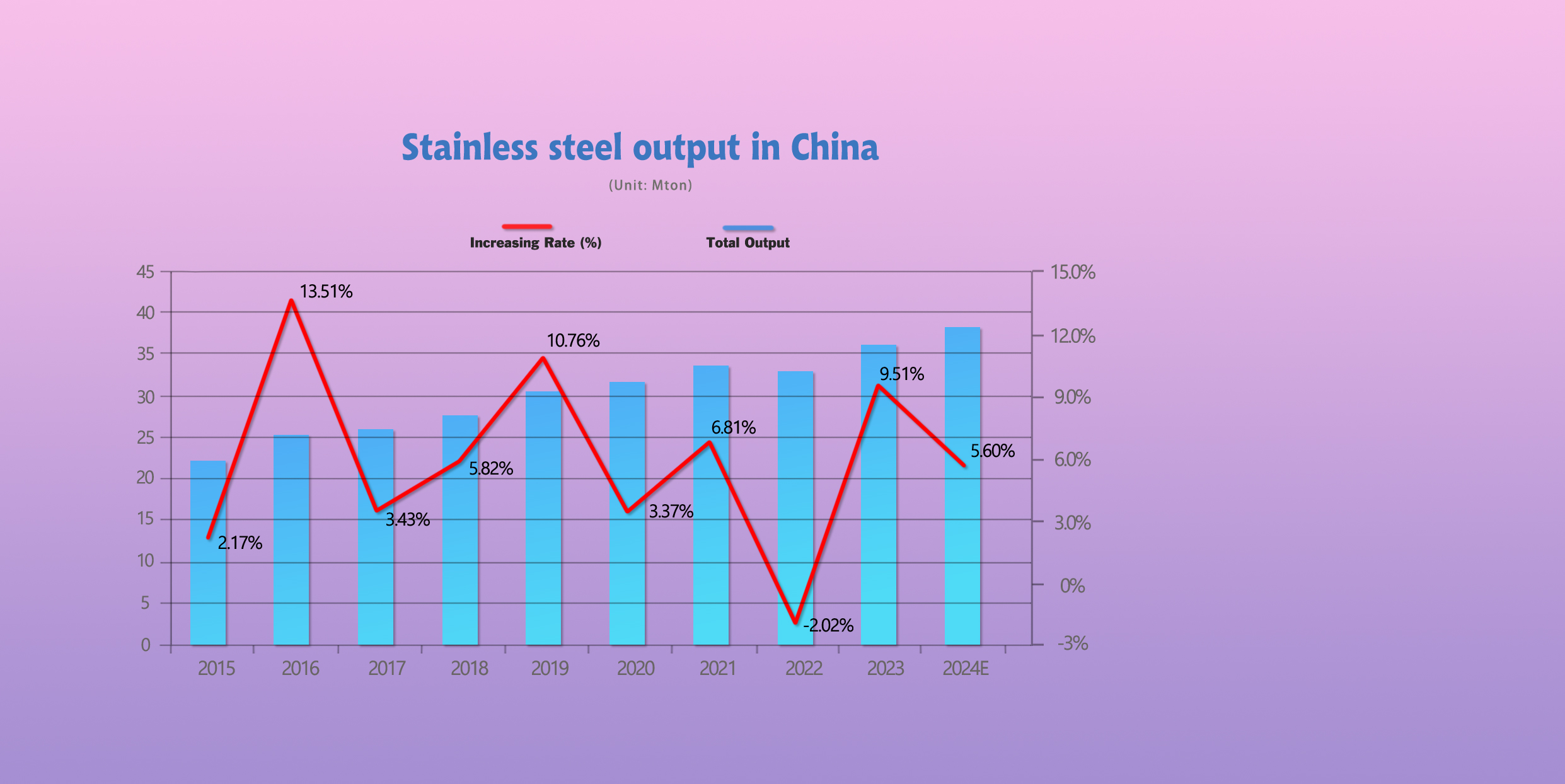

It seems that the crashing down Chinese stock market did not affect the stainless steel market. Last week, the stainless steel prices maintained a steady growth. The reason is that because of the Chinese New Year holiday, steel mills will start their maintenance period, cutting down the production. About the maintenance of steel mills, the longest one will end in March. According to an institution, China's stainless-steel production was 36.12 million tonnes, yielding a 9.51% YoY increment in 2023, while the world output was about 57 million tonnes; the projected output in 2024 is 38.2 million tonnes, which YoY increases by 5.6%. The expanding scale of stainless steel production is not a pleasing sign, because the oversupply has long existed in China. As for sea shipping, attacks on shipping vessels in the Red Sea and the resulting diversion of freight could lead to a shortage of shipping containers in Asia in the coming weeks. The drought in Panama Canal is lowering the efficiency of the North American freight line, causing the sea freigh to North America to spike. There only one week left to Chinese manufacturers, and some of them have already started days off. Now, we are also working on arranging delivery under the container shortage situation. If you want to dive into the market, please scroll to the full report of Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,150 | 17 | 0.84% |

| Foshan | 2,195 | 17 | 0.82% | ||

| Hongwang | Wuxi | 2,065 | 22 | 1.17% | |

| Foshan | 2,065 | 18 | 0.95% | ||

| 304/NO.1 | ESS | Wuxi | 1,975 | 15 | 0.84% |

| Foshan | 2,000 | 17 | 0.90% | ||

| 316L/2B | TISCO | Wuxi | 3,620 | 22 | 0.65% |

| Foshan | 3,750 | 53 | 1.50% | ||

| 316L/NO.1 | ESS | Wuxi | 3,595 | 17 | 0.49% |

| Foshan | 3,555 | 59 | 1.75% | ||

| 201J1/2B | Hongwang | Wuxi | 1,395 | 14 | 1.11% |

| 1,400 | 15 | 1.22% | |||

| J5/2B | Hongwang | Wuxi | 1,310 | 10 | 0.83% |

| Foshan | 1,315 | 17 | 1.42% | ||

| 430/2B | TISCO | Wuxi | 1,255 | 4 | 0.37% |

| Foshan | 1,255 | 0 | 0.00% |

TREND|| Future price rose four days in a row.

The spot price of stainless steel in Wuxi maintained a steady growth last week: the 200 and 300 series rose, 400 series stabilized. Social inventory had a MoM decrease while the purchase activities were stimulated by the steel mill maintenance.

The most traded contract of stainless steel rose by US$51/MT (or 1.9%) to US$2115/MT.

Stainless steel 300 series: Spot price went up hesitantly.

Until last Thursday: The most traded base price of cold-rolled 4-foot mill-edge stainless steel 304 (Private steel mill) rose by US$28/MT to US$2035/MT, hot-rolled stainless steel had a US$21/MT jump to US$1985/MT.

The uptrend of spot price and future price somewhat boosted the market in the midweek but then turned sedated.

Stainless steel 200 series: Maintenances and price limitations continued.

The spot price of stainless steel 201 in the Wuxi market remained an uptrend last week: Until Thursday, the most traded base price of cold rolled stainless steel 201/J1 jumped by US$21/MT to US$1375/MT; cold rolled stainless steel 201J2/J5 had a US$14 growth to US$1290/MT; 5-foot hot rolled stainless steel lifted by US$7 to US$1305/MT.

Stainless steel 400 series: Prices stood firm.

The mainstream quoted price of cold-rolled and hot-rolled stainless steel 430 remained stable at US$1265/MT and US$1145/MT respectively.

TISCO and JISCO remained unchanged for their guidance price of stainless steel 430/2B, both closed at US$1450/MT and US$1570/MT.

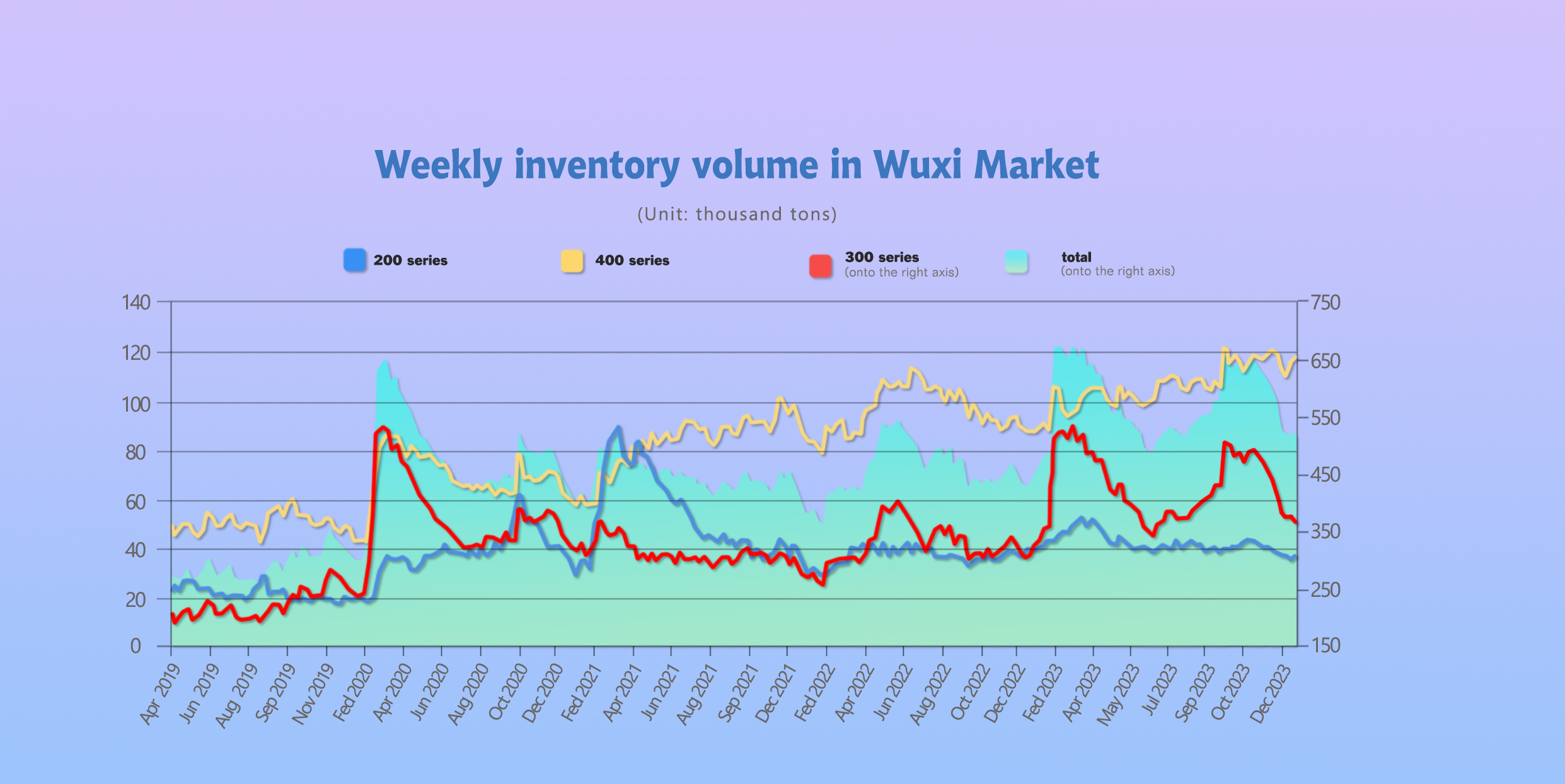

INVENTORY|| Destocking and Maintenance might boost up the price before Chinese New Year.

The total inventory at the Wuxi sample warehouse downed by 2784 tons to 516,762 tons (as of 18th January).

the breakdown is as followed:

200 series: 1,170 tons up to 335,874 tons

300 Series: 6,269 tons down to 364,101 tons

400 series: 2,315 tons up to 116,787 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| January 11th | 34,704 | 370,370 | 114,472 | 519,546 |

| January 18th | 35,874 | 364,101 | 116,787 | 516,762 |

| Difference | 1,170 | -6,269 | 2,315 | -2,784 |

Stainless steel 300 series: Producers start cutting output.

Affecting by the regular pre-festival stocking, the social inventory of the 300 series went down last week. The supply is expected to decrease as most of the steel producers are gradually commencing maintenance.

Stainless steel 200 series: Destocking record ended.

Steal resources from Tsingshan arrived in Wuxi as usual and Beigang’s annual furnace maintenance is underway, the price went up smoothly.

Stainless steel 400 series: a slight increase.

The market transaction received a cold reception last week while the quote price of stainless steel 430 stabilized, but some of the specifications was reportedly out of stock. The inventory pressure is likely to ease off in the short term.

Steel mills maintenance scheduled:

POSCO (Zhangjiagang): Conducts maintenance from late February until early March

LISCO: 6 days Spring Festival holiday, 20,000 tons ~ 30,000 tons production will be affected.

Shengyang Metals (Shandong): Conducts maintenance from 1st February ~ 16th February 10,000 tons ~ 20,000 tons production will be affected.

JinHui Steel (Henan): Operation date to be announced.

Huale Alloy (Jiangsu): 14 days Spring Festival holiday, maintenance will conduct from 3rd February to 17th February, 35,000 tons production will be affected.

Yongjin (Jiangsu): Maintenance throughout February.

Yongjin (Hongwang): shorten Holiday in February.

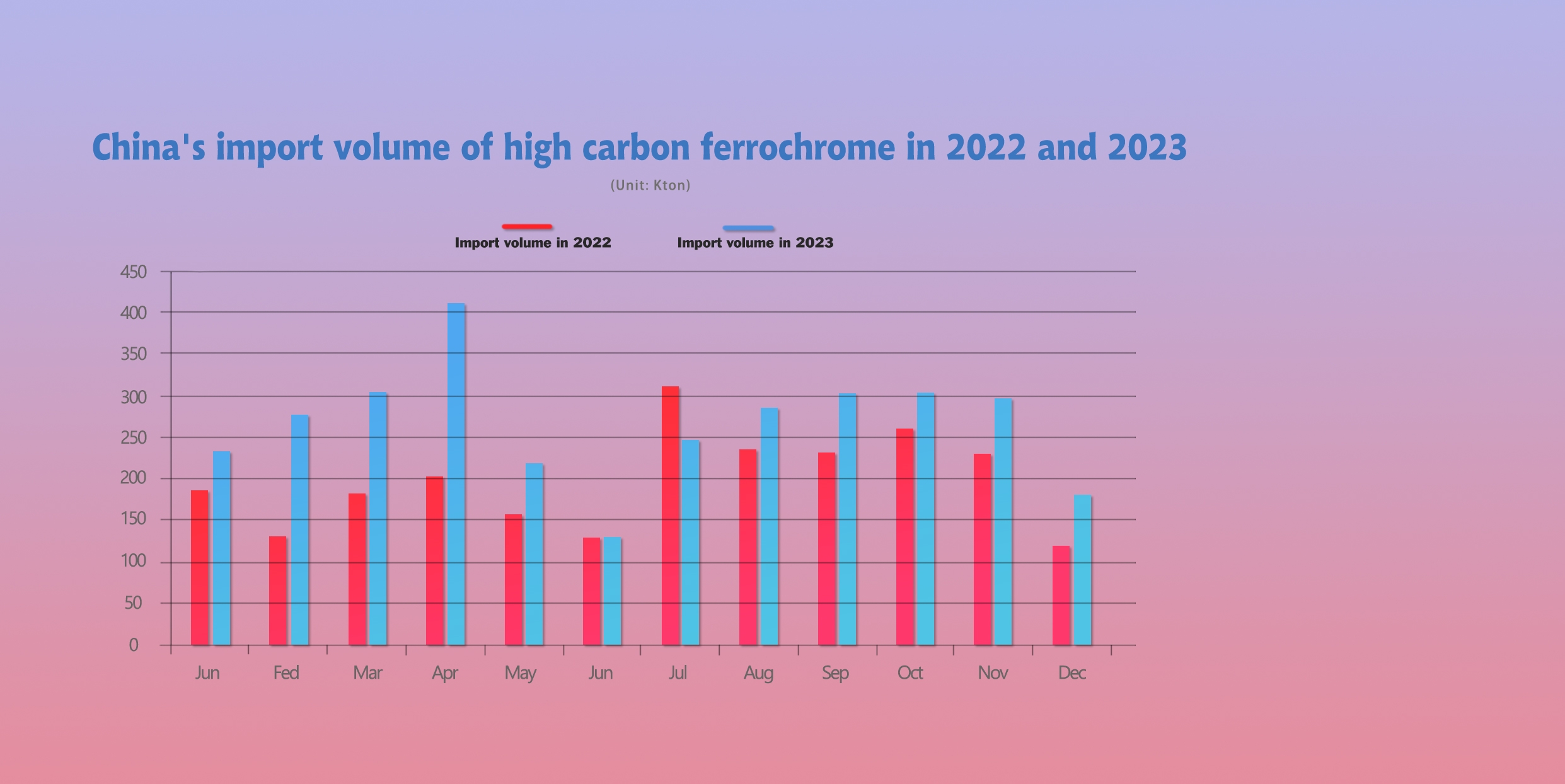

RAW Material|| Risking a bigger collapse in price, More Ferrochrome will be pumped to market.

The retail price of high-carbon ferrochrome (50% Cr) has been stabilizing at between US$1305/MT and US$1335/MT since 2024. It is believed that the current smooth running of the price trend is backed by the solid demand and the unshakable production cost. However, the surging supply of ferrochrome might be the X-factor in the long term.

According to the statistics, in 2023, China’s total production of high-carbon ferrochrome in major production areas had an 817,700 tons (or 12.58%) growth from the previous year, it was concluded as 7,317,600 tons.

The supply of ferrochrome is very likely to grow further in 2024, as numerous furnaces will be upgraded and set to push the output to a higher level in the first half of 2024.

Until November 2023, the import of ferrochrome also had a significant growth of 33.36% from the previous year. It is believed that the spike in importation was owed to the shrinking demand in Western countries. Nevertheless, the growing demand for ferrochrome in China was another reason for the importation to increase. The World Stainless Association has released figures for the first nine months of 2023 showing that stainless steel melt shop production increased by 2.5% year–on–year to 42.6 million metric tons, China produced 26.6 million tons and registered a growth of 13.4%. It is estimated that the total import volume in 2023 will be closed at 3.2 million tons.

Currently, domestic production and imports of high-carbon ferrochrome have increased simultaneously, leading to a sudden surge in the supply pressure in the high-carbon ferrochrome market in 2024. At the same time, concerns about the weakening of the high chrome market have also emerged. Considering the downstream demand for raw material stocking before the Spring Festival and the impact of the Spring Festival travel rush on logistics transportation costs, it is expected that the high-carbon ferrochrome market will continue to stabilize before the Spring Festival. However, the post-Spring Festival market situation remains to be observed, as a decline in demand after the festival could increase the risk of price decline.

Summary|| Mills implemented furnace maintenance amid thinning margins and disappointing demand.

Recently, the stainless-steel market has shown a relatively strong performance, and the current supply-side pressure is not significant. Steel mills are controlling output to create conditions for a price increase. However, as the year-end approaches, downstream consumer demand is gradually diminishing, which will limit the extent of price increases.

300 Series: Overall, after continuous destocking, the current pressure on circulating supply is limited, and there is potential demand for inventory replenishment before the holiday season. In addition, the impact of steel mill maintenance during the Spring Festival is expected to boost downstream purchasing, leading to short-term fluctuations in private cold-rolled prices following futures prices. Attention will be paid to the pace of steel mill resource arrivals.

200 Series: Last week, steel mills continued to deliver stainless steel resources, and the latest guidance price from Tsingshan on the 17th stimulates active market transactions. While the annual routine maintenance plan for Beigang New Material's blast furnace is underway, and multiple factors are supporting stable and upward price movements. It is expected that the price of 201 will remain stable and upward in the near future.

400 Series: In the short term, trader stocking before the holiday and the release of downstream orders may increase demand. The price of 430 stainless steel is expected to stabilize before the holiday.

Production: China’s stainless-steel production yielded 9.51% YoY increment.

China’s total production of crude stainless steel in 2023 was 36.12 million tons, which concluded a 9.51% (or 3.14 million tons) lift YoY.

Here is the breakdown:

Series 200: Production: 11,167,200 tons, a 7.6% (or 789,100 tons) lift YoY and 30.9% out of total of 36.12 million tons.

Series 300:Production: 18,695,400 tons, a 11.01% (or 1.85 million tons) lift YoY and 51.8% out of total of 36.12 million tons.

Series 400: Production: 6,263,000 tons, 8.58% (or 490,510 tons) lift YoY and 17.3% out of total 36.12 million tons.

2024 China stainless steel production forecast (Estimated):

Total production: 38.2 million tons, 5.6% (or 2.1 million) increase

200 series: 11.40 million tons, 2.1% increase.

300 series: 20 million tons, 7% increase.

400 series: 6.8 million tons, 7.8% increase.

MACRO|| Red Sea disruption could lead to shortage of containers.

Learn more: https://youtu.be/8D4SsvMDgi0?si=QmFGGxCW_3in5-sc

Attacks on shipping vessels in the Red Sea and the resulting diversion of freight could lead to a shortage of shipping containers in Asia in the coming weeks, the chief executive of DHL Tobias Meyer said on last Wednesday.

Such a shortage could occur because the containers may not be transported back to Asia in sufficient quantities, Meyer said at a panel discussion in Davos.

Troubles continue brewing in the Red Sea, nearly all container ships have been rerouted away from the Suez Canal towards the longer route around the Cape of Good Hope since Yemen’s Iranian-backed Houthi militants last month stepped up attacks on vessels transiting the Gulf of Aden and southern Red Sea.

From China Shipping Weekly that the impact of the Red Sea crisis on the supply chain is gradually expanding. The latest news is that Asia may be facing a shortage of containers.

Analysis firm Vespucci Maritime stated that in recent times, approximately 390000 TEU of containers have been transported back to the Far East region per week, both fully loaded and unloaded, from Europe and the East Coast of the United States. This means that before the Chinese Lunar New Year, the number of containers arriving at Asian ports will decrease by 780000 TEU compared to before.

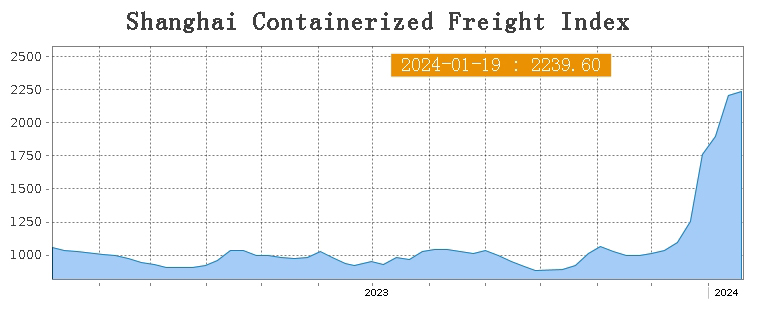

Sea Freight|| Container rate surge slows as Chinese New Year approache

The freight rate on various freight line went for different direction. On 19th Janurary, the Shanghai Containerized Freight Index rose by 1.5% to 2239.61.

Europe/ Mediterranean:

The hiking freight rate of European freight line is now entering stoppage time.

On 12th Janurary, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3030/TEU, which drop by 2.4%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4067/TEU, which lifted by 0.7%

North America:

The drought in Panama Canal is lowering the efficiency of the North American freight line.

On 19th January, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$4320/FEU and US$6262/FEU, reporting a 8.7% and 7.7% spike accordingly.

The Persian Gulf and the Red Sea:

On 19th January, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf dropped by 10.9% from last week's posted US$1982/TEU.

Australia/ New Zealand:

On 19th January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1258/TEU, a 3.9% jump from the previous week.

South America:

On 19th January, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2714/TEU, an 5.6% slide from the previous week.