The holiday of Spring Festival is approaching, the demand will go weaker. Last week, steel mills increased the new arrivals volume to the market, such as Ansteel LISCO and Baosteel Desheng, which stopped the reducing trend of inventory in the past three weeks.

300 series of stainless steel: Profit drops and the monthly output hits the bottom in 2021.

In December, the output of the stainless steel 300 series was 1,310,700 tons, decreasing by 124,600 tons from the previous month. Among them, the crude steel output of wide plate MoM decreased by 92,600 tons to 936,000 tons. In December, the monthly profit per ton of steel hit a new low in 2021, and the output of the 300 series also hit a low record.

The inventory of the stainless steel 300 series also increased after the three-week drop. During the new year holiday from January 1st to January 3rd, Tsingshan sent cold-rolled and hot-rolled products to the market and keeps delivering until now. As we mentioned above in the article, Tsingshan increased the opening price and the market prices keep increasing. However, the buyers are more cautious now, so the transaction started to decline last Wednesday and Thursday.

What’s more, because Delong adjusts the transportation from land to sea, which reduces the number of products sent to Wuxi. It also leads to backlogs in the steel mill’s inventory for now.

400 series of stainless steel: Lower pressure on the inventory backlog.

Different from 200 series and 300 series, the inventory of 400 series decreases because steel mills reduced delivery. So far, the price of 400 series has remained at US$1,555/MT for a long time and the inventory volume stays high. No wonder, TISCO and JISCO reduced the production of 400 series in December.