Trend||304 decreases by about US$125/MT in a week.

Last week, both futures and spots of stainless steel were bearish. Until Friday, Contract 2109 closed at US$2,990/MT, dropping by US$121/MT. About the spot product, in Wuxi market, cold-rolled SS304 of private-owned mills decreased by US$31/MT, and the 4-foot mill-edge SS304 of private-owned mills went down to US$3,155/MT.

304: Good and bad factors seesaw and the price will fluctuate in a short period.

Due to production limit and power rationing policies, production keeps reducing. In July, the crude steel production of stainless steel is 3,015,000 tons in China, which is 90,000 tons lower than the production of May. As for 300 series, the production comes to its first decline since March, decreasing by 68,400 tons. In August, it is predicted that the production of 300 series will still decline, by about 30,000 tons because of the power rationing policy carried in Beigang New Materials and production cut in ESS. The supply will keep reducing.

From the perspective of inventory of last week, the inventory volume of 300 series in Wuxi market increased by 7,200 tons, rising to 292,900 tons. Last week, Tsingshan and Beigang New Materials had several ships of new resources arrived in the market, and Delong also had about 3,000 tons of resources every day supplied to Wuxi market. Besides, the logistics have gradually recovered from unstable weather conditions, and thereby many state-owned resources were delivered. Most of these new resources are the previous overdue products, which were settled down for certain downstream buyers. What is more, the purchasing intention turns better after the prices dropped significantly. Therefore, the inventory did not cause backlog, and still maintains at a low level within this year.

What risks are hidden in the future?

1. Stainless steel futures have trended weakly. Last week, the stock price of contract 2109 was once around US$2,995/MT which was US$188/MT lower than the spot price. The difference affects the spot market. Besides, Contract 2108 is going to start settlement this week, and the total amount will reach 20,000 tons, which will partly supply to the spot market.

2. From the raw material supply side, the supply gap is narrowing, because the production of 300 series is reducing so is the demand for ferronickel. Except for that, it is not economical to buy ferronickel for steel mills recently. Steel mills will suppress the raw material price to increase in the future, so it is possible that the raw material cost will reduce.

200 series: Raw material is in short; steel mills cut down production.

Until mid-August, the 200 series inventory volume of the sample warehouses in Wuxi and Foshan increased by 8,400 tons compared to late July, increasing to 192,000 tons. The inventory has been consuming in July because of the production limit, environmental control, storms, typhoons and steel mills reduced their production.

In August, a large volume of goods arrives. Typically, in Foshan, the inventory stacks up obviously. In Wuxi market, the inventory of cold-rolled products is sufficient while the 5-foot hot-rolled products are in short, which mainly are 10.0mm~ 12.0mm. The price difference between cold rolled and hot rolled products maintain high.

Based on current production, a steel mill in east China is required to rectify the issue of the high furnace by the investigation team in July. The rectify term might last for around 3 months, which will influence the production of 200 series. Beigang New Materials has been stuck in power rationing policy, result in a sharp drop in production. Although HNJH has recovered from the production limit, the production maintains low. With more delivery arrives, the supply to the market will expand.

Generally, with more supplements and low opening price, the price of 201 fell from high price and now the profit margin declines to the break even point. Last week, the price of 200 series rose a bit due to raw material shortage and production cuts. This week, the price of 200 series is predicted to maintain or slightly increased by US$8/MT~US$16/MT.

400 series: The price of high chrome dropped.

Last week, high carbon ferrochrome decreased by US$16/MT, reducing to US$1,800/50 base tons. The falling price owes to the previously inflated quotation prices. The electric power rationing control is still influencing Inner Mongolia and Guangxi Province, failing to increase the production and supply of high chrome. In July, the production of high chrome dropped by more than 80,000 tons. Supply remains tight in August.

As for the production of 400 series in August, it is expected to decrease. Typically in Shandong area, it is estimated that the reduction will reach over 60,000 tons. The supply of 400 series also tightens up in August.

However, it does not mean a boost factor. Last week, the transaction met a bleak moment. Traders have adjusted the price down due to weak demand. Besides, with logistics recovered and the products arrived, the inventory increased by 2,700 tons in a week, reaching 83,300 tons, remaining at a high level.

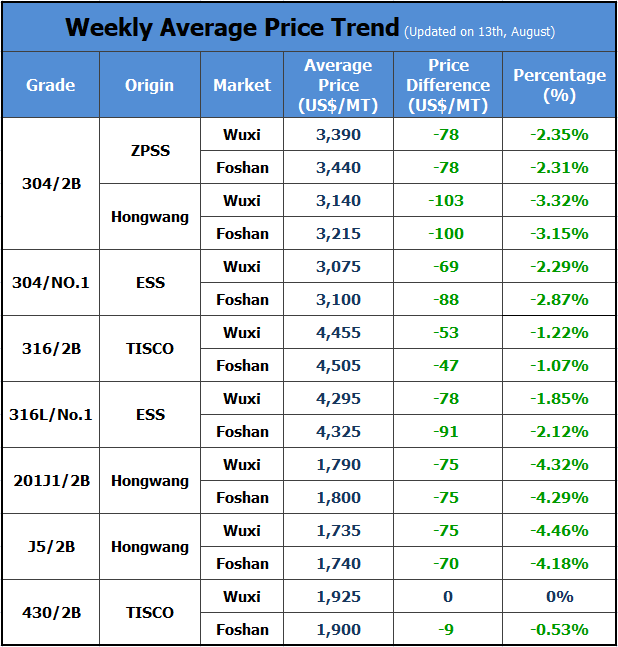

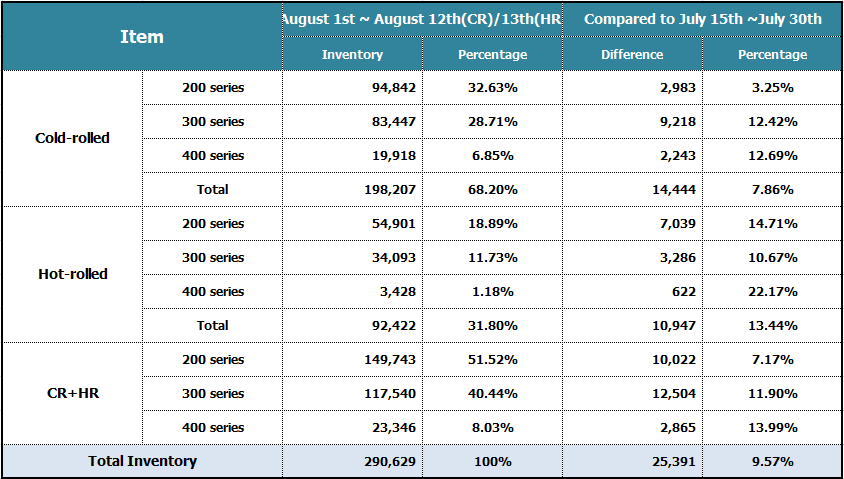

Inventory|| Total volume increases by 9.57%. All series of products inventory increase in Foshan during the first half of August.

The statistics of cold-rolled and hot-rolled stainless steel were collected on August 12th and August 13th respectively, which is used for comparison to the data of the second half of July.

Inventory data in Foshan market

Summary

The total volume of the sample inventory is 290,629 tons, which is 25,391 tons higher than the last statistics about the inventory of late July and the increasing percentage is as high as 9.57%. The inventory of 200 series rose by 10,022 tons 7.17%, reaching 149,743 tons; 300 series increased by 12,504 tons, 11.90% higher, rising to 117,540 tons in total; 400 series went up to 23,346 tons, which is 2,865 tons higher and he increasing percentage is 13.99%.

Production Origins Analysis

Compared to the data of late July, regardless of different series or CR and HR, the inventory all increased.

200 series: About cold-rolled products inventory, the increase comes from Foshan Chengde, Hongwang, while other production areas had little increase in supply. The latest producing date of Foshan Chende is 9th and 10th August while Hongwang is August 6th; about HR, products from Tsingshan takes the major place.

300 series: About CR, Delong, Hongwang, Yangjiang Yongjin increase more. The latest producing date of Hongwang and Yangjiang Yongjin is August 5th and August 12th respectively while Delong mostly is on 31st July.

400 series: As for CR, Zhaoqing Hongwang, Qingtuo Shangke increase the most, after are Runxin, Shengixn, and Jiangmen Liancheng; about HR, 420J2 of Tsingshan increased the most.

Reasons

1. Inventories of Beigang and Chengde have decreased slightly, while hot-rolled 304 narrow strips have increased slightly, while other sources of origin are all arriving, so the overall inventory has increased significantly.

2. The arrival of goods was delayed due to early typhoons, heavy rains, epidemics and other reasons. Logistics has recovered smoothly in the past half a month. The previous backlog of resources is reflected in the inventory increase this time.

3. It has been a while that the price difference between Foshan and Wuxi is large. Some resources in Wuxi are transferred to Foshan in order to sell at higher prices.

4. When the prices dropped, demand for tubes and sheets was weak. Some sheet producers even provided paid vacation to employees, which stacked up the products.

5. Some thicknesses of CR 304 are difficult to sell. Thicker sheets can be calendered to sell but the thinner sheets such as 0.3/0.4mm are left in the warehouses.

6. After the market trend collapsed, hype stopped, circulation slowed down, willingness to purchase declined.

7. Some refused to receive the high-price CR 201 that was bought earlier, resulting in stacked inventory.

Opinion|| Future of stainless steel market

The prices of major contracts of stainless steel futures fluctuated last week. Last week earlier, the price dropped down to around US$2,950/MT and later bounced back to US$3,075/MT but it soon fell. Overall, it was hard to get back to the increasing trend.

Basically, the market has supports to price increase.

The recent market tends to be gloomy, but it has yet to cause a large decrease. From the perspective of raw materials, ferronickel and ferrochrome are stuck in tight supply, which is a determinative factor supporting the price to stay high; analyzed from the demand side, in a short term, there won’t be large change and purchasing confidence will recover after the partly epidemic declines in China.

However, it is hard to say the stainless steel prices will increase in a long run.

This month, China’s M2 (Monetary Aggregate) and social financing scales have experienced a decline in their growth rates. It is possible that China’s liquidity inflection points may appear. At the same time, China’s PPI (Producer Price Index) remains high, and the gap with CPI(Consumer Price Index) widens. Overall, the pressure on industrial product price regulation is greater; Secondly, in terms of supply, the 300 series stainless steel has not been significantly reduced. The major steel mills have put the production restriction mainly on plain carbon steel and 200 series, and priority is given to ensuring the better profitable 300 series.

Accounting for 48.7% of total imports, China has become Russia’s largest supplier of stainless steel

According to data from Russia's SpetsStal, from January to June this year, Russia's stainless steel imports amounted to 206,810 tons, an increase of 4.8% year-on-year.

In the first half of this year, Russia's stainless steel imports increased by 15.9%, while stainless steel imports fell by 25.5% year-on-year. During this period, Russia’s imports of seamless steel pipes and welded stainless steel pipes fell by 16.6% and 24.2%, respectively, while the country’s imports of stainless steel coils increased by 64.4% year-on-year.

In June of this year, China accounted for 48.7% of Russia's total stainless steel imports and became Russia's main supplier of stainless steel. At the same time, India and Indonesia accounted for 15.6% and 6.6% of Russia's total stainless steel imports, followed by Taiwan and Ukraine, which accounted for 6.1% and 4.2%, respectively.

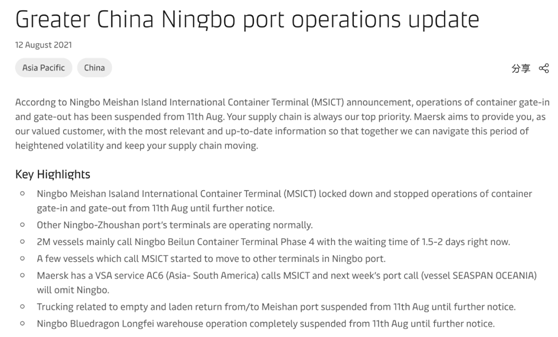

Maersk, Hapag-Lloyd and CMA CGM announced the suspension of calls to Ningbo Zhoushan Port.

On August 11, during a routine test of workers at Ningbo Zhoushan Port, a positive case of the coronavirus nucleic acid test was found. Currently, they are being isolated in designated hospitals for observation.

Same day at 3 pm, Ningbo Zhoushan Port Meishan Terminal (MSICT) has suspended all loading and unloading services and ship operations, and other port areas of Ningbo Zhoushan Port are operating normally.

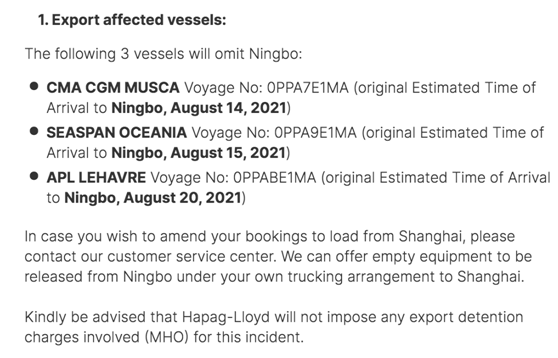

In view of this, many liner companies including Maersk, Hapag-Lloyd and CMA CGM have also made voyage adjustments one after another.

Maersk's announcement

Hapag-Lloyd's announcement

Ningbo Zhoushan Port stated that it will further coordinate the on-site workers in all its subordinate ports and make arrangements for on-site workers after the resumption of production in accordance with the relevant requirements for epidemic prevention and control.

What needs to be reminded is that due to the impact of the epidemic, the terminal business is still dynamically adjusting, and the liner company will also update the countermeasures at any time. Shippers and freight forwarders still need to pay close attention.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China