Trend|| After the holiday, stainless steel prices spike, and the trading volume goes up.

Before the Chinese National Holiday, both futures and spot prices rise. Until the closing, on Friday (Oct 8th), stainless steel futures Contract 2111 rose to US$3,360/MT, which is US$125/MT higher than a week earlier before the holiday. As for the spot, the base price of the cold-rolled 4-foot mill-edge product increased to US$3,465/MT and on October 9th, it continued to increase by US$30/MT.

300 Series: Prices and trades are flourishing but the “dual control” remains as the biggest boom.

After the holiday, the stainless steel trading volume increases. More downstream purchasers are actively sending inquiries. Before the holiday, many traders stocked up and now they are keen on selling because the prices increase now.

Stepping into October, dual control seems to get loose in some regions. It is reported that a stainless steel enterprise in Jiangsu province has had three ferronickel production lines returned to work since October 1st. As for the steel milling, there is news saying that more than 70% of the productivity has recovered. But the majority is that the dual control remains harsh. A steel mill in Southern China has been under the eye of dual control. It has shut down all of the production lines since September 6th, and it is yet to restart. If it still adheres to the goal——the production in 2021 shall not surpass that in 2020, there is only about 400,000 tons of the production volume left to the steel mill in the fourth quarter. Experts believe that the steel mill can hardly return in October and only until December, will the mill start to produce. Influenced by the shutdown, GDYJ and GDHW are facing a shortage of hot-rolled raw materials and will suspend from time to time. Soon, the supply of stainless steel will remain tight.

About the futures market, the main contract of stainless steel increased by US$157 at the opening and fluctuated around US$3,340, closing at US$3,360/MT which is US$124/MT higher than the closing price of October 8th. The warehouse receipts of stainless steel are 11,521 tons, positioning in the record low. If it continues to decline, stainless steel futures will still have the risk of the market corner.

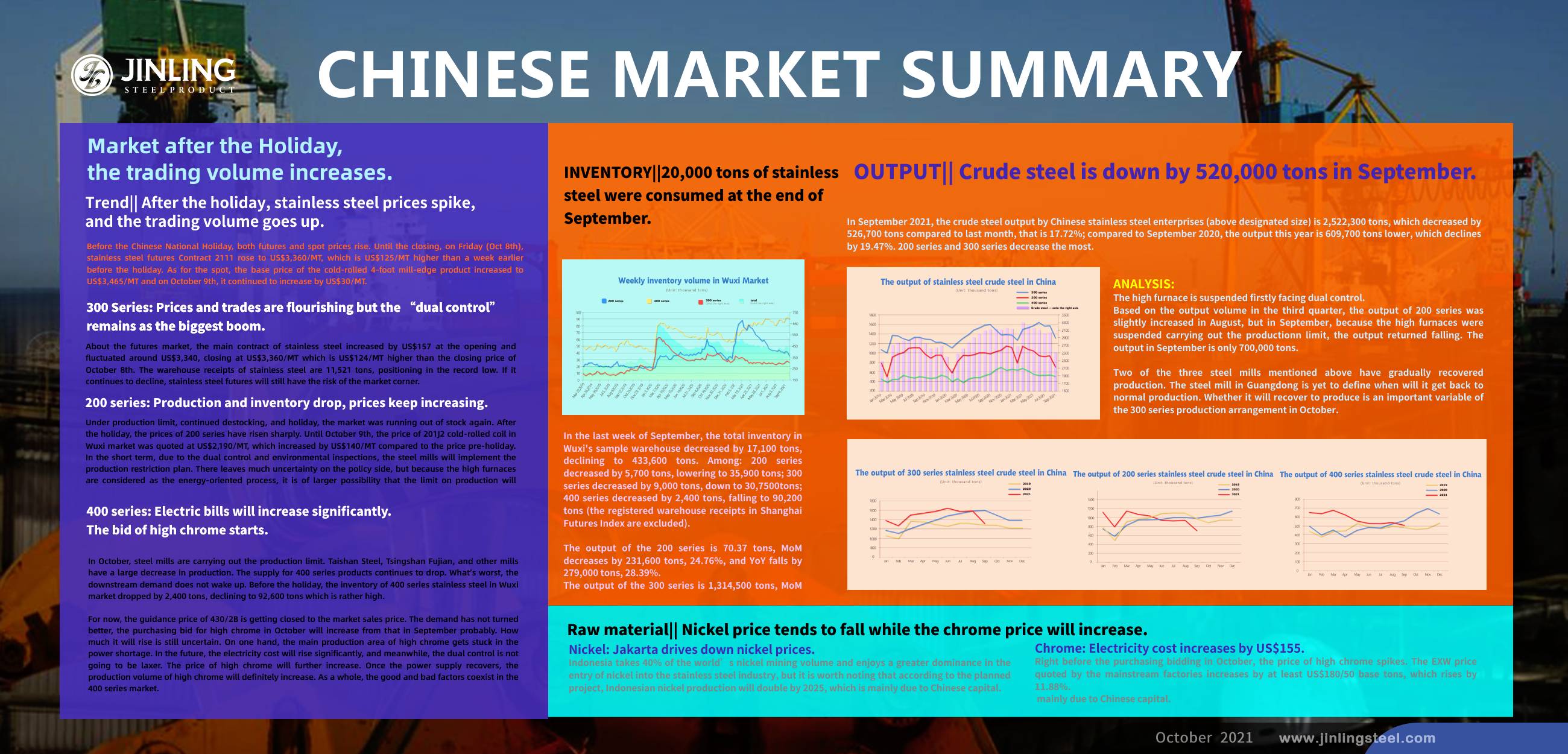

About the inventory, at the end of September, in Wuxi’s sample warehouse, the total volume reduced by 17,100 tons, dropping down to 433,600 tons. The inventory volume of 300 series declines by 900 tons, lowering to 307,500 tons. The “dual control” influences greatly on stainless steel production. It is predicted that 300 series inventory will have a decrease of more than 200,000 tons. Moreover, at the end of September, traders have to make deliveries to have their capital returned. Therefore, the arrival volume from steel mills dropped much. The resources in steel mills reduce because the agents of the state-owned steel mills have a signed trading volume every month, and closing to the end of a month, traders pick up more products.

As for the raw material, lately, the mainstream quotation of high ferronickel maintains at around US$230/nickel. Influenced by the dual control, the ferrochrome production volume in Jiangsu, Shandong, Guangdong dropped significantly in September. But it gradually recovers after October. The high nickel iron is recovering from the shutdown. 11 production lines of the ferronickel of Delong start producing. Other mills also begin working but they need to avoid the peak time of the electricity use. Generally, after the holiday, the supply of high ferronickel will increase and the price does not have a boost to rise. Currently, stainless steel enterprises mostly are reducing production, which causes low demand for ferronickel.

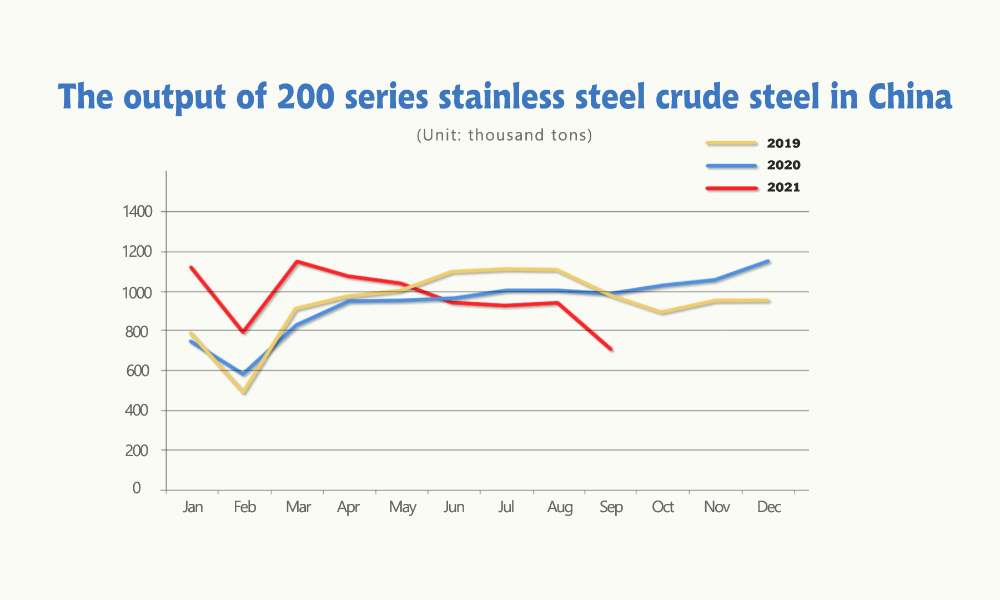

200 series: Production and inventory drop, prices keep increasing.

As of late September, the 200-series inventories in Wuxi and Foshan were 177,600 tons, which is 20,000 tons lower than mid-September. Under production limit, continued destocking, and holiday, the market was running out of stock again. After the holiday, the prices of 200 series have risen sharply. Until October 9th, the price of 201J2 cold-rolled coil in Wuxi market was quoted at US$2,190/MT, which increased by US$140/MT compared to the price pre-holiday. In the short term, due to the dual control and environmental inspections, the steel mills will implement the production restriction plan. There leaves much uncertainty on the policy side, but because the high furnaces are considered as the energy-oriented process, it is of larger possibility that the limit on production will remain strong. It is predicted that the prices of 200 series will be still on a rise.

400 series: Electric bills will increase significantly. The bid of high chrome starts.

The raw material price is still the biggest reason related to the ups and downs of 400 series prices. Although the electricity shortage is smaller in October, the control on high chrome factories remains strict. Some factories were in power off for 6 days. In a short term, the supply for high chrome tightens up.

In October, steel mills are carrying out the production limit. Taishan Steel, Tsingshan Fujian, and other mills have a large decrease in production. The supply for 400 series products continues to drop. What’s worst, the downstream demand does not wake up. Before the holiday, the inventory of 400 series stainless steel in Wuxi market dropped by 2,400 tons, declining to 92,600 tons which is rather high.

For now, the guidance price of 430/2B is getting closed to the market sales price. The demand has not turned better, the purchasing bid for high chrome in October will increase from that in September probably. How much it will rise is still uncertain. On one hand, the main production area of high chrome gets stuck in the power shortage. In the future, the electricity cost will rise significantly, and meanwhile, the dual control is not going to be laxer. The price of high chrome will further increase. Once the power supply recovers, the production volume of high chrome will definitely increase. As a whole, the good and bad factors coexist in the 400 series market.

Summary:

300 series: The production limit did not get loose as expected after the holiday. The maintenance and power limit continue to hinder more production arrangements. The market is now in low inventory, the prices are increasing. It is expected that the CR of the private-owned mill will surpass US$3,435/MT.

200 series: In the short term, dual control and environmental inspection keep affecting steel mills’ production schedules. There leaves much uncertainty on the policy side, but because the high furnaces are considered as the energy-oriented process, it is of larger possibility that the limit on production will remain strong. It is predicted that the prices of 200 series will be still on a rise.

400 series: As a whole, the good and bad factors coexist in the 400 series market. The prices will maintain stable, at around US$1,835/MT.

INVENTORY||20,000 tons of stainless steel were consumed at the end of September.

In the last week of September, the total inventory in Wuxi's sample warehouse decreased by 17,100 tons, declining to 433,600 tons. Among: 200 series decreased by 5,700 tons, lowering to 35,900 tons; 300 series decreased by 9,000 tons, down to 30,7500tons; 400 series decreased by 2,400 tons, falling to 90,200 tons (the registered warehouse receipts in Shanghai Futures Index are excluded).

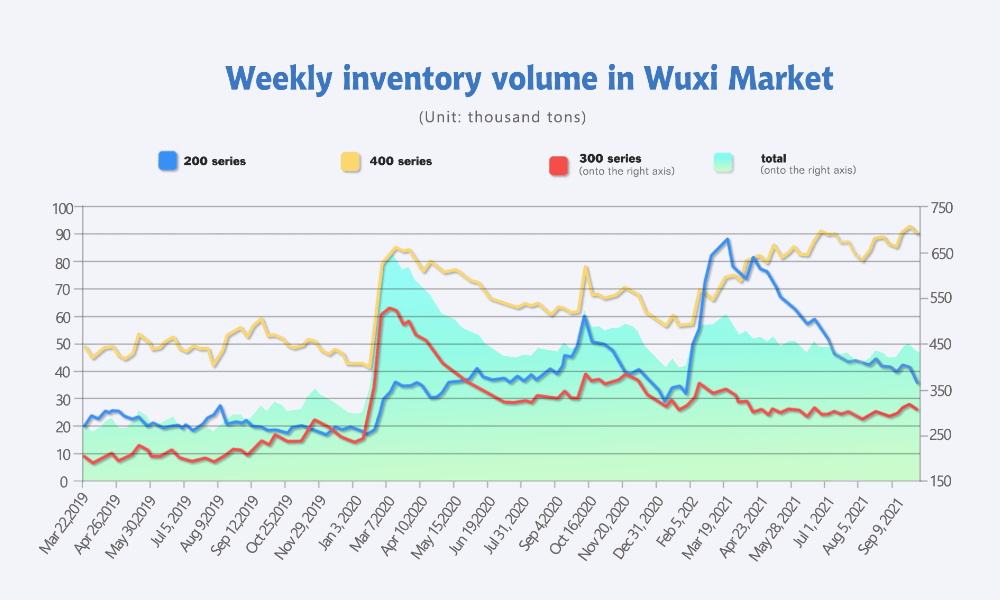

OUTPUT|| Crude steel is down by 520,000 tons in September.

September, in the late summer, some people may felt cold, because of the multiple policies fell on together. Dual control, environmental inspection, and shortage of coal and electricity power, many steel mills announce production reduction and even suspension. The price of stainless steel futures reached US$3,660/MT. Although the futures price has turned down, it still maintains strong due to the tight spot supply. On October 11th, the base price of CR 304 by private-owned mills was quoted at US$3,495/MT which increased by US$420/MT compared to the price in early September. 200 series did not faint at all under the output reduction. After the holiday, the CR 5-foot 200 series products rose beyond US$2,170/MT.

DATA

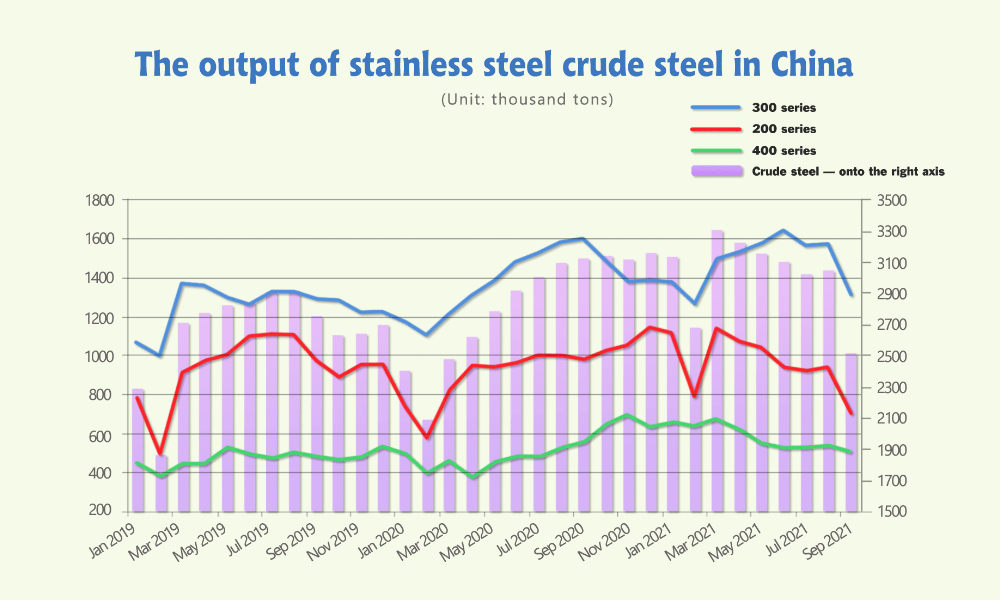

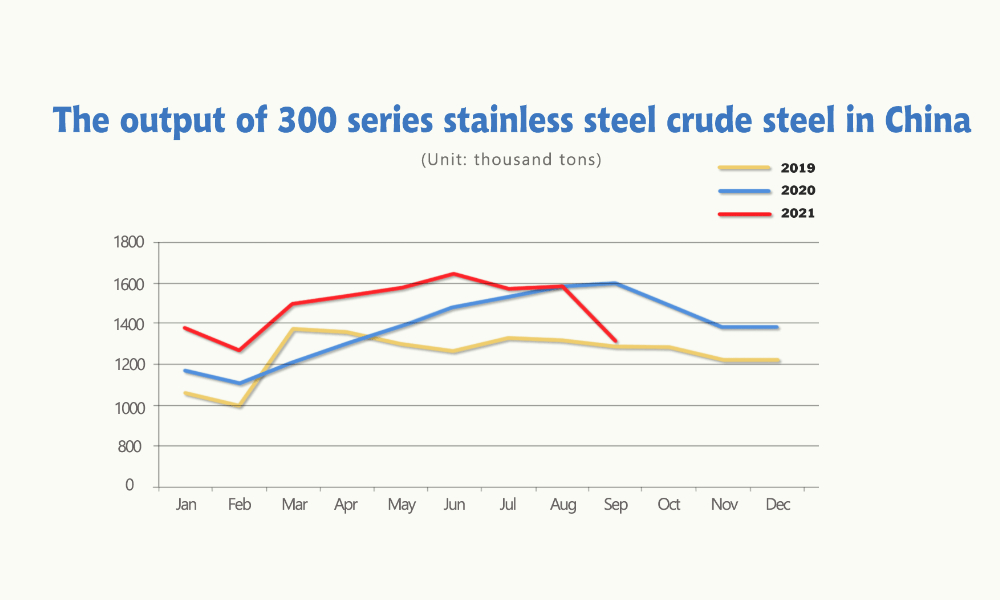

In September 2021, the crude steel output by Chinese stainless steel enterprises (above designated size) is 2,522,300 tons, which decreased by 526,700 tons compared to last month, that is 17.72%; compared to September 2020, the output this year is 609,700 tons lower, which declines by 19.47%. 200 series and 300 series decrease the most.

The output of the 200 series is 70.37 tons, MoM decreases by 231,600 tons, 24.76%, and YoY falls by 279,000 tons, 28.39%.

The output of the 300 series is 1,314,500 tons, MoM decreases by 265,900 tons, 16.82%, and YoY falls by 279,300 tons, 17.52%.

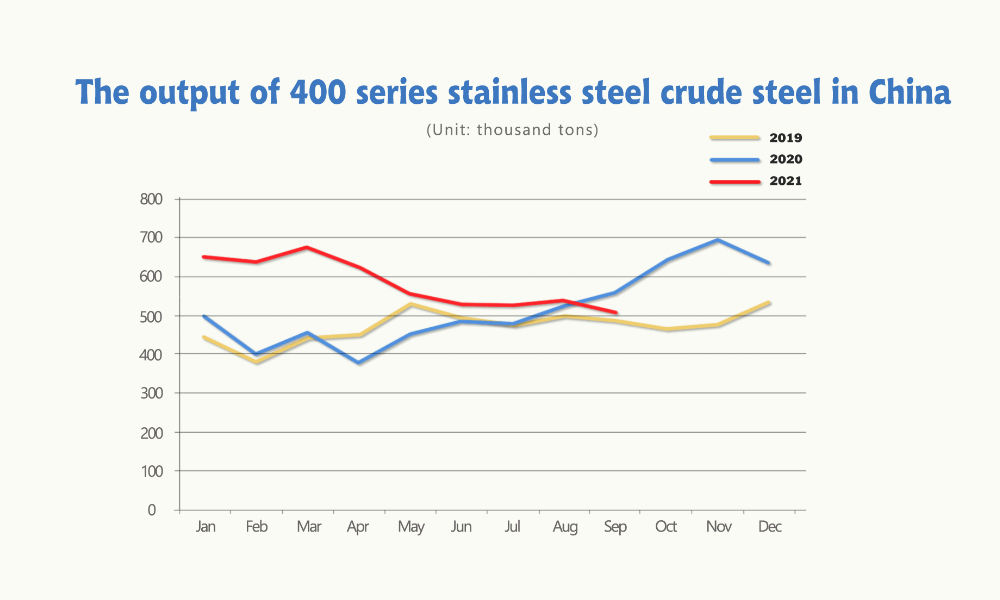

The output of the 400 series is 506,100 tons, MoM decreases by 27,200 tons, 5.09%, and YoY falls by 49,400 tons, 8.6%.

ANALYSIS

200 series: The high furnace is suspended firstly facing dual control.

Based on the output volume in the third quarter, the output of 200 series was slightly increased in August, but in September, because the high furnaces were suspended carrying out the productionn limit, the output returned falling. The output in September is only 700,000 tons.

The decrease in production in September is mainly out of the electric power limit in Guangxi, and the environmental inspection in Shandong, Guangdong, and Jiangsu. Due to insufficient hydropower in Guangxi, the third quarter continued to lack electric power, resulting in the decline of stainless steel output. What’s worst, Beigang New Materials even shut down all the production lines. As for the situation in the latter provinces, because of the dual control and environmental inspection, Guangqing stopped all the production lines, SY closed the high furnace, and later, HL also shut down all of its production lines.

The output of 300 series declined significantly.

In September, the production of 300 series is 1,314,500 tons, MoM decreases by 265,900 tons which is rather large. As for the sheet crude steel reduces significantly, by 240,000 tons. The production of strip and billet fluctuates.

According to the "Completion of Energy Consumption Targets in Various Regions in the First Half of 2021", from January to June, the energy consumption of 9 provinces (regions) in Qinghai, Ningxia, Guangxi, Guangdong, Fujian, Xinjiang, Yunnan, Shaanxi, and Jiangsu rises instead of falling compared to the same period last year. Then, the environmental protection inspection team started the investigation in various provinces and cities. A steel plant in Yangjiang, Guangdong strictly implemented the production limit policy, and has ceased production since September 6. Besides, two steel mills in Jiangsu have also received the notice of power limit. The three steel mills together reduced the production of the 300 series by 280,000 tons in September, which is a key factor of the large reduction of the 300 series.

Two of the three steel mills mentioned above have gradually recovered production. The steel mill in Guangdong is yet to define when will it get back to normal production. Whether it will recover to produce is an important variable of the 300 series production arrangement in October.

400 series: Gloomy demand stops steel mill from producing.

Different from the sharp reduction in the output of 200 series and 300 series, the output of 400 series did not change a lot. Most of the steel mills maintained their normal production, except for a steel mill in Eastern China that reduce half of its production. Earlier in September, CR 430 in Wuxi market was quoted around US$1,900/MT. But due to weak demand, the actual trading price was lower. Until late September, the total inventory of 400 series in Wuxi market increased above 90,000 tons. Steel mills said that lacking orders limits the production to increase. Therefore, in September, the production September declines significantly compared to the same period of last year.

As for the raw material, the electric power limit has continued in Inner Mongolia, Sichuan, Hunan and other major production areas in September. Besides, the production was stopped in Guangxi and Guizhou, which amplifies the shortage of high chrome. It is predicted that in October, the output of high chrome will still be influenced greatly by the dual control.

Overall, the decrease of crude steel output in September completes even surpasses the requirement of Beijing. The prices of 200 series and 300 series both increase significantly. During the three quarters of 2021, the output of stainless steel crude steel is 27,210,000 tons which is still higher than the same period of last year, increasing by 2,690,000 tons, which is 11% higher. However, the production goal of this year is not to surpass the output of 2020. Although the output decreased a lot in the third quarter, there are 1,500,000 tons to be reduced in the fourth quarter. It is believed that the supply will remain tight and the prices will stay high.

Raw material|| Nickel price tends to fall while the chrome price will increase.

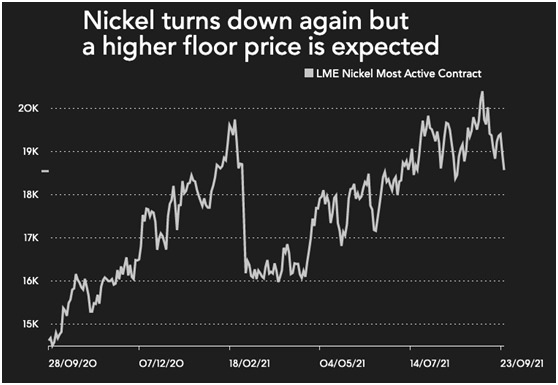

Nickel: Jakarta drives down nickel prices.

Indonesia takes 40% of the world’s nickel mining volume and enjoys a greater dominance in the entry of nickel into the stainless steel industry, but it is worth noting that according to the planned project, Indonesian nickel production will double by 2025, which is mainly due to Chinese capital.

The shortage of electric power in China is extending from the upper stream down to the families. Beijing’s strike on steel manufacturers compresses the stainless steel market which is the major demand for nickel. Therefore, the nickel market has been gloomy.

Although the automobile makers are splendid in recent years, actually no more than 10% of the nickel supply enters the battery producing chain. Asia is the central market of nickel, typically the Indonesia-China stainless steel industry.

By 2021, the nickel price seemed to fall below US$20,000, but with the news of the nickel matte announced by Tsingshan—— a new process to produce nickel, making the price of the nickel pig iron (NPI) drops to the bottom within one year.

Although facts have proved that Tsingshan’s new process from NPI to matte, to sulfate, has a very large carbon emission per ton.

It took less than 6 months for the market to digest Tsingshan’s doubts about the environmental footprint of the new processing, and the price regained a 7-year high of US$20,705 on September 10.

A week later, Indonesia released heavy news that it would restrict nickel exports, but unlike the action of Tsingshan, it failed to lead the market. The LME nickel price has now returned to US$18,450.

Although the market did not make a response as Jakarta wished, a report by BMO Capital Markets at the time summed it up as follows:

Just as the nickel market was in a period of relatively clear trends between supply and demand, Indonesia threatened to change the rules of the game again. According to reports, it plans to ban the export of nickel products or impose taxes. "

BMO stated that even if it is unlikely to completely ban nickel, any refined nickel restrictions will be a new development that will have a greater impact on global market than ore bans.

BMO believes that market volatility will continue. As in the past decade, Indonesia’s “volatile nickel policy” will drive development and prices:

The success of Jakarta’s ban on ore exports has made this Asian country the world’s largest producer of refined nickel (thanks to the large-scale investment of Chinese companies such as Tsingshan), and the proposed ban in Jakarta will affect 70% of exports of any nickel product. "

Higher base price

The exports of BOP (12%-14% Ni) and ferronickel (25%-30% Ni) account for the vast majority of Indonesia's annual 900kt exports, mainly to China. “In the short term, if the restrict is degraded to the imposition on exports, then the cost of Indonesian nickel delivered to the market will rise again."

This will see the base price of LME nickel rise in the short term.

Indonesia already accounts for 40% of the world’s nickel mining volume and enjoys a greater dominance in the entry of nickel into the stainless steel industry, but it is worth noting that according to a planned project, the country’s nickel production will double by 2025. This is again mainly due to Chinese capital.

The latest policy proposal of the Indonesian government on nickel is in line with its overall ambitions for the local electric vehicle industry through the establishment of Indonesia Battery Holding Co., Ltd.

Indonesia’s policy has successfully attracted more than US$10 billion in investment from battery manufacturers in China and South Korea. As demand for electric vehicles increases, hope that Jakarta can retain its existing nickel resources.

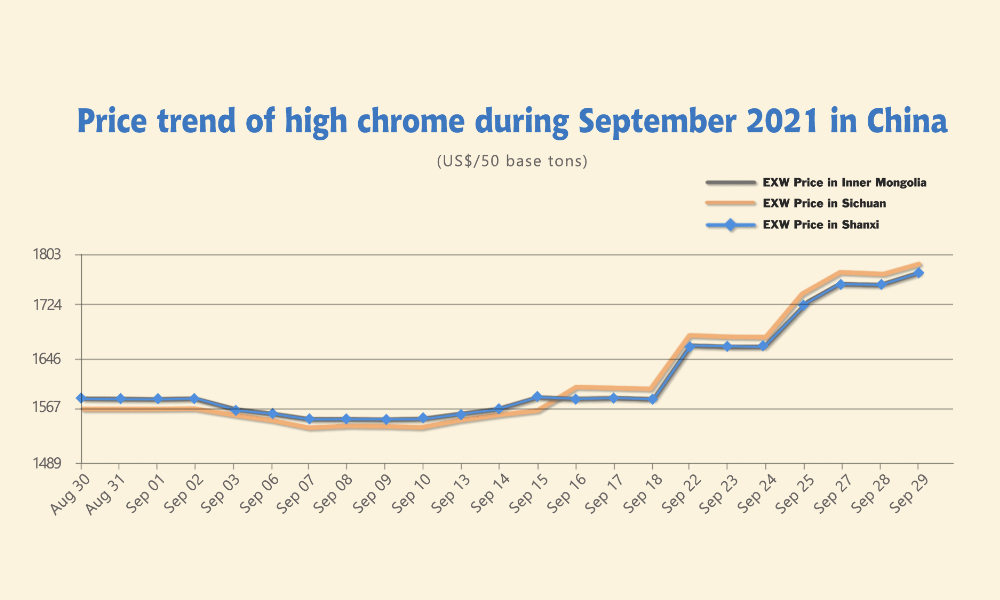

Chrome: Electricity cost increases by US$155.

Right before the purchasing bidding in October, the price of high chrome spikes. The EXW price quoted by the mainstream factories increases by at least US$180/50 base tons, which rises by 11.88%.

On September 27, the Inner Mongolia Development and Reform Commission issued a notice (draft for comments) on the guaranteed minimum electricity price for electricity market trading users. The “guaranteed minimum electricity price”, is a system used after the increasing cost and price of the electric power, which is to ensure the users staying in the market when the prices increased. Now, China increases the price limit. Thermal power (coal) electricity prices can rise by no more than 20% of the benchmark price, compared with the previous upper limit of 10%.

The “guaranteed minimum electricity price” will be effective on November 1st.

According to feedback from local factories, if this policy is implemented, the cost of electricity for high chromium production will increase by more than US$155/50 base tons. Considering that the production costs have been increasing due to various reasons, after the holiday, the price of high chrome shall maintain high or even rise.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China