|

Grade |

Origin |

Market |

Average Price (US$/MT) |

Price Difference (US$/MT) |

Percentage (%) |

|

304/2B |

ZPSS |

Wuxi |

3,315 |

115 |

3.75% |

|

Foshan |

3,365 |

115 |

3.70% |

||

|

Hongwang |

Wuxi |

3,215 |

112 |

3.77% |

|

|

Foshan |

3,185 |

80 |

2.69% |

||

|

304/NO.1 |

ESS |

Wuxi |

3,235 |

113 |

3.80% |

|

Foshan |

3,245 |

81 |

2.73% |

||

|

316L/2B |

TISCO |

Wuxi |

4,770 |

110 |

2.44% |

|

Foshan |

4,805 |

102 |

2.25% |

||

|

316L/NO.1 |

ESS |

Wuxi |

4,715 |

144 |

3.25% |

|

Foshan |

4,715 |

118 |

2.66% |

||

|

201J1/2B |

Hongwang |

Wuxi |

1,975 |

43 |

2.39% |

|

Foshan |

1,950 |

41 |

2.33% |

||

|

J5/2B |

Hongwang |

Wuxi |

1,880 |

46 |

2.71% |

|

Foshan |

1,865 |

45 |

2.64% |

||

|

430/2B |

TISCO |

Wuxi |

1,640 |

38 |

2.60% |

|

Foshan |

1,680 |

33 |

2.20% |

TREND|| Stainless steel prices to fall when production cut to finish.

The price of stainless steel for last week was tended to increase then went down. At the beginning of last week, the downstream manufacturers were in need of stocking up, and thereby the transaction stayed hot. The main futures contract of stainless steel rose rapidly early this week, increasing by US$70/MT which made it exceeding US$3,130/MT. But as the stock-up finished, the transactions turned weaker. Until last Friday, the futures rolled over and the price of the stainless steel increased to US$3,170/MT, which earned arbitrage. Influenced by National Development and Reform Commission (NDRC) which has emphasized on intervening commodities for the prices rising rapidly, the rising tendency of the stock prices fades away.

So far, the price of stainless steel futures dropped a bit, but there have supports from the downstream, majorly for two reasons:

1. The cost of raw material rose. The price of nickel iron continued to climb this week, purchasing became more in steel mills, and tight supply for scrap stainless steel appeared. However, due to the low inventory of chrome iron, the high price of ferrochrome will remain and the cost of stainless steel owned a strong rising tendency which causes the cost of stainless steel increasing.

2. The downstream consumers are optimistic towards the market, and keep stocking up after Spring Festival. After the spot price fell back, the downstream demand will rise again.

However, another view suggests that the positive factors have begun to reduce after the stainless steel futures prices rebound, while on the contrary, the negative factors are gradually arising. For the current high stainless steel prices, it would be better to stay cautious, because there are still some passive factors remaining, such as the expectations for the FED to cut rate, the situation in Ukraine and Russia, the recovery of stainless steel production, the NDRC investigation on the raw material side, etc.

300 series of stainless steel: Prices to fall. Good and bad factors seesaw at high.

After the holiday, the prices of stainless steel have consecutively increased. At the start of last week, the prices of stainless steel futures and spot continued to rise, compared to that on February 11th, the highest price last week rose by US$172/MT. Latter last week, the prices began to fall. As for the spot products, compared to the closing price on February 11th, the cold-rolled stainless steel 304 of private-owned mills grew by US$64/MT, to US$3,155/MT; about hot-rolled stainless steel 304, the spot price increased by US$96/MT, to US$3,235/MT. Generally, the market was bullish when the prices increased earlier the week, and the transaction went low when the futures market cooled down on February 17th and 18th.

Cost: Last week, the price of high nickel-iron by mainstream factories that quoted, compared to that on February 11th, rose by US$6/nickel to US$244/nickel. As for the ferrochrome price, it rose by US$16/MT to US$1372/MT. The theoretical production cost of cold-rolled stainless steel 304 was rapidly increased by US$57/MT to US$2956/MT. At present, taking the cold-rolled stainless steel 304 of private-owned mills as an example, the profit earned by the metallurgical production is around US$58/MT. As the prices of hot-rolled products exceed the prices of cold-rolled stainless steel, to steel mills, it is more profitable to produce the hot-rolled stainless steel.

200 series of stainless steel: Due to the weak demand, transactions and prices stay pessimistic.

As the downstream returns to work, their purchases were awaken, which brought a considerable volume of transaction. Shengyang in Shandong and Tsingshan provided the first opening price of this year. In the aspect of market resources, the stainless steel 200 series resources of the Steel Plant arrived normally last week which mainly for Baosteel Desheng and Beigang New Materials, except that ,there were also a few BH resources that reached Wuxi, but most are Cold-rolled stainless steel. So far a tight stock situation in the five-foot hot-rolled market remains, therefore some traders have taken up the future orders already.

As for the price last week, in the Wuxi market, the mainstream base prices of cold-rolled mill-edge stainless steel 201 increased by US$40/MT, currently quoted at US$1818/MT; the base prices of mill-edge J2/J5 rose by US$40/MT during last week, quoted at US$1,722/MT; the price of the five-foot hot-rolled stainless steel has been grown by US$8/MT in a week, to US$1,882/MT. The price difference between the hot-rolled and cold-rolled products narrowed down to around US$159/MT.

About the transactions, downstream concentrated on replenishment to stock at the beginning. Part of the demand remains, but the market turnover already weakened after the holiday. Moreover, the five-foot hot-rolled products are still out of stock currently, which hinders more transactions. The prices dropped a little. Though the cold-rolled inventory is adequate, due to the low demand, the transaction was light.

400 series of stainless steel: After the holiday, the demand was increasing which heats the transaction.

The supply maintains as last week, but as the traffic control in Guangxi Province was relieved, the factories recover from the producing suspension. Influenced by the environmental control during the Beijing Winter Olympics, the production of high chrome in Inner Mongolia and Shanxi Province reduced, not to mention that some factories in Southern China seized production. Therefore, in February, the output of high chrome dropped a larger range compared to that of last month.

Summary:

In general, the current drop in stainless steel is regarded as a short-term adjustment. After all, the stock price has increased by almost 2,000 points after the Spring Festival. However, the prices dropped under the influence of the intervention in commodity prices by NDRC and the epidemic in Wuxi. Meanwhile, the supply will also cause the prices to decrease because the Shanghai Futures Exchange and the social inventory both occur excessive-stockpiling. Fortunately, the purchase remains positive, so the pressure on supply may not emerge until March.

In conclusion, the consumption of stainless steel in a short time is quite positive, and at the same time, the cost support is solid. After the enterprise is stable expected next week, the consumption is expected to rise again.

300 series of stainless steel:

Brought by the production limit and reduction in January and in February, the increasing price trend gradually fades, and currently high-profit steel production is expanding; Factory recovered to work gradually; There were more Stainless steel 02 contract resources of the settlement in the market this week so that easing the current spot tension and making prices rise in fluctuation in a short time. Besides, NDRC investigates price fluctuation of iron ore making iron ore futures prices fell from high, ending with a limit down. The rising tendency of the price in the market weakened, and private-owned cold-rolled prices this week are expected to fall slightly by US$32/MT to US$476/MT around. The high inflection point of stainless steel is coming soon, but the growing tension between Russia and Ukraine is needed to be paid attention to. It supports nickel prices to hit a new high which affects stainless steel prices to a large extent.

200 series of stainless steel:

Last week, the overall performance of stainless steel 201 was light. The five-foot hot-rolled product reversed the previous upsurge situation and ushered the first price drop in this year. At present, although the cold-rolled product is still expensive, low-priced shipments appeared in the market and the price of stainless steel 201 is expected to move down slightly this week.

400 series of stainless steel:

In the Wuxi market, TISCO and JISCO stainless steel 430/2b quoted at US$1,547/MT, increased by US$16/MT compared that of February 11th, and the market transactions became more last week, supporting prices rising. Prices of Chrome ore are still increasing as well so that making costs of high chromium production continued to increase also. Despite the lifting of traffic control in Guangxi, as the cost is too high and the resumption of manufacture is low, rising prices still be supported by the factories of high-chromium. However, without the support of transactions in batches, the prices generally keep steady. At present stainless steel 400 series factories still support rising prices, and making transactions difficult concerning the high price. Stainless steel 430/2b price is expected to level off this week, maintains at about US$1,547/MT.

Inventory||Inventories are rising slightly, and that is just the beginning.

| Inventory in Wuxi sample warehouse (Unit: thousand tons) | 200 series | 300 series | 400 series | Total |

| February 14th ~ February 18th | 30.5 | 295.6 | 86.6 | 413.0 |

| February 7th ~ February 11th | 29.4 | 292.8 | 88.1 | 416.6 |

| Difference | 1.1 | 2.8 | -1.5 | 2.4 |

The total stock of sample warehouses in Wuxi increased by about 2, 400 tons to 413,000 tons last week. 200 series inventory increased by 1,100 tons to 30,800 tons;300 series inventory increased by 2,800 tons to 295,600 tons;400 series inventory decreased by 1,500 tons to 86,600 tons.

200 series: Market demand was insufficient, inventory increased slightly.

Last week, stainless steel 201 trading in the Wuxi Market rose firstly and then tended to decrease. Before the Lantern festival, Downstream recovered to work gradually, part of the downstream stock replenishment demand exists, thus transactions were still more; But with the completion of downstream replenishment, market demand decreased, and later that Shandong offered the March futures prices of stainless steel 201 five feet hot-rolled products on Tuesday, the severe shortage situation of stainless steel 201 hot-rolled products released, then the transactions became less. The main arrivals of goods in steel mills are still Baosteel Desheng and Baogang New Material. The 200 series spot stock in the Wuxi market increased slightly by about 1100 tons and the cold-rolled products take up a large account of increased volume. The five feet hot-rolled goods so far are still in the situation of lacking spot stock.

300 series : with more inventory, market still warms up.

Last week, 300 series inventory increased slightly, most of the warehouse inventory increased. Currently, arrivals of goods in steel factory increased, DL quotation price is below the market price; Traders ordered and picked up goods actively. State-owned Steel Plant storage that before the stock has been reduced which mainly because of the recent great deals in the early period and active agent delivery. Though transactions become more, most of them are deals between traders; with high stainless steel prices, downstream kept waiting and seeing. The 2202 stainless steel contract started to have settlement last week for nearly 49,600 tons, plus 22,100 tons settlement in January. There will be 71700 tons settlement resources flowing into the market recently it is expected to have a large increase in stock for short time.

Until February 17th, the inventory of 300 series in the Wuxi market increased by 2800 tons to 295,600 tons compared to that on February 11th. Market turnover was good in the previous period, steel resources have been in stock gradually, traders and downstream purchasing are in an active position, but the overall inventory growing amount is limited. However, the 2202 contract for stainless steel futures is completed last week, and the spot market will be a focal point in the coming days which means the spot resources will be supplemented.

400: Decrease in stock, and agents take delivery actively.

400 series inventory decreased slightly, thanks to the good transactions. And the 300 series price rose rapidly, some downstream clients considering using cheaper 400 series taking the place of 300 series products. The inventory pressure got released due to the decrease of the stock last week.

Raw Materials|| The major raw materials of stainless steel continue to increase in prices.

China starts to intervene for the price of iron ore keeps rising.

The futures price of iron ore has increased by 60% in recent three months. In case it is a malicious hype, The National Development and Reform Commission (NDRC) has started to investigate and notice some major companies. One of the reasons, both the supply and demand of iron ore are weak, which makes little sense for the futures market to increase greatly recently.

Since 2022, the price of iron ore continue to increase, and thereby NDRC starts to intervene and investigate. On February 8th, the iron futures 2205 hit the record high since August 2021, closing at US$131/MT which was 19% higher than the price at the beginning of 2022. The price was US$49 and 60% higher, compared to the lowest price on November 18th, 2021, at US$82/MT.

In the morning of February 9th, NDRC announced that due to the abnormal development of the iron ore price, the Commission and State Administration for Market Regulation (SAMR) would meet the relating iron ore firms to warn them the prices should be accurate based on the matter of fact, and fake information and price gouging are forbidden.

In response to the investigation, the next day, on February 9th, the futures of iron ore dropped greatly by 5.9%, closing at US$125/MT.

Ferromolybdenum rose by US$1,116/MT (with a molybdenum content of 60%).

Lately, ferromolybdenum is one of the most active goods in the stainless steel raw material market. The price and trading volume of ferromolybdenum has kept increasing before the holiday.

Until February 17th, the EXW price of the ferromolybdenum increased to US$27,119/MT (with molybdenum content of 60%), which was US$1,116 higher.

Except for large trading volume, the reason for the increasing price of ferromolybdenum is the rise of molybdenum concentrate price. Until February 16th, the major molybdenum concentrate price went up by US$14/MT, and that of 47% molybdenum content rose to US$242/MT.

It is predicted that the increasing price of molybdenum concentrate will push the price of ferromolybdenum to rise further. The recent trading volume from steel mills was almost 5,000 tons after the holiday. The purchasing price goes higher to US$27,119/MT (with a molybdenum content of 60%).

What contributes to the increase, is that during the Winter Olympics, the environment protection measures were taken strictly in the major production regions, such as Liaoning and Henan Provinces, which appeals to tightening output and supply. Besides, the supply chain was insufficient due to the epidemics in Huludao where transportation is controlled. The less the supply gets, the more eager the demand becomes. Steel mills want to purchase and stock up more, which supports the price to rise.

Ferronickel: Supply drops while price rises.

Lately, the price of high nickel iron keeps increasing. On February 14th, the EXW price rose by US$2/nickel to US$239/nickel. After the holiday, the mainstream quotation of high nickel iron has risen by US$11/nickel within one week.

The continuous increase owes to the tight supply after the holiday. The environmental protection measures also fell on the high nickel iron market during the Winter Olympics. The ferronickel factories in Shandong Province are required to reduce the production by 50% from February 1st to March 15th. In another major production area, Fujian Province, the factories have been in maintenance until now.

As early as January 2022, the supply of high nickel iron has started to tighten because of the long holiday when factories reduce production and begin maintenance.

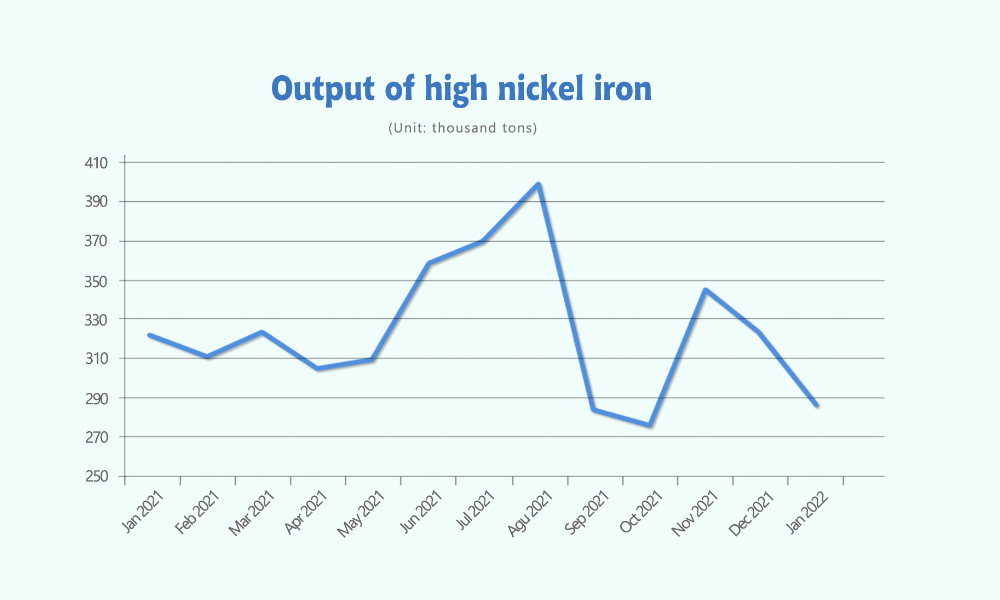

According to the statistics, the total output of high nickel iron by Chinese ferronickel producers and steel mills in January 2022 was about 286,200 tons, MoM reducing by 35,300 tons compared to the output in December of 2021, which was 321,500 tons.

Global Shipping|| Ports are congested, sea freight will keep increasing.

At present, many ports in China are facing congestion due to the spread of the Omicron and the partial lockdown of the city. Shipping companies in China temporarily change the ports to avoid the almost paralyzed ports, which has become a norm. For example, the port of Ningbo is facing severe delays though it has fully recovered from the last pandemic, and thereby many container ships have been headed to Shanghai.

However, situation in Shanghai Port is no better than Ningbo. Many ships are caught in a dilemma of a one-week delay. Some market participants said that this situation is expected to be eased after the Beijing Winter Olympics, but before that, the supply chain won’t run sufficiently, and there may be more delays in shipping schedules.

As in the abroad ports, it is reported that the port congestion in the western US seems to be worsening. The port workers are negotiating wages. This negotiation may become a decisive factor affecting the global supply chain this year. Once the strike happens, the congestion will trigger a series of chain effects. Imports and exports will be blocked. It is expected that the sea freight will also peak at the moment.

On February 17, Matson Shipping revealed its financial results for 2021, whose net profit increased by 380.3% in 2021.

In 2021, the cargo volume of Matson China routes was 184,800 FEU, YoY increase by 55.4%.

Matt Cox, Chairman and CEO of Matson Steamship, said that the continued strong transportation demand in the Chinese market is the main driving force of Matson's consolidated revenue growth.

"In sea shipping, as the volume of e-commerce, apparel and other goods continues to grow, the demand for expedited shipping on our routes in China has increased significantly. However, as consumption continues to rise, the supply chain in the United States is tight, and congestion remains. It's the main problem placing on the trans-Pacific route." He said.

He believes that the congestion is likely to continue until the peak transportation season in October 2022, and expects that the transportation demand of Matson China routes will continue to increase in 2022.