From November 7th to November 11th, all major grades of stainless steel prices fell based on the weekly. But the price rebounded on Thursday due to the increasing stock price as the US inflation index dropped. Another good news from China side also boosted the stock market. Beijing finally begins to take its hands off the extremely strict quarantine. Will things return to track soon? If you want to know the details and price outlook, please keep reading Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICE

|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

2,655 |

-34 |

-1.34% |

|

Foshan |

2,700 |

-34 |

-1.32% |

||

|

Hongwang |

Wuxi |

2,545 |

-27 |

-1.11% |

|

|

Foshan |

2,560 |

-24 |

-0.99% |

||

|

304/NO.1 |

ESS |

Wuxi |

2,450 |

-37 |

-1.57% |

|

Foshan |

2,500 |

-31 |

-1.30% |

||

|

316L/2B |

TISCO |

Wuxi |

4,275 |

-30 |

-0.72% |

|

Foshan |

4,335 |

-23 |

-0.54% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,095 |

-57 |

-1.42% |

|

Foshan |

4,145 |

-43 |

-1.06% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,555 |

-30 |

-2.05% |

|

Foshan |

1,515 |

-19 |

-1.31% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,475 |

-35 |

-2.54% |

|

Foshan |

1,445 |

-23 |

-1.69% |

||

|

430/2B |

TISCO |

Wuxi |

1,260 |

-13 |

-1.11% |

|

Foshan |

1,255 |

-13 |

-1.12% |

TREND|| Another week of poppy red, turning point still in vague.

The spot price of stainless steel across major series were continuing to dive last week. The slackened inflation rate also dragged down the US dollar rate which boosted the commodity prices and stainless steel futures price rebounded. Until last Friday, the most traded contract price of stainless steel rose by US$42 to US$2560/MT.

Stainless steel 300 series: Price had dropped, again.

The spot price of stainless steel 304 was weakening last week. The price of cold-rolled 4-foot mill-edge stainless steel 304 fell by US$21 to US$2495/MT, while hot-rolled stainless steel 304 by the private-owned mills was quoted at US$2440/MT with a $36 drop week-on-week. Delong and Tsingshan showed an effort on maintaining a stable spot price by adjusting their agency’s shipment price during the week.

The theoretical production cost drops $21 to US$2570/MT.

Stainless steel 200 series: Slow digestion in inventory had made the price sink.

The spot price of stainless steel 201 was trending downward last week. The base price of cold rolled stainless steel 201 dropped $29 to US$1510/MT. Both the base price of cold rolled stainless steel 201J2 and hot rolled 5-foot stainless steel had decreased by US$36 to US$1430/MT and US$1460/MT correspondently.

The performance of spot transaction of stainless steel 201 was powerless as the demand at downstream was remaining low, and both producer and marketer were suffering significant losses. Obviously, there was a mood of pessimism pervading the market.

Stainless steel 400 series: Low demand constrained the price growth.

The guidance price of stainless steel 430/2B quoted by TISCO was stabilized at US$1360/MT, while JISCO levelled off at US$1315/MT. The price of stainless steel 430/2B in Wuxi dipped down between US$1250-US$1260/MT and there was no further development in the purchasing demand from downstream.

In summary:

Stainless steel 300 series:

The increment of the production in October was finally transformed into market supply, but it is becoming a burden on inventory as the demand level was laying low still. The US Fed reserve might slow its pace on increasing interest rates, which will support the stainless steel price to rise in the short term. The price of stainless steel 304 is projected to roam between US$2495-US$2510/MT.

Stainless steel 200 series:

Poor performance on transactions indicated a weakening spot price. The spot price could be predicted low as the inventory was stacking up and there was no sign of quick digestion in the short period.

Series stainless steel 400:

With poor transactions and dropping spot prices, the stainless steel 400 series was seemingly repeating the pattern of the 200 series and 300 series last week. But the raw material cost of stainless steel 400 series is growing steadily recently, and thereby it is predicted that the price of stainless steel 430/2B won’t fall much and tend to remain stable in the short term.

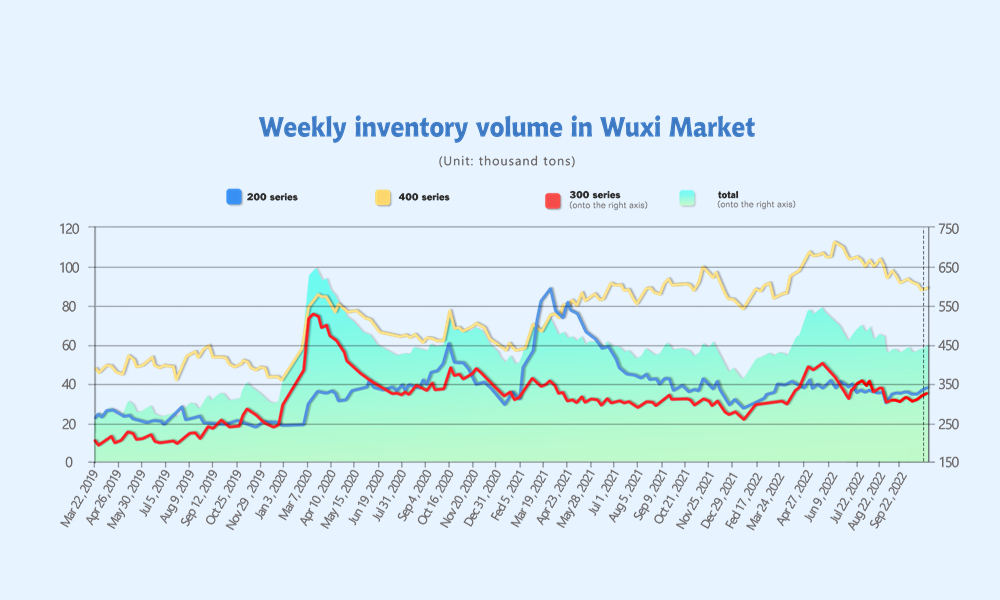

INVENTORY|| Piling up inventory turning into a barrier to price growth.

The inventory level at the Wuxi sample warehouse rose by 8,873 tons to 449,553 tons (as of 10th November).

the breakdown is as followed:

200 series: 1,070 tons up to 37,500 tons

300 Series: 6,229 tons up to 323,512 tons

400 series: 1,574 tons down to 88,541 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| November 3rd | 36,430 | 317,283 | 86,967 | 400,680 |

| November 11th | 37,500 | 323,512 | 88,541 | 449,553 |

| Difference | 1,070 | 6,229 | 1,574 | 8,873 |

Stainless steel 200 series: Production increased to fill up the inventory

Beigang New Material and Baosteel took up a major part of the slight inventory increment of the stainless steel 200 series last week. While the inventory was apparently piling up, some specification such as the thickness of 2.68mm of cold rolled stainless steel J2/J5 was still out of stock. As Beigang New Material raises production, the inventory of stainless steel 201 will suffer pressure later, as expected.

Stainless steel 300 series: imbalance supply-demand to cause the indigestion

The inventory of the stainless steel 300 series has increased for consecutive three weeks. Both cold-rolled and hot-rolled stainless steel inventory rose last week while the digestion is not likely to speed up. The reason is the expansion of the crude steel production of the stainless steel 300 series which rose by 300,000 tons in October to 1.65 million tons.

Stainless steel 400 series: Price to drop slightly

The inventory of the stainless steel 400 series had a similar picture to the others: rose on inventory but slow digestion due to the low demand. Not likely to have significant movement in the short term.

RAW MATERIAL|| Costs are heading high

NICKEL: LME nickel rose due to the promising sales in electronic vehicle

Last Friday, LME decided not to ban Russian metals. "The LME does not propose at this time to prohibit the warranting of new Russian metal nor to impose thresholds or limits to the amount of Russian stock permitted in LME warehouses," "While there is evidently an ethical dimension as to the global acceptability of Russian metal, we believe the LME should not seek to take or impose any moral judgments on the broader market.”, the LME addressed.

The exchange said it will continue to monitor the flow of Russian metal in LME warehouses and to provide transparency, it will publish regular reports from January 2023 detailing the percentage of warranted Russian metal in LME warehouses.

LME nickel had soared to the highest level since June, affected by the increasing inflation rate in the US, the steady growth in the electronic car market, and the rumor of supply disruption from Norilsk Nickel, the biggest refine nickel producer in Russia. The bounce back of the LME nickel price began right after the latest statistic on US inflation was released. The figures revealed the 7.7% growth in the CPI in October and the suggestion of a slack interest rate rise.

The promising performance of the automotive industry had brought Nickel to investors’ attention since it is a crucial material in making electronic cars. China New Energy Vehicle (NEV) had just set a new record in production and sales volume in October, about 762,000 cars produced and 714,000 cars sold. According to ArgusConsulting, the sales volume of the electronic car in Europe is projected to reach 4,500,000, twice as much as 2021’s level. The demand for car batteries will climb up to 490GW, the Marex estimates.

Investors still feel optimistic toward Nickle despite the inflation and economic recession being “the elephant in the room”. The amount of approved LME warehouses had reduced by up to 60% across the globe in the past year, the market would act sensitively over any disrupted supply.

Chrome: Production cap and the flood hold up the price fall

The price of high chromium drops in consecutive weeks but will be stabilized. It is because the production will drop in the coming winter due to the “winter production cap” that currently implementing in North China.

The price of chromium ore remained stable, but the chromium ore importation from South Africa is in the “trouble water” lately. Started by the Department of Meteorology of South Africa, at least five provinces are experiencing devastating floods caused by heavy rainfall. Hence, transportation was not fully recovered from the major strike last month.

SEA FREIGHT: Bearish market continues to weaken the freight rate.

The sluggish situation of China's container transportation market was continuing as the demand was still laying low. freight rate on multiple sea routes continued to drop. Until 11th November, the Shanghai Containerized Freight Index was downed by 8.6% to 1443.29.

Europe/ Mediterranean: The overwhelming economy in Europe had driven the manufacturing index to break the threshold, and the energy price is continuing to spike along with the progress of warfare between Russia and Ukraine.

On 11th November, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1478/TEU, an 16.2% decrease. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$2,061/TEU, down by 7.2%.

North America: The US economy added 261,000 jobs in October, the labour department announced on Friday, the latest report confirmed the remarkable strength of the US jobs market. The unemployment rate rose to 3.7%, still close to a 50-year low.

On 11th November, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$1632/FEU and US$4223/FEU, 2.9% and 13.6% fall accordingly.

The Persian Gulf and the Red Sea: Freight rate had dropped slightly after the rose in the week before. On 11th November, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf had an 8.9% fall from last week's posted US$1650/TEU.

Australia/ New Zealand: The freight rate continued to drop. On 11th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1,006/TEU, down by 16.2% from the previous week.

South America: The supply-demand curve was imbalanced and drag the freight rate down. On 11th November, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2944/TEU, down by 22.9% from the previous week.

“Dark clouds on the horizon”, warns Maersk

Benefiting from the skyrocketed freight rate in 2021, major Shipping firms had “their ship comes in”, but the good old days are coming to the end with the sluggish demand on the shipping and diving freight rate. The shipping giant, Maersk, addresses that “global container demand is expected to contract between 2% and 4% in 2022”.

China: Quarantine is taking hands off

China’s domestic economy shows weaker in October than in September because of the pandemic and quarantines according to the latest financial data.

The real estate remains bearish. When real estate sales come out of the bottom period is the key to promoting the rapid improvement of economic expectations. At the same time, changes in epidemic prevention policies are also key variables that affect market sentiment and demand in the real economy.

What’s new?

For close contact and inbound personnel, change "7+3" to "5+3"; no longer determine sub-close contact; cancel medium-risk areas; for spillover personnel in high-risk areas, from 7-day centralized isolation to home isolation; Cancel the circuit breaker mechanism for inbound flights.

Since October, with the spread of COVID-19, the epidemic impact index has exceeded its high point in April this year, and the economic activity index has trended downward. It is expected that with the optimization of epidemic prevention, the momentum of production and demand will be released, and economic activities may stabilize and increase.