There leaves not much time for you to purchase from China as the Chinese New Year falls earlier than before, and Chinese factories will begin the new year holiday one month earlier. In mid-December, many Chinese suppliers will gradually have their days off. About the recent stainless steel market, the global demand continues to soften. As our clients said, their stock has been stagnating because of the weak purchase. The sea freight mostly went down, except for the route to the Persian Gulf and the Red Sea which had an obvious rebound. About the macro economy, as the latest news, the US Fed raised the interest rate by 75 bps for the 4th time in a roll. In China, the factory activity unexpectedly fell back below 50 in October. More about the Stainless Steel Market Summary in China, please keep reading.

WEEKLY AVERAGE PRICE

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,665 |

18 |

0.72% |

|

Foshan |

2,710 |

18 |

0.71% |

||

|

Hongwang |

Wuxi |

2,570 |

10 |

0.40% |

|

|

Foshan |

2,590 |

3 |

0.11% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,490 |

28 |

1.19% |

|

Foshan |

2,515 |

17 |

0.70% |

||

|

316L/2B |

TISCO |

Wuxi |

4,230 |

50 |

1.24% |

|

Foshan |

4,285 |

45 |

1.09% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,095 |

39 |

0.99% |

|

Foshan |

4,125 |

8 |

0.21% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,545 |

13 |

0.88% |

|

Foshan |

1,515 |

13 |

0.90% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,485 |

11 |

0.82% |

|

Foshan |

1,455 |

8 |

0.63% |

||

|

430/2B |

TISCO |

Wuxi |

1,240 |

14 |

1.25% |

|

Foshan |

1,230 |

14 |

1.26% |

TREND|| Price fails to increase though steel mills open to boost it

The spot price of the stainless-steel series was differentiated last week, stainless steel 201 and 430 had a slight increase while stainless steel 304 was heading downward throughout the week. The price of the most-traded contract of stainless steel fell by US$94 to US$2460/MT after the dramatic surge before last week.

Stainless Steel 300 series: Spot price dipping down.

The spot price of stainless steel 304 was weakening and fluctuated, the cold-rolled 4-foot mill-edge stainless steel 304 closed at US$2505 with a US$56 drop, and the hot-rolled 5-foot stainless steel 304 fell by US$42 to US$2460/MT. The earlier last week, quoted by the Tsingshan, the spot price got to rebound. But it had soon turned down due to the sluggish transaction and slowed digestion of market inventory.

Stainless steel 200 Series: Powerless transaction pushing up the spot price

The spot price of stainless steel 201 remained stable performance and had strong momentum last week. Until 28th October, the base price of cold-rolled stainless steel 201 rose by US$7 to US$1520/MT, the base price of cold-rolled stainless steel 201J2 remained unchanged at US$1450/MT, the price of hot-rolled 5-foot stainless steel rose by US$7 to US$1475/MT.

Stainless steel 400 series: Production cost shifting up and the price creeping upward.

The guidance price of stainless steel 430/2B remained at US$1325/MT, quoted by TISCO. JISCO however rose by US$14 to US$1285/MT.

The quoted price on the Wuxi market had increased slightly, closing between US$1240-US$1250/MT. The demand remains sluggish.

The EXW price of high chromium maintained stable at between US$1310-1325/MT (with 50% high chromium). The price of chromium ore was continuing increase, while the price of iron ore remain stable.

In summary:

Stainless steel 300 series:

The increasing demand in the third quarter lifted the stainless-steel price. The price of raw materials and production had increased collectively in recent two months. The transaction volume had turned down eventually as the market was showing a negative reaction toward the high-standing price. Hence, the newly increased production capacity slowed the digestion of market inventory, and then the price faced down.

Stainless steel 200 series:

The spot price of stainless steel 201 remains steady and has strong momentum. The rise and fall of the price were deeply influenced by the inventory level and market performance of stainless steel 304. The inventory shortage of stainless steel 201 will be continuing in the short term as the supply of the mills was shirking, and the spot price is projected to be volatile.

Stainless steel 400 series:

The EXW price of high chromium was stabilized while the spot price of chromium was still up raising. The quoted price in the Wuxi market had raised to between US$1240-US$11250/MT. It is predicted that the price of stainless steel 430/2B is to rise steadily as the cost of raw materials might increase robustly in November.

Stainless steel futures: Downstream purchase remains cautious.

On October 27th, the stainless steel futures price maintained fluctuated slightly in the morning but it dived in the afternoon. Until the closing, the most-traded contract of stainless steel futures closed at US$2,515/MT which was US$22 lower than the day before.

The upward momentum of the most-traded contract of stainless steel had ceased, heading downward to US$2490.

The dropping price of stainless steel future could be owed to the:

1. The demand on the downstream was remain sluggish although the transaction on the market was mostly heating up by the traders, the downstream users were being conservative in their purchasing.

2. The inventory of warehouse receipts was considered low, and the leveling-off margin between the spot price and the future price had limited the growth of the stainless steel future market.

In summary, the dropping futures price was a strong indicator of the lackluster demand in the stainless-steel spot market. The hyping cost of the raw material had become a puzzle that was left for the industry to solve, mills might have to diversify their distribution channel to retain the bargaining power and the profit margin.

Thus, the future price of the stainless-steel series is projected to be volatile.

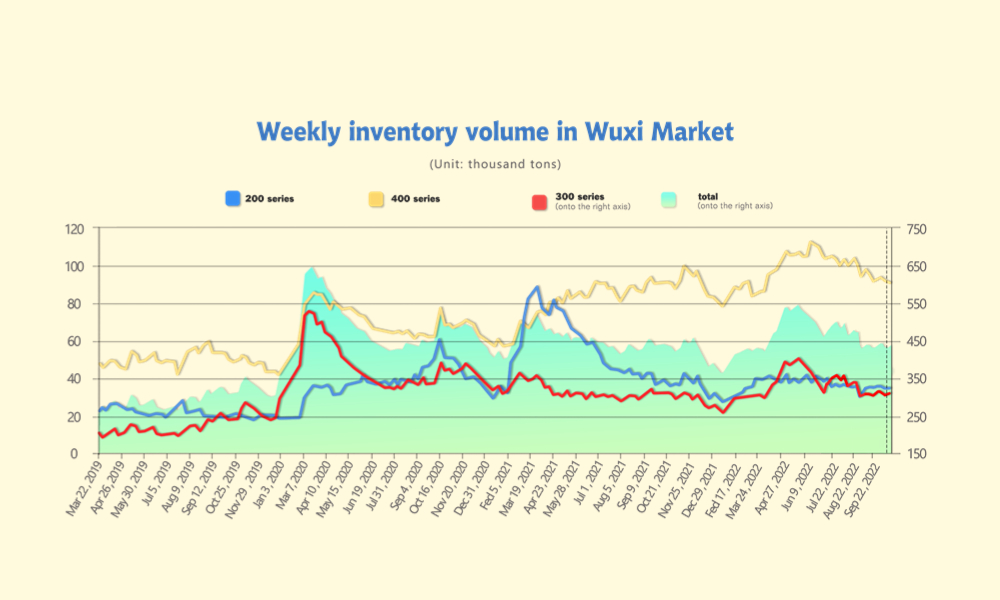

INVENTORY|| 300 series spot stock rises to over 310,000 tons and pressure arises.

The inventory level at the Wuxi sample warehouse rose by 6,244 tons to 436,733 tons (as of 27th October).

the breakdown is as followed:

200 series: 220 tons up to 34,690 tons

300 Series: 6,484 tons up to 311,638 tons

400 series: 460 tons down to 90,405 tons

Stainless Steel 200 series: Inventory shortage as the production drop

The inventory of stainless steel 200 series had merely 200 tons rose to 34,700 tons, and Baosteel contributed most of the resources. Currently, the production output was deeply constrained by the high cost of raw materials, and the chain reaction resulted in an inventory shortage. On the other hand, the worsening shortage on some specifications had stabilized the spot price of this stainless-steel series. The inactive transaction of stainless steel 201 was a strong indicator of the bearish market.

Stainless steel 300 series.: Inventory increased slightly and caused burdens

Inventory of stainless steel 300 series rose by 6,500 tons to 311,600 tons. The future price fluctuated at a high level during last week while the spot price was powerless on growth. There were about 100,000 tons of cold-rolled stainless steel imported from Indonesia from August to September, and it is projected to remain the equivalent amount in the coming November.

Stainless steel 400 series: Price increase as inventory drop marginally

Inventory of Stainless steel 300 series drops slightly by 460 tons to 90,405. Mills were supportive of the quoted price as the cost of input was increasing. The digestion of inventory was slowed, and the downstream users are likely to make a purchase to accelerate the digestion.

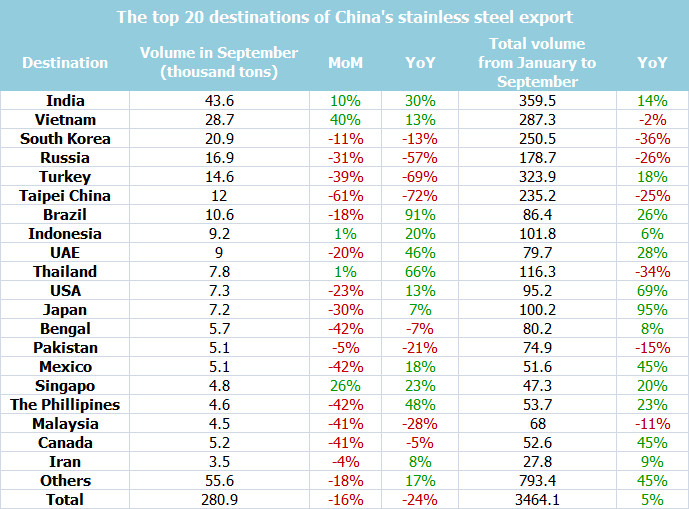

EXPORT: Top 20 exporting destinations of Chinese stainless steel in September

According to China Customs, the Export amount of stainless steel in September totaled 280,900 tons, a 19% drop compared to August. India listing the top of the Stainless-steel export amount among all other destinations, accounting for 43,600 tons with a 10% increment from last month, 30% growth, compared to the same time last year.

RAW MATERIAL|| Costs remained high

Nickel: ShFE nickel might fluctuate to decrease

The most traded contract price of ShFE nickel fluctuated last week but was powerless to grow.

The price of nickel ore, the price rose slightly. the shipment of nickel ore from the Philippines is entering the slack period as the Philippines is entering the rainy season.

As for ferronickel, the price continued to rise. Hence, the import amount of ferronickel in September hit a new height with 650,000 tons. It is believed that the mills are making purchases ahead in response to the levying tariff in Indonesia. The falling price of ferronickel and stainless steel had prompted the price of ferronickel.

As for refined nickel, the downstream users were holding a wait-and-see attitude under the circumstance that the price was high standing. Traders in China narrowed the gap between the spot price and future price in warming up the transaction but harvested non-ideal results. The demand for refined nickel was recently downed as the LME nickel inventory level did not vary.

The US dollar index was falling but it is likely to rebound soon. The US interest rate is very possible to be increased by the US Fed Reserve.

It is predicted that the nickel ore and ferronickel will be in strong momentum in the short term while refined nickel will end the fluctuations at a high price and turn down.

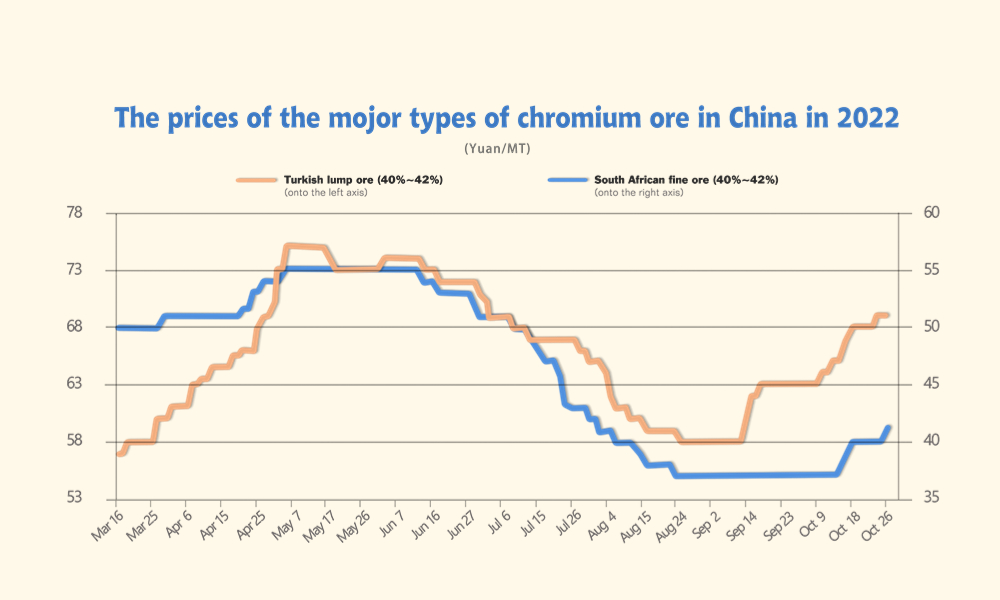

Chrome: Supply and selling price rise simultaneously

The price of high chromium was stabilized after the spike, but chrome was increasing, the tight supply and increasing costs were the main reason for the price increment of high chromium. The supply of high chromium had continued to drop for 4 consecutive months since June, downing 28,400 tons to 448,500 tons.

According to China Customs, the import amount of ferrochrome in September had fallen by 1.01% to 232,600 tons, totaling 154,200 tons, South Africa contribute the most imported amount of ferrochrome. The total import amount of ferrochrome this year accumulated 1,773,400 tons, about a 16.26% drop from last year.

The production cost of high chromium had skyrocketed due to the on-and-on pandemic in China and the rising price of chromium, the supply to the market then was logically affected by the low output from the mills and the raw material shipment delay from South Africa. The production and transportation of high chromium were seriously affected in Inner Mongolia from 23rd October to 29th October due to the pandemic spike in the major production area.

The price of chromium ore was accelerating due to the strike at the South African port and the continuing pandemic in China. The price of concentrated ore (40%~42%) from South Africa rose by CNY¥6 to CNY¥51/MT.

The tendering-base purchase of high chromium in November among the major mills in China was up and running, it is estimated that the purchase price of high chrome will be hiking, refer to the current quote price interval US$1310-US$1325/MT (with 50% of high chromium) and the tendering-base purchase price in October US$1155-US$1185 (with 50% of high chromium).

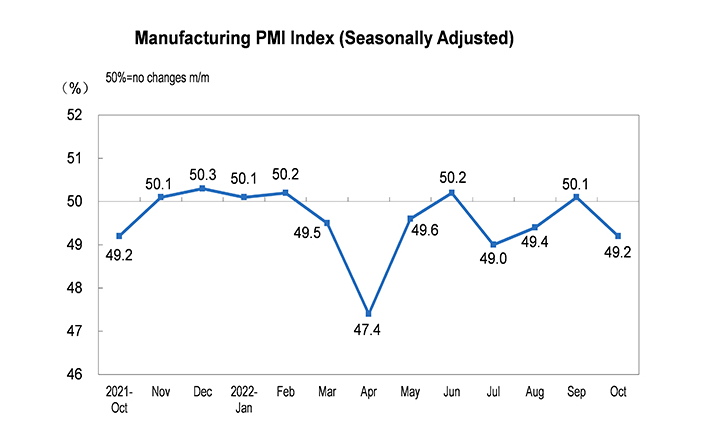

China’s factory activity unexpectedly fell back below 50 in October

The official manufacturing purchasing managers' index (PMI) stood at 49.2 from a 50.1 reading in September, the National Bureau of Statistics (NBS) said.

The key indicators that constitute the manufacturing PMI were all lower than the threshold showing a stagnating tendency.

The production index was 49.6 percent, decrease 1.9 percentage points from the previous month, indicating that manufacturing production activities have fallen.

The new order index was 48.1 percent, decrease 1.7 percentage points from the previous month, indicating that the market demand of the manufacturing industry continued to decline.

The raw material inventory index was 47.7 percent, increase 0.1 percentage point from the previous month, indicating that the inventory of major raw materials in the manufacturing industry was in slightly narrowed decline.

The employment index was 48.3 percent, decrease 0.7 percentage point from the previous month, indicating a decline in the employment outlook of manufacturing enterprises.

The supplier delivery time index was 47.1 percent, decrease 1.6 percentage points from the previous month, indicating that the delivery time of raw material suppliers in the manufacturing industry continued to slow down.

SEA FREIGHT: Freight rates continue to drop

The sluggish situation of China's container transportation market was continuing as the demand was still laying low. freight rate on multiple sea routes continued to drop. Until 28th October, the Shanghai Containerized Freight Index was downed by 4.6% to 1697.65.

Europe/ Mediterranean: According to Markit, The S&P Global Eurozone Manufacturing PMI in October fell to 47.1, the fourth straight period to a 23-month low. It indicated that the economic situation is worsening in Eurozone, and manufacturing activities were quite down. Hence, the cost of living also peaks high due to the high standing inflation rate. On 28th October, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2,102/TEU, an 11.6% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2,344/TEU, down by 8.7%.

North America: According to Markit, The S&P Global US Manufacturing PMI in October posted 49.9, the new low since June 2020. On 28th October, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1902/FEU and US$5318/FEU, 6.3% and 5.7% fall accordingly.

The Persian Gulf and the Red Sea: On 28th October, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had a 19% growth from last week's posted US$1727/TEU.

Australia/ New Zealand: Although the demand for provisions was stabilized in the local market, the freight rate continued to drop. On 28th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1,354/TEU, down by 9.6% from the previous week.

South America: The supply-demand curve was imbalanced and drag the freight rate down. On 28th October, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US4541/TEU, down by 10.2% from the previous week.