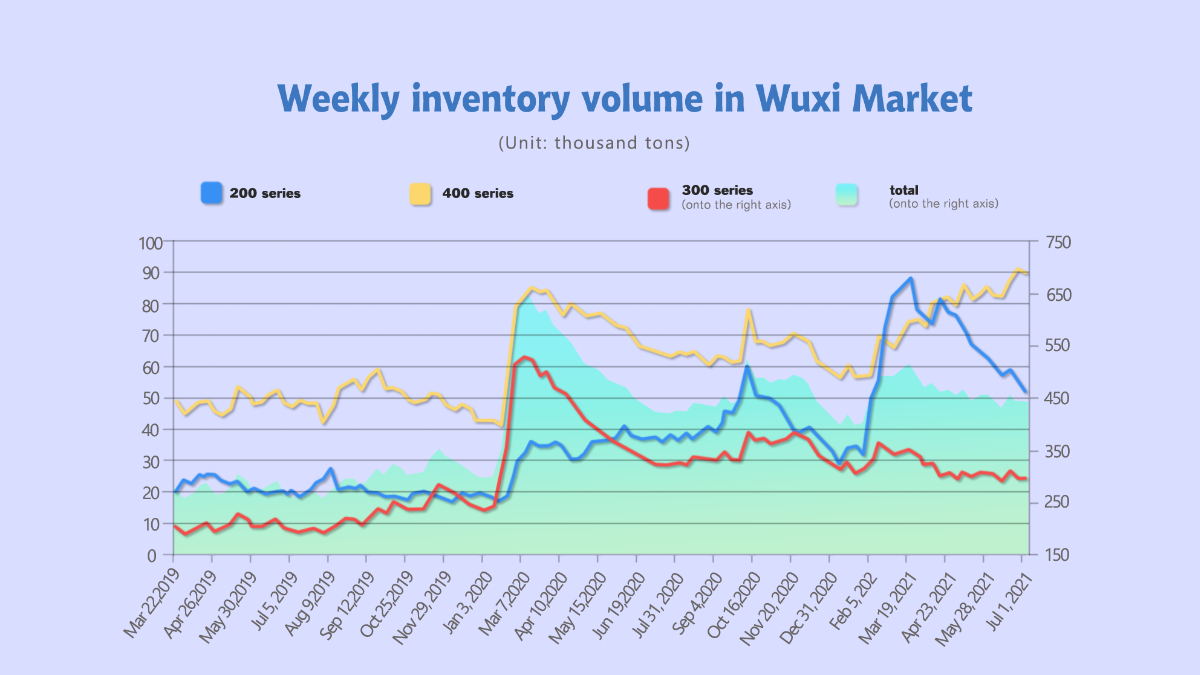

Inventory|| Caution! Inventory backlogs of 300 series later.

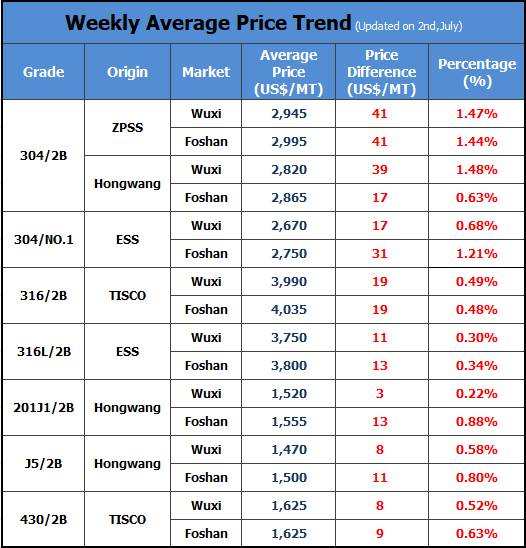

On First July, at the end of the trading day, stainless steel futures contract 2108 dropped by US$25/MT in one minute. A plot of futures short sale would earn US$125. In the latter market trend, 304 starts its ups and downs.

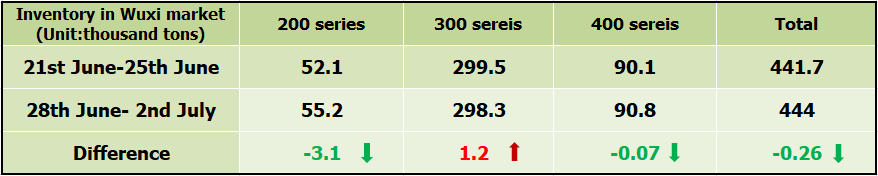

According to the inventory data, last week, the total inventory of Wuxi was 441,700, decreasing by 2,600 tons. 200 series inventory reduced by 3,100 tons, down to 52,100 tons; 300 series inventory rose by 10,200 tons, reaching 298,500 tons; 400 series inventory decreased by 70,000 tons, getting down to 90,100 tons.

200 series: The inventory volume continues to decrease and the price begins to rise.

Lately, the situation of SS201 has been stable. Compared to the high profit of SS304, steel mills show less enthusiasm in producing SS201. Therefore, the output of SS201 reduces and accelerates the decline of inventory.

And now, some agents lead SS201 to increase. Considering the low inventory volume, mostly, traders follow suit. Recent transactions give positive feedback toward the increasing price. SS201 inventory is still being consumed, which might last for a while and support the price to increase.

300series: The inventory increases a bit.

Last week, the spot price of SS304 was maintained at a high level. The transaction is in low demand. Although there are some out of stock, the prices just failed to rise. For now, the demand from downstream manufacturers turns weak because of the previous purchase and recent high inventory volume.

The risk of SS304 market will arise because it is certain that the supply will increase. A mill in Eastern China will expanse the supply of 300 series in July in its milling project phase 2. What’s more, due to the high profit of 300 series, steel mills will still produce more 300 series. It is believed that the pressure of large inventory will become a risk to the market if the demand maintains low.

400series: Weak demand and high inventory volume.

Last week, the price of SS430 remains stable. In Wuxi market, the cold-rolling 430 stays around US$1,625/MT. The transaction situation did not turn better and the inventory-consuming speed is slow.

Last week, the inventory of 400 series reduced a little, but the total inventory remains above 90,000 tons, a high level during this year. It shows that the market is and will be in a circumstance of oversupply. At present, some steel mills have finished their overhaul, and the output of the 400 series will resume in the later period. The market performance of 400 series is still not optimistic.

TREND||SS304 goes ups and downs but the decreasing tendency remains.

On 2nd July, LME nickel closed at US$18,330/MT, increasing by US$235/MT. Stainless steel Contract 2108 increased by US$1/MT at night, closed at US$2,710/MT.

On 3rd July, in the stainless steel spot market, the price of SS304 stopped declining after decreasing largely for consecutive two days. Hot-rolling 304 even had a slight bounce of US$16/MT. Hot-rolling 304 spot with 4.0-8.0mm by private-owned mills was quoted at US$2,635/MT. Cold-rolling, 4-foot, mill-edge by Delong and Beigang New Material maintained the base price at US$2,745/MT (US$2,825/MT in 2.0 slit). Yongjin quoted the sheet product at US$2,825/MT and US$2,905/MT in 2.0 slit. As for 201, the quotation remains generally. Cold-rolling, 4-foot, mill-edge J1 by mainstream mills was quoted US$1,490/MT, J2 and J5 were at around US$,1445/MT, and 5-foot, hot-rolling was about US$1,540/MT.

304: Supply is increasing while demand is declining.

Supply: For now, the profit earning from 300 series is advantaged. Some mills are going to enlarge the production of 300 series.

Demand: It is now in the slack season, but the 300 series stainless steel is of high price. Buyers began to stop chasing high prices and are on the fence. As for the export business, it is forecasted that the trend is not doing well. In May 2021, China's stainless steel exports totaled 366,200 tons, decreasing by 44,300 tons from the previous month. The influence of the export tax rebate cancellation has gradually manifested. The cost-effectiveness of Chinese stainless steel is faded. What’s more, the coverage of overseas vaccines has expanded, and production has gradually returned to normal, squeezing China's stainless steel export market.

What is uncertain and may affect greatly in the market?

At present, raw materials have a great influence on the price of stainless steel. Now Indonesia's stainless steel production is growing, and thereby the flow of ferronickel into China is decreasing. However, the domestic production of ferronickel is difficult to increase substantially due to the limited supply of nickel ore.

Like we reported in the last market summary, the Indonesian ban on ferronickel export, and Russia will impose US$2,321/MT tariff on nickel export, and other news will affect the ferronickel price to increase. Besides, rumor has it that Tsingshan will be less motivated in the future settlement, which will also influence the stainless steel spot market, futures stock, and LME nickel.

201: The pressure on inventory is small.

From the perspective of cost, due to the environmental inspection and production limit, the delivery of raw material is postponed, pushing the price to rise. Last week, the price of ferrochromium increased by US$16-US$31/MT, electrolytic manganese increased by US$63/MT. The sharp increase in cost further squeezes the profit margin of steel mills. Inevitably, the production of cold-rolling 201 J1 might lose US$23-US$31/MT. Thanks to the larger profit margin than 300 series and 400 series has, the future new output will be 300 series and 400 series, reducing the inventory pressure of 200 series.

About the inventory statistics, the 200 series inventory is 52,100 tons, decreasing by 3,100 tons. The supply of steel mills to the market is limited. In June, the trend of destocking was maintained, but the rate has slowed down. Both cold and hot rolling products are out of stock. Recently, some agents have taken the lead to increase the price of SS201. Taken the low inventory into account, market traders are willing to follow the increase. In the slack season, demand and supply are becoming less influential to the price, and thus, the cost of raw material might become the key factor to either the price of SS201 increases or decreases.

400 series:

Raw material: In the major high chrome production area, the legacy of the power rationing policy is still affecting productivity. In June, the production from Inner Mongolia, Guangxi, Sichuan all reduces. Because of the downward trend, it is predicted that the high chrome production in June will decrease to 510,000 tons or lower. The situation will turn better after 15th July as people predict, but to a large extent, the OOS will remain.

Spot supply: JISCO recovers from the overhaul, so the production increases. The high chrome increases significantly in price, which boosts the 400 series market. The purchase is enlarged, and the inventory fell last week. If the steel mills keep boosting the price, it is believed that the downstream buyers will follow suit.

FORECAST:

The general pressure on inventory is under control because steel mills are yet to set large delivery to the market. But the high quotation price suppresses buyers’ willingness, so next week, 300 series will remain the declining trend in price. Caution, the price bounces from the bottom.

SS201 will probably remain stable. The coil of 201J1 is going to stay around US$1,475/MT.

Because of the increase of raw material costs, for example, the price of high chrome increased by US$16/50 base tons last week, as well as Tsingshan also increased the purchasing price to US$146/50 base tons, the price of 400 series will rise. However, the increase won’t be easy due to the large inventory. It is estimated that the transaction price of 430/2B will go to US$1,635~US$1,650/MT.

HOT SPOT|| The quantity of export orders falls hence occurs concern of demand in July.

In June 2021, the Chinese manufacturing purchasing manager’s index (PMI) was 50.9%, which continues to fall by 0.1% from the previous month. It is currently above the threshold, indicating that the manufacturing industry is still expanding, but the momentum of economic growth continues to weaken slightly.

In detail, the growth rate of manufacturing supply and demand slowed down in June. The PMI index declined slightly for three consecutive months. The production index was 51.9%, down by 0.8% from the previous month; the new order index was 51.5%, increasing by 0.2% from the previous month. But the new export order index in June was 48.1%, which was 0.2 % lower than last month. Month-on-month, the decline continues, indicating that abroad demand has kept weakened and export growth may slow down in the future.

In terms of stainless steel export, based on the export data in May, it sharply dropped by 10.79% compared to April, typically the export volume of strip fell by 32.89% month-on-month. The decline of stainless steel exports is mainly due to the following reasons:

1. The impact of the cancellation of the stainless steel export tax rebate announced at the end of April has gradually manifested. After the tax rebate becomes 0, the advantages of importing stainless steel from China have been greatly weakened.

2. News of the imposition of tariffs on exports is overwhelming in the market. Before the news reaches the ground, it is difficult for both the buyers and sellers to reach a common ground in the terms of these uncertain export tariffs in orders.

3. The scope of vaccination has expanded, and the resumption of work and production in overseas markets is gradually getting back, while the production advantage of the domestic supply chain will be reduced. Therefore, stainless steel exports in the third quarter will be difficult to maintain the strong momentum as it was in the second quarter.

“Export orders in June decreased by about 30% from the previous high”, appealed by export expertise. The fall in export orders adds uncertainty to whether the demand in July can be maintained at a high level.

Stainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in ChinaStainless Steel Market Summary in China