Do you start to purchase as before in September this year? There are many distracting signs mixed in the stainless steel market, but we believe that the basic tone of the price will remain gloomy to a large extent, but you shall pay attention to some specifications of the 200 series and 400 series which have been through production reduction and now they are running out of stock. The extra-long pandemic and quarantine in China limit the economy to recover quickly. Meanwhile, the real estate crisis gets the whole situation worse. To curb the downward trend, Beijing keeps reducing interest rates. In a time of inflation, it should count as a different move. According to the latest speech of Powell, he stressed that strict monetary policy is necessary, and his commentary hinted that the Fed won’t hit the brakes on monetary tightening until inflation is tamed. All the signs combined together are getting confusing. But in a short term, the market needs time to get itself fixed although China continues to give hands out such as more infrastructures on the way. If you are interested in other indications of the stainless steel market, please roll down to the full report of the Stainless Steel Market Summary in China.

On August 15, the People's Bank of China announced that the open market operation rate and the medium-term lending facility (MLF) rate were cut by 10bp to 2.00% and 2.75%, respectively.

Further on August 22nd, Monday, the People's Bank of China announced a cut in two benchmark interest rates. The one-year loan prime rate (LPR) which is the preference banks offer to businesses and households, was cut from 3.7 percent to 3.65 percent. The five-year LPR, which is the reference for mortgages, was also cut from 4.45 percent to 4.3 percent. The two LPRs are at a historic low.

Beijing lays hopes on the cuts in interest rates to pass through the real estate crisis and the depressively slowing-down economy. 5.5%, the goal of the annual GDP of 2022 is left on the edge.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,555 |

-26 |

-1.08% |

|

Foshan |

2,600 |

-26 |

-1.06% |

||

|

Hongwang |

Wuxi |

2,440 |

-24 |

-1.01% |

|

|

Foshan |

2,460 |

13 |

0.57% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,365 |

-21 |

-0.91% |

|

Foshan |

2,400 |

-3 |

-0.13 |

||

|

316L/2B |

TISCO |

Wuxi |

3,950 |

-38 |

-0.99% |

|

Foshan |

3,985 |

-53 |

-1.36% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,705 |

-24 |

-0.66% |

|

Foshan |

3,745 |

-26 |

-0.73% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,505 |

1 |

0.11% |

|

Foshan |

1,500 |

10 |

0.75% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,435 |

1 |

0.11% |

|

Foshan |

1,440 |

10 |

0.79% |

||

|

430/2B |

TISCO |

Wuxi |

1,255 |

7 |

0.65% |

|

Foshan |

1,255 |

7 |

0.65% |

TREND|| Steel mills reduce production to stop losing more money. Grades of 200 and 400 series increased in price.

Until 26th August, the price curve of 201 stainless steel and 430 was flatted, with no dramatic movement, stainless steel 304 had a slight raise after a dull start. The most-traded contract of stainless steel futures increased by US$29/MT to US$2400/MT compared to a week ago.

300 series of stainless steel: Prices bounced back, and the trading atmosphere warmed up.

Promising news stimulated the metals market as the drop of the LPR had brought a whole new dynamic to the market, turning the price of the commodities and future price of stainless steel into green color. 304 cold rolled 4-foot stainless steel at Wuxi remains the same level at US$2390/MT. Hot rolled stainless steel closed at US$2360/MT with a US$29 increase. Both the cost of ferronickel and ferrochromium decreased, so the production cost of cold-rolled stainless steel 304 dropped by US$11.

200 series of stainless steel: Prices were stable but it had a spotlight last week.

The spot price of both cold-rolled stainless steel 201and 201J2 stainless steel had US$7 raise to US$1480/MT and US$1415/MT respectively. The hot rolled 5-foot stainless steel remains the quotation at US$1415/MT. Last Thursday, as the stainless steel futures rose, LME Nickel and ShFE nickel increased as well, and the spot market was successfully lightened up. The transaction of spot products warmed up. But the nickel futures soon cooled down, and thereby the enthusiasm in spot transactions failed to persist.

400 series of stainless steel: Production cut will remain until September.

The price of cold-rolled stainless steel 430 remains steady at US$1255/MT. The suspension of production among the chromium mills in Sichuan is expected to last until the end of August, and the supply of high chromium is descending continually.

Summary:

300 series of stainless steel: The mills are already suffering a certain amount of losses from cold-rolled stainless steel 304 production, production halt is the new black among the mills. The raise on future price had a positive effect on the spot price, cold rolled stainless steel 304 is expected to linger upward.

200 series of stainless steel: : The price level of stainless steel 201 was getting better, and the prices slightly increased though it is restricted by the low demand while steel mills did not give up propping up the prices. The price of 201 is expected to remain steady and cold-rolled 4-foot stainless steel 201J2 and J5will hover between US$1435/MT and US$1450/MT.

400 series of stainless steel: : The production cost of the 400 series is continually shifting downward. But TISCO and JISCO maintained strong and increased their quotation of SS430/2B hanging around US$1270- US$1295, approximately US$15-$29 higher than a week ago. It is expected that the price of SS430/2B will wander between US$1280 and US$1295 in a short term.

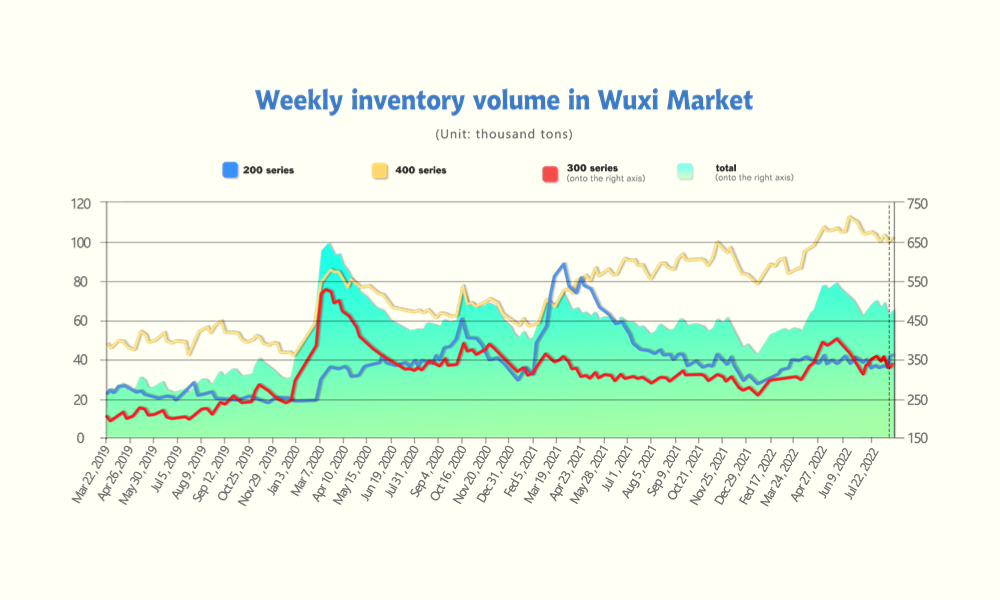

INVENTORY|| More specifications are running out of stock.

Until 25th August, the inventory level of the sample warehouse at Wuxi stood at 476,400 tons, up 14,000 tons from last week.

Here is the breakdown:

200 series: 500 tons down to 34,900 tons

300 Series: 11,000 tons up to 338,400 tons

400 series: 3,500 tons up to 103,100 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| August 18th | 35,451 | 327,371 | 99,584 | 462,406 |

| August 25th | 34,891 | 338,415 | 103,113 | 476,419 |

| Difference | -560 | 11,044 | 3,529 | 14,013 |

The fact is that more specifications of stainless steel materials are running out of stock. Although the stainless steel 300 series had an increase in inventory, the strip resources of SS 304 and the CR SS304 wide sheet are out of stock. HR SS 201 of strip runs out. Rumor also has it that 201 J1 and J2 will fall short in the stock.

200 series of stainless steel: Output of steel mills continues to shrink.

The inventory level of 201 at Wuxi is still running short as the mills are reducing the supply volume to the market to stopping-loss. Also, some mills are cutting the output volume to the market in reaction to the reduced orders though they have large backups.

300 series of stainless steel: Steel mills hauled the production, and 200,000 tons of output will be influenced in August.

The 11,000 tons increase mainly concentrates on the mill’s inventory. Currently, most of the volume is held by the mills, and the social inventory had a slight decrease, but the inventory pressure is increasing as the enormous amount of shipments from Indonesia is piling up in the warehouse in China. Some specifications are running out of stock, and in August, 200,000 tons of production might be reduced as the stainless steel mills seized the production.

400 series of stainless steel: Production will keep decreasing.

The inventory of 400 series decreased by 3500 tons to 103,100 tons. JISCO halved its production of series 400 to 40,000 tons and TISCO suspended production for 10 days from 16th August. Taishan Steel has changed its production line to plain carbon steel. The AOG of Series 400 was reduced, but the increased price barely has a positive response, the inventory level will be volatile on a small scale expectantly.

Raw Materials|| Indonesia to expanse the tax imposition on nickel products.

From August 22nd to 26th, the price of high-grade ferronickel played weakly. The mainstream EXW price of high-grade ferronickel was US$184/Ni ~ US$187/Ni which was US1/Ni lower on a one-week basis. Some quotations even went down to US$182/Ni.

LME Nickel was fluctuating. Until last Thursday, August 25th, LME nickel was quoted at US$21950/MT which increased by US$175 compared to a week ago, ramping slightly by 0.08%.

The price of nickel ore remained steady last week. The production cost of high-grade ferronickel maintains at the same level and thereby most iron mills are losing money. On one hand, the ferronickel factories have been in deficit for a while and the price has played weak steadily. On the other hand, China’s ferronickel producers are no longer willing to keep the price low and they are trying to maintain the price. However, steel mills turn their purchase to Indonesian ferronickel which is even cheaper. Although the output and import volume of ferronickel both fell significantly, and more steel mills suspended production in August, the inventory volume of high-grade ferronickel is still oversupplying. In a short term, the price of high-grade ferronickel will remain weakly stable.

INDONESIA: Export tax imposes on some nickel products

Indonesia may impose a tax on nickel exports this year, President Joko Widodo said on August 18, as the biggest producer of the electric-vehicle battery metal looks to refine more at home. Last week, there was news about the tax rate regarding nickel products: 10% on nickel coarse sand, 5% on NPI, 2% on nickel matte, FENI, MHP, etc.

The range of Indonesia’s ban on the export of some nickel products has been expanding. The first was in 2014, then in 2017, and the last time was in 2020. The bans have dealt a huge blow to China, the largest nickel importer. In 2020, China’s nickel Import volume reached around $2.35 billion. The ban on nickel export has led to a shift from nickel ore to its downstream and higher-value products, ferronickel and nickel pig iron. But now Indonesia also plans to tax on these two products.

LME: Nickel from Russia and Belarus are hauled.

On August 24, the London Metal Exchange (LME) imposed a ban on nickel originating in Russia and Belarus, which is another sanction imposed on Russia although the energy and resources are now getting scarce. The ban takes effect immediately in approved warehouses located in the UK. The latest ban comes shortly after the UK government imposed a 35% import tax on all base metals from Russia and Belarus, which can be dated back to April 1, 2022, including other Russian metals such as lead, copper, and aluminum. Not until July 20, Russian nickel export to the UK was restricted.

The ban will undoubtedly affect nickel stocks, but the rising nickel production in Indonesia and the uncertainty over China's economic growth rate make it unlikely to cause a greater impact on nickel prices, an analyst said.

OPINION: Beijing and Washington’s moves to drive the metal market in different directions.

Almost all countries are facing inflation and sluggish demand. Regarding how to overcome it, the two economic giants have their own ways. Beijing is releasing more flexible interest rate policies and keeps reducing them in order to boost domestic demand and save the real estate crisis. As for the US, it seemed that the interest rate hike can be slowed down when the CPI dropped in July, but recently, Powell again raised the topic, implying that Fed might keep the rate hike on the ground. Every action of these two economic giants will easily and profoundly influence the stainless steel industry.

China cuts down interest rate to revoke the sluggish market.

As China reduces the rates on August 22th, the steel price remained at a one-week high on August 24th, although the concerns of economic recession keep stirring the longs.

The most traded rebar contract on the Shanghai Futures Exchange rose by 0.50%, while hot-rolled coil gained 1.4%. In addition, stainless steel prices rose by 0.4%.

Signs that China is poised to boost its economy with a massive injection of capital appear to mobilize optimism among metals buyers.

However, the future is still gloomy in a long term, because the prolonged pandemic and the depressive global economy have led to sluggish demand for steel.

On August 26th, the price of China’s iron price increased and it is the biggest weekly rise in four years. The most-traded January iron ore on the Dalian Commodity Exchange rose 2.3% to 730 yuan ($106.50) a tonne, for a weekly gain of 7.3% and on track for its biggest weekly gain since July 29. The most-traded October contract on the Singapore Exchange rose 2.1% to $105.25 a tonne.

A trader based in China said that the market is getting better. The inventory of steel mills is low. When the temperature tunes lower, the demand from the manufacturing industry will arise in one or two months. Eventually, the demand for materials will increase.

Watch the video: How the extreme heatwave affects the commodity market?

Many areas in China have suffered from the extreme heatwave this summer, which constraints the construction which has large consumption of steel. Meanwhile, the heat has caused a power outage and as a result, the power supply to industries is limited. Unable to maintain production, many industries are damaged to different extents. Two days after decreasing the interest rate, on August 24th, Beijing promises to increase the fund and financial support for the infrastructure building which will boost the demand for steel.

They will stimulate domestic demand when the economy is seriously hurt during the pandemic. The incentives are helpful to rebuild market confidence. The trader also said that the demand for steel is still constrained by the pandemic and weak manufacturing activities.

Being hawkish is a long way to go —— FED will keep fighting against inflation.

The Forum that ran about Reassessing Constraints on the Economy and Policy was held on August 26th. Powell’s speech has attracted enough attention from the world.

Powell emphasized the ambition to fight against inflation when inflation is out of control.

Powell said that lowering inflation may require a sustained period of below-trend growth. While lowering inflation, will also bring some pain to households and businesses. These are the costs of lowering inflation, but failing to restore price stability will mean more pain. These words may mean that the Fed has anticipated the possible prospect of slowing growth and rising unemployment in the future, but is willing to pay the price for inflation to return to stability.

"Letting down" prematurely could have more serious consequences.

Powell said that the experience of the 1970s proved that preventing high inflation requires a lengthy period of very restrictive monetary policy, and the historical records strongly against prematurely loosening policy. In response to the fall in CPI inflation in July, Powell said that the improvement in one single month was far from enough. It is still too early to turn "doveish". Regarding the future path of interest rate hikes, Powell said the Fed will firmly raise interest rates to a sufficiently restrictive policy range to ensure that inflation can fall back to 2%. In terms of suppressing demand, Powell described it as taking forceful and rapid steps to moderate demand, which may mean that interest rate hikes will continue and U.S. monetary policy will keep tightening up.

More Fed officials turn hawkish.

In 2022, St. Louis Fed President Bullard supported the Fed to continue raising interest rates by 75 bp in September, and said he was reluctant to say that inflation had peaked. The Fed should raise the target interest rate to 3.75% to 4% by the end of the year. San Francisco Fed President Daly also supported a 50 or 75 bp rate hike in September, saying that the Fed would not stop raising interest rates anytime soon and that tightening would continue until at least 2023. In 2023, the voting committee, Minnesota Fed President Kashkari was one of the most doveish Fed officials also turns his back on, saying that the current 8-9% inflation rate may cause inflation out of control. If so, a very aggressive, hawkish move would have to be taken to re-anchor inflation expectations.

INDIA: Export volume slumps due to the export tax on some stainless steel products.

On August 22, India's engineered product exports have a year-on-year growth of 0.20% in July, according to the Indian Engineering Export Promotion Association from the General Directorate of Business Intelligence and Statistics (DGCI&S). India's engineered product exports in July were estimated at $9.56 billion compared to $9.55 billion in July 2021.

In July, India's engineered product exports to China slumps by 57.9% and this is the highest drop in the past months. The exports decreased by 55%, 52.2%, and 48.2% respectively in June, May, and April. To the EU, the major export destination of India, the engineered products export decreased by 15.8% to US$1.68 billion while in the same period of last year, it was US$1.64billion. The engineered products exported to UAE also YoY fell by 14.5% to $445.6 million. The US remains the biggest importer of Indian engineered products. It increased YoY by 21% to US$1.64 billion in July this year.

Mahesh Desai, chairman of EEPC India, believes that it is not just global factors that have affected India's exports in recent months.

"That export duty on steel products, especially stainless steel products, has affected India's export competitiveness in the global market. Current data shows that in July , India's steel exports fell by 56.1% year-on-year. There are reports that India’s steel exports have become more expensive compared to competitors in China or Southeast Asia due to export taxes.”

He urged the government to reconsider export duties on stainless steel products to maintain India's competitive edge.

Some people in the Indian stainless steel industry believe that the Indian government will not completely remove the export tax on stainless steel.