Perhaps, it is time to confirm your purchase from China. For one, stainless steel prices have been stably rising in China. Second, sea freight is decreasing. Third, the Chinese New Year of 2023 falls earlier, on January 22nd. It means that most of the steel mills will start their holiday in late December, about three months later. Some people might still have concerns because the demand remains gloomy. Besides, the global economy is volatile and we don't think this will be settled down in the short term. The US CPI increases in August, which also worries people if the Fed to raise the interest rate. But in China, the governmental measures are showing some recoveries in the manufacturing industry as the investment in fixed assets rises in August though the real estate remains weak. If you want to know more about the dynamics of the stainless steel market, just keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,700 |

122 |

4.98% |

|

Foshan |

2,745 |

122 |

4.89% |

||

|

Hongwang |

Wuxi |

2,635 |

128 |

5.36% |

|

|

Foshan |

2,615 |

104 |

4.38% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,545 |

112 |

4.87% |

|

Foshan |

2,585 |

129 |

5.54% |

||

|

316L/2B |

TISCO |

Wuxi |

4,050 |

112 |

2.94% |

|

Foshan |

4,100 |

99 |

2.57% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,950 |

157 |

4.28% |

|

Foshan |

3,950 |

119 |

3.22% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,565 |

43 |

3.05% |

|

Foshan |

1,555 |

31 |

2.19% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,505 |

46 |

3.40% |

|

Foshan |

1,495 |

31 |

2.28% |

||

|

430/2B |

TISCO |

Wuxi |

1,300 |

14 |

1.24% |

|

Foshan |

1,290 |

10 |

0.87% |

TREND|| All major grades of stainless steel rise in price.

The price of 430 stainless steel had stabilized while 201 and 304 stainless steel had a roller coaster ride last week. The price of the most-traded contract of stainless steel dropped US$23 to US$2570/MT.

Series 300: stockout, resupply and lift off

Both the spot and future price of stainless steel keep surging up on the first day after the mid-autumn festival with a $73 increase, the trading on the market was entirely stimulated. However, the typhoon had swept away the momentum when it just skimmed over East China in the last mid-week, the market was then cooled down.

The mainstream price of 304 cold rolled 4-foot mill-edge stainless steel had a US$43 rose to US$2560/MT, and the hot rolled 304 stainless steel was quoted at US$2520 with a $58 rose compared to the Friday before last week.

The theoretical production cost of 304 cold-rolled stainless steel rose by $34 to US$2530/MT.

Series 200: Prices steadily rose.

All variants of series 200 have totalled a $29 increase during last week, the price of 201 stainless steel at Wuxi was still reaching upward to $1540 201J2 cold-rolled stainless steel closed at $1480, hot rolled 5-foot stainless steel closed at $1495.

The market at Wuxi reacted badly due to the low volume of demand in the post-mid-autumn festival and the logistic interruption led by the typhoon mentioned above, the downstream clients are remaining discretion on purchase options.

Series 400: 430 eased off the growth

The price of 430/2B stainless steel is anchored between US$1300-1305/MT, as quoted by JISCO and TISCO.

The spot price of chromium was climbing last week, and the price of iron ore was stabilized. The production cost of high chromium was increased outstandingly, and the production is expected to decrease slightly as some of the factories in Guizhou province, Inner Mongolia and Shanxi province are experiencing production halts or production cuts.

Stainless steel futures: The increasing nickel price pulls SS futures.

The price of the most-traded contract of stainless steel was hovering at the level of US$2590/MT last week.

A gap could be distinctively seen on the chart of Stainless steel futures this month, the price was surging upward while the market turned quiet after the mid-autumn festival.

It is because:

1. The mills had downsized their production earlier as they were suffering from the production loss, now the production and the profit margin is gradually back to the preceding level.

2. The clients in downstream were less motivated, and the market was bullish-liked.

As a whole, the growing size of the spot goods price and future goods price cannot be matched despite the surging future price.

Facing the increasing stainless steel futures prices, some people still hold a negative view of the spot market, believing that the spot can hardly rise at the same pace as the futures because down to earth, the demand remains weak.

Summary and forecast:

Series 300:

The inventory remains at a low level due to the production cut and the interruption of the logistic which influence by the severe weather. The price of 304 cold-rolled stainless steel is projected to stabilise at between US$2520-$2590/MT as some of the mills are resuming production.

Series 200:

The three weeks’ upward surging price seemingly come to an end despite the spot price remaining at a high level, then customers downstream were being conservative. The inventory level of series 200 has gone down slightly last week, and the spot price of cold-rolled J2/J5 stainless steel is likely to be volatile at between US$1480-$1510/MT.

Series 400:

The production cost of series 400 stainless steel was recently going down, the price might be lingering at between US$1305-$1335/MT this week.

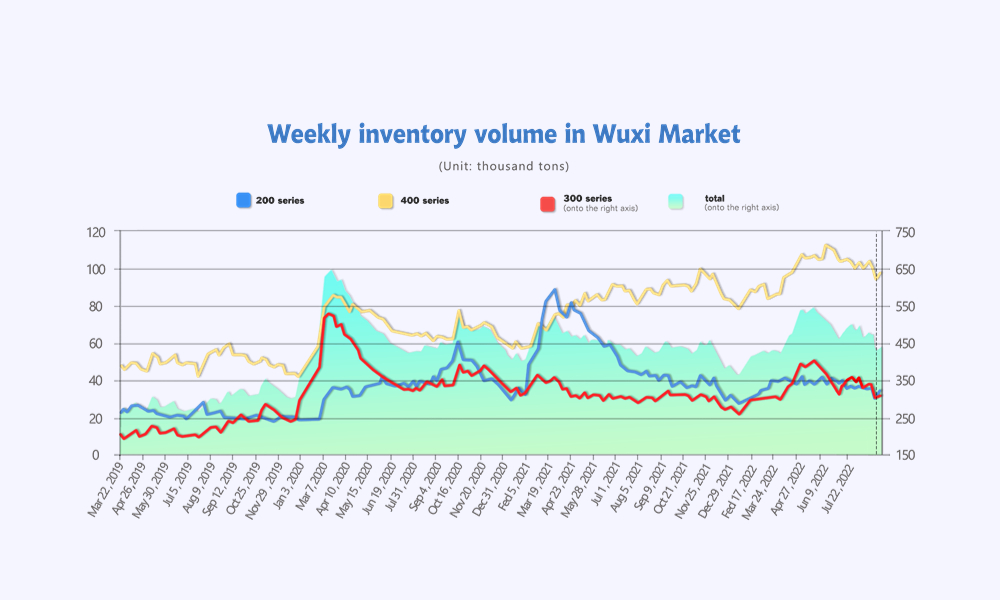

Inventory || 12,000 tons refill somehow become a disappointment.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| September 8th | 32,625 | 300,814 | 92,673 | 426,112 |

| September 15th | 33,650 | 306,838 | 97,591 | 438,079 |

| Difference | 1,025 | 6,024 | 4,918 | 11,967 |

The inventory level at the Wuxi sample warehouse was downed by 12,000 tons to 438,100 tons (as of 15th September).

The breakdown is as followed:

200 series: 1,025 tons up to 33,650 tons

300 Series: 6,024 tons up to 306,838 tons

400 series: 4,918 tons up to 97,591 tons

Series 200:

The inventory level had a rebound after three weeks’ sinking as the product of Baoshan Iron and BG new material was successively gathering at Wuxi. However, typhoon Muifa has disrupted some of the shipping last week, and the shipping is projected to arrive earlier this week. The majority of the inventory increment of series 200 was cold-rolled stainless steel, a certain thickness of 201J2/J5 stainless steel such as 0.85mm, 0.88mm and 2.68mm, were still running low on inventory.

Series 300:

There was a slight increase in the preposition warehouse and a slight decrease in the social warehouse. The resume production pumped up the AOG a little. The transportation of resources was also affected by the typhoon.

Series 400:

The supply pressure of series 400 stainless steel is notable in the short term as the production of series 400 is resuming and the demand downstream is staying low.

RAW MATERIAL|| Insufficient supply pushes up the ore prices.

Nickel:ShFE Nickel rushes to US$28,885/MT

On 16th September at 9 pm (GMT+8), the most traded contract price of ShFE nickel soared up to US$28,885/MT, the most traded contract price of stainless steel was also reached at the high point of US$2640/MT later at 10:30 pm.

The most traded contract price of ShFE nickel had hiked to around US$29,325 once earlier last week before the impact of underestimated prediction of US CPI and the increment of interest rate, then it soon bounced back above US$28,595.

While the logistic of the nickel mine was greatly affected by typhoon Muifa, and the rainy season in the Philippines is also shrinking down the supply, the miners do not seem to adjust the price quote.

As for the refined nickel, the price was standing high and the market transaction was plain. LME Nickle inventory had rapidly reduced by 51,600 tons. The major fire at Nornickel (Russia) had raised concern about the Nickel supply. The US inflation rate was, and the US fed reserve might raise the interest rate again during this week.

In summary, the nickel price was standing at a firm position under the influence of upraising stainless steel prices.

Chrome: Supply reduces, which pushes up the price.

The spot price of the concentrated ore (40%~42%) from South Africa had risen to US$6/MT

The supply of H-C Ferro Chrome was shrinking, and the price was increasing correspondingly. It is reported that the number of industries producing high chromium in South China is growing, and downstream clients were turning their eyes to the suppliers in North China, turning transactions in the high chromium market active.

The power shortage in South Africa has attracted the stainless industry's attention, and the price of chromium ore is stepping upward.

Eskom, the electricity supplier in south Africa had announced that there will be a power cut from 10 AM 20th September to 5 AM 23rd September. Earlier in April, the flood had ceased the operation at the port of Durban which had a great impact on the chromium ore supply, and now the power cut would be worsening the issue.

MACRO|| Volatile is still the tone of the global market.

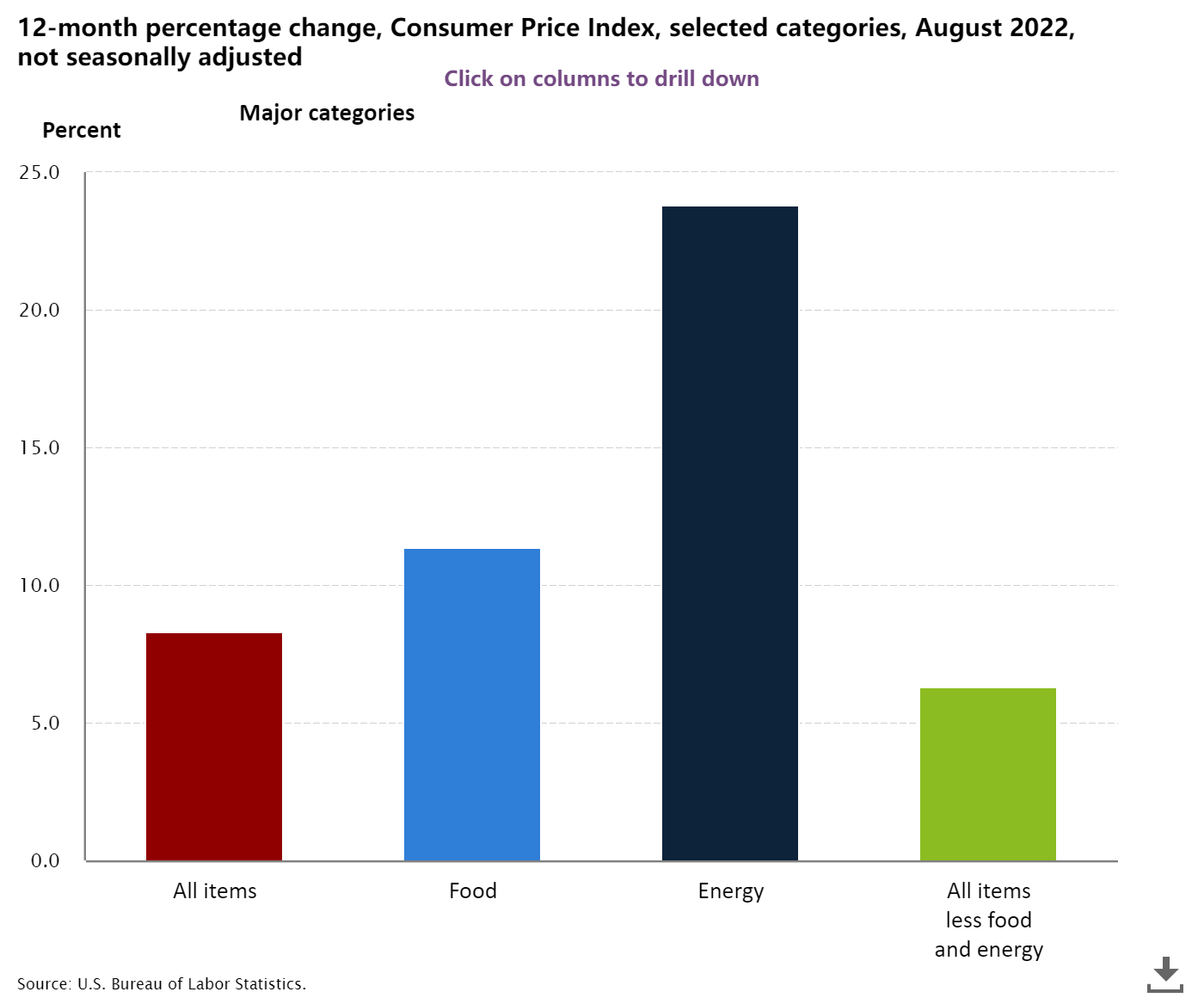

US CPI for all items rises 0.1% in August as shelter and food increase, gasoline falls

In August, the Consumer Price Index for All Urban Consumers increased 0.1 percent, seasonally adjusted, and rose 8.3 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.6 percent in August (SA); up 6.3 percent over the year (NSA). While the recent drop in oil prices has cooled down inflation a bit, other prices continue to soar, keeping core inflation strong. In our view, the continuous inflation will force the Fed to raise rates by 75 bps in September. This should be a hard and right step for the Fed. Overall, it is expected the U.S. monetary policy to remain tight in the next 6-12 months.

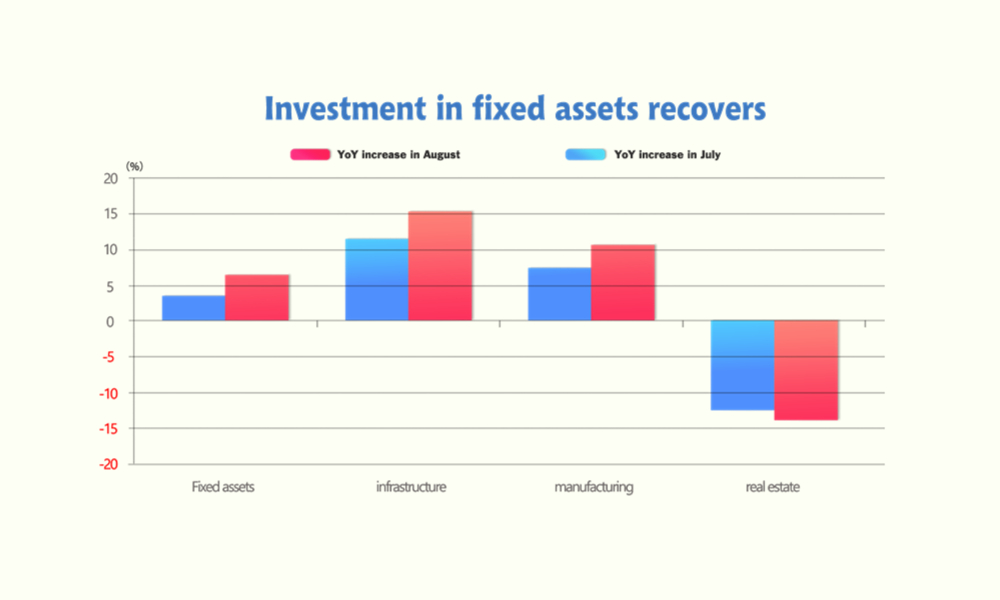

China's infrastructure investment gradually offsets the slump in real estate.

As Beijing keeps boosting the infrastructure, the total investment is recovering and offsets the pressure of the sluggish real estate. Industrial production also increased under the threats of heatwave and power outages. Domestic consumption remains weak due to the strong quarantines in China. As for export, the tepid global demand results in a decline in international trading. It is hopeful that in the rest of 2022, the governmental measures will continue to help domestic demand rise and push the economy to recover.

India’s steel export YoY decreases by 66% in August.

In August, India's steel exports fell by 66% year-on-year to 450,000 tons, as orders for major products in major markets declined and prices rose. Exports in the same period last year were 1.33 million tons. However, exports of finished steel rose by 20% from July.

Finished steel includes unalloyed products (the main export category) as well as alloyed and stainless steel products.

In the first five months of the fiscal year (April-August), exports fell by almost 53% to 3.02 million tons, compared with 6.4 million tons in the same period last year, according to India's steel ministry.

Indonesia's export reduces as some commodities decrease in price.

Indonesia's exports are expected to slow down in August as some top commodity prices fall, but its trade surplus is expected to remain around $4 billion.

Indonesia's exports rose by 19.19% year-on-year in August, lower than the 32.03% increase in the previous month; imports increased by 30.60% year-on-year, and the growth rate was lower than 39.86% in July. The trade surplus in August was $4.09 billion, while it was $4.22 billion in the previous month.

The resource-rich country has been enjoying an export boom against the backdrop of rising commodity prices, which has fueled its economic recovery from the pandemic.

POSCO’s suspension might bring a 1.7-million-ton deficit in output

It was fire, then it was typhoon and flood. POSCO is recovering from these accidents. However, some production lines might be suspended for three months. POSCO said the shutdown could cost about 1.7 million tons of output. Sales may fall by 2.4 trillion won ($1.72 billion), which counts for 2.7 % of last year's sales volume.

SEA FREIGHT keeps decreasing.

Recently, China's export container transportation market has been sluggish, and transportation demand is losing its growth momentum. Last week, the market freight rates of ocean routes continued to adjust the trend. On September 16, the Shanghai Export Containerized Freight Index released by the Shanghai Shipping Exchange was 2,312.65, down by 9.7% from the previous week.

Europe/ Mediterranean: According to data released by the European Economic Research Center, the ZEW economic sentiment index in the eurozone in September was -60.7, down by 6% from August, showing that the people are generally pessimistic about the economic development prospects of the eurozone. On September 16th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$3,545/TEU, down by 8.6% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$3,777 /TEU, down by10.5% from the previous week.

North America: The US CPI in August MoM increases by 0.1% and YoY rises by 8.3%, showing that the inflation remains historic high and beyond the market expectation. People worry that the Fed will take more aggressive measures to control and curb inflation. On September 16th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$3,050/FEU and US$7,176/FEU, respectively, down by 12.5% and 7.6% from the previous week.

The Persian Gulf and the Red Sea: Demand continues to drop in the local market. On September 16th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$1,232/TEU, decreasing by 16.8% from the last week.

Australia/ New Zealand: On September 19th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$2,262/TEU, down by 9.1% from the previous week.

South America: Some economic entities have great debts and influenced by the financial fluctuations. On September 16th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$6,342/TEU, decreasing by 11.7% from the previous week.

The shipping industry might rock bottom in the future two years.

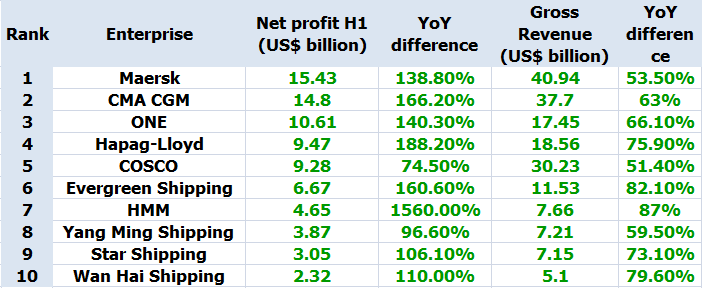

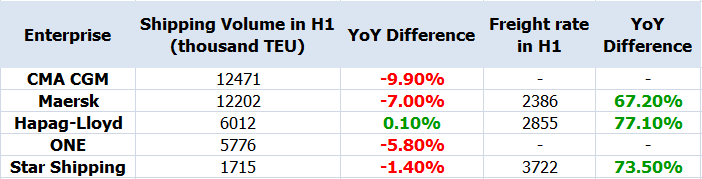

Ten top liner companies release their revenue in H1 of 2022. Ten of them break the record high revenue. Although the sea freight has begun to drop and the declining trend is to remain, the price is still at its historic high level which supports the fast rise in the revenue. However, some enterprises hold a pessimistic view of the market in H2. Even worst, another opinion holds that the transportation market will fall to the level as worst as that in the pre-pandemic. The advantages brought by the Black Swan might be close to the end.

Record-high revenue

Maersk remains the most profitable linear company in the first half of 2022.

HMM catches the spotlight for its astonishing YoY net profit rise which is 1560%.

Overall, the 10 listed liner companies made a total profit of about US$80 billion in

the first half of the year. Maersk and Hapag-Lloyd also raised their full-year forecasts for 2022 based on their excellent first-half performance. Maersk expects full-year actual earnings before interest, taxes, depreciation and amortization (EBITDA) of $37 billion and actual earnings before interest, taxes, depreciation and amortization (EBIT) of $31 billion. Hapag-Lloyd expects full-year EBITDA to reach $19.5 billion to $21.5 billion, and EBIT to reach $17.5 billion to $21.5 billion.

Price rises while demand falls

Different from the previous bull market when both the sea freight and demand increased, during the H1 of 2022, the transportation volume falls obviously compared to the same period of 2021. The demand for sea shipping declines because of the geopolitics conflict, declining global economy, continuous pandemics and insufficient supply chains. Inflation becomes “broad-based” worldwide. Consumption intention drops, shipping demand declines, and thereby the shipping volume decreases significantly in the first half.

In the meantime, the sea freight has started to fall from its peak. According to SCFI, earlier in 2022, the peak was 5109.6, while on September 16th, the index fell to 2312.65. Although the decline is remaining, the sea freight is still high because it just went wild during the pandemic. Besides, due to the long-term contract which is set at a high price, linear companies already have a stable income and maintain their high revenue.

Maersk's cargo volume in the first half of 2022 was 6.101 million FEU, about 12.202 million TEU, a year-on-year decrease of 7.0%. Besides, its average shipping freight was $4,771/FFE, about $2,386/TEU, sharply increasing by 67.2% year-on-year.

Maersk analyzed that the decline in cargo volume was mainly due to weak market demand and supply chain bottlenecks. Among them, the cargo volume on the Asia-Europe route declines the most, and the cargo volume in the European market also drops. The substantial increase in average freight rates was attributable to higher levels of contract freight rates. Rolf Habben Jansen, CEO of Hapag-Lloyd, explained that “The performance in the first half of the year was exceptionally strong, mainly due to the significant increase in freight rates." Hapag-Lloyd's freight volume in the first half of 2022 was basically the same as the same period last year, at about 6.012 million TEU, but the average shipping fee increased by 77.1%, to $2,855/TEU.

Star and ONE cargo volumes fell 1.4% and 5.8% year-on-year, respectively, but freight rates surged.

But the operation cost also increases because of the rising cost of fuel, ship charter and port handling. Many linear companies said they are having the largest cost ever. According to data released by Maersk, its average fuel cost in the first half of 2022 was US$718/ton, compared with US$437/ton in the same period last year, which increases by 64.3%.

Pessimistic prospect

The market went wild in the beginning, and concerns arise later. In the future, linear companies tend to be negative. The decline in global consumer spending was already evident this summer and will lead to a decline in shipping demand as international trade normalizes in the second half of the year. Recently, we can notice that sea freight continues to decrease, and the tendency is to remain. In the second half of the year, the global environment will become more complex and severe. Geopolitics and high inflation will bring uncertainty to global economic development and commodity trade.

Although HMM has the largest increase in net profit in the first half, the company is cautious in evaluating its business in the second half. The uncertainties such as the increasing energy price, inflation, the unstable geopolitics will still be threats to the supply chain. ONE also holds a similar view to the transportation market because of the tepid trading market.

The industry will rock bottom and 2024

According to a report released by HSBC Global Research recently, freight rates are expected to bottom in the 2023-2024 downward cycle, driven by overcapacity, after two years of unprecedented gains in the container shipping market. The agency further predicts that in 2023-2024, the container shipping market will enter a downward cycle, and profits are expected to drop by 80%. It is expected that the profitability of liner companies will bottom out in 2024.