After the Mid-autumn Festival, the stainless steel and nickel prices maintain the rising pace. On Monday, September 12th, the LME nickel price increased by US$1,440/MT to US$24,400/MT. As China’s market returned from holiday, ShFE nickel increased by US$1,561/MT to US$27,959/MT, rising by 5.91%. The most-traded contract of stainless steel futures ramped by US$96/MT to US$2,548/MT, and the rising percentage was 3.92%. If you want to know more about the stainless steel market summary in China, please keep rolling down.

WEEKLY AVERAGE PRICES

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,595 |

61 |

2.55% |

|

Foshan |

2,640 |

61 |

2.50% |

||

|

Hongwang |

Wuxi |

2,520 |

76 |

3.27% |

|

|

Foshan |

2,520 |

77 |

3.33% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,445 |

70 |

3.11% |

|

Foshan |

2,470 |

67 |

2.95% |

||

|

316L/2B |

TISCO |

Wuxi |

3,960 |

48 |

1.27% |

|

Foshan |

4,020 |

64 |

1.68% |

||

|

316L/NO.1 |

ESS |

Wuxi |

3,815 |

64 |

1.78% |

|

Foshan |

3,850 |

73 |

2.00% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,530 |

26 |

1.89% |

|

Foshan |

1,535 |

35 |

2.54% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,470 |

29 |

2.21% |

|

Foshan |

1,475 |

35 |

2.65% |

||

|

430/2B |

TISCO |

Wuxi |

1,290 |

25 |

2.16% |

|

Foshan |

1,290 |

22 |

1.90% |

TREND|| 304 poked through US$2600/MT after Mid-autumn

LME nickel spiked up US$300 to $21900/MT, and the price of future contract 2210 closed at US$2650/MT with a $24 increase. Until 9th September morning, the price was still upward surging.

Stainless steel 300 series: 304 futures Soaring high with the spot price

The price of cold-rolled 4-foot mill-edge stainless steel 304 strip coil closed at US$2520/MT, a $29 difference from the day before 9th September; hot-rolled stainless steel 304 had $15 up to US$2475, quoted from Delong.

The price of the most-traded contract of stainless steel 2210 breaks through the price level of $2600.

Therefore, the market was optimistic about positive reaction toward the price increase last week. Both cold and hot rolled 304 stainless steels has gone up by $15 until 9th September.

Nevertheless, the price of cold-rolled stainless steel 304 recorded nearly $145 rise from US$2385/MT to US$2530/MT since the beginning of the September. The demand for replenishment and the inactivity of resource circulation on the market are likely to have major influence on the current price level.

316L stainless steel:

It is worth mentioning that 316L stainless steel had a dramatic $102 spike to $3870/MT last week, the first increase since May. The supply level of cold-rolled stainless steel is reaching downward lately although it is not as low as the hot-rolled stainless steel. The price of cold-rolled stainless steel is likely to go up in the coming week.

Until 9th September, the base price of cold-rolled cut-edge stainless steel closed at US$4015/MT, accumulating a $131 rose last week.

Stainless steel 200 series: Fifteen hundred is drawing near as Fourteen hundred is in the air

Following the upward trend of the price of stainless steel, J2/J5 stainless steel is back to the level of US$1430/MT, as quoted by FJDX. The mainstream price of J2/J5 rose $15 to US$1460/MT, while hot rolled 5-foot stainless steel closed at US$1475/MT, affected by the low level of inventory. The mainstream price of cold rolled stainless steel J1 reached US$1520/MT, but there are exceptions on the market quoted at US$1550/MT.

Stainless steel 400 series: Smoothly and firmly uprunning

The price of stainless steel 430/2B had a clear upward movement, settling between US$1270/MT to US$1275/MT, as quoted by JISCO and TISCO. On the other hand, the production cost of series 400 was shifting downward. Hence, the mills are gradually stopping losses from the previous volatility. The price of 430/2B is likely to grow steadily to US$1270/MT-1375/MT in the short term.

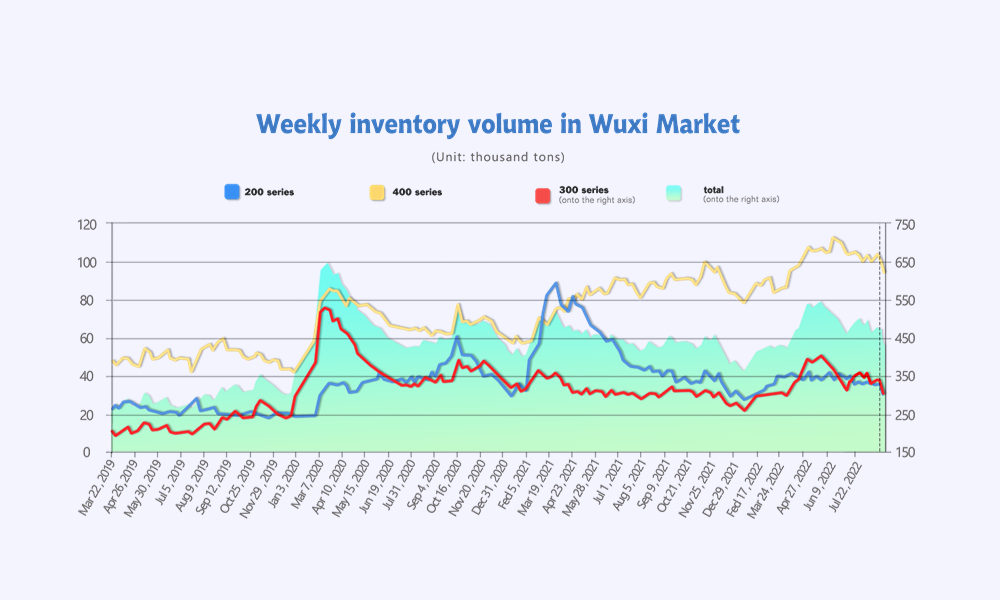

INVENTORY|| Inventory is falling down, crisis is lurking

The inventory level at the Wuxi sample warehouse was downed by 43,062 tons to 426,112 tons.

the breakdown is as followed:

200 series: 2,038 tons down to 32,625 tons

300 Series: 34,443 tons down to 300,814 tons

400 series: 6,585 tons down to 92,673 tons

Stainless steel 200 series: Price running up for four consecutive days to lighten the inventory burden

The cold-rolled stainless-steel inventory from the large-size trader took up a major proportion of the 2,100 tons reduction, which is the new low since February.

The AOG was still staying at the lower-level last week, the price of cold and hot rolled stainless steel are back to the US$1430 level as the spot price was soaring. Eventually, the inventory reduction was accelerated.

Stainless steel 300 series: The bullish market stimulated inventory digestion.

The significant hike in the price of stainless-steel futures and NIM resulted in the reduction of inventory and the growth of the spot price, as it reached the US$2460 level, the transaction volume was lessened.

There was approximately 140,000 tons of series 300 stainless steel production had been cut in August, and TISCO took up to 70,000 tons in 10 days during the second half of August.

The production resumption is on track as the production plan for September and October are scheduled in order, although the arrival of the Indonesian shipment is still giving pressure on the inventory.

Stainless steel 400 series: Frequent transactions heating up the market

The production had reduced 90,000 tons in August. The production loss of the mills has been gradually recovering as the price of the cold rolled 430 stainless steel is climbing up recently.

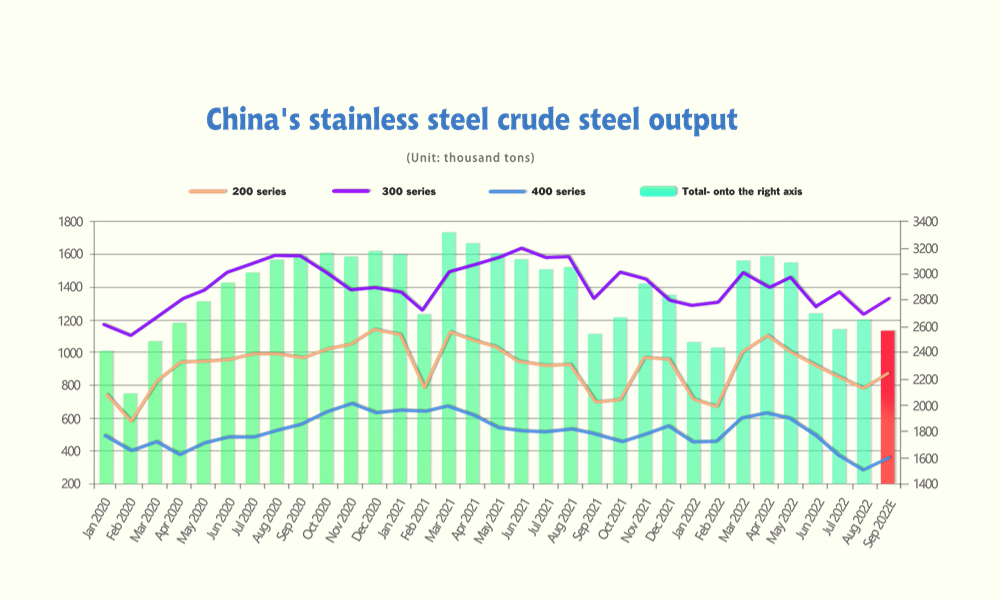

Crude stainless steel: A cut on output remains

The production of crude stainless steel in August is totaling 2,295,800 tons, 285,300 tons (11.05%) lesser than last month, 753,200 tons short compared to the same period last year.

Here is the breakdown:

Series 200:

- Production: 784,700 tons, 62,100(7.33%) tons lesser than last month, 150,600 ton (16.1%) lesser than same period last year.

Series 300:

- Production: 1,228,100 tons, 137,800 (10.09%) tons lesser than last month, 352,300 tons (22.29%) lesser than same period last year.

Series 400:

- Production: 282,900 tons, 85,500 (23.21%) tons lesser than last month, 250,400 tons (46.95%) lesser than same period last year.

As a whole, the inventory level in the market is lowered as the mills had reduced their production in September, however, the production volume is very likely to rebound.

In summary:

The key:

The price of stainless steel may be volatile under the influence of the hot sales period “Golden September”. However, the concept of “Golden September” is still waiting to be testified in the stainless-steel industry.

Stainless steel Production: Mutual

The industry average profit is approaching the break-even point, between -2% to 2%.

Stainless steel social inventory: Short

Inventory level at 583,300 tons after slight descending (until 2nd September)

Stainless steel warehouse inventory: Surplus

Inventory level at 1,585 tons (as of 7th September)

RAW MATERIALS|| Material cost is increasing

Nickel: The price of ferronickel remains stable and steel mills raise the purchasing price slightly.

From September 5th to 9th, the high nickel iron was stable in price. Until September 9th, the EXW price of high nickel iron in China was maintained at US$183/Ni ~ US$186/Ni.

Before the Mid-Autumn Festival, the LME nickel fluctuated to decrease as people believe that the Fed is going to keep raising the interest rate. ShFE nickel followed to drop as well and closed at around US$23,558/MT, decreasing by US$1,835/MT compared to September 2nd. However, on September 12th, when China was still in the Mid-autumn Festival, the LME nickel price soared and stimulated the stainless steel prices in China to increase.

The ferronickel imports from Indonesia decreased but are still high. The global nickel supply is larger than the demand because the industry has been bearish. Whether Indonesia is to impose a tax on nickel product export will deeply influence the market.

Although the price of nickel ore reduced a bit to US$66~US$69/MT (CIF), and the high nickel iron production cost declined, most of the nickel-iron producers are still losing money. Therefore, the iron factories are unwilling to lower the prices. Steel mills, such as ESS, raised the purchasing price to US$185/Ni which was about US$2 higher compared to a week ago. Chinese ferronickel price is still less competitive than the Indonesian. Both domestic production and import volumes decreased significantly, but because many steel mills continue to reduce production, the supply of high nickel iron is surplus. In a short term, it is predicted that the high nickel price will remain stable.

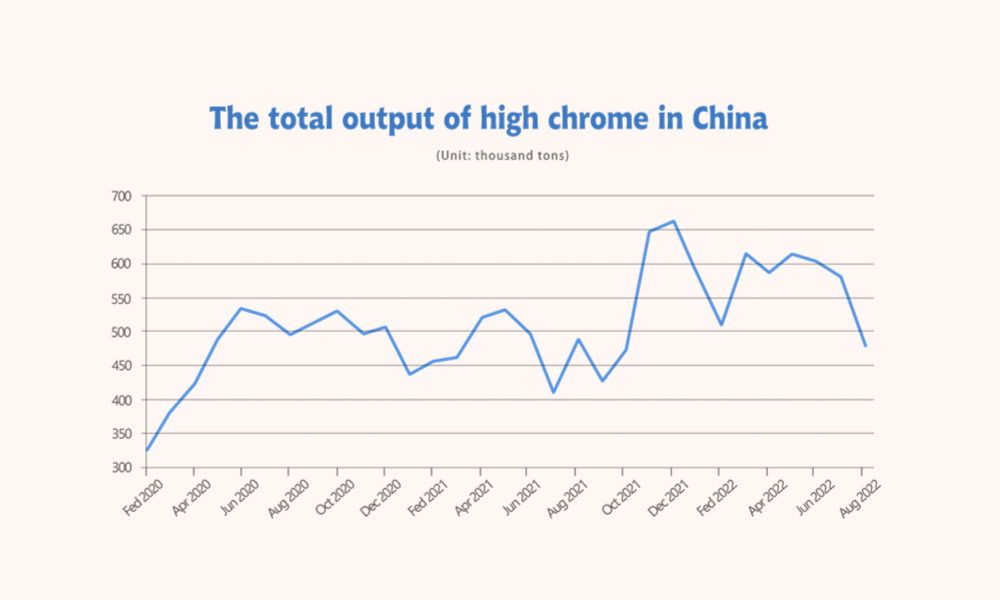

Chrome: Spot supply decreased by 100,000 tons, and prices rose.

The price of high-carbon ferrochrome increased after a long drop, On September 7th, the EXW price increased to US$1,137/MT (with 50% of chromium content) which increased by US$36/MT after September.

The price rise comes from the decrease in the production of high chrome. The supply shrinks.

According to the statistics, in August, China’s domestic production of high chrome was about 476,900 tons dropping by 99,900 tons on an a-month basis and the decreasing percentage was 17.3%.

From June to August, China’s high chrome production decreased in all major production areas. The reasons are,

- Since the second quarter, stainless steel mills have started to reduce their production to lower the risk of overstock during the sluggish market. This results in the low demand for high chrome and the price has kept decreasing.

- The price of chrome ore decrease, but the declining speed is slower than the high chrome’s drop in price. The producers of high chrome have to struggle with the difference and sustain the deficit.

- The broad power outage this summer has caused a large scale of production suspension which influences the output.

In September, the high chrome producers in Inner Mongolia again carry out the plan of reducing the output.

"Because the production cost of ferrochromium was seriously inversely related to the market price, the company suffered serious losses. New Steel Union started to stop production in some of its subordinate factories in August, and the furnace blocks of other factories avoided peak production. In August, the production of ferrochromium decreased by 30%. In September, Continue to maintain production cuts. Subsequent production will be adjusted at any time as the market changes.”

So far, the spot price of chrome ore is getting stable while the coke price is weakening. What’s worse, steel mills do not give up the reduction of production in September, which means that the demand for chrome products is decreasing.

Sea Freight continues to drop

Recently, China's export container transportation market has been sluggish, and transportation demand is losing its growth momentum. Last week, the market freight rates of ocean routes continued to adjust the trend. On September 9, the Shanghai Export Containerized Freight Index released by the Shanghai Shipping Exchange was 2,562.12, down by 10.0% from the previous issue.

Europe/ Mediterranean: PMI of August in Eurozone was 48.9 according to Markit. The activity of the service industry is constraining for the first time after March 2021. The output of the manufacturing industry continues to decline for consecutive three months. Facing inflation and an unstable economic future, the economy is going down. \On September 9th, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European base port market was US$3,877/TEU, down by 8.8% from last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean base port market was US$4,222/TEU, down by 11.6% from the previous week.

North America: The non-farm employment in the US in August increased by 315,000 which is the smallest increase after April 2021; the unemployment in August was 3.7% which increased by 3.5% compared to July and it is the first increase after January 2022. The employment situation is losing momentum. Inflation remains high and the Fed will stay hawkish in its monetary policy. On September 9th, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East base ports were US$3,484/FEU and US$7,767/FEU, respectively, down by 12% and 6.6% from the previous week.

The Persian Gulf and the Red Sea: It lost the rising momentum on the demand side. On September 9th, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the basic port of the Persian Gulf was US$1,481/TEU, decreasing by 16.2% from the last week.

Australia/ New Zealand: On September 9th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the basic ports of Australia and New Zealand was US$2,489/TEU, down by 6.5% from the previous week.

South America: The local economy is seriously influenced by the Fed’s interest rate hikes. The ecnonmy is fluctuating. On September 9th, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American base ports was US$7,183/TEU, decreasing by 10% from the previous week.