China's manufacturing PMI in March difficultly bounced back above 50% after consecutive 5 months under the threshold. Last week, from March 25th to 29th, the Chinese stainless steel market was sluggish and the weekly average prices of all major grades of 300 and 200 series declined. 400 series maintained stably as usual. The main contract price hit a low of US$1965/MT during last Friday night trading, breaking the previous low. With insufficient confidence from end-users and only essential purchasing activities, inventories accumulated. From the perspective of production cost, nickel is risking even lower prices although the current price is low enough that part of the nickel production in the world fails to earn profit. The reason is that the biggest nickel supplier in the world, Indonesia is keeping an expansive pace in nickel mining and exporting. Capacity for nickel pig iron, which is used to make stainless steel, is projected to expand by up to 15 percent in three years from the current 1.9mn tonnes, said an official. Some experts express worries about the increase of nickel output in the future. If you would to know the specific prices and industrial news, please keep reading our Stainless Steel Market Summary in China.

WEEKLY AVERAGE PRICES

| Grade | Origin | Market | Average Price (US$/MT) | Price Difference (US$/MT) | Percentage (%) |

| 304/2B | ZPSS | Wuxi | 2,100 | -31 | -1.54% |

| Foshan | 2,140 | -31 | -1.50% | ||

| Hongwang | Wuxi | 2,005 | -34 | -1.75% | |

| Foshan | 2,005 | -36 | -1.90% | ||

| 304/NO.1 | ESS | Wuxi | 1,930 | -32 | -1.75% |

| Foshan | 1,940 | -28 | -1.52% | ||

| 316L/2B | TISCO | Wuxi | 3,570 | -39 | -1.13% |

| Foshan | 3,630 | -45 | -1.27% | ||

| 316L/NO.1 | ESS | Wuxi | 3,400 | -42 | -1.27% |

| Foshan | 3,450 | -45 | -1.33% | ||

| 201J1/2B | Hongwang | Wuxi | 1,355 | -35 | -2.75% |

| Foshan | 1,355 | -28 | -2.21% | ||

| J5/2B | Hongwang | Wuxi | 1,265 | -32 | -2.73% |

| Foshan | 1,275 | -24 | -2.02% | ||

| 430/2B | TISCO | Wuxi | 1,250 | 0 | 0.00% |

| Foshan | 1,250 | 0 | 0.00% |

TREND || Stainless Steel Futures Hit New Lows.

Last week, the spot prices of stainless steel in Wuxi market showed weak and fluctuating trends, with continuous declines in prices for 300 series and 200 series, while prices for the 400 series remained stable. The decline in raw material prices and the resulting cost reduction led to a downward trend in stainless steel prices. The main contract price hit a low of US$1965/MT during Friday night trading, breaking the previous low. With insufficient confidence from end-users and only essential purchasing activities, inventories accumulated. As of last Friday, the main contract price for stainless steel fell by US$22.3/MT to US$2000/MT, a decrease of 1.18%.

300 series: Increasing inventory pressure, market concessions promote transactions.

Last week, the prices of stainless steel 304 fluctuated downward. As of Friday, the mainstream base price of cold-rolled four-foot 304 (private steel mill) in the Wuxi area was reported at US$1950/MT, a decrease of US$28/MT from the previous Friday; the private hot-rolled price was reported at US$1925/MT, a decrease of US$21/MT from the previous Friday. Last week, the market operated with fluctuations, with the cancellation of agent price controls by Tsingshan at the beginning of the week leading to a pessimistic outlook in the market. With the resonance of futures and spot prices trending downward, the trading performance was lackluster. With the fluctuation and exploration of futures prices, Tsingshan set new prices to support prices, but affected by inventory pressure and the decline in nickel-iron prices on the raw material side, the cost support shifted downward. Most traders still actively reduced prices to promote sales, and with demand showing no signs of improvement, Tsingshan offered agents a discount of US$14/MT to facilitate transactions, and low-priced resources from last week still had a decent trading performance.

200 series: Prices caught spring cold.

Last week, the spot prices of 201 in the Wuxi market were mainly lower. As of Friday, the mainstream base price of cold-rolled 201J1 in Wuxi was down by US$7/MT from the previous Friday, currently at US$1325/MT; the mainstream base price of J2/J5 cold-rolled was down by US$14/MT from the previous Friday, currently at US$1230/MT; the mainstream price of five-foot hot-rolled stainless steel was down by US$14/MT from the previous Friday, currently at US$1315/MT. Since Tsingshan and Hongwang lifted price control measures last week, downstream customers have been purchasing on demand, with a lack of willingness to replenish inventory at low prices, resulting in strong market watch sentiment. The price of 201 has fluctuated downward with poor transaction performance.

400 series: Reduction in inventory, weak and stable operation of 430 prices.

Last week, the guidance price for 430 cold-rolled by TISCO was US$1465/MT, and the guidance price for 430 cold-rolled by JISCO was US$1585/MT, both unchanged from the previous week. Last week, the mainstream quotation for 430 cold-rolled stainless steel in Wuxi market was US$1245/MT-US$1255/MT, and the price for 430 hot-rolled was US$1135/MT, both unchanged from the previous week.

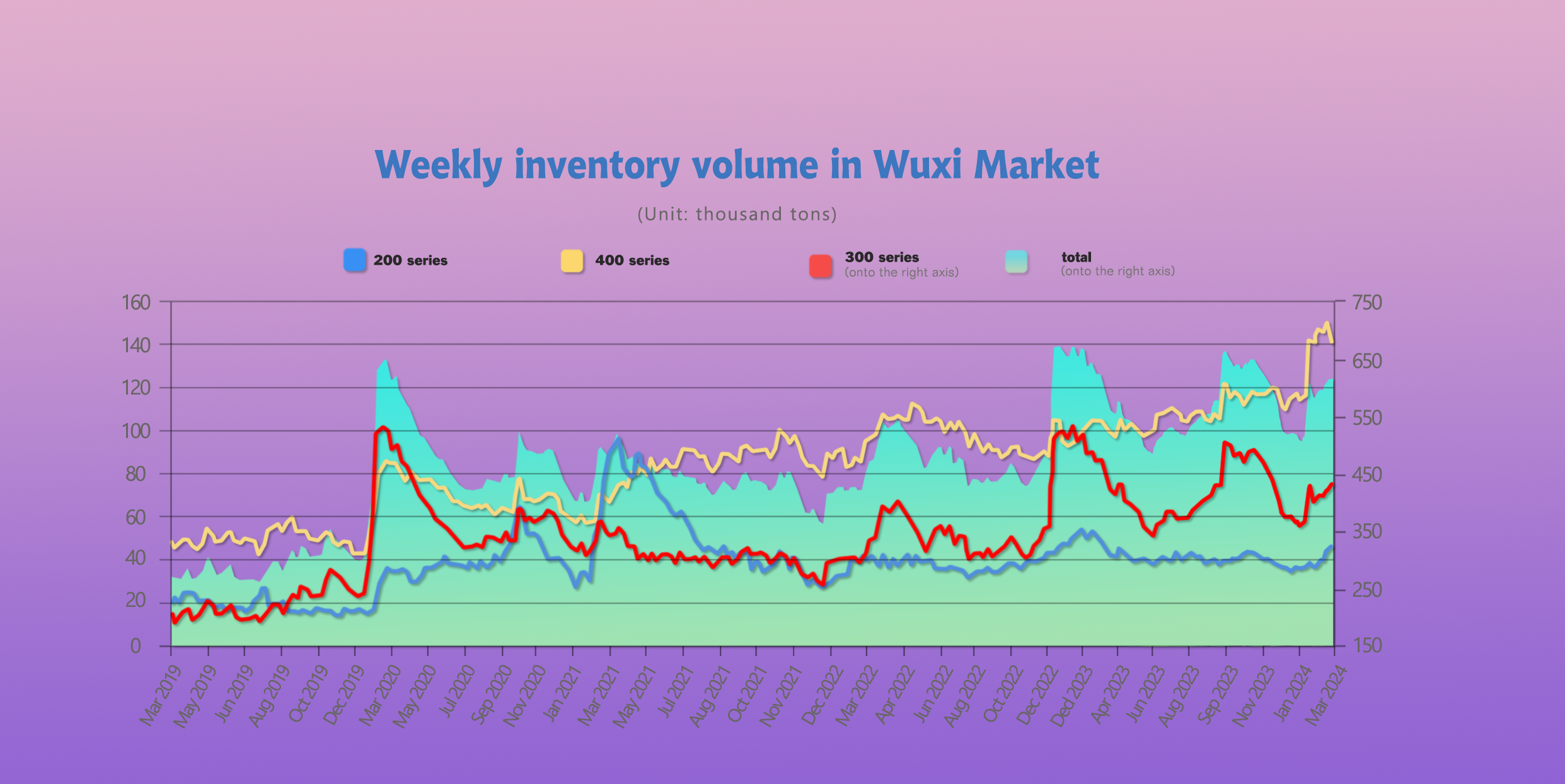

INVENTORY|| Accumulation continues.

The total inventory at the Wuxi sample warehouse increased by 2,596 tons to 519,546 tons (as of 28th March).

the breakdown is as followed:

200 series: 2462 tons up to 45,538 tons,

300 Series: 11,150 tons up to 428,924 tons,

400 series: 9,258 tons down to 139,703 tons.

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| March 21th | 43,076 | 417,774 | 148,961 | 609,811 |

| March 28th | 45,538 | 428,924 | 139,703 | 614,165 |

| Difference | 2,462 | 11,150 | -9,258 | 4,354 |

300 Series: Costs Fall, Inventories Continue to Increase.

Last week, with the acceleration of Indonesian approval and the increase in nickel supply, the nickel iron price has fallen compared with the previous month, and the cost has slightly fallen. Spot trading is weak, and inventory digestion is slow.

The spot and futures prices fluctuated and bottomed out. The confidence of downstream enterprises in the future market is insufficient, and just-needed purchases are the main ones. In addition, the arrival of cold-rolled registered warehouse warrant resources has increased. The current valuation is relatively low, and the price may rebound after bottoming out in the future, driving the improvement of transactions. It is estimated that the inventory will be slightly reduced next week, and the subsequent production of steel mills and the recovery of market demand will continue to be monitored.

200 Series: 0.25 Million Tons, 201 Continues to Increase Inventory.

Affected by the relaxation of the transaction control measures on cold-rolled 201J2 transactions by Tsingshan last week, the price fell slightly. In addition, major steel mills arrived one after another, and downstream customers purchased as needed, resulting in inventory accumulation. The focus in the later period will be on the arrival of steel mills and market transactions.

400 Series: From Increase to Decrease, 430 Price Runs Weakly and Steadily.

Last week, the market quotation of 430 cold-rolled was weak and stable. Approaching the end of the month, steel mills urged settlement and delivery, and traders took the initiative to destock and recover funds.

Raw Materials: Nickel Iron Prices Weakly Fall.

The EXW price of high-nickel iron continued to fall last week, and as of Thursday it was reported at US$235/Nickel point, down US$2.7 from last Thursday, It is understood that a major steel mill in South China purchased several thousand tons in this price level.

The SHFe nickel continued to fall last week, falling to a minimum of US$18230/MT. As of Thursday's close, the main Shanghai nickel contract closed at US$18,500, down US$1042/MT (or 5.4%) from last Thursday.

Last week, stainless steel and nickel prices both fell, and the impact of the slow approval of RKAB in Indonesia has weakened. Local officials said that the approval is currently being accelerated. At present, stainless-steel producers are suffering from serious production losses, and the willingness to suppress raw material purchase prices has increased. At present, the nickel ore price is relatively firm, and after the nickel iron price falls, the domestic steel mills losses have increased, and production is reduced. It is expected that the nickel iron price will be stable and weak in the short term.

SUMMARY|| Stainless Steel Social Inventory Accumulation Suppresses Prices.

Stainless steel prices were weak and volatile last week. The downstream demand digestion capacity was average, and the social inventory continued to increase. The raw material prices have loosened, and the steel mill production profits are on the verge of loss. The current spot resources are generally sufficient. The focus is on the subsequent social inventory destocking speed and changes in the planned production of steel mills. It is expected that stainless steel will run weakly and volatile in the later period.

300 Series:The previous steel mill production capacity has been gradually released, the supply pressure has increased, the cost support from the raw material end has shifted down, the downstream demand release has been slow, and the pressure of spot market inventory and warehouse warrants has continued to remain high. The profits of steel mills are squeezed, and it is expected that the spot price of cold-rolled 304 will maintain a weak and volatile trend in the short term.

200 Series:The recent spot market transactions have been weak, and the downstream demand release has not met expectations, which has limited support for stainless steel prices. In the absence of major actions by steel mills, it is expected that the price of stainless steel 201 will still be weak and volatile in the short term.

400 Series:The raw material cost is high, and most steel mills are losing money. They have a strong willingness to raise prices, but the downstream is still mainly purchasing on demand. Considering that the current 400 series inventory is still high, it is expected that the price will run weakly and steadily in the short term.

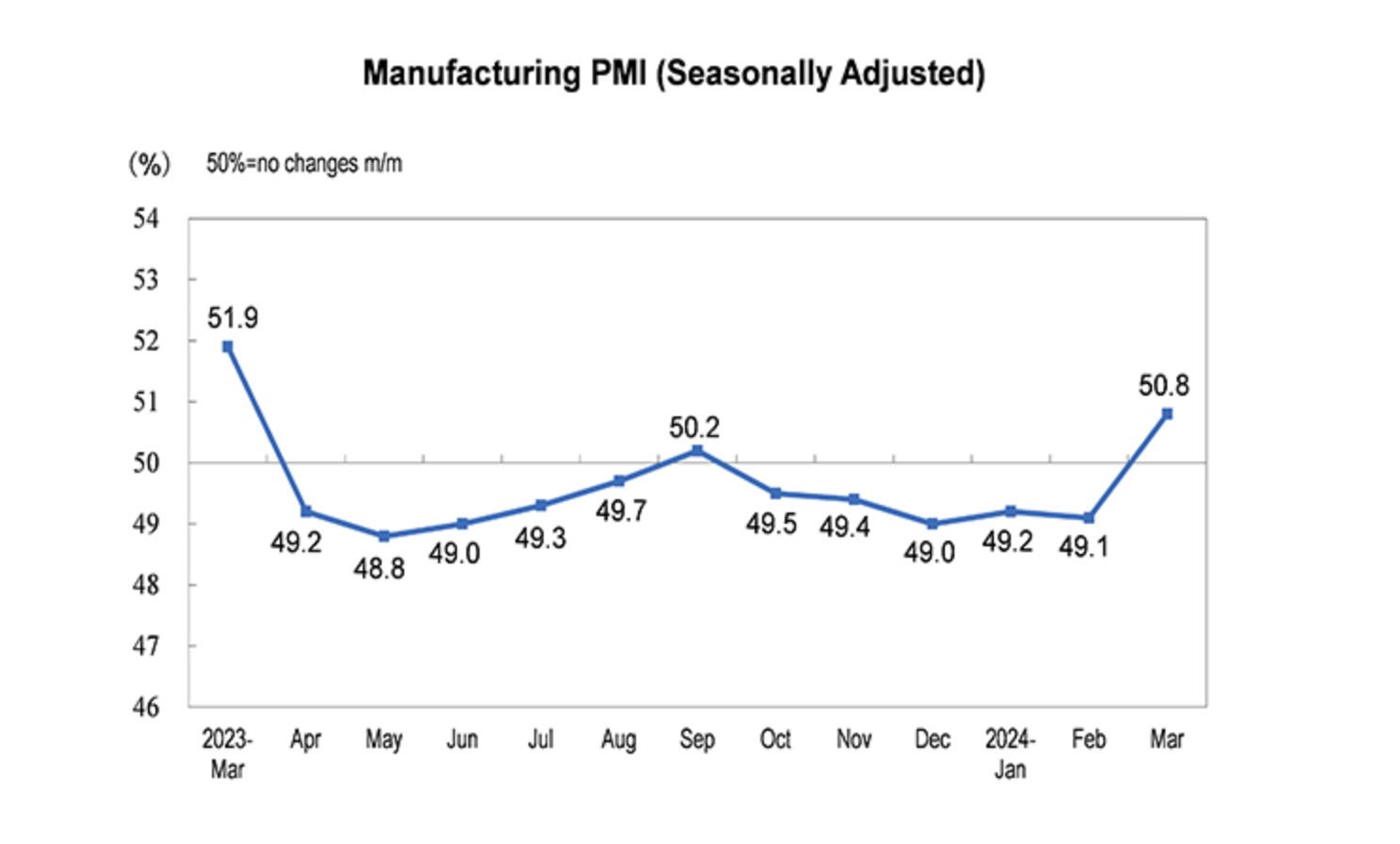

MACRO|| China's Manufacturing PMI Barely Climbed to 50.8% in March.

The China's official manufacturing PMI rose 1.7 percentage points from the previous month to 50.8% in March, better than the Bloomberg median forecast of 50.1%; the non-manufacturing business activity index rose 1.6 percentage points from the previous month to 53.0%. The improvement in demand helped the PMI return to the expansion zone, but the marginal improvement in external demand was better than that in domestic demand. The service industry is differentiated, with production-related improvements and holiday consumption-related declines. The construction industry improved, but the magnitude was weaker than seasonality, indicating that infrastructure and real estate construction are still slow.

Indonesia to accelerate nickel output despite low global prices.

Indonesia will press on with plans to expand nickel output despite a supply glut that is forcing rivals to shut down mines, as the world’s top producer aims to keep prices low and protect long-term demand for the metal crucial to electric car batteries, a senior government official has said. The country’s production capacity for battery-grade nickel is expected to quadruple to 1mn tonnes by 2030, said Septian Hario Seto, the deputy co-ordinating minister for investment and mining. Capacity for nickel pig iron, which is used to make stainless steel, is projected to expand by up to 15 per cent in three years from the current 1.9mn tonnes, he added. Nickel prices have slumped 30 per cent in the past year on elevated supply from Indonesia and softer demand. More than half of global nickel production is unprofitable at current prices of about $16,500 per tonne.

“We don’t see any reason why we should not expand production of nickel for battery materials,” Seto told the Financial Times. “What we want to achieve is price equilibrium. The responsibility for us as the biggest nickel producer is to supply enough nickel so that the EV [electric vehicle] transition can progress smoothly.” The surge in low-cost nickel supply from Indonesia will wipe out rivals in the next few years, the head of French miner Eramet warned last month.

Australia’s Wyloo Metals is shutting down nickel mines in Western Australia, while BHP has said it is considering the closure of some nickel operations. But Seto said increased output amid output cuts elsewhere would help stabilise nickel prices that have been volatile in recent years. He projected long-term nickel prices — which briefly traded above $100,000 a tonne in 2022 — would be between $18,000 and $19,000.

Any significant threat to nickel demand would damage Indonesia’s economy. Foreign direct investment has hit records in recent years, and the current account balance reached a surplus in 2021 after a decade of deficits thanks to the boost to the domestic nickel industry. “From Indonesia’s perspective, they want to protect the industry as it is a substantial revenue source and contributor to the economy,” said Harry Fisher, a senior consultant at Benchmark Mineral Intelligence. “They have got reason to try to keep prices at a sustainable level. And they have got some leverage.”

Sabrin Chowdhury, head of commodities at BMI, a unit of Fitch Solutions, noted that lower nickel prices might not guarantee sustained demand as lithium batteries were cheaper. Indonesia’s expansion would be “more catastrophic for nickel producers in the longer term”, she added.

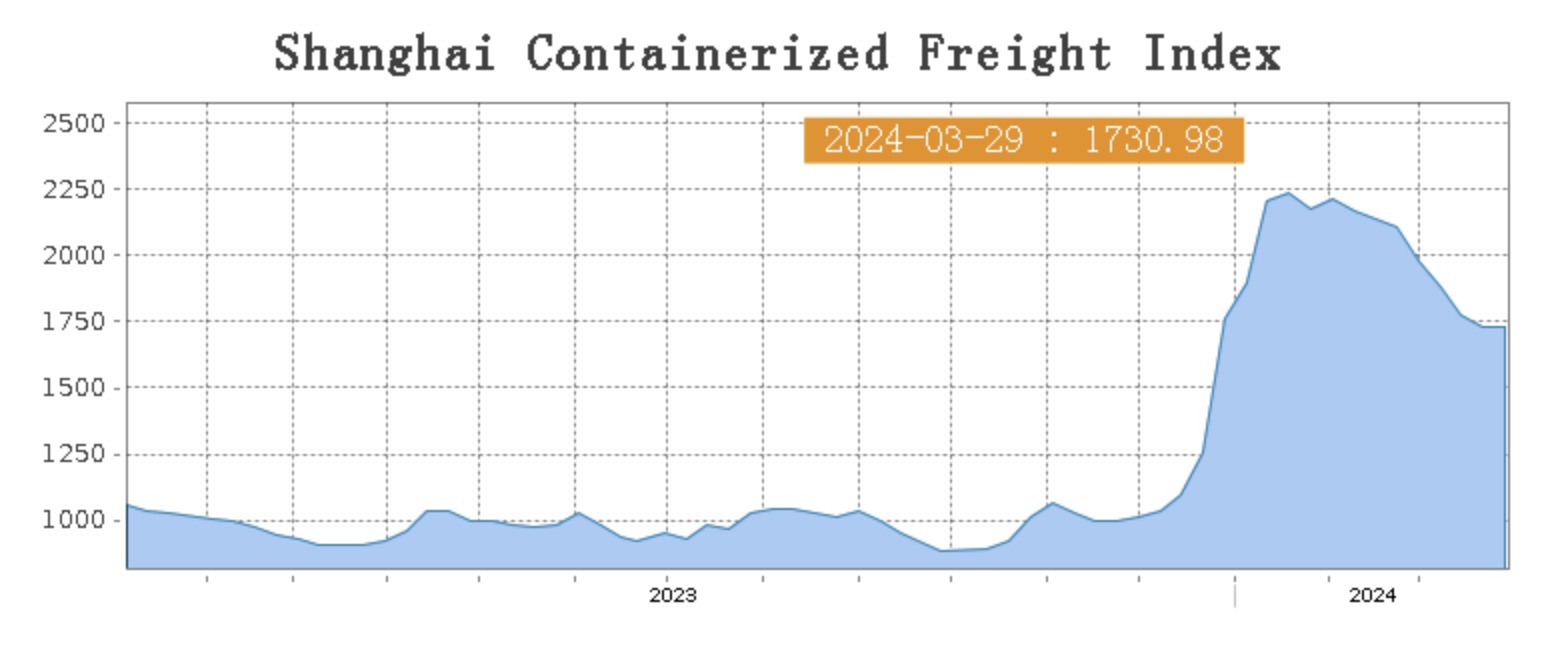

Sea Freight|| Shipping Market Holds Steady, Freight Rates Drop.

China’s Containerized Freight market continued to be interrupted by the regional fluctuation. On 29th March, the Shanghai Containerized Freight Index fell by 0.1% to 1730.98.

Europe/ Mediterranean:

According to data released by the European Commission, the euro zone economic sentiment index in March was 96.3, and the consumer confidence index rose to its highest level since February 2022, showing that the European economy continues to recover. Last week, transportation demand remained stable and improved, the supply and demand relationship improved, and market freight rates rebounded after continuous adjustments.

On 29th March, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$1994/TEU, which 2.6% higher than last week. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3009/TEU, which increased by 4.2%.

North America:

On 29th March, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$3407/FEU and US$4447/FEU, reporting a 5.9% and 8.2% fall accordingly.

The Persian Gulf and the Red Sea:

On 29th March, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf surge by 12.9% from last week's posted US$1697/TEU.

Australia/ New Zealand:

On 29th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$729/TEU, a 11.3% slide from the previous week.

South America:

On 29th March, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2788/TEU, an 9.3% growth from the previous week.