Facing the tepid demand and slack market, steel mills had pushed the raw material prices to drop to maintain their profit. But it makes the stainless steel prices even lose support price because the raw material prices also decreased. Two weeks ago, some steel mills set the lowest price to resist the prices to go any lower. It didn't work. At the end of the day, the root of the decrease is the insufficient demand in China. Last week, the sea freight from Shanghai to South America increased the most, by 5.8% to US$7,632/TEU. Besides, the US interest rate hike will cool down the commodity market but some opinions questioned that this might lead to a recession because the market have already gone down. More about stainless steel prices and the tendency, as well as other news related to your business, keep reading the Stainless Steel Market Summary in China for last week.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,070 |

-68 |

-2.26% |

|

Foshan |

3,115 |

-68 |

-2.23% |

||

|

Hongwang |

Wuxi |

2,930 |

-109 |

-3.74% |

|

|

Foshan |

2,925 |

-100 |

-3.45% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,875 |

-103 |

-3.61% |

|

Foshan |

2,915 |

-88 |

-3.06% |

||

|

316L/2B |

TISCO |

Wuxi |

4,690 |

-77 |

-1.67% |

|

Foshan |

4,725 |

-63 |

-1.37% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,370 |

-85 |

-1.96% |

|

Foshan |

4,410 |

-94 |

-2.15% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,620 |

-35 |

-2.27% |

|

Foshan |

1,610 |

-27 |

-1.80% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,505 |

-42 |

-2.96% |

|

Foshan |

1,510 |

-33 |

-2.34% |

||

|

430/2B |

TISCO |

Wuxi |

1,490 |

-42 |

-3.00% |

|

Foshan |

1,490 |

-23 |

-4.63% |

Trend|| All grades of stainless steel prices dropped. The futures price is way higher than the spot price.

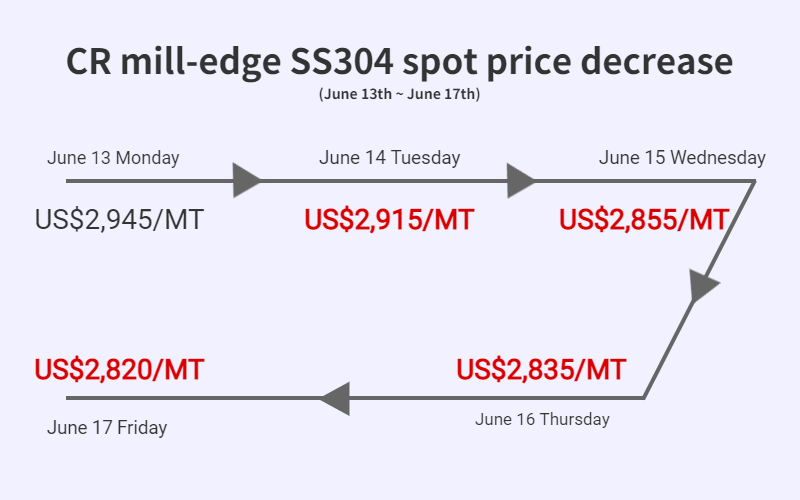

From June 13th to June 17th, the spot and futures prices of stainless steel slumped and transactions remained weak. Until June 17th, the most-traded contract of stainless steel futures decreased to US$2,785/MT which was US$182/MT lower compared to the price on June 10th.

300 series of stainless steel: Production costs were reduced, and stainless steel prices dropped significantly.

Last week, the spot price of stainless steel 304 continued to decrease. Until June 17th, the cold-rolled stainless steel 304 by the private-owned mills in Wuxi was cut down by US$136/MT to US$2,835/MT. The price of hot-rolled stainless steel 304 by the private-owned mills was US$2,850/MT which was US$106/MT lower than the price on June 10th. The price has kept declining. To maintain the cash flow, steel mills reduce the stainless steel prices to stimulate sales. However, the transaction remained weak.

The price of high-graded ferronickel decreased by US$11/Ni last week, to US$1,405/MT and the price of ferrochromium remained at US$1,405/MT (with 50% of chromium content). Therefore, the theoretical production cost of the cold-rolled stainless steel 304 was down by US$103/MT.

DROPS of last week

The price of spot CR stainless steel 304 kept decreasing, which has dropped below the price of the hot-rolled product. The hot-rolled stainless steel 304 remained at around US$2,850/MT since June 15th. Meanwhile, the stainless steel spot price also fell lower than the futures price on June 17th when Tsingshan gave an opening price of futures of cold-rolled stainless steel 304 for July which was above US$2,900/MT.

200 series of stainless steel: The transaction and prices kept going down.

Similar to the decrease of stainless steel 304, the spot of 201 dropped every day last week and the transaction weakened. The cold-rolled 201J2 and J5 dropped below US$1,480/MT and the price of cold-rolled stainless steel 201J1 also dropped, which was the same price as the hot-rolled price. Until June 17th, the base price of the cold-rolled mill-edge stainless steel 201 decreased by US$53/MT to US$1,565/MT; as for the SS201J2 and J5, it declined by US$60/MT to US$1,450/MT; and the price of the 5-foot hot-rolled stainless steel 201 has reduced by US$170/MT to US$1,575/MT.

The transaction of stainless steel 201 was weak last week. The spot price has decreased for consecutive 4 days. Chinese domestic demand remains gloomy. Most of the traders said that their sales volume of stainless steel 201 decreased by 60%. The market has stuck in a cold sentiment, and people mostly hold a pessimistic attitude toward the future market.

400 series of stainless steel: Demand remains weak and the inventory keeps increasing.

The cold-rolled stainless steel 430 continued to drop last week. On June 16th, the cold-rolled stainless steel 430 in Wuxi was US$1,475/MT which decreased by US$45/MT compared to the price on June 9th. The domestic supply for high chromium was reduced because the factories cut down the production due to the high cost. Recently, the import of chromium ore and ferrochromium reduces and the import volume of ferrochromium decreased slightly and the Chinese domestic high chromium supply in June will decrease.

Summary:

300 series of stainless steel: The price of ferronickel has fluctuated to drop, which keeps knocking down the price of stainless steel 304. Fed raised the benchmark interest rate by 75 basis points to 1.50%-1.75%, and the prices of stainless steel futures and spot both fell. The profit for steel mills is low, which strikes down their productivity and output. The social inventory of stainless steel has been reduced for consecutive 3 weeks and the price of the warehouse receipt is low, which provides some possibilities for the stainless steel prices to rise.

200 series of stainless steel: So far, the spot of stainless steel 201 remains weak. Steel mills failed to raise the price by setting the lowest price last week. The future market is expected to be gloomy due to the tepid demand, but since the production cost is stable, the decline in price will start to slow down, It is predicted that the price of stainless steel 201 will remain fluctuating, and the cold-rolled stainless steel 201J2 will stay above US$1,450/MT (Coil).

400 series of stainless steel: JISCO and TISCO have reduced the price of stainless steel 430/2B to US$1,460/MT ~ US$1,465/MT which sharply dropped by US$60/MT from the price on June 10th. Even in the market, there were deals traded at around US$1,590/MT. From the perspective of production cost, the bidding price of the high chromium of JISCO and TISCO remained while the price of coke increased. The cost increased generally, but the oversupply is still the essential problem. In the short future, sellers tend to release the inventory and thus the price of SS430/2B will remain weak, and stay above US$1,435/MT.

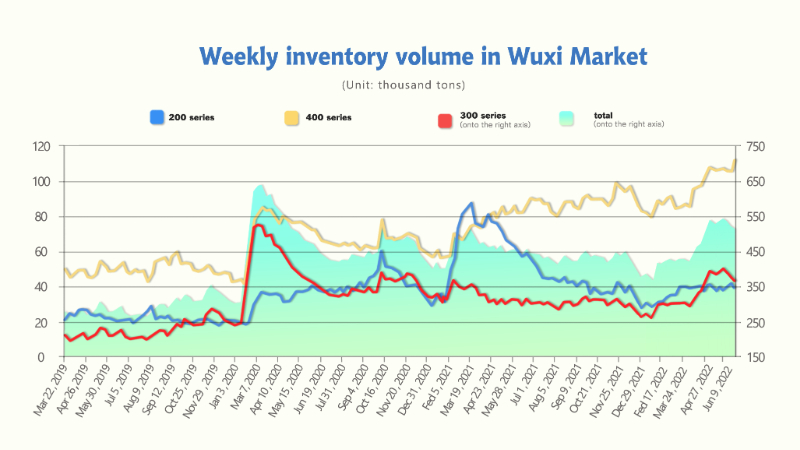

INVENTORY|| Under the weak transaction, the inventory continues to drop.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| June 9th | 40,821 | 372,726 | 104,668 | 518,215 |

| June 16th | 37,720 | 358,337 | 111,743 | 507,800 |

| Difference | -3,101 | -14,389 | 7,075 | -10,415 |

Last week, the inventory volume in the Wuxi sample warehouse continued to decrease by 10,600 tons to 507,700 tons. 200 series inventory decreased by 3,200 tons, to 37,700 tons; 300 series decreased by 14,400 tons, to 358,300 tons; 400 series increases by 7,000 tons to 111,700 tons.

200 series of stainless steel: Steel mills reduce delivery volume.

The inventory slightly decreased by 3,200 tons to 37,700 tons and the cold-rolled resources decreased the most. Baosteel Desheng remains the biggest supplier while other steel mills reduce the output to the market.

300 series of stainless steel: Steel mills reduce the prices to enlarge their cash flow.

The inventory of the stainless steel 300 series decreased greatly. Delong is facing a financial problem. To enlarge the cash flow, Delong kept reducing the opening price which was lower than the average market price. As the inventory remains high and demand is low, some steel mills reduce the delivery volume, and Delong reduces the inventory to one cargo ship a week. A new annealing and pickling line of Liyang Delong has begun on June 18th. It is expected that the hot-rolled resource supply will increase in East China.

According to Shanghai Futures Exchange, until June 15th, the stainless steel warehouse receipt decreased by 4,192 tons to 15,180 tons which is the new low in the recent 5 months. On April 8th, the inventory peaked at over 80,000 tons.

400 series of stainless steel: Delivery reduces, and the transaction is bland.

JISCO continues the overhaul. LISCO and TISCO cut down the production of 400 series in May, which affects the supply now. However, the trade has been bland, the inventory remains large and last week it increased by 7,000 tons compared to a week ago, reaching 111,700 tons.

FREIGHT|| Sea freight continues to increase from Shanghai to South America, rising by 5.8%.

The SCFI on June 17th decreased by 11.35% compared to 4233.31 on June 10th, lowering to 4221.96.

North America: From June 13th June 17th, the average space utilization rate of ships in the USWC and USEC routes of Shanghai Port is basically close to the full load level. On June 17, the freight rates (sea shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$7,489/FEU and US$10,073/FEU, respectively, down by 1.8% and 0.2% from the previous week.

Persian Gulf and Red Sea: The freight rates continued to rise. On June 17, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$3,417/TEU, increasing by 4.6% from the previous week.

Australia/ New Zealand: The demand for transportation of various living materials remained high. Last week, the average space utilization rate of ships in Shanghai Port was basically at full load level, and the spot market booking price was generally stable. On June 17, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$3,402/TEU, which was basically the same as the previous period.

South America: South America is struggling with the COVID-19. It is highly dependent on the import of various living materials and medical supplies. Last week, the average space utilization rate of ships in Shanghai Port was above 95%. On June 17, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$7,632/TEU, rising by 5.8% from the previous week.

MACRO|| Fed raises interest rate by 0.75%, cooling down the inflation or risking recession?

The U.S. inflation rate reached 8.6% in May, a 40-year high, and the U.S. is facing the worst inflation in the past 40 years.

On June 16, the Fed raised its benchmark interest rate by 75 basis points to a range of 1.50%-1.75%, the largest rate hike since 1994. After the news was released, the offshore CNY soared sharply, once exceeding 800 basis points last week, rising to a maximum of 6.6663, the largest increase since 2017. On the same day, the central parity rate of the CNY against the U.S. dollar was reported at 6.7099, rising by 419 basis points, and the onshore CNY against the U.S. dollar exchange rate closed at 6.7162 yuan at 16:30. In the meantime, influenced by the Fed rate hike, both Chinese stainless steel futures and spot dropped in price.

Worry has it that the aggressive rate hikes may effectively curb inflation, but the economy may suffer a recession, and strongly dampen the global commodity demand. While inflation is rising, the economy has already slowed down. The inflation is likely to continue higher due to the East Europe turbulence. Inflationary pressures and a pullback in demand have weighed on the pace of manufacturing expansion, while the housing market has cooled rapidly and consumer confidence has eroded, meaning the momentum of the U.S. economy has begun to slow.

Will the Ocean Shipping Reform Act of 2022 address US supply chain disruption?

Another important act that Biden tries to curb inflation is the pass of the Ocean Shipping Reform Act of 2022, signed on June 16th. It marks the first reform in the ocean shipping industry in 24 years in the US.

What leads to reform?

“In my State of the Union address, I called on Congress to address ocean carriers’ high prices and unfair practices because rising ocean shipping costs are a major contributing factor to increased costs for American families. During the pandemic, ocean carriers increased their prices by as much as 1,000%. And, too often, these ocean carriers are refusing to take American exports back to Asia, leaving with empty containers instead. That’s costing farmers and ranchers—and our economy—a lot of money. ” said a statement by the World Shipping Council (WSC) responding to these comments by the POTUS. WSC is the united voice of international liner shipping with many international shipping lines as members.

Because of the COVID-19, many ports in the world have been stuck in quarantine and low efficiency. The US has an increasing demand for e-commerce and imports, typically from Asia, and its ports have faced serious congestion, particularly, the West Coast ports, bearing the brunt with up to 100+ ships waiting outside the ports of Los Angeles and Long Beach for a berth to offload the goods.

Liner companies face tougher regulation in U.S. after the bill signed

Not long ago, FMC released the final report of its investigation into the impact of the new crown pneumonia epidemic on the US supply chain. Among them, the issue of "liner companies monopolizing the market and charging indiscriminately" is the focus of attention.

The bill aims to ease the current bottlenecks in the U.S. maritime supply chain, while meeting the import and export needs of the country’s companies, reducing the shipping cost that is eventually transferred to the end-customers.

The Maritime Reform Act adds the following new provisions to carriers and terminal operators, including:

(A) Expands safeguards to combat retaliation and deter unfair business practices;

(B) Clarifies prohibited carrier practices pertaining to detention and demurrage charges and vessel space accommodation;

(C) Establishes a shipping exchange registry through the FMC;

(D) Expands penalty authority to include refund of charges;

(E) Increases efficiency of the detention and demurrage complaint process.

With the legislation, the U.S. wants to ensure that liner companies no longer ship empty containers directly back to Asia, but instead prioritize shipping U.S. exports.

However, WSC believes that the supply chain bottlenecks that the United States is currently facing should not be solely the responsibility of carriers.

A survey report mentioned that although high freight rates helped liner companies gain immense profit, the abnormal strong consumer demand in the United States and the supply chain congestion caused by the pandemic were the reasons for the surge in freight rates, not because of a lack of competition in the container shipping market.