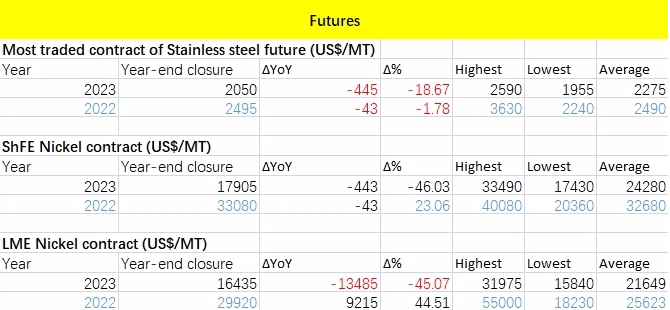

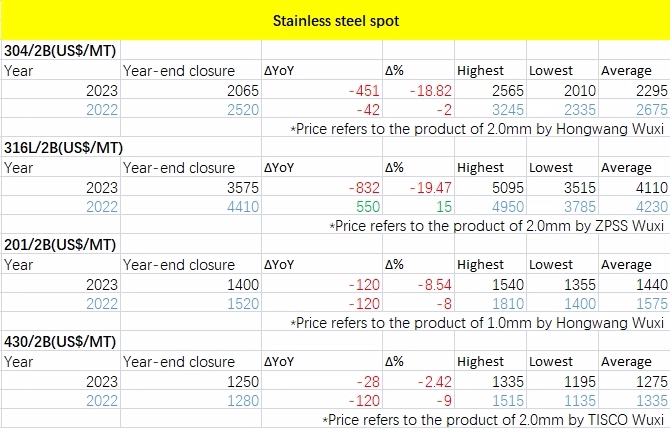

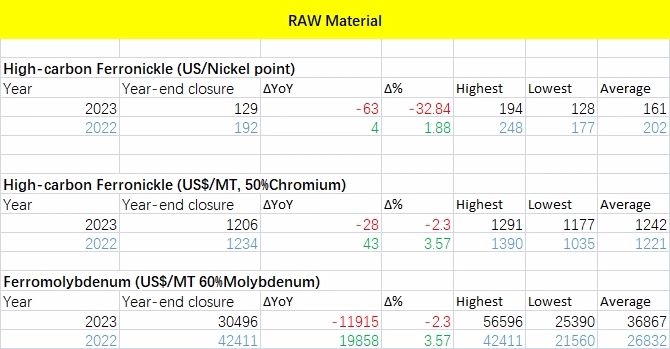

Happy New Year! It is always good to look back to history to make well preparation for a new start. This time we prepare a comparison of the key prices between 2022 and 2023, to clarify the general situation. Literally, the result is almost terrifying. There is no increasing sign-up in the data. LME Nickel plunged by 45% in 2023 from 2022. Stainless steel 304 also lost US$454/MT in the past year. The lowest point in the year hit US$2020/MT, which referred to the price of ZPSS Wuxi. Stainless steel 316L fell the greatest by US$837/MT, although we can see a frantic rise in regard to ferromolybdnuem which once went up to US$56596/MT. Will the desperate trend reverse? In the short future, we are afraid that the answer might be no. The tepid demand and pessimistic of buyers will still make the prices remain low. One good news is that the stainless steel spot inventory in China continues to decline. At least, the balance looks better now. Keep it going with more informative news in our Stainless Steel Market Summary in China, and have a good day!

2023 Review|| Nickle tanked 46% and stainless steel lost 19%

The post-pandemic period seemingly was rougher than what people expected, the economy had another year of rollercoaster riding. Hiking interest rates, depreciation of the Chinese yuan, and the fall from grace of China’s property market were forcing the nickel price to dive. LME nickel and ShFE nickel fell by 45.07% and 46.03% respectively.

The whole stainless steel industry was also in misery after the pandemic: the foundation for economic recovery remained weak, and steel plants quickly released their production capacities. Throughout last year, stainless steel production profits remained low, exerting pressure that led to a decline in raw material prices, causing a resonating downward trend in nickel stainless steel prices.

TREND|| Blast in Tsingshan also light up the market

Influenced by the incident in Indonesia, the future price of stainless steel fluctuated last week. The trade volume harvested a sounding growth at the start of last week but it got back to sedation in the mid-week. Eventually, the future price was concluded in a downtrend on Friday. The most-traded contract price once hit US$2135/MT then closed at US$2060/MT.

Stainless steel 300 series: a small increase

The market price of stainless steel 304 was hesitant but faced upward: the mainstream base price of cold-rolled 4-foot mill-edge stainless steel 304 closed at US$2045/MT on last Thursday; hot rolled stainless steel rose US$7/MT to US$2000/MT.

Stainless steel 200 series: quotation rose.

Until last Thursday, the mainstream base price of cold rolled stainless steel 201J1 gained US$21/MT from the previous Friday and reached US$1380/MT, both cold rolled stainless steel 201J2/J5 and 5-foot hot rolled stainless steel 201J1 jumped by US$28/MT, closed at US$1300 and US$1315/MT respectively.

On 26th December, Tsingshan released the guidance price of stainless-steel future for the first quarter of 2024 and order a strict implementation.

Stainless steel 400 series: Prices stabilized.

The mainstream quote price of cold-rolled and hot-rolled stainless steel 430 remained steady at US$1270/MT and US$1140/MT accordingly.

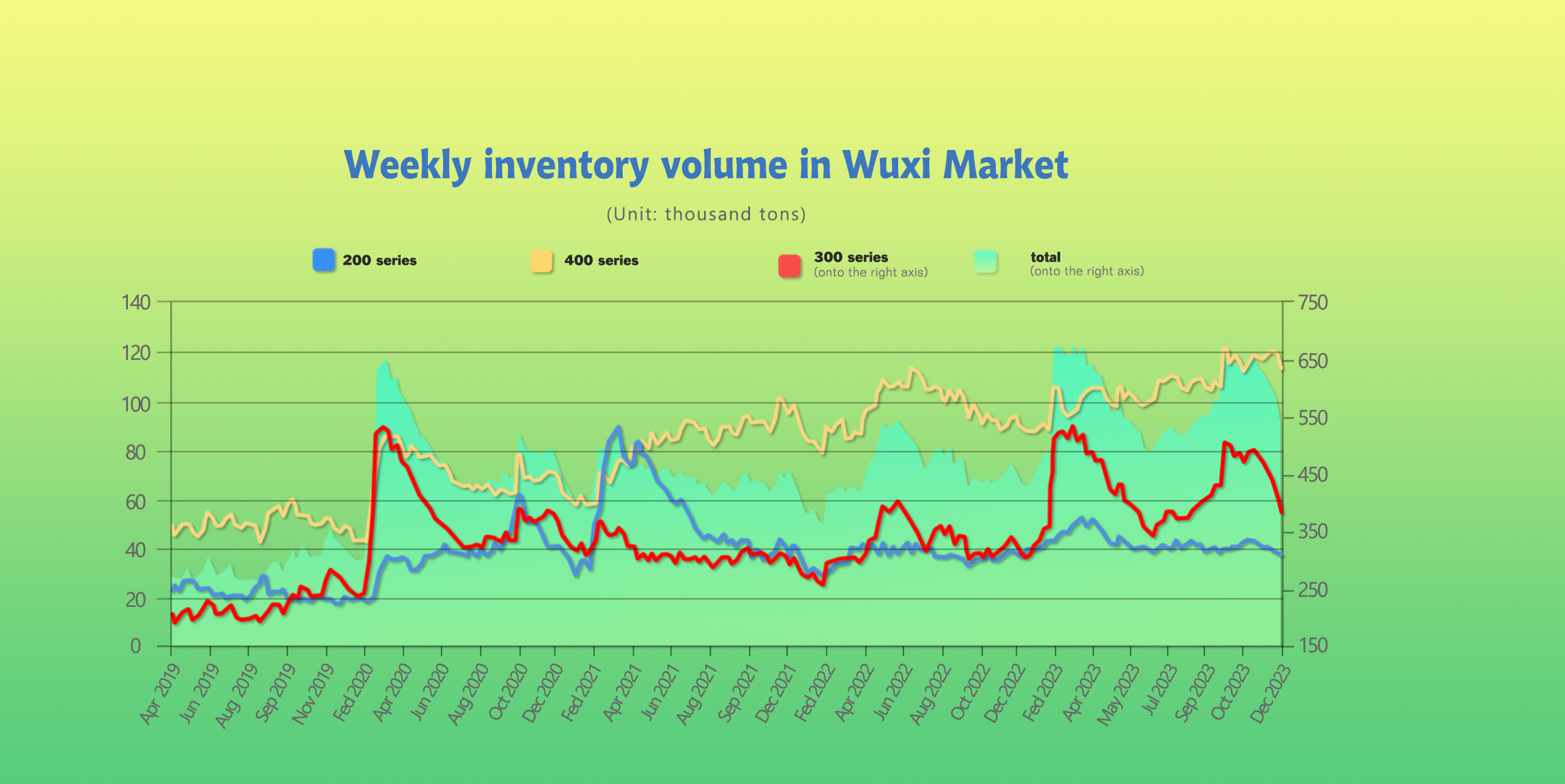

INVENTORY|| Inventory had been dropping for 6 week in a row.

The total inventory at the Wuxi sample warehouse downed by 40,909 tons to 528,498 tons (as of 28th December).

the breakdown is as followed:

200 series: 1,028 tons down to 36,180 tons

300 Series: 33,137 tons down to 380,587 tons

400 series: 6,744 tons down to 111,731 tons

| Inventory in Wuxi sample warehouse (Unit: tons) | 200 series | 300 series | 400 series | Total |

| December 21st | 37,208 | 413,724 | 118,475 | 569,407 |

| December 28th | 36,108 | 380,587 | 111,731 | 528,498 |

| Difference | -1,028 | -33,137 | -6,744 | -40,909 |

Stainless steel 300 series: further drop in inventory.

The future price and spot price of stainless steel harvested a decent growth last week, while the resources arrival at a low level. It is understood Delong in Yangzhou and Liyang regions continues to operate with reduced production, while Qingshan's order acceptance is relatively good, but there is a shortage of arrivals before the holiday, and arrivals are expected to gradually increase after the holiday. Pre-holiday active deliveries, combined with low arrivals, have led to an increase in the weekly de-stocking volume in East China, exceeding thirty thousand tons in a single week.

Stainless steel 200 series: destock continues.

Hot-rolled stainless steel 200 series recorded a 6.38% decrease in inventory last week while the destocking record is already counting up to the “eighth consecutive week.”, the level in social inventory is considered as low.

Stainless steel 400 series: final decline before 2024.

Destocking finally happened due to the low supply and stock clearance in the Wuxi market right before 2024.

It is believed that the inventory pressure could take a while to diminish.

RAW Material|| Bloomberg: Nickel Is Year's Biggest Metals Loser

In a mostly lackluster year for metals trading, nickel emerged as the worst performer and might not see a reprieve anytime soon.

The metal used in stainless steel and electric vehicle batteries posted an annual drop of 45% on the London Metal Exchange, the biggest decline since 2008. That's by far the worst outcome among industrial metals and contrasts with a 2.2% gain for copper or with iron ore's advance of about 20% in Singapore.

ShFE Nickel had a roller coaster ride last week. Until last Thursday, the most traded contract closed at US$18620/MT with a US$41/MT (or 0.22%) drop.

Workers protest in Indonesia after blast at Chinese-funded nickel plant.

Hundreds of Indonesian workers have protested for better work safety standards following an explosion at a Chinese-funded nickel processing plant that killed 18 people and injured dozens more.

About 300 workers joined Wednesday’s rally, said the chairman of the Serikat Pekerja Indonesia Sejahtera (SPIS) workers’ union, Katsaing, who goes by one name like many Indonesians.

The protesting workers gave a list of 23 demands to management, according to a letter sent to police by unions representing the workers.

The demands included that smelters be better maintained, health clinics be improved to deal with emergencies, and Chinese workers be required to learn the Indonesian language.

Indonesia’s manpower ministry will strengthen work safety laws, Deputy Minister Afriansyah Noor pledged.

Summary: Prices tend to fall in the near future

Stainless steel futures prices experienced fluctuations and a downward trend last week. Against the backdrop of the year-end off-season, downstream demand performed averagely, and the overall transaction performance was moderate. At the end of the month, there were more agency deliveries, and social inventories decreased significantly.

Traders still maintained relatively low inventories. Raw material prices saw a slight increase, and steel mills still retained certain profits. Overall, there is not much pressure on spot resources, and the market maintains a cautious and wait-and-see attitude. In the future, there is still considerable pressure on agency deliveries, and overall, the current contradictions in the fundamentals of stainless steel have eased somewhat. In the off-season market context, demand is the main variable affecting market performance.

Going forward, continuous attention should be paid to downstream procurement and stocking conditions. The expectation is for stainless steel to experience weak and fluctuating operations in the near future.

MACRO|| PMI extended the downtrend as demand remain sluggish.

China’s factory activity shrank in December to the lowest level in six months, fueling expectations the government may have to act soon to add impetus to the economy.

The official manufacturing purchasing managers index declined to 49 in December, from 49.4 in November, the National Bureau of Statistics said in a statement on Sunday. Economists had expected a reading of 49.6.

In December, the industries with the most significant increase in the demand gap compared to November include the metal products industry (-13.5 ppt), non-ferrous metal smelting and processing industry (-11.0 ppt), and the apparel industry (-9.4 ppt). When breaking down the demand structure, both domestic and foreign demand are weakening marginally.

Weak demand and sluggish confidence has also been reflected in deepening consumer price deflation and shrinking imports. The worst property downturn in modern China is expected to persist, which will further curb demand for goods from furniture to home appliances.

In December, among the major developed economies, only the Eurozone remained unchanged from November, standing at 44.2%. In contrast, the United States and Japan both experienced a month-on-month decline, decreasing by 1.2 percentage points and 0.6 percentage points, reaching 48.2% and 47.7%, respectively.

The new order index stood at 48.7 in October, a decrease of 0.7 percentage points from the previous month.

Amid the shrinking PMI demand, factory owners cut payrolls for the fourth straight month and at the quickest pace since May.

"The expansion of market supply and demand did not translate to an increase in hiring," said Wang Zhe, economist at Caixin Insight Group, adding some surveyed firms said existing capacity was sufficient to handle additional orders under the current market condition.

"Looking to the new year, there is still room for adjustments in fiscal and monetary policies," Wang said, calling for strengthened efforts in increasing employment to alleviate pressure on the job market.

Sea Freight|| Freight rate skyrockets.

The overall freight market was greatly affecting by the military conflict on the Red Sea, freight rates continued to hike.

On 29th December, the Shanghai Containerized Freight Index surged by 40.2% to 1759.57.

Europe/ Mediterranean:

The European freight line is now unfortunately caught up in a whirling vortex of the dispute in Red Sea, most of the sea freights are forced to sail in longer route. The freight rate of European freight line is expected to hike despite some sea freight companies announces resume sailing in Red Sea.

On 29th December, the freight rate (maritime and marine surcharge) exported from Shanghai Port to the European major ports was US$2694/TEU, which rose by 80%. The freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the Mediterranean major ports market was US$3491/TEU, which surged by 70%.

North America:

On 29th December, the freight rates (shipping and shipping surcharges) for exports from Shanghai Port to the US West and US East major ports were US$2553/FEU and US$3559FEU, reporting a 37.6% and 19.3% spike accordingly.

The Persian Gulf and the Red Sea:

On 29th December, the freight rate (maritime and marine surcharges) exported from Shanghai Port to the major ports of the Persian Gulf lifted by 38.5% from last week's posted US$2045/TEU.

Australia/ New Zealand:

On 29th December ,the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to the major ports of Australia and New Zealand was US$1051/TEU, a 13.9% jump from the previous week.

South America:

On 29th December, the freight rate (shipping and shipping surcharges) for exports from Shanghai Port to South American major ports was US$2793/TEU, an 19.4% rose from the previous week.