Would you skip the US dollar to trade? It provides a larger negotiable space for the trading parties and it can lower costs from a financial perspective. On March 29th, Brazil said that Beijing and Brazil signed an agreement on trade in mutual currencies, abandoning the US dollar as an intermediary, and planning to expand cooperation on food and minerals. More countries and regions tend to use the Chinese Yuan to trade. Back to the stainless steel market, the prices keep falling within our expectations and the major reason is the sluggish demand. Stainless steel 316L dropped the most, by US$329/MT on a week basis, the decrease in molybdenum price worsens the decline situation. If you want to know more about the Stainless Steel Market Summary in China, just keep reading.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,480 | -49 | -2.09% |

| Foshan | 2,525 | -49 | -1.99% | ||

| Hongwang | Wuxi | 2,405 | -44 | -1.90% | |

| Foshan | 2,390 | -56 | -2.41% | ||

| 304/NO.1 | ESS | Wuxi | 2,320 | -65 | -2.86% |

| Foshan | 2,370 | -53 | -2.30% | ||

| 316L/2B | TISCO | Wuxi | 4,290 | -256 | -5.81% |

| Foshan | 4,375 | -329 | -7.22% | ||

| 316L/NO.1 | ESS | Wuxi | 4,080 | -303 | -7.14% |

| Foshan | 4,155 | -303 | -7.02% | ||

| 201J1/2B | Hongwang | Wuxi | 1,540 | -3 | -0.21% |

| Foshan | 1,525 | 1 | 0.10% | ||

| J5/2B | Hongwang | Wuxi | 1,455 | 4 | 0.33% |

| Foshan | 1,450 | 0 | 0% | ||

| 430/2B | TISCO | Wuxi | 1,280 | 0 | 0% |

| Foshan | 1,270 | 0 | 0% |

TREND|| 300 series was free falling into the abyss.

The spot price of the stainless steel series was generally feeble.

Grade 201 and grade 430was stable but weak, and grade 304 created a steeper slope. The mainstream contract price of stainless steel fell from US$95/MT to US$2290/MT.

Stainless steel 300 series: Costs drop, and spot price follows suit.

Until last Friday, the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 closed at US$2315/MT with a US$59 drop, and hot-rolled 304 fell by US$74 to US$2275/MT.

Stainless steel 200: Limitation lifted, the price might have a slip.

Last week, the spot price of 201 stainless steel in the Wuxi market has shown a generally stable but slightly weak trend. At the beginning of last week, due to the price restrictions imposed by steel mills, the spot market was relatively inactive. As the end of the month approached, traders focused mainly on selling their inventory, leading to a drop in spot prices. Last Thursday morning, Tsingshan canceled the price restrictions to encourage sales, but transactions were still at a standstill, and spot prices subsequently fell, with some shipments observed at US$1400/MT. As of March 31st, the mainstream base price of 201 cold-rolled steel in the Wuxi market has dropped by US$7/MT compared to last Friday, closed at US$1510/MT; the mainstream base price of 201J2 cold-rolled steel has dropped by US$15/MT compared to last Friday, quoted US$1420/MT; and the mainstream price of five-foot hot-rolled steel has dropped by US$15/MT compared to the week before last week, closed at US$1445/MT.

Stainless Steel 400: The price trend stayed calm.

This week, the guidance price of TISCO ‘s 430/2B market was lowered to US$1420/MT, a decrease of US$29/MT compared to the end of last week. The guidance price of JISCO’s 430/2B market remained unchanged at US$1515/MT compared to the end of last week. However, in the Wuxi market, the price of 430/2B remained weak and stable at around US$1280/MT-US$ 1285/MT, which was the same as the end of last week.

Summary:

300 Series Stainless Steel: Currently, inventory levels remain high, and many steel mills continue to maintain reduced production. However, the improvement in inventory pressure is limited, and more significant production cuts are still needed. Meanwhile, the purchase price of nickel pig iron continues to fall, causing the production cost of steel mills to decrease rapidly, and the center of gravity for stainless steel prices is trending downwards. It is expected that the price of stainless steel will maintain a weak trend in the short term.

200 Series Stainless Steel: Steel mills so far have canceled the price limit, and the support for spot prices is weak, combined with downstream demand that has yet to see a clear improvement. It is expected that spot prices will continue to decline. However, in the near future, several steel mills have successively undergone maintenance and shutdowns. The Baosteel Desheng cold-rolled equipment maintenance ended and resumed normal operations during the week. Beigang New Materials will also implement production cuts in April, and the inventory pressure of the 200 series may be relieved in the future. We will keep an eye on steel mill releases and downstream demand recovery.

400 Series Stainless Steel: The mainstream ex-factory prices of high-chromium stainless steel have weakened last week, while the spot prices of chromium ore have stabilized. The spot inventory of 400 series stainless steel in the Wuxi market has slightly increased. During the week, the market transactions did not show any significant improvement, and the price support was weak. Considering that steel mills are suffering from severe losses and have reduced production recently, resulting in reduced arrivals to the market, it is expected that the 430/2B price will maintain a weak and stable trend.

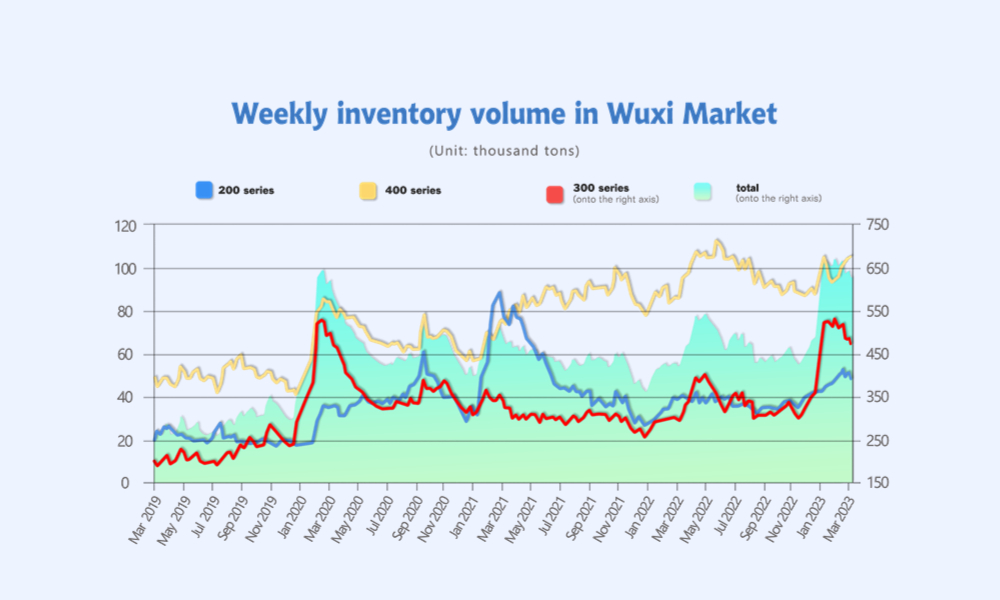

Inventory|| Weak purchasing power and negative production cut result in the remaining huge inventory.

The inventory level at the Wuxi sample warehouse fell by 8,780 tons to 623,361 tons (as of 30th March).

the breakdown is as followed:

200 series: 540 tons up to 48,100 tons

300 Series: 9,921 tons down to 471,020 tons

400 series: 601 tons up to 104,241 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| March 23rd | 48,100 | 480,941 | 103,640 | 632,141 |

| March 23rd | 48,100 | 471,020 | 104,241 | 623,361 |

| Difference | 540 | -9,921 | 601 | -8,780 |

Stainless steel 300 series: Shipment sent rapidly, but not much efficiency.

900 tons of cold-rolled resources and 900 tons of hot-rolled resources made up the 9900 tons of inventory drop of the 300 series. During last week, the spot price of 300 series stainless steel showed a weak downward trend, and market transactions were lackluster. Steel mills continued to deliver resources, with Delong cold-rolled steel fully distributed and Tsingshan’s Indonesian Yongwong resources continuously arriving in Wuxi, resulting in slow inventory clearance for cold-rolled steel. Recently, raw material and finished product prices have fallen simultaneously, and the market has a strong wait-and-see attitude, leading to slow inventory clearance.

Stainless steel 200 series: Steel mills in maintenance, supply in short.

Recently, steel mills have frequently implemented production cuts. Recently, Baosteel has completed a 10-day cold-rolled equipment maintenance, resulting in a slight decrease in market arrivals compared to last week. Coupled with weak spot transactions this week, the overall outbound volume is not large, and spot inventory has not fluctuated significantly. In addition, Beigang New Materials will also start a 10-day comprehensive steelmaking, hot rolling, and cold rolling maintenance plan in April. It is estimated that the product will reduce by about 60,000 tons, mainly in the 200 series. It is expected that the inventory pressure of the 200 series will be slightly reduced in the future. It is understood that the current spot inventory of 201J2/J5 cold-rolled 0.48mm, 0.68mm, and 0.85mm thicknesses in the market is slightly short.

Stainless Steel 400 series: Demand is still lackluster.

This week, the 400 series stainless steel market has seen weak trading with weak price support and slow destocking of inventory. With the weak price trend and high production costs of 400 series stainless steel, steel companies are facing serious losses. Recently, more steel mills have implemented production cuts, and it is expected that the price of 400 series stainless steel will remain weak and stable in the short term, with a small decrease in inventory in the later period.

Raw material|| Ore prices slump all the way down

The EXW price of high-grade ferronickel fell US$10/MTU to US$270/MTU, which has reached a nearly two-year low, with the mainstream. With the significant drop in nickel iron prices, the profits of steel mills have slightly recovered, and the subsequent purchasing pressure may weaken. Domestic iron mills are facing increased losses, and some have reduced production to cope with these losses. Recently, news of steel mill production cuts has been frequent, leading to reduced demand for raw materials. Overall, in the short term, nickel iron prices are expected to remain weak, but the downside is limited.

Looking at the trend of molybdenum iron prices, the high point for the year was US59,260/60 tons, and it has fallen to the current level of US$30,350/60 basic tons, a drop of 39.8%. The market's low price has fallen nearly below the US$30,000 mark! Although molybdenum iron has fallen more sharply, in terms of costs, the drop in molybdenum iron has led to a reduction in the cost of 316L by less than US$1145, which is faster than the drop in the spot price. The reason for this is still related to the market's supply-demand contradiction, as there is significant resistance to trading, and the market price game has intensified, resulting in a continued decline in the market.

This week, the mainstream EXW price of high-chromium has fallen significantly, to US$1415-US$1445/50 basic tons, down US$10 from the end of last week. The spot price of chromium ore is stable, and the price of coke is weak. The comprehensive production cost of high-chromium has decreased slightly, but the decrease is less than the decrease in the selling price.

Macro|| Trade in YUAN; China’s PMI in March rose

Brazil has begun to accept trade settlements and investments in yuan, with an agreement reached between central banks in February, and the appointment of a yuan clearing bank and access to the Cross-border Interbank Payment System, the China equivalent to international financial messaging service Swift, last week.

Last year, Sino-Brazil bilateral trade rose 4.9% year-on-year to US$171.49 billion, according to the Chinese government. China’s exports to Brazil, including machines, computers, steel, textiles and autos, surged 15.7% to US$61.97 billion. China’s imports from Brazil, including iron ore, soybeans, crude oil and paper pulp, fell 0.4% to US$109.52 billion.

Chinese and French energy companies this week finalized the first-ever deal on liquified natural gas (LNG) in China settled in the renminbi yuan currency. The trade, involving 65,000 tons of LNG imported from the United Arab Emirates, marks a major step in Beijing's attempts to undermine the US dollar as a universal "petrodollar" for the gas and oil trade.

The recently visited Iranian President Raisi also discussed with China increasing the proportion of settlements in their local currencies. According to the latest data from the Iranian Financial Forum, as of December last year, the proportion of the Chinese yuan in Iran's foreign reserves had exceeded 22%. Iranian Economy Minister Handouzi stated that the Chinese yuan already accounts for a considerable proportion of trade between China and Iran.

The Chinese yuan has become a "major player" in Russia's foreign trade, according to Russia Today (RT) on 22nd March, citing data released by the Bank of Russia in its Financial Market Risk Report on Thursday.RT reported that yuan's share in Russia's import settlements jumped to 23 percent by the end of last year, from 4 percent in January 2022. Its share in export settlements also grew to 16 percent from only 0.5 percent.

Iraq's central bank said on 22nd February, it planned to allow trade from China to be settled directly in yuan for the first time, in an attempt to improve access to foreign currency. The central bank has been taking urgent steps to compensate for a dollar shortage in local markets, which prompted the cabinet to approve a currency revaluation earlier this month. Earlier in January, Saudi Arabia's finance minister said the kingdom is changing the way it provides assistance to allies, shifting from previously giving direct grants and deposits unconditionally, and being 'open' to discuss trading in non-dollar currencies.

China's manufacturing PMI is down but remains to expand in March

The purchasing managers' index (PMI) for China's manufacturing sector came in at 51.9 in March, down from 52.6 in February, data from the National Bureau of Statistics showed Friday.

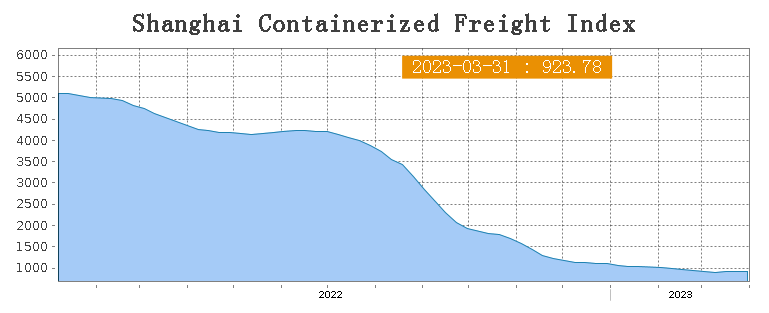

Sea Freight|| Routes to South America and the Middle East increase significantly

Freight rates overall on multiple sea routes trended differently last week as the market is still recovering, On 31st March, the Shanghai Containerized Freight Index rose by 1.7% to 923.78.

Europe/ Mediterranean: Economic Sentiment Indicator was the result of lower confidence in industry and services, future economic outlook remains uncertain since the recent banking crisis is looming in Europe and the US.

Last week, transportation demand remained flat. Until 31st March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$884/TEU, which fell by 2.4%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$1602/TEU, which fell by 0.2%.

North America: The interest rate had been raised aging by the Fed last few weeks, escalating worry of economic recession.

Until 31st March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1,148/FEU and US$2,010/FEU, 0.6% and 1.4% fall accordingly.

The Persian Gulf and the Red Sea: Until 31st March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 16.3% rose from last week's posted US$1040/TEU.

Australia/ New Zealand: Until 31st March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$318/TEU, which gained by 1.9% from the previous week.

South America: The freight market had a significant rebound. on 31st March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$1721/TEU, an 21% rose from the previous week.