Chinese stainless steel prices remain the decreasing tendency, while the sea freight has been rising in the past four weeks. It is such a dillemma to decide when to purchase from China. More about Stainless Steel Market Summary in China, just keep reading.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,120 |

-22 |

-0.72% |

|

Foshan |

3,165 |

-22 |

-0.71% |

||

|

Hongwang |

Wuxi |

3,025 |

-24 |

-0.82% |

|

|

Foshan |

3,010 |

-17 |

-0.57% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,960 |

-20 |

-0.69% |

|

Foshan |

2,985 |

-26 |

-0.89% |

||

|

316L/2B |

TISCO |

Wuxi |

4,735 |

-51 |

-1.10% |

|

Foshan |

4,760 |

-49 |

-1.05% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,430 |

-65 |

-1.49% |

|

Foshan |

4,475 |

-65 |

-1.49% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,645 |

-3 |

-0.22% |

|

Foshan |

1,625 |

3 |

0.20% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,540 |

13 |

0.93% |

|

Foshan |

1,535 |

3 |

0.24% |

||

|

430/2B |

TISCO |

Wuxi |

1,525 |

-11 |

-0.74% |

|

Foshan |

1,505 |

-4 |

-0.27% |

Trend|| Futures prices rose while spot prices decreased.

From June 6th to 10th, all grades of stainless steel spots were fluctuating and reduced generally. The stainless steel futures increased slightly. Until June 10th, the most-trader contract of stainless steel futures increased by US$41/MT compared to the price of June 3rd, reaching US$2,950/MT. But the stainless steel spot price continued to drop as steel mills triggered the sell-off. The base price of cold-rolled stainless steel 304 by the private-owned mills decreased by US$30/MT, to US$2,955/MT. The price difference between futures and spots narrowed to US$75/MT.

300 series of stainless steel: Spot prices of cold roll and hot roll continued to reduce.

Though the futures price has risen, once peaking at US$2,975/MT, the spot prices were weak. Steel mills wanted to get their bankroll back by reducing the selling prices. The cost kept decreasing, and so did the trading prices. Until June 10th, the base price of the cold-rolled stainless steel 304 by the private-owned mills declined by US$30/MT to US$2,955/MT compared to the last weekly price. As for the hot-rolled stainless steel 304 by the private-owned mills, the price also dropped by US$30/MT, to US$2,940/MT. The spot prices remained steady earlier in the week, and meanwhile, the futures prices climbed up. The transaction was heated up for a while before the spot prices turned to decrease. Later last week, the spot prices slightly reduce, and buyers were back to wait and see.

After the Dragon Boat Festival in May, the price of high-nickel iron kept decreasing. Thereby, the theoretical production cost of the cold-rolled stainless steel 304 was reduced by US$47/MT.

200 series of stainless steel: Steel mills reunited to stop the prices from dropping.

Last week, the spot price of stainless steel 201 in Wuxi increased firstly because two steel giants, Tsingshan and Beigang New Materials united to prop up the prices by setting the lowest price limit of cold-rolled 201J2 and J5, that is US$1,535/MT. But soon, after one day, the price started to decrease again on Tuesday. The increase was offset by the decrease. Until June 10th, the base price of the mainstream cold-rolled mill-edge stainless steel 201 remained at US$1,610/MT, the same as the price of June 3rd. The mill-edge stainless steel 201 J2 and J5 increased by US$15/MT, to US$1,505/MT. But the price of the hot-rolled 5-foot stainless steel decreased by US$15/MT to US$1,625/MT. Currently, the price of stainless steel plates is lower than the price of the coil because some sellers reduce the price of the plate. The price difference was about US$30/MT. Most traders are pessimistic about the Chinese domestic market.

400 series of stainless steel: Demand remains weak.

The price of the cold-rolled stainless steel 430 remained stable at US$1,525/MT which was the same price on June 3rd. Due to the high production cost of high chromium, many Chinese chromium producers choose to reduce their production and even stop producing. It is predicted that in June Chinese domestic chrome supply will decline.

Summary:

300 series of stainless steel: The price of ferronickel has been decreasing, which reduces the production cost of SS304, but it did not enlarge the profit margin of the steel producers because the spot prices also fell. Steel mills intend to reduce their output to support the price rise. The stainless steel 300 series production on schedule MoM was reduced by 80,000 tons in June. After the serious pandemics, Beijing keeps boosting the economy, and the recovery of all industries is getting clear. The market inventory in Wuxi and Foshan is both reduced. In a short period, the oversupply of stainless steel will come to an end, which might stabilize and raise the stainless steel prices.

200 series of stainless steel: So far, the market is tepid still. Although steel mills set the lowest price limit, the prices can’t stop decreasing. Because stainless steel 200 series is comparably less profitable, many steel mills cut down output starting from the 200 series. The Chinese output of crude steel in June drops significantly, but the output reduction will need more time to affect the stainless steel market. It is predicted that the price will be fluctuated and tend to be weak. The price of cold-rolled stainless steel 201J2 (coil) will stay above US$1,490/MT.

400 series of stainless steel: In Wuxi, the price of stainless steel 430/2B of TISCO and JISCO declined to US$1,510/MT~US$1,520/MT which dropped by US$15/MT. Some people said that the transaction price was down to US$1,490/MT. From the perspective of production cost, the bidding price of high chromium from TISCO and JISCO in June remains the same as last month. But the price of coke rose, and the increasing cost maintains the price of 400 series. But the inventory is high while the demand remains tepid. It is predicted that the price of stainless steel 430/2B will be stable and slightly fall, staying above US$1,475/MT.

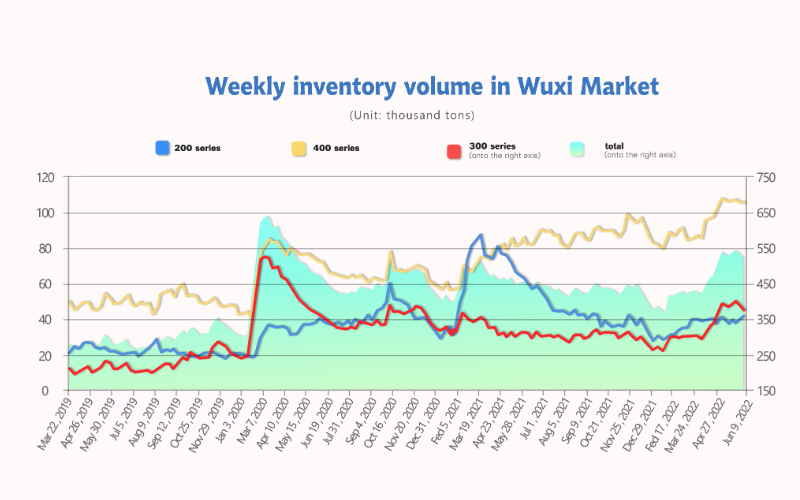

INVENTORY|| Steel mills tend to reduce output to raise the prices.

Last week, the inventory volume in the Wuxi sample warehouse continued to decrease by 9,138 tons to 518,215 tons. 200 series inventory increased by 1,918 tons, to 40,821 tons; 300 series decreased by 10,929 tons, to 372,726 tons; 400 series reduces by 127 tons to 104,668 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| June 2nd | 38,903 | 383,655 | 104,795 | 527,353 |

| June 9th | 40,821 | 372,726 | 104,668 | 518,215 |

| Difference | 1,918 | -10,929 | -127 | -9,138 |

200 series of stainless steel: Steel mills failed to keep the prices up and the inventory increased.

The inventory of stainless steel 200 series in Wuxi slightly increased by 1,900 tons to 40,900 tons. Both cold-rolled and hot-rolled stainless steel inventory increased and the majority of resources were from Baosteel Desheng and Beigang New Materials. The purchasing heat was only maintained last Monday because the two steel mills set the lowest price. Last Tuesday, the transaction was turned down quickly. Except for Monday, the whole week was covered by the gloomy market sentiment. Therefore, the inventory of 200 series increased.

300 series of stainless steel: Pre-delivered inventory was shifted out, reducing the local inventory.

The stainless steel 300 series inventory was reduced by 11,000 tons to 372,700 tons in Wuxi’s sample warehouse. The main reason for the decrease is that steel mills shifted their pre-stock inventory out because the stocking area was locked down several times due to the investigation on aluminum. The stainless steel prices have kept decreasing. To keep the prices up, many steel mills plan to reduce the production so as to decrease the pressure of large inventory. The stainless steel 300 series production arrangement in June is to drop by 80,000 tons to 1,370,000 tons. With the demand recovering gradually, the inventory will continue to go down.

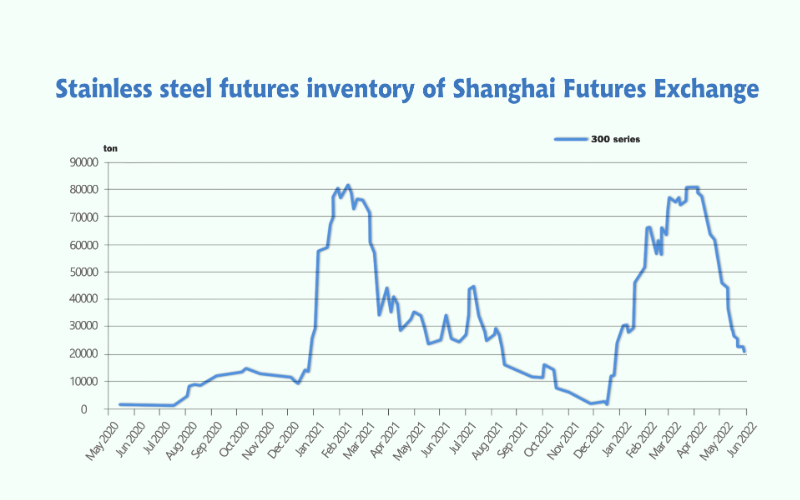

According to Shanghai Futures Index, until June 8th, the stainless steel futures inventory was 20,500 tons which have reduced by over 60,000 tons compared to the peak, 81,400 tons on April 8th.

400 series of stainless steel: Steel mills maintenance reduces the inventory.

In June, JISCO continues the overhaul. In May, LISCO and TISCO reduced the output of the stainless steel 400 series, so the total output of the stainless steel 400 series drops in June. However, the spot inventory in Wuxi only decreased by 100 tons to 104,700 tons. The reduction seems to fail to change the oversupply situation.

Raw materials||The price of nickel will fluctuate to decline.

Recently, the price of stainless steel has continued to decline. The profits of steel mills have been greatly compressed, and it is already near the break-even line. In terms of ferronickel, the price has dropped significantly last week, and the market transaction price is about US$227/Ni. Due to the large stainless steel inventory, steel mills have to find a cut in the cost, such as ferronickel. At the same time, the cost of nickel ore is expected to fall. Ferronickel mills reduce the price to promote transactions, and it is expected that the price of ferronickel will remain weak next week.

In June, many steel mills indicated that they will reduce production, and it will reduce the demand for high-nickel iron. Since the beginning of this year, Indonesia's ferronickel output and export volume has increased. Thanks to its low production cost, and higher nickel content than that of domestic ferronickel, it has begun to take over the Chinese domestic ferronickel market. It is predicted that in June, the production of ferronickel will continue to fall.

As for the refine nickel, the inventory of LME nickel fell to 70,500 tons which is comparatively low. The U.S. inflation data hit a new high, leading to the market interest rate hike, which will reduce nickel prices to a certain extent. It is expected that the market will fluctuate to drop.

LME hit by $450mn lawsuit from Elliott Management over nickel market chaos

The London Metal Exchange was again accused.

The Hong Kong Exchange announced on the 7th that its wholly-owned subsidiaries, the London Metal Exchange (LME) and LME Clear, were named as defendants in a judicial review claim filed by Jane Street Global Trading, LLC. The claim seeks to challenge the LME’s decision to cancel nickel contract transactions executed on or after 00:00 UK time on March 8, 2022, and claims an amount of approximately US$15.34 million. LME management believes that the claim has no legal basis and the LME will vigorously defend it. Jane Street Global Trading, LLC is an American market maker known for its quantitative expertise.

On the morning of June 6th, the Hong Kong Exchange announced that two well-known US hedge funds Associates, L.P. and Elliott International, L.P. filed the same claim against LME and LME Clear, with a claim amount of about US$456 million. LME management also believes that the claim has no legal basis and will vigorously defend it.

The source of these three lawsuits is the short-squeezing event of London Nickel that occurred in early March this year. Affected by European and American sanctions on Russian nickel, from March 1st to 4th, LME nickel rose from US$24,225/MT to US$29,130/MT, surging by 20%. On March 7th and 8th, London nickel suddenly surged irrationally, rising to a maximum of more than US$100,000/MT, and the highest increase in less than two days was 248%.

On the evening of March 8, the LME urgently announced that it would suspend nickel trading, and decided to cancel all nickel transactions executed in OTC and LME select screen trading systems at or after 00:00 on March 8th, 2022, UK time, and postpone the original nickel trading. Delivery of all spot nickel contracts scheduled for delivery on March 9th, 2022.

In response to the claims of the above three institutions, the LME responded that the suspension and cancellation of nickel trading was to safeguard the overall interests of the market. On March 7, 2022, the nickel market price increased significantly. However, the LME believed that trading as of the evening's close was orderly. Then in the early morning of March 8, 2022, nickel prices rose sharply in a short period of time. After discussions with LME Clear, the LME has decided to suspend trading in all nickel contracts from 08:15 UK time on the same day and cancel all transactions executed on or after 00:00 UK time on 8 March 2022. The decision to suspend trading comes as the nickel market is already out of order. The LME retroactively cancelled the transaction in order to return the market to the last point in time when the LME could be confident that the market was functioning in an orderly manner. It is important to stress that the LME has always acted in the overall interest of the market. LME nickel trading then resumed on March 16, 2022 on all LME venues where trades are executed.

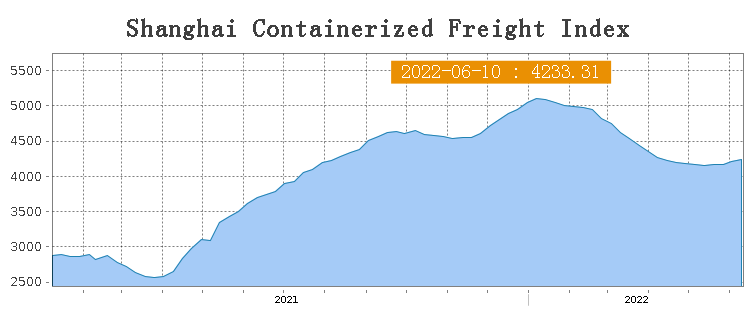

Freight|| The export freight from Shanghai has increased for consecutive 4 weeks.

The freight rate in the container shipping market has continued to rise recently after falling for several months. From May 20th to June 10th, Shanghai Containerized Freight Index has increased for 4 weeks, rising by 2%.

Since Shanghai was unlocked from the pandemics in June, the volume of goods at Shanghai ports has continued to increase.

Data shows that since June 1, the cargo volume of Shanghai's sea and air ports has recovered to more than 90% of the pre-pandemic level. In terms of shipping, since June, the daily container throughput of Shanghai Port has exceeded 119,000 TEUs.

Analysts from Shanghai Shipping Exchange said that as the transportation authorities continued to actively guide and support relevant port and shipping companies to resume normal production and operation, the recovery of Shanghai Port was good, and the export container transportation market remained stable.

In terms of routes, on June 10,

- the freight rate (shipping freight and shipping surcharges) of Shanghai Port to the basic port market in South America was US$7,216/TEU, 7.7% higher from a week ago;

- the freight rate of Shanghai Port to the basic port market of the Gulf area (shipping and shipping surcharges) was US$3,267/TEU, increasing by 7.5% from a week ago;

- the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic port of Australia and New Zealand was US$3,405/TEU, rising by 1.7% from the previous issue.

In addition, the freight rates of main routes in Europe and America remained stable.