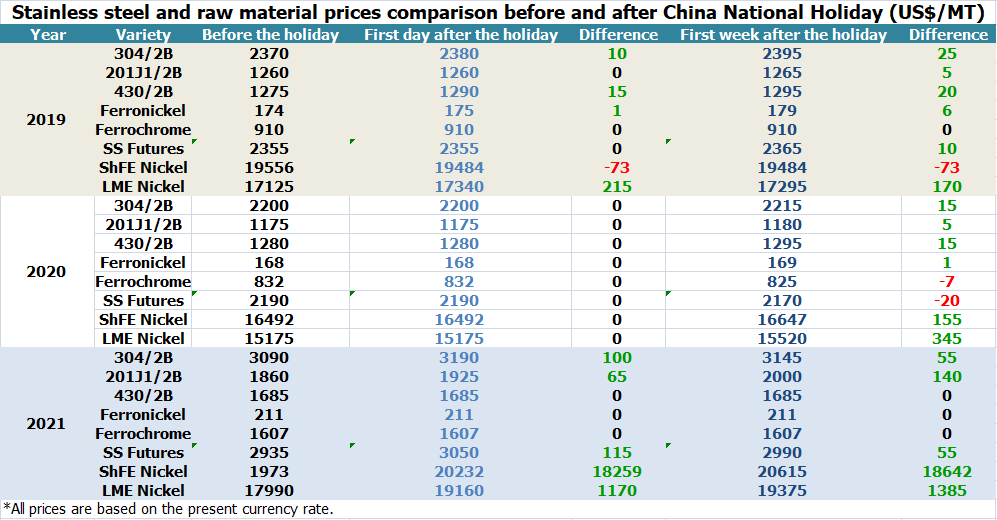

China's trading market rested for 7 days during the National holiday. On October 8th, the first day of work, we saw small increases in the stainless steel price and it tend to remain stable till October 12th. But the transaction which shall be heated up as tradition was calm earlier on October 9th. This circumstance, for many people, is "surprisingly within expectation". Compared to the prices in the past three years, the prices of stainless steel and other related commodities showed a rising tendency. Influenced by the sluggish global demand, domestic and abroad buyers are more conservative in their purchases. But the dark time has passed, seemingly, because the stainless steel prices stopped decreasing which has reduced for 4 months, and now it is stably increasing. According to the latest production schedule of steel mills, the cold-rolled stainless steel output is to decrease in October and the prices, as analytics said, "have chances to rise in October". The sea freight collapsed as global demand falls, and the decline start to slow. However, based on the prosperity index, people lose confidence in the sea shipping industry. The sea freight, we predicted, will remain weak. If you want more other analysis about Stainless Steel Market Summary in China, please keep reading.

Weekly average price sep2~sep30 before the national holiday

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,630 |

-4 |

-0.17% |

|

Foshan |

2,670 |

-4 |

-0.17% |

||

|

Hongwang |

Wuxi |

2,545 |

-7 |

-0.29% |

|

|

Foshan |

2,555 |

11 |

0.47% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,420 |

-34 |

-1.47% |

|

Foshan |

2,500 |

0 |

0% |

||

|

316L/2B |

TISCO |

Wuxi |

4,065 |

46 |

1.17% |

|

Foshan |

4,120 |

54 |

1.38% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,015 |

60 |

1.56% |

|

Foshan |

4,035 |

94 |

2.47% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,540 |

3 |

0.20% |

|

Foshan |

1,540 |

20 |

1.42% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,475 |

6 |

0.42% |

|

Foshan |

1,470 |

10 |

0.74% |

||

|

430/2B |

TISCO |

Wuxi |

1,260 |

-16 |

-1.35% |

|

Foshan |

1,265 |

-16 |

-1.36% |

TREND||the price of Stainless steel to rise after the China National holiday

After decreasing for 4 months, in September, the stainless steel prices start to rebounce. Last month, the most-traded contract price of stainless steel futures rose to US$2640/MT, and the spot price of stainless steel 304 had also reached above US$2545/MT. Following the down trending price of Oil and Non-Ferrous Metal, the price of stainless steel was also falling, while the interest rate was increasing across the globe.

The US dollar index had a downward reaching at 110.05 at the beginning of last week, then rebinding to 112.78 on 7th October. The 16% increase in US oil had prompted the energy price, the LME nickel closed at US$22,415/MT on 7th October with 4.47% up compared to the week before.

The spot price of stainless steel had a "high jump" after the 7-day holiday.

On October 8th, the cold-rolled stainless steel 304 was quoted at around US$2530/MT, and the hot-rolled 5-foot stainless steel was quoted at about US$2445/MT. The low inventory level was signaling the price increment on the market while the transaction was rather active on October 8th, the first working day.

The restocking is seemingly still a necessity since the whole process concluded one day after the holiday. Nevertheless, Xinhai Technology, recently acquired by TISCO, is starting its production and supply. As a whole, it is estimated that the price of stainless steel is projected to be volatile.

However, influenced by the tepid demand at home and abroad, the restocking period is greatly shorted than the past years. On October 9th, market traders said the transaction was calm, and it seemed that the need for restocking has completed on the first day to work.

Price remained stable and slightly increased in the morning inquiry on October 9th

Compared to the spot price on October 8th, the cold-rolled 4-foot mill-edge stainless steel 304 remained at US$2530/MT, while the stainless steel 201 J series had a small rise. The cold-rolled mill-edge stainless steel 201 was quoted at US$1525/MT, stainless steel 201J2/J5 was quoted at US$1470/MT, both rising by US$14/MT. As for the hot-rolled 5-foot stainless steel, it was quoted at US$1460/MT, increasing by US$7/MT. Some of the specifications such as those thicknesses of 0.85mm, 0.95mm, and 1.25mm run short on inventory.

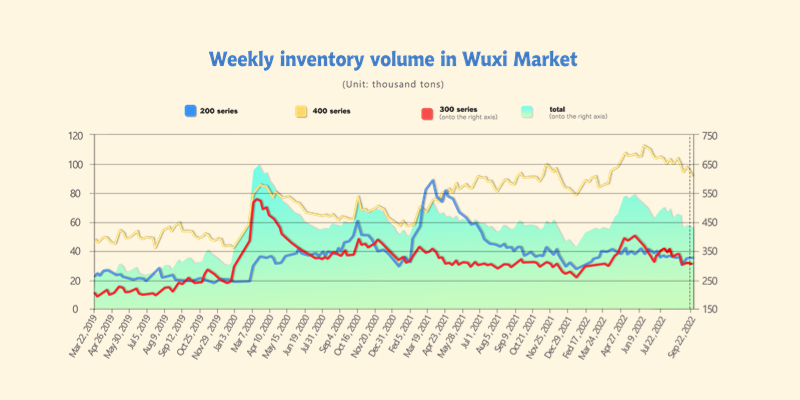

Inventory||Inventory drops in three consecutive weeks before the National holiday

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| September 22nd | 34,800 | 307,317 | 94,128 | 436,245 |

| September 29th | 34,990 | 304,516 | 90,296 | 429,802 |

| Difference | 190 | -2,801 | -3,832 | -6,443 |

The inventory level at the Wuxi sample warehouse was downed by 6,443 tons to 429,802 tons (as of 29th September).

the breakdown is as followed:

200 series: 190 tons up to 34,990 tons

300 Series: 2,801 tons down to 304,516 tons

400 series: 3,832 tons down to 90,296 tons

Stainless Steel series 200: Inventory was heaping to warm the market up

The inventory level of Stainless Steel series 200 had gone up for four consecutive weeks (as of 30th September), Baosteel Desheng and Beigang new material had contributed the most amount of inventory resupply. Client at the downstream had warmed up the market a bit just a couple of days before the 1st of October, but soon enough it had turned cold in preparing for the holiday.

Stainless Steel series 300: Tiny cut back on inventory

The inventory decreased slightly from 2,800 tons to 304,500 tons. The future price of stainless price weakened in the last week before China National day (1st October) but the spot price is to say otherwise. The shipment was running smoothly during the week, but the market transaction was quite down as the holiday come. The agents of state-owned mills had finalized their settlement which has cut off the inventory level of some preposition warehouses. There were four cargo ships from Tsingshan holding arrived on site, but the volume of stainless steel 300 was decreased. It is believed that the inventory level will be increasing significantly.

Stainless Steel series 400: Transaction was cooling off

Inventory level had decreased slightly by 3,800 tons to 90,300tons. The market has shown a moderate performance on the transaction as the mills were actively sending shipments which led to the downed price. The purchase demand was seemingly low as the long holiday was drawing close, the price is likely to remain stable after the market reopens.

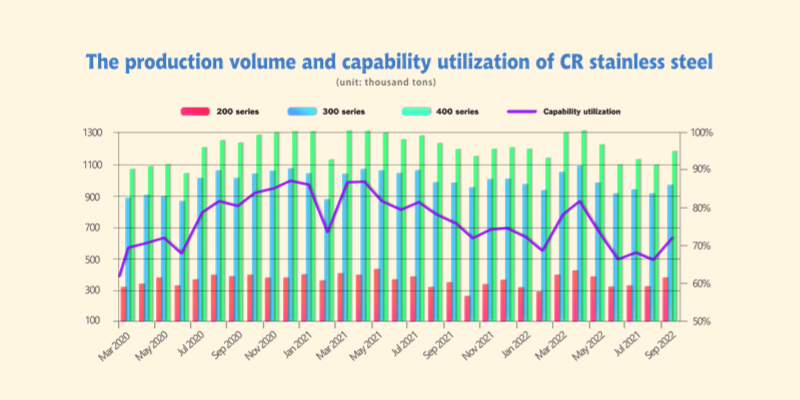

The outlook of cold-rolled stainless steel MoM decreased in October

1. Production volume of stainless steel in September concluded at 7.97% higher than last month, but 1.32% lesser than the same period last year.

The total production amount of cold-rolled stainless steel across 34 mills in September was 1,180,200 tons, approximately 87,120 tons increase. The Capacity Utilization was 71.5%, a 5.2% increase.

The production of cold-rolled stainless steel

| Oct 2021 | Sep 2022 | Oct 2022 E | MoM | YoY | |||

| 200 series |

|

|

376 | 15.59% | 8.55% | ||

| 300 series | 633.1 | 587.2 | 591.5 | 0.73% | -6.57% | ||

| 400 series | 216.5 | 180.6 | 212.7 | 17.77% | -1.76% | ||

| Total | 1196 | 1093.1 | 1180.2 | 7.97% | -1.32% |

Transactions were failed to influence by the "golden September" high season and being rather dull. The price of stainless steel had bounced back from falling as most of the mills were resuming production throughout September, Stainless steel series 400 had the most increment among Stainless steel series 300 and Stainless steel series 200.

Stainless steel series 200 totaling 376,000 tons of production, a 15.59% growth from August, an 8.55% increase compared to the same period last year.

Stainless steel series 300 had concluded 591,500 tons of production in September, merely a 0.73% increment compared to last month, a 6.57% cut-off from the same period last year. The deduction was owed to the systematic adjustment made by some of the mills to improve the production level of stainless steel series 200.

Stainless steel series 400 had 212,700 tons of production in September, approximately a 17.77% increase from last month and 1.76% lesser than the same time last year. The cold rolled product had the most significant increase, contributed by JISCO TISCO and Beigang new material.

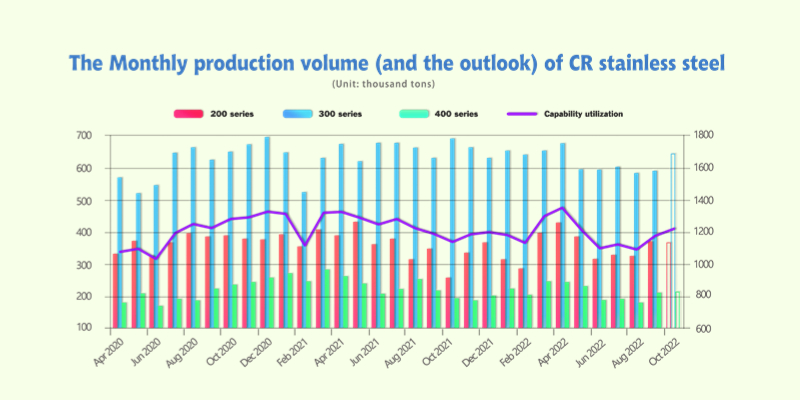

2. The 34 major stainless-steel mills in China are projected to have 1,219,500 tons of cold-rolled stainless-steel production in October, about a 3.33% increase from September, approximately 6.55% up compared to the same period last year.

The production volume of the three main series of cold-rolled stainless steel is estimated that

Stainless steel 200 series:

365,000 tons, 2.93% down compared to September, and 42.47% up compared to the same period last year.

Stainless steel 300 series:

642,700 tons, 8.66% up compared to September, and 7.44% down compared to the same period last year.

Stainless steel 400 series:

211,800 tons, 0.42% down compared to September, and 9.18% up compared to the same period last year.

As it had mentioned above, the negative correlation between Stainless steel series 200 and Stainless steel series 300 on production volume is owed to the systematic adjustment made by a mill in South China. The slight decrease in stainless series 400 could be led by the mill in East China.

Chances high for China steel prices to go up in Oct

Chinese prices are likely to rebound in October with market fundamentals improving and macroeconomy support policies coming into force, predicted Wang Jianhua, the chief analyst of a Chinese steel institution, in his monthly outlook. But pessimism still haunts the market, he admitted. As of September 26, China's national composite steel price under The institution's assessment had dropped by Yuan 13.8/tonne ($1.9/t) from August 31 to reach Yuan 4,209.1/t, with the average price during September 1-26 losing Yuan 104/t on month.

Market participants can probably expect prices to keep falling in the coming months, Wang noted. "Inevitably, market sentiment will be depressed by persistent COVID-19 containment policies, the approach of the traditional 'heating season' in northern regions of China (when steel production is often cut), and fears about a global economic recession," he explained. Nonetheless, he suggested that there is no need to be so pessimistic because domestic steel demand showed signs of recovery in September.

For example, the daily trading volume of construction steel comprising rebar, wire rod and bar-in-coil among the 237 Chinese trading houses under the institution's tracking averaged 182,288 tonnes/day over September 1-29, jumping by 34,857 t/d or 23.6% from the average daily trading volume during August. On September 27 alone, the volume even hit a one-year high of 276,754 tonnes.

"Actual consumption over the past two months has soundly disproven the claims of market 'bears' that Chinese steel demand has plummeted by 30-50% during the past year," Wang noted. Market participants should regain their confidence in steel prices, he stressed.

As for October, traditionally a month for high steel consumption in China, there is room for steel demand to grow further, he added, as most construction companies will ramp up the pace of work on building projects while the cool and mild weather lasts. Steel end-users will replenish input materials since their current steel stocks are quite low.

Meanwhile, the liquidity of financial assets in China keeps improving with the growth in national tax revenue, and the national investment in infrastructure and manufacturing industries has increased in recent months, both of which provide a solid support for steel prices.

On the other hand, the domestic steel supply is likely to decline overall in the coming months, according to the institution's assessment, and this will also give a boost to steel prices.

Among the 247 domestic steel mills tracked by the institution, only around half enjoyed some profit margins on their finished steel in September, and many were teetering on the brink of losing money – a situation had already prompted steelmakers to refrain from ramping up output, Wang said.

Given the steel mills' voluntary production cuts and their mission to keep this year's total crude steel output lower than that of last year, the institution estimates China's crude steel output will edge up slightly to 86.5 million tonnes in October and then keep below 80.4 million tonnes in November and December, close to this year's lowest levels.

Raw material|| Nickel price outlook: Targets for 2022

As demand was expected to soften due to headwinds from monetary tightening and risks of recession, what will be the nickel price forecast for 2022?

On 6 October, according to the Australian government's September quarterly report on resources and energy, Kallanish expects that the average price of nickel in 2022 will be $24,900 per ton due to the impact of the Russian-Ukrainian conflict.

On 9 September 2022, ANZ Research forecast nickel to average $25,350 a tonne in 2022, climbing to $25,800 in 2023 and $23,700 in 2024.

Fitch Solutions lowered its nickel price forecast for 2022 to $24,250/tonne as of 8 September, down from $27,500 on 8 July. It also revised its nickel price forecast for 2023 downward to $22,500, from $24,000 on 8 July.

On 16 June 2022, Fitch Ratings revised its nickel price forecast for 2022 to $25,000/tonne from $20,000.

Trading Economics expected nickel to trade at $24,290.62 a tonne by the end of this quarter, based on its global macro models and analysts expectations as of 12 September. In addition, the economic data provider estimated the metal to average $28,767.63 in 12 months' time.

Analysts did not provide nickel future price predictions for 2025 to 2030.

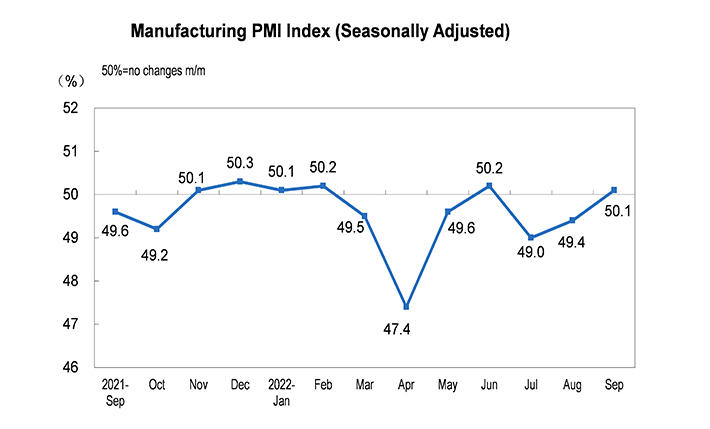

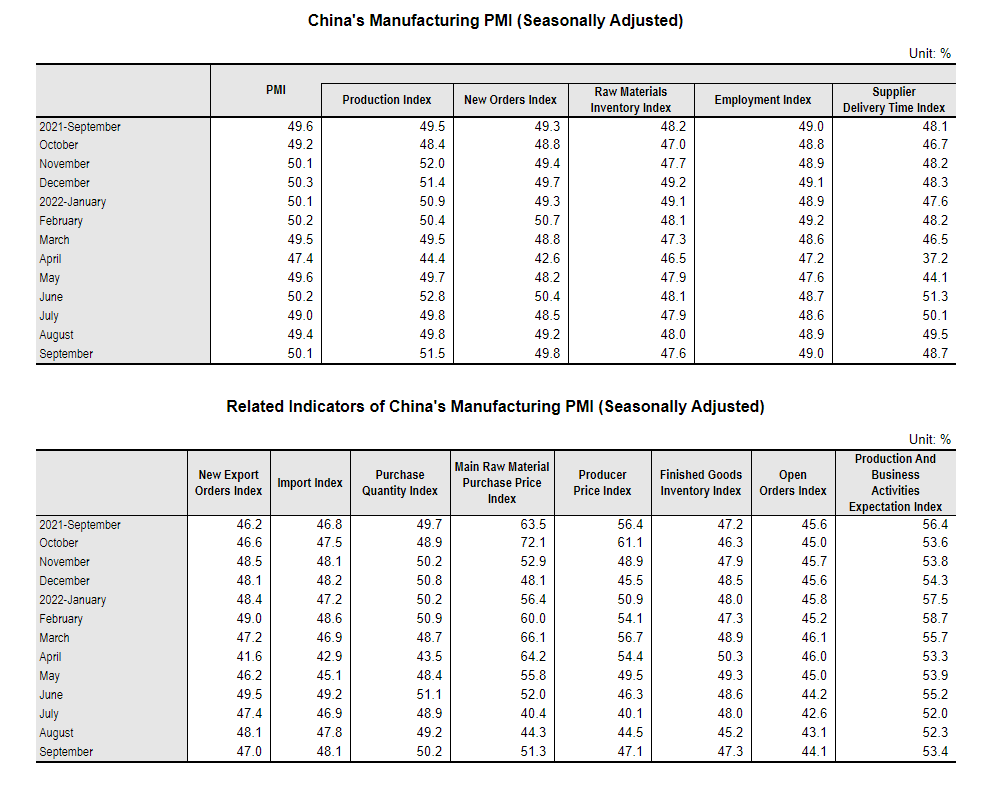

Macro|| China's PMI recovers and goes to 50.1% in September

In September, the Purchasing Manager Index (PMI) of China's manufacturing industry was 50.1 percent, an increase of 0.7 percentage points from the previous month, moving into the expansion range.

The production activity recovers a lot from the power outage during the heatwave. China's domestic demand is getting better because the government keeps supporting the construction industry from the policy side. But we can see the exporting demand is decreasing, as the new export orders fell by 1.1ppt month-on-month to 47%. For that, the Chinese government also push out new policies and preferences for exporting enterprises to stimulate the export business.

Inventories are still depleting, and prices have diverged. In September, the inventories of raw materials and finished products decreased by 0.4ppt month-on-month and increased by 2.1ppt to 47.6% and 47.3%, respectively. Although the rate of detoxification of finished products has slowed down, they are still in the contraction range. The metal product industry, chemical fiber and rubber and plastic products industry, ferrous metal smelting and calendering processing industry, which had a relatively fast removal rate of finished products in August, slowed down the inventory removal rate in September, but still showed a state of removal.

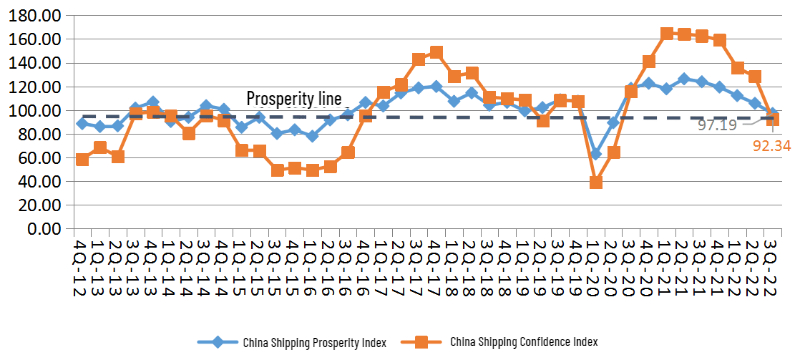

Sea freight||The shipping industry slides into contraction.

"Since the third quarter of 2020, the China Shipping Prosperity Index and Confidence Index have both fallen into the recession range in the Q3 of 2022 for the first time."

The Shanghai International Shipping Research Center recently released the China Shipping Prosperity Report for the third quarter of 2022.

The report shows that in the third quarter of 2022, the China Shipping Prosperity Index was 97.19 points, down 8.55 points from the second quarter, entering a weak recession range; the China Shipping Confidence Index was 92.34 points, down by 36.09 points from the second quarter, falling to a weak recession range.

This is the first time since the third quarter of 2020 that both the prosperity index and the confidence index have fallen into the recession range.

In the fourth quarter of 2022, the China Shipping Prosperity Index is expected to be 95.91 points, decreasing by 1.28 points from the third quarter, and remain in the recession range; the China Shipping Confidence Index is expected to be 80.86 points, down by 11.47 points from the third quarter, falling into the depressed range.

Confidence indices of all types of shipping companies have declined to vary degrees, and the overall market remains pessimistic.

It is expected that the profitability of shipping companies will continue to deteriorate, and the entrepreneurs are not confident about the future.

According to the China Shipping Prosperity Survey, in the fourth quarter of 2022, the prosperity index of shipping companies is expected to be 91.01 points, down 2.84 points from the third quarter, and continue to remain in the weak recession range; the confidence index is expected to be 62.87 points, down from the third quarter 15.08 points, the market will be more depressed.

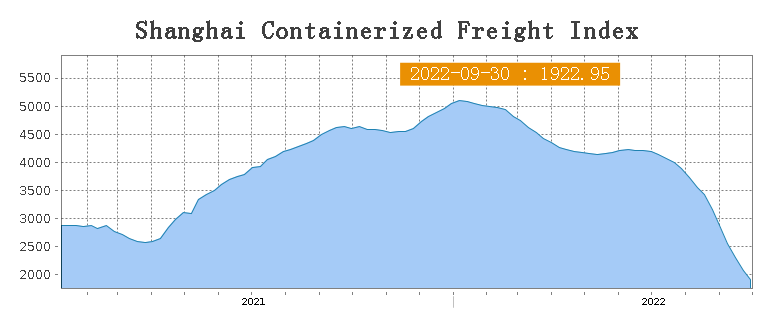

Index: Demand for shipping remains sluggish, sea freight keeps reducing.

Recently, the transportation market maintains sluggish, and transportation demand is getting weaker. From September 19th to September 23rd, the market freight rates of ocean routes continued to decrease. On September 30th, the Shanghai Export Containerized Freight Index released by the Shanghai Shipping Exchange was 1922.95, down by 7.2% from the previous week.

On September 23, the SCFI was 1922.95.

Europe/ Mediterranean: According to Markit, in September, the manufacturing PMI in Eurozone is 48.5 which is the lowest in recent 27 months. All the indicators are in the contraction area and deteriorating. As winter is approaching, the energy crisis is worsening. Before the Chinese National Holiday (October 1st), the peak of sea shipping did not show up. The demand for exporting transportation remains weak and sea freight continues to drop. On September 30th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$2,950/TEU, down by 6.7 % from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$2,999 /TEU, down by 7.7% from the previous week.

North America: As the Fed raises the interest rate, it is more difficult for US enterprises to remain low on expenditure. The demand fails to increase before the long holiday in China, the sea freight keeps decreasing. On September 30th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$2,399 /FEU and US$6,159 /FEU, respectively, down by 10.6% and 5.8% from the previous week.

The Persian Gulf and the Red Sea: Demand is weak, but the declining pace slows down. On September 30th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$912/TEU, decreasing by 7.7% from the last week.

Australia/ New Zealand: Demand remains tepid. On September 30th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$1,850 /TEU, down by 5.4% from the previous week.

South America: Demand for shipping is low. On September 30th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$5,025/TEU, decreasing by 8.3% from the previous week.