TREND|| Stainless steel prices drop. The limits on electric power supply weaken

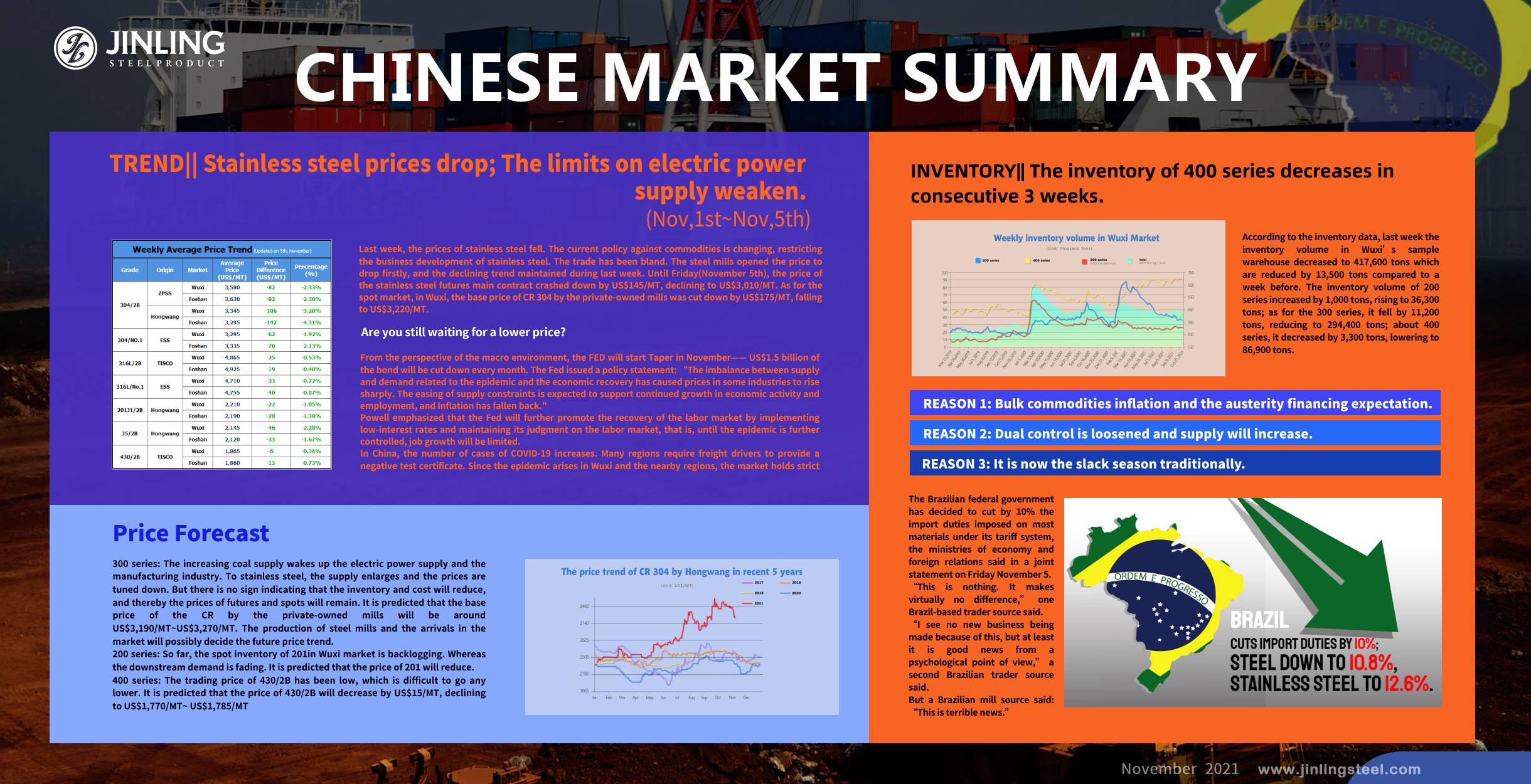

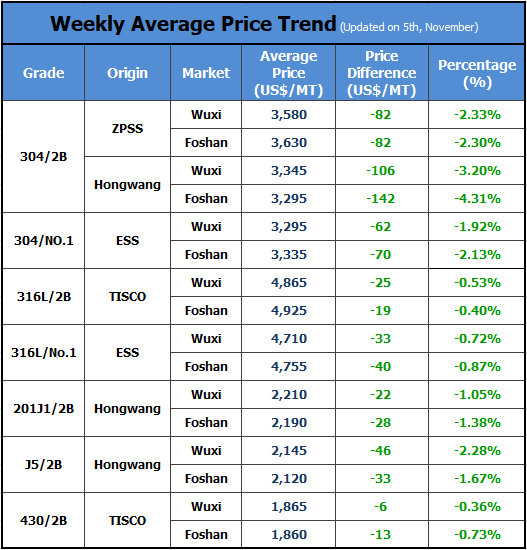

Last week, the prices of stainless steel fell. The current policy against commodities is changing, restricting the business development of stainless steel. The trade has been bland. The steel mills opened the price to drop firstly, and the declining trend maintained during last week. Until Friday(November 5th), the price of the stainless steel futures main contract crashed down by US$145/MT, declining to US$3,010/MT. As for the spot market, in Wuxi, the base price of CR 304 by the private-owned mills was cut down by US$175/MT, falling to US$3,220/MT. Are you still waiting for a lower price?

300 series: The legacy of the production control drives the prices down.

From the perspective of the macro environment, the FED will start Taper in November—— US$1.5 billion of the bond will be cut down every month. The Fed issued a policy statement: “The imbalance between supply and demand related to the epidemic and the economic recovery has caused prices in some industries to rise sharply. The easing of supply constraints is expected to support continued growth in economic activity and employment, and Inflation has fallen back."

Powell emphasized that the Fed will further promote the recovery of the labor market by implementing low-interest rates and maintaining its judgment on the labor market, that is, until the epidemic is further controlled, job growth will be limited.

In China, the number of cases of COVID-19 increases. Many regions require freight drivers to provide a negative test certificate. Since the epidemic arises in Wuxi and the nearby regions, the market holds strict prevention, which causes burdens to the delivery of stainless steel in the short term.

About the futures, last week, the prices kept falling. Until Friday(November 5th), the price of the stainless steel futures main contract crashed down by US$145/MT, declining to US$3,010/MT. The drops in the previous weeks were the result of the governmental control against the coal prices, while the recent price drops are the outcome of the production and supply recovery. Both the spot and futures prices suffer from the market expectation and began to fall. Even the spot 304 price fell greater. In Wuxi, the base price of CR 304 by the private-owned mills was cut down by US$175/MT, falling to US$3,220/MT. The base price of 304 NO.1 by Guangqing was quoted at US$3,255/MT which decreases by US$80/MT compared to the price on October 25th. The price difference between CR and HR again turns minus.

About the supply of October, the production of 300 series amounts to 1.476 million tons, MoM increasing by 12.28%, 161,500 tons; while, it decreased by 12,800 tons, declining by 0.86% compared to the same period of last year. Thanks to the increasing power supply, the production of 300 series climbs up. It is noteworthy that the inventory volume of 300 series dropped the most, consumed 11,200 tons, reducing to 294,400 tons, which is the largest fall since April this year. The reduction is part of the legacy of the dual control when the production dropped greatly, but now with the expectation of production and supply turning positive, traders proactively sell under the decreasing price.

As for the nickel trading market, the high nickel iron was less active last week. the EXW price was maintained at around US$240/MT. In September, Delong’s ferronickel project in Indonesia was once stopped because of the suspense power supply. Not until October, did it finish the maintenance but it is still yet to fully recover from it. Therefore, it is expected that it will need to purchase within China.

Besides, in November, it is expected that the domestic production of stainless steel will increase, which will create more demand for raw materials. Therefore, the price of ferronickel will remain strong and stable. Although the imports from The Philippines reduce, the ore inventory in China is enough for current production, and so the price will remain.

200 series: The price keeps falling, and the inventory increases.

Last week, the delivery of 200 series arrived. The price in Wuxi market started to drop gradually. Until November 5th, the average price of the CR mill-edge coil of 201J2 is around US$2,100/MT, which was about US$45/MT lower than the previous average price. Currently, the price difference between CR and HR widens, which is about US$237/MT for now. Last week, the price of the CR 201J2 dropped by US$47/MT, quoting at US$2,040/MT; as for the HR 5-foot J1, it cut down by US$55/MT, quoting at US$1,930/MT.

The trade also went down as the prices dropped. The decreasing sea freight did not activate the export trade because of the lack of containers, hindering the stainless steel export whatever it is raw materials or manufactured products. The products that can’t sell out have to turn their heads to the home market, causing the stainless steel products to overflow within the domestic market.

400 series: The high cost fails to stop the decreasing price trend.

The high chrome factories in Tsinghai, Guangxi, Hunan and other regions have kept enlarging their production. In October, the production of high chrome increased by about 40,000 tons. With more market inventory, the steel mills get rid of chrome shortages.

More production lines are going to recover from the previous suspense. However, the demand remains gloomy. The inventory volume decreased by 3,300 tons last week, which still stays high.

Last week, Tsingshan settled the purchasing price of high chrome at US$1,658/50 base tons (tax inclusive, to factory, in cash). The price is nearly US$50 higher compared to that in October. Other steel mills are yet to publicize the purchasing price, but based on Tsingshan, we can see the cost of 400 series will keep rising.

Summary:

300 series: The increasing coal supply wakes up the electric power supply and the manufacturing industry. To stainless steel, the supply enlarges and the prices are tuned down. But there is no sign indicating that the inventory and cost will reduce, and thereby the prices of futures and spots will remain. It is predicted that the base price of the CR by the private-owned mills will be around US$3,190/MT~US$3,270/MT. The production of steel mills and the arrivals in the market will possibly decide the future price trend.

200 series: So far, the spot inventory of 201in Wuxi market is backlogging. Whereas the downstream demand is fading. It is predicted that the price of 201 will reduce.

400 series: The trading price of 430/2B has been low, which is difficult to go any lower. It is predicted that the price of 430/2B will decrease by US$15/MT, declining to US$1,770/MT~ US$1,785/MT

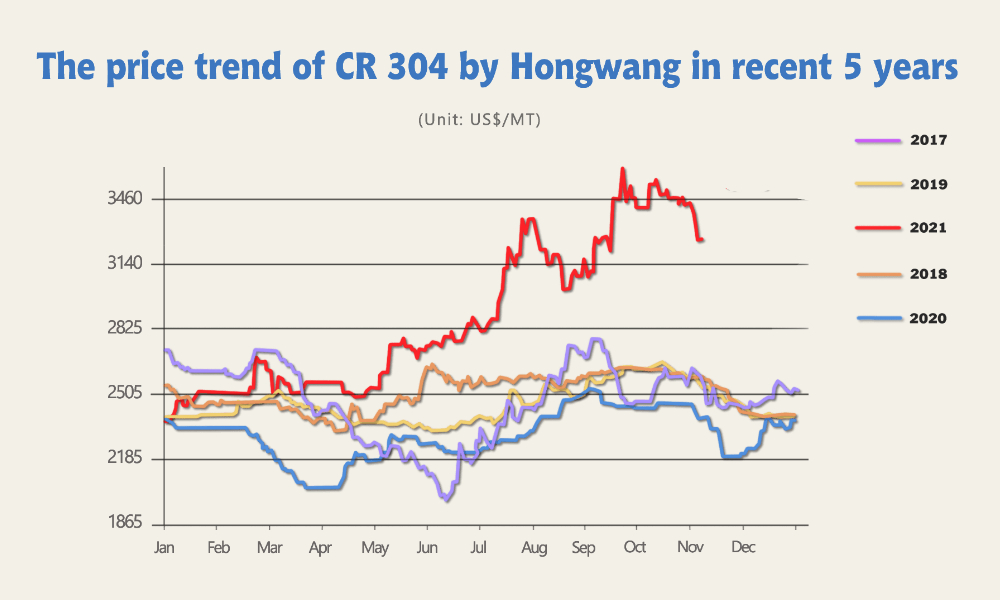

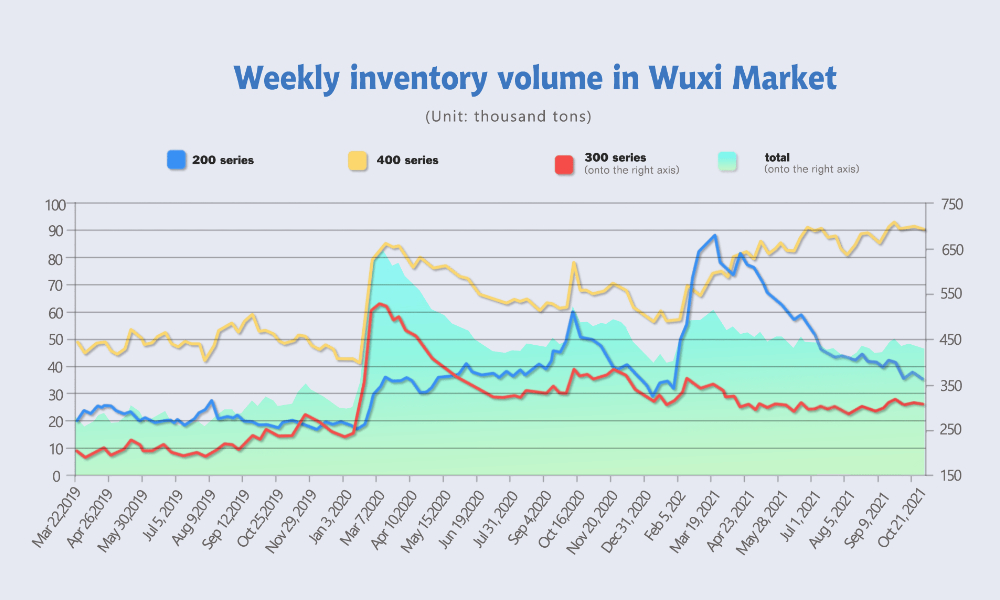

INVENTORY|| The inventory of 400 series decreases in consecutive 3 weeks.

According to the inventory data, last week the inventory volume in Wuxi’s sample warehouse decreased to 417,600 tons which are reduced by 13,500 tons compared to a week before. The inventory volume of 200 series increased by 1,000 tons, rising to 36,300 tons; as for the 300 series, it fell by 11,200 tons, reducing to 294,400 tons; about 400 series, it decreased by 3,300 tons, lowering to 86,900 tons.

200 series: The inventory increases slightly.

The inventory volume of 200 series increased by 1,000 tons, rising to 36,300 tons.

Last week, the price of 200 series dropped for consecutive 4 days. The CR 201 in Wuxi market was reduced by around US$25/MT, quoting at US$2,180/MT; the CR 201J2 was reduced by US$32/MT, lowering to US$1,945/MT. It is reported that Baosteel Desheng, Beigang New Materials, Ansteel LISCO delivered CR and HR resources. A large number of new arrivals add some pressure on the market. The trade of CR and HR have been, accelerating the backlogs in the market. Tsingshan and Hongwang decreased their opening prices two times within the week, which drove down the prices to fall. The actual trading price of CR J2 was down to US$2,040/MT.

300 series: The inventory reduces the most.

The price of 304 continued to decrease. The CR 4-foot mill edge 304 by the private-owned mills in Wuxi market was quoted at US$3,270/MT, which was US$125/MT lower than the price on October 29th. The mainstream price of HR 304 was US$3,275/MT, reduced by US$55/MT.

The inventory of 300 series dropped largely, which is the biggest drop since April this year. The reason lies in the dual control which causes the production to fall. Guangqing has been stopped producing for two months. Although there is news saying the mill will get back to work in October but it does not realize until now. The price of 304 keeps decreasing and traders proactively sell and deliver, consuming the spot inventory. Thanks to the larger power supply, the tight stainless steel supply will be released.

400 series: The inventory continues to drop.

The inventory of 400 series drops for the consecutive 3 weeks because the steel mills’ agents pick up the products to complete their set goal. Besides, it is said that a steel mill in eastern China has stopped the production of 400 series and it is yet to know when it will recover.

WHY the stainless steel prices keep decreasing?

If say the prices in October were fluctuating, then entering November, the prices have been cracking down and look like it is not going to take a brake.

REASON 1: Bulk commodities inflation and the austerity financing expectation.

Since October 19th, the thermal coal futures price has dropped for consecutive ten days, fell down to US$140/MT from its highest record US$313/MT, cutting down by 55%. On October 27th, the Price Department of the Chinese National Development and Reform Commission convened a meeting to study measures to intervene in coal prices. This is by far the most direct intervention measure China has made. Except for the political intervention, China adjusted the coal inventory through imports and larger production. The coal inventory increases and the price has begun to return normal.

Another policy also deeply affects the demand side of stainless steel. The tax on real estate is now in effect in some experimental cities, which is considered as a restraint to the bubble housing price. The policy starts in October and almost simultaneously the sluggish demand is placing in front of the building materials stock market. The prices crumble. Futures like HRB, glass as well as stainless steel began their road to lower prices. As in the global market, although the epidemic has not yet been fully controlled, the employment situation that the Fed is concerned about is still pessimistic, due to the severe inflation, it is possible that a tightening policy will be initiated within the year. With this expectation, the ferrous metal futures which were increasing steadily also declined and the futures market has entered a transitional phase.

REASON 2: Dual control is loosened and supply will increase.

Since mid-October, the dual control measures were loosened in Guangxi and Jiangsu Provinces. Besides, Fujian province has also recovered to a normal power supply since November 1st. As the major stainless steel production areas, the stable and sufficient power supply in Jiangsu, Guangxi, Fujian is beneficial to the production of steel mills. The future supply of stainless steel is optimistic.

REASON 3: It is now the slack season traditionally.

To the stainless steel market, the peak season is September and October. Based on the past trend, the price of 304 drops when November starts.

After the peak season, the tight supply got relief. The spot price is weakening. In Wuxi market, the CR 304 by private-owned steel mills was reduced to US$3,340/MT, while in Foshan, the price was even lower, falling to US$3,220/MT.

On the whole, the decline in bulk commodities may continue to drive down the current price of stainless steel. The Fed’s tightening fiscal policy will further negatively affect the bulk market. To adapt to the future market, the prices are currently difficult to stabilize. It is worth mentioning that the current marine freights have fallen sharply compared to the previous period, and the Baltic Dry Bulk Freight Index fell to a low of nearly three months. The weakening of freight rates may help alleviate the current difficult situation of stainless steel terminal exports. However, it cannot be ignored that in Chinese ports, they are still in a state of lack of containers.

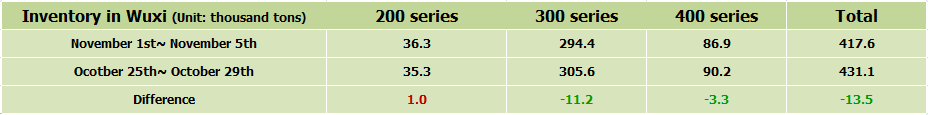

Brazil cuts import duties by 10%; steel down to 10.8%, stainless steel down to 12.6%.

The Brazilian federal government has decided to cut by 10% the import duties imposed on most materials under its tariff system, the ministries of economy and foreign relations said in a joint statement on Friday November 5.

Among the changes, duties on the majority of flat-rolled and long steel products will be cut to 10.8%, from 12% currently. Import taxes on stainless steel will drop to 12.6% from 14%, and aluminium ingots and billets will face a duty of 5.4%, down from 6%.

The changes will affect more than 87% of the commodities subject to the tariff system, the ministries said.

“This is nothing. It makes virtually no difference,” one Brazil-based trader source said.

“I see no new business being made because of this, but at least it is good news from a psychological point of view,” a second Brazilian trader source said.

But a Brazilian mill source said: “This is terrible news.”

The changes will remain in effect until December 31, 2022,

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China