Last Friday, a bomb ignited the stock market. Beijing finally responded to the gloomy real estate industry with a series of historically boosting policies. Stocks rose instantly and so as the stainless steel prices because people saw the chances once the government started to buy the wait-for-sale houses which are stagnating in the market. Stainless steel prices went up last Friday and the increasing tendency lasts till now (May 23), when the steel mills just now increased the opening price and then soon closed the quotation because of the spiking price. However, due to the tepid trading and the increasing output from steel mills, the spot inventory still stacked up last week and it will keep rising as steel mills' production in May expands. Looking at the global dynamics, the US raised the import tax on stainless steel products from China to 25%. The increase has little impact on the market because the trading volume is small. What is currently changing the game is the continuously increasing sea freight. Last week, Shanghai Containerized Freight Index went up by 9.3%, among which the routes from Shanghai port to South American basic ports spiked by 22.4%, averaging at US$6686/TEU. It is never easy to decide to buy. The current product's price is only one of the dimensions, its future prices, transportation costs, time and so many other elements are also under your consideration, right? So, JINLING METALS is always here to help you to build a healthy logistics and supply chain, don't miss out the Stainless Steel Market Summary in China, and just keep reading the analysis in detail.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,165 | -15 | -0.72% |

| Foshan | 2,205 | -15 | -0.71% | ||

| Hongwang | Wuxi | 2,065 | -15 | -0.76% | |

| Foshan | 2,065 | -15 | -0.77% | ||

| 304/NO.1 | ESS | Wuxi | 2,000 | -14 | -0.74% |

| Foshan | 2,000 | -10 | -0.55% | ||

| 316L/2B | TISCO | Wuxi | 3,695 | 8 | 0.24% |

| Foshan | 3,745 | 8 | 0.22% | ||

| 316L/NO.1 | ESS | Wuxi | 3,530 | -6 | -0.16% |

| Foshan | 3,540 | -7 | -0.22% | ||

| 201J1/2B | Hongwang | Wuxi | 1,400 | 6 | 0.45% |

| Foshan | 1,390 | 2 | 0.13% | ||

| J5/2B | Hongwang | Wuxi | 1,315 | 6 | 0.49% |

| Foshan | 1,305 | 2 | 0.14% | ||

| 430/2B | TISCO | Wuxi | 1,240 | 0 | 0.00% |

| Foshan | 1,240 | 0 | 0.00% |

TREND|| Boldest Market Rescue Measures Propel Stainless Steel Prices Higher.

Stainless steel futures prices experienced an initial decline followed by a rebound this week. Overall, spot stainless steel prices were sluggish, reflecting the weak sentiment in the market. However, on Friday, driven by the sharp rise in nickel prices, stainless steel prices also rallied, with trading volume significantly increasing. The main stainless steel futures contract closed at US$2130/MT this week, up 0.56% for the week. The lowest price within the week was US$2080/MT.

In the spot market, stainless steel prices in the Wuxi market remained stable with slight declines for the 200 and 300 series, while the 400 series remained stable. The market sentiment was initially subdued, but steel mills maintained their firm pricing stance, and traders adjusted their quotes in line with the futures market fluctuations.

On May 17, the People's Bank of China (PBOC) announced a series of measures to boost the real estate market. These measures include canceling the lower limit for the interest rate on first- and second-home commercial personal housing loans at the national level, lowering the interest rate on personal housing provident fund loans, and lowering the minimum down payment ratio for personal housing loans. The battered real estate stocks rebounded in response, influencing the bulk commodity market.

300 Series: Supply and Demand Contradictions Highlighted, Inventory Continues to Increase.

The market for 300 series stainless steel experienced some price adjustments last week, highlighting the ongoing tension between supply and demand. Prices for 304 cold-rolled sheets remained flat in Wuxi, with private four-foot sheets holding steady at US$2030/MT. However, private hot-rolled sheets saw a slight decrease of US$14 to US$1995/MT compared to pre-holiday levels. Early in the week, prices fluctuated before dropping.

While steel mills attempted to hold firm on pricing, cautious market sentiment and reduced speculative demand led to price softening as the week progressed. High inventory levels and continued production further weakened the justification for price increases. Entering the traditional slow season, downstream demand has fallen, with customers adopting a just-in-time purchasing approach, resulting in sluggish overall transaction activity.

200 Series: 0.14 Million Tons! Inventory Increases Again, Can 201 Stay Stable?

The 200 series market in Wuxi remained relatively stable last week. Prices for cold-rolled 201J1 and J2/J5 held steady at US$1375/MT and US$1290/MT respectively. Hot-rolled 201J1 sheets saw a minor decrease of US$7 to US$1340/MT compared to the previous week. Steel mills maintained flat pricing, with traders offering limited discounts. The overall market atmosphere was quiet, with end users placing minimal orders and adopting a just-in-time purchasing strategy. Transactions remained average throughout the week.

400 Series: Slight Inventory Reduction, Supply Pressure Eased.

Inventory levels for the 400 series saw a slight reduction, easing some supply pressure. TISCO and Jiugang maintained their guidance prices for cold-rolled 430 at US$1470/MT and US$1600/MT respectively. In Wuxi, state-owned cold-rolled 430 traded between US$1240/MT and US$1245/MT, with hot-rolled sheets holding at US$1135/MT. All prices remained unchanged from the previous week.

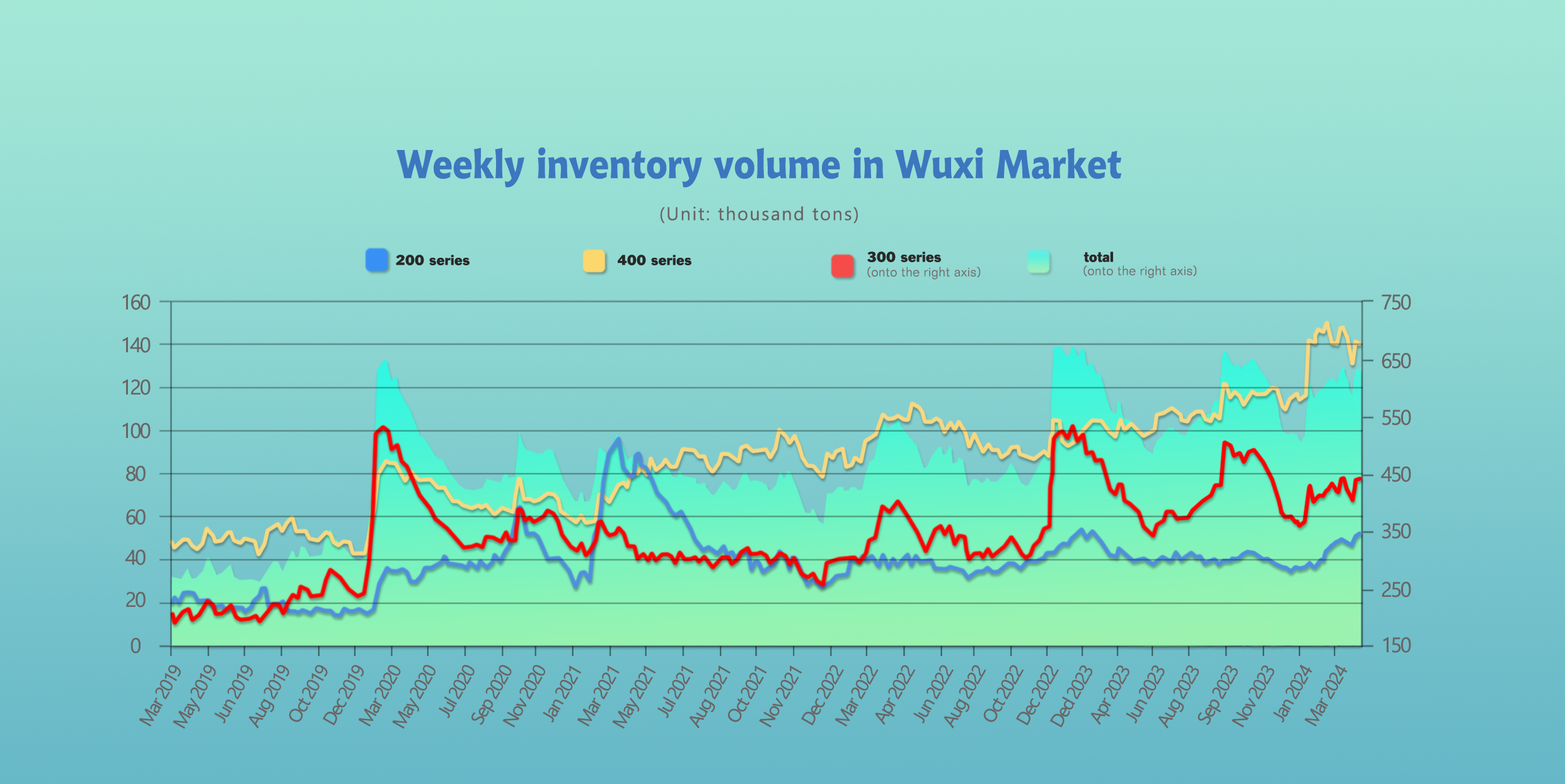

INVENTORY|| Sluggish Stainless Steel Demand Puts Downward Pressure on Future Arrivals.

The total inventory at the Wuxi sample warehouse up by 3,514 tons to 630,397 tons (as of 16th May).

The breakdown is as followed:

200 series: 1,382 tons up to 51,410 tons,

300 Series: 3,395 tons up to 439,650 tons,

400 series: 1,263 tons down to 139,337 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| May 7th | 50,028 | 436,255 | 140,600 | 626,883 |

| May 16th | 51,410 | 439,650 | 139,337 | 630,397 |

| Difference | 1,382 | 3,395 | -1,263 | 3,514 |

300 Series: Supply and Demand Imbalance Becomes Apparent.

During last week, the futures prices weakened, causing spot prices to fall in tandem. The arrival of resources from the Tsingshan increased, leading to a significant rise in hot-rolled inventory for the 300 series. As the market continued to decline, the number of hedging resources decreased, and the number of warehouse receipts also dropped, resulting in a decrease in cold-rolled inventory. Considering current raw material prices, steel mills are operating at a loss. The production for May is expected to remain high, and due to insufficient off-season demand, inventory is anticipated to continue increasing next week. Attention will remain on subsequent production and market transaction volumes.

Note: After considering warehouse receipts, the social inventory and warehouse receipts for the 300 series cold-rolled in the Wuxi area totaled 371,200 tons this week, down by 8,900 tons (2.34%) from last week and up by 125,400 tons (51.02%) from the same period last year.

200 Series: Another 14,000 tons increase!

During last week, the production volume in May remained high, estimated at around 1.22 million tons, maintaining supply pressure. The recent fluctuating rise in raw material prices supported stable prices for the 201 series. However, end customers' orders were poor, and market confidence was lacking, leading to small inventory increases. Short-term spot prices for the 201 series are expected to trend weakly, with a focus on market transactions and steel mill arrivals.

400 Series: Slight Inventory Reduction, Supply Pressure Eases.

As the downstream purchasing gradually returned to normal levels, transactions mostly involved low-priced resources or just-in-time purchases last week, resulting in small reductions in both cold and hot-rolled inventories. The cost support from raw materials remained strong, and steel mill profits gradually recovered, although there were still slight losses, leading to a strong price-maintaining mentality. Current 400 series inventory remains high, and with the increase in steel mill production in May, market supply pressure is expected to increase. Next week, inventory may rise, and attention will continue on inventory changes and market transactions.

RAW MATERIAL|| Nickel Chromium Prices Remain Stable.

Shanghai nickel prices fluctuated strongly this week, with the main Shanghai nickel futures contract closing at US$20,770/MT on Thursday, up US$678/MT or 3.42%. The ex-factory price of high-nickel pig iron remained stable at US$240/nickel point as of Thursday, unchanged from last Thursday.

The mainstream ex-factory price of high-chromium raw materials is US$1330-1360/50 reference ton, up US$14/50 reference ton from last week. The fifth round of price increase for coke was put on hold, and the pace of increase in the comprehensive production cost of high-chromium slowed down, with a slight increase. The mainstream long-term purchase price of high-chromium for steel mills in May remained unchanged month-on-month. Due to better-than-expected steel bidding prices, factories have maintained their production enthusiasm recently, and high-chromium output has continued to increase, putting greater pressure on market supply. Given that stainless steel output has remained high recently, there has been some increase in demand for high-chromium raw materials.

Both supply and demand for high-chromium have increased, but the growth rate of high-chromium output is faster than the growth rate of stainless steel output, and the situation of oversupply of high-chromium is becoming apparent. In the short term, there is insufficient momentum for prices to continue rising, and they are expected to fluctuate around the current level.

SUMMARY|| Can Macro Benefits Revive a Weakened Fundamental Market?

300 Series: The domestic and international macroeconomic benefits are gradually being released, with growing expectations of overseas interest rate cuts improving investment sentiment. However, terminal demand remains weak. The effects of previous high production rates are gradually surfacing, highlighting supply-demand conflicts. Stainless steel prices are under pressure, and short-term cold-rolled 304 spot prices are expected to fluctuate widely.

200 Series: Recent electronic trading has been volatile with a lackluster transaction atmosphere. End customers have shown poor order intake, relying mainly on just-in-time purchasing. In May, the supply pressure from steel mills increased, leading to accumulated social inventory. In the face of supply and demand struggles, the short-term spot prices for the 201 series are expected to remain volatile.

400 Series: Raw material costs continue to provide strong support, and steel mill profits have somewhat recovered, leading to a strong price-supporting sentiment. Currently, downstream purchases are gradually returning to normal levels, with demand-driven procurement. The spot market inventory is slowly being digested, and with increasing supply pressure, there is a constant tug-of-war between supply and demand. Prices are under pressure, and the short-term prices for the 430 series are expected to remain weakly stable.

MACRO|| US Section 301 Tariffs: What Impact on Stainless Steel and Nickel Iron?

On May 14, the United States announced the results of the four-year review of the Section 301 tariffs on China. In addition to the existing Section 301 tariffs on China, the US will further increase tariffs on imports from China, including electric vehicles, lithium batteries, battery components, critical minerals, solar panels, port cranes, and medical products. Among them, the tariff on steel products will be raised to 25%, and the largest increase will be the tariff on Chinese electric vehicles, which will be raised by 100% from the original 25%.

Will the new tariff of 25% on stainless steel exported to the United States have an impact on stainless steel exports and disrupt the supply-demand balance?

In 2023, the total amount of stainless steel exported to the United States was 86,552.7 tons, with an average monthly export of 7,212.7 tons. China's total stainless steel exports last year were 4.1372 million tons, and exports to the United States accounted for 2.09% of total exports. According to the breakdown by category of exports to the United States last year: plates and coils 41,200 tons, strips 5,793 tons, profiles 12,657.8 tons, and tubes and pipes 26,901 tons.

As can be seen from the data from last year, the proportion of stainless steel exported to the United States is very small, and the total amount for the whole year is less than the sales volume of a single steel mill agent. The impact of the US tariff adjustment on the price of stainless steel is very limited.

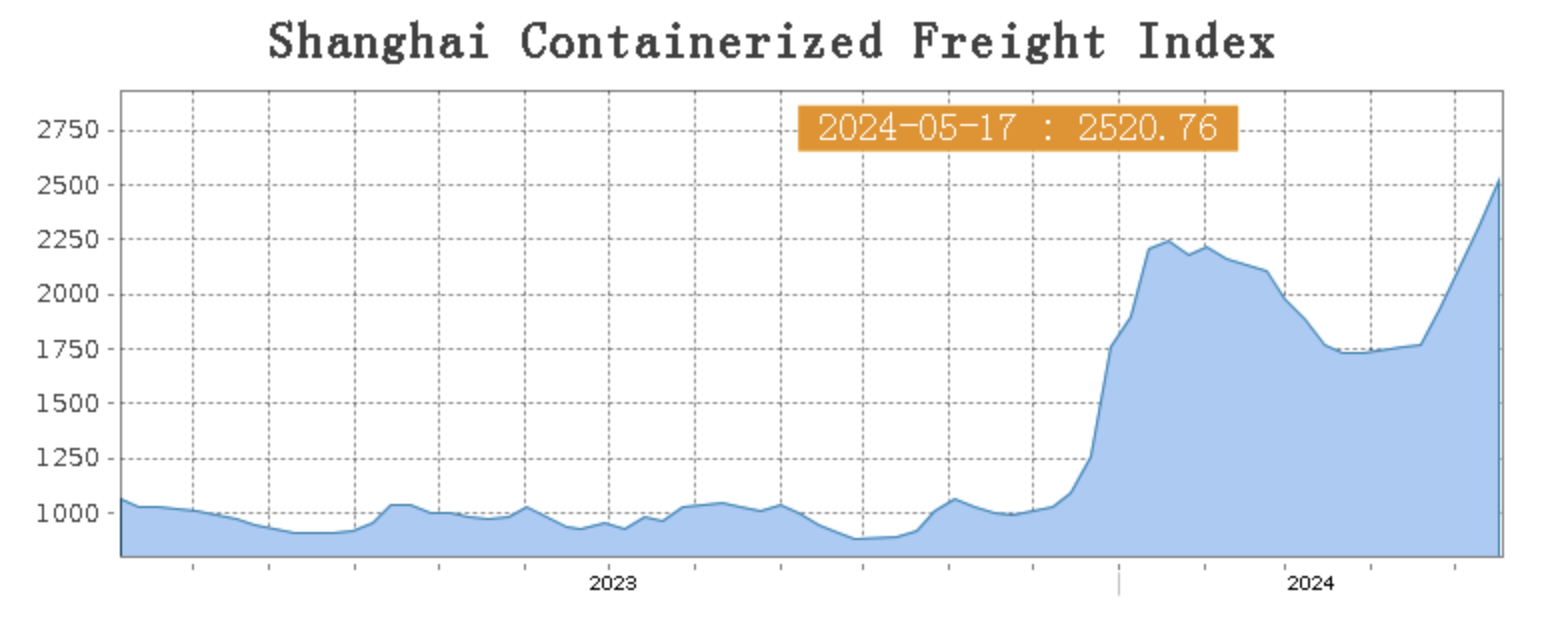

Sea Freight|| Steady Improvement in Shipping Market, Composite Index Continues to Rise.

Last week, China's export container shipping market continued to maintain a stable and positive trend. The supply and demand situation for long-haul routes remains favorable, leading to a continued increase in the composite index.

On 17th May, the Shanghai Containerized Freight Index rose by 9.3% to 2520.76.

Europe/ Mediterranean:

According to data released by the European Economic Research Center, the eurozone's ZEW economic sentiment index rose to 47 in May, higher than the previous value and market expectations, the highest level since February 2022. This shows that the eurozone economy continues to recover steadily and that consumer confidence in economic growth is optimistic.

On 17th May the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3050/TEU, which rose by 6.3%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3957/TEU, which up by 1.1%

North America:

On 17th May, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$5025/FEU and US$6026/FEU, reporting a 14.4% and 8.3% spike accordingly.

The Persian Gulf and the Red Sea:

On 17th May, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 4.6% from last week's posted US$2221/TEU.

Australia/ New Zealand:

On 17th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1259/TEU, a 7.7% jump from the previous week.

South America:

On 17th May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$6686/TEU, an 22.4% surge from the previous week.