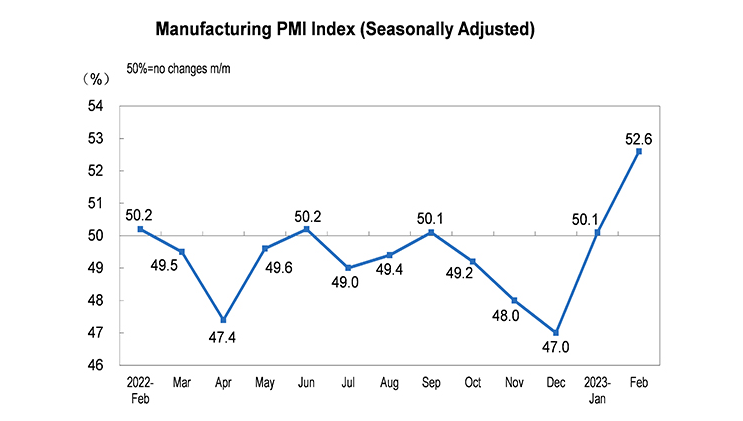

The stainless steel domestic market was subdued last week, and we can see an obvious drawback in the weekly average prices overall. Although Chinese downstream manufacturers were conservative in their stocking and producing strategy, the manufacturing PMI of February 2023 exhilaratingly increased by 2.5% from last month to 52.6%. The momentum of economic recovery remains strong. The TWO SESSIONS being held these days confirm that the goal of GDP growth for 2023 is set at 5% which is the most moderate aim during the recent 30 years, it is believed that the recovery will not be easy but China will go steadily. Through prime minister, Li Keqiang's speech, Beijing will continue to focus on propping up the infrastructure development. If it is so, hot-rolled materials will become popular in the domestic market. As for the global market, due to the rising cost of raw materials, Indian stainless steel prices have kept climbing to maintain the profit margin. While in China, the domestic nickel price was hit, because NORNICKEL, the largest nickel producer in Russia, sells to China in yuan. If you want to go deep into the market, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,690 | -23 | -0.91% |

| Foshan | 2,724 | -23 | -0.93% | ||

| Hongwang | Wuxi | 2,610 | -25 | -1.00% | |

| Foshan | 2,610 | -22 | -0.88% | ||

| 304/NO.1 | ESS | Wuxi | 2,560 | -29 | -1.20% |

| Foshan | 2,575 | -13 | -0.54% | ||

| 316L/2B | TISCO | Wuxi | 5,045 | -79 | -1.60% |

| Foshan | 5,125 | -64 | -1.29% | ||

| 316L/NO.1 | ESS | Wuxi | 4,855 | -70 | -1.48% |

| Foshan | 4,855 | -67 | -1.41% | ||

| 201J1/2B | Hongwang | Wuxi | 1,570 | -9 | -0.60% |

| Foshan | 1,545 | -7 | -0.51% | ||

| J5/2B | Hongwang | Wuxi | 1,470 | -6 | -0.43% |

| Foshan | 1,480 | -9 | -0.64% | ||

| 430/2B | TISCO | Wuxi | 1,360 | -3 | -0.23% |

| Foshan | 1,355 | -3 | -0.24% |

TREND|| An unexpected twist in series 300 as the output and inventory reduce.

The price trend of the stainless steel series overall was bearish last week: the spot price of stainless steel 201 fell after stabilized, Stainless steel 304 dipped down, and Stainless steel 430 loss only by a fraction.

Stainless steel 300 series: Prices and inventory level dived synchronously.

Until Friday, the most traded base price of cold-rolled 4-foot mill-edge stainless steel 304 was quoted at US$2530/MT with US$37 fell and hot-rolled stainless steel fell US$44 to US$2525/MT. There is still a mass of inventory waiting to be digested, and the whole market is now placing hope on the fast recovery of the demand in the downstream industry.

Stainless steel 200 series: Prices headed down due to the huge gap in supply-demand

The most traded base price of cold-rolled stainless steel 201 dropped US$15 to US$1530/MT, stainless steel 201J2 lost US$22 to US$1425/MT and hot-rolled 5-foot stainless steel fell US$7 to US$1495/MT.

The downward future price of stainless steel implicated the spot price to a lower-level last week. Stainless steel 201 dropped US$7 to US$1425/MT.

The transaction overall was bearish last week.

Stainless steel 400 series: weak price and high inventory

TISCO remained unchanged on the guidance price of stainless steel 430/2B, US$1510/MT; TISCO lift US$15 to US$1525/MT. The quoted price of 430/2B in the market was roaming between US$1360/MT-US$1370/MT.

Baoxin (Ningbo) announced the EXW price of cold-rolled stainless steel products in March:

Cold-rolled 430: US$1685/MT, a US$29 raise.

Cold-rolled 304: Orders negotiated separately.

The EXW price of high chrome maintained stable at between US$1435/MT-US$1465/MT (with 50% of high chromium). There was not much change in the price level of raw materials.

Summary:

Stainless steel 300 series: Steel mills get the upper hand in purchasing raw materials in the circumstance that the market is still considered bearish.

Stainless steel 200 series: The market performance did not show any promising signal of rebound, even though the spot price had dropped.

Stainless steel 400 series: The price movement was flat, and the common quote price rallied between US$1360/MT-US$ 1370/MT. The price trend could remain stable but weak in the short term.

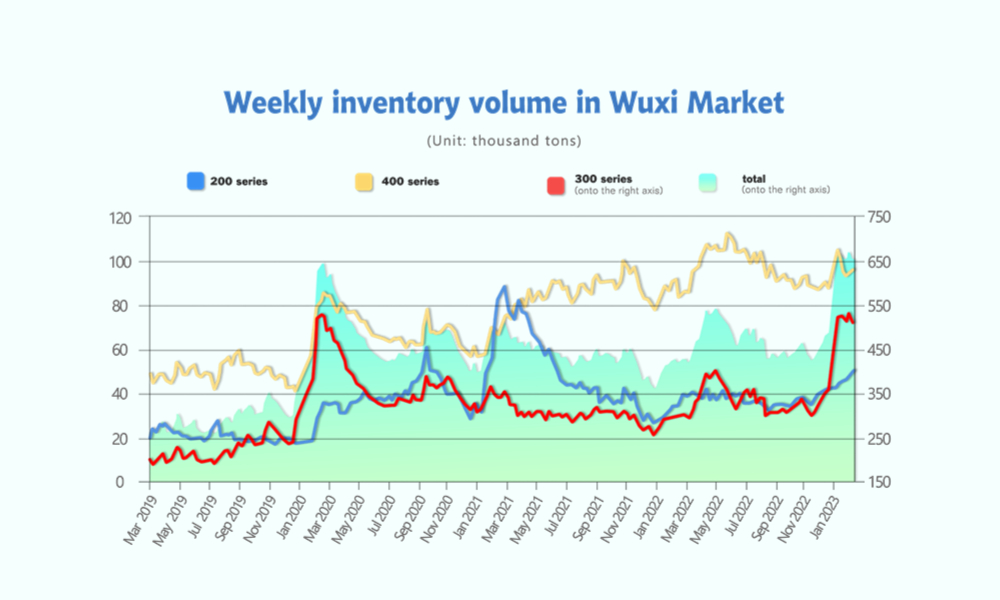

Inventory|| 300 Series had a 20,000 tons descent

The inventory level at the Wuxi sample warehouse fell by 18,984 tons to 650,803 tons (as of 2nd March).

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| February 23rd | 48,060 | 527,777 | 93,950 | 669,787 |

| March 3rd | 49,310 | 506,043 | 95,450 | 650,803 |

| Difference | 1,250 | -21,734 | 1,500 | -18,984 |

the breakdown is as followed:

200 series: 1,250 tons up to 49,310 tons

300 Series: 21,734 tons down to 506,043 tons

400 series: 1,500 tons up to 95,450 tons

Stainless steel 300 series: hot-rolled resources are more popular in domestic market recently

A sudden decrease was made by the hot-rolled resource last week, creating a distinctive slide in the overall inventory. Generally, it can be owed to the work resumption in the construction industry, the demand for particular stainless-steel specifications surged in a short period of time.

Stainless steel 200 series: Price fell and inventory continued to stack up.

The inventory of the 200 series rose slightly by 1,200 tons, and the demand nonetheless is desperate for a rebound.

Stainless steel 400 series: Inventory already rose for three consecutive weeks

Similar to any other stainless steel series, the supply could not completely match up with the demand in downstream, the digestion of inventory was slowed, and transaction was also being sluggish. It is expected that the inventory will hardly drop.

RAW MATERIALS|| Production cost dropped.

The EXW price of high-grade ferronickel fell US$2 to US$305/MTU, while ferrochrome remains stable at US$1435/MT (with 50% high chrome).

Nickel: Oversupply led to the price fall; NORNICKEL ships goods to China in Yuan

The oversupply of domestic nickel-iron supply is difficult to change. Nickel-iron plants and some steel mills have high stocks of nickel-iron and combined with weak stainless-steel prices, the production of 300 series stainless steel continues to decline. Currently, the loss is nearly US$165/MT, and steel mills still have room for bargaining in subsequent procurement. The recent sharp decline in nickel prices also has a negative impact on nickel-iron. While the price of nickel-iron is approaching the cost line, some iron mills have already incurred losses. Overall, in the current oversupply situation, the short-term nickel-iron price is stable but weak.

On March 2, the news said that NORNICKEL, the largest nickel producer in Russia, shipped goods to China in RMB. The spots were priced based on the mixed price of SHFE and LME. Nickel futures prices fluctuated greatly. Affected by the news concerning NORNICKEL Nickel, SHFE nickel prices fell sharply last Friday and closed at US$28,255/MT with a US$449 drop.

Marco|| China's economony maintains a strong momentum

China: Manufacturing PMI of Febrauary rises

China’s official manufacturing purchasing managers’ index (PMI) rose to 52.6 in February, while the non-manufacturing gauge rose to 56.3 last month.

The official composite PMI, which includes both manufacturing and services activity, rose to 56.4 in February, up from 52.9 in January.

The Shanghai Stock Exchange Composite Index finished sharply higher on Wednesday following gains from the financials, properties, and resource stocks. For the day, the index picked up 2.42 percent to finish at 3,312.35 after trading between 3,272.04 and 3,315.16, the highest point in seven months.

INDIA:Stainless steel prices soar due to the increasing cost of ore

Molybdenum prices rocket upwards

Molybdenum prices had already reached their highest level in 17 years by the end of January 2023. Pure molybdenum has now cracked the $100,000 per tonne mark in Asia, up almost 150% since February 2021.

Important raw material for stainless and tool steels

The influence this has on the molybdenum prices, but also of further processed products, can no longer be overlooked in the market. Stainless steel prices for the grades AISI 316/316L (1.4401, X5CrNiMo17-12-2, UNS S31600/ 1.4404, UNS S31603, X2CrNiMo17-12-2) have jumped significantly. Stainless steel producers are already waiting for the necessary raw material supplies to be able to produce 316/316L at all. Delivery times for 316 from new production are already becoming much longer.

But molybdenum is not only used in stainless steel, but also in many other alloyed steels and tool steels.

The prices for chrome ores had also recently reached their highest level since January 2021 and were even higher than the record value from May 2022. After the FerroChrome benchmarks were last carried over from Q4 2022 to Q1 2023 without changes, a new increase in the benchmark prices is indicated here. Prices for the stainless steel grade AISI 430, which is considered to be the benchmark for the chrome-dominated stainless steel grades, are already rising worldwide.

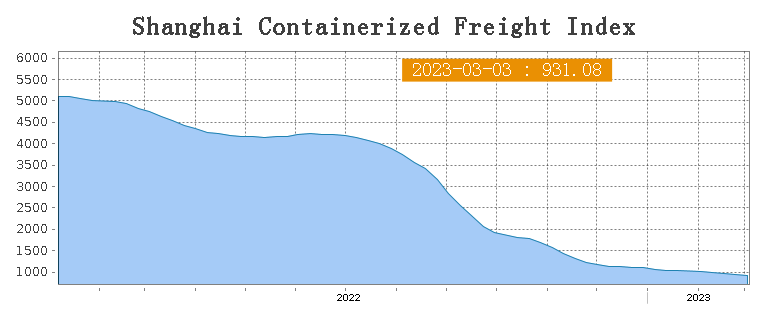

SEAFREIGHT|| Freight rate continues to head down.

Freight rates overall on multiple sea routes continued to dip last week as the market is still recovering. On 3rd March, the Shanghai Containerized Freight Index was downed by 1.6% to 931.08.

Europe/ Mediterranean: The energy crisis caused by Russo-Ukrainian War is still far from over, and it keeps excreting influences on the sea freight industry.

Until 3rd March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$865/TEU, an 1.9% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1600/TEU, down by 0.3%.

North America: The demand is recovering but slower than expected.

Until 3rd March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,200/FEU and US$2,321/FEU, 2.8% and 2.9% fall accordingly.

The Persian Gulf and the Red Sea: Until 3rd March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 6.2% fall from last week's posted US$965/TEU.

Australia/ New Zealand: Until 3rd March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$344/TEU, which was downed by 3.5% from the previous week.

South America: The supply-demand in the freight market is now balanced, On 3rd March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1482/TEU, a 1.7% drop from the previous week.