China's Manufacturing PMI of May (49.5%) fell back to the contraction zone after two months above the threshold. The performance of export contributed a great part to the economic expansion in 2024. However, in May, the new export order index sharply dropped by 2.3%, indicating the shrinking global demand for Chinese manufacturing. Meanwhile, raw material price and EXW price index both increased, which were also in line with the situation of the stainless steel industry. Lately, the ore products like nickel and chromium materials have been rising. Due to the slow procedure of RKAB, in the short term, the ferronickel will maintain robust, supporting the stainless steel prices. The production of stainless steel in China remains large in June, bringing pressure to the trading market, which is the main reason for the weak price. People are still looking to the government for more substantial support to realize in the next couple of months and the previous policies to take effect. Anyway, get down to the current situation, sea freight is still the trickiest problem-- higher rates, longer time, and more unstable status are all making the globe trade more uncontrollable. Read our Stainless Steel Market Summary in China, and stay on track.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,200 | 8 | 0.41% |

| Foshan | 2,240 | 8 | 0.40% | ||

| Hongwang | Wuxi | 2,100 | 7 | 0.35% | |

| Foshan | 2,105 | 14 | 0.71% | ||

| 304/NO.1 | ESS | Wuxi | 2,025 | 7 | 0.37% |

| Foshan | 2,025 | 4 | 0.22% | ||

| 316L/2B | TISCO | Wuxi | 3,670 | 0 | 0.00% |

| Foshan | 3,770 | 8 | 0.23% | ||

| 316L/NO.1 | ESS | Wuxi | 3,545 | 3 | 0.08% |

| Foshan | 3,550 | 10 | 0.29% | ||

| 201J1/2B | Hongwang | Wuxi | 1,415 | 14 | 1.09% |

| Foshan | 1,415 | 18 | 1.42% | ||

| J5/2B | Hongwang | Wuxi | 1,315 | 0 | 0.00% |

| Foshan | 1,315 | 7 | 0.58% | ||

| 430/2B | TISCO | Wuxi | 1,240 | -1 | -0.07% |

| Foshan | 1,240 | 0 | 0.00% |

TREND|| Stainless steel spot prices remained on rise slightly.

Stainless steel prices followed the market trend last week, rising slightly after testing a new high on the upper shadow line, before retreating. Traders' quotations fluctuated with the market, and inventories decreased slightly. As of Friday of last week, the main stainless steel contract price fell US$4.2/MT to US$2165/MT from the previous week, a decrease of 0.20%.

300 Series: Futures Surge Boosts Transactions.

Last week, the price of 304 stainless steel saw steady increases. As of Friday, the mainstream base price for privately-owned cold-rolled four-foot 304 in Wuxi rose US$2055/MT, and the price for privately-owned hot-rolled 304 rose to US$2020/MT, both up by US$7/MT from last Friday. At the beginning of last week, the futures market remained volatile, traders kept their quotes stable, end-users purchased on an as-needed basis, and transactions were average. Then, in the middle of the week, the futures market surged quickly, breaking the year's high, coupled with rising raw material prices, improving traders' sentiment. Consequently, spot prices were adjusted upward, market trading activity increased, and downstream procurement improved. However, with high market inventory pressure and weak end-user demand, the motivation for stainless steel price increases was insufficient. The high futures prices led to wide fluctuations, highlighting the supply-demand struggle, resulting in average transaction performance throughout the week.

200 Series: Tsingshan Adjusts 201 Price Spread, Market Response Lukewarm.

Last week, the spot price for 201 stainless steel in the Wuxi market was generally stable with slight increases. As of Friday, the mainstream base price for 201J1 cold-rolled in Wuxi rose to US$1385/MT, up US$14/MT from last Friday. The base price for J2/J5 cold-rolled remained at US$1290/MT, and the price for 201J1 five-foot hot-rolled remained at US$1340/MT, all unchanged from last Friday. Tsingshan Hongwang announced a new 201 price spread adjustment, followed by price increases from Tsingshan affiliates, primarily selling at low prices for volume sales. Market transactions were generally average throughout the week.

400 Series: Prices Unchanged Despite Inventory Reduction.

As of Friday, the guiding price for TISCO's 430 cold-rolled stainless steel last week was US$1470/MT, and JISCO's 430 cold-rolled guiding price was US$1600/MT, both unchanged from the previous week. Last week, the mainstream price for state-owned 430 cold-rolled stainless steel in the Wuxi market remained at US$1245/MT, and the price for 430 hot-rolled remained at US$1135/MT, both unchanged from the previous week's prices.

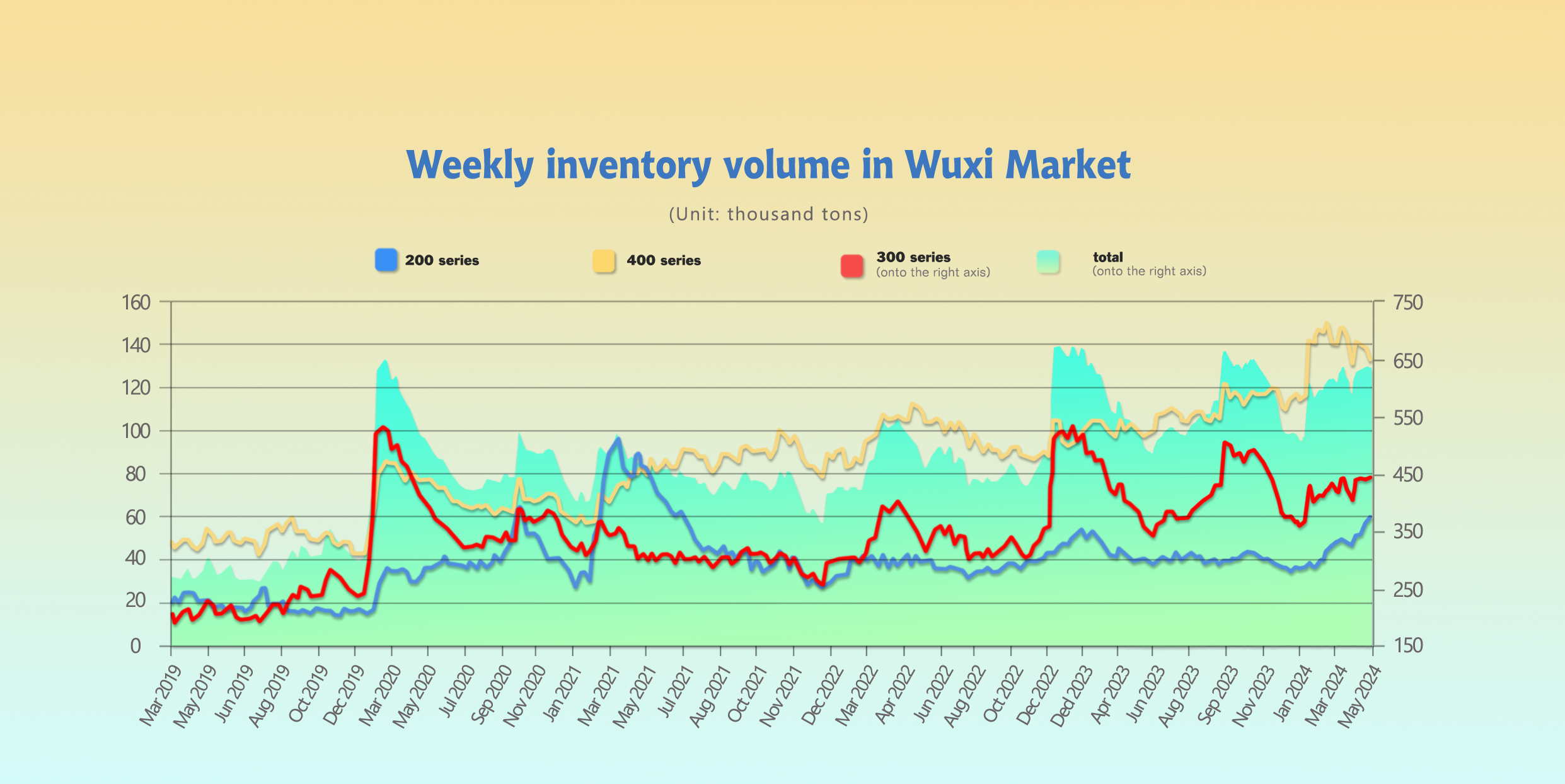

INVENTORY|| High Prices Drive Inventory Decline.

The total inventory at the Wuxi sample warehouse downed by 1,886 tons to 632,913 tons (as of 30th May).

the breakdown is as followed:

200 series: 3,232 tons up to 59,612 tons,

300 Series: 27 tons up to 440,874 tons,

400 series: 5,145 tons down to 132,427 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| May 23rd | 56,380 | 440,847 | 137,572 | 634,799 |

| May 30th | 59,612 | 440,874 | 132,427 | 632,913 |

| Difference | 3,232 | 27 | -5,145 | -1,886 |

300 Series: Warrant Levels Remain High, Cold-Rolled Inventory Decreases Again.

Last week, the main futures prices rose, and spot prices followed with a slight increase. Market arrivals decreased compared to the previous week, and some steel mills reduced their output. End-users maintained a strong wait-and-see attitude, purchasing mainly on an as-needed basis, resulting in a slight increase in hot-rolled inventory. The continuous rise in futures prices stimulated hedging resources to enter the market, keeping warrant levels high, with registered warrants continuing to increase and cold-rolled inventory continuously decreasing. Calculating with the current raw material prices, steel mills are operating at a slight loss, maintaining high production levels. With relatively weak off-season demand, a slight increase in inventory is expected next week.

200 Series: Limited End-User Demand.

During last week, 201 stainless steel prices rose steadily. The price adjustment for the 200 series by Tsingshan Hongwang failed to improve market transaction sentiment. Steel mill production continued at high levels, maintaining supply pressure. Poor demand from end-users, who purchased mainly on an as-needed basis, led to continuous inventory accumulation.

400 Series: Continuous Inventory Reduction in May, Supply Pressure Eased.

Nearing the end of the month, traders were eager to sell, and market buying sentiment was strong, with most transactions based on low-priced resources and as-needed orders. Additionally, the shutdown and maintenance at Taishan Steel at the end of May reduced market arrivals, leading to a continuous decline in social inventory. Compared to the same period in previous years, the current spot market inventory remains high. With the gradual release of high production effects in May, market supply pressure will not decrease. In the short term, 430 prices are expected to remain stable, with continued attention to inventory changes and market transactions.

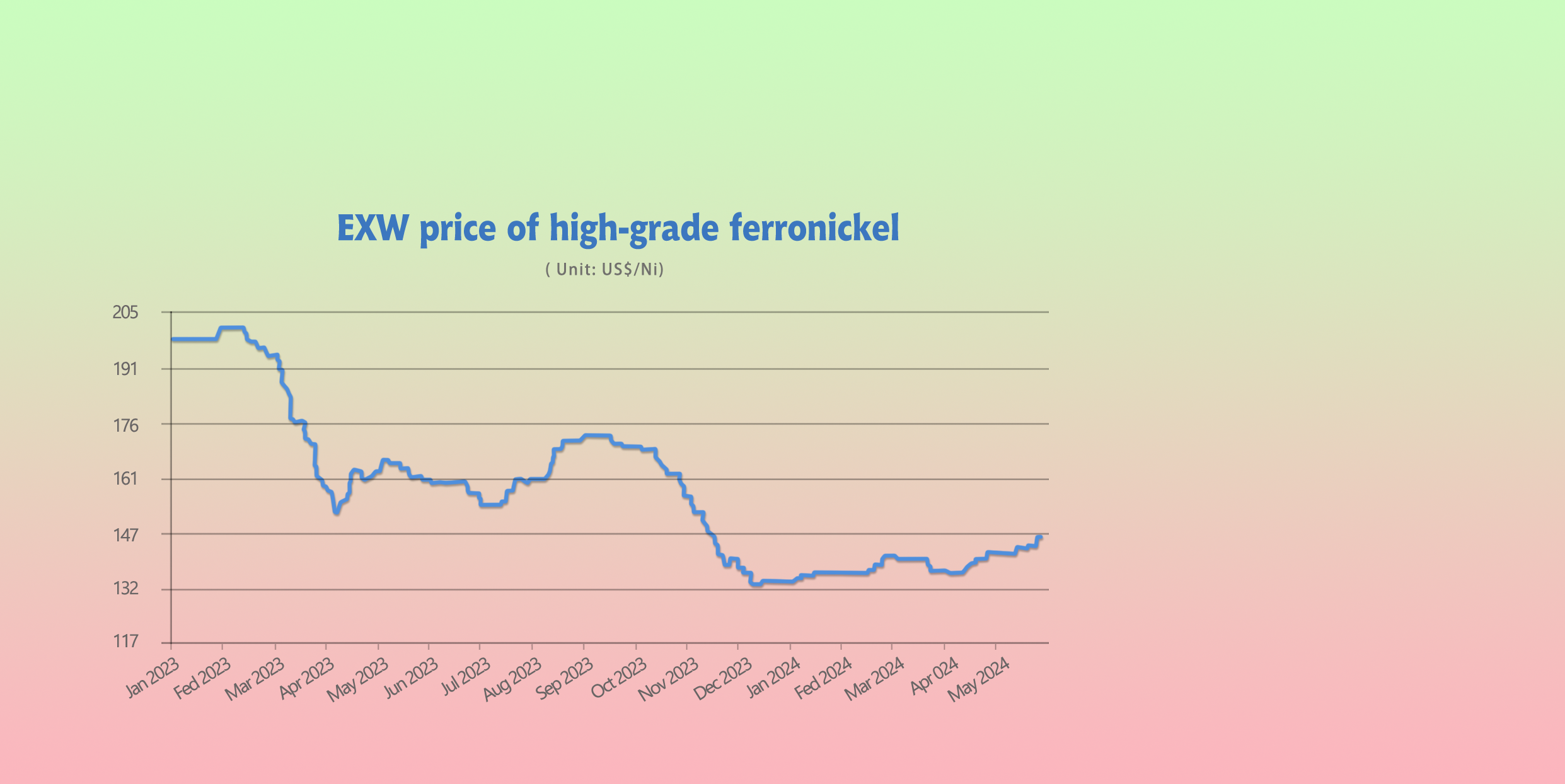

RAW MATERIALS|| Cost Support to Strongly Underpin Stainless Steel Prices in the Short Term.

Nickel: Big mill procurement prices break through the 1,000 mark, nickel iron prices continue to rise.

Last week, Shanghai Futures Exchange Nickel (SHFE nickel) fluctuated first and then rose. As of Thursday's close, the main SHFE nickel contract was priced at $21,445 per ton, down $1.4 per ton from last Thursday, a decrease of 0.01%.

This week, high-nickel iron ex-factory prices ran steadily and strongly. As of Thursday, the price was $34.2 per nickel unit.

This week, Jiangsu Dehui's procurement price of high-nickel iron was $141.3 per nickel unit (ex-factory with tax) for thousands of tons, and Tsingshan's procurement price was $139.16-139.86 per nickel (delivered with tax) for tens of thousands of tons of high-nickel iron. The domestic mainstream steel mills' procurement prices for high-nickel iron continued to rise.

While concerns over the New Caledonia riots and Indonesian volcano have subsided, the slow and disappointing approval process for Indonesia's RKAB projects continues to tighten nickel ore supply. This, combined with persistently high premiums, creates a strong cost environment that supports rising nickel iron prices. As a result, domestic nickel iron plant profits have rebounded, prompting previously idled or reduced production lines to restart. This trend is expected to continue in the short term, with a focus on procurement prices from major steel mills.

SUMMARY|| Stainless Steel Futures See Wild Swings, Spot Market Relatively Stable.

300 Series: While rising raw material prices are putting some upward pressure on stainless steel prices, weak demand from downstream buyers is limiting significant gains in both futures and spot markets. Additionally, steel mills are maintaining high production levels, further hindering price hikes. This tug-of-war between strong supply and weak demand is expected to lead to short-term fluctuations for 304 cold-rolled spot price.

200 Series: June is typically a slow period for the stainless steel market. Although steel mills may continue high production levels, weak end-user demand, with purchases focused on immediate needs only, suggests continued dominance of supply over demand. This dynamic is likely to result in short-term volatility for 201 stainless steel spot price.

400 Series: Domestic steel mills are securing high-carbon ferrochrome (a key raw material) at stable prices compared to last month, providing some cost support. However, current raw material costs still translate to losses for steel mills, leading them to hold onto their pricing. With the high production levels from May starting to hit the market, supply pressure is expected to remain high, potentially leading to continued high inventory levels. Balancing the cost support from raw materials and the high production costs, the price range for 430 cold-rolled in June is predicted to be between US$1220/MT and US$1275/MT.

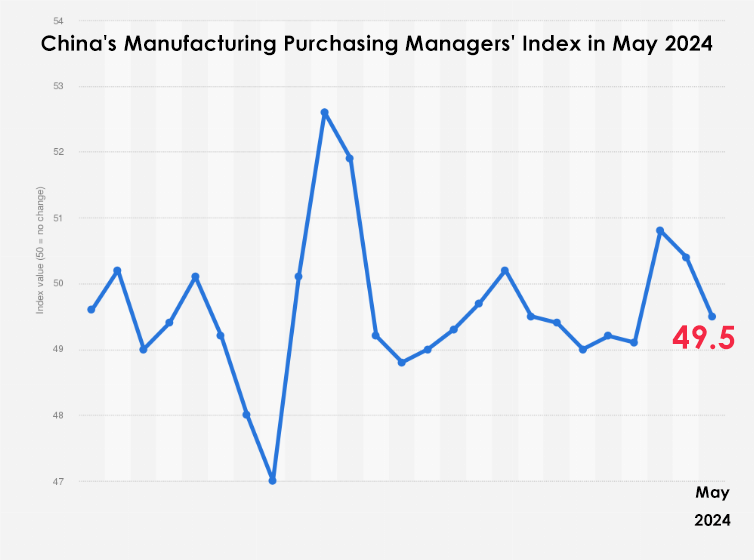

MACRO|| China's May Manufacturing PMI Unexpectedly Falls into Contraction Zone, Further Highlighting Weak Demand.

According to data released by the National Bureau of Statistics, China's manufacturing purchasing managers' index (PMI) for May was 49.5%, lower than the previous month's 50.4%, and falling below the 50-point mark that separates expansion from contraction for the first time in two months.

The new export orders index for May fell sharply by 2.3 percentage points to 48.3%, significantly below expectations. This contrasts with the sharp rise in the US S&P manufacturing PMI to 50.9% in May and the fact that the JPMorgan global manufacturing PMI index remained in expansionary territory for four consecutive months until April.

It is worth noting that the production index and the new orders index in the May manufacturing PMI are in expansionary and contractionary territory, respectively, indicating that the "strong supply and weak demand" situation in the macroeconomy is further highlighted, which will also constrain the upward momentum of prices in the future.

The two price indices in the May manufacturing PMI both rose significantly across the board. Among them, the ex-factory price index rose by 1.3 percentage points to 50.4%, and the main raw material purchase price index rose sharply by 2.9 percentage points to 56.9%. This is consistent with the recent rise in prices of domestic bulk commodities such as steel, cement, and coal, which is mainly driven by supply-side compression. As the gap between the main raw material purchase price index and the ex-factory price index widens, it will put certain pressure on the profits of downstream manufacturing industries in the future.

The manufacturing PMI is likely to remain in contractionary territory in June, but the contraction may ease somewhat. On the one hand, the global manufacturing industry is expected to maintain its upward momentum in the short term, and external demand will continue to have a positive driving effect on China's manufacturing performance. On the other hand, the issuance of ultra-long-term special government bonds in May and the significant acceleration of the issuance of special bonds, coupled with a series of policies in Beijing that will drive faster growth in manufacturing investment and infrastructure investment, will all have a certain pull-up effect on both the supply and demand sides of the manufacturing industry. However, it is also necessary to closely monitor the impact of the real estate industry's development on the overall level of manufacturing sentiment.

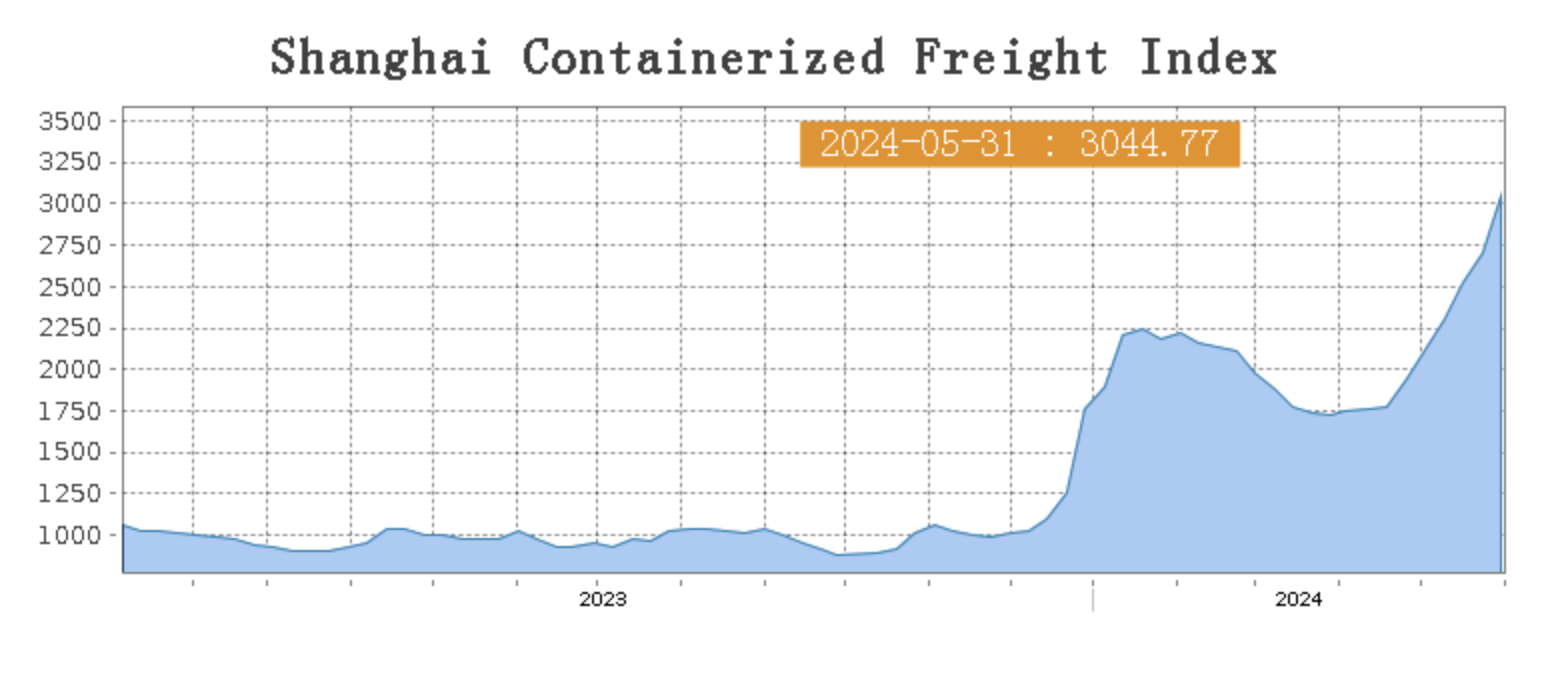

Sea Freight|| Tight Capacity Drives Market Freight Rates Upward.

As of last Friday, spot freight rates for a 40-foot container from China to Northern Europe reached $4,615, nearly 3.5 times the rate on May 1st, but still below the historical high of $14,407 set in January 2022. This price does not include the $10,000 "diamond rate" for prioritized cargo.

Spot rates from China to the US East Coast reached $6,061. In comparison, the rate on May 1st was $2,772, and the record high in January 2022 was $11,900.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 31st May, the Shanghai Containerized Freight Index rose by 12.63% to 3044.77.

Europe/ Mediterranean:

According to data released by the European Union's statistics office, the eurozone's economic sentiment index for May was 96, better than the previous value and market expectations. In addition, the situation in the Red Sea has not been alleviated, leading major shipping companies to continue detouring their voyages, exacerbating market sentiment of tight shipping capacity supply.

On 31st May, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$3740/TEU, which rose by 9.71%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$4720/TEU, which surged by 11.5%

North America:

On 31st May, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$6168FEU and US$7206/FEU, reporting a 18.87% and 11.17% spike accordingly.

The Persian Gulf and the Red Sea:

On 31st May, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 6.32% from last week's posted US$2542/TEU.

Australia/ New Zealand:

On 31st May, the freight rate (shipping and shipping surc-harges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1342/TEU, a 4.11% jump from the previous week.

South America:

On 31st May, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$7408/TEU, an 4.85% growth from the previous week.